The 🔴Optimist: OP Superchain News #27-1

#1 media about The Superchain: Optimism, Base, Mode, Zora, Lyra, Ancient, Redstone, Worldcoin, Mint, Lisk

First of all, i’d like to express my thanks to you readers, for your comments, support, likes on this Journey. Big 👏 to the team for making The Optimist the go-to Media for everything about DEFI on Layer 2 chains.

Click in your preferred language to access the translated document:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🟡Mode: Mainnet Launch & Airdrop 1

All you need to know about Mode mainnet & Airdrop 1 launch: growth phases, ecosystem, airdrop points system, etc… Welcome Mode to the Superchain.

🔵Mode Partners: Ethena Labs & Redacted Cartel

What if all bridged-in assets to Mode will generate double-digit yield that will fuel onchain incentives to users & protocols?

🔥Hottest news

Your new bi-weekly breakdown of the most juicy news about the Superchain.

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, we were pleased to receive on Stage :

Oath foundation Update: Bebis, founder of the Oath Foundation, provided some updates about Oath chapters, Ethos Reserve, and more.

KELP DAO - Liquid Restaking Token: Listen to Amit, founder, about Restaking, EigenLayer & Kelp DAO

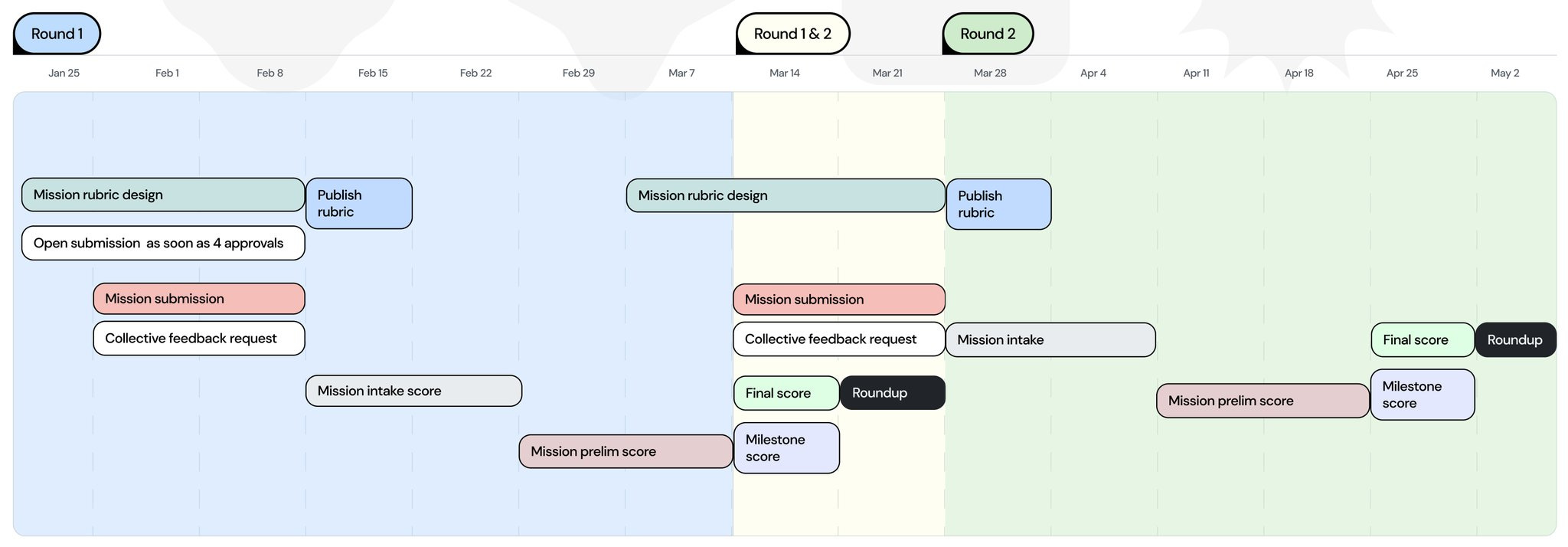

GOVERNANCE & VOTE TIMELINE

If you wish to delegate your OP Tokens to Subli => Go to this page, and click on DELEGATE. Delegate Address: 0x3b128c6c1207d72092a8b3f6d651dfe54682a404

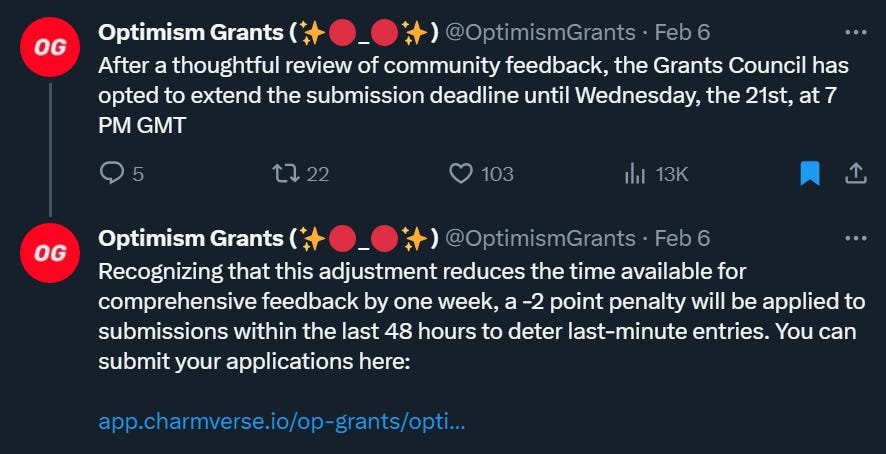

Spotlight Project: Optimism Grant open for application

Builder & Growth experiment grant are now open for applications until 15-Feb. Go to this page to apply, or get all the relevant information for this.

This is only round 1, if you miss this one, apply for round 2.

🟡Mode: Mainnet Launch & Airdrop 1

by Nataliii

In Newsletter #25-1, we told you what Mode is. But since that time, the project has had many interesting updates, so sit down more comfortably and enjoy the alpha information.

Why are we interested in this project?

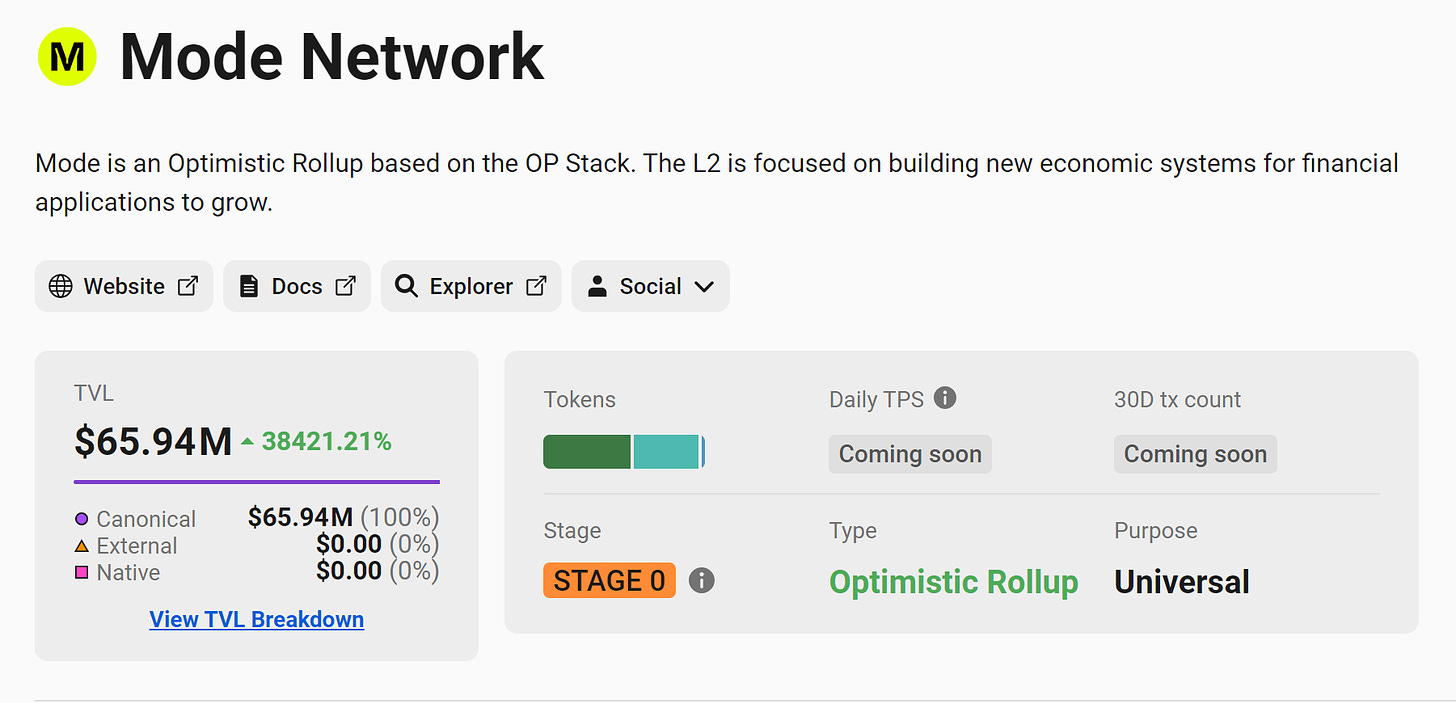

First of all, Mode is the Modular DeFi L2 powered by Optimism and granted 2m OP tokens to bootstrapp the chain. Mode is forging new economic systems for growth, striving to become The DeFi Hub of Optimism's Superchain.

We also must to tell you about the Mode team. We cannot be more excited about it:

James Ross: Founder of Hype (the most famous marketing agency in Crypto).

Nick Dijkstra: Product Lead, Hypepartners co-founder.

The main event of last week was, of course, the launch of Mode Mainnet and details about Airdrop.

Mainnet Launch & Airdrop 1

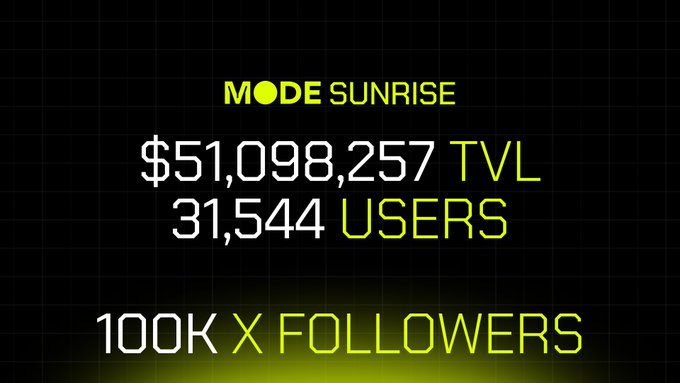

Last week was launched Mode Mainnet and it was crazy! Mode has reached $50M Million TVL in 48 hours and 31k users!

And on the date of writing this article (February 05) TVL is more than $60M!

And what is most interesting for the community, the project immediately announced the details of the future airdrop:

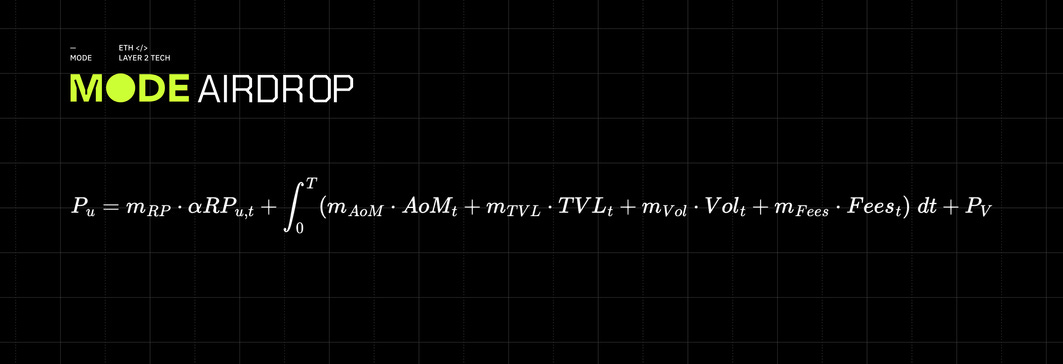

550,000,000 MODE (5.5% of total supply) for the first campaign, rewarding users who actively contribute to growing the network (400 000 000 for airdrop). Mode focuses on rewarding those who enhance the Mode, Optimism, and Ethereum ecosystems without locking up tokens for months.

Mode create a rewards system that's both transparent and fair. Your past activity on chains like Ethereum, bridging to Mode, referrals, and app usage within Mode ecosystem are all valued and rewarded.

Here you can see a formula of airdrop.

Have you seen many projects that immediately provide their community with a ready-made airdrop formula? And the Modе provided it!

Thus, as you can see, the team is set up for maximum transparency and clarity.

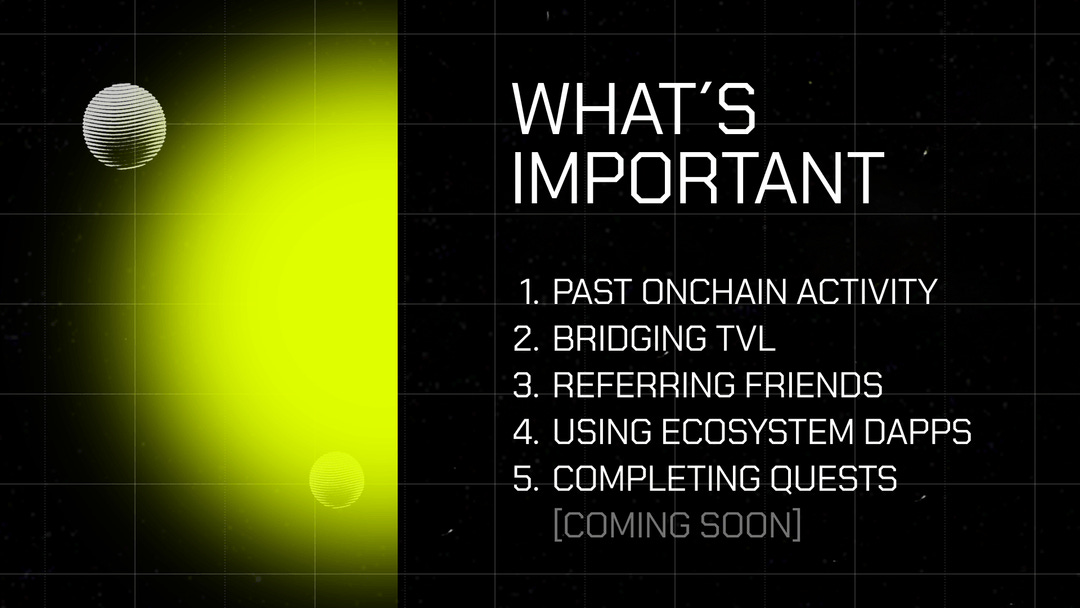

Here’s how to start earning points on Mode Past Onchain Activity:

Earn points based on past activity across 150 protocols and projects from 6 key categories. All points can be viewed when connecting your wallet and can be claimed by bridging to Mode. The categories are:

DeFi - users of DeFi apps

NFT - holders of NFTs

Scaling - users of Layer2s

OG - users of OG DeFi apps like Maker, Curve, Yearn

Degen - users of leverage apps

Yield - apps that give users yield

How to earn points now?

Bridge Assets to Mode

Invite Friends to Mode (earn 16% of the points they collect)

Use Ecosystem Apps

Complete quests on Mode

How to get early access to Mode airdrop?

Restricted Access: Use this link to get eligible to the Airdrop: This is the only way to access Airdrop 1 campaign & grab a share of 550,000,000 $MODE tokens to be claimed in April 2024

And some alpha for you:

Total $MODE distribution: 10 billion

At 1b$ valuation, 1 $MODE = 0.1$

500m $MODE at 200m$ TVL => Average of 2.5 $MODE per 1$ deposited, so 25% yield in 3 months

Equivalent to 100% APR😱

Ofc, this is an average estimate and the above doesn’t take into account volume, tx number, etc…

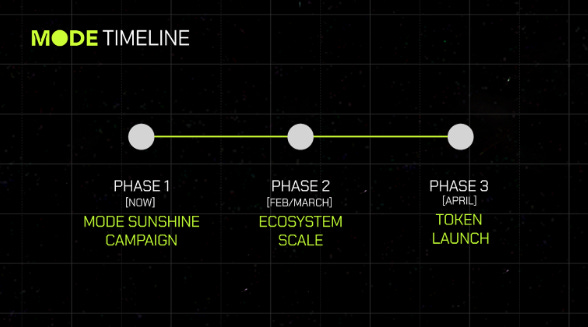

Timeline

Phase 1 - Mode Sunrise - Now to April

You can access mode sunrise see your score and earn points by bridging to mode, inviting friends and using ecosystem apps.

Phase 2 - DeFi ecosystem and Native Yield - Feb/ march

Defi ecosystem applications and native yield launches on Mode.

Phase 3 - Token launch - April

Mode dao will launch. Points will be converted to mode tokens and distributed.

More info about airdrop here

Ecosystem Cartel

Mode partnered with top tiers projects such as:

Ethena Labs: Bridged-in stables will be deposited in Ethena, generating REAL yield to the Smart Treasury => Used for DEFI incentives Expect this to be live for Phase 2 mainnet launch, expected late Q1

Dinero (Redacted Cartel): all bridged in $ETH will be deposited in Dinero, into apxETH (highest yield liquid staking token). All yields go to the Smart Treasury again being used to incentivize onchain activities.

Napkin maths based on Optimism Bridged-TVL:

What’s else?

After discussing the most important news of last week, let's move on to others updates.

1. Explore Mode Ecosystem Through Intract

Phase 1 Social week was ended, but you can take a part in second Phase. Wait the beginning. Link here.

2. Mode Sunrise Campaign is Live on Layer3

It's your chance to dive into the Mode ecosystem and earn rewards for your participation. Get ready to bridge, explore, and earn https://layer3.xyz/collections/explore-mode-mainnet

3. Mode Name Service (MNS) registration is LIVE

Secure your unique MNS name today with Space ID and start racking up points! Grab your MNS ❯❯

https://mode.space.id

4. Standard Protocol Launches on Mode Network

Standard Protocol comes to Mode Network to usher in a new chapter of cooperative growth, equitable innovation, and unmatched transparency, setting a new standard for DeFi engagement and community empowerment.

Standard Protocol is a DeFi platform, a decentralized Robinhood, tailored for both casual DeFi users and professional traders. It emphasizes fairness and transparency, offering peer-to-peer trading where smart contracts secure tokens. The platform is enhanced with smart tools to provide a seamless DeFi trading experience, including zero slippage.

As you can see, the project is eventful. So stay tuned, we will tell you about all important updates on Mode!

😁Meme of Week

🔵Mode Partners: Ethena Labs & Redacted Cartel

By Thomas

If you are a regular reader of this newsletter, you have likely been informed about the launch of Mode's mainnet: it unfolded successfully, garnering approximately $51 million in TVL in 48 hours & over 31,000 users

(If you don't know what it is, check out our article on the subject).

Now, the network is gearing up for the deployment of its phase 2: a major step marking the rollout of DeFi applications designed for users.

You’ve probably heard about Blast or Manta and their native ETH yield. For the launch of this phase, Mode has partnered with several strategic partners: discover today Ethena Labs & Redacted Cartel. If you don’t understand how BIG these announcements are, then read carefully the below:

Ethena Labs

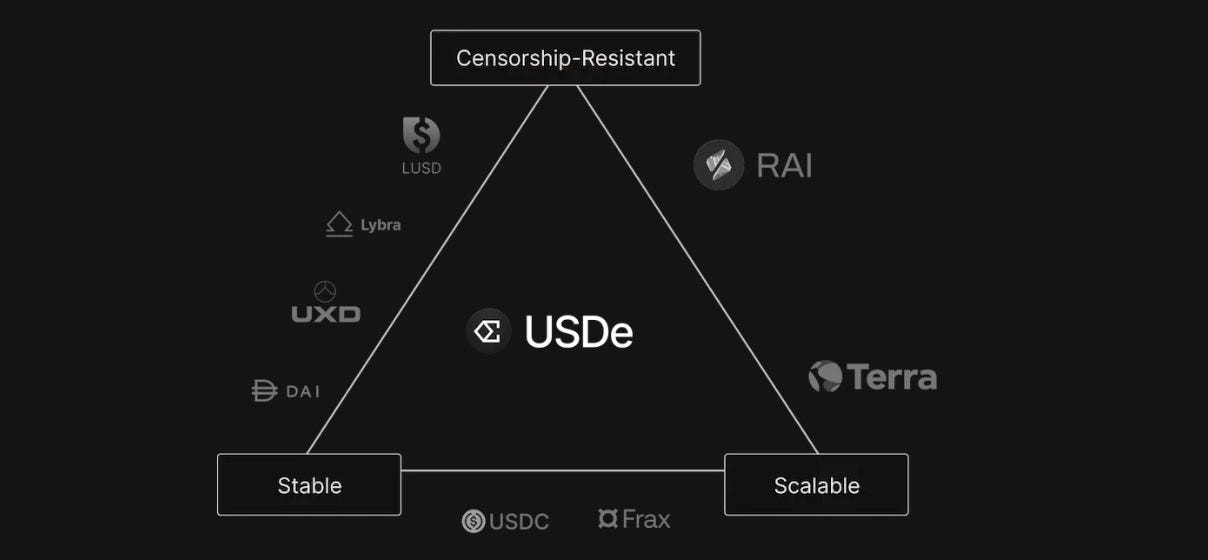

Ethena Labs is a protocol aimed at providing decentralized financial infrastructure through two main products: a stablecoin and a “internet bond”.

Its stablecoin, named $USDe, is particularly intriguing as its operation theoretically addresses the trilemma problem of stablecoins: namely, Censorship, Stability, and Scalability.

To achieve this, USDe relies on a unique system. It is backed by delta-neutral positions on ETH, allowing it to maintain stability while being scalable.

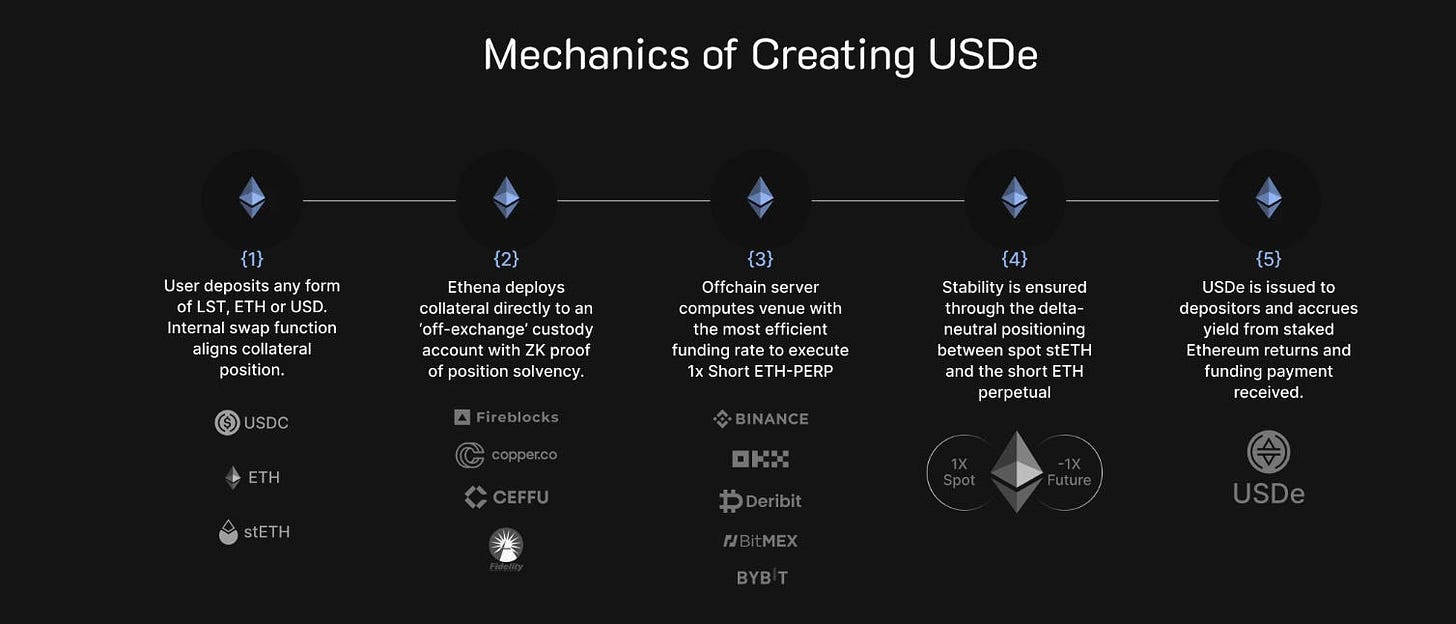

In practice, here's how the creation of USDe unfolds:

The user deposits $USDC and/or $ETH/stETH into a vault

Ethena Labs divides the capital into two parts: the first part goes to an off-chain exchange, while the second remains in $stETH

The off-chain funds are intended for shorting ETH via a perpetual contract, while the on-chain funds remain in stETH

This delta-neutral position not only backs USDe at 1:1 (capital efficient) but also provides it with a yield!

This is achievable through holding stETH and the yield from the funding rate. Since its launch in private beta, USDe has displayed an annualized yield of approximately 18%. Incredible, isn't it?

And guess what? You'll also be able to take advantage of this yield when the protocol is deployed on Mode, by the end of the first quarter of 2024.

Once USDe is established in the DeFi landscape, the team will deploy fixed-rate and variable-rate bonds to further its goal of becoming a decentralized financial infrastructure.

But the most interesting part is that all stablecoin bridged-in will be deposited in ETHENA, generating double-digit yield, that will go to Mode Smart Treasury and likely to be deployed onchain for user/protocols incentives.

Redacted Cartel

If you're a DeFi OG, you probably know Redacted Cartel for its Hidden Hand or PIREX products.

Well, today, Mode is partnering with the protocol through its newest product, Dinero.

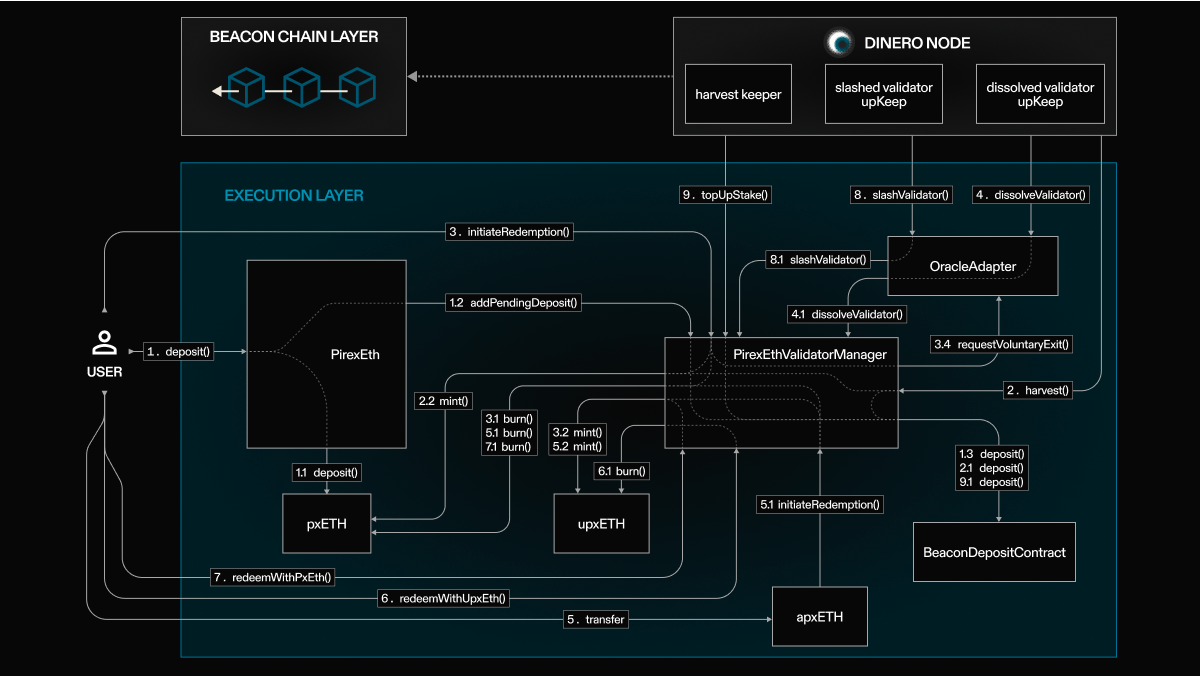

Dinero is a 3 products solution: (Lite paper available here)

New Liquid Staking Token pxETH with dual tokens system

DINERO Stablecoin

Private RPC for blockspace building with DINERO to be used as gas fee, which could then result in a decentralized sequencer (specifically for Mode use case)

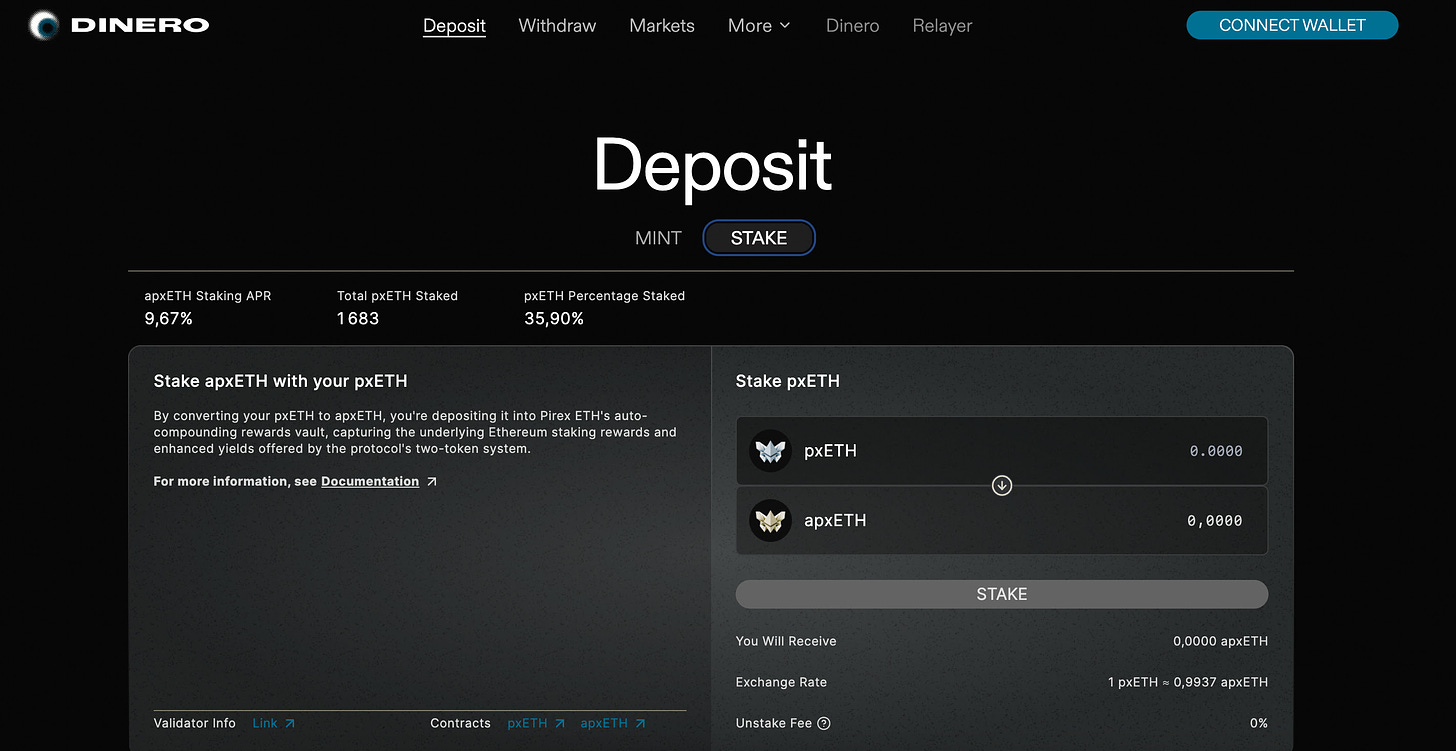

Dinero focuses on LSTs through two assets, $pxETH & $apxETH:

The pxETH is a staked version of ETH but without yield. The benefit of holding this token is to use it in DeFi to take advantage of incentives distributed by the team in $BTRFLY.

The apxETH, on the other hand, is a non-liquid staked version of pxETH.

Unlike pxETH, apxETH generates a yield from staking rewards. This yield is automatically compounded to maximize rewards.

As of today, apxETH has a higher yield than its classic counterparts (approximately 9.67% APR).

Why? Well, it's quite simple:

When a user stakes their ETH into pxETH, the ETH deposited on Dinero is staked and generates yield.

However, as you've read, the staking yield is not distributed to pxETH holders. Therefore, apxETH holders benefit from the absence of native yield for pxETH holders, allowing them to claim a larger share of the rewards.

Currently, only 35.90% of circulating pxETH is staked (the rest is used in DeFi as collateral or in liquidity pools).

As this figure decreases, the APR increases and vice versa.

These two tokens cater to all profiles: the more conservative opt for apxETH for its 'native' yield, while the 'degens' turn to pxETH, which is more profitable but riskier (exposed to DeFi protocols).

By integrating Redacted Cartel into Mode, users will be able to take advantage of the opportunities offered by pxETH and apxETH to generate yield. This is a strategic partnership as Mode will be the only L2 available for this protocol.

As for ETHENA, all bridged-in ETH will be deposited into Dinero, will generate double-digit yield, that will go to Mode Smart Treasury and likely to be deployed onchain for user/protocols incentives.

I strongly recommend to listen to our podcast with Redacted, there are plenty of Alpha there.

Conclusion

You see, Mode is striving to properly prepare its ecosystem to welcome and retain the maximum number of applications/users.

With its fee-sharing system, the more applications on the network are used, the more their developers will receive a portion of the sequencer fees. It's a win-win system!

In any case, count on us to closely monitor the development of this high-potential L2

🔥Hottest news

🎁Wombat Exchange releases new whitepaper of Volatile Pool (welcome to single-sided LP) & for their gamified bribe market 2.0

🚴♂️✈ AERO & VELO coinbase listing on 06-Feb

♥ We love the Art winners announced on 19/02

✨Avantis mainnet beta live on Base

🛑 $sUSD stablecoin rated “F” by Bluechip agency. Read their report here (no redemption mechanism is one of the problem)

🤝ChaoLabs, a risk management firm, is partnering with Optimism to scale native $USDC from Circle on OP Mainnet

🟢 Lyra tokenomics V2 voted APPROVED by the DAO. 150m LYRA tokens will be used to boostrap the chain & protocol over 2 years, reduced trading fee, revue sharing set-up sending back 15% to Optimism (Superchain)

🎯New job at OP Labs: Staff Product Manager. Check out all the vacant positions

🌉The official Superchain bridge will be built by SuperBridge

✖ Cross-chain lending protocol, Pike Finance, just launched on Base, Optimism, Arbitrum & Ethereum. Powered by wormhole and circle CCTP for bridging & pyth network as oracles provider

⛓ Optimism has put a proposal to get TreasureDAO (gaming ecosystem) to move to the superchain

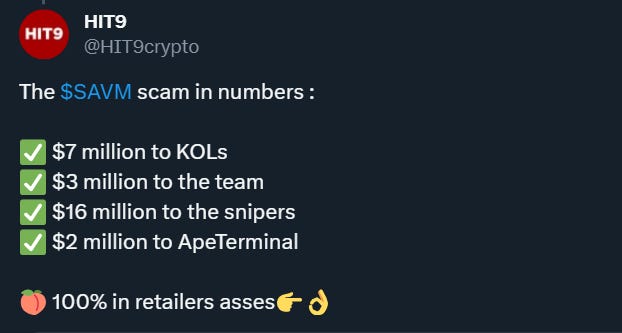

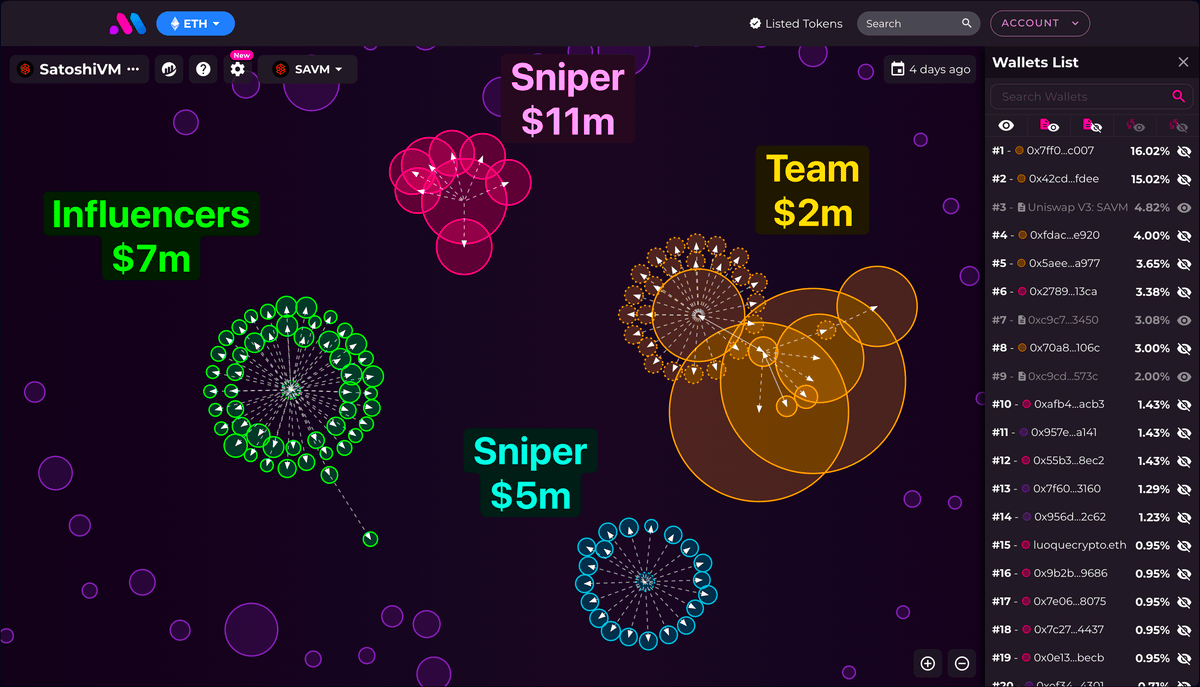

✖ Post of the week:

🟠Podcast:

Podcasts are the source of Alpha🔥. And what if you can transform 1h of listening into 5min of reading? The 🔴Optimist Podcast partnered with Revelo Intel to provide written notes of all podcasts for FREE.

The Optimist Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.