The 🔵Optimist: (L)Earn with Defi #36

Tips, Tools & Strategies for your personal journey in DEFI on the Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed our previous Superchain News, don’t worry, just click HERE

Click on your preferred language to access the translated version:

Chinese - French - Japanese - Persian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

👿 Drakula App is the new Tik Tok

Built on Farcaster, powered by $DEGEN, and with a 1m$ Creator fund, Drakula App is the new consumer App driving thousands of users to create SHORTS videos. Read to discover Drakula.

💹 Crypto market review

Bi-weekly update on the Crypto Market.

➡➡➡ 🤯 Quote of the Week

🔎 Technical Analysis: Centrifuge ($CFG) & Ondo Finance ($ONDO)

🔴 Silo Finance is live on Optimism!

For those new to Silo, their architecture not only limits risk exposure but also allows the integration of exotic and less capitalized assets. Check out our deep dive below to learn more!

Spotlight : Segment Finance

Discover Segment Finance, your top-tier lending and borrowing protocol on 🟠BOB. Deposit your assets and unlock a world of earnings: lending yields, Segment points, and Spice points with one of the highest ratio on BOB $/point, from the ongoing BOB Fusion Season 2 campaign.

With integrations of major assets from Threshold, StakeStone, Sovryn and working with reliable Oracles providers such as DIA & Redstone, borrowers can leverage their portfolio low interest rate.

Start Bridging on 🟠BOB here and connect to https://app.segment.finance/

👿 Drakula App is the new Tik Tok

by Tom

Drakula is a video SocialFi app on BASE. Since its launch in March, over 20,000 content creators have already joined. Currently, Drakula combines short-form video scrolling with a speculative mechanism à la friend.tech.

But the goal is much bigger for this app built on top of the Farcaster social graph: Could Drakula move from Degens to mass adoption?

Drakula App Link

A Social App…

In essence, Drakula is a social app. Users can access it through a browser on Android mobiles and desktops (it’s also available on Apple TestFlight). You can sign in with your Farcaster, Google, Apple, or… TikTok account.

Once in the app, it’s very familiar: your feed is composed of short videos that you can enjoy and doomscroll endlessly.

Scroll through your feed and discover a variety of content : From dancing and music shorts to foodie adventures, fun with pets, and lots of artistic performances,.... You'll also find top Farcasters and famous web3 podcasters like Bankless and Laura Shin sharing snippets of their shows.

Fueled by Speculation

But what sets Drakula apart is its SocialFi twist? Letting you bet on which creators will rise to fame.

Each time a creator uploads their first video, a unique creator token is minted. These tokens can be traded by the community via a bonding curve mechanism similar to friend.tech.

The price of a creator token starts at 1.060 $Degen (around 20$ today) and increases as more tokens are bought, following a quadratic formula.

$Degen

On Drakula, the price of creator tokens is denominated in $Degen, one of the tokens emerging from the active community on Farcaster. It gained significant traction during the spring Base boom (coinciding with Drakula's launch) and later gave birth to The Degen L3 chain. Right now, $Degen is sitting at a $329.9M market cap, which would give an impressive $858.37M fully diluted MC.

$Degen has evolved from being just a memecoin. It has built its own L3 network on Base (the Degen chain uses $DEGEN as its native gas token) and other utilities are being added to it. For instance, it's now possible to mint certain NFTs on Zora by paying with $Degen instead of ETH.

$Degen community members are incentivized to stay active on Farcaster and hold a specified amount of $Degen (10,000) to qualify for token rewards. Once qualified, users receive a daily tip balance based on their points, which they can use to tip other members on Farcaster.

Currently, the second round of $Degen airdrops is underway in its fifth season, with more than 25% of the tokens remaining for future distribution.

From Degen Dungeon to Consumer App?

While this speculative aspect of Drakula initially attracted a degen crowd, the long-term goal is to move towards broader user adoption by improving the user experience, expanding the app's features, and most importantly, attracting talented creators.

Drakula could demonstrate the tangible benefits of onchain social apps for creators.

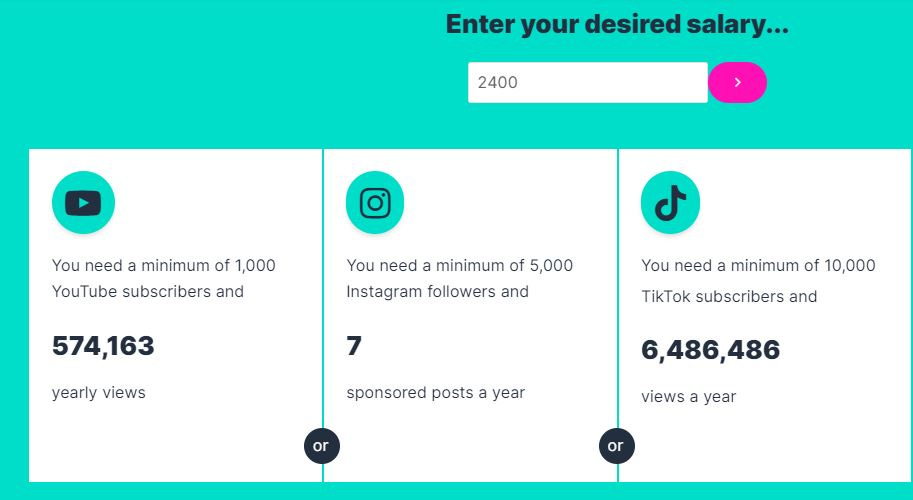

The problem : It's no secret that web2 platforms like TikTok, YouTube, and others pay very little per view, with extremely high thresholds to start generating a decent income for the time invested. For example, to earn a modest $200 per month ($2,400 annually), you would need something like 6 million TikTok views a year! Thresholds are high, resulting in only a few major influencers making a significant income.

Alternative Revenue Models for Creators : Web3 socials like Drakula could offer a different business model by paying content creators their fair share, even if they don’t have millions of views and followers.

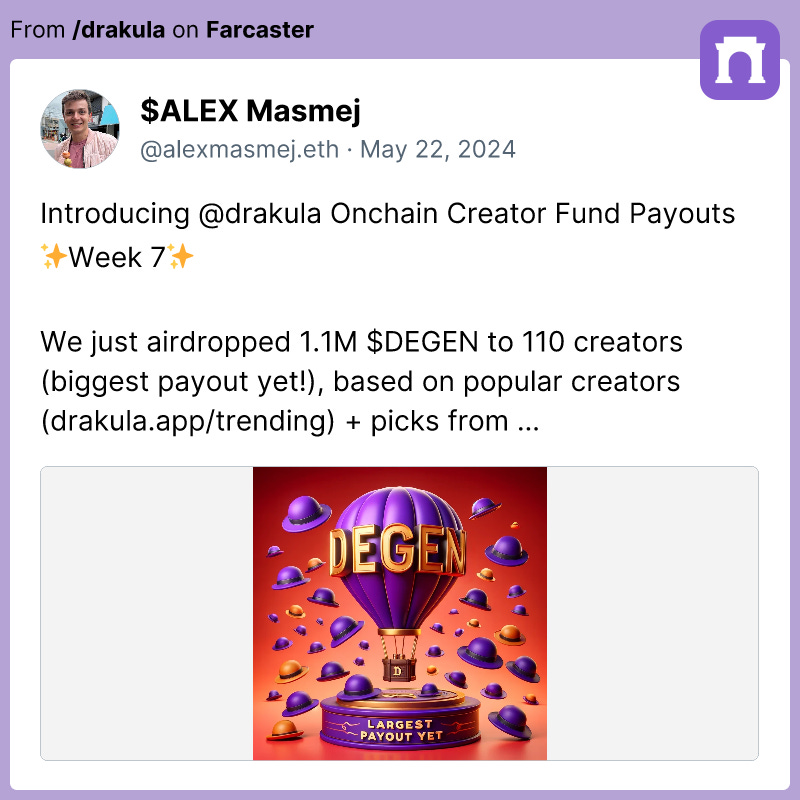

As we have seen, creators on Drakula earn $Degen from the trading fees of their creator tokens. In the first two weeks of Drakula's launch, creators collectively earned over $1 million in $Degen (although the speculative hype has since cooled).

But trading fees are not the only possible source of revenue.

Drakula also encourages quality content via the Degen Creators Fund. This fund supports creators weekly by providing additional financial incentives.

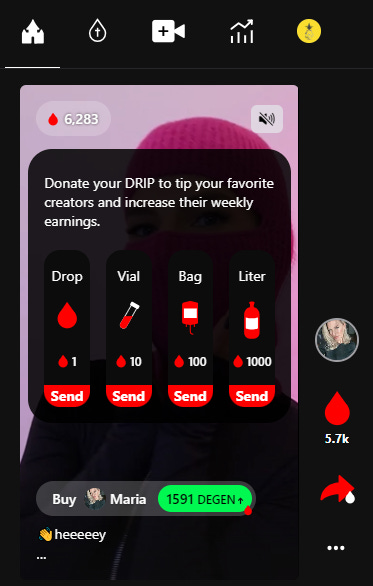

To boost engagement between creators and their community, Drakula also features “Drip” (formerly known as Blood), the app’s points system. The more you use the app, the more Drips you earn, and you can tip your favorite creators with it. It’s similar to a ‘like button’, but with a spectrum, and it boosts creator revenue.

The Drakula team is agile and open to considering other economic models. They might move beyond the Speculative Bonding Curve, which remains a PVP degen trading mechanism that may not be sustainable long-term. In the future, Drakula could adopt a model where users pay a stable price for a creator's NFT, which could then grant access to special experiences or perks related to the content creator (for now, the creator NFT has no other utility than trading).

Source:

A Bunch of Challenges

Challenges are not lacking for Drakula to be truly successful: Improving the feed algorithm, moderating AI content, moving beyond the bonding curve model, further leveraging the Farcaster social graph (if you sign in with your Farcaster account, your followers are imported, but this feature doesn't yet have a real impact on your feed.)

Drakula will also need to address the temptation of “earn to watch” points mechanism, which could be easily gamed. Regulators could be against such incentives, especially considering the trend in some countries to reduce screen time, particularly among young people.

Conclusion

If you're a video content creator, you should definitely give Drakula a try to experiment with its innovative revenue model.

As a user, whether you’re speculating on creators and the degen side, accumulating some Drip points (and betting on a potential Drakula airdrop), or just discovering cool video content, Drakula offers a glimpse into what a consumer app with a decent UX can look like.

💹 Crypto market review

by Axel

Bitcoin

In the previous article, we highlighted that buying opportunities were emerging. We might have entered the market a bit early since the altcoin market has been in the red for the past two weeks. However, is this the time to panic? Let's study the market factually.

In the weekly timeframe, Bitcoin continues to consolidate above its monthly support.

In the daily timeframe, Bitcoin is retesting its bull flag and continues to consolidate. Bitcoin is on support.

Bullish signs: In the weekly and monthly charts, Bitcoin is consolidating above its monthly support (green line). In the daily chart, Bitcoin is consolidating and is on support (blue and purple).

Bearish signs: We are in the summer trading period.

DXY

The indicator is still moving within its range. A short-term bullish spike has caused a significant downturn in the overall market.

USDT.D

We were bearish on this indicator. However, it is currently moving upward, which is not favorable for the cryptocurrency market. We hope this is just a dead cat bounce, as this indicator typically moves inversely to the market.

Altcoins

Bitcoin Dominance: The indicator is still trading above its blue support. If the indicator breaks above the 57% resistance, it would be a strong bearish signal for altcoins. We are currently near resistance. The resolution of the ongoing bearish divergence formation may take some time.

ETHBTC: Ether has broken above its blue resistance from the bottom of its range. The weekly divergence is still ongoing. We need more consolidation before next leg up.

TOTAL3: The indicator is at support. We hope this is the bottom because if the support is broken, the next significant support is at 450-470B market cap.

Conclusion

Bitcoin continues to consolidate and is currently on daily support. We can expect a significant rebound soon. If the supports are breached on the downside, we will cut a portion of our positions to buy lower. However, this will only be a small part of our positions because the market has already corrected significantly.

Regarding altcoins, we are approaching red signals, but we haven't reached them yet. We will discuss $CFG and $ONDO in the second part, which we presented in previous articles. Indeed, we believe the narratives that worked earlier this year will continue to perform as the market recovers.

From a market sentiment perspective, we see more traders on Crypto Twitter talking about market tops and deeper corrections to $44,000. We don't think these price levels are realistic today. This has never happened during a halving cycle. Moreover, institutions are accumulating Bitcoin and preparing for the arrival of other ETFs.

Patience will be rewarded once the summer trading period passes. These times are challenging but necessary to exhaust all sellers, allowing the market to regain momentum when the time comes.

🤯 Quote of the week

By courtesy of QuotableCrypto

🔎 Technical Analysis on $CFG, $ONDO

By Axel

In previous newsletters, we presented $ONDO and $CFG. Today, we propose to follow up on these trades to see if our plan is still relevant.

$CFG (Centrifuge)

In newsletter #34, we presented this altcoin. We were bullish as long as the uptrend was defended (red support) and the RSI consolidated above its support (green).

Since then, both the price and RSI have broken below their respective supports. Therefore, our trading plan is no longer valid. In this case, we prefer to cut the position with a loss of about 10% and wait for a new setup to emerge.

We had started to buy around the $0.46 support level at a proportion of 20% while waiting for a setup to develop. It now appears that the next significant support is around $0.35. However, given the current market conditions, we will build our position over the medium term.

$ONDO (Ondo Finance)

We discussed this altcoin in the previous newsletter. As a reminder, we were bearish on this asset in the short term. We observed that the price was very close to the 1.618 level, which is a profit-taking zone, and the RSI was showing divergence on the daily chart.

Since then, the price has corrected by 30% and has approached our target. We mentioned that the price would likely return to the psychological price level of $1, which aligns with Fibonacci level 1.

Currently, we have started buying by placing some orders around $1. Given the market conditions, we will enter gradually and build our position for the medium term.

🔴 Silo is Live on Optimism!

By Thomas

Dear readers,

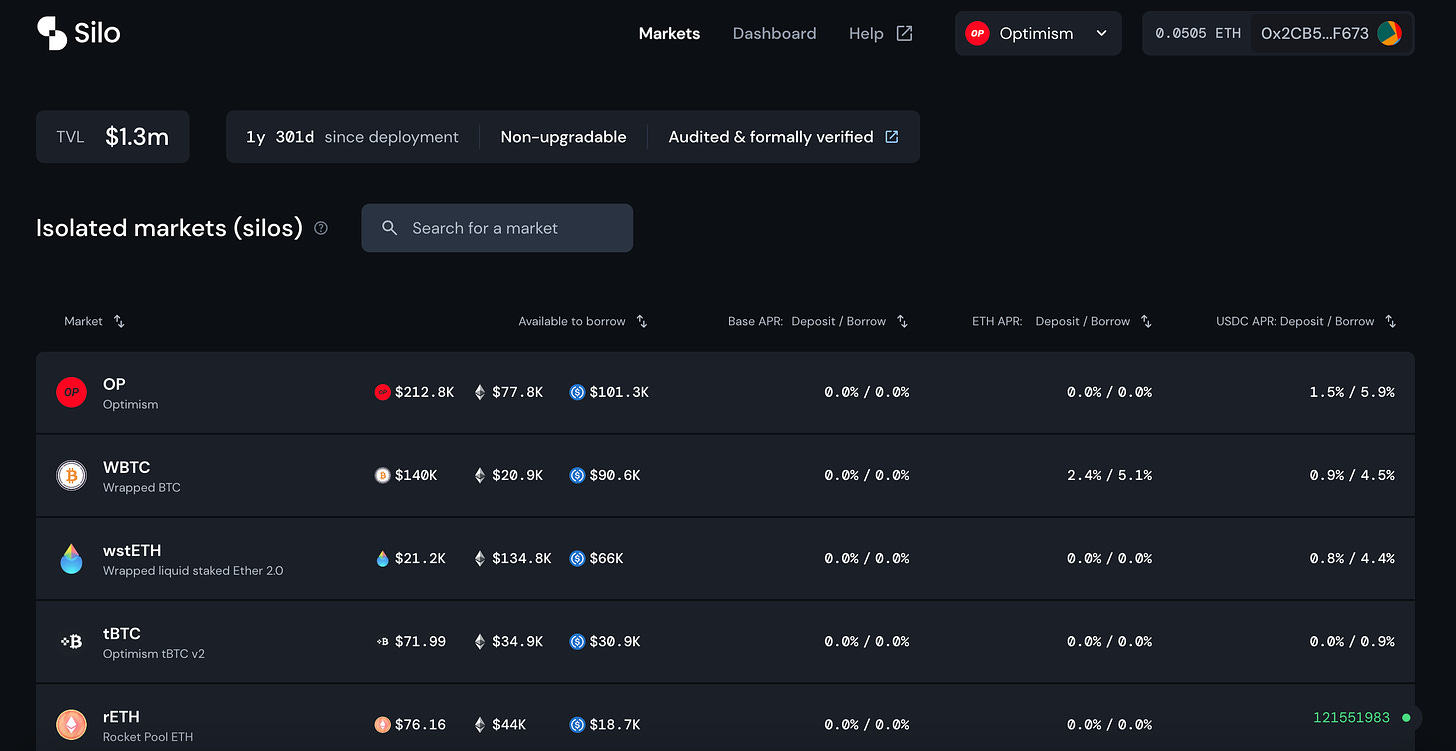

Silo is now available on the Optimism Mainnet!

If you are an active farmer but unfamiliar with this protocol, you are in the right place. Silo is the perfect platform for your borrowing strategies.

Discover what it is and how to use it correctly.

What is Silo ?

Silo is a borrowing protocol based on isolated markets.

Unlike Aave, where all assets are grouped within the same pool, Silo operates with independent markets (called “silos”).

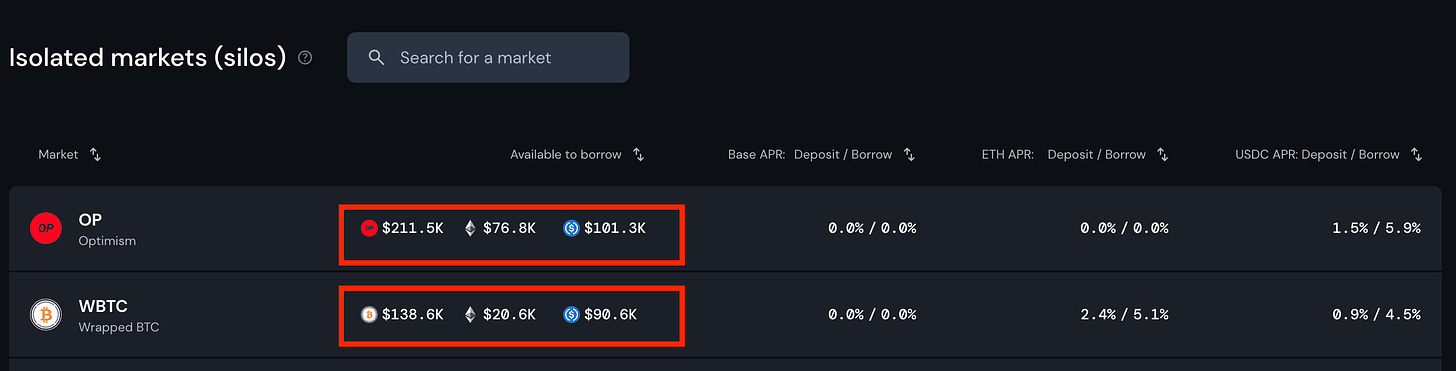

As you can see, each silo has its own assets. These are divided into two categories:

Base assets: These are the assets specific to a silo. You won't find a Base asset in two different markets (e.g., OP).

Bridge assets: These are assets that are exposed to the Base asset. Bridge assets are used across multiple silos.

Example on the Optimism silo: OP is the Base asset, and ETH and USDC are the Bridge assets.

This architecture allows for risk limitation, as if you do not want to be exposed to a particular Base asset, you simply avoid interacting with its silo.

Why is the isolated market approach interesting?

As mentioned above, the concept of isolated markets is particularly useful for compartmentalizing your risk (and preserving the health of the protocol in case of a malfunction of an asset).

But this architecture is also relevant for easily integrating "degen" assets (no need for an asset to meet specific risk parameters).

This is why you can use exotic assets on certain silos (such as pt-eETH) or less capitalized assets (such as VELO).

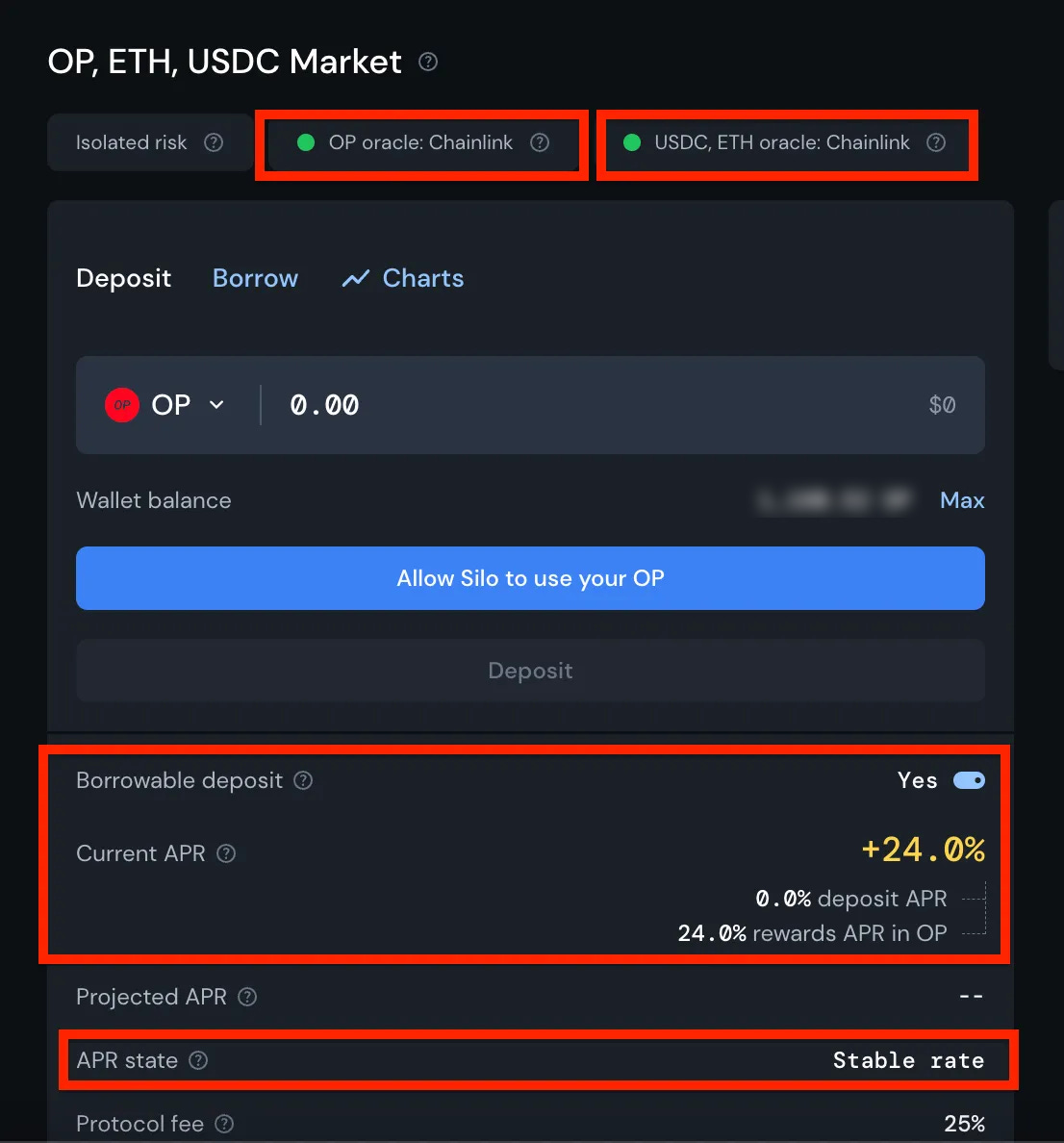

The silos have common components in which their own risk parameters are defined. By clicking on any silo, you can find:

The oracle used

Borrowing parameters

Interest curve

Collateral status

These parameters allow you to easily see what you are exposed to.

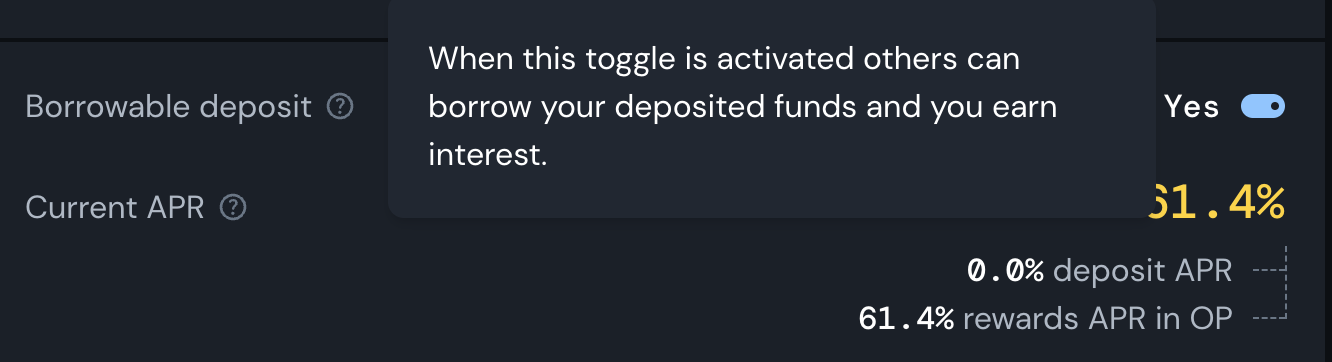

And the collateral status is particularly useful for lenders: it allows you to protect your deposit.

Indeed, when this function is activated, no one can borrow the cryptos you have deposited. However, you do not earn any APR. Therefore, you have two choices:

Protect your deposit if you want to add an additional security measure.

This is relevant especially when the utilization rate of the deposited asset is at 100%. It allows you to still withdraw your assets.Gain more yield if you want to prioritize the efficiency of your strategy.

Deployment on Optimism

As stated in the title, Silo is now deployed on the Optimism Mainnet.

This integration is significant as it coincides with the launch of a rewards campaign in OP.

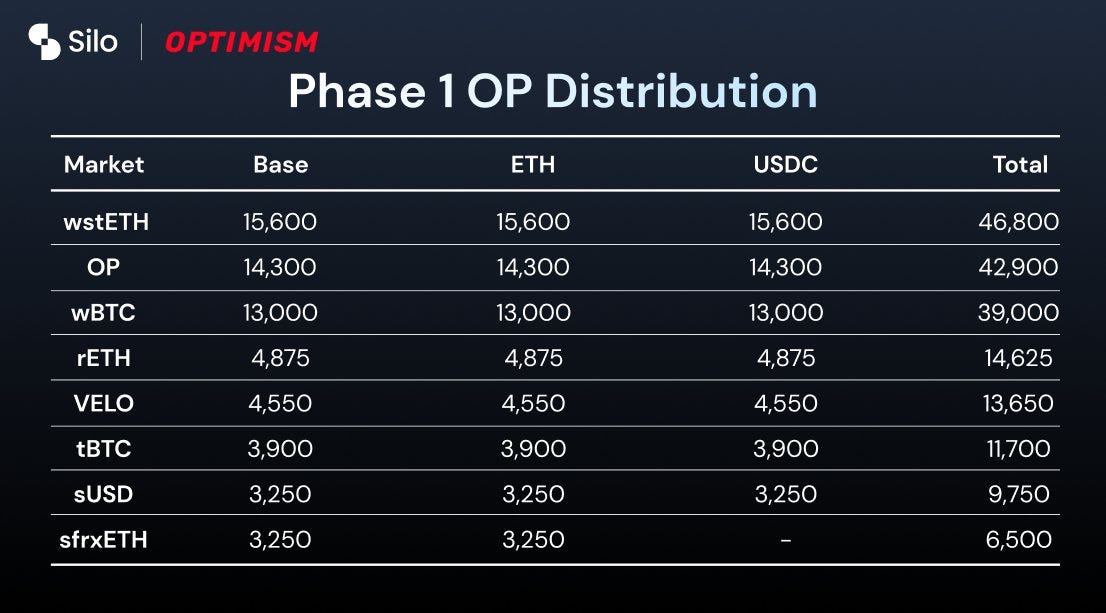

In total, 250,000 OP will be distributed to lenders in silo. The distribution occurs in two main phases, each lasting 60 days.

100,000 OP will be distributed in the first season and 150,000 in the second. Here is the breakdown of rewards for Phase 1:

Since the campaign started today (18/07/24), it's probably relevant to deploy positions to maximize OP rewards...

Silo token

Finally, Silo has its own token.

Named $SILO, it can be converted into veSILO by locking tokens for a defined period (from 2 weeks to 3 years).

Holding veSILO offers a multitude of benefits, including:

Increasing your yield when interacting with a silo (lending and borrowing)

Receiving a share of the SiloDAO revenues (if the DAO chooses to activate revenue sharing).

Voting on SILO emissions for cross-chain lending markets

Creating proposals such as the deployment of gauges

As of today, this new governance system has not yet been deployed. It will be released simultaneously with the launch of SiloV2.

The new version of the protocol will integrate new components such as this new governance, permissionless markets, and new liquidty vaults 👀

Check out this proposal to learn more.

Conclusion

This presentation of Silo is now complete! Using Silo can be very relevant for generating yield on exotic assets or simply compartmentalizing your risk.

Since the platform has just launched on Optimism, there are still plenty of opportunities to explore there.

Happy farming!

The Optimist Social accounts:

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.