Welcome in Part 2 of the newsletter #19. This content has been split from the OP Superchain News thanks to community feedback. Our goal is not only to keep you up to date but also providing tools & tips to ease your journey in personal finance management in Web 3. So thanks a lot to you for bringing great ideas to improve this newsletter 🙏

If you missed part 1 [OP Superchain News], don’t worry, just click HERE.

Subscribe for free to not miss anything on the Optimism Superchain.

Click in your preferred language to access the translated document:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Turkish - Vietnamese

🟡DEFI Trends: What’s the best web3 wallet on your mobile?

With 7 billion mobile phones and 8,1 billion people in the world. Wallet on mobile will be the 1st interaction of Normies with Crypto, so what’s our fav one?

🟢Crypto market review & Tips

Bi-weekly update on the Crypto Market. In this release, we provide some insights about Smart money flow that can provide some thoughts about the current state of the market, thanks to onchain reading on Tether treasury in/out flow.

🟤Farming strategy: Leverage your OP token

Metronome just deployed few new features such as msOP. Leverage your OP to access higher yield, plus we’ll give you some tips to secure your position.

Spotlight project: Oath Ecosystem

The OATH ecosystem is changing the world of DEFI by setting up new standards for security, capital efficiency and real yields.

With Ethos Reserve V2 coming soon and updated tokenomics on the way, OATH is set to shake things up on Optimism going into 2024. You can find $OATH on Velodrome and check out their site at oath.eco.

Follow Oath Foundation on X & Turn on notifications.

🟡Defi for Noobs: What’s the best web3 wallet on your mobile?

by Subli

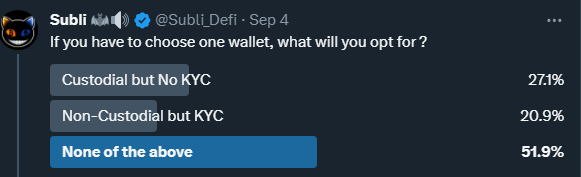

I have asked on X what would you choose as wallet based on the below criteria. Answer was a no brainer: Non-Custodial & No KYC!

My brother in law asked me something few weeks ago: Tell me about crypto & onboard me.

What’s the best support to onboard Normies? Mobile Phone

What’s the best wallet on Mobile to onboard Normies? 🙄

🤯This question found answers after weeks of wallets testing.

The rise of Web3 wallets on mobile is undeniably paving the way for the next wave of retail adoption during the upcoming bull market. I've explored 9 different wallets on my Huawei P30, which runs on Android. The insights shared below are purely my personal perspectives, based on my own DEFI experiences.

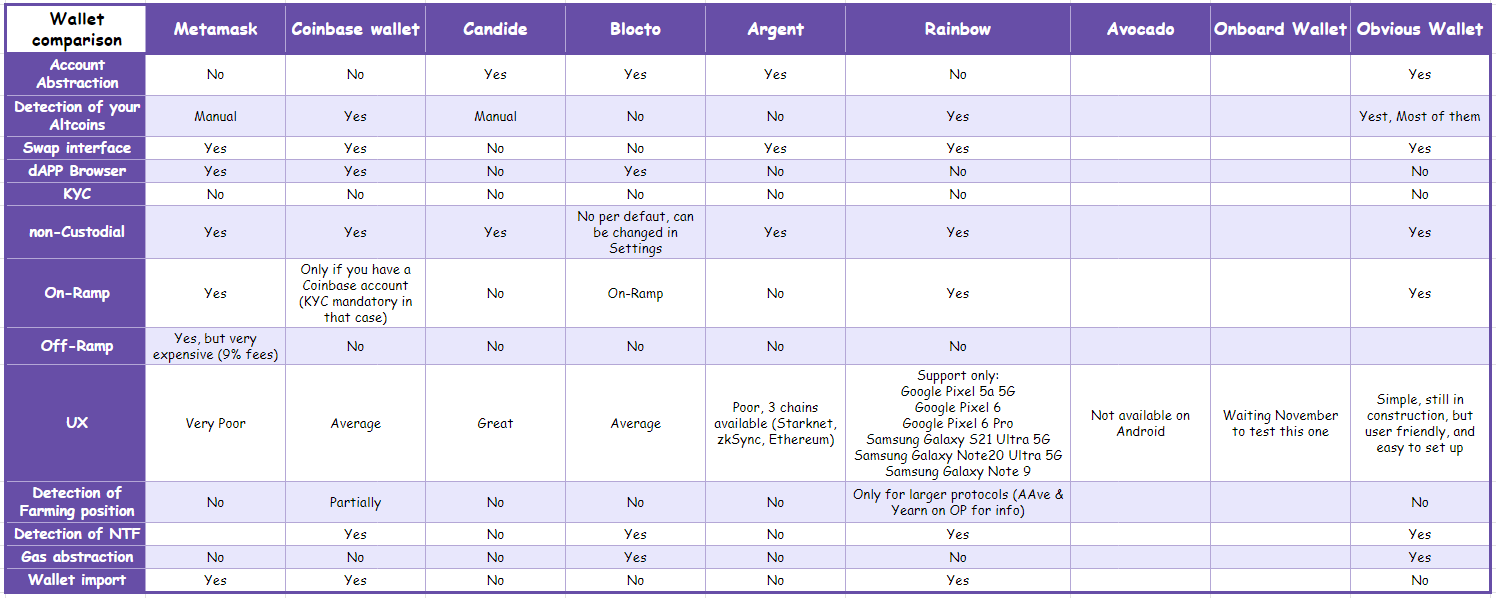

Here were the different chosen criteria to test the wallet:

Account abstraction: Create a wallet with Web2 login (password or google logs) - no more 12 words seed phrase

Detection of your altcoins: Coingecko references 10k+ tokens. Are they detected on the wallet?

Swap interface: Allow to swap token directly on the wallet

dAPP browser: Access protocol website through the wallet to be able to connect to it and use it

KYC: Does the wallet require you to provide your identity?

non-Custodial: Your key, Your funds

On-Ramp: Buy crypto with FIAT currency

Off-Ramp: Withdraw crypto to FIAT currency

UX: My own feedback

Farming position: Detection of my farming positions through DEFI protocols (Liquidity Pool, Staking, Lending/Borrowing)

NFT: Detection of NFT

Gas abstraction: Perform transaction without taking care of having the right token to pay fees

Wallet import: Import an existing web3 wallet

Here is the result of my research:

In my perspective, the ideal product encompassing ALL the following features remains elusive, although efforts are underway, particularly around integrating ERC 4337 tech (account abstraction) in smart wallets:

Account & Gas abstraction

In-app Swap & Bridge

dAPP browser

Overview of all farming positions (both DEFI & NFTfi)

For those keen on understanding ERC 4337 in depth, I recommend reading into the thread by Zeneca provided below.

Unfortunately, the perfect product is not out………. yet

However you can easily have a mix of wallets to access all necessary features for your DEFI journey, all on your mobile.

inAPP Swap & Bridge + dAPP Browser wallet = COINBASE WALLET

Account & Gas Abstraction wallet = OBVIOUS WALLET

Scree all your farming position (DEFI & NFTfi) App = DEBANK

Conclusion

The trajectory undeniably points towards mobile dominance, and it's something you'd do well to monitor closely. The forthcoming retail wave is likely to bypass CEX, given the controversies surrounding FTX and the never-ending FUD on Binance.

So what would be their option? Directly to DEFI. It's clear as day one that 2024 will be the year of SmartWallets. And what if these wallets decide to release tokens, rewarding their early adopters with airdrops?

What’s best to close this article with a bit of Speculation! ✈️

Do you have another opinion, another wallet i should check out?

🟢Crypto market review

by Axel

Bitcoin

The sluggish crab market continues. There has been little evolution since the previous newsletter, with Bitcoin moving slowly following its correction from the peak at $69,000. We observed a Bitcoin reaction at the $25,000 support level, where we took a small position with a stop loss below the support. What should be done now?

Bullish signs: The daily divergence is still in play, and the support has not been breached.

Bearish signs: A daily correction is currently underway, and there's a potential for the support to break down.

What we are looking for now is for the RSI to break above the blue curve to the upside. However, this may still take some time as we are in an accumulation phase.

DXY (U.S. Dollar Index):

Regarding the DXY index, there's nothing new to report. The divergence is still ongoing, and we maintain a bearish outlook on this index as global hegemony dynamics are being reshuffled.

CME Gap:

Since the previous newsletter, no new gaps have emerged. As a reminder, the remaining open gaps are located at $20,000 and $35,000. We mention the CME gaps because they represent significant targets in case of sudden market movements.

Altcoin:

As discussed in previous newsletters, it is not yet opportune to expose oneself to altcoins. The time will come, but for now, it is still preferable to remain in Bitcoin or stablecoins.

Conclusion

As demonstrated, the market is moving slowly, and we are in an accumulation phase before a more significant movement. The longer the accumulation, the more forceful the subsequent move is likely to be. We believe that market makers are still accumulating, but this does not negate the possibility of a Bitcoin drop if the $25,000 support is breached to the downside.

Patience is crucial. Avoid getting overly involved in the market and, most importantly, stay mentally prepared for when we gain better visibility into the market.

🎓Educational Content: Money flow to/from Tether

Disclaimer: The following information is a theory and should be approached with caution. We have no formal proof of what we are about to explain. However, practical observations have supported this theory, and we aim to outline its main points below.

If you are a diligent reader of the trading section, you may recall from the conclusion of newsletter #16 that we strongly believed market makers were in an accumulation phase. What leads us to this conclusion? How can it be demonstrated?

The major players and market makers are believed to use the Tether company to enter the cryptocurrency market. They deposit 1 $USD of FIAT currency and mint 1 $USDT on Tether.

Small players like us do not have access to this information, however blockchain is transparent & public.

These transactions can be identified through whale alert account (strongly advise to follow it) for which notifications can be set up on X or Discord. Small trick, we are not interested in ALL transaction, only those conducted on the Ethereum blockchain. Why? Market makers move millions of funds, and currently Layer 2 or Alternative Layer 1 doesn’t hold enough liquidity for them to perform safe & efficient transaction.

Here's an example of an alert: Bitfinex (CEX) → Tether.

This transaction is of interest to us because first it is on the Ethereum blockchain and mentions the Tether treasury. In this case, $50 million is being sent back to the Tether Treasury. What’s interesting about this transaction?

Occurs 4 days after BTC local top at 28.6k$

Price increase of 10% from previous local bottom 24.9k$ (lowest price since mid-March 2023)

We think the wallet behind this fund transfer is likely taking profits back to FIAT.

But, apart of trying to interpret onchain data which could lead to a false interpretation, what interests us here is that the smart money is in action.

Now, let’s make a step back. These transactions involving Tether on ETH chain were rare during the downtrend of Bitcoin from $69,000 to $15,000 (Nov ‘21 → Nov ‘22). However the amount of such transaction has increased since.

While Market Makers or Whales are not your friend, especially in such illiquid market where price can be easily moved using few millions $, just remember that the more transactions of this kind we have onchain, the more active the major players are, which is favorable to the market.

🟤Farming strategy: Farming Smart OP token

By Subli

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

We've previously discussed Metronome, and they're back with another exciting announcement. Introducing OP's new Smart Farming Strategy. Wondering how to earn a 15% APY on your OP? Let's dive in!

Smart Farming allows user to leverage the yield of one token, generated through Vesper protocol, by minting/borrowing a synthetic asset and swapping it to the original one.

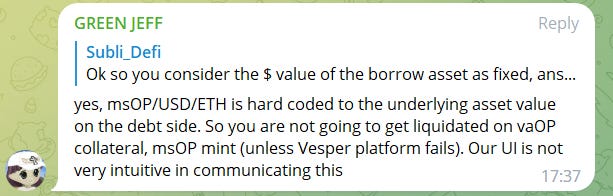

I can loop (perform the above flow) multiple times up to a 3x Leverage position. But i’m pretty sure your next question is: What is the risk of liquidation?

The risk is NULL! Yes you hear me! Why?

Cause the price of the minted synthetic OP is Hard Coded to the price of the underlying Asset, here OP. This has been confirmed by the team:

I have then chosen to go for max leverage(3x). The bottom statement shall be considered only if you deposit a token different from the minted one.

Few things to consider though:

Risk of exploit/hack → If Metronome looses all his deposited Assets, then impossible to redeeem all msTokens 1:1.

vaOP strategy: Here vaOP is the yield bearing token when OP is deposited in lending protocols (you need to check this on Vesper directly). So no risk of having vaOP price deviating from OP price

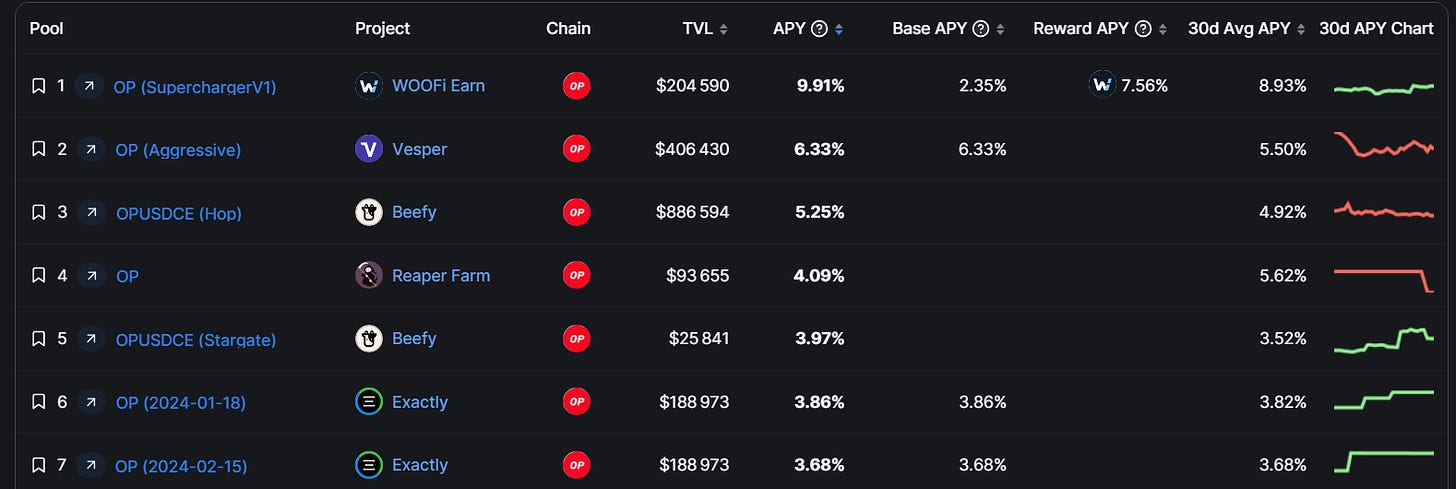

So with metronome, I can aim at 14,5% APY on my OP Tokens, being the best farm for OP according to Defillama:

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

The Optimism Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.