The 🔴Optimist: OP Superchain News #23-1

The best source of news about Layer 2, OP Stack, Optimism Superchain

First of all, i’d like to express my thanks to you readers, for your comments, support, likes on this Journey. Big 👏 to the team for making The Optimist the go-to Media for everything about DEFI on Layer 2 chains.

Click in your preferred language to access the translated document:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Turkish - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔴Redstone : The new Gaming chain of the OP Superchain

Wanna learn more about 🟥Redstone the new L2 chain focused on Gaming, and part of the Superchain? We have you covered!

🔵Projects Research : Contango leverage trading platform

What if I tell you that Contango is solving the biggest problems of leverage trading platform: Deep Liquidity. Meet the future of Finance, plugging in to AAve, Sonne Finance, and other lending protocols’ liquidity to allow leverage trading.

🔥Hottest news (new section)

Your new bi-weekly breakdown of the most juicy news about Optimism Superchain.

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, we were pleased to receive on Stage :

Stablecoin Roundtable: Listen or read the note about Stabecoin Risk Assessment with Ethos Reserve, Gravita, Liquity, Protocol_Fx and Bluechip

GOVERNANCE & VOTE TIMELINE

If you wish to delegate your OP Tokens to Subli => Go to this page, and click on DELEGATE. Delegate Address: 0x3b128c6c1207d72092a8b3f6d651dfe54682a404

🔴Redstone : The new Gaming chain of the OP Superchain

by Nataliii

GameFi is one of the innovative trends in the field of cryptocurrency technologies. In 2023, projects combining game mechanics, NFT and DeFi are rapidly developing. The main reason for their growth is new earning opportunities for investors and ordinary players, as well as attention from large companies.

What is GameFi?

This term is formed from two words – Game and Finance. It is used to refer to blockchain projects that allow you to monetize the gaming experience. The essence of the idea boils down to the following: the user can make a profit for what develops within a certain game. This became possible due to the fact that the game concept includes the use of blockchain technologies and cryptocurrencies. If you were here in 2022, you would probably remember of Axie Infinity, once valued close to Electronic Arts:

Such games can be combined with any decentralized finance (DeFi) tools:

lending;

loans;

farming;

tools for issuing new tokens;

algorithmic stablecoins, etc.

Characters, land plots, artifacts, weapons and armor in such games are created in the form of NFT. That is, they become digital assets that can be bought and sold in the game itself and beyond. What kind of cryptocurrency will be used for calculations within the project is determined by its creators. Often, a custom token is created for this purpose.

Web 3.0 games, also referred to as blockchain games, are a new generation of video games. They are incredibly well designed with the assistance of Web 3.0 technology. Unlike conventional games, which might be centralized and managed by software providers, Web 3.0 games are created on blockchain platforms, which offer transparency, safety, and consumer ownership. These games use non-fungible tokens to symbolize in-sport assets, providing you with real ownership in addition to the capability to exchange, sell, or use these assets throughout several games.

Why GameFi is popular?

Gaming has managed to become a full-fledged industry with millions of engaged users. The sphere of decentralized finance and tokenization of objects is rapidly gaining popularity. All these areas are combined in the GameFi industry.

Plus, blockchain games do not require serious hardware to participate in the project. You can play from mobile phones or weak PCs. Due to these characteristics, GameFi projects are very profitable and affordable.

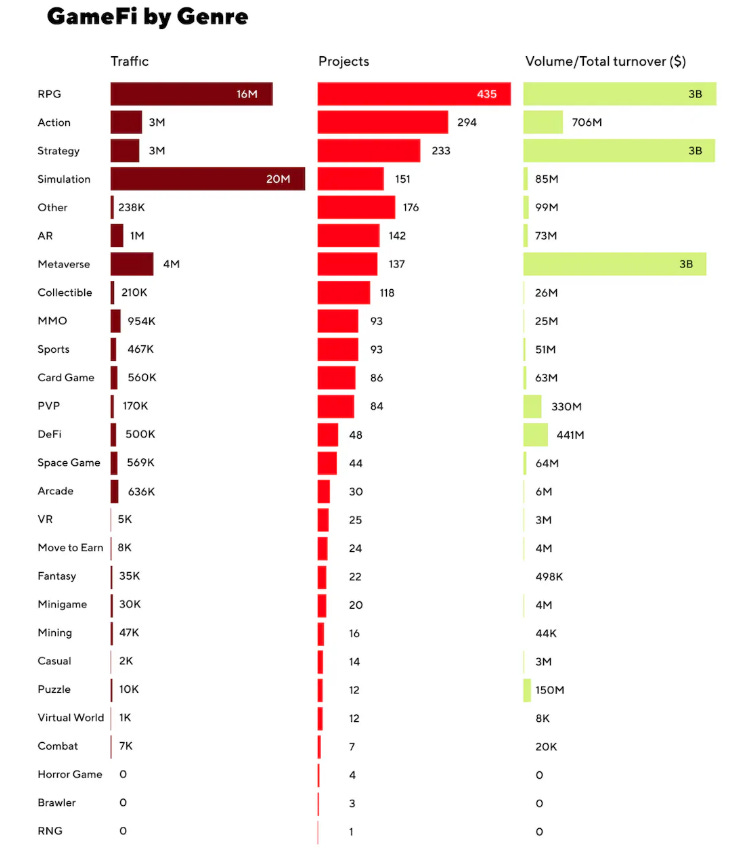

It's interesting to see how much the popularity of the game depends on the genre in which they are released.

So we can see TOP-5:

RPG

Action

Strategy

Simulation

Metaverse

Ordinary gamers, in turn, come to blockchain games in order to create objects, pump them up and sell them at a high price. Most of these activities are designed for young people, but there are options for those who are in adulthood. An example is playing cards with a reward in the form of cryptocurrency.

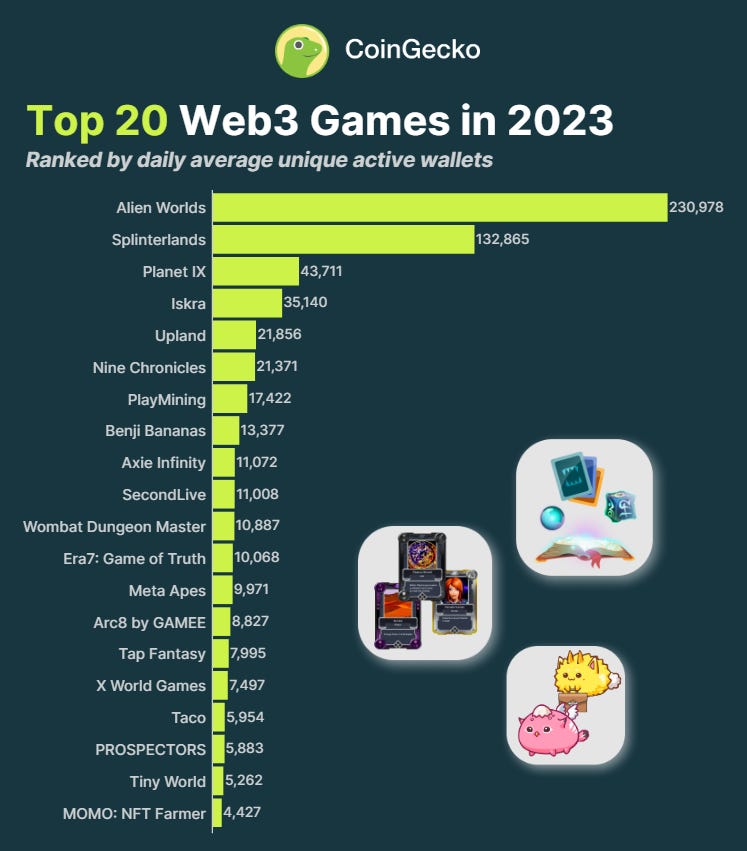

The Web3 gaming market size is projected to be worth US$ 23,926.0 Million in 2023. The market is likely to surpass US$ 133,228.2 Million by 2033 at a CAGR of 18.7% during the forecast period. The demand for Web 3 gaming is driven by several factors, such as decentralization and ownership, play-to-earn economy, interoperability and cross-platform support, community-driven development, and enhanced security and transparency.

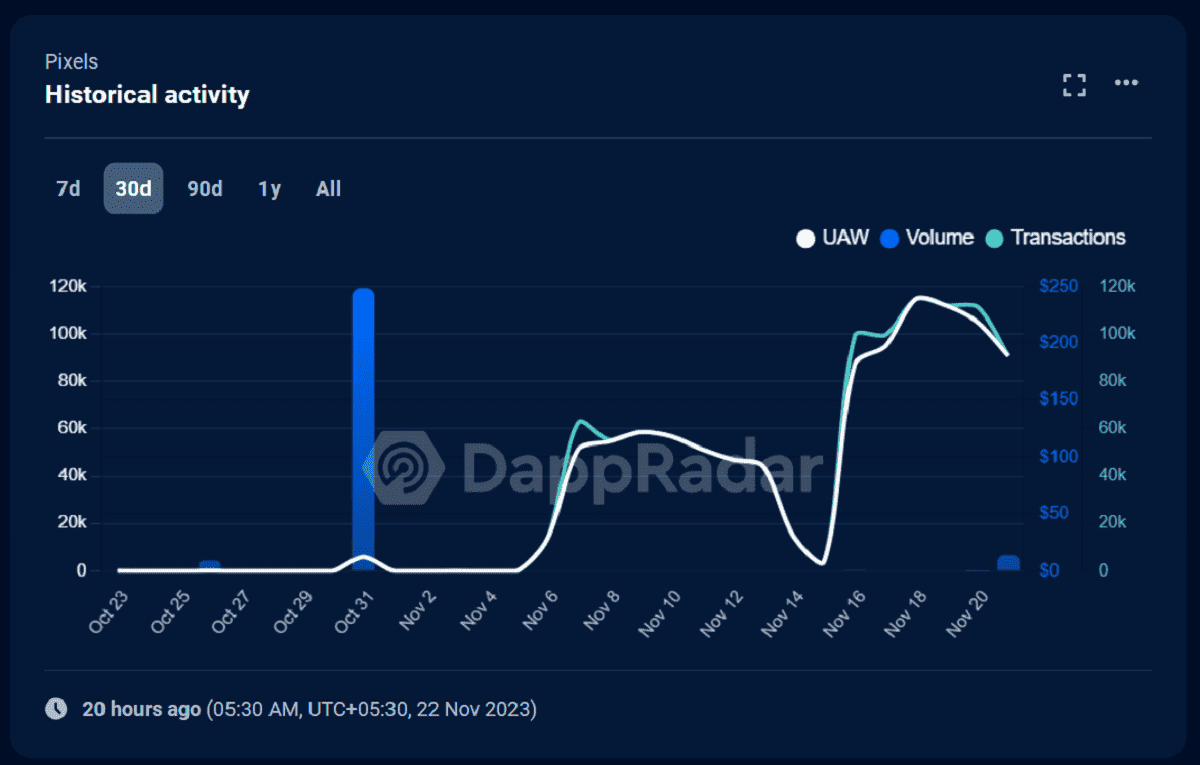

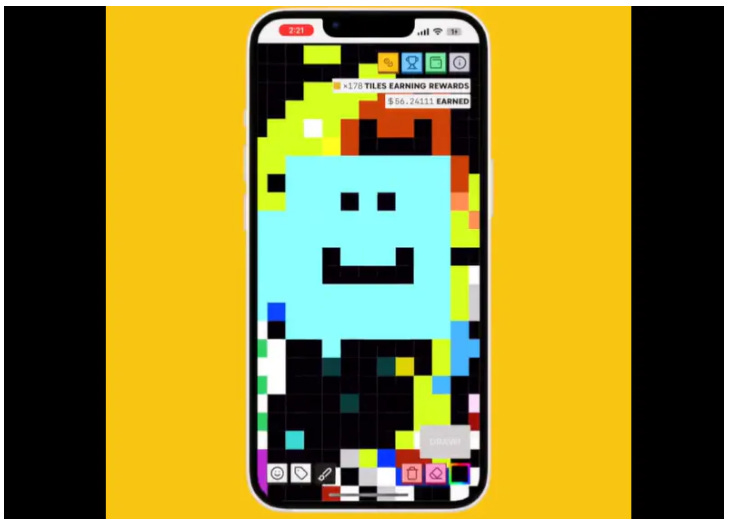

We can see an increase in player activity on the example of the game Pixels (from less than 5k players to almost 120k in one month):

Welcome to Redstone

In the middle of November Lattice announced Redstone, a super cost-effective L2 for onchain games, worlds, and other ambitious applications.

Redstone is a Plasma-inspired Alt-DA chain, built on the OP Stack🤯

For our fellow Nerd readers, if you wish to have more info about what is a Plasma Chain, recently brought back to life by Vitalik at DevConnect, please read this article from Blockworks: https://blockworks.co/news/vitalik-buterin-plasma-hype

The Redstone Ecosystem

Redstone uses Holesky ETH for transactions. The Redstone bridge is here: https://redstone.xyz/deposit

November 15 the Redstone testnet was launched publicly. In addition to Sky Strife, in-house onchain RTS game, other MUD builders soon launching games on the testnet include Small Brain Games, Gaul, and Primodium. Redstone mainnet will launch later next year.

So there are 4 projects on Redstone now:

Small Brain Games - building a new on-chain game every 6 weeks. Prev: Words3. Currently: Drawtech - an onchain drawing game (available only on mobile now)

GAUL - build an eternal road into a wild land—get equipment, dig, slash, and pave mile after mile of treacherous terrain. Become the ultimate roadpilled NPC. Play the demo at http://gaul.app

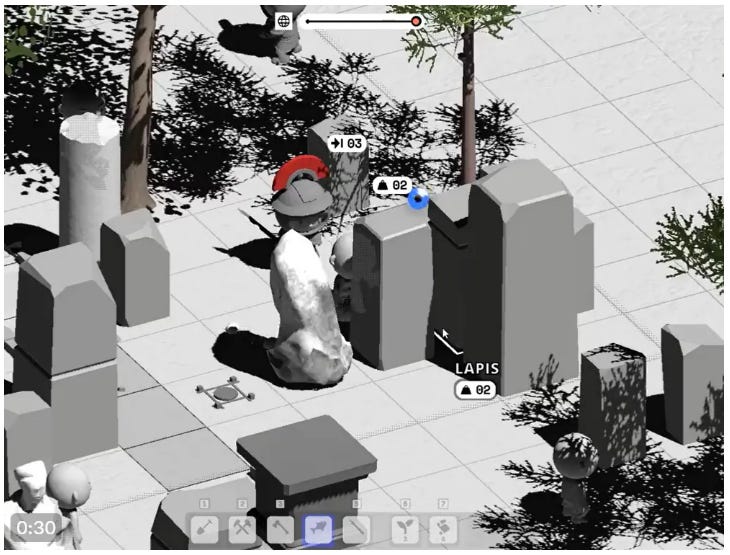

Primodium - is a groundbreaking open-source, fully on-chain game where players engage in the design and construction of automated production pipelines to generate increasingly intricate industrial products, offering a unique gaming experience that adapts to the constraints of the crypto landscape. The game is designed to be multiplayer, allowing players to interact with each other.

In this immersive gaming experience, participants embark on a multifaceted journey where success hinges on strategic decision-making and adept resource management. The gameplay unfolds through several fundamental actions:

Exploration: Commencing as a player involves scouting selected starting coordinates on the map, uncovering and harnessing valuable natural resources such as iron, copper, lithium, and more. These resources function as the lifeblood of your industrial empire, essential for both forging items and constructing buildings.

Logistics: Streamline the movement of gathered resources to their required destinations. Optimize resource flow within your expanding empire using conveyor belts and other logistical infrastructure.

Production: Establish factories to synthesize raw materials into valuable forged items. These factories form the core of your production pipeline, enabling the creation of advanced technology and equipment.

Infrastructure Development: Strategically build a network of factories, resource gatherers, and infrastructure to enhance your industrial base. Plan and arrange facilities to maximize efficiency and productivity.

Research: Progress in technology and knowledge through research endeavors. Unlock new blueprints, upgrade machinery, and gain a competitive edge over other players on the planet.

Combat: Participate in tactical battles with fellow players. Construct weapons, assemble armies, and wage warfare to establish dominance over rival factions. Be prepared for intense competition and epic conflicts.

The game features various objectives that players can fulfill, such as defeating enemies, constructing specific buildings, and researching particular technologies. Successful completion of these objectives rewards players with resources, items, and experience points.

You can play here

Sky Strife - the fully onchain real-time strategy game.

Season 0 launched on November 27th, and will last for 3 weeks until December 15th. It is your first opportunity to mint a Season Pass for Sky Strife, which will allow holders to access exclusive maps, access free matches, and set match entrance fees, rewards, & access lists.

Conclusion

Fully integrating Redstone into the Superchain and turning the upgrade keys over to the Security Council will take time, but both are committed to the challenge.

So that’s why we are so excited about this new partnership with Redstone, and even more excited for developers in the ecosystem to start leveraging the onchain (and offchain!) magic that Redstone enables.

😁Meme of Week

🔵Projects Research : Contango leverage trading platform

By Subli

Opening a trade with leverage on the cheapest fees protocol while paying >50% of funding rate isn’t a bit silly?

What if, instead of paying interest rate, you will be rewarded to open a trade? I’m not joking. Welcome to CONTANGO V2, a perpetual protocol available Ethereum Mainnet, Arbitrum, Polygon, Optimism, Base and Gnosis, launched 2 months ago.

How does Contango work?

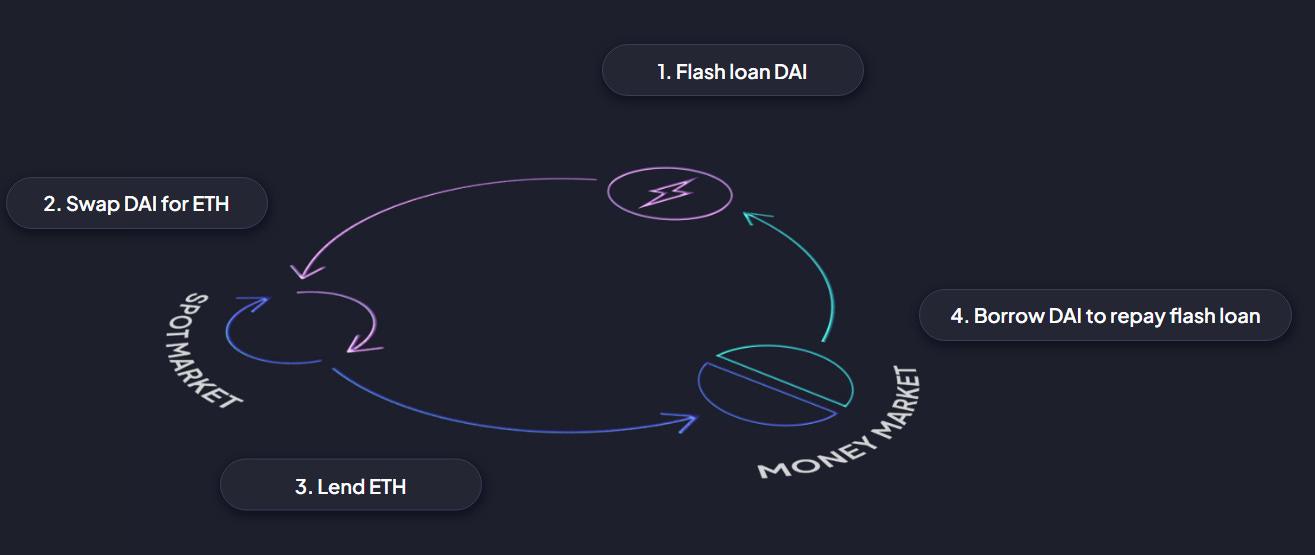

Contango is built on top of lending protocols like AAVE, Sonne Finance, and many others. By using flashloan and looping, people can get access to a leverage position.

While DefiSaver & Instadapp offers a very similar producst, Contango aims to be made for Traders with specific features:

Lending markets integrations: Contango integrates the most used lending protocols on the different chains, so not only AAVE V3 for example, resulting in a larger choice of interest rate, liquidity & farming opportunities

Predictable interest rate: As interest rates on lending protocols are not very volatile, except in very rare occasion like just before Shanghai Upgrade, leverage trade cost are easily predictable and cheap compared to other perps protocols

Trading Price: On perps projects, price usually depends on Oracles or Order book. Since Contango doesn’t have an Order Book, the price quoted in the UI is the Spot Price routed via Mean Finance meta aggregation tool

Traders User Interface: Similar UI as any perp protocol

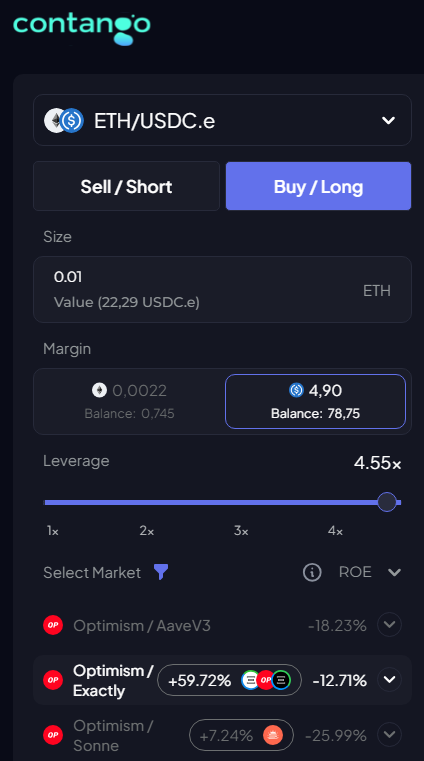

Leverage yield Farming & Airdrop opportunities: Since Contango synthetizes positions by looping on underlying lending markets, traders can obtain rewards from those protocols by simply trading on Contango. This extra yield might offset a negative funding rate (the "APR" on Contango) or stack on top of a positive funding rate, making the trading experience on Contango a money-making machine. For example, taking a 4.5x leverage long position on ETH/USDC pair, on Exactly Finance, has a negative funding rate but rewards more than offset it, making the overall ROE (Return On Equity) pretty interesting!

And recently, Contango integrated Spark Fi, a new lending platform powered by Maker. And taking a trade through their lending/borrowing market will qualify you to $SPK airdrop

Where does Contango fit in the Perps ecosystem?

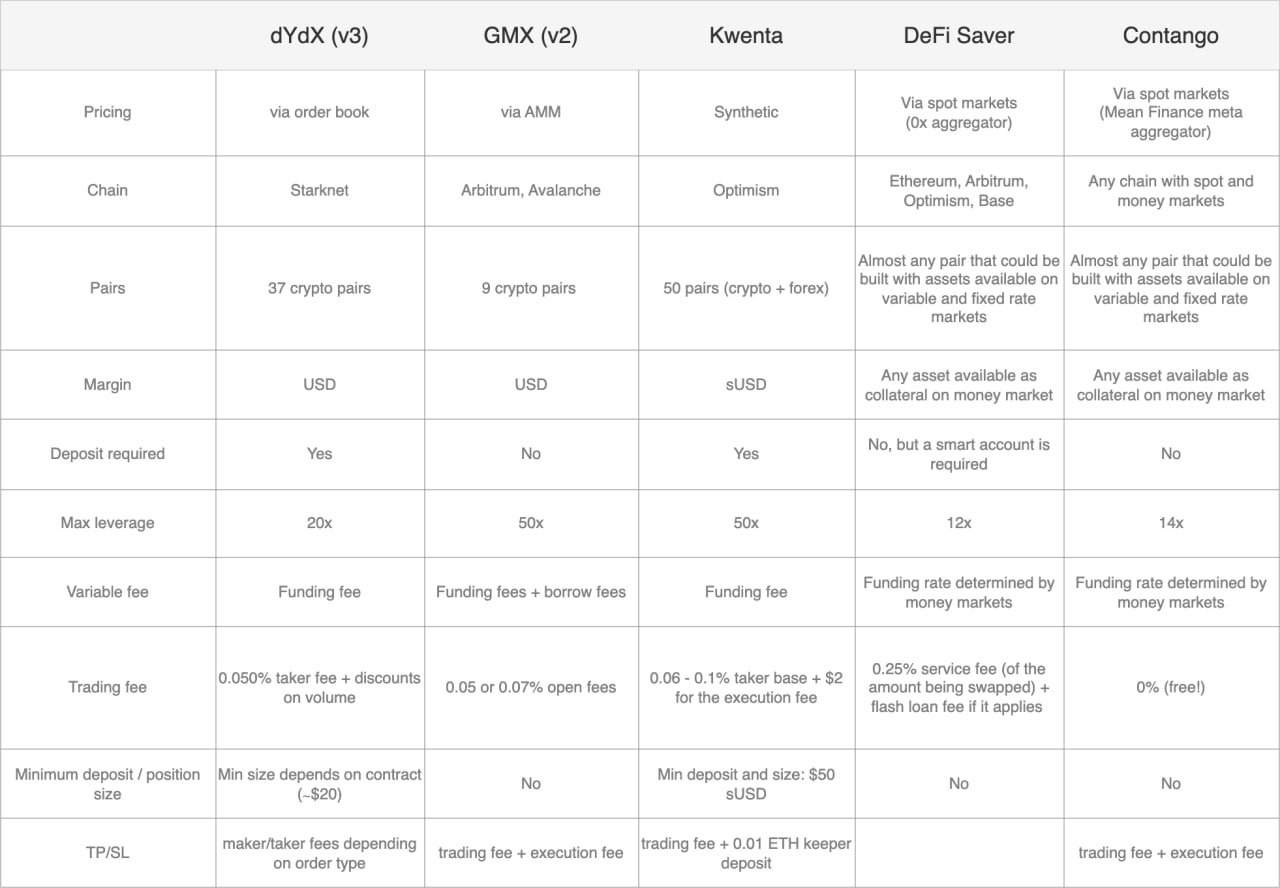

In a recent article written by Contango, a comparision table showed the differences between the latest and dYdX, GMX, Kwenta & DefiSaver:

What I like to see at Contango are the following features:

No need to pay for liquidity. As Contango doesn’t hold any TVL as it plugs into lending protocols, it doesn’t need to print governance token and incentivize liquidity providers….and I know how much it could cost

The scalability of the protocol is unlimited. As more chains & lending protocols exist, more pairs on more chains will be available for traders. Currently, Contango aggregates 13b$ of liquidity on different lending protocols.

No need to deposit funds into a smart wallet, your funds are directly deposited into the lending protocol

Altcoins trading available

Business model & tokenomics

Currently Contango takes 0% fee, so trading on the platform is free, and already reach 10m$ Open Interest. But protocol fees will be turned on at one time, that”s for sure.

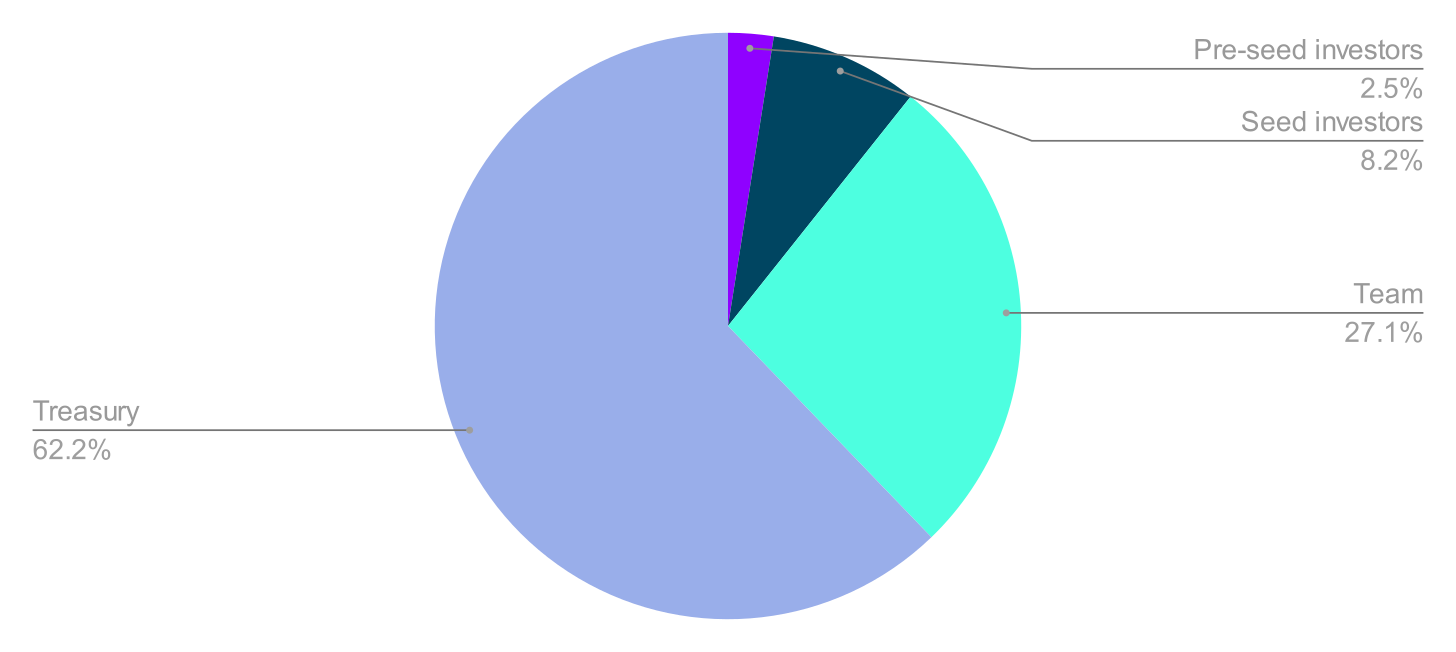

On the other side, on Contango Docs, a tokenomics is being revealed and you’ll notice that 11,7% belongs to early investors, while a big part is being held by the treasury, most likely ready to be used for any future incentives to bootstrapp the protocol. So for the Tokenomics: read the below as TO BE DEFINED.

Contango run 3 fund raising event for a total of 4.46m$ of collected funds at a valuation of 45m$ (quite low for a perps protocol if it manages to generate substantial volume). Participants to these fund raises are well known VCs & Angels in the industry:

Conclusion

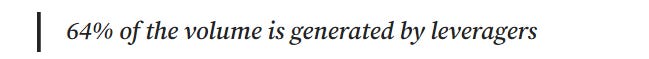

While Open Interest is very easy to capture on GMX or Kwenta, it’s much more difficult to assess on lending markets. However, Morpho, a lending/borrowing yield optimizer built on top of with 572m$ TVL, conducted a research on its users behavior which resulted in:

By attracting long term traders through a proper trading interface, and with what sounds to be the cheapest way to leverage BTC, ETH or Altcoins, Contango is well positionned to see significant growth over 2024, for which the Perps narratives will definitively take off in my own opinion. This is a narrative i’ve been following since 2022 and never really took off. But with the recent volatility and price surge of BTC, it could be that traders will come back and will start choosing alternatives to Centralized Exchanges.

While degen traders will look for protocols for x50 leverage, long term investors will look for cost-effective & predictable solutions.

With 2 months old only, and approx 2m$ of Open Interest, Contango is a project I’ll be following closely in the coming months.

🔥Hottest news (new section)

🎁Advent Calendar launched by The Optimist : One event per day = One reward per day. All quests accessible here: https://www.tideprotocol.xyz/users/spaces/1389

💙Synthetix deployment on Base with brand new features:

USDC as collateral

SNX token on Base

Integrator fee sharing: 20%

New tokenomics on Base: 50% of fee sharing used to buy back & Burn SNX token + Kwenta proposal to buyback SNX for governance purpose 🔥

🎮 New Play-to-Earn MMO strategy game launched on Base: MetaApes

🦋Redacted Cartel is about to launch MARIONETTE, a new voting optimizer to facilitate optimized rewards & improved UX for token voters, goodbye late wednesday voting struggles on Velodrome forks. More info here.

🟡Mode Network: Ambassador program closed, DEFI degen hackathon launched.

🚴♂️Velodrome & Aerodrome RELAY (voting optimizer) live! Forget your late wednesday voting struggles. More info HERE.

🐵New proposal from Optimism foundation to have Apechain (specific layer 2 for Bored Ape Yacht Club (BAYC) community) moving onto the OP Stack, part of the Superchain. Folow the forum post here.

🏛The first nationally regulated yield bearing stablecoin $USDM by Mountain Protocol, received a B+ rate from Bluechip. Soon on OP Mainnet ?

🔥 Wombat Echange, new DEX with efficient stableswap mechanism, just launched on OP Mainnet, boosted by the OP Grant (80% APR on stablecoin, 30% on ETH at the time of writing)

✖ Post of the week:

Operation Red Wars powered by Clique has started. Participate to the EVENT #1, BRIDGE, to earn a total of 100k OP tokens. Link to access the event HERE.

The Optimist is pleased to be the official media partner🤝 to provide all updates related to OP Red Wars event.

🟠Podcast:

Podcasts are the source of Alpha🔥. And what if you can transform 1h of listening into 5min of reading? The 🔴Optimist Podcast partnered with Revelo Intel to provide written notes of all podcasts for FREE.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

The Optimist Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.