Thank you for reading this freshly cooked newsletter. Your continuous support means a lot for me, and keeps fueling me to dig into Base and the surrounding ecosystem for you.

if you missed the previous newsletter, it’s just one click away from you HERE.

————————————— This Week Menu ——————————

🦸♂️Weekly News on the Superchain

🔵 Anzen Finance: RWA backed stablecoin

Why Anzen / $USDz onchain data / Peg Stability / Yield opportunities / Airdrop

🚑 Post of the Week

🦸♂️ Weekly News

🔴 Optimism Airdrop #5 is now claimable : 10m+ OP tokens distributed

🚴♀️Velodrome is getting ready to activate interoperability in the Superchain

🌊Clearpool is launching its own chain, Ozean

🎲Betmode is now live on Base, and launched a new engagement campaign on Intract

👛Jesse Pollak is going to lead Coinbase Wallet together with Base

🏰Fortunafi announced the first tokenized hedge fund on Base

📱World Mobile token WMT has migrated on Base and is now live on Aerodrome. Check this awesome thread from my fren: https://x.com/0x7d54/status/1841141277259071629

🔵Anzen Finance: RWA backed stablecoin

As part of my Base weekly project breakdown, this week I’d like to introduce you Anzen Finance, founded by Ben Shyong in 2022.

Why did I choose Anzen Finance as the first project to discover?

1- Remember my thesis about RWA on Base → Just read it here

2- The stablecoin market might be the largest market by growth in 2024/2025: According to RWA_xyz, “Tokenized assets (RWAs) represent $176 billion today, or nearly $15 billion excluding stablecoins, across 150+ tokenized asset issuers on 20+ public blockchains”

Let’s start with a quick introduction:

Protocol Type: RWA backed stablecoin

Tokens: Stablecoin $USDz / Gov. Token $ANZ (not released yet)

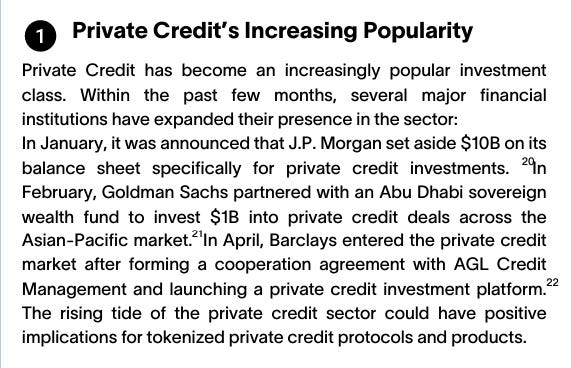

TVL: 63m$ (which 70% on Base) -> Rank #12 protocol on Base

Today, I’m going to cover:

Why Anzen?

$USDz onchain data

Peg Stability

Yield opportunities

Airdrop

So why Anzen Finance ?

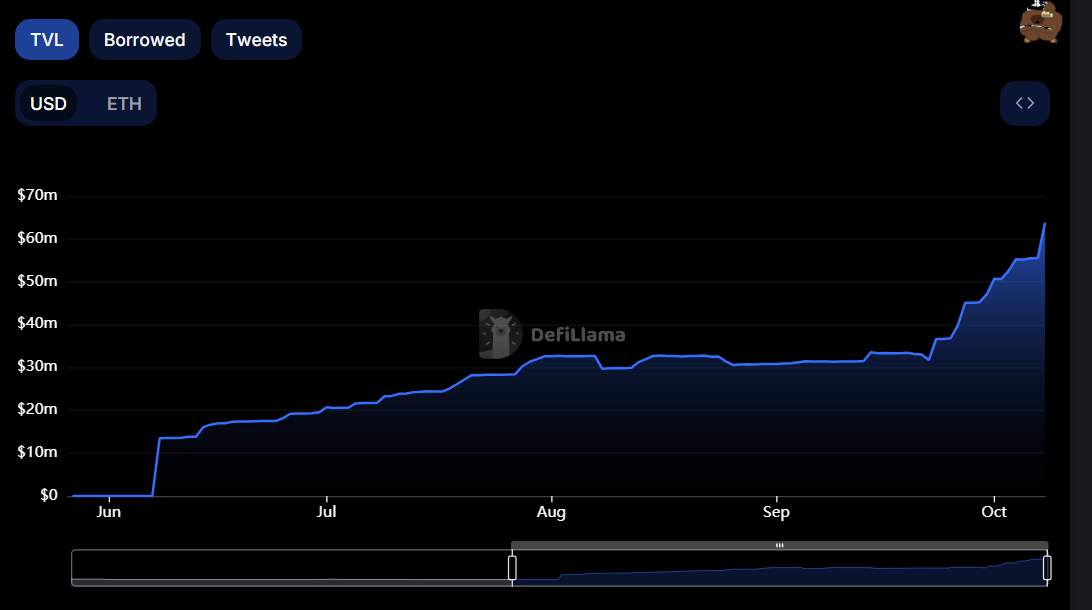

Cause the next Defi revolution is undergoing, and is called STABLECOIN

1. Stablecoin Market Cap is now sitting at 172b$, new ATH since June/2022.

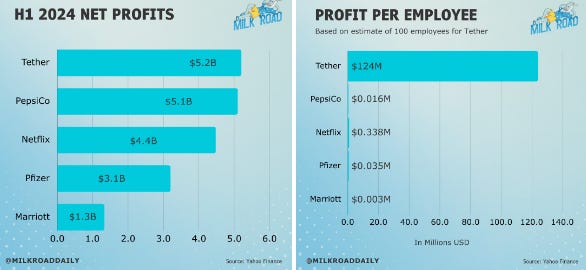

2. Tether is making more profit per head than most of the web2 companies: RWA.xyz

3. Circle is the 1st MICA approved stablecoin issuer in Europe with $USDC & $EURC:

The number of stablecoins keeps increasing and Anzen Finance is now a new player in the game, issuing $USDz backed by RWA assets.

Anzen stablecoin is backed by Cash (21%) & Private Credit Note (79%). For underwriting and custody, Anzen has selected a licensed and well-established partner, Percent.

But what is a Private Credit ?

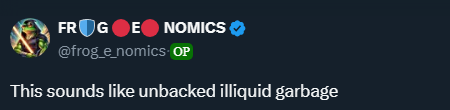

First reaction could be:

Well, people have terrific PTSD from $USDR, Tangible protocol. $USDR is backed by Real Estate, a very illiquid & volatile market:

So what’s the difference with $USDz?

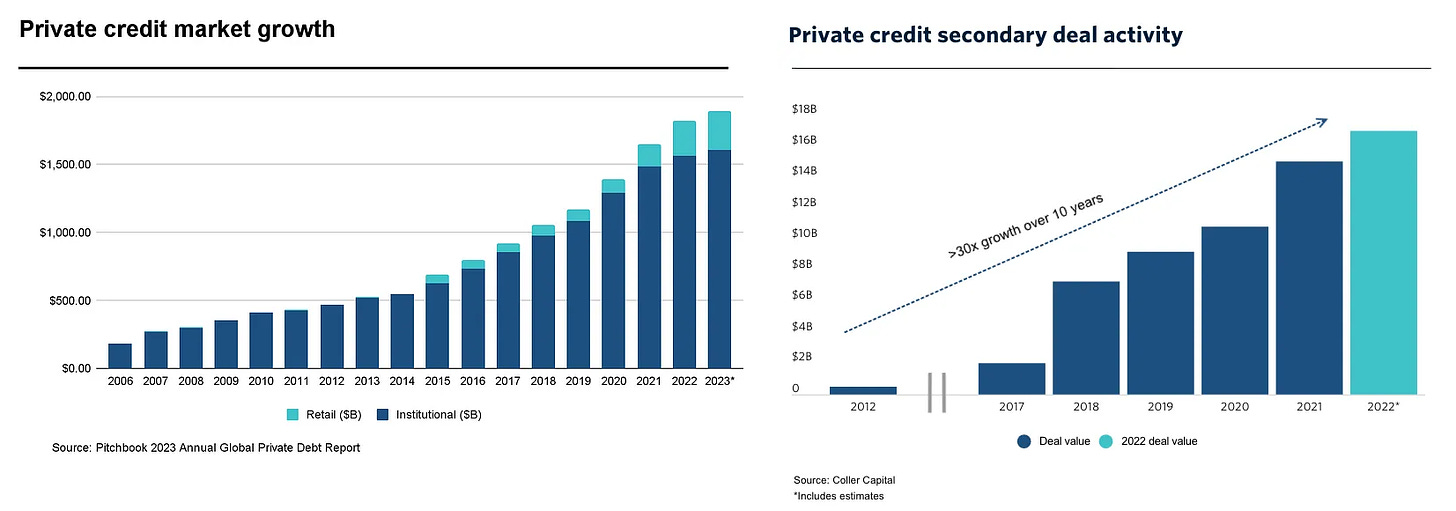

First: Private Credit value is not volatile cause the underlying value in based on the loan amount (fixed), and interest rate (fixed). The only changing parameter is the maturation date (aka the loan duration). When the loan ends (maturity date), the credit is paid back.

Second: Private Credit is more liquid than Real Estate.

The growth of the Private Credit Market and its secondary market have been tremendous the past years:

Third: Not a 100% sign of confidence, Anzen Finance & Percent are backed by Industry expert (thanks Crunchbase):

$USDz Onchain DATA

Market Cap of $USDz (aka # of stables minted) is going Up & to the Right, pretty interesting growth (data from Defillama).

The Cash side of the backing is coming from Blackrock $BUILD tokenized fund

And together with Private Credit , the overall generating APY is around 10% APY.

90% this yield is given back to users staking $USDz onchain or LP'ing on @AerodromeFi (through voting incentives)

As private credit notes have a maturity duration, Anzen dashboard provides an average # of days to convert the backing into cash (between 86 to 185days). If you know Pendle, then you will easily understand that there is a discount to buy a product having a maturity date in the future. This brings to me the question, what about the Peg? Can $USDz = 1$ at all times?

Peg Stability

One of of every user main concern

Coingecko reports a max depeg of 3.2%, while dexscreener shows a less nice curve (but haven’t checked if it was a real depeg or just a UI wick)

1. $USDz liquidity on Base / Aerodrome is really, really deep => 37m$ TVL on USDz/USDC pool

2. 20% of the backing is in cash

3. Private Credit Note are more liquid than Real Estate

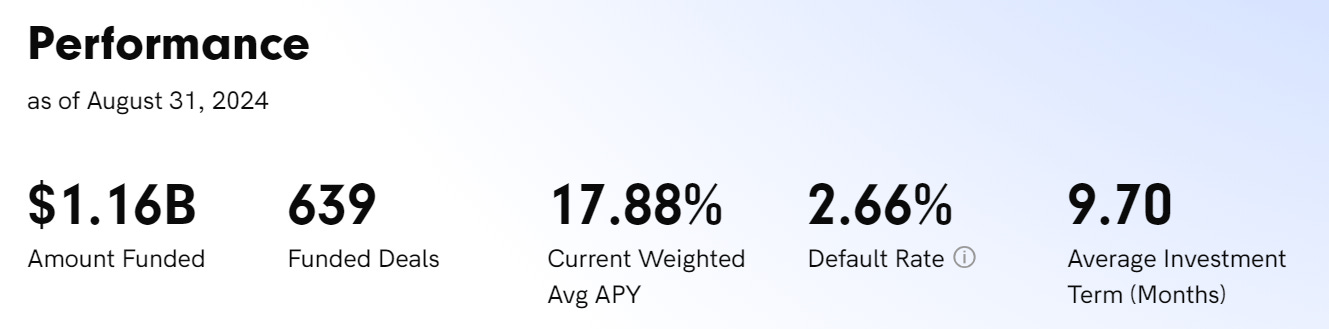

4. Average payment default according to Precent is around 2,66%

=> Report here.

So as a conclusion, I’m considering that $USDz cannot go lower than 0.97$, as it will be bought back onchain, and redeemed to the RWA backing.

Yield with $USDz

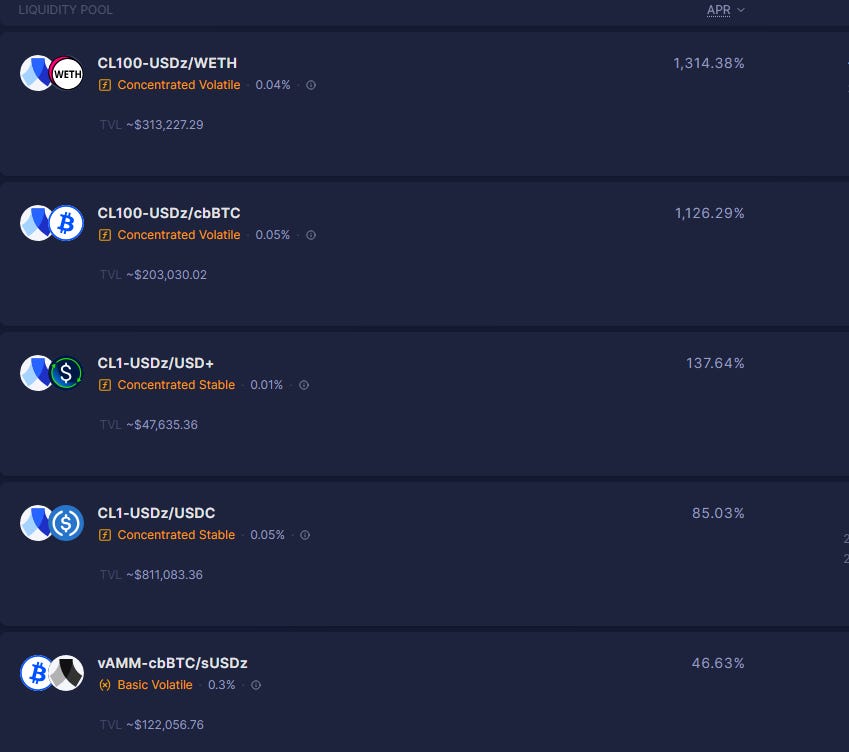

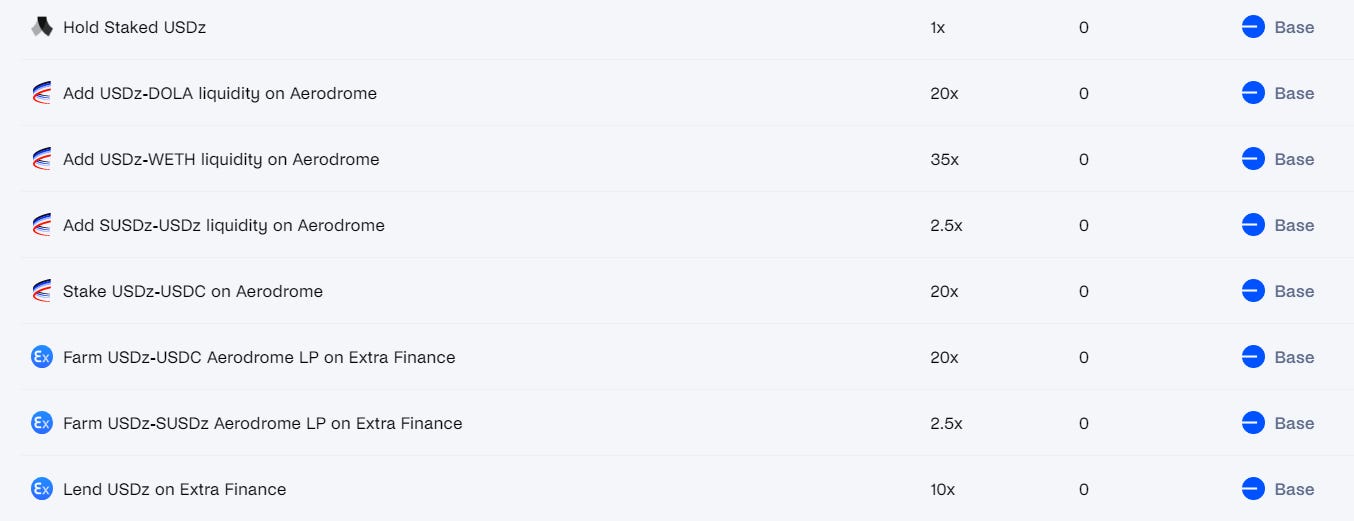

1. On Aerodrome , You have plenty of choice:

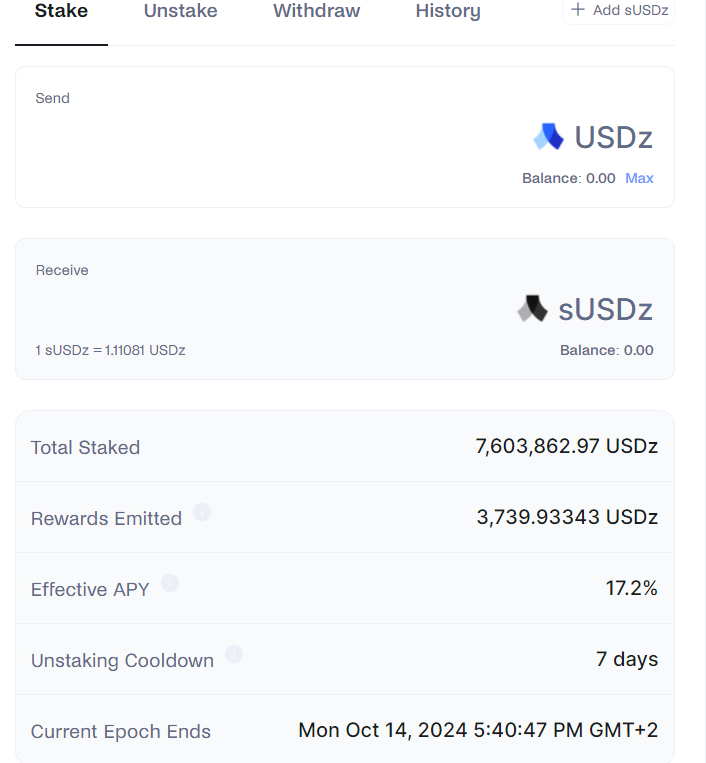

2. Stake USDz on Anzen protocol (Ethereum Mainnet), and earn a share of the RWA yield : 22% APY + 7d cooldown period

Once staked, you receive $sUSDz that you can farm elsewhere. If you understand the dual token model, it's pretty powerfull!

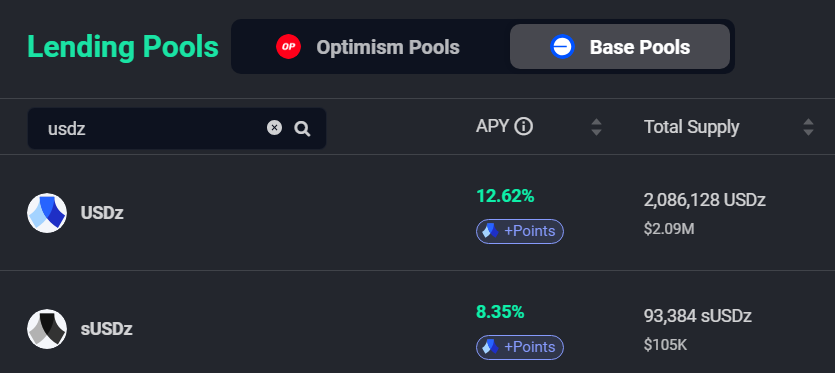

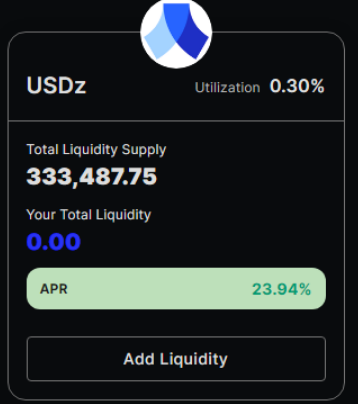

3. Lend or compound yield on Extra Finance:

4. You can provide liquidity to Kravtrade (Perps). Watch out as it is a counter party vault, so you are the house. When traders win, you loose. When they loose, you win.

Finally, Beefy has also you covered with insane yields and an Automatic Liquidity Management feature built on top of the Concentrated Pool of Aerodrome :

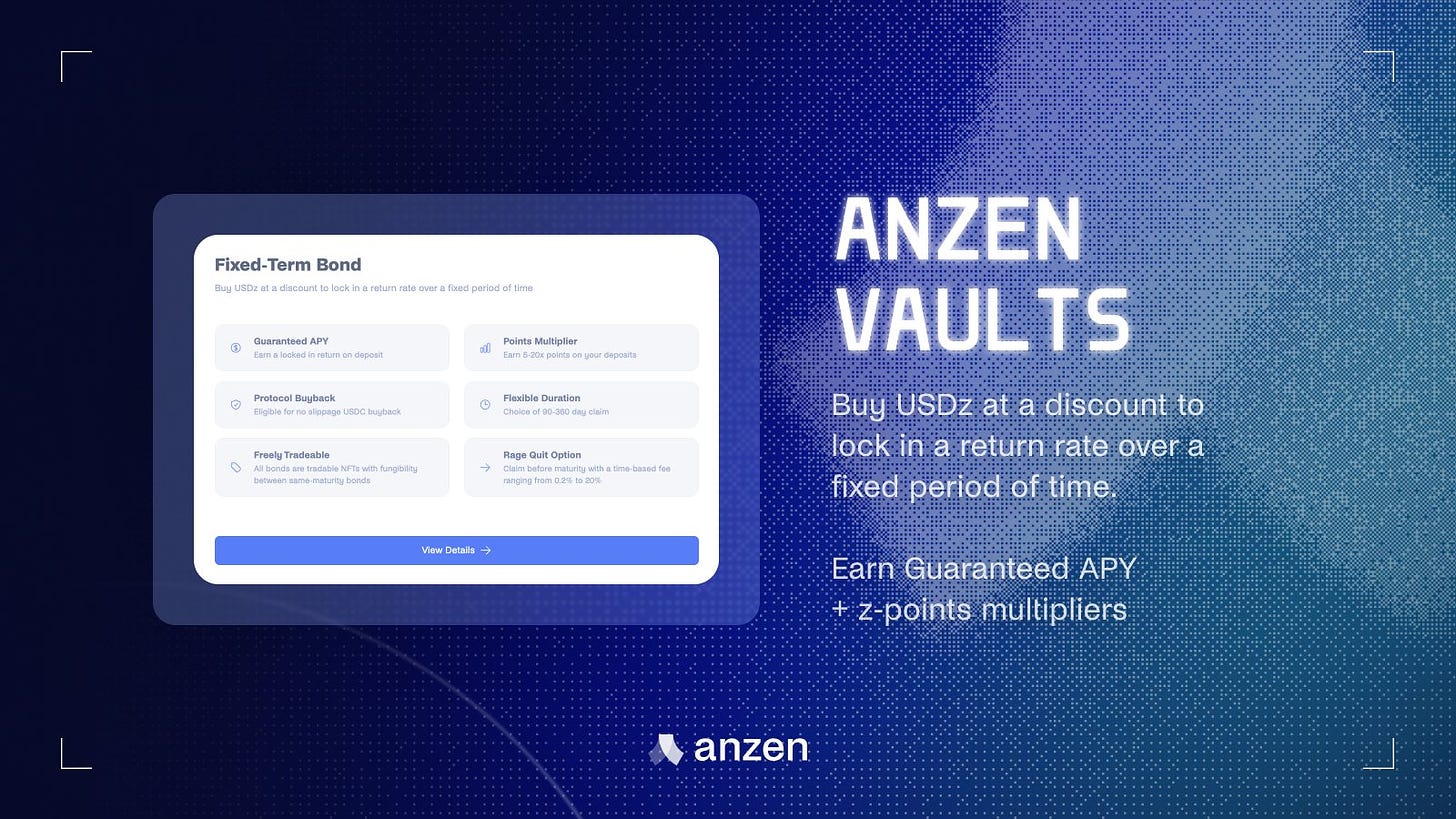

Anzen just announced USDz vaults offering fixed yield over a certain locking duration (welcome Pendle), with increased points from 5x to 20x. Users will be able to “Rage Quit” their position against a small premium. Click the pic below to access more info:

$ANZ #Airdrop you said?

Welcome to Z-Points!

Provide liquidity & Earn points with a multiplication factor based on the selected farms => Full dashboard here:

The team has revealed the tokenomics, but we can safely assume that it’ll be around 5% of the total supply.

But what will be the utility of $ANZ?

Wait for future announcement, but we can safely expect as well a kind of locking mechanism that will benefit long term aligned users.

Conclusion

Anzen Finance is fitting one of my biggest narrative for this cycle: RWA + Base

While $USDz has, for me, a slight depeg risk, the growth and redemption mechanism should allow for a quick recovery to 1$.

Anzen is Bridging Tradfi with Defi, and use Defi composability to generate more yields than Tradfi players could expect. These guys know how to operate the distribution channel, think about how Ethena grows so fast.

I've been studying this project since a while now and was very happy to bring this to you today.

I’d like to thank the following people who answered all my questions that let me write this exhaustive article:

- Ben Shyong (Anzen Founder)

- Nelson Chu (Percent founder & CEO)

🚑 Post of the Week

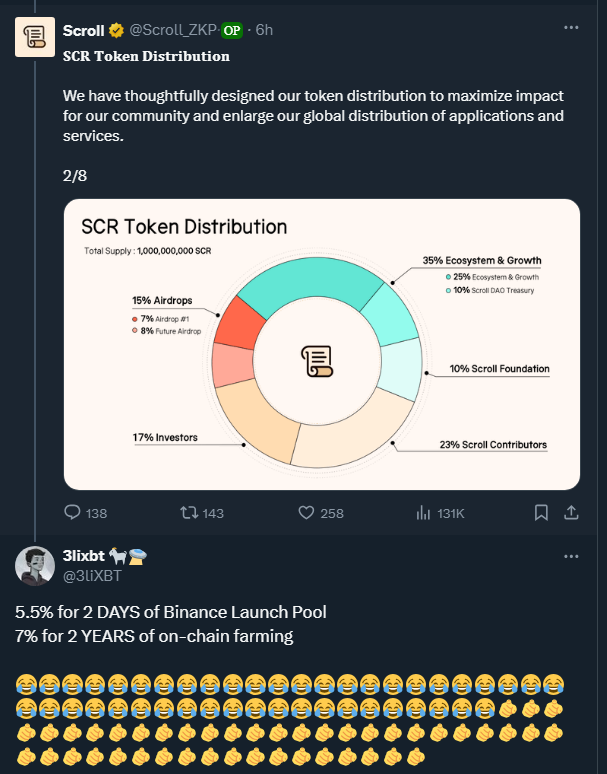

Don’t get milk! Choose your farming project wisely.

Disclaimer: Nothing in this content is financial advice. I may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky. Be ready to loose everything you invest in.