Thank you for reading this freshly cooked newsletter. Your continuous support means a lot for me, and keeps fueling me to dig into Base and the surrounding ecosystem for you.🌱

If you missed the previous newsletter, it’s just one click away from you HERE.

————————————— This Week Menu ——————————

🦸♂️ Superchain news

📈 Superchain Stats

🔵MORPHO : The new Lending/Borrowing stack

What is Morpho / Pros & Cons / $MORPHO token launch / Yield opportunities

🏈 Post of the Week

🔓 Token unlock in the next 7 days

Partner: If you wish to sponsor this newsletter, feel free to contact me on X @subli_defi

🦸♂️ Weekly News on the Superchain

🚴♂️Velodrome Superchain 1.0 is now live on 🟡Mode Network, using Hyperlane interoperability

🌱Superseed is joining the Superchain. It’s the first chain having a native token allowing self repaying loan. Supersee reveals its fair Public Sale at 20m$ market cap, 100m$ FDV

🌊Ozean (Clearpool) partnered with tradfi player, Helix Finance, managing 375m$, brining more private credit onchain

☸The Defi Collective is launching the L2Beat for protocols, reviewing the decentralization & immutability of DEFI protocols. Check DefiScan here → https://www.defiscan.info/

💲Kraken, Robinhood, Paxos, Galaxy, and others created the Global Dollard Network, stablecoin issuer, with their new stablecoin $USDG. Could it be the native stablecoin on Ink chain?

🥇Talent Protcol, your onchain professional passport, has been backed by the Base Ecosystem Fund from Coinbase Ventures, and just launched its $TALENT token, reaching a nice & steady 5x after launch

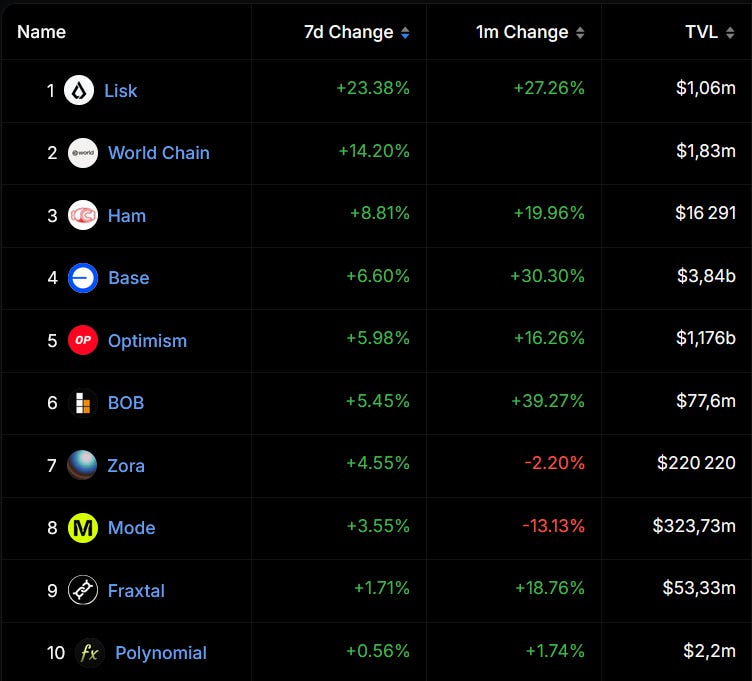

Superchain Stats - TVL Change Leaderboard

Lisk moving to the #1 seat, thanks to uniswap now available on mainnet. BOB surging to rank #4, after an impressive TVL growth! And nothing seems stopping BASE…

Source: https://defillama.com/chains/Superchain

🔵MORPHO : The new Lending/Borrowing stack

Morpho is the #5 lending/borrowing protocol in Crypto with 2.5b$ TVL, versus the leading one being AAVE with 21b$. So why that much interest? Because Morpho is not yet one year old & set to disrupt the lending market.

Starting as a lending yield optimizer on top of Compound & AAVE, Morpho has become Morpho, a permissionless protocol where user can set their own lending/borrowing parameters, and this is a much bigger deal than you think.

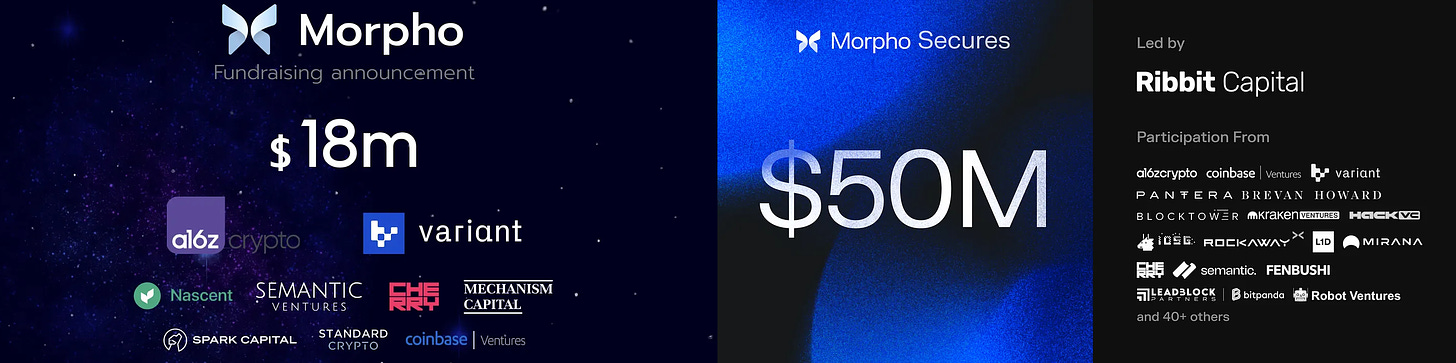

It’s also important to note that Morpho secured in June 2023 18m$ investment and in August 2024 another 50m$ through leading VCs such as a16z & Coinbase Ventures (more in the article) :

Protocol Type: Lending/Borrowing

Tokens: $MORPHO (TGE expected soon…)

TVL: 2.5b$ (which 12% on Base) -> Rank #4 protocol on Base

Today, I’m going to cover:

What is Morpho ?

Pros & Cons

$MORPHO token launch

Yield opportunities

What is Morpho ?

Morpho has been founded by Paul Frambot (DEFI is future of France🥖) and released the whitepaper in October 2023. As you may know, every lending pool has a series of parameters setting up maximum loan to value, liquidation threshold, interest rate curve, and many others more exotic. In AAVE or Compound, these parameters are managed by the DAO, pool by pool.

On the other way, Morpho has objectives to break the Lending Protocol paradigm:

Change the name of “Pool” to “Vault” 😱

Not Trustless: DAO covers the protocol parameters

Not Efficient: It provides inefficient rate spread, low collateralization factors, and charges fees to maintain the platform itself.

Not Flexible: It has a limited number of assets listed. Users have no choice but to subscribe to the one-size-fits-all risk-return profile proposed by the DAO.

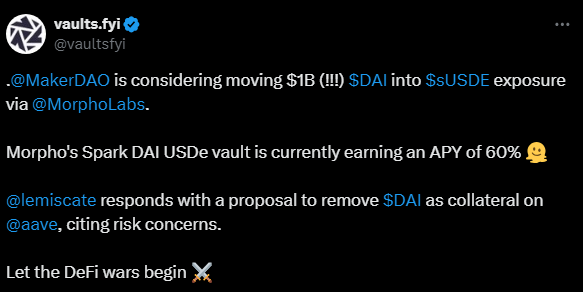

And this different vision of such primitive tool in DEFI started a rivalry between AAVE & Morpho :

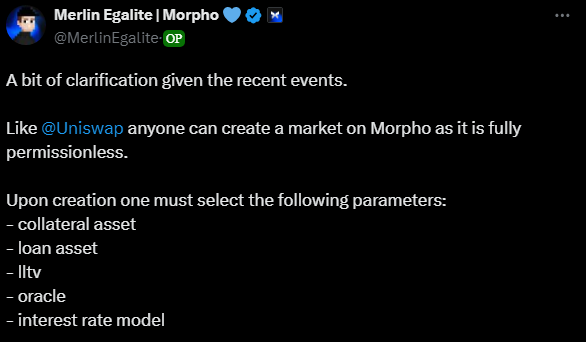

So Morpho is a trustless and efficient lending primitive with isolated & permissionless market creation. Consider Morpho as being the Uniswap of the lending market.

So you may wonder? How, as a user, am i going to set my own parameters to borrow 1k $USDC against $SOL as collateral? Sorry to tell you, but you may not their targetted user.

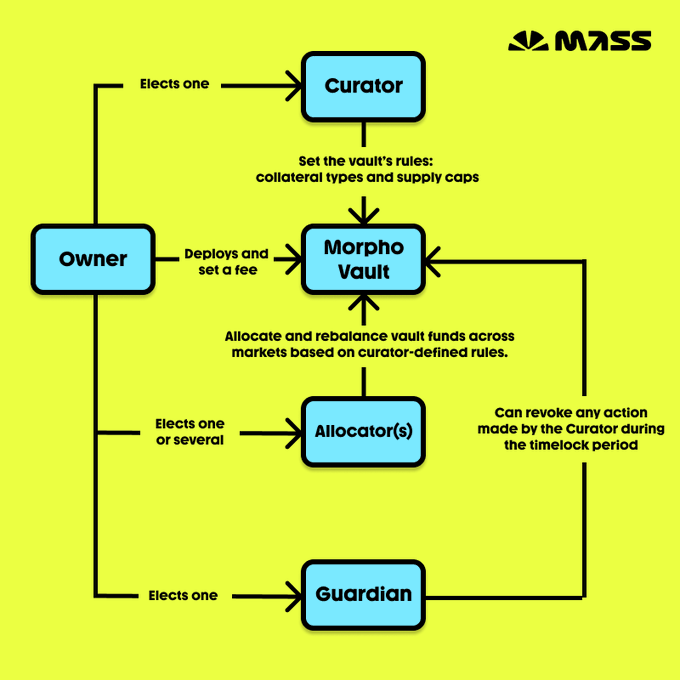

Over time, we have seen some expert companies specialized in Risk Assessment or funds management: Gauntlet / Steakhouse financial / RE7 Labs / MEV capital / Block Analitica / B.Protocol. These projects are called CURATORS.

MASS has made an amazing diagram to explain how Curator fits into Morpho :

Pros & Cons

Pros:

Isolated lending vault protect lenders to bad debt from other vaults

Morpho is building an Infra on which specialist can create any market => the Fat App Thesis

Curators are here to respond to user needs so can create vault with specific parameters and optimize yields

Optimized yield for lenders

More exotic assets such as $uSOL from Universal Asset or the first synthetic $ETH, msETH from Metronome.

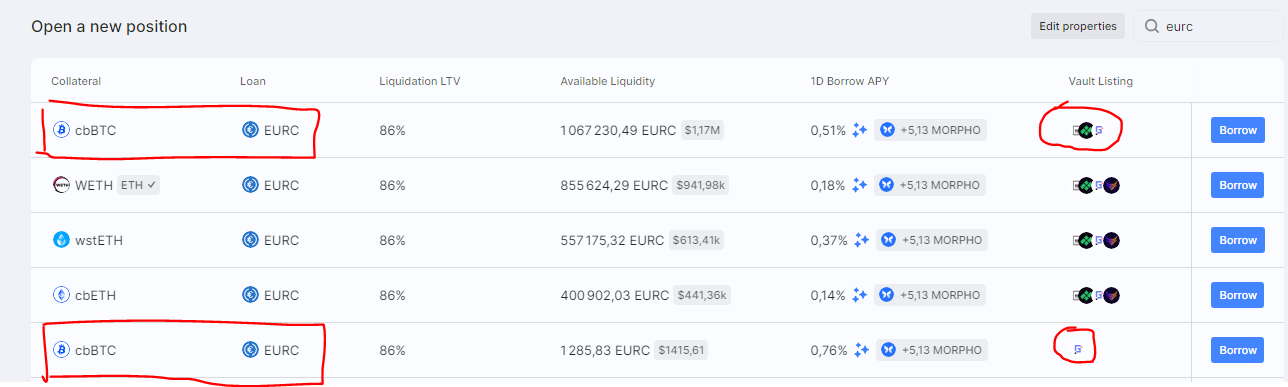

So you will likely find similar vaults but with different parameters, like below with $cbBTC as collateral & $EURC as loan:

Cons:

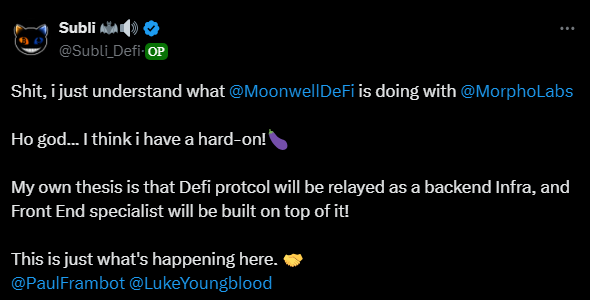

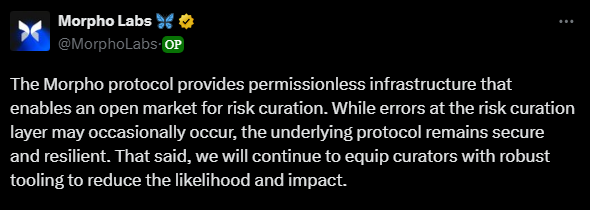

Fragmented liquidity. Having the same tokens curated by different projects may confuse the users => Moonwell has responded to this by developping a yield optimizer on top of Morpho vaults where the vaults supply liquidity to markets deployed on Morpho. Users can borrow from these markets and benefit from higher collateralization factors, lower costs, and deep liquidity

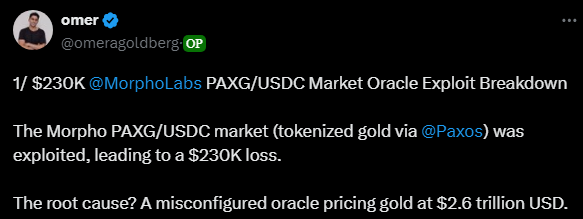

Curator is responsible for their vault security and unfortunately this could lead to some humain failure:

So now, let’s talk about $MORPHO.

$MORPHO token launch

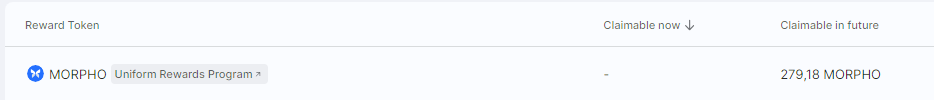

$MORPHO is the governance token or Morpho Labs. An incentive program allowing user to earn $MORPHO based on funds deposited / borrowed on the protocol is live since June 2022. However the current token is not transferable. A recent DAO vote approved the creation of a new liquid $MORPHO token, and will trigger token listing on DEX & CEX.

Ticker: MORPHO

Contract Address: 0x9994E35Db50125E0DF82e4c2dde62496CE330999 (Ethereum Mainnet)

Deployed: 24 June 2022

Maximum Supply: 1,000,000,000 MORPHO

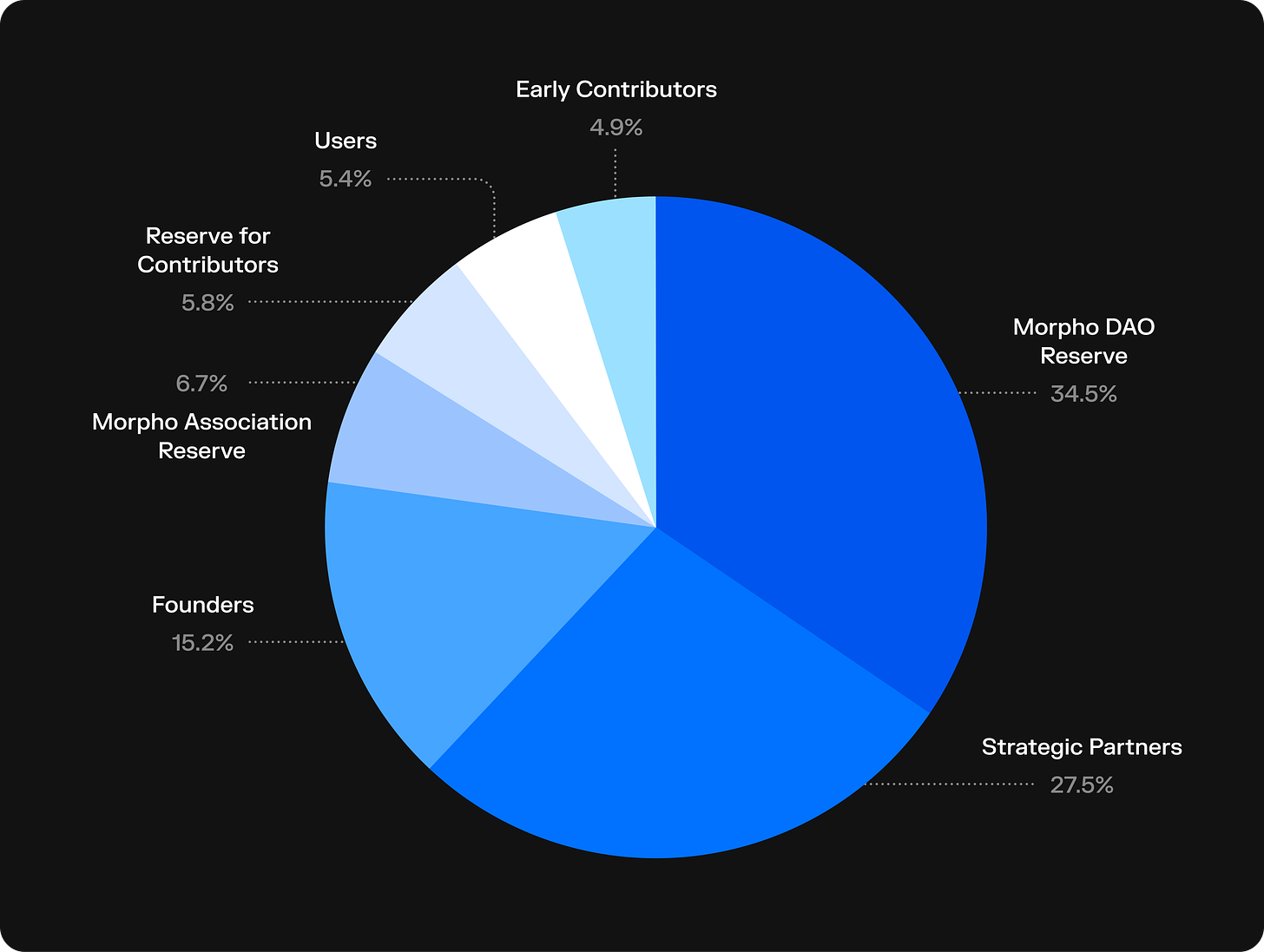

Here is the token distribution :

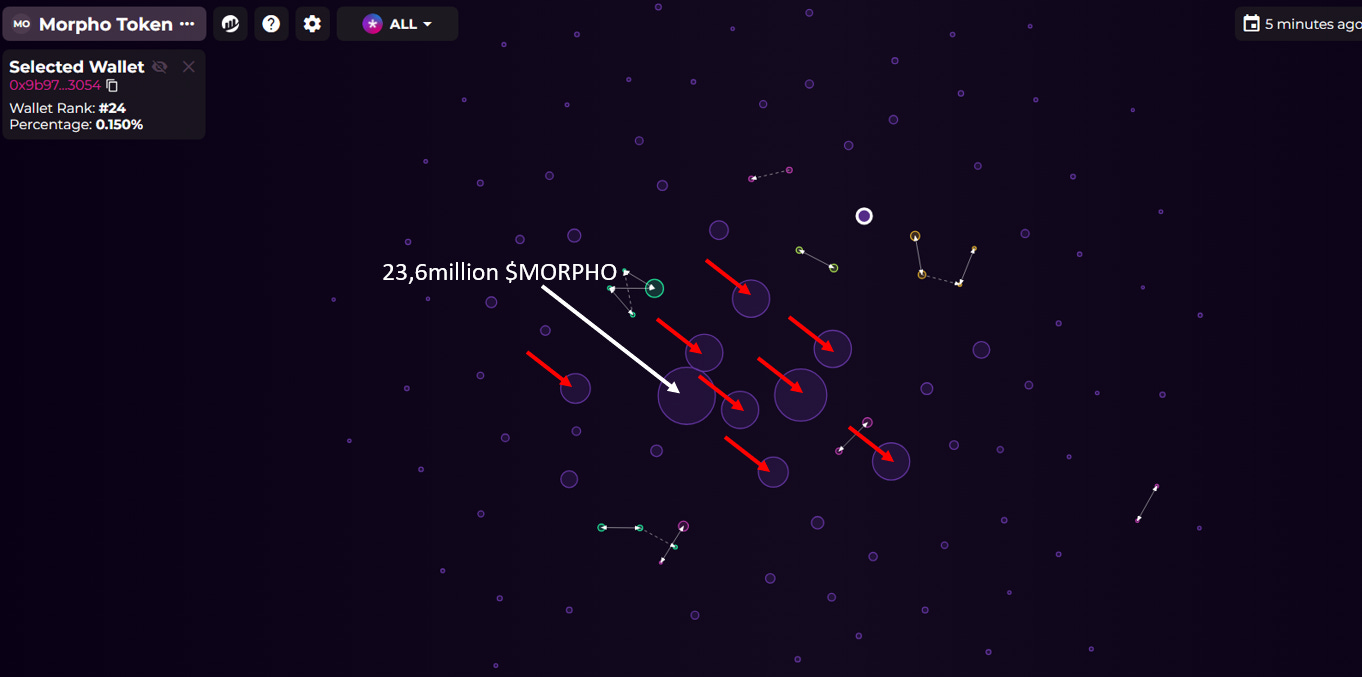

As of end of October 2024, 5.4% of the total supply has been distributed as incentives. And from what I can see from BubbleMaps, there are quite few well positioned whales:

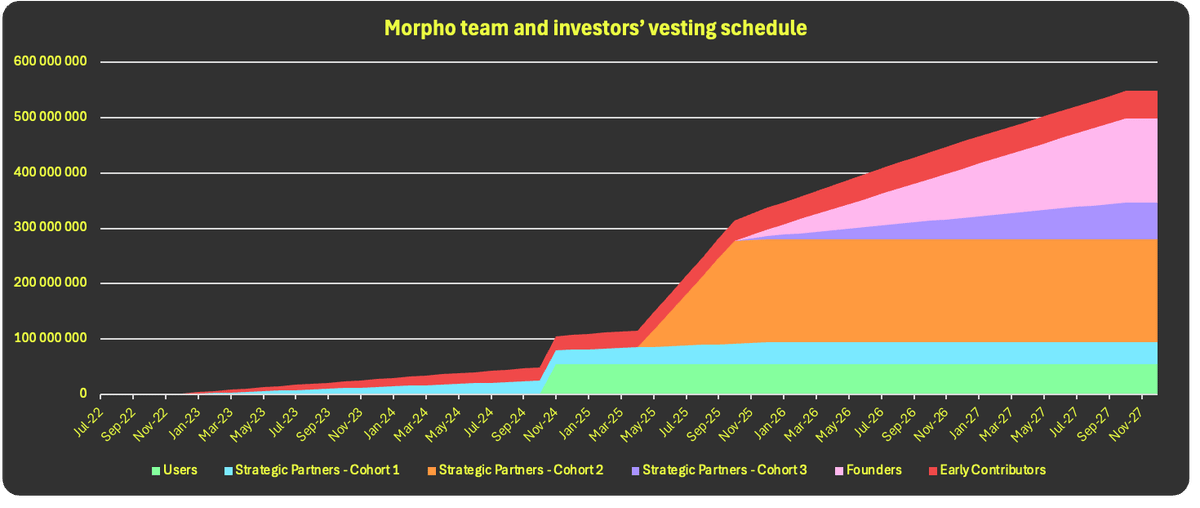

And finally, based on the cliff & vesting schedule, here is the estimated token supply over time (thanks MASS for providing this):

An analysis of this tokenomics shows that if the token listing occurs before April 2025, approx 10% of the token will be in circulation only making it a low float / High FDV project, as we can easily expect 1b$ FDV. Only then, the inflation rate will explode to 500% (annualized) => Expect some high volatility

But wen launch?

A DAO vote just ended, approving the creation of a new $MORPHO token on Base, so expect listing soon on Coinbase.

One thing for sure, as Morpho has been seeded by Coinbase Ventures, and deployed on base, expect $MORPHO on ✈ Aerodrome.

Yield opportunities:

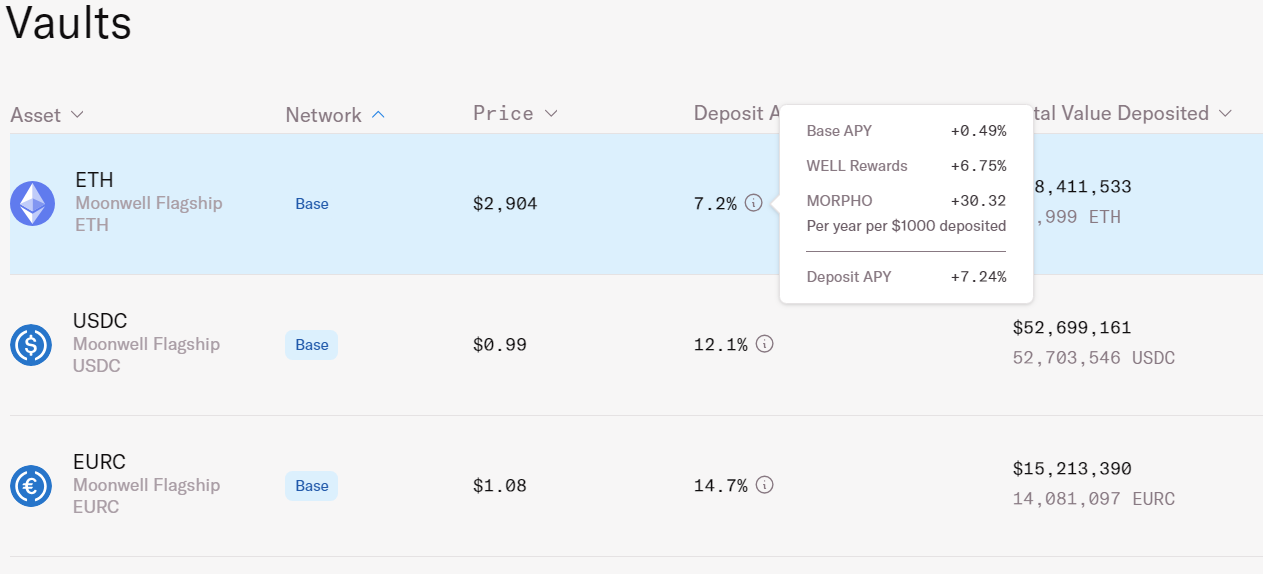

For Lenders, the best is to deploy liquidity on Moonwell Vaults, as described above. Below yield in % excludes $MORPHO as price will be defined after listing. BUUUTTT, if we assume 1b$ FDV, and 1billion tokens, a very basic napkin would be 1 $MORPHO = 1$ => meaning that $ETH vault is currently printing 10.5% and $EURC vault 18%.

Conclusion

DEFI has seen its primitives built during the DEFI summer back in 2020 & 2021. Primitives haven’t changed much, people are even complaining about DEFI getting boring & without innovation since early 2024 (except Restaking pioneered by Eigen Layer). BUUUTTT, yes there is always a but, don’t miss the forest behind the tree.

My own thesis is that DEFI protocols are being built to become the backend into which smart contract will govern the way money flows. At the same time, other protocols will focus on the Front End to propose a greater User Experience.

This is what we see between AAVE & World Financial Liberty (Trump’s sons project), and Morpho & Moonwell.

By building the Morpho Stack, Morpho has become a DEFI Infra project on which everyone can build on top:

And with US presidency election, won by Trump, I expect things to move up quickly.

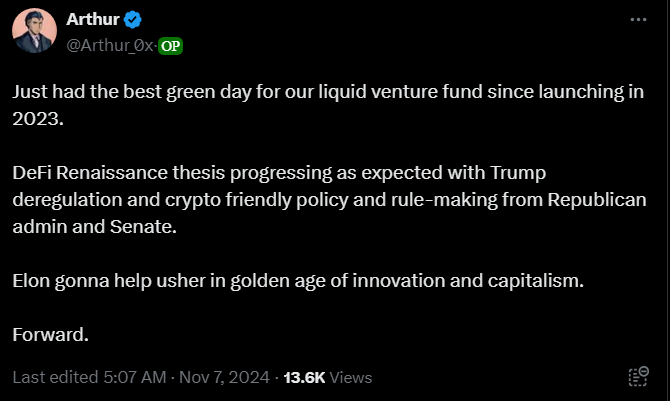

And remember what says Arthur_OX from Defiance Capital, one of the largest liquid fund in Crypto:

🏈 Post of the Week:

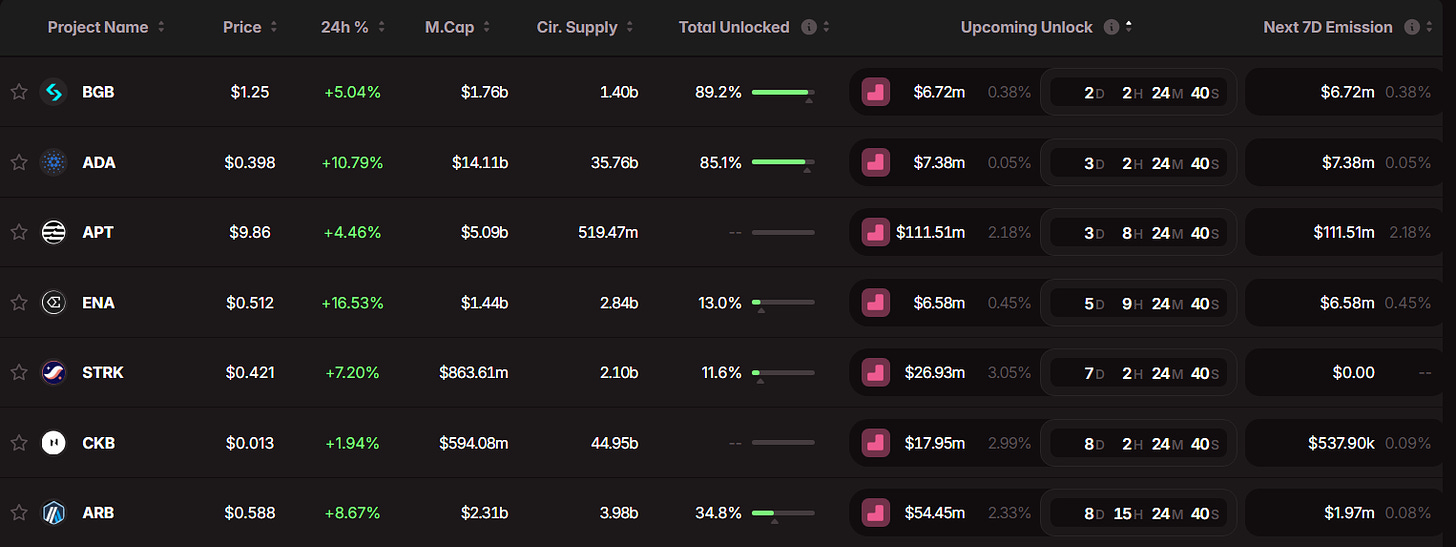

UNLOCK IN THE NEXT 7 DAYS

Referral: https://token.unlocks.app//?aff=Subli or Code SUBL1

Benefit: 15% discount on PRO subscription

Disclaimer: Nothing in this content is financial advice. I may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky. Be ready to loose everything you invest in.