The 🔵Optimist: (L)Earn with Defi #25-2

Learn & Earn with DEFI: Optimism, Base, Mode, Zora, PGN, Lyra, Ancient, Redstone, Worldcoin, Mint, Lisk

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed part 1 [OP Superchain News], don’t worry, just click HERE.

Click on your preferred language to access the translated version:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔵How to Secure your funds in DEFI

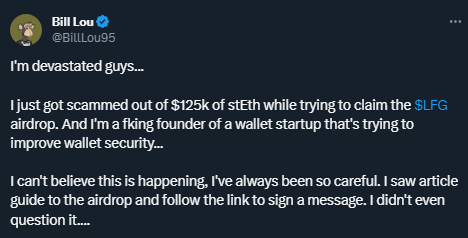

Security must be everybody’s priority. Loosing your funds can happen to anyone, at any time. Scammer are getting smarter over time, such that even DEFI OG & developpers have been recently scammed, loosing thousands of $.

🟢Crypto market review

Bi-weekly update on the Crypto Market. Some bullish sign that could lead to an ETHEREUM + ALT Season.

🍀Trading Tips: OP Trade follow-up

After having spotting the buy zone in our previous newsletter, and after making new ATH, it’s time to follow-up on our trade.

🟤Farming Strategy: Intent X & Hyperliquid Airdrop farming

We explain how to farm Airdrop of what might be the 2 top most interested perps protocols right now with very little risk & at close to 0 cost.

Spotlight project: Oath Ecosystem

The OATH ecosystem is changing the world of DEFI by setting up new standards for security, capital efficiency and real yields.

With Ethos V2 now live, bringing new features such as 1-click leverage & LST as collateral, and updated tokenomics on the way, OATH is set to shake things up on Optimism in 2024. You can find $OATH on Velodrome and check out their site at oath.eco.

Follow Oath Foundation on X & Turn on notifications.

🔵How to Secure your funds in DEFI

by Thomas

If you are active within the crypto ecosystem, you have undoubtedly noticed that scams have been incredibly numerous in recent weeks.

Indeed, the surge in prices and the numerous airdrops have unfortunately attracted a good number of scammers, trying by all means to steal your precious cryptos. And don’t think you’re smarter than them, even OG’s & Builders got hit:

Discover today how the most common scams work to navigate DeFi safely.

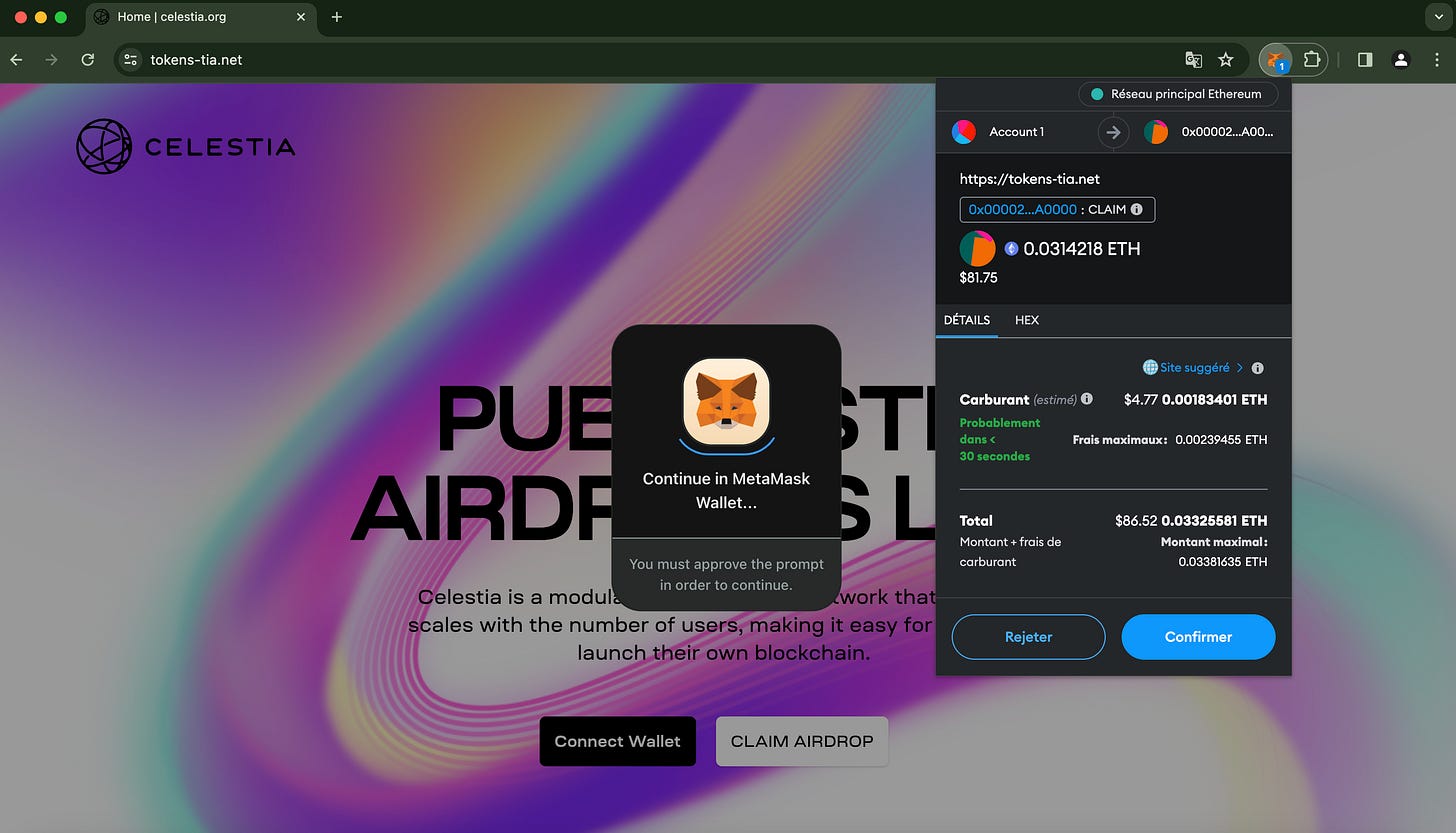

#1 Detecting a fraudulent transaction on a phishing site

Phishing sites are rampant in the crypto ecosystem: these are replicas of real pages that encourage you to sign fraudulent transactions on them.

At the moment, a good number of scammers are creating fake airdrop claim pages to try to get you to sign.

Here is a fake $TIA token claim page. As you can see, the function displayed on Metamask indicates 'CLAIM'.

Except, of course, that is not the case at all: by activating it, it will redirect your cryptos to the hacker's wallet...

Now, several solutions are available to you to avoid falling into this kind of scam:

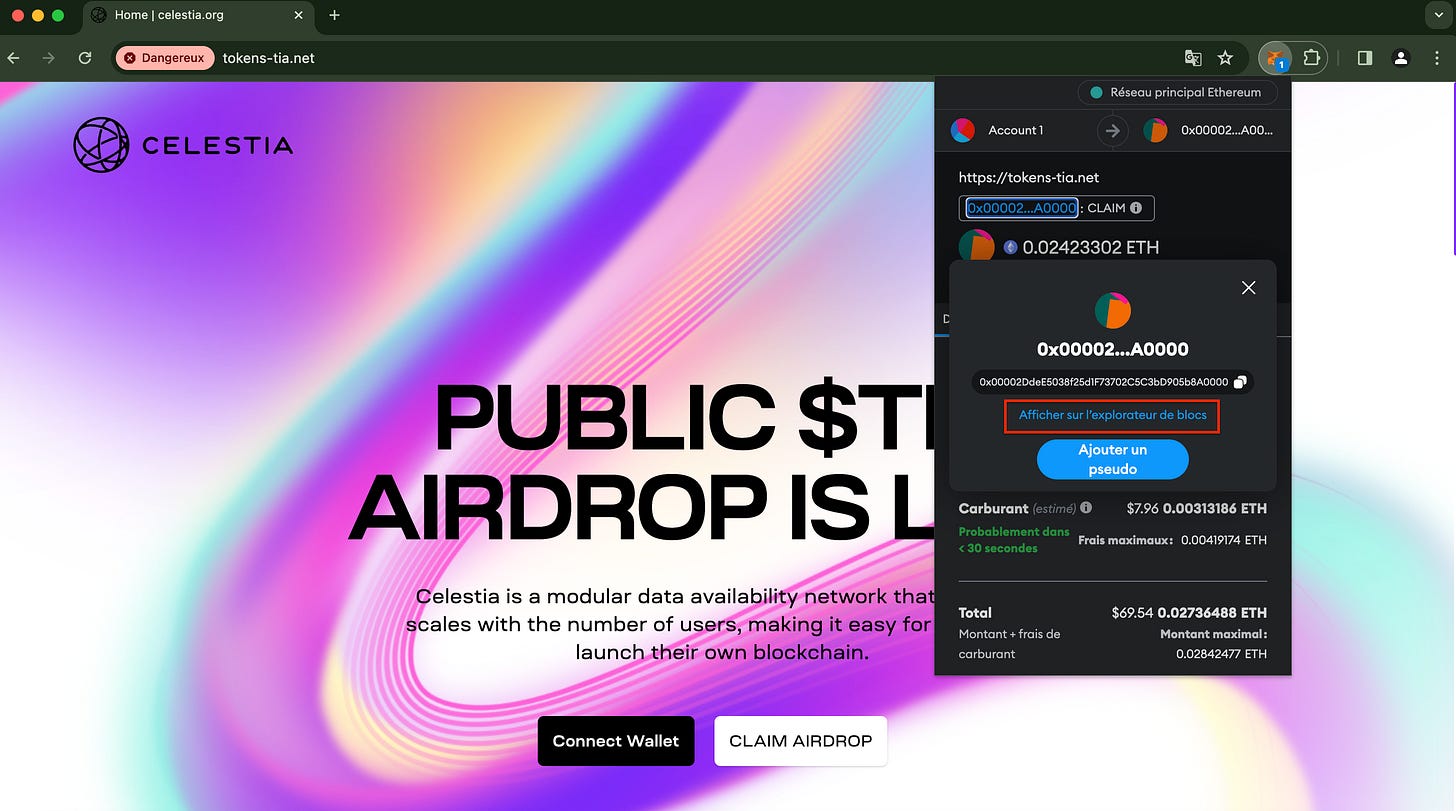

If you use Metamask :

ALWAYS verify the function you are about to activate.

For that, simply click on it and then click on 'View on the block explorer'

This will redirect you to Etherscan (or the blockchain explorer used), and you can verify whether the transactions are fraudulent or not.

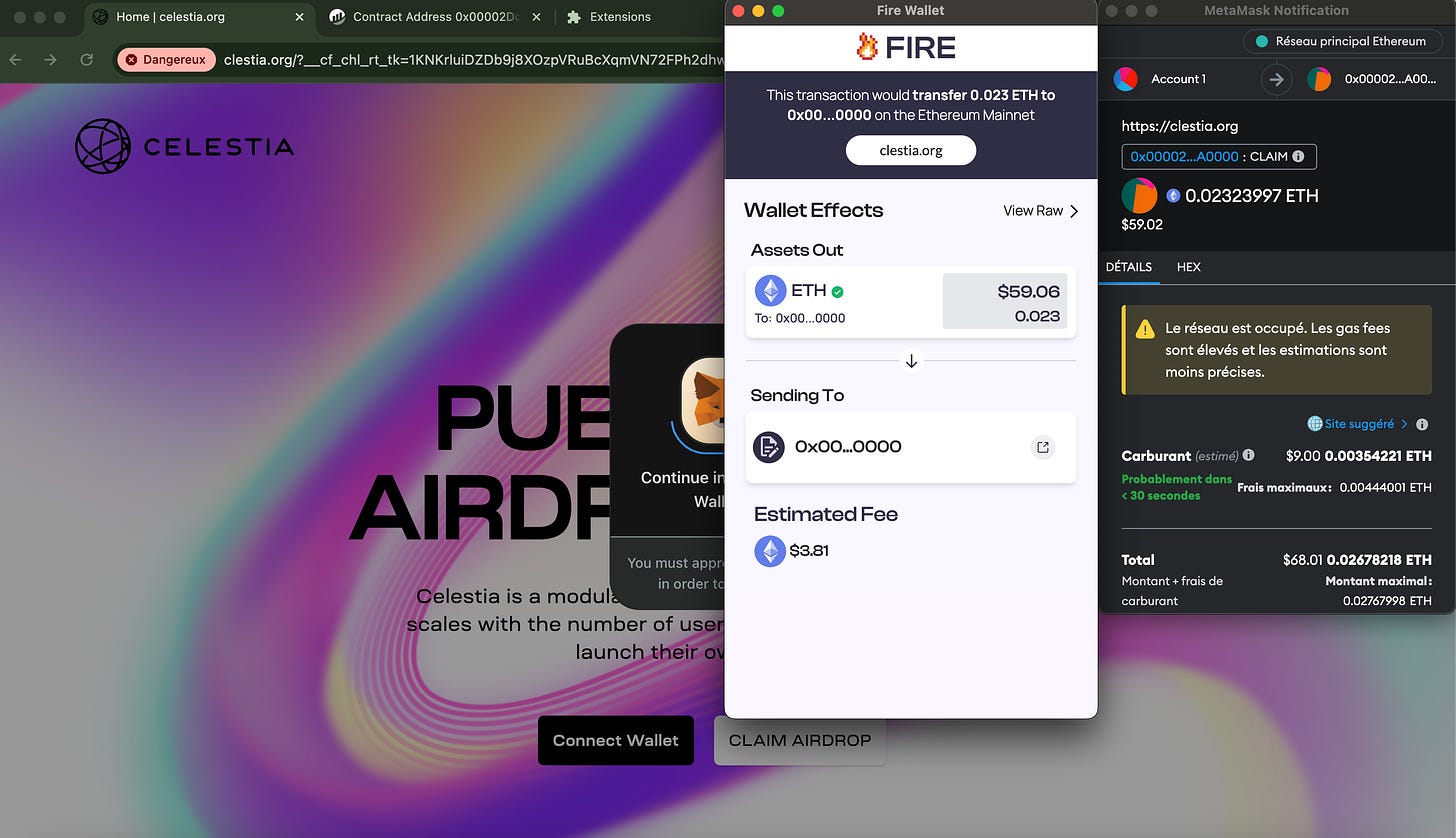

Use the Fire extension for a better preview of the transaction.

In this case, the extension indicates that I am about to send all my $ETH to a contract (and not claim $TIA 🥶).

If you use Rabby or another wallet supporting a better preview of assets:

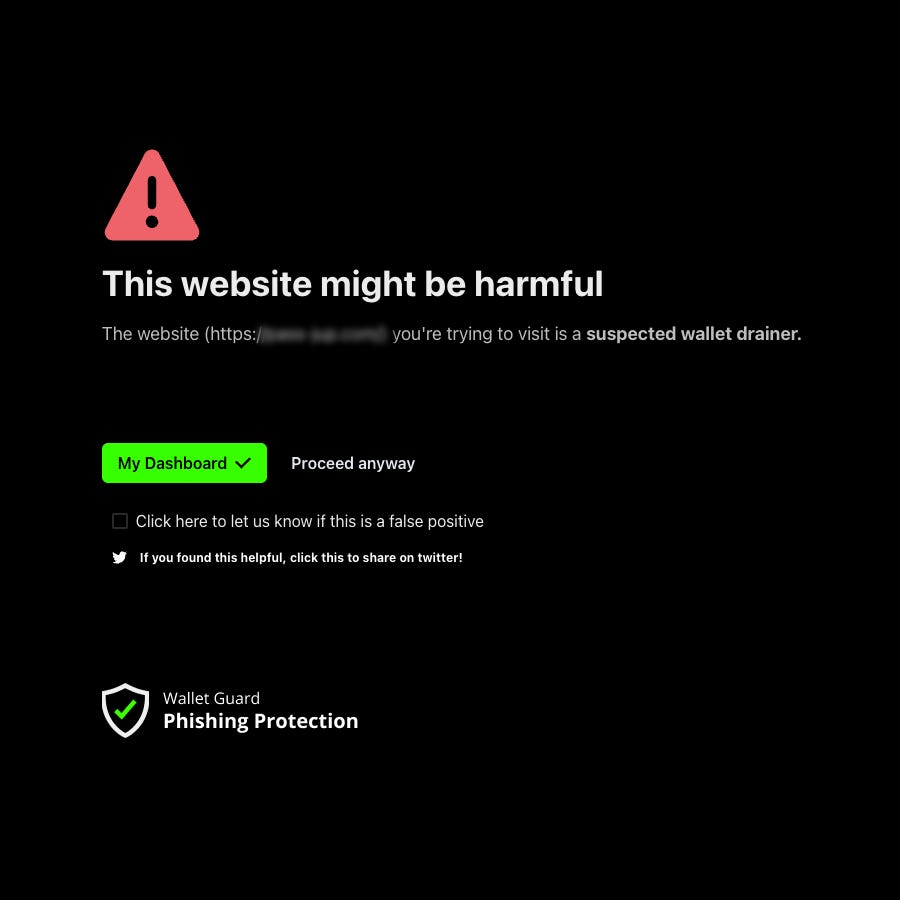

Install the WalletGuard extension, which allows you to receive a notification when you are on a fake site: it can save your life.

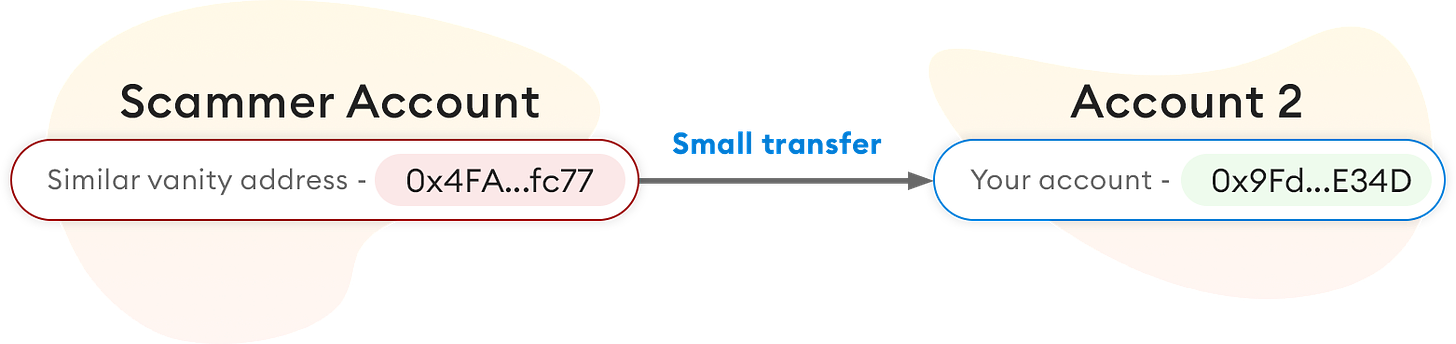

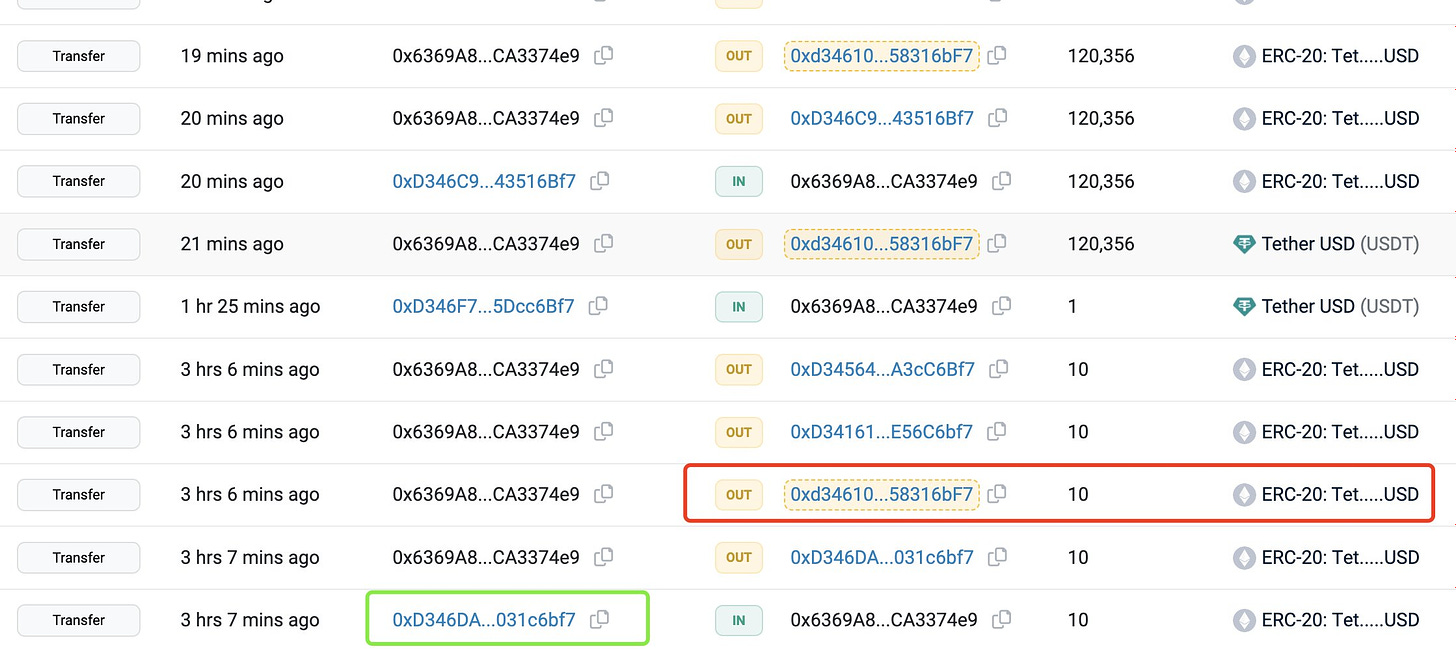

#2 Protecting Yourself from "Address Poisoning"

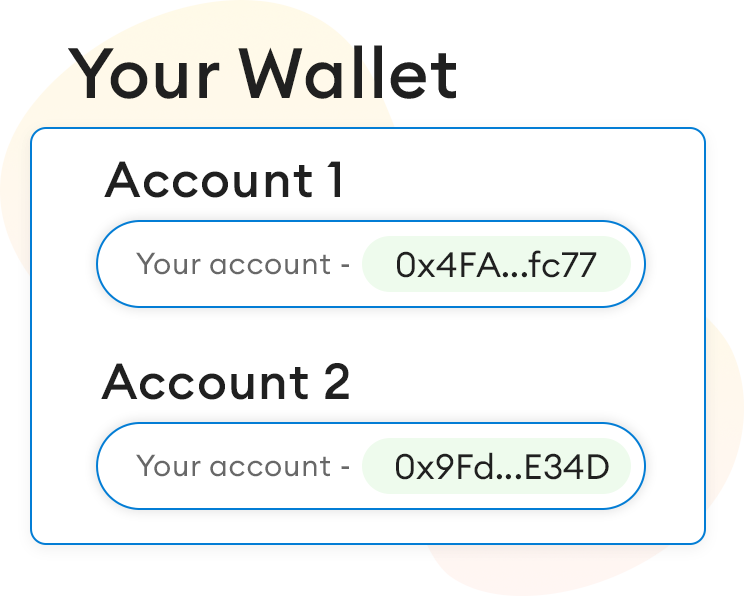

This type of scam is prevalent when you are an active user of DeFi. It occurs when you regularly make transfers between your accounts.

The scammer will replicate one of your addresses and send you cryptos.

By doing this, he will 'poison' your transaction history: the last cryptocurrency you received will no longer come from your second account but from the scammer's, who will have an address similar to yours.

By copying the last address from your transaction history, you are therefore likely to directly select the scammer's address and send your tokens to them.

Source :

https://twitter.com/realScamSniffer/status/1746166042827837828

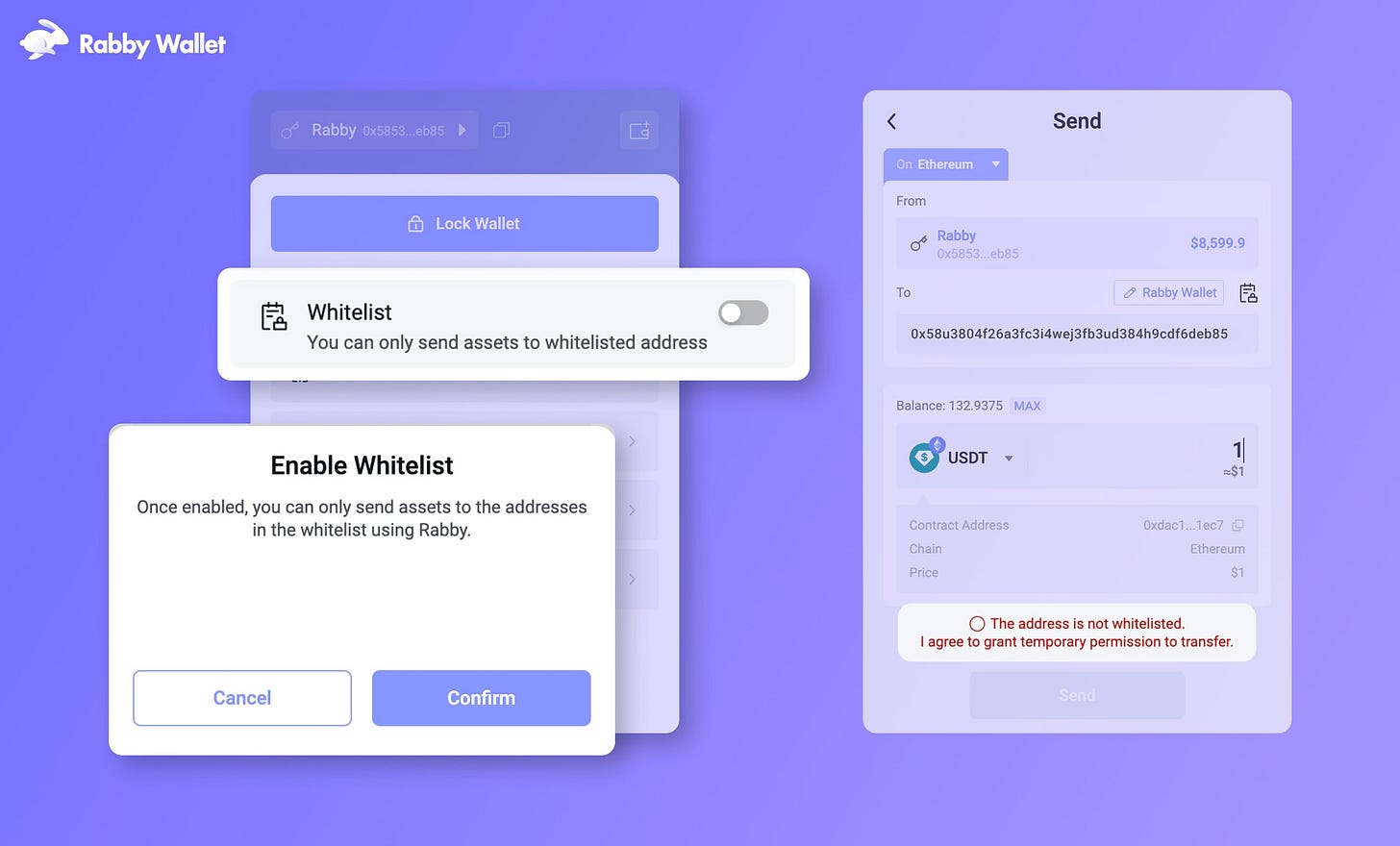

This kind of manipulation can be truly devastating in case of inattention. That's why Rabby has implemented a superb UX to prevent this.

By activating the whitelist system on all your addresses, you ensure that you do not fall into this kind of trap.

(Do it right now, it could save you!!!)

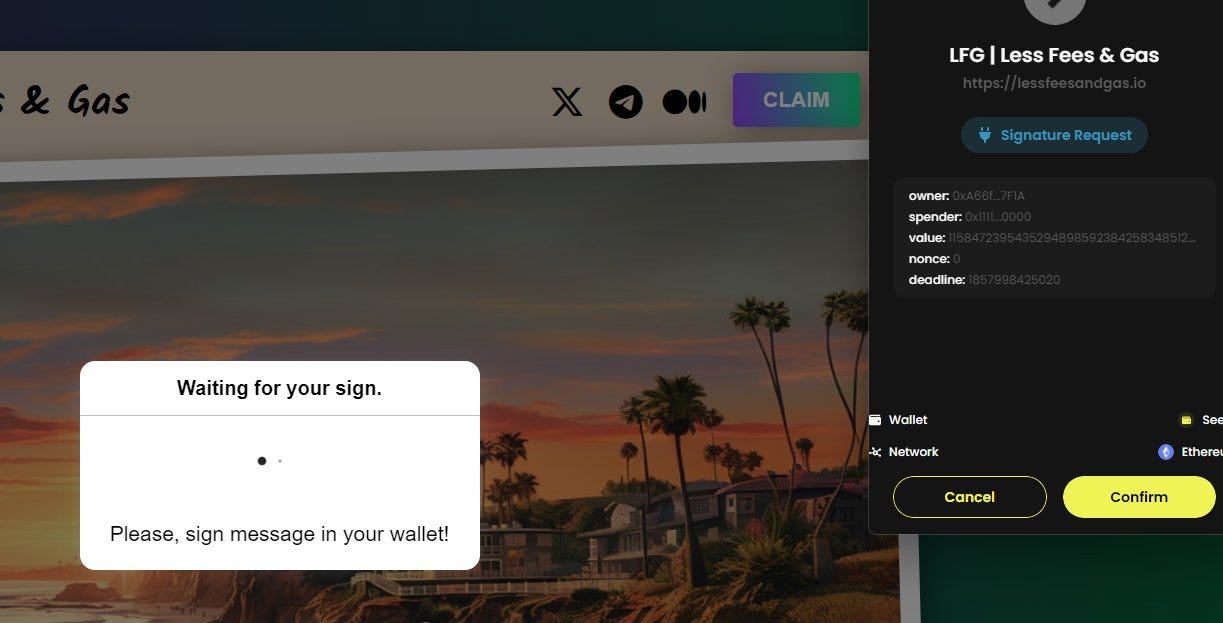

#3 Detecting falses signatures

This last scam is much more sophisticated as it becomes undetectable during the asset preview in some wallets.

It occurs when you are on a phishing site: your wallet asks you to sign a transaction to log in.

Except, the signature is fraudulent: by signing, you transfer all your funds to the scammer's wallet.

What makes it difficult is that DeFi users are accustomed to signing messages to connect their wallet to some sites. And Rabby doesn't always manage to detect the content of the signature...

So, it is more likely that you fall for this scam if you do not have the right tools.

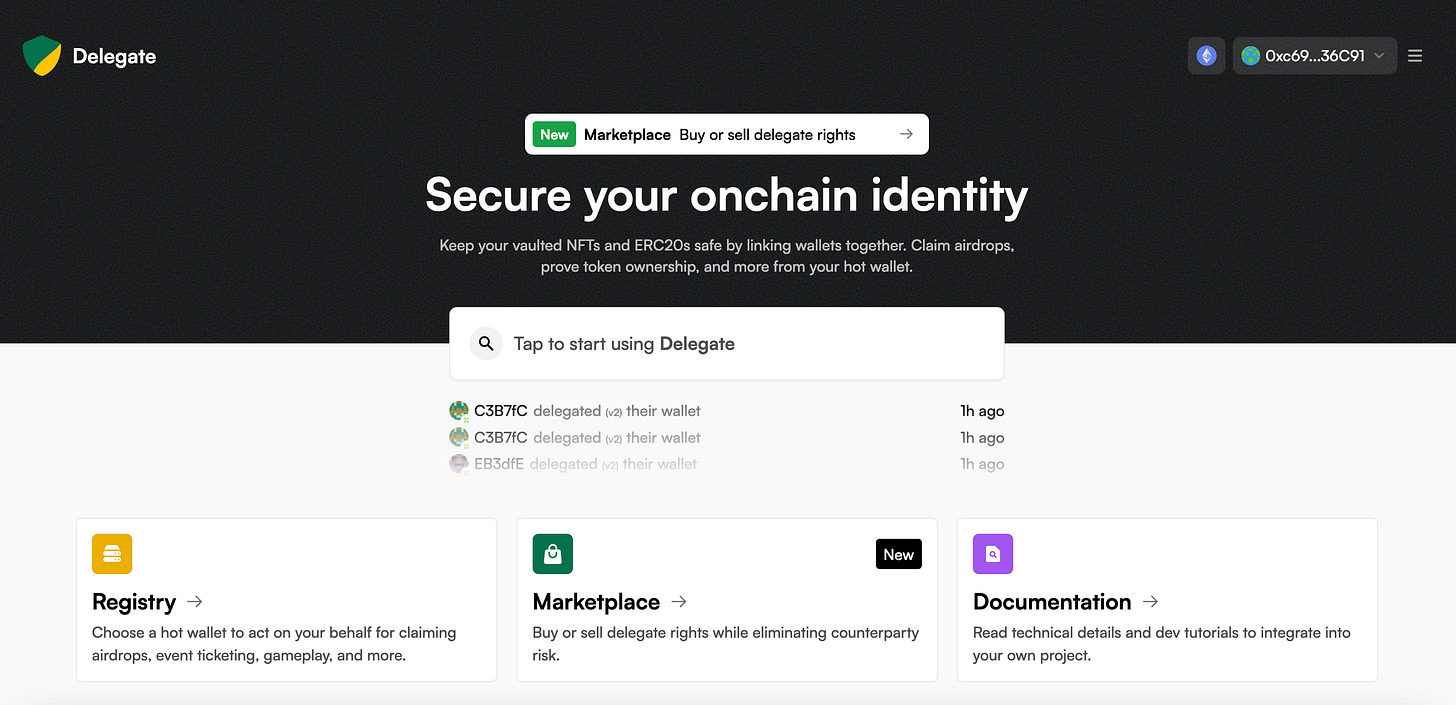

To minimize the risks, we recommend:

To install WalletGuard extension to receive an alert when you are on a phishing site (similar to scam #1).

To use Delegate.io to delegate the signature of your cold wallets to hot wallets.

As you can see, navigating through DeFi today is a bit like moving on a battlefield: one wrong step, and you explode.

Therefore, it is necessary (in addition to following the advice mentioned above) to keep one thing in mind: 'If you're not sure what you're signing, DON'T SIGN.!!!'

Don't succumb to FOMO, always double-check the sites you are on. And if unfortunately, you happen to fall victim, try to diversify your assets across multiple addresses.

The wave of opportunities has also brought scammers, so stay safe, friends 🙏.

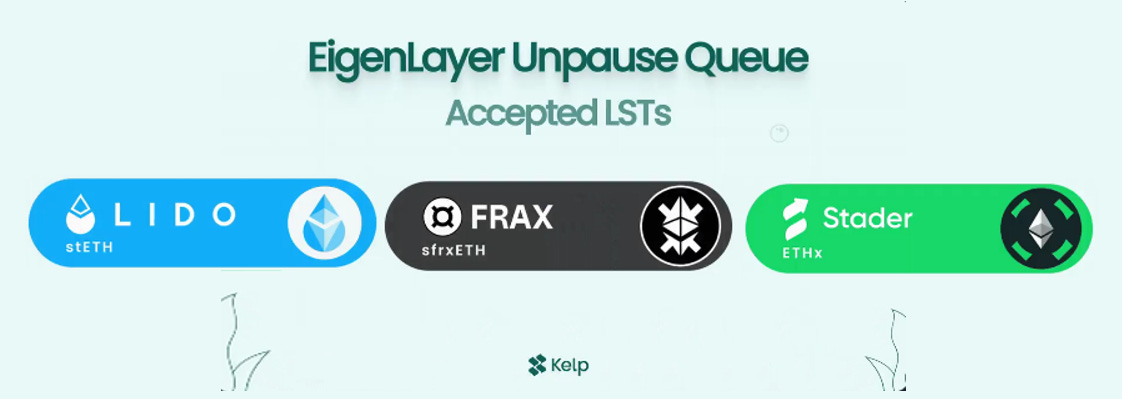

Spotlight project: Liquid Restaking by KELP DAO

Eigenlayer cap increase is planned for 5 days ONLY from Jan-29. Kelp DAO is thrilled to announce to open up deposit right now. In addition to stETH, ETHx, you can now deposit sfrxETH from FRAX.

Deposit right now, receive $rsETH, and chill while earning :

Staking Yield

EigenLayer point rewards

Kelp DAO point rewards + BONUS

Future re-staking Yield

Round 2 is here, don’t miss it, and deposit now HERE.

🟢Crypto market review

by Axel

Bitcoin

Since our last analysis, the price has shown minimal movement. The year-end holidays are not lead to market activity, with market makers taking a break… They are human being like us, remember. Let's start with a clean slate and analyze the market objectively to be prepare for the next move.

Bullish signs: We are currently in an uptrend; resistances are meant to be broken.

Bearish signs: Bitcoin is currently encountering three significant resistances.

Bitcoin is approaching the resistance of the previous bullish channel (orange). It has touched the 0.618 Fibonacci retracement level (see point 2 in the educational content of NL#20). It is at the top of its bullish channel (red).

On the daily timeframe, the bearish divergence has evolved into hidden bullish divergence. See NL#2 for more information about divergence.

DXY (U.S. Dollar Index):

The DXY index appears to be seeking a relief bounce. We have a bullish divergence on the weekly chart.

Feel free to refer to NL #1 to understand how to interpret the DXY index.

CME gap

Following the bullish momentum in the cryptocurrency market, a new CME gap has been created. However, we believe that the CME gap will be filled before the newsletter is published.

The currently open CME gaps are at the following price levels:

$43,000

$40,000

$31,600

$29,800

$27,000

$26,300

$20,500

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin Dominance: In our previous analysis, we noted the weakening of this indicator. Now, we see a breakdown of the trend to the downside, which could be favorable for altcoins.

Tickers TOTAL2 & TOTAL3: We've seen several candles confirming the breakout from consolidation for these indices. This is excellent news for altcoins, which have now entered bullish territory.

Ethereum: Ether is the leading altcoin in terms of market capitalization. It's crucial to keep an eye on it as it often serves as the first signal of an altseason. When Ethereum experiences a strong uptrend, it tends to pull the entire altcoin market along with it.

Ether is currently facing resistance, but once the bullish trend is confirmed, it will provide a strong bullish signal for altcoins.

Conclusion

Bitcoin is currently facing three significant resistances in high timeframes. It will likely require consolidation before breaking these resistances and re-entering its bullish channel (orange).

While we maintain a bullish stance, considering the bullish divergence on Bitcoin in the daily chart, we will adjust our stablecoin allocation based on risk management. This adjustment will happen when the Fib 0.5 is breached to the downside on the daily chart, which corresponds to levels below $42,500. This approach aims to facilitate buying opportunities between the Fib 0.236 and 0.382 levels.

Regarding altcoins, we will continue to ride the trend until signs of a reversal. A resumption of the bullish trend on the ETHBTC pair would be a strong signal, complementing the breakout from consolidations in TOTAL2 & 3 Tickers, along with the waning dominance of Bitcoin.

🤯Quote of the week

By courtesy of QuotableCrypto

🍀 Trading Tips: OP Trade

Since the last technical analysis of the $OP token, the price has experienced an upward movement. This outcome was predictible for those closely monitoring the trade, as we had emphasized the importance of watching for a breakout from consolidation. This trading technique was introduced in the educational content of NL#19. The price is now approaching the resistance of the bullish channel:

The price is now moving between the purple and red lines. Profits were taken at the purple line. This doesn't mean the movement is over, but, as with Bitcoin, the token will likely need to consolidate before making new highs.

On the daily chart, the price surged once the 0.236 Fib was broken to the upside.

We remain bullish on the token as long as the price is between the purple and red lines on the weekly chart. If the red support is broken to the downside, we will sell 30% of our position in line with our risk management.

🟤Farming Strategy: Intent X & Hyperliquid Airdrop farming

By Subli

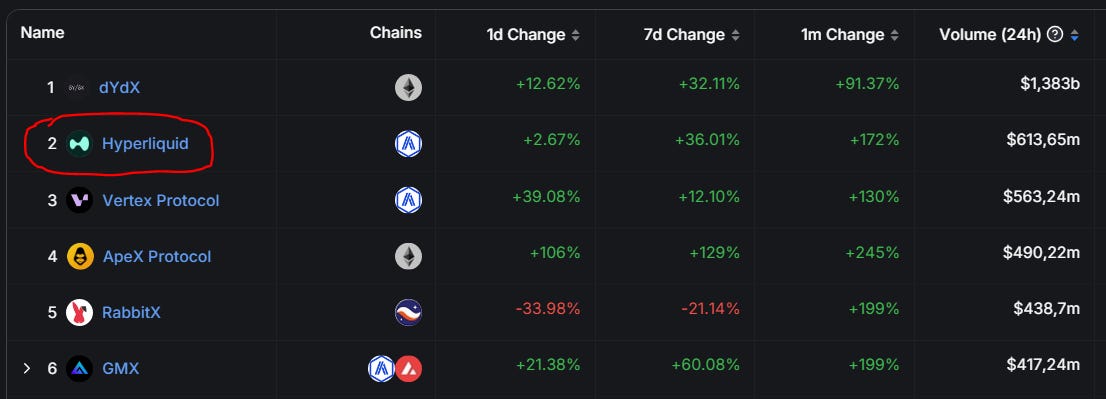

Perpepetual protocols are still in my TOP PICK protocols for 2024/2025. So why these 2 protocols? Here is why:

#2 DEX in terms of Volume according to Defillama

Chain: Arbitrum

No Token : Airdrop highly expected

Launched 2 months ago, top 24 in trading volume

Chain: Base

No token : Airdrop highly expected

How to farm both airdrops at 0 risk & cost?

Delta neutral is your answer.

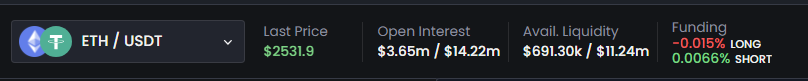

LONG: Take a long position without leverage on INTENT X. Funding rate: you pay +0.015%/hour => 131%/year

SHORT: Take a short position of the same amount without leverage on HYPERLIQUID. Funding rate: you get paid -0.0128%/hour => 112%/year

Your short profit/loss is compensated by your long loss/profit, and you only pay 131%-112%=19% APR of fees.

This strategy is pretty simple, and is being used by few people. I’d like to thank An0n for providing this very nice tip. And to thank him, you will find his referral here below:

Hyperliquid: https://app.hyperliquid.xyz/join/AN0N

Intent X: https://app.intentx.io/trade/BTCUSDT?referral=an0n

You can as well follow this big whale on Debank.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

The Optimist Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.