The 🔴🔵Optimistic Newsletter #10

The unique DEFI Newsletter on OP Superchain written by Defi Users for Defi Users

First of all, i’d like to express my thanks to you, for your comments, support, likes on this 🔴🔵Optimistic Journey. Big 👏 to my 4 teammates & all the translators as all this work could not have seen the light without them.

And finally, welcome to the 607 new subscribers to this newsletter.

Thanks for reading The 🔴🔵Optimistic Newsletter (by Subli_Defi)! Subscribe for free to not miss anything on the OP Superchain

Click in your preferred language to access the translated document:

Chinese - French - Japanese - Korean - Persian - Russian - Thai - Turkish - Vietnamese

MENU OF THE WEEK

🔴Tech. update: Season 4 - Into the Superchain by Messari

The 🔵🔴Optimistic Newsletter read the complete research report from Messari, crypto media platform, about Optimism Superchain. We have collected the key points only for you, Optimism community.

🔵How to avoid scam projects

The meme season is in full swing. 90% of the projects are scammed, and one guy created even more than 100 scam projects. How to avoid them and reduce your risk when aping-in into a meme token? Our best read content so far is brought to you.

🟣Project update: Extra Finance

Extra Finance is an Optimism native Leverage Farming Protocol that recently launched their Beta Version on Optimism. Let’s discover this project and their pretty HOT & SPICY roadmap for their coming weeks. Read the article as the team discloses their 💰tokenomics and 🪂Airdrop plans.

🟢Macro-Analysis: BTC / ALTCOIN

Bi-weekly update on the Crypto Market. We hope you didn’t get rekted on this meme season. $meme, $ben, $ bob, $pepe were leading these last two weeks. This has been an insider play from the beggining and as always called a local top in the market. Where are we going now, which strategy are we looking at?

Personal reading: Last essay from Arthur Hayes about the banking system state in US.

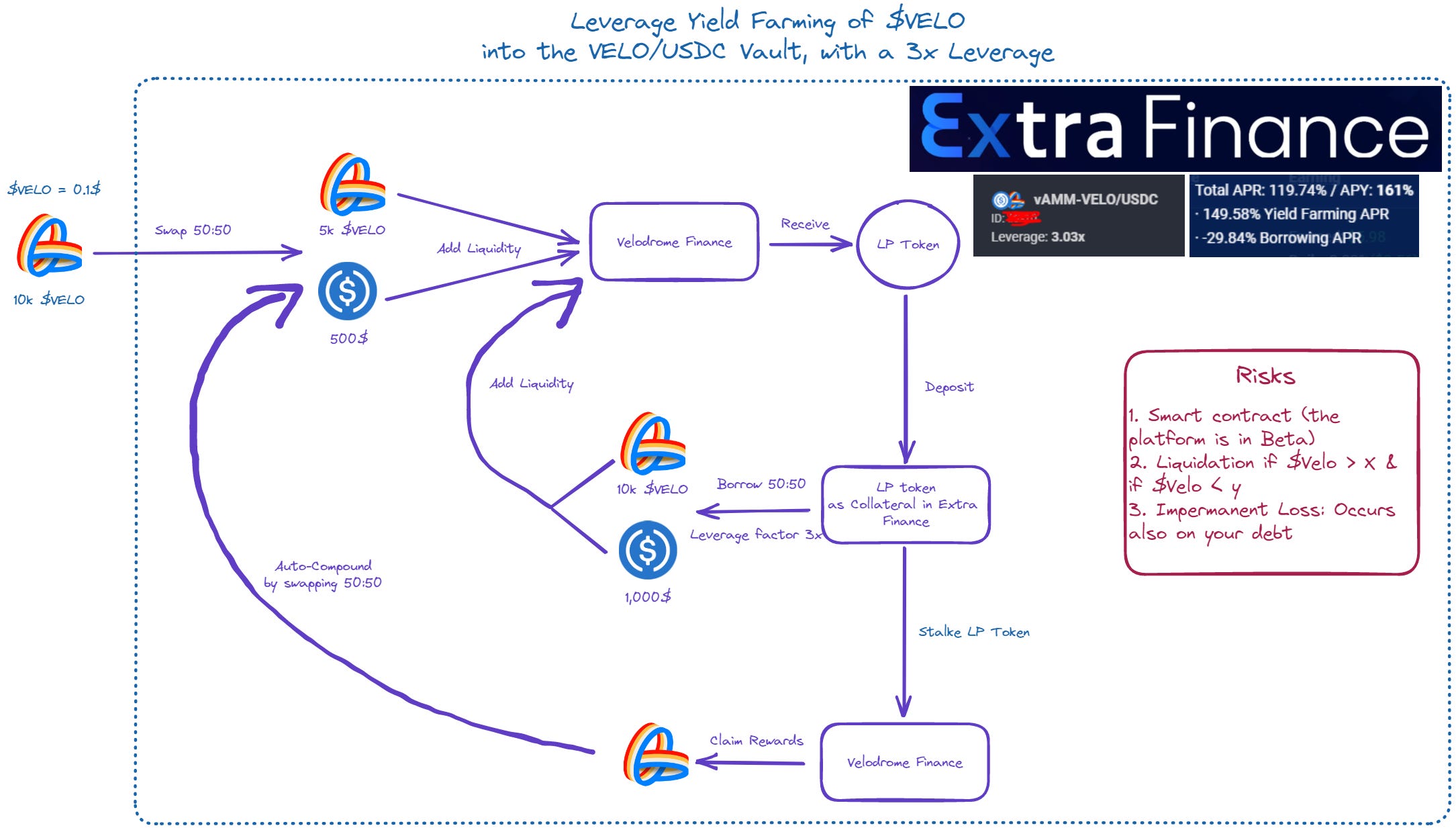

🟤Farming Strategy on Extra Finance

As Extra Finance is the Project subject of this newsletter, we are going to present you a leverage farming position we have taken on the VELO/USDC vault.

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live :

Arcadia Finance

Lido Finance

Podcast available at the end of the newsletter.

⚫The Optimistic series Campaign is live - Engage to Earn 30k OP

Questoors, come, engage about #Optimism by completing this series of quests, and earn OP token.

https://www.tideprotocol.xyz/users/campaign/7d82cadc-77dc-432d-85cf-4810ffa5280e

Timeline:

Quest #1: 🟢Live - End on 31-July

Quest #2: 🔴Closed - 🔥14 🔴OP earned by every NFT holder! CONGRAT’S! 🪂Airdrop will be done in the coming weeks (setting up the process with Tide3)

Quest #3: 🟢Live - End on 31-May (Submission closed on 28-May)

GOVERNANCE TIMELINE

Cycle 12a votes (click on the link below to access the detailed proposals):

Intent #1 Budget proposal (1m OP) ✅

Intent #2 Council intent budget proposal (5.285m OP) ✅

Intent #3 Budget proposal (1m OP) ✅

Intent #4 Budget proposal (3m OP) ✅

OP SUPERCHAIN STATUS

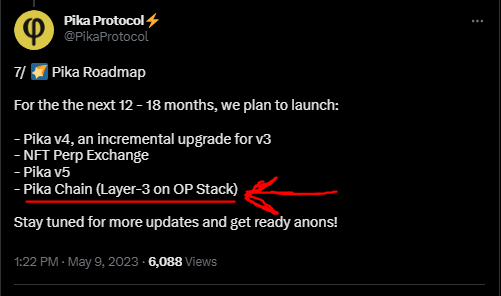

🟡Pika Protocol is the new one on the List

⚫Worldcoin is also coming to the Superchain. Worldcoin is building the world’s largest identity and financial network.

Ethos Reserve is the official Sponsor of The🔴🔵Optimistic Newsletter

Ethos Reserve is for me the most simple leverage position available on Optimism. Deposit ETH, wBTC or OP and mint ERN stablecoin with only a fixed fee on your borrowed amount, no more variable interest. Intuitive user interface, secured by 154 auditors, efficient architecture, users can also earn multiple rewards (ERN, OATH, wBTC, ETH, OP).

If you wanna try Ethos Reserve, it’s here: https://ethos.finance/

🔴Tech. Update: Into the Superchain by Messari

Messari is one of the best Crypto media and research platform. Reading their analysis report, it's like having a treasure trove of insights that we get to share with our optimistic community. We have summarized and pointed the key points of this article for you ONLY.

Join us in this optimistic journey!

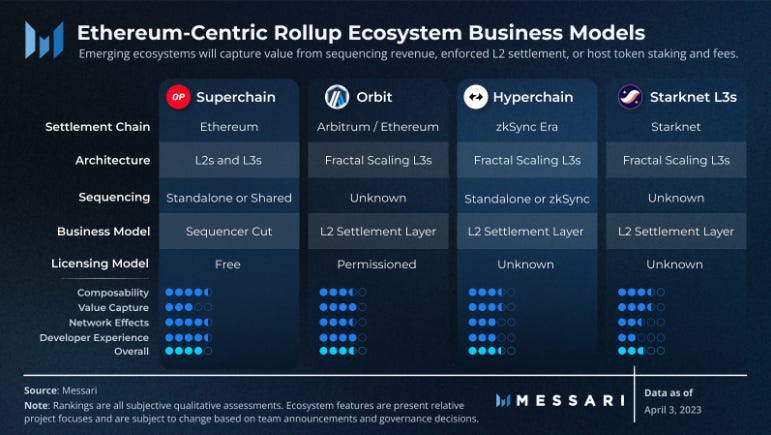

Into the Superchain: The Rise of Ethereum-Centric Rollup Ecosystems

Ethereum scaling is currently undergoing a transformative revolution, fueled by the introduction of rollup systems that facilitate the sharing of resources. Allow me to introduce you to the Superchain, an extraordinary collective of Ethereum-based chains driven by the powerful OP Stack software.

By breaking free from restrictions, the Superchain places the utmost priority on addressing the needs of developers. These rollups serve as a turbocharged solution, greatly enhancing transaction speed while reducing costs. However, it is essential to navigate the challenges posed by congestion, fragmented liquidity, and complexities across different rollups with careful consideration. To overcome the scalability limitations of Ethereum, we immerse ourselves into rollup ecosystems with a shared infrastructure. These ecosystems provide flexible environments to execute transactions, better communication between chains, and exciting opportunities for developers. Various projects are taking this approach, each bringing their unique features and designs to the table.

For example, projects such as Arbitrum, zkSync and Starknet build layer 2 solutions that can serve as regulatory layers to deploy advanced layer 3 applications. However, projects like Polygon may require token staking in order to access shared infrastructure.

They provide a low barrier to entry and support public goods, making it attractive for developers to contribute to the ecosystem. The architecture of the Superchain makes Ethereum chains unite for incredible possibilities. It's an ecosystem that brings together various chains from the Optimism Mainnet L2 to customizable OP Chains under the OP Stack. You'll witness an atomic cross-chain composable, through the Ethereum mainnet gateway "Chain Factory", collective governance, and a marketplace for shared sequencing protocols, the Superchain revolutionizes how chains interact.

Each OP Chain will connect to the chain factory, a bridge smart contract on Ethereum L1 and it will be governed by the Optimism Collective.

😱Yes you hear it well, in the future it does make sense that Optimism Mainnet will become the main layer for Governance, deciding how the Public Goods funding is shared by all superchains.

By connecting to this bridge, OP Chains get two important things: security derived from Ethereum consensus as well as social decisions of the Optimism community.

The Superchain is like a big network where OP Chains connect and work together, some of them can even team up and share a sequencer set, OP Chain's get to decide how they want to do the sequencing. They can do it themselves, use the Optimism Collective's sequencers, or even team up with a decentralized sequencer set. In fact, it's expected that there will be a marketplace with different options for sequencing.

With the Bedrock update, the protocol ensures that deposits made on Layer 1 are properly timed and aligned with the creation of blocks on the main Layer 2 chain. This process is named chain derivation, where the primary Layer 2 chain is determined by a combination of sequencers and verifiers. This works by taking data from the Layer 1 block, Layer 2 transactions, and new deposits from Layer 1.

Developers now have a new revenue model at their disposal. Self-sequencing allows them to profit from fees and MEV on their chains. By employing decentralized sequencers, developers can enhance accountability and interoperability. Shared sequencers enable seamless cross-chain communication, eliminating intermediaries and costly consensus verification. Optimism's vision involves an auction-based sequencing model where prospective sequencers pay for the right to earn fees and share revenue with retroactive Public Goods Funding (RPGF).

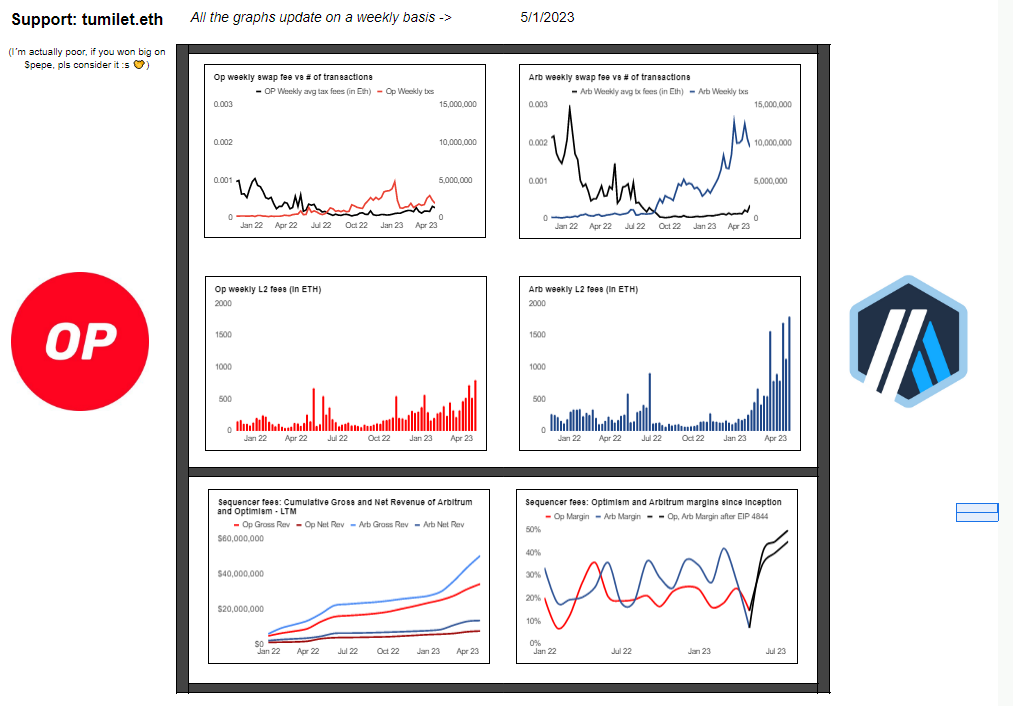

And when we talk about Revenue Model, i recommend to have a look at what Tumilet is doing. It’s an amazing work, and will probably be very interesting on how Optimistic Rollup will generate revenue.

The Superchain operates in a competitive market with various alternatives for extracting value. What sets it apart is that it doesn't aim to profit from individual users or developers, but from service providers who want to participate in its ecosystem. The revenue generated from this will be used to support public goods. With the development of the no-code platform Conduit to launch and manage OP Chains, it will likely grow even more.

Joining the Superchain involves collective governance through the chain factory and using the bridge for secure cross-chain transactions. However, upgrade decisions for the bridge are made by the wider OP community, which encourages participation in governance and the use of the OP token. The Superchain shows early success, offering low entry barriers and flexibility for developers, with RPGF enhancements, future optimizations and further strengthening its ecosystem.The Superchain is being built to offer the broadest range of possibilities. For users, it means accessing a cost-effective computing platform for various applications.

And that's a wrap! If you want to read the full report you can click here. You will need a subscription!

A big thank you to Optimism and Messari for their incredible work. This is just the beginning of an awesome journey!

🔵How to avoid SCAM tokens: $Pepe, $Bob, $Jim, $Elon?

In this meme season, 90% of the projects are scam. What are the different possible scams? How to avoid them?

This piece is outside of Optimism news since we don’t have a meme/pepe season (yet….while if you look closer you may find one). But we think it’s the goal of everyone to protect their funds and ape safe in these new tokens.

Type of scams:

Honeypot: You can buy but not sell. How to check this? Buy 1$ of token, try to sell your token. Sale going through doesn’t prevent this token to be a scam, look below:

Contract upgrade: Contract that can be modified, can stop any sale from being executed at any point of time

Liquidity unlocked: Owen can withdraw the fund at any time

Large Holders: Large token holders can dump their token moving the token price to 0

How to avoid them:

We would highly recommend that you bookmark the thread of Aylo on how to reduce your risk to ape in a scam project. It shows you how to use BubbleMaps to check older distribution, and the new tool from De.Fi that helps you to scan token contract to sniff for any issue.

🟣Project update: Extra Finance

In this article we are going to present Extra Finance, an Optimism native Leverage Yield Farming & Lending protocol, what does it offer, what does it solve in the Defi space, and their juicy roadmap for the coming weeks (token launch, airdrop campaign, protocol launch, etc…). Let’s dive in:

What is Extra Finance

Some of the team members behind Extra Finance were involved in Francium project, Leverage Yield farming protocol on Solana who saw a TVL ATH at 420m$ in December 2021, representing at that time almost 3% of Solana TVL.

Extra Finance leverages a LP token position. Currently built on top of Velodrome Finance, the top 1 DEX of Optimism, the team planned to integrate Uniswap V3, Beethoven X, and other Dexes to propose more vaults.

It’s pretty similar to Impermax or Francium if you know these projects. However Extra Finance offers some interesting features that will ease user life.

Friendly User Interface:

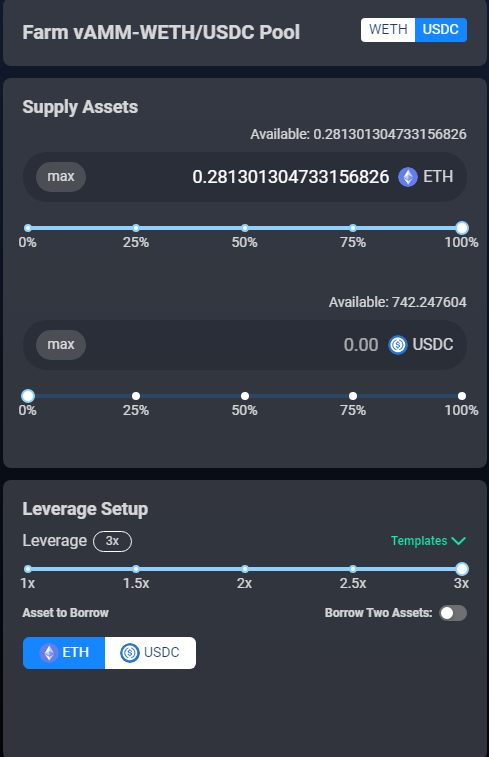

Zap-in / Zap-Out function. Something i discovered on Beefy Finance a year ago. Instead of depositing your LP token only, you can deposit one of the two tokens only.

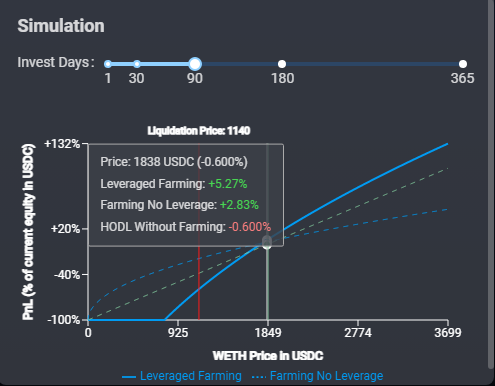

Simulate your leverage position with an self explanatory diagram and compare the yield based on Hold without farming / Farming no Leverage / Leveraged Farming

Customized vault

Choose your deposited token

Choose your borrowed asset

Choose your leverage factor

Pseudo Delta-Neutral vaults: Delta Neutral vaults are quite commonly built on top of Perps protocols. Buy ETH on a Dex, and Shot Eth on a Perp protocol. Delta Neutral vault prevents user to be exposed to held assets volatility while earning yields. And building Dela Neutral on LP token can make you earn LP fees while not being completely exposed to the volatility of the crypto market.

Finally, for the safest farmers, you can also Lend your tokens to earn passive yield.

Beta Launch

Extra Finance announced on May 9, the release of their Beta Version:

The Beta version follows a community limited testnet version, and aims to be fully accessible by anyone. It will allow to:

Test Extra Finance UI

Get users more knowledge about Leveraged Yield Farming

Possibility for $EXTRA Airdrop

Interesting to say also that Extra Finance has been audited by Peckshield. You can find the report by clicking this link: Peckshield Report PDF

And in terms of security, Extra Finance just announced also a partnership with Insurace, very famous insurance protocol working also with Lifi.

Roadmap & Token Launch

The team released also their 2023 Roadmap & beyond which looks very interesting.

In the coming months, Extra Finance will add the following features:

CLAMM Integration

One-click Farming Templates

Calculation Tools

Advanced Strategy Vaults

Social Farming

Tokenomics:

Total Supply: 1billion $Extra tokens

$Extra token will also be launched in couple of days from the time we are writing this newsletter., and liquidity could be added on Velodrome Dex.

$EXTRA token will adopt a vote-escrowed model aka veTOKEN like velodrome finance, up to a duration of 1 year, antogether with a protocol revenue sharing model.

veEXTRA holders will receive:

Protocol fees used to buyback $EXTRA from the market & distribute it to lockers

$EXTRA Liquidity Mining for lockers

Airdrop:

3% of the total supply will be airdropped to the following users:

Early Optimism ecosystem users/delegators

Velodrome LP Users

Extra Finance testnet users with valid feedback

Extra Finance community OGs

Leverage yield farming enthusiasts → This might refer to Beta User

In order to qualify for some of the airdrop, you should complete the quest on Zealy platform (click the picture below):

Conclusion

We’re still very enthusiastic when we see people building on the Optimism chain. Leveraged Yield Farming is not as easy as LPing on a Dex, and as we say “Great Rewards come with Great Risk”.

Taking such position requires a very understanding on leveraging a LP position & a great dose of risk management to avoid being liquidated.

I wouldn’t be surprised to see Extra Finance to apply for a forthcoming OP grant, so watch out the official twitter page announcement to not miss any opportunity.

Few links if you want to know more about Extra Finance:

Beta Version access: https://app.extrafi.io/farm

Discord: https://discord.gg/b9jNEWMe

Twitter: https://twitter.com/ExtraFi_io

Documentation: https://docs.extrafi.io/extra_finance/

Quest on Zealy: https://zealy.io/c/extrafi/invite/0Ty0Yha4oWgNb0glPRl-7

Personal Reading recommendation:

Arthur Hayes is a smart entrepreneur & trader. His last essay about the crisis of the banking system is a masterpiece, and if you have to have a macro view of USA financial system and FED decisions, give it a read.

Click here to access the article.

Final Arthur’s Quote: “Therefore, it’s Up Only! Just make sure you are not the last sucker in the Western financial system when the bill comes. Get your Bitcoin, and get out!”

🟢Macro-Analysis: BTC / ALTCOIN

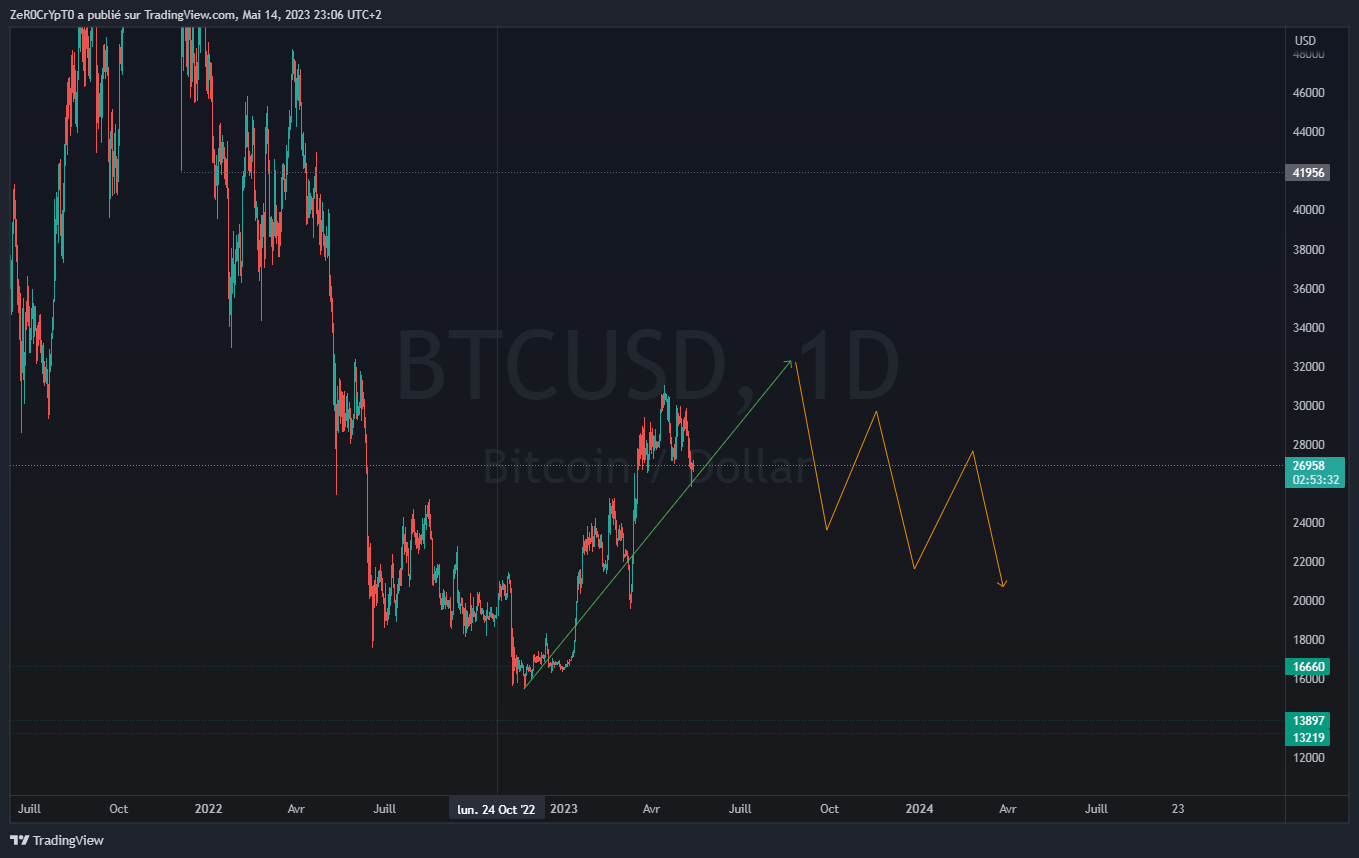

BTC my fren, where are you going?

BTC is currently in consolidation, which can be observed as it is inversely correlated with DXY, which is currently rising following the validation of its divergence, as seen in the previous newsletter.

The correction of BTC is normal: as seen in wave theory, each impulse is followed by a correction.

Is the correction over?

It is still too early to tell. BTC can either continue to rise from this zone or return to its trend or even lower since large liquidity zones were created during the previous impulses.

As long as BTC does not make a violent move to the south, we can expect it to correct in order to make a new bullish move. The correction of the last impulse we are currently in is in a 4-Hour timeframe, but we should not forget that it could also be the start of a greater correction on the Daily timeframe, to correct the impulse that started at 15,000$. Keep in mind that a daily correction is much longer and can last 6 to 12 months.

It will be considered that if BTC holds the 25,000$-24,000$ zone and resumes its upward trend, the correction of the 4-hour movement will end and we would expect a higher high. However, in this case, even if BTC makes a new high, the whole Daily impulse will have to retrace at one time.

BTC Dominance

Regarding Bitcoin dominance, there is currently a bearish divergence on the Daily RSI, plus BTC D. is at the top of its range. If the divergence is validated, we can expect a decrease in its dominance. This would then imply that smart money will orientate their holdings more in other cryptocurrencies (remember the smart money cycle in Crypto).

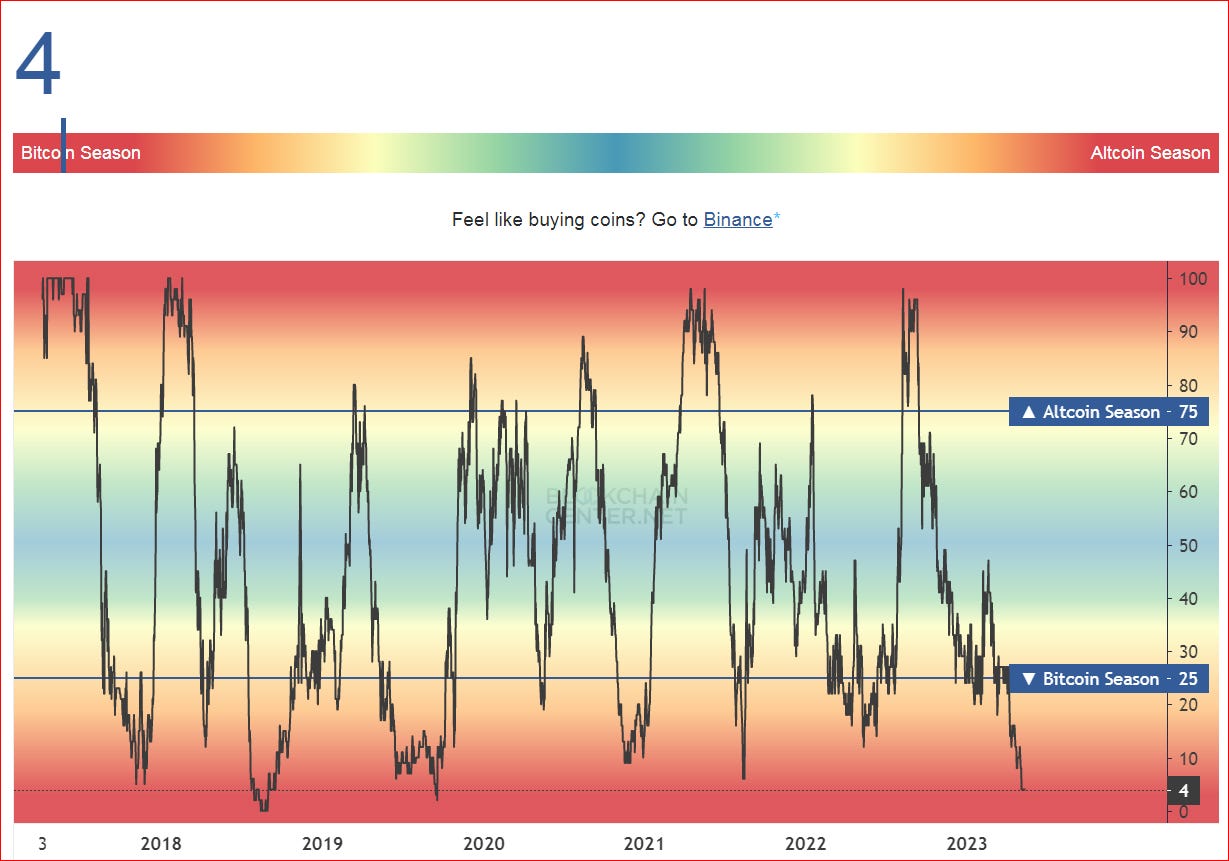

Wen Alt Season?

How can we learn more about the current capital distribution in the crypto market? We can use the altcoin season index.

It indicates that we are currently at a historically low level, in the midst of the Bitcoin season. Historically, the chart has never stayed long in this zone and a strong rebound has occurred each time.

This could be another indication of a short to medium-term migration of capital towards altcoins, which are currently at very low levels (most of them are in the oversold zone on the Daily RSI). The current price levels of altcoins may also represent buying opportunities for savvy investors or traders hoping to profit from the movement of money flows. It is interesting to see how the price action develops in the coming days for altcoins.

Conclusion

Trading: We will continue watching the price action and try to ride the next bullish wave & avoid being too greedy and take some profits if BTC returns to 31,000$.

Investing: The 25-24,000$ zone is ideal for continuing DCA. Altcoins are at interesting valuation levels. However, remember one thing:

It can always go lower!

🟤Farming strategy: Leverage Farming Position on Extra Finance

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

🚧Warning: This leverage position faces risks of liquidation, so do your own research before entering in it, and don’t copy blindly what is described below.🚧

Objective: Maximize the Yield on our VELO bag

Means: Different options available

Hold VELO - APR 0%

Farm into vAMM-VELO/USDC Liquidity Pool in Velodrome Finance - APR 50%

Leverage 3x LP vAMM-VELO/USDC LP in Extra Finance - APR: 120%

So we ape into Option 3 using Extra Finance, and here is what Extra Finance does on our behalf:

In this strategy we have decided to deposit 100% VELO and borrow 50% USDC & 50% VELO. But you can also deposit 100% VELO and borrow 100% USDC (Short velo), or deposit USDC and borrow VELO (Long Velo). You can find more strategy on Extra Finance doc: https://docs.extrafi.io/extra_finance/leverage-farming/strategy

Extra Finance User Interface is so great that it gives us estimate of our yield depending on the time we hold your position (assumption: APR remains constant on Velodrome) and the different options stated above:

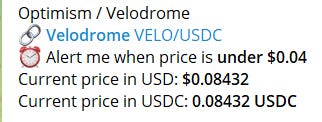

How to manage our position and avoid being liquidated?

1st, we can see your liquidation point from the above charts:

On day 1: You get liquidated when Velo < 0.0193

On day 365: You get liquidated when Velo < 0.00152

We don’t want to get our eyes stuck to the Price Chart of VELO, so we set up a Telegram Alarm on Dexscreener. How to do this?

Go to the Velo price chart: https://dexscreener.com/optimism/0xe8537b6ff1039cb9ed0b71713f697ddbadbb717d

And click on “Alerts” (see picture below):

Then we just follow the different steps described by the bot on Telegram and set up an alarm when Velo price is under 0.04$, that should leave us enough time to manage our position and not get liquidated by a Red Whick falling down to Goblin Town (meaning to the South):

Here is how we set up our position. Hope you liked this presentation, and again make sure to understand all the underlying risks if you want to use this position.

🟠Podcast:

Arcadia Finance

Lido Finance

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of all podcasts. Access granted to Revelo members.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

Subli_Defi Social accounts:

Discord Handle: Subli#0257

Twitter: Subli_Defi

Lenster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

—————————————————————————————Disclaimer————————————————————————————

Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.

———————————————————————————————————————————————————————————————————

super

great