First of all, i’d like to express my thanks to you readers, for your comments, support, likes on this Journey. Big 👏 to the team for making The Optimist the go-to Media for everything about DEFI on the Superchain.

If you are a new subscriber, welcome onboard. Don’t hesitate to leave us a message, we would be happy to solve one of your problem.

Click in your preferred language to access the translated document:

Chinese - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔥Hottest news

Your bi-weekly breakdown of the most juicy news about the Superchain

🔴 Growth of Superchain: Lumio & Cyber

The superchain keeps expanding and sits now with 13 chains forming the Superchain. In this article, we will present two new chains: Lumio (connecting Aptos to EVM) and Cyber (the 1st L2 secured by restaking)

➡➡➡🦄Meme of the week

🔵Cross chain lending powered by Wormhole: Pike Finance

The title says all. More details in this article, with a point system currently live, getting you access to the only sale of $PIKE token.

➡➡➡✒ Post of the week

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, we were pleased to receive on Stage :

Pike Finance: Cross chain lending protocol powered by Wormhole

Velodrome: The MetaDEX

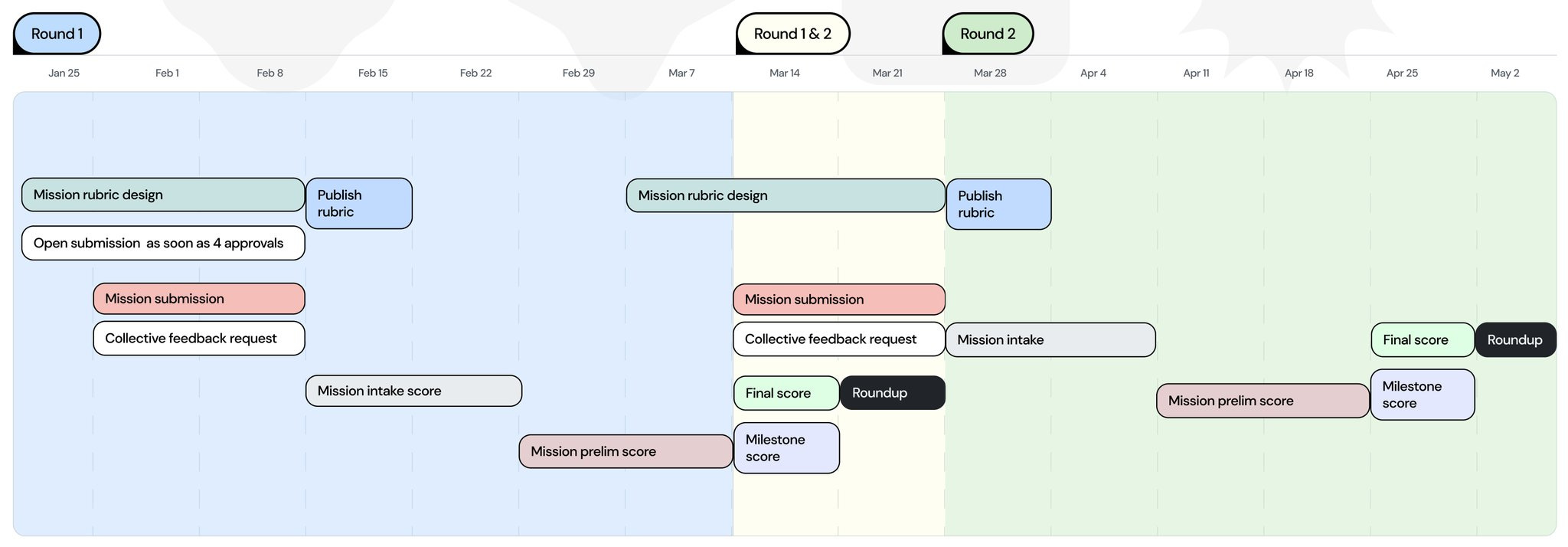

GOVERNANCE & VOTE TIMELINE

Next round applications open until 21-Mar 7PM GMT

If you wish to delegate your OP Tokens to Subli => Go to this page, and click on DELEGATE. Delegate Address: 0x3b128c6c1207d72092a8b3f6d651dfe54682a404

🔥Hottest news

📢Cyber - the new social layer 2 with restaking - is joining the superchain

🗣3rd web has announced a 3m$ fund to launch Superchain App Accelerator

🎁Arcadia Finance V2 is set to launch on 25 March with new features

🔵 OpenCover released Onchain cover on Pendle. Buy on Base or OP and get covered on Ethereum, Arbitrum & OP

🎮 Parallel, onchain game now live in Beta on Base, released its whitepaper

🏠 Propy Keys has launched on Base, with quest available on Coinbase Wallet, and PRO got listed on Aerodrome

🆔Clique, Identity oracles, raised 8m$, round lead by Polychain Capital (check our podcast #39 for more info abt this project)

💪Dencun upgrade is live since 13/03, bringing transaction fees to few cts

📈Kwenta is now live on Base, and released their vision of Kwenta future in this article

🔣Protocol_Fx is launching the 1st stablecoin backed by Restaking token. 1st partnership is with Etherfi. Expect more news soon 👀

💛 ezETH & eETH Liquid Restaked Token has now landed on Mode. Hold it in your wallet to earn more $MODE points

🟢Lyra added $USDT & $wstETH as collateral, hit ATH after ATH, and sit now as #1 options protocol in terms of volume according to DefilLama

🔴 Growth of Superchain: Lumio & Cyber

by Nataliii

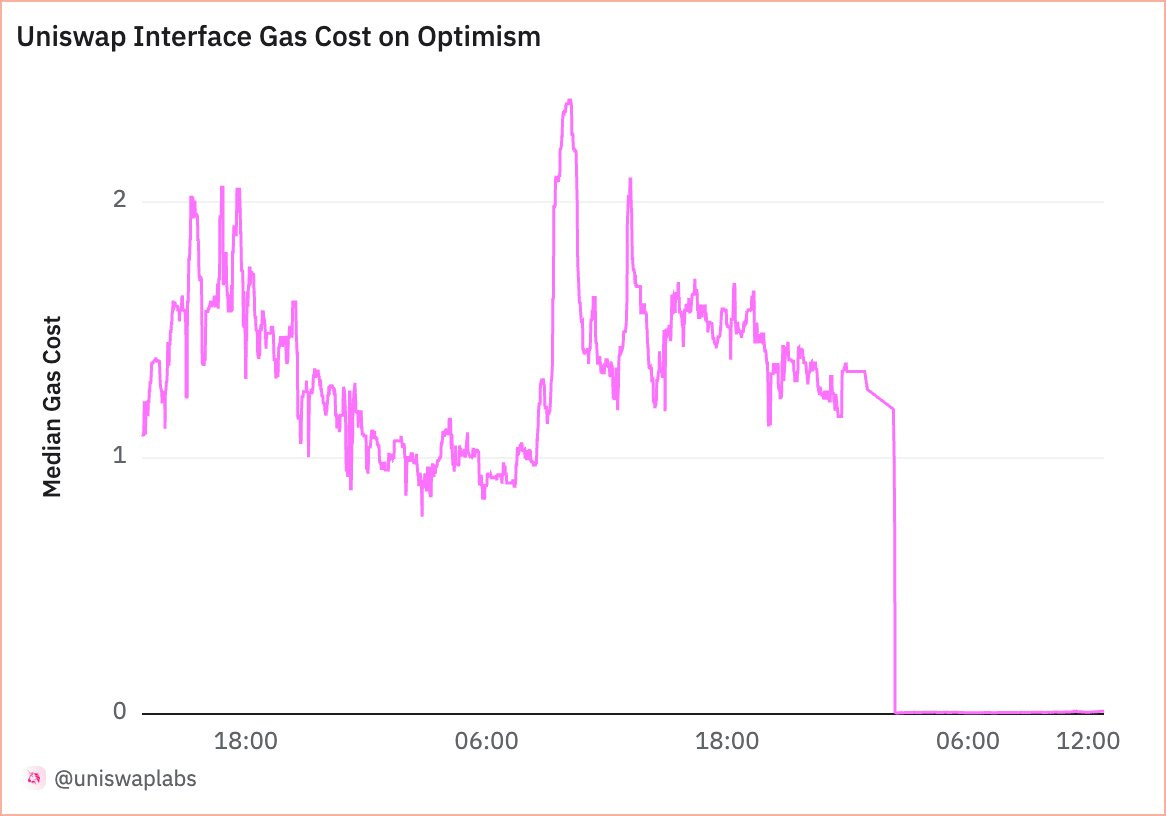

The Superchain continues to grow actively. Many different factors contribute to this. One of these factors is one of the smallest gas cost among all Layers 2.

Just look at this:

It seems like Optimism is a cheapest L2 now!

Thanks to these advantages, more and more new projects will join the Superchain, and perhaps in the near future the Superchain will become the largest ecosystem among all L2.

But today we will talk about two new projects that have been functioning in the Superchain for only a couple of weeks.

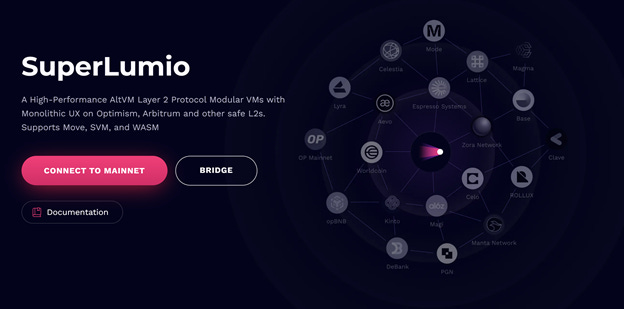

The first one is - **Lumio **and it’s mainnet called SuperLumio.

Lumio

Lumio is the first optimistic rollup to bring together the ecosystems of Ethereum and Aptos. It is EVM-compatible, built using the OP Stack, and settles on Ethereum – all the while leveraging the safety and efficiency of Move VM, Aptos’ virtual machine.

Lumio makes it easy to migrate dApps from Ethereum to Aptos, to experience EVM at the speed of Move VM and even to enable cross-VM calls. Their vision is to interconnect liquidity across multiple chains – at top speed and at the lowest cost possible.

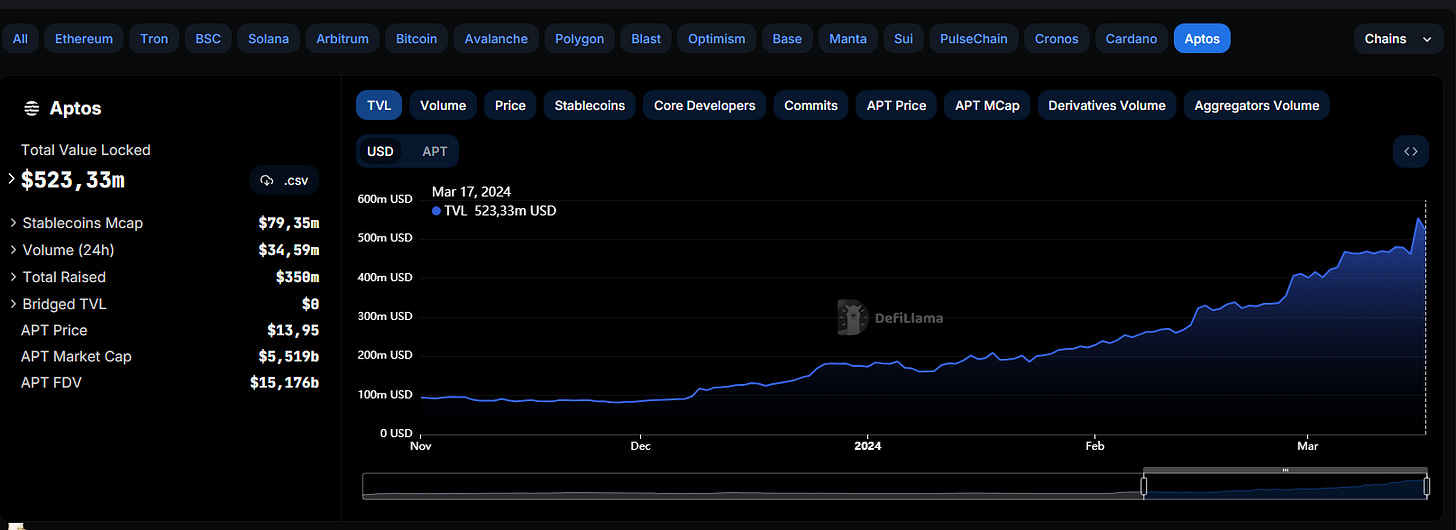

If you think APTOS is not interesting, just check this:

APTOS: TVL: 520m$, 6x in about 4 months 👀

SuperLumio

SuperLumio is part of the Superchain, the emerging network of interconnected L2s spearheaded by Optimism, next to Optimism, Base, Mode, and many others.

The reason to join the superchain? Benefit the tech upgrade & collaborative work to scale the superchain. For examples, DENCUN upgrade occurred on all the chains of the superchain at the approx same time,.

What advantages does Lumio have?

- Move & EVM compatible

The best of both worlds: familiar Ethereum tools supercharged with the speed and security of Move VM. Deploy on any of the two networks easily using Aptos CLI or any EVM-compatible CLI.

Lumio is designed to be both execution and settlement layer agnostic, so it can support many virtual machines and L1/L2 networks: Ethereum, Aptos, Optimism, Avalanche, zkSync, etc.

Lumio leverages the best of Optimism and its Rust implementation – the most technologically advanced among optimistic rollups. In the next phase, Lumio team have a plan to upgrade Pontem L2 to their own stack while also integrating it with Superchain.

How to use SuperLumio

SuperLumio is now live on mainnet, so it can be used to make real transactions. You can already add SuperLumio to MetaMask with the following parameters:

Name: SuperLumio

RPC:

https://mainnet.lumio.io

Chain ID: 8866

Coin: ETH

Block explorer:

https://explorer.lumio.io

Notta benne:* Lumio on testnet has been rebranded as xLumio.*

The feature release progression for Lumio should be more or less as follows: MetaMask support → Bridge → Pontem Wallet support → NarSwap DEX launch. The order can change, though, so do follow the news on X, Telegram and Discord.

And let’s talk about second newbie on Superchain - Cyber.

Cyber

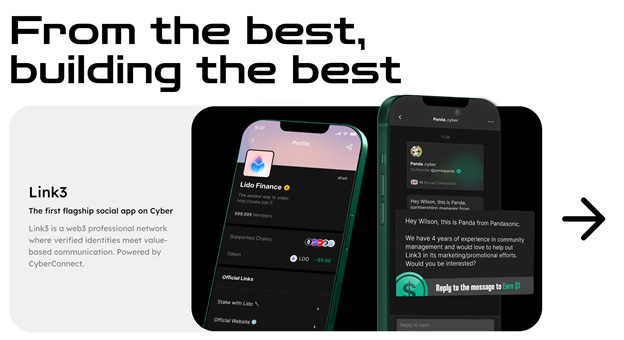

Cyber is a social layer for web3 that allows developers to create social applications, giving users control over their digital identity, backed by $25M in funding from Multicoin, Binance Lab, Animoca Brands, Hashed, The Spartan Groups, Delphi Digital, and many others 🔥🔥🔥

The first flagship social app powered by CyberConnect is a project you may know: Link3 - a web3 professional network where verified identities meet value-based communication.

Cyber recently launched their own L2, based on the Optimism/Eigen Layer, in partnership with Altlayer. Cyber is the first modular L2 designed for social and mass adoption.

What makes Cyber the de facto choice for web3 social users & developers?

Web3 needs social. Social needs a better L2. Social will help the onchain economy further diversify away from DeFi use cases and welcome more mass users.

Cyber can execute 100k+ txs per second with sub-cent gas fees.

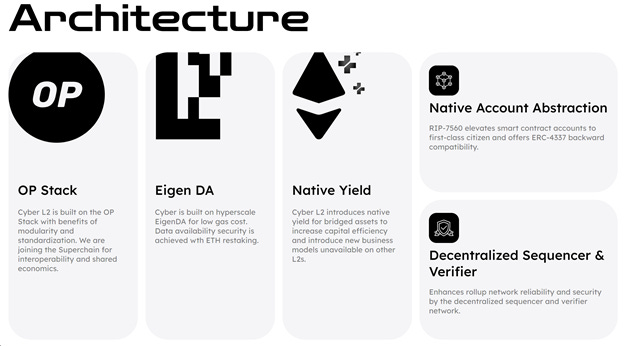

Architecture

OP Stack

Cyber L2 is built on the OP Stack with benefits of modularity and standartization. It helps for interoperability and shared economics.

Eigen DA

Cyber is built on hyperscale EigenDA for low gas cost.

Native Yield

Cyber L2 introduces native yield for bridged assets. Bridged ETH will be staked and yield will be distributed into Cyber ecosystem.

Decentralized sequencer

The dual stake model utilizes both the CYBER token and EigenLayer’s restaked ETH to maximize network security.

Incentives

On Cyber, developers and their users:

◆ earn native yield with bridged ETH, LST, and LRT.

◆ earn passive income through shared protocol fees.

◆ earn ecosystem rewards.

What else?

Gasless experience (Paymaster sponsors new user’s transactions with Account Abstraction

Seedless & Self-Custody (Supports native Passkey)

Economic Rewards

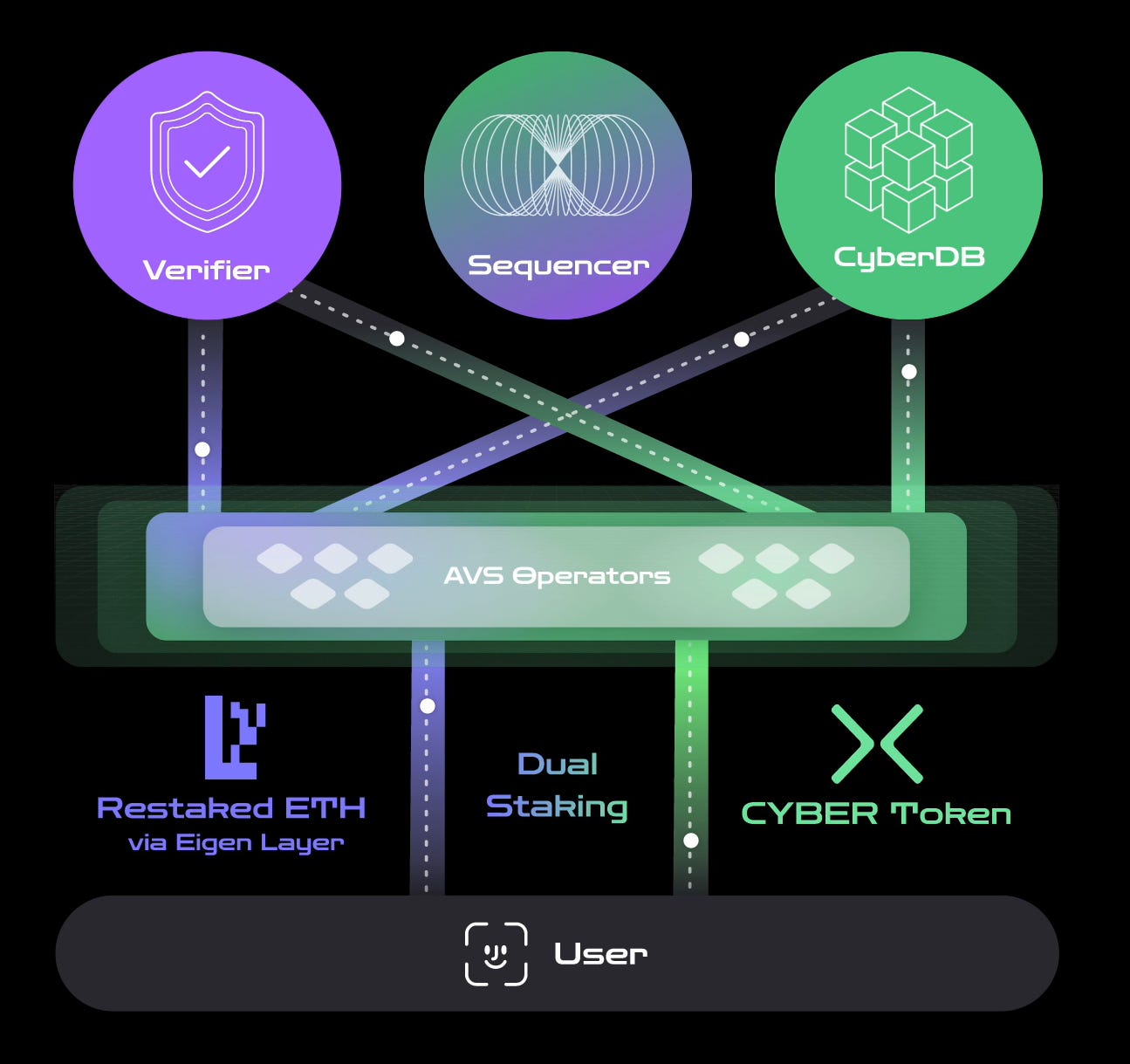

The economic rewards for CYBER stakers comprise three parts:

Season 2 rewards

Farm points by staking $CYBER, refer your friends, and earn $CYBER

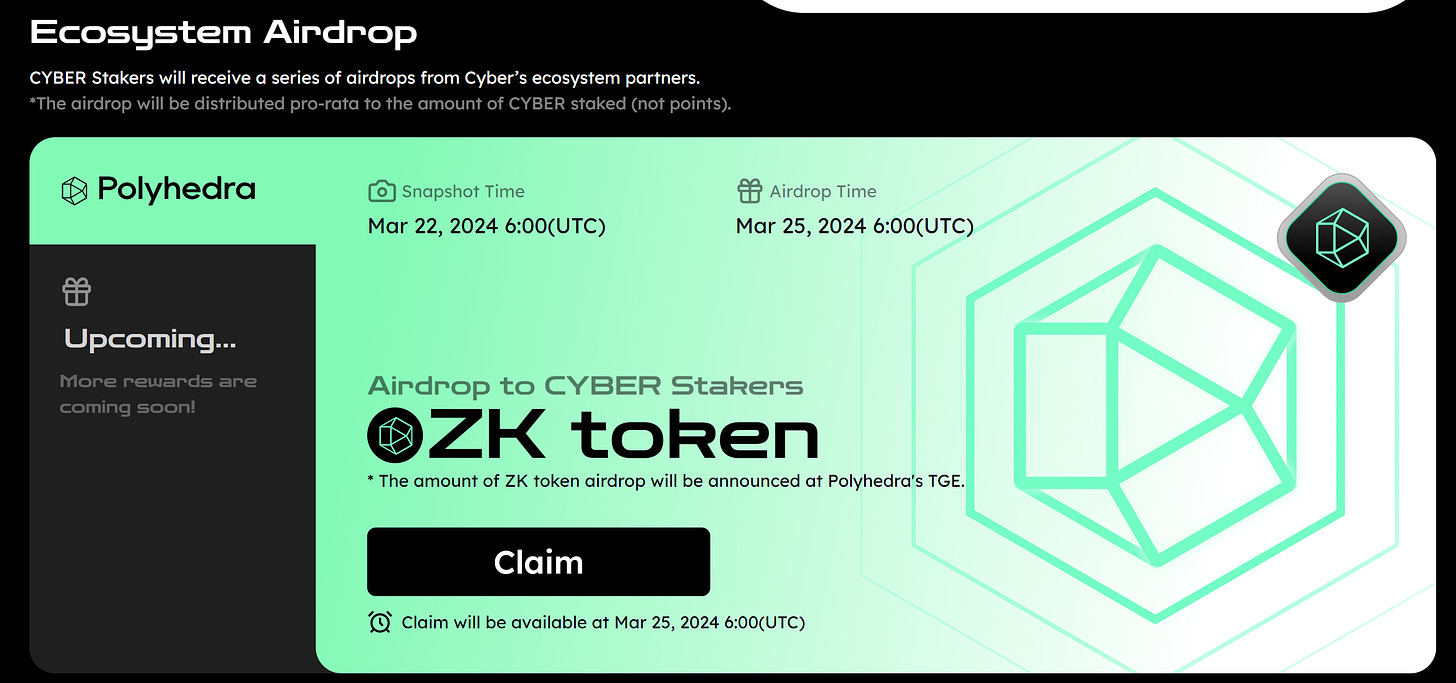

Ecosystem Airdrop

Do you remember $TIA stakers?

Network Revenue Sharing

CYBER is staked to AVS operators that run sequencers, verifiers, and CyberDB to enhance Cyber's security. In return, it is intended that CYBER stakers will share the revenue from these services programmatically.

Staking Incentives

5.5m $CYBER will be distributed over 6 years.

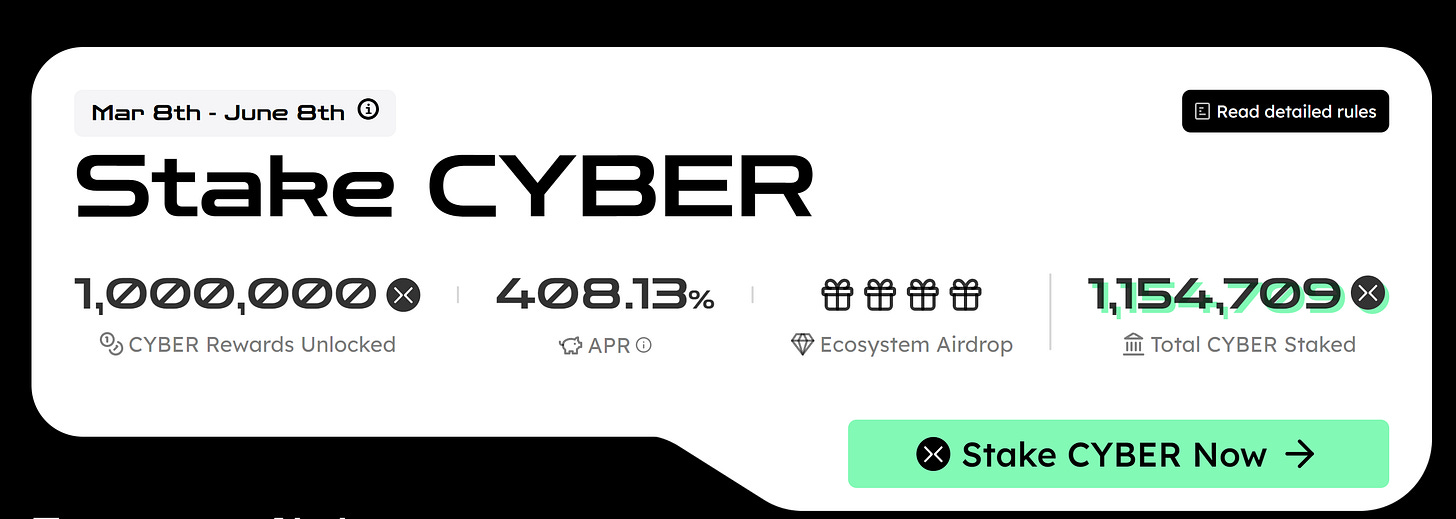

Staking activity

In honor of this recent launch, $CYBER stacking activity season 2 has started.

1 million $CYBER or $11.8 million has been allocated, and it will be distributed to stakers from 08.03 to 08.06.

You can stake $CYBER with 408.13% (!) APR (updated on 18 March).

Before the Cyber mainnet launch, staked CYBER cannot be unstaked. After the mainnet launch, the unstake process, which is at a CYBER holder’s discretion, will take 21 days.

*Staking is not available in restricted countries, including the US, Canada, China, Iran, North Korea, the Syrian Arab Republic, and Cuba.

Ecosystem Airdrop

$CYBER Stakers will receive a series of airdrops from Cyber’s ecosystem partners, such as ZK Polyhedra which will offer zkBridge to Cyber users. As such, $ZK will be airdropped to $CYBER stakers.

The snapshot will be taken on 22.03, 6 am UTC.

Distribution of the airdrop on 25.03, 6 am UTC

To qualify for the ZK airdrop, you need to deposit at least 10 CYBER($120).

How to qualify?

Go to the website, connect the wallet (referral code in this link).

Select the BSC/Optimism/Ethereum network and lock tokens. You can buy $CYBER on Velodrome. Click here.

Unstake will be available with the launch of Eigen Layer, ~ Q2 2024. The withdrawal will take 21 days. Check EigenLayer announcement about Mainnet.

TL;DR: Stake Cyber, collect your share of a 1 million $CYBER pool, get eligible to Polyhedra Airdrop, and expect other project AIrdrops too. A triple profit!

You can read more in this article.

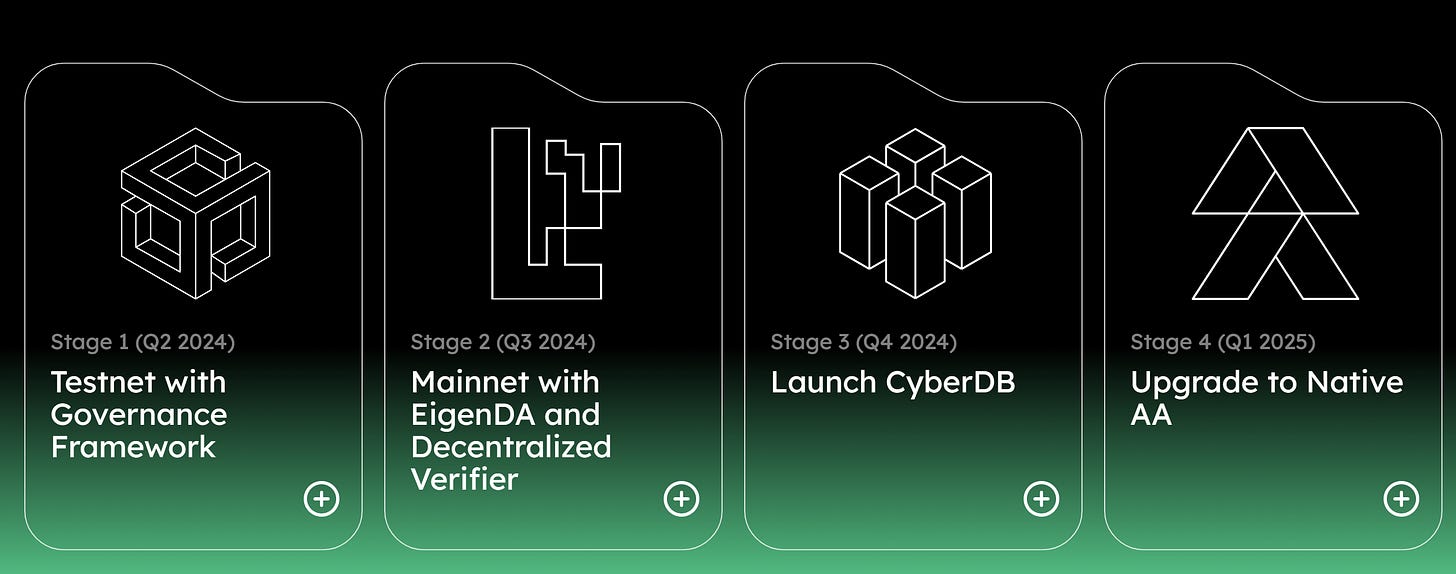

Roadmap

And in conclusion just look to the Cyber Roadmap:

As we can see 1st stage will begin in Q2 2024 and will focus on establishing Cyber L2’s core infrastructure and develop tools. So the beginning is almost here.

2nd stage is mainnet that will starts in Q3 and integrate EigenDA.

3rd stage - Q4 2024 - Launch CyberDB constructed upon EigenLayer’s AVS architecture.

Stage 4 - Q1 2025 - upgrading EOAs to smart contract account to unlock countless UX benefits (flexible gas fee delegation, programmable accounts).

Conclusion

I wonder what projects the Superchain will be replenished with in the future... We'll find out soon, stay tuned and stay Optimistic :)

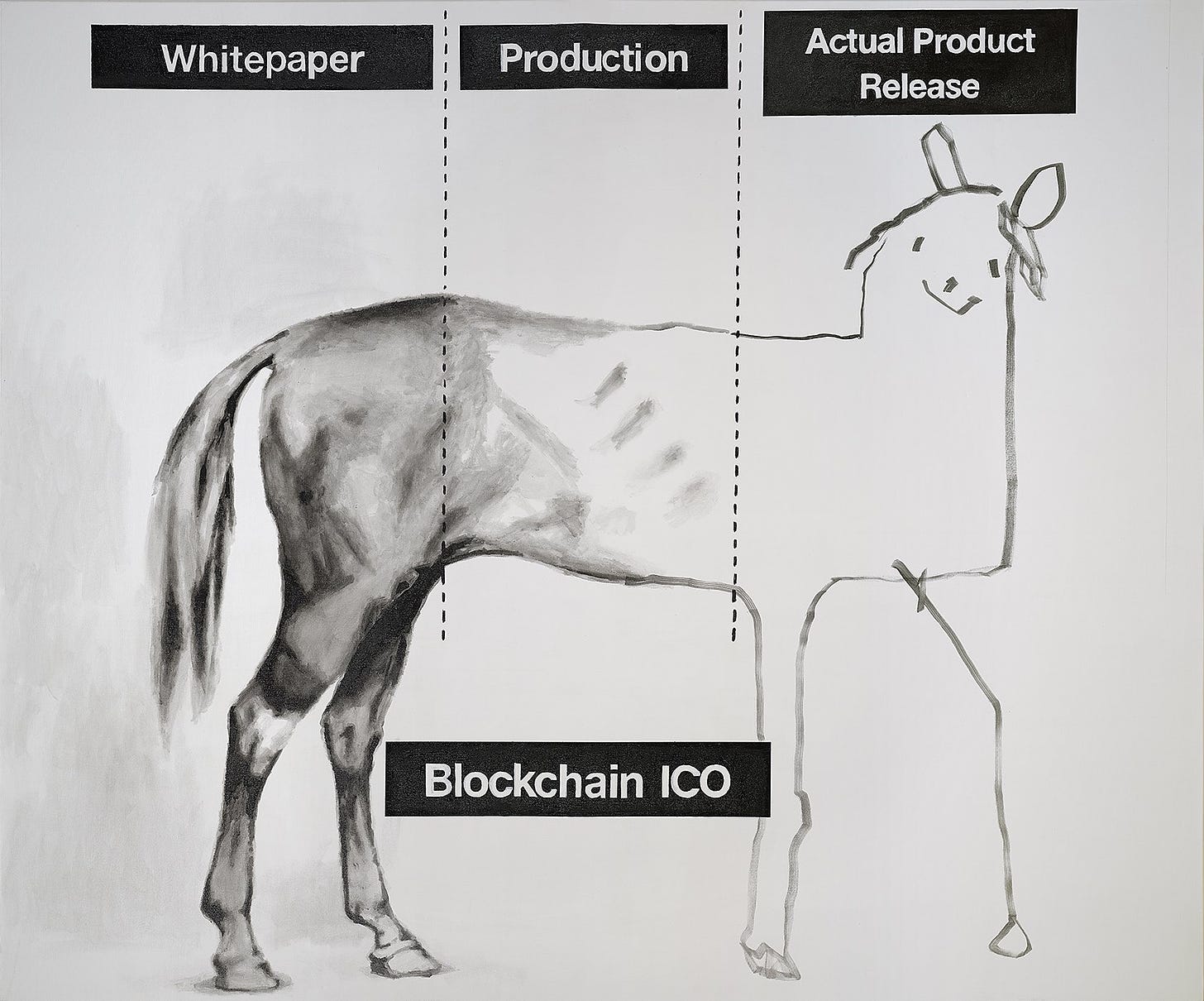

🦄Meme of Week

🔵Cross chain lending powered by Wormhole: Pike Finance

By Subli

The lending market was, in my opinion, a bit behind in terms of innovation. All new chains have their own stack of AAVE or COMPOUND forks. Innovation started by Radiant early 2023, enabling cross chain lending/borrowing without using a bridge. But, you may know that Bridges are a big source of failure, being the #1 applications hacked with >2b$ exploited so far.

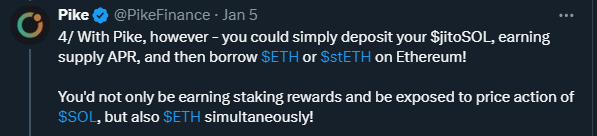

As of now, cross chain lending maket are only EVM compatible, but what if you could deposit collateral on Base, borrow on Solana without using a bridge? You dream about it, Pike Finance built it.

Powered by Wormhole & Pyth

Firstly, it’s important to say that Pike Finance received a co-grant from Wormhole & Circle, which is an amazing proof of trust in this new project.

What do users want? Using the chain where their liquidity is, and access opportunities on other chains without moving their funds.

Pike Finance aims at becoming the largest cross chain lending protocol for native assets (aka ARB on Arbitrum, OP on OP Mainnet, etc…). But how does it work?

Pike FInance is using the Lend Hub & Spoke architecture. Users can use its liquidity on the Spoke chain as collateral for borrowing on another chain.

Base Hub

The hub, located on the Base chain, manages business logic, accounting, and user's asset positions. It coordinates Spoke chains for operations like supply, borrowing, repayment, and withdrawals.

Spoke Chains

Spokes store liquidity, allowing native assets to be used as collateral for cross-chain borrowing without requiring wrapping or transfers across token bridges.

The main benefit of this architecture is that funds are not wrapped nor transferred across chains (except for USDC that will be bridged using CCTP technology from Circle).

Finally, as an oracle solution, Pike Finance is using Pyth, very well known & used by Synthetix for their perps applications.

EVM & non-EVM chains

As of today, Pike Finance has been live in a limited version since feb-2024, with a lending & borrowing cap to allow the protocol to monitor the system health. As of today, the following chains are available.

But the team has made its priority to become the 1st cross chain lending protocol connecting EVM & Solana chains. What a use case… 🚀

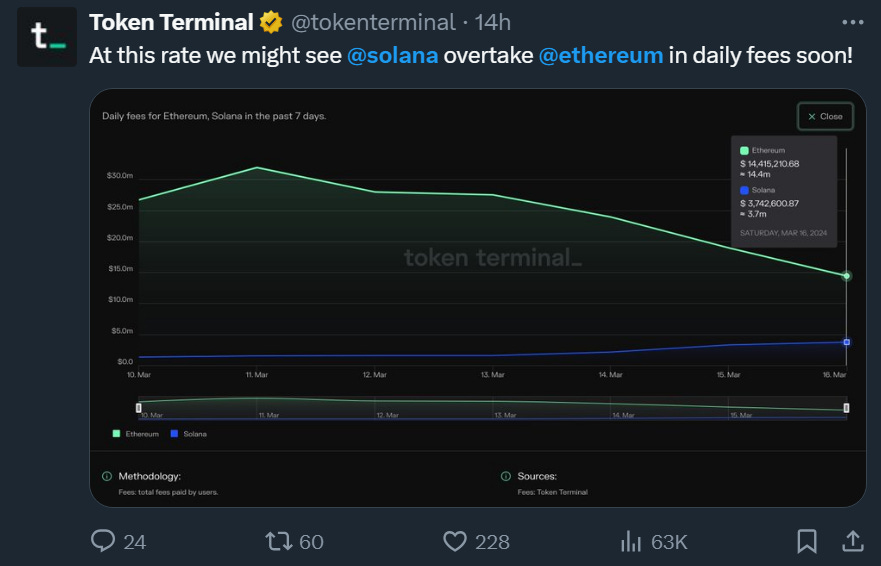

Pike has chosen to build on Base to make Pike more lightweight, faster, cheaper, and secure. And with DENCUN live since couple of days, it’s true that gas fees will be very much close to Solana ones. The team also showed interest to deploy to Monad & Blast.

On a personal note, I always wonder why this type of innovative project chose Base at their home chain… And I always end up answering that there is a high likelihood Coinbase could play a Venture roles in this case (NFA? totally speculative).

$PIU & $PIKE

$PIKE is the governance token, and the only way to get it before TGE is to participate to the community presale. The project has not raised any money with VCs or private investors, and all allocations not allocated to the team, will be available during the community presale.

Your allocation will be based on your offchain & social belongings and your onchain activity.

All of the above will make you earn $PIU, the new liquid point farming token issued by Pike.

Points farming have gained a lot of traction since months, and Kelp DAO was the 1st project making EigenLayer points liquid through $ KEP token. Pike Finance is using the same meta. The more $PIU you get, the greater will be your allocation during the community presale.

The PIKE PIU PROGRAM (PPP) has launched since 15/03 and will last 31 days (so should end arounf the 15/04). During this period, there are few ways to earn $PIU:

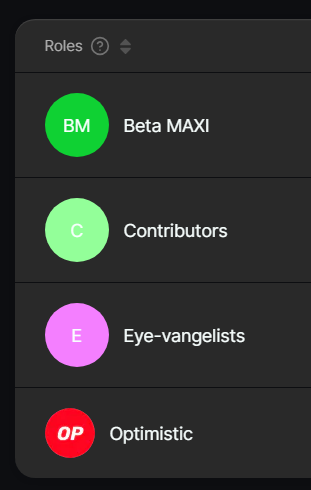

Your discord roles: (roles can be cumulated, so will be your $PIU allocation)

Lend on Pike Finance: https://app.pike.finance/. For info, caps will be raised but limited to 15k$ soon.

Borrow on Pike Finance. As Pike Finance is earning core market is Borrowing, borrowers will have a greater PIU allocation

What’s the maximum you can get?

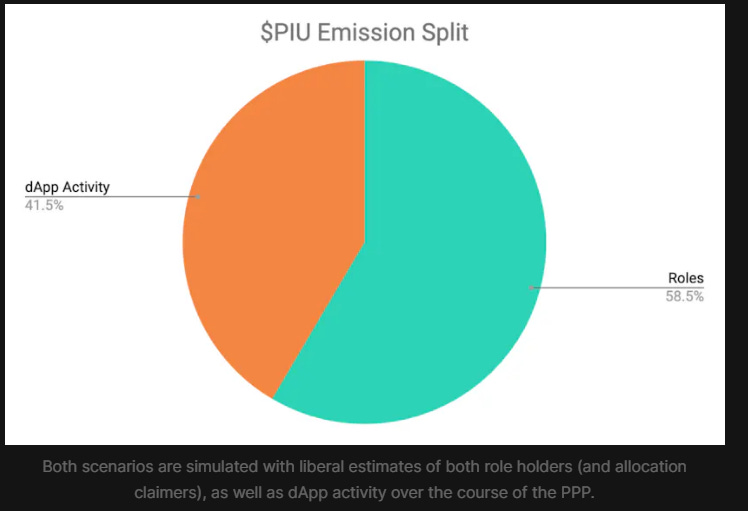

The split between roles & onchain activity is as follows:

The number of PIU is capped based on the below TVL:

Deposits from $3.5M to $20M

Borrows from $400K to $8M

If you deposit 15k$, and max borrow, you will get 0.075% of the total allocation from dAPP activity (i.e: 8,370,000 $PIU).

For info, here are my roles on Discord, granting me an additional 1,600,000 $PIU.

Total $PIU expected to be earned by myself: 9,970,000 $PIU / a total of 27b $PIU planned to be distributed (0.037%).

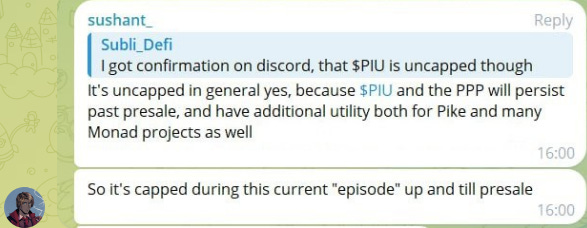

So, this might be one of the most fair launch ever, as whales or airdrop farmers won’t get a lot of shares in the presale. But what if $PIU has more utility that we think? 👀 The team hinted collaboration with Monad projects...

And what's next?

Go to this page to claim your $PIU: https://piu.pike.finance/, claimable on Base & Solana (not live at the time of writing)

And since, liquidity will be available on Base & Solana, you can easily increase or sell your $PIU.

Here is $PIU contract on Base: 0x68f216bDe507F6cE6c66955D1b4216a402E94CF3

🛑Watch out for scam liquidity🛑

But as explained earlier, $PIU will grant you access to the community presale. The more you hold, the more allocation you will get. There are 4 Tiers within the ranking (Tier 1, 2, 3, General), with Tier 1 being the highest achievable tier.

Secret Alpha: Pre-sale will happen on 25/03/24 🤫

The gamification of the community presale can’t be better. We know how much Crypto Boys & Girls love this. And with the recent Hype on Solana plus the team connection with Monad blockchain, i think Pike is just starting something really big. Keep an eye on Pike:

Happy “Pike It Up” everyone!

✒ Post of the week

🟠Podcast:

Podcasts are the source of Alpha🔥. And what if you can transform 1h of listening into 5min of reading? The 🔴Optimist Podcast partnered with Revelo Intel to provide written notes of all podcasts for FREE.

The Optimist Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.