The Optimistic Newsletter #1

The unique Newsletter about DEFI on Optimism blockchain written by Defi Users for Defi Users

- Governance/Tech updates

Optimism investment/grant allocation is directed by The Governance. Watching where the DAO is moving can give you an edge on your investment or farming options. Let’s go through the main changes for the coming weeks.

- Project Update: ALCHEMIX

Alchemix just voted to allocate the 250k granted $OP over the course of 6 months to both vault depositors on Alchemix and liquidity providers on Velodrome Finance. A detailed analysis on how you can benefit from it.

- On-chain analysis: Optimism Quests

Optimism quests will end on January 17th 2023 and has been followed by a lot of users in view of potential Airdrops. So how many of you completed the 18 Quests? Let’s run through some on-chain statistics to see where you fit.

- Crypto Market Macro-Analysis: Trader/Investor, Bull/Bear, what strategy to adopt ?

As I used to say, yield farming will never overcome price decrease of a token. Yield farming is a brick to add on top of your investment strategy. Where are we at the moment, what trading behavior should we adopt? Let’s focus on the Crypto Price Action at this beginning of the year.

- Interactive Community Section: Farming Strategy

For each release, i’ll present one farming strategy on Optimism protocols presented by one Optimism Community Member. Make a thread on twitter and send it to me via DM.

GOVERNANCE / TECH UPDATES

Why following the Governance of Optimism? It’s simple, you will be able to learn:

Optimism technical development → This will lead what Optimism will be in the future

Optimism grant initiatives → Following the money will give you an edge on your investment

So let’s sum-up what are the major events for the coming weeks:

Season 3 of $OP Grants will start with a new process.

Former committees have been replaced by a Grant Council that has been elected for 1 season, with 2 committees: Builders Committee & Growth Experiments committee

Optimism's third season of Governance Fund Grants begins on Jan 26. Two committees this Season: 🛠 Builders Committee – goal to maximize the number of developers building on Optimism 🚀 Growth Experiments Committee – goal to maximize the number of users of apps on OptimismSome information about Season 3:

Budget: 5m $OP

Start date: 26th January

Duration: Approx 10 Weeks

As always, these grants are usually meant to attract sustainable liquidity, so follow me on twitter @Subli_Defi for a complete review of this season 3!

Optimism 2022 review

For those who follow the official optimism foundation account (for those who don’t, just do it now: @optimismFND) , you could access the latest blog post on the official Miror account, and have been able to mint this NFT (don’t cry if you didn’t make it), it is not related to any future airdrop. But i guess it’s an interesting thing to judge engagement (334k minted NFT).

https://optimism.mirror.xyz/O8DesNLJ5HXD6C55Lwnks8xIPU45BjJlwZARKWBqXuE

And don’t forget to subscribe to the Official Newsletter.

Retroactive Public Good Fundings

In February 2023, 10M $OP will be distributed to the people and projects powering the public goods that make Optimism possible.

Timeline is as follows:

Project nominations: Jan 17 - 31

Final project signup deadline: Feb 7

Voting: Feb 21 - March 7

So if you participated in 2022 in the growth of Optimism, don’t hesitate to apply, and if you need support on it, my DM are open.

PROJECT UPDATE: ALCHEMIX

Alchemix, a protocol allowing to take a self repaying loan in $ETH or in Stable, just voted to allocate his 250k $OP grant to incentivize users & liquidity providers. Here is how you can benefit from it:

Vaults Boost: Using Yearn Finance Vaults

Allocation = 125k $OP distributed over 6 months. Distribution will be as follows:

50% distributed to yvWETH vault

25% distributed to yvDAI vault

25% distributed to yvUSDC vault.

So if we estimate an APR of 5% on yvWETH vault, that would lead to a TVL of: 2,4m$ worth of $ETH (at current $OP price)

For info, Yearn Finance vaults are yet to be released, expect it soon.

Liquidity Incentives: On Velodrome Finance

Allocation = 125k $OP distributed over 6 months. Vote results are as follows:

50% as bribes on the alETH/WETH pool

25% as bribes on the alUSD/USDC pool

25% as bribes on the alUSD/MAI pool -> For info, QiDAO will also bribe this pool with the same bribe value as Alchemix, doubling the liquidity or the APR at constant TVL

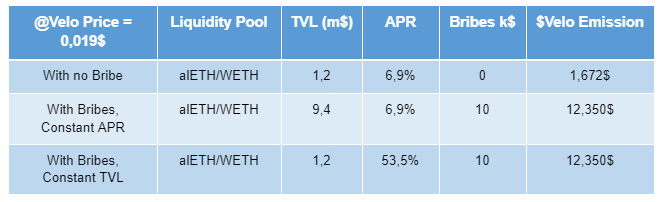

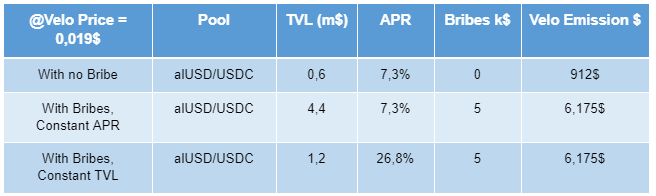

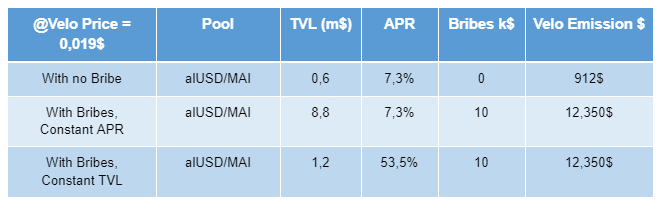

As of today, Alchemix is voting to the above pools using their own veVELO allocation, with no bribes. So what would be the new APR with these incoming bribes?

Liquidity Pool: alETH/WETH

Liquidity Pool: alUSD/USDC

Liquidity Pool: alUSD/MAI

ON-CHAIN ANALYSIS: OPTIMISM QUESTS

1/ Reminder of OP's first airdrop

The first user airdrop delivered 5% of the total number of $OP. Optimism launched its first airdrop on 1 June to 248,699 early adopters. An average of few ETH up to 40,000$ was granted per wallet! It was clearly one of the most generous Airdrop for the start of the bear market.

2/ Wen airdrop#2 ser? :THE QUESTS

We DO know there will be future airdrops. However eligibility criteria for the #2 one has not been disclosed yet, so speculations are in everybody’s mouth. However, The Optimism Team launched a series of Quests to complete, which we ALL think will required to be eligible for the future airdrops.

Optimism Quests are a simple exploration of the Optimism app ecosystem. Just by completing a short quiz and task, users will be able to mint a commemorative NFT. There are 18 NFTs to earn.

If you followed @Subli_Defi on Twitter , you probably minted them all, Congratulations to you!

The Quests could definitely be one of the multipliers for eligibility requirements for Airdrop #2 (but nothing is confirmed by the team). The quests will end on January 17th 2023, so hurry up!

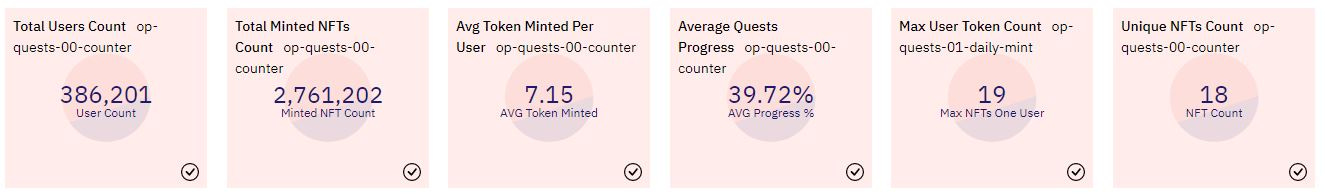

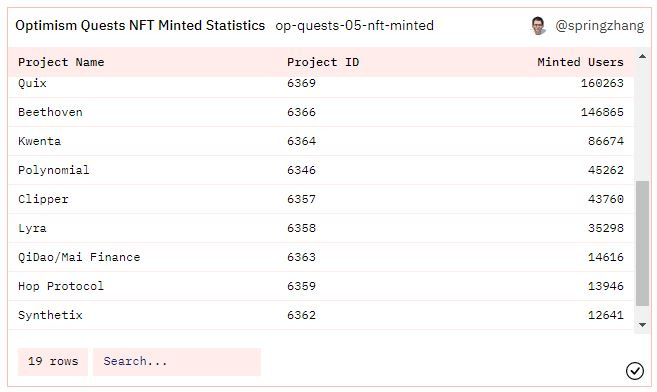

3/ Statistics of the Optimism Quests Tracking:

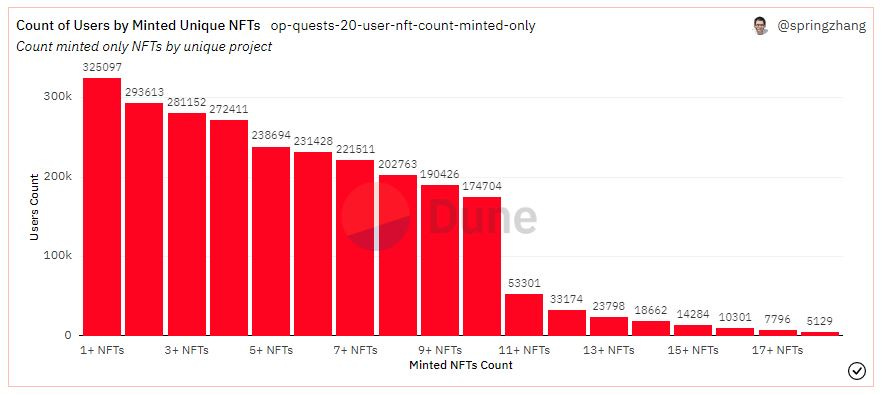

An average of only 7 NFTs per wallet for 386 000 Wallets

Only 5129 Wallets completed the 18 Quests, Why ser??

Easy quests up to 10:

Deposit, swap, bridge, Provide LP, between 20$ to 50$ without locking duration and risk of loss, are the easiest tasks for this quest, that’s why Uniswap, Stargate,Pooltogether, Velodrome are the most minted NFT.

Medium-difficult quests up to 17, over $300 dollars:

As we can see, beyond 10 NFT, the number of eligible users reduced significantly.

Hop Protocol, QiDao, Lyra, are the less completed quests, due to more complexity to use the protocols, longer locking period resulting in being exposed to volatility thisin period of bear market.

Thanks to @springzhang / Optimism Quests Tracking (OP Version Odyssey, Galxe NFT)

https://dune.com/springzhang/optimism-quests-tracking

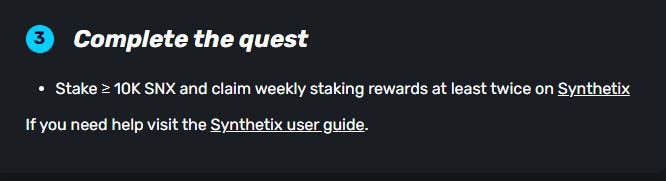

Difficult quest up to 18 with SNX

The least minted NFT is the defi bluechip SNX (Stake 10,000 $SNX for a minimum of 2 weeks) which is almost financially impossible to complete for the retails.

However, up to November 2022 Synthetix quest rules were to stake only 100 SNX to complete the quest. Why this change?

To avoid Sybil attacks and prevent retails who do not understand how Synthetix is properly working (stake $SNX, mint $sUSD, manage your Health Factor to claim your rewars & avoid liquidation), Synthetix decided to increase the entry barrier at 10 000 SNX & continue focusing on the growth of the protocol, which is by the way the second larger in TVL on Optimism.

You still want to know more about $SNX Staking, please check my Notion Page on "Synthetix", i have a full tutorial on VIdeo that explains how to fo it.

The Optimist NFT is a customizable profile picture project that can represent user identity across the Optimism ecosystem.

Furthermore, Quest NFTs can be used to unlock different traits in the Optimist NFT, if you earn them yourself.

Tier 1: Earn ≥4 distinct quest NFTs to unlock [redacted]

Tier 2: Earn ≥7 distinct quest NFTs to unlock [redacted]

Tier 3: Earn ≥10 distinct quest NFTs to unlock [redacted]

Bonus:

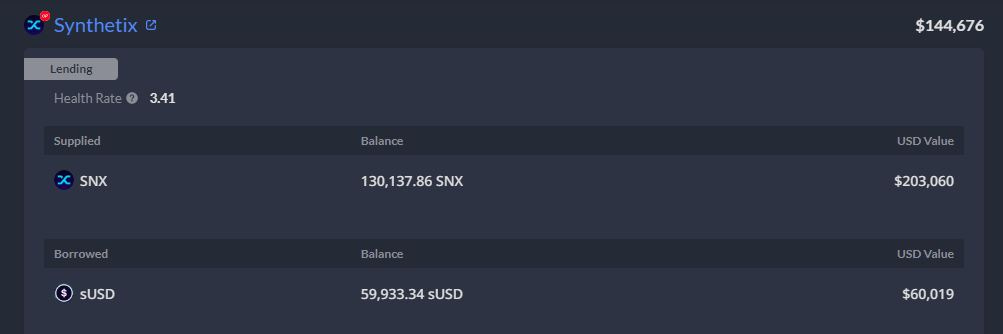

Tetranode in position on SNX Optimism.

Tetranode, the $ETH whale and king DEFI OG on Twitter, usually use exclusively Ethereum and Arbitrum, but he has a staking position of 130k $SNX, it’s an amazing move, and will be interesting to follow!

https://debank.com/profile/0x9c5083dd4838e120dbeac44c052179692aa5dac5?chain=op

MACRO-ANALYSIS: TRADER/ INVESTOR, BULL/ BEAR, WHAT STRATEGY TO ADOPT?

Whether you are a day trader, swing trader or investor, it is essential to have basic knowledge of the price evolution of the product you are investing in. Managing a portfolio requires personal investment, and it is important to educate yourself and avoid letting emotions take over reason, which would lead to making mistakes.

This section is for educational purposes for newcomers to this market to quickly learn good practices for following your cryptocurrency investments, or for more experienced individuals looking to have a macro view of the markets.

First, it is important to understand yourself. Who are you?

Day trader:

A trader focused on small timeframes (between 1min and 1H). Generally, the day trader seeks to close positions before the close, but since the crypto market is open 24/7, positions can be held for a few minutes to 24/48 hours.

A day trader needs volatility, and altcoins are currently very volatile.

Swing trader:

A trader focused on larger movements, from a few days to several weeks (between 4H and 1D). This is often the most preferred type of trading, as it allows for larger gains when the market is bullish without having to spend all day in front of the screen.

A swing trader needs upward or downward movements. However to take a long position it is preferable to have a sign of a trend reversal. And for a short position Bitcoin has already corrected more than 75% so the risk-reward ratio is not very interesting. Moreover, it is always better to trade with the trend. Short in bear market and long in bull market.

Investor:

An investor has a long-term view of the market in which they invest. They focus on larger timeframes (between 1W and 6M). As Warren Buffet, considered to be the world's greatest investor to date, said, you have to be prepared to see your investments cut in half for several years to deserve an explosion in the course and the profits associated with it.

Finally, for investors, current Bitcoin prices are considered an opportunity and they should start DCA (dollar cost averaging).

When to expose your capital?

We all would like to have a crystal ball to know the future price action or a time machine to buy Bitcoin in 2009. Of course this is not possible, but we will see the principles and tools that allow us to have our own analysis and therefore adapt our risk management.

Above all, it should be understood that to this day, Bitcoin remains the king of cryptocurrencies. It will make the weather for the thousands of other existing cryptocurrencies. Whether Bitcoin is bullish or bearish, the rest of the market will follow.

It is often said that Bitcoin moves in conjunction with the S&P 500 and inversely with the DXY dollar index. Therefore to take a position or to follow your investments, it is necessary to analyze several parameters other than cryptocurrencies. In this article, we will focus on the DXY index, which measures the value of the US dollar compared to other foreign currencies.

DXY Weekly:

We notice that the index has been correcting since late September 2022 and is currently testing the former resistance, which has now become support. If this retest validates this new support, it would allow for a new bullish momentum for DXY and so a downtrend for the Crypto market, otherwise the correction will continue. This correction has allowed the cryptocurrency market to catch its breath.

DXY Daily:

A divergence on the 1D timeframe is currently taking place and we are currently at a major support level that we saw in the weekly analysis. If this divergence plays out, the index will resume its upward movement and Bitcoin would then be impacted. Here are two options:

DXY makes a higher high, so Bitcoin can see a new lower low

DXY makes a lower high, so Bitcoin could make a higher low, which would indicate a change in trend for a new possible bullish momentum.

As a conclusion, it might be a good time for investors to DCA-IN on cryptos, however for traders, we are still waiting for a clear sign showing the right direction for Bitcoin, and so the rest of the Crytpo market.

In the meantime, stay cautious.

INTERACTIVE COMMUNITY SECTION: FARMING STRATEGY

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

Today strategy is about Velodrome Finance where i’m explaining my strategy to lock VELO for veVELO and earn Voting incentives or Bribes every week. I’ll show you how I can increase my veVELO by 2,7x without any additional invesment.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

Optimism Discord: https://discord-gateway.optimism.io/

Discord Handle: Subli#0257

Subli-Defi Social accounts:

Twitter:

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi