First of all, i’d like to express my thanks to you readers, for your comments, support, likes on this Journey. Big 👏 to the team for making The Optimist the go-to Media for everything about DEFI on Layer 2 chains.

Click in your preferred language to access the translated document:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Turkish - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🟡New chain on the Superchain: Mode Network

Mode Network is a new chain, built on the OP Stack, part of the Optimism Superchain. Founded by crypto OG & pro marketers, and based on new collaborative model Onchain Collaborative, here is a quick presentation of what you should expect.

🟣Projects Research : Oath Ecosystem - The new Era

The past 3 months, the Oath Ecosystem has overcome a major LIFT. Let’s dive in Ethos Reserve V2, Oath Chapters, Digit.xyz & brand new $OATH tokenomics.

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live :

Entangle: New blockchain providing a layer of liquidity & decentralized oracles for omni chain farming. Testnet V3 live & Mainnet around the corner.

OpenCover & Nexus Mutual: Onchain Insurance or Cover is one of the tool that can get your funds back after a protocol attack. Discover what they can offer.

GOVERNANCE & VOTE TIMELINE

If you wish to delegate your OP Tokens to Subli => Go to this page, and click on DELEGATE. Delegate Address: 0x3b128c6c1207d72092a8b3f6d651dfe54682a404

Newsletter Recommendation: Blocmates

Ever wondered why you’re behind in the markets? Probably because you’re not subscribed to the blocmates newsletter. Landing every Friday and packed with:

🔥 Market commentary

🔥 The Degen corner

🔥 Project updates

🔥 The latest headlines

🔥 AND tons of actionable alpha

Gaining an edge has never been this fun! What are you waiting for?

Subscribe → Newsletter | Telegram ←

🟡New chain on the Superchain: Mode Network

by Stacy

In the ever-evolving landscape of blockchain technology, a new contender has emerged with a bold vision for the future. Mode, an L2 solution built using OP Stack and set to be a part of the Superchain, is designed to catalyze hyper-growth within the Ethereum ecosystem. Mode is championing a growth-first approach that promises to redefine the web3 experience.

Building Mode: A Growth-First L2 Solution

The architects of Mode are seasoned veterans from the largest ecosystems in web3. Their collective experience has crystallized into a singular vision: an L2 that not only supports but actively incentivizes and rewards the triad of developers, users, and protocols.

Mode's mainnet is poised to launch with groundbreaking features:

Contract Secured Revenue: Developers will earn a share of the fees generated by the smart contracts they deploy.

Referral Revenue: Rewards are in store for those who refer new participants to the network, fostering a culture of growth and collaboration.

Project Growth Dashboard and Tooling: A suite of analytics and integration tools will empower developers to scale their applications and communities effectively.

Mode's ambition is not just to establish a leading L2 platform but to become the central hub for users and liquidity within the Superchain ecosystem.

A Platform Approach to Ecosystem Building

Reflecting the platform-centric models of the early 2010s internet companies, Mode draws inspiration from the likes of Shopify. Just as Shopify evolved from a store builder to an integrated platform for growth, Mode is set to provide web3 developers with a comprehensive dashboard and access to state-of-the-art growth tools.

Integrations Powering the Mode Dashboard:

Spindl: A cutting-edge web3 analytics tool.

Guild: Tools for automated community management.

Addressable: Solutions for launching targeted web3 advertising campaigns.

Galxe: A leading platform for building web3 communities.

JokeRace: Governance participation tools.

3RM: A web3 CRM for relationship management.

Quest Terminal: Micro airdrops for on-chain actions, developed by Rabbithole.

These integrations are designed to offer developers unparalleled access to distribution channels, enabling them to build and scale sustainable on-chain businesses.

Joining the Mode Ecosystem

Mode is actively inviting applications to join its Public Testnet, offering support through Discord and Twitter. The ecosystem is already bustling with a variety of applications and protocols:

Deployed to Testnet:

Mode Bridge: The native bridge facilitating seamless transactions within the ecosystem.

Thirdweb: An open-source web3 development stack.

Pyth: A provider of real-time market data across numerous blockchains.

Blockscout: A comprehensive open-source blockchain explorer.

In Progress:

Hyperlane: An interoperability layer connecting blockchains.

Covalent: A unified API for historical blockchain data.

Snapshop: A decentralized governance voting platform.

Upcoming:

Connext: A leading interoperability protocol.

The Graph: An indexing protocol for organizing and accessing blockchain data.

Aori: A non-custodial trading infrastructure for decentralized options and spot trading.

Becoming a Mode Cooperator

Mode is excited to unveil Cooperators, their ambassador program. This initiative is a testament to the thriving Mode community and its commitment to collective growth. As a Cooperator, members will:

Gain direct access to Mode's core team.

Receive career development opportunities through mentoring and hands-on experience.

Enjoy early access to Mode's new releases and ecosystem projects.

Earn competitive rewards for their contributions.

More info here & apply here. Watch-out, there are a limited number of seats.

Timeline & Conclusion

Currently available on testnet, and mainnet planned for end of 2023, early 2024.

Mode is not just building an L2 solution; they are crafting an ecosystem where collaboration is the cornerstone of growth, and every contribution is valued. By prioritizing the application layer and providing robust tools for development and growth, Mode is setting the stage for the next wave of mass adoption in the Ethereum ecosystem.

Discord: https://discord.com/invite/modenetworkofficial

Mirror: https://mode.mirror.xyz/

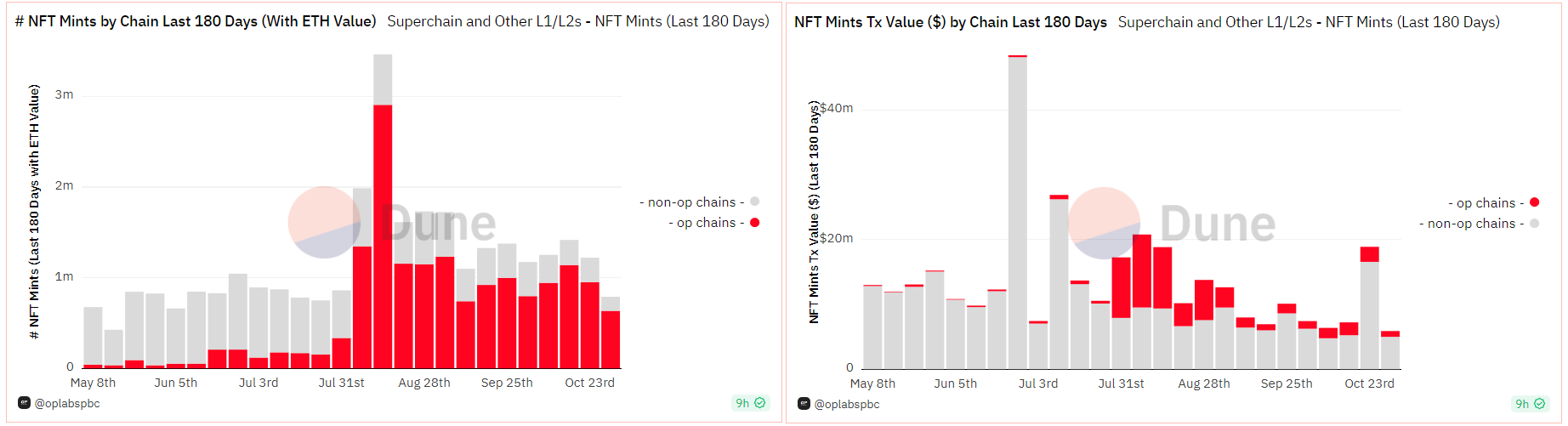

Chart of the Week: Superchain NFT leading in # but not in $

Note: Filtered NFT mints if there are ETH value transfers in the minting transaction, By courtesy of OPlabs

Personal take: Mind that NFT is not necessary JPEG, think also about Univ/Sushi V3 LP, Aerodrome/Velodrome veNFT, etc…

🟣Projects Research : Oath Ecosystem - The new Era

By Subli

From the Byte Masons to the Oath Foundation, tremendous works & upgrades have been done by the team. A world where composability is built through in-house engines, aiming at targetting the best risk/yield ratio in the whole DEFI space. In this article, we will be diving into four important topics:

Ethos Reserve V2

Oath Chapters (being the OP Stack of DEFI protocols)

Digit.xyz launch

$OATH tokenomics revamp

Ethos Reserve V2

Ethos Reserve V1 was already presented on the Newsletter #8, give it a read if you start from the beginning as we are going to cover the updates from V1 to V2 here.

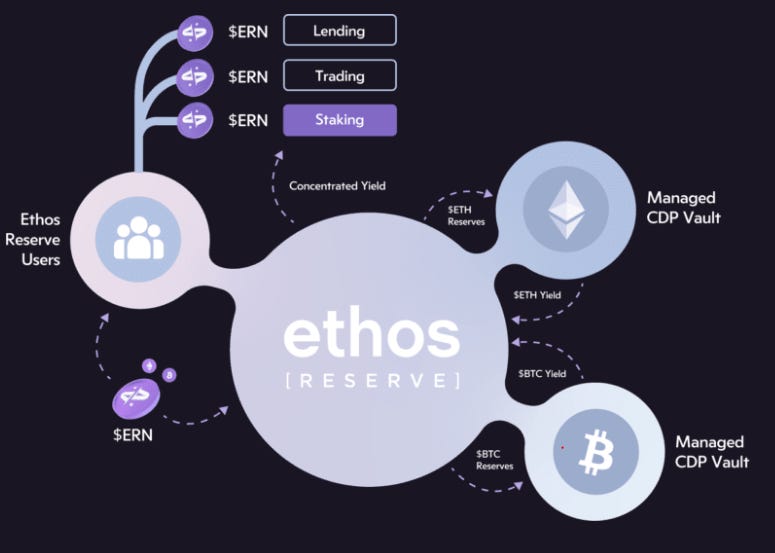

But first, what distinguishes Ethos Reserve from other CDP protocols like Liquity or Others? It is the ability to rehypothecate idle collateral to trusted partner lending markets or yield aggregators to capture yields. The accumulated yield is then used to buy $OATH off the market to distribute to the Stability Pool as incentives, creating the first sustainable CDP platform in all of DeFi (there is no extra token emission added on top)

Ethos Reserve V2 has been developed after seeing that “most” of the stablecoins didn’t keep peg. Whether it is >1 or <1, both situations are negative for large users & institutions.

So what V2 bring as changes?

New collateral assets: Liquid Staking Tokens (staked ETH here we go)

Leverage your position in one click

Level up the yield generated by the deposited collateral in partnership with Yearn Finance

Yield scales with usage. With TVL increase & more $ERN minted, the yield generated for the stable is able to grow alongside it

LST-backed stables have also some issues to prevent from goign underpeg (like $GRAI from Gravita protocol). That’s why all the above is needed to support a better and more stable peg management (balance long and short demand for stable).

The high available yield for $ERN is leading the need for market makers to buy $ERN on the market, resulting in high bid pressure and an overpegged stable (>1). By adding support to LST, LST holders will be able to leverage their Liquid Staked Token to mint more $ERN, resulting in shorting $ERN, making thus a balance between long & short.

Expected Outcome: Increased users target (1) => Reduce buy pressure of $ERN (2) => Increased yield (3) => Increased users target => …and so on

Proposal for Ethos v2 implementation:

Forum: https://forum.oath.eco/t/ogp-08-ethos-reserve-v2-implementation/115

Snapshot: https://snapshot.org/#/oatheco.eth/proposal/0xc2ff96ce6ae8e88d7b5a2aa3a52c332b62590ce71005f607d770f971758b7f1f

Oath Chapters

If you now understand that the OP Stack is the layer 2 standard, OATH Chapters is set to become the DEFI protocol standard. OATH chapters are the first DEFI licensing model based on Ethos Reserve codebase. It brings to other builders:

Shared security

Shared value

Shared building goals

The objective3 is“to give to other team the ability to take that tech stack and start their own business, build their own relationships, all with the support with the OATH Foundation” - Justin Bebis, CEO & Founder of the Oath Foundation

Why does it to relate to the Oath Ecosystem? A revenue sharing program will be put in place to redirect fees to the OATH Ecosystem, fees being used to buy-back $OATH on the market and reward users/stakers on Ethos Reserve.

1️⃣st OATH Chapter has been deployed on Mantle: AURELIUS FINANCE

It uses the codebase of Ethos Reserve and add an integrated Lending protocol in it, making an easy, immutable and predictable source of yield for the $AUSD stablecoin. How?

By depositing collateral, user will mint $AUSD which will be deposited on the supply-side of the lending protocol. The borrowing demand is thus really cheap, which will drive the demand on the borrow side, thus increasing yield on $AUSD (lending side) and thus on the CDP collateral deposits. This result is a positive feedback loop between the borrowers of AUSD and the borrowers on the lending protocol, where AUSD minters are decreasing the costs for lending protocol borrowers, and in turn those borrowers are paying AUSD minters for their supplied collateral. => If you want to know more the difference between a CDP and a lending protocol, don’t miss the Newsletter #21-2

And what’s best to attract new users? A grant (Approx 80k$ at the time of writing).

What’s next for OATH Chapters?

Real World Assets: Treasuries, REITs, and low-risk or principal protected products

Delta-Neutral stablecoin: Partner with DEFI Asset Managers

Deployment of other chapters on other chains

Proposal for Aurelius implementation:

Forum: https://forum.oath.eco/t/ogp-draft-oath-chapter-establishment-proposal-aurelius/122

Digit.xyz

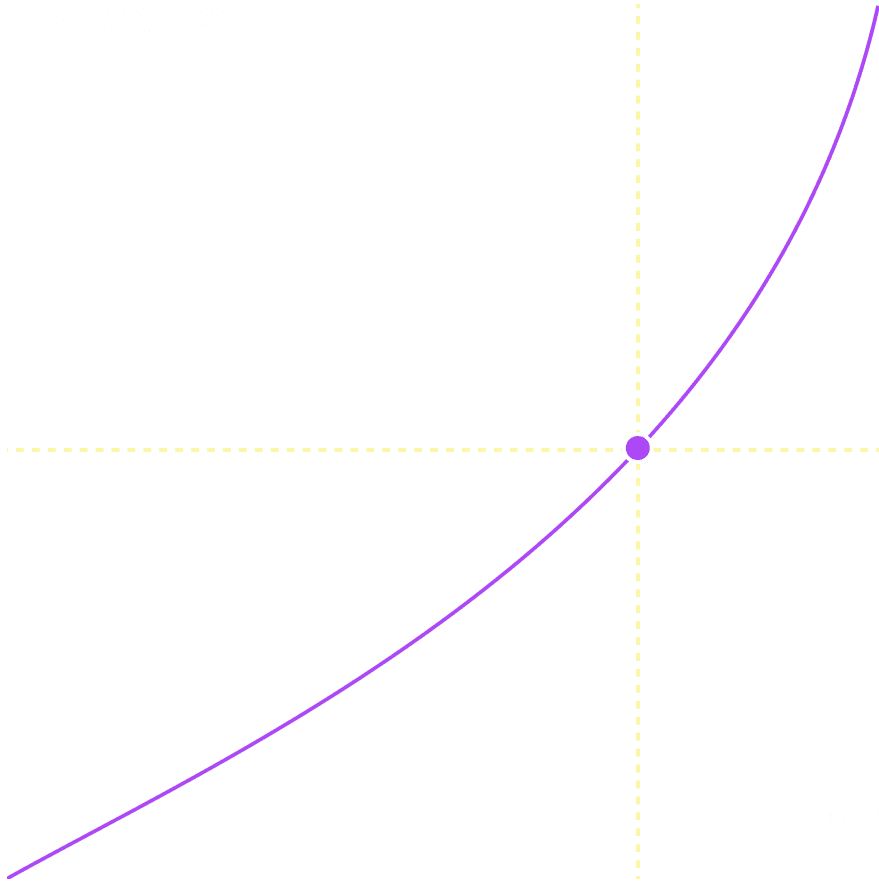

The common standard in DEFI is based on rewarding Liquidity Providers in function of the size/share of the deposit in the pool (MasterChef contract). Digit is built upon a ne primitive called “Reliquary” a contract designed by the Byte Masons that looks to be the new standard in DeFi for incentive distribution. Rewards are then distributed to liquidity providers not only based on the size of their position, but also based on the position’s maturity (=duration elapsed since time of deposit).

TL;DR: The more you hold the position, the more you earn

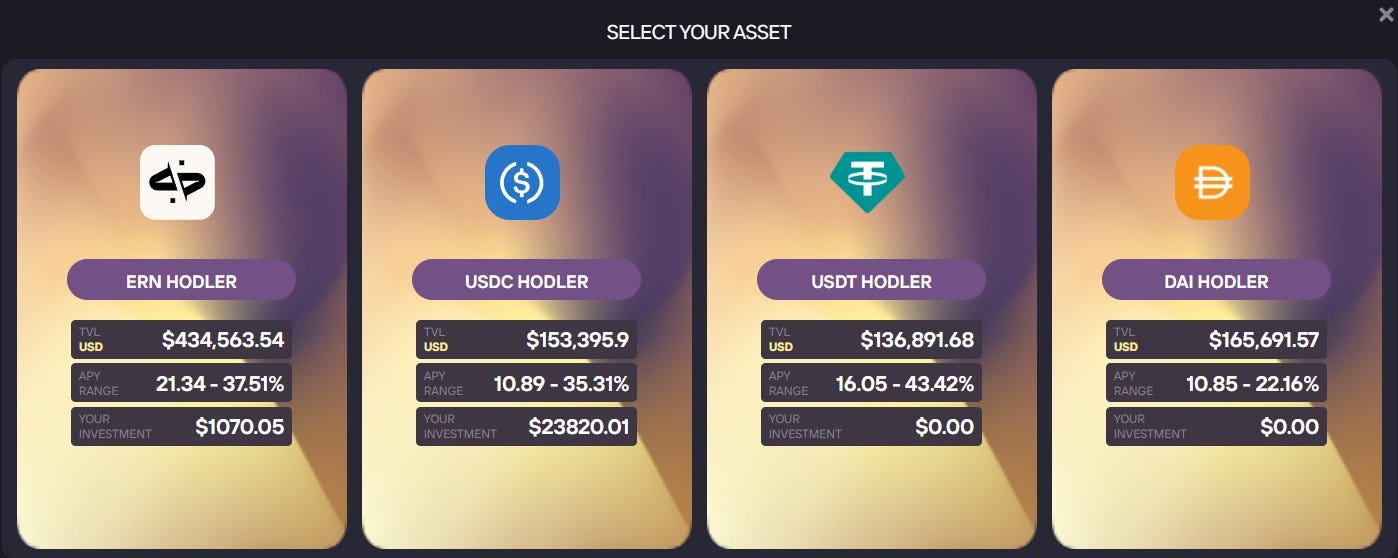

This technology has been used for the first time on Beethoven X (friendly fork of Balancer on Optimism). Now, on Digit.xyz you can find extremely interesting yield on stablecoins. Expect max yield after a deposit duration of 6 months (can be modified through governance for each vault).

When Ethos Reserve V2 will be live, expect to see $OATH staking pool here.

The range in reward yield indicates the difference between a newly created Relic and one that has matured over time. Rewards are auto-compounded in the vault to grow the underlying position over time.

$OATH Tokenomics

I hope that the more you read this article, the more you understand all the DEFI lego that is currently being built. The revamp of the $OATH tokenomics is another LEGO, and not the least.

Prevent from liquidity fragmentation & decision to build the deepest incentivized $OATH liquidity on Optimism only

Welcome to option token $oOATH. If you don’t know what this is, i STRONGLY suggestion you listen (or read the written note) to this podcast:

The🔴Optimist Podcast #34: oTOken & Defi incentives model

Option tokens, and by extension oOATH, align protocols and their loyal users by effectively taxing mercenary farmers and transferring that value to long term liquidity providers. In the case of oOATH, that “tax revenue” will be streamed to bOATH holders who are supporting the ecosystem with their liquidity

Increase utility of $bOATH (which is the yield bearing asset made up by 80% of $OATH & 20% of WETH deposited Beethoven X). Here is the LP Link.

Airdrops of Chapters tokens

Platform fees from Ethos Reserve & Reaper Farm

Revenue from $oOath

All of this yield will be distributed as time-weighted rewards through Digit!

Link governance proposal:

Forum: https://forum.oath.eco/t/ogp-draft-oath-tokenomics-upgrade-proposal/127

Conclusion:

Scalability ⬆

Users target ⬆

Token sell pressure ⬇

REAL YIEL ⬆

Alignement between REAL YIELD distribution and long term holder✅

I’m bullish on all the changes listed above, and can’t stand to see increase of TVL thanks to whales & institutions joining. And to end this article, I strongly advise you to read the 10 key learnings the OATHfoundation caught after several discussions with hedge funds & institutions: 10 things to know about Institutions

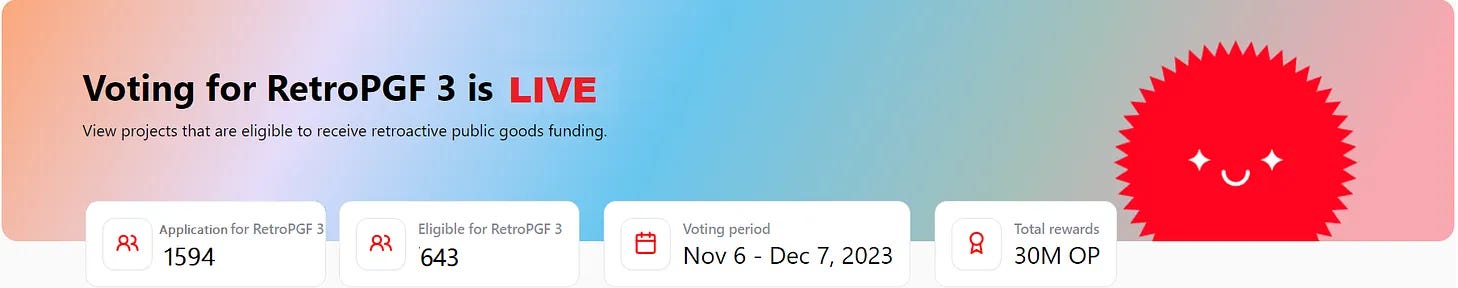

🟢Picture of the week: 643 projects eligible for 30m $OP

🟠Podcast:

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of all podcasts for free.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

The Optimist Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.