The 🔴🔵Optimistic Newsletter #15

The one & unique DEFI Newsletter on OP Superchain written by Defi Users for Defi Users

First of all, i’d like to express my thanks to you, for your comments, support, likes on this 🔴🔵Optimistic Journey. Big 👏 to my 4 teammates & all the translators as all this work could not have seen the light without them.

And finally, welcome to the 254 new subscribers to this newsletter.🚀🚀

Thanks for reading The 🔴🔵Optimistic Newsletter. Subscribe for free to not miss anything on the OP Superchain.

Click in your preferred language to access the translated document:

Chinese - Filipino - French - Japanese - Korean - Persian - Russian - Spanish - Thai - Turkish - Vietnamese

TOPICS OF THE WEEK - TIME TO FLY

🔴Governance: Season 4 - Cycle 13 - Grant winners

9 projects were granted a total of 1m OP tokens. How to benefit from it and farm some rewards? We provide you the full details here.

🟣Project Review : Chainlink

Chainlink just released CCIP (cross chain interoperability protocol), making a revolution in the cross messaging world. The first project benefiting from this is Synthetix. Let’s break these technical details into more digestable content.

🟡Project Review: Liquid Staking with Ankr Staking

It took 3 years to reach 18m of ETH tokens staked, but +30% only in the last 3 months. Welcome Ankr Staking to Optimism. Let’s dig into it.

🟢Crypto market review & Learning tips

Bi-weekly update on the Crypto Market + educational tips on what means Hedging a position.

🟤Farming Strategy: >60% on ETH?

Farming strategy provided by Complete Degen.

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live :

Ether.fi: Decentralized Liquid Staking + Re-staking

Podcasts available at the end of the newsletter.

Spotlight project: Ethos Reserve

Ethos Reserve is an official Sponsor of The🔴🔵Optimistic Newsletter

Ethos Reserve is for me the most simple leverage position available on Optimism. Deposit ETH, wBTC or OP and mint ERN stablecoin with only a fixed fee on your borrowed amount, no more variable interest.

Ethos Reserve has recently revealed its roadmap to scale ERN usage in three phases: init, advance, and evolve - ERN omnichain, staked ERN, support of Liquid Staking Tokens assets, … Curious on what it says? Give it a read by clicking here.

If you wanna try Ethos Reserve, here is the official link: https://ethos.finance/

⚫The Optimistic series Campaign is live - Engage to Earn 30k OP

Questoors, come, engage about #Optimism by completing this series of quests, and earn OP token.

https://www.tideprotocol.xyz/users/spaces/258

Timeline:

Quest #1: 🟢Live - End on 31-September

Quest #2: 🔴Closed - 🔥14 🔴OP earned by every NFT holder! CONGRAT’S! 🪂

Quest #3: 🔴Closed - 🔥25🔴OP earned by every NFT holder! CONGRAT’S! 🪂

Quest #4: 🔴Closed - 🔥11🔴OP earned by every NFT holder! CONGRAT’S! 🪂

Quest #5: 🔴Closed - 🔥30🔴OP earned by every NFT holder! CONGRAT’S! 🪂

Quest #6: 🐻You’re not ready for this… Quest planned for September

GOVERNANCE TIMELINE

Cycle 13 : Ended / Cycle 14: started

Spotlight Project: Overtime

Overtime Markets is an official Sponsor of The🔴🔵Optimistic Newsletter

Join the thrill of the game with Overtime, your premier web3 sportsbook, offering incentivized campaigns (OP & ARB) around the biggest sports events.

With over 35 leagues and innovative on-chain parlays, why just watch when you can earn?

Try Overtime Here.

🔴Governance: Season 4 - Cycle 13 - Grant Winners

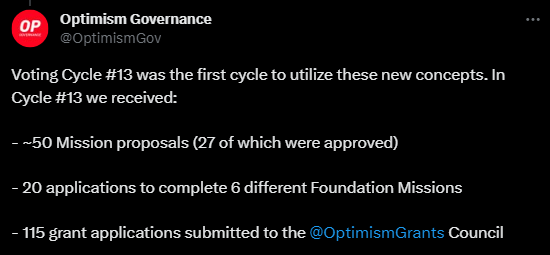

The Grants Council recently concluded its review of Experiments and Builders Grants for Cycle 13, marking a significant milestone in the pursuit of innovative projects within the Web3 ecosystem.

Out of the 106 proposals received, the Grants Council voted in favor of 27 projects, leading to a grant rate of 24.5%, slightly lower than the 33.8% rate seen in S3. The Experiments Sub-Committee and the Builders Sub-Committee played their roles effectively, voting in favor of 10 and 16 projects, respectively. The grant rates for these sub-committees stood at 21% and 33%, emphasizing their careful consideration of the projects.

In this article, we will present you the finalists & how us, as users, could benefit from their OP Grants. Remember, be the first to APE in the incentivized vaults to be the first to earn MAX OP rewards:

Aura Finance (150k OP)

Aura Finance is a meta-governance protocol built on top of Balancer. On Optimism, Aura will launch on top of Beethoven-X, friendly fork of Balancer, when Balancer deploys cross-chain gauges onto Optimism.

OP will be used one of the both solutions depending on their efficiency at the time incentives start:

Liquidity providers as additional rewards

vlAURA holders to incentivize more votes & this more BAL emissions on Optimism pools

Wrt to the 2nd option, OP bribes will match protocol bribes, so that would be a x2 for vlAURA holders.

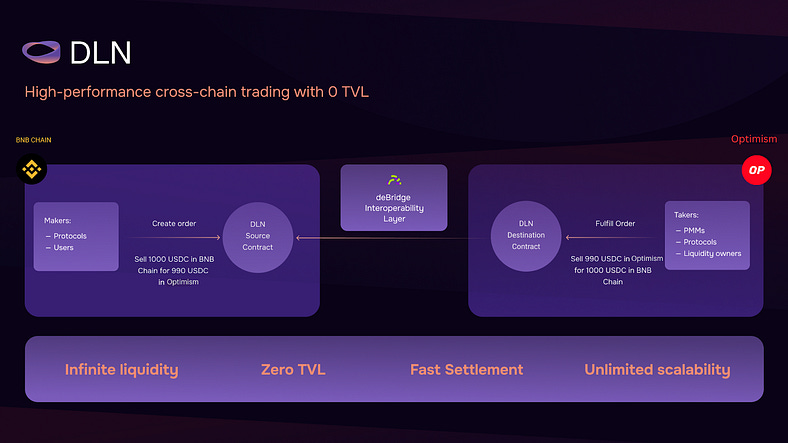

DeBridge(100k OP)

They’re building deBridge and DLN. deBridge is a secure cross-chain infrastructure for high performance interoperability. By removing the bottlenecks and risks of liquidity pools, deBridge enables DeFi applications to scale faster with ultra capital-efficient and deep liquidity transfers across chains.

DLN is a high-performance cross-chain trading infrastructure built on top of deBridge, that enables native cross-chain trading of any assets with zero slippage, and without liquidity at risk (0 TVL).

All OP tokens provided via this grant will be allocated towards incentives to users and PMMs. Since the incentives are volume-based. Every two weeks we’ll generate a snapshot of all DLN market orders to/from Optimism ecosystem, calculate their USD equivalents at the moment of trade and rebate 4bps + gas cost to makers and 4bps + gas cost to takers (Gas cost should not exceed 5% of the market trade value to be eligible for rebate).

Extra Finance(104k OP)

Extra Finance is an Optimism Native Leveraged Yield Farming (LYF) Protocol, and is now live on Optimism Mainnet.

The grant will be used like this:

75% as liquidity incentives mainly on Lending pools. 3,000 OP tokens/week during 6 months + $EXTRA token matching the OP incenvites.

25% for farming activities and effective strategies

19,500 OP incentives for top leverage yield farmers (check leaderboard)

6,500 OP incentives for engagement campaigns on platforms like Tide Protocol

Allocate 2,000 OP every 2 weeks for 6 months for leverage yield farming

Layerswap (145k OP)

Layerswap is building a one-stop gateway for onboarding users to Web3 projects from any funding source — be it cards, banks, blockchain networks, or custodians like Centralized Exchanges.

100% of $OP will be distributed as an incentive for users to bridge to Optimism through Layerswap. We'll distribute the tokens in 3 rounds, first round starting once we receive the initial grant amount.

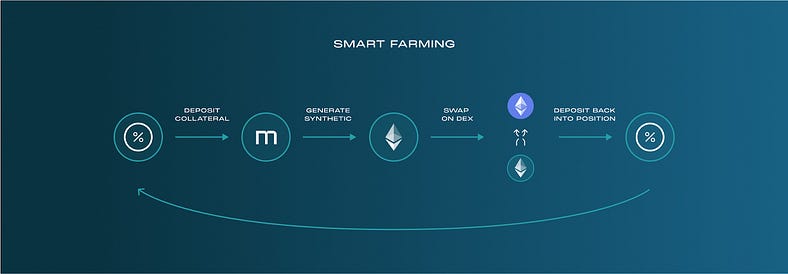

Metronome (149k OP)

Metronome is a new DeFi synthetics ecosystem that has both innovated and iterated upon what existed prior in the decentralized synthetic space, creating a secure, user friendly dApp, where users are able to supercharge their yield generation and trade crypto assets in a capital efficient manner. Metronome has three main components: Synth, Marketplace, and Smart Farming.

80% of the granted tokens (119,000 OP) will be allocated towards Velodrome bribes on a weekly basis, as follows:

msETH-ETH: 5,000 OP

msUSD-USDC: 3,500 OP

msOP-OP: 1,500 OP

The remaining 20% (30,000 OP) will be allocated strategically as incentive matching with partners for activities like co-incentivized partner LP pools.

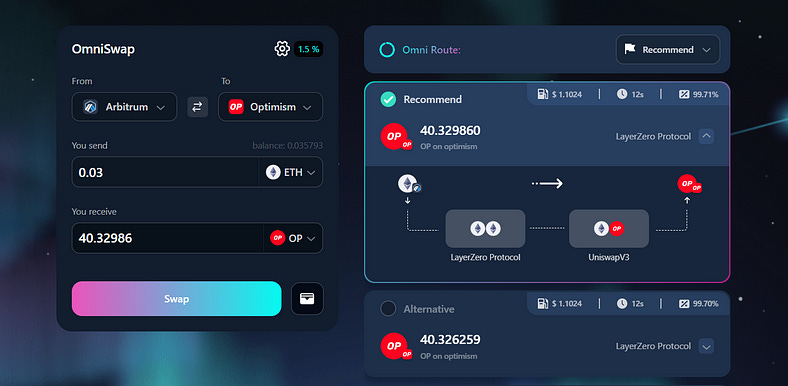

OmniBTC (90k OP)

OmniBTC is an omnichain DeFi platform that connects all the on-chain liquidity using interoperability protocols such as L0, Wormhole, Celer Network. OmniBTC is also a decentralized cross-chain swap and lend/borrow platform built across multi-VM ecosystems, aiming to connect and unify all the on-chain liquidity for seamless and low-cost cross-chain transactions.

The grant will only be used to attract more users to experience Optimism. We would like to use the grant to do the following promotion.

Bridge Assets from/to Optimism. OmniBTC will incentivize users who bridge assets from other chains to Optimism by using the grant.

Integrate with DEXs on Optimism. OmniBTC will integrate with more DEXs on Optimism(now supporting UniV3), so that users can easily swap assets on other chains for any assets on Optimism.

3. OmniLending extends to Optimism. OmniLending, the first available cross-chain lending function, will support Optimism so that users can easily deposit $OP in our pools and borrow other assets on any chain. They can also deposit assets on other chains but borrow assets on Optimism. The biggest advantage for users is that they don’t need to bridge bridge bridge, but directly leveraging assets on Optimism.

4. Invite Competition. Users who invite more new users to finish the OmniSwap from/to Optimism or deposit/borrow assets on Optimism can claim extra $OP as reward.

Distribution plan:

11.11% – Phase1: Drop to first 100 users who have bridged assets(≥10,000) to Optimism.

6.66% – Phase2: Incentives To Users Who Bridge Assets to Optimism via OmniBTC.

20% – Phase3: Incentives to users who realize OmniSwap from/to Optimism.

5.55% – Phase4: Marketing and Awareness.

38.88% – Phase5: Incentivize users who experience OmniLending on Optimism.

8.88% -- Referral Activities.

Pendle (112k OP)

Pendle protocol enables permissionless tokenization and trading of yield. Pendle allows anyone to purchase assets at a discount, obtain fixed yield, or long DeFi yield. The protocol enables this by taking yield-bearing tokens and then splitting them into their principal and yield components, PT (principal token) and YT (yield token) respectively, which allows them to be traded via Pendle’s AMM.

The Pendle AMM is purposely built for trading yield derivatives in a capital efficient manner with negligible impermanent loss due to the pool pair being strongly correlated.

Distribution plan:

100% of the OP allocation will be for LP incentives on Pendle;

4,000 OP per month will be allocated per pool with the allocation lasting over 4 months (a total of 16,000 OP for 4 months per pool). With a total requested OP grant allocation of 112,000, Pendle is targeting to onboard and incentivize up to 7 pools over the course of 6 months;

The 7 incentivized pools are not yet selected, but the team aims to support a mix of LSDs such as wstETH and rETH, stablecoins, other high-quality yield-generating assets such as those from Velodrome, Aura, Sonne Finance, Tarot, and more;

The Pendle community will further vote for the vePENDLE gauges on Optimism to channel additional PENDLE incentives to the pools

=> $PENDLE on Velodrome soon?

Tide Protocol (40k OP)

If you don’t know Tide Protocol, then you just missed the largest Airdrop done through the Optimistic Series campaign.

Tide makes it easy to launch and measure data-driven and effective incentive programs.

It’s clear that building vibrant communities is hard. Web3 marketing remains very technical, the presence of Sybils seeking rewards is high and the distribution of incentives is broken. This causes inefficient airdrop allocation, low retention and wasted development resources.

Tide helps projects allocating tokens based on CAC, LTV and real, actionable metrics.

Distribution plan:

Month 1: 5 protocol campaigns | 10k OP

Month 2: 5 protocol campaigns | 10k OP

Month 3: 5 protocol campaigns | 10k OP

Month 4: 5 protocol campaigns | 10k OP

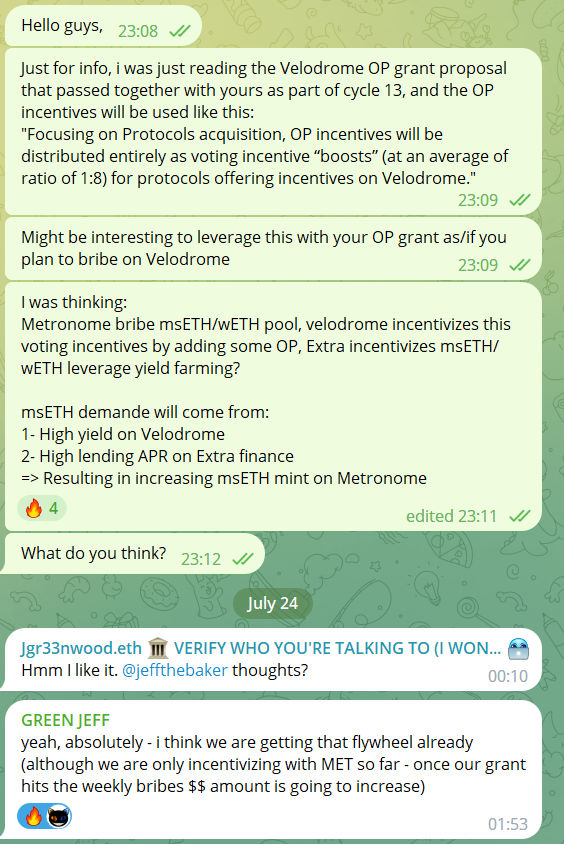

Velodrome (150k OP)

This grant will allow Velodrome to continue only a part of its “Tour de OP”.

Focusing on Protocols acquisition, OP incentives will be distributed entirely as voting incentive “boosts” (at an average of ratio of 1:8) for protocols offering incentives on Velodrome.

So veVELO holders will receive direct benefits from this OP incentive program, and Liquidity Providers should also expect higher yield on the incentivized pools.

That’s it for Cycle 13. Cycle 14 has already opened for your info.

Happy farming to all of you.

🟣Project Review : Chainlink releases CCIP

The future will be cross-chain and Chainlink understands it.

Chainlink announced that CCIP has entered the Mainnet early access phase on the Avalanche, Ethereum, Optimism and Polygon blockchains.

This news, places the protocol as one of the main actors in the expansion of the interchain economy. Summer promises to be hot this year… Bullish!

What is the Chainlink CCIP

CCIP is an ultra-secure interoperability protocol, powered by Chainlink’s decentralized oracle networks, reliable and easy to use for building cross-chain applications and services for protocols as well as for Capital Markets.

An inter-chain standard of security, flexibility and community, which the entire industry can adopt to interact and build on top of each other.

This standard was created to actively participate in solving the cross-chain problem (too many) and unlock a new wave of innovation in Web3.

Web3 is interconnected

The arrival of Web3 gives us a glimpse of a cross-chain future.

Layer 2 networks, sidechains, subnets, application chains, parachains and many other environments for developers and users to choose from.

PROBLEM: All these solutions have fragmented applications, on-chain assets and market liquidity across different disconnected blockchains.

This lack of interoperability slows innovation and hinders progress and mass adoption of the Web3. Not to mention the problem of security.

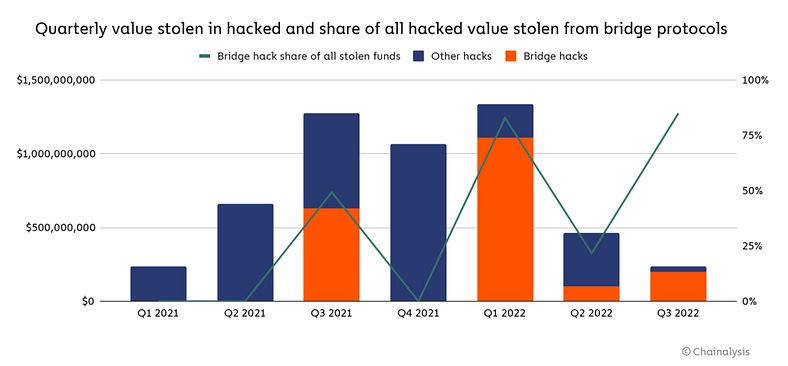

The majority of technology stacks currently in use are not secure enough, encouraging the multiplication of inter-chain exploits. Sad observation!

Chainalysis estimates that $2 billion in cryptocurrency was stolen in 13 hacks of separate cross-chain bridges. Attacks on bridges account for 69% of the total funds stolen in 2022 so far (link to source article below)

Cross-Chain Bridge Hacks Emerge as Top Security Risk (chainalysis.com)

Chainlink’s solution — The CCIP

With CCIP, developers have the ability to create their own cross-chain solutions (using arbitrary messages) quickly, easily and securely.

CCIP also provides simplified token transfers, allowing protocols to start transferring tokens between chains using audited token pool contracts.

The mission of Chainlink is very clear: to set a new standard for utility, security, reliability and cross-chain development experience to all.

Cases of use of the CCIP

The CCIP offers impressive possibilities in terms of cross-chain operation

Cross-chain tokenized assets: Transfer tokens across blockchains from a single interface and without having to build your own bridge solution.

Cross-chain collateral: Cross-chain lending applications for depositing collateral on one blockchain and borrowing assets on another.

Cross-chain liquid staking tokens: Bridge liquid staking tokens across multiple blockchains for utilization in DeFi apps on other chains.

Cross-chain data storage and computation: Employ data storage solutions that enable users to store arbitrary data on a destination chain and execute computations on it using a transaction on a source chain.

CCIP = Chainlink security

CCIP is powered by Chainlink’s decentralized oracle networks, which have a proven track record of securing tens of billions of dollars and more than $8 trillion in on-chain transaction value. But it doesn’t stop there…

The CCIP also has additional security mechanisms that go beyond other cross-chain solutions, such as customizable rate limits on token transfers and a separate Active Risk Management (ARM) network that monitors the validity of all cross-chain transactions. Chainlink always brings security!

Market leaders are already using CCIP

The main DeFi protocols specialized in derivatives and loans, such as Synthetix, already adopt CCIP live on the mainnet. Aave, BGD Labs, also integrates Chainlink’s CCIP, on the mainnet into the protocol. Good job!

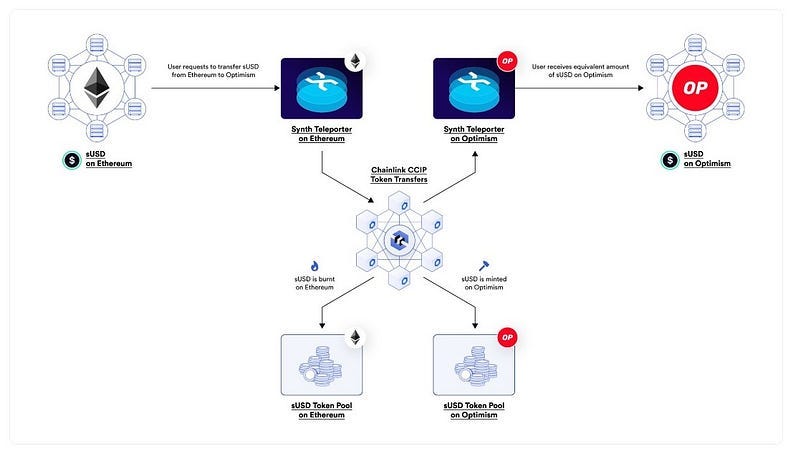

Synthetix - Cross-Chain Liquidity

One of its recent additions to Synthetix V3, the Synth Teleporter, offers users a simplified method for transferring Synth liquidity between chains.

The native sUSD (the protocol unit of account) is burned on the source string and then minted on the destination string. Simple and effective.

The Synth Teleporter employs Chainlink CCIP to burn and mint tokens across chains safely and accurately, ensuring security and reliability.

This combustion and mint model promotes greater capital efficiency without the need for liquidity pools its constraints of traditional bridges.

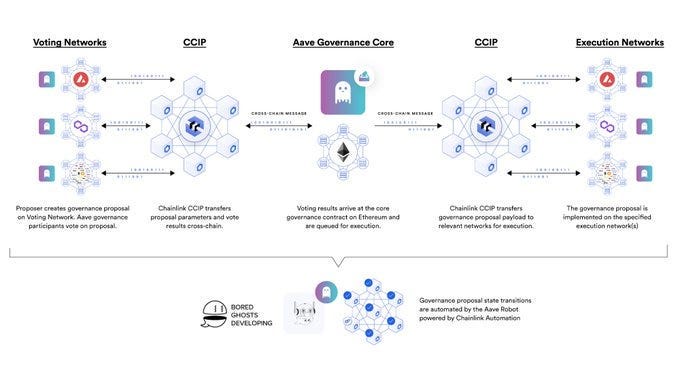

Aave - Cross-Chain Governance

Aave used several different native chain bridges to support its multi-chain governance mechanism and used Ethereum as its voting network.

Once Chainlink CCIP became available, the Aave community voted to integrate the protocol due to its gas-efficient design, proven infrastructure, scalability to new networks, and ease of integration.

BGD Labs, a Web3 development initiative, integrates Chainlink CCIP into Aave Governance V3 to future-proof the cross-chain system.

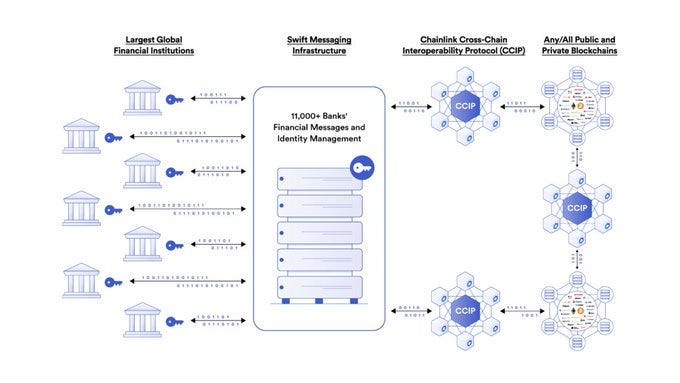

Cross-chain connectivity for financial markets

Through CCIP, companies can connect and interact in any public or private blockchain environment directly from their existing backend systems.

Swift and more than a dozen financial institutions and financial market infrastructure providers have already started exploring CCIP for token transfers between public and private chains via the Swift messaging.

The list of collaborators includes Australia and New Zealand Banking Group (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX) and The Depository Trust and Clearing Corporation (DTCC) And that’s just the beginning…

To learn more about this specific topic: Swift explores blockchain interoperability to remove friction from tokenised asset settlement | Swift

Conclusion

No doubt CCIP will have a significant impact on the cross chain ecosystem.

LINK price action saw an impressive +70% since end of June. While you can for the moment only trade LINK on Synthetix Perps V2 front ends like Kwenta & Polynomial, we, users, are still expecting LINK token to be available on Optimism for Spot buy.

So wen LINK on OP and contract call to stake LINK on L1? Just a matter of time in our opinion.

🟡Project Review : Liquid Staking with ANKR

Liquid Staking Token or #LST has been in all CT mouth since half of the year now. Remember our detailed on-chain analysis about staked ETH and Shanghai upgrade? Read our article on The🔵🔴Optimistic Newsletter #8

So whats is the state of LST on Optimism? And where does Ankr Staking fits into this? Let’s break it down.

1. State of Liquid Staking

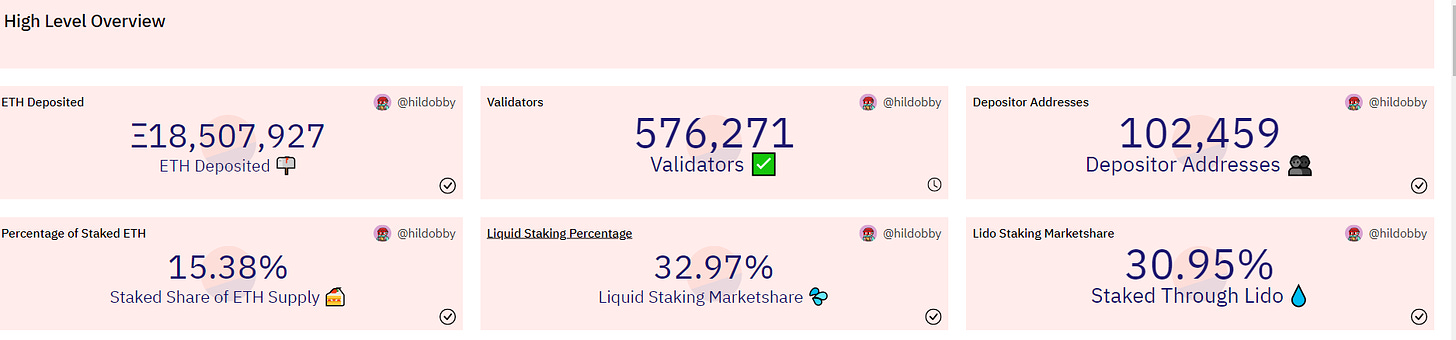

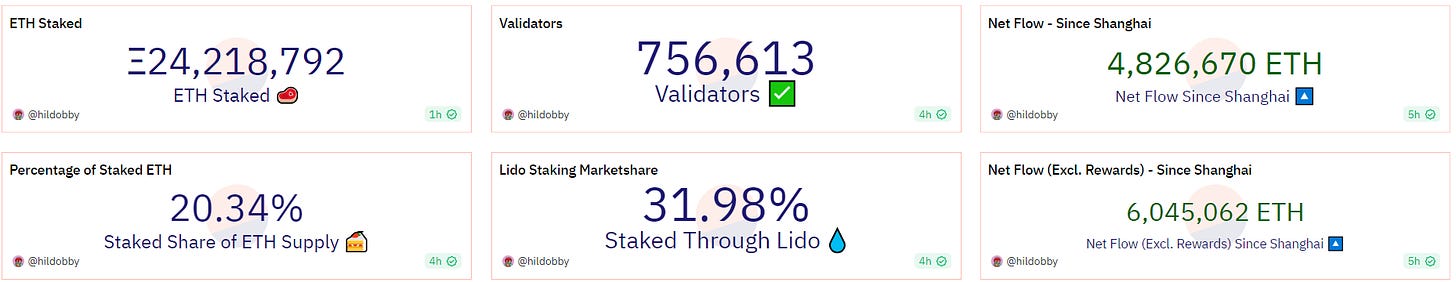

State of ETH staking from 2020 to April-23:

State of ETH staking in July-23:

+30% in the last 3 months in ETH staked, +31% in validators number. These are some impressive metrics and if you study Tokenomics, you could only be bullish on ETH.

Liquid Staking protocols, still ranked as 1st category of DEFI protocols in TVL, saw also a steady growth from last TVL ATH back in April 2022, almost reaching new ATH:

There are currently 102 liquid staking protocols listed on DefiLlama. Where does Ankr Staking stand ?

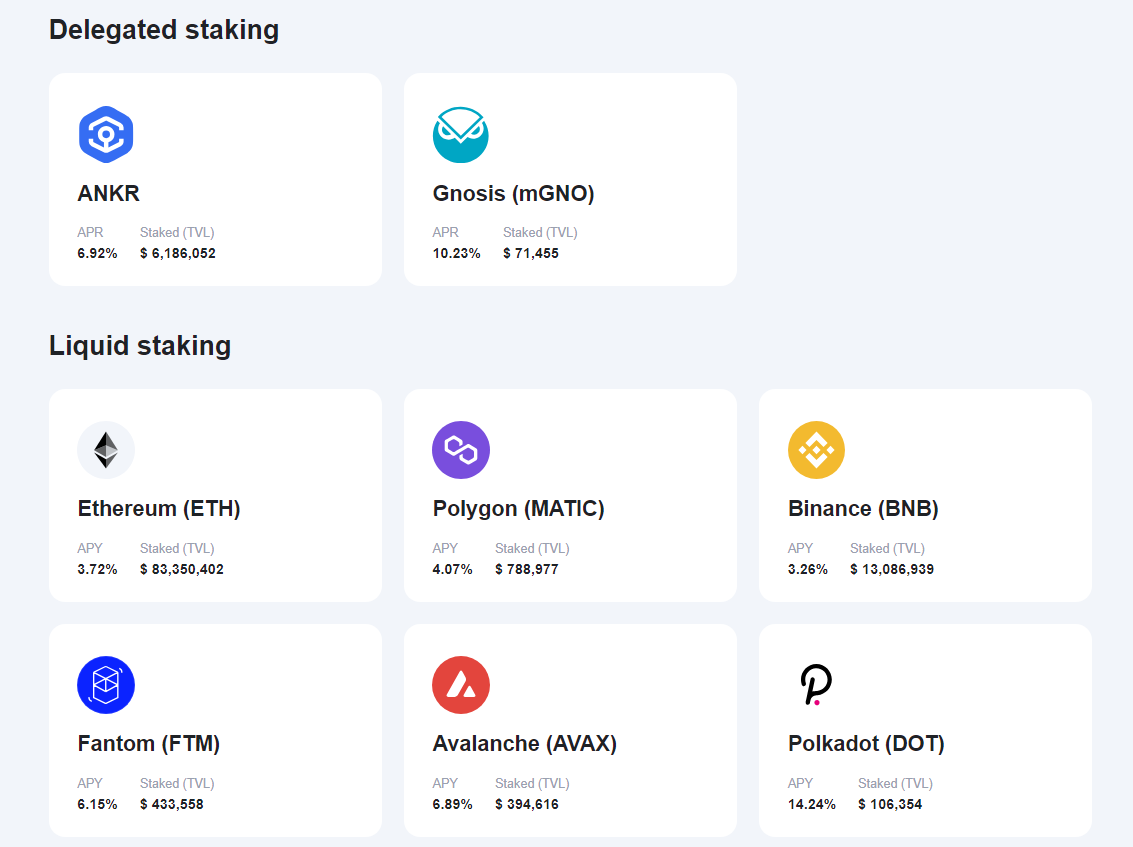

2. Ankr Staking

Ankr Staking is a multi-product protocol, but today we will focus on Ankr Staking solution. Ankr Staking offers liquid staking solution on various EVM chains, has a TVL of 105m$ which >90% is done on ETH liquid staking.

The success of any liquid staking protocol lives in the usage & yield offered to its LST users.

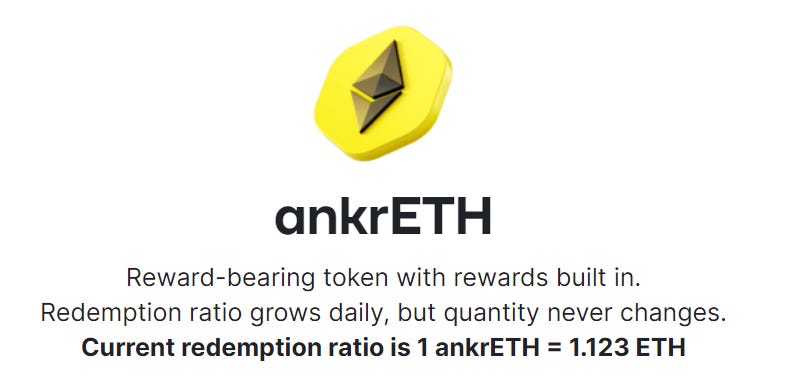

ankrETH Staking :

Staked ETH on Ankr Staking: 45k

Rank in terms of Staked ETH: #21

Offered yied: 3.92% APY

Liquid Staking Token:

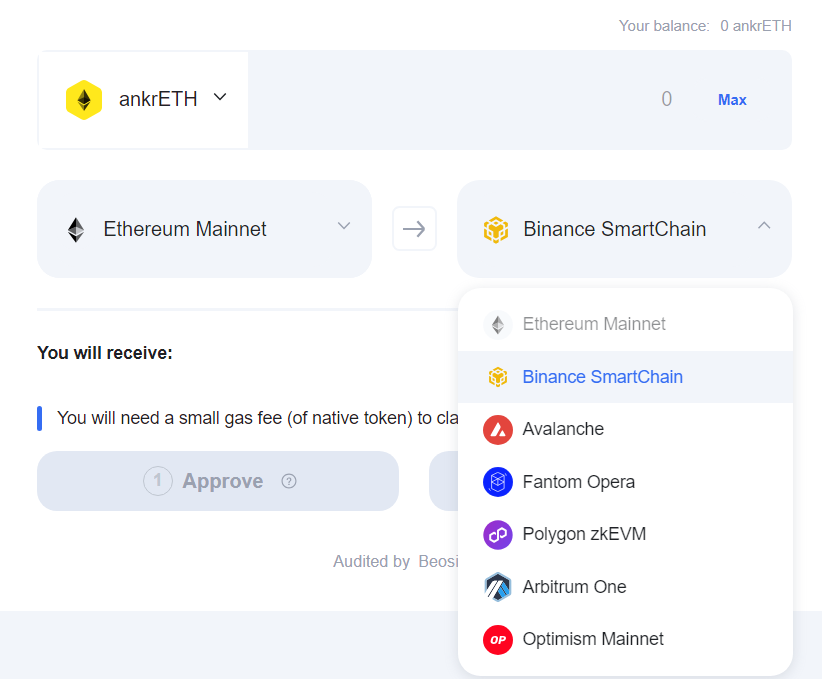

Chain deployment: ankrETH will be available on multi chains which has been secured through an audit provided by Salus_Sec (Audit report)

ankrETH can be staked on mainnet & bridged to 6 different blockchains, meaning you can find liquidity on these chains. Ankr Staking is the only liquid staking server provider that does not rely on 3rd parties for bridging purposes.

We all know that bridges are the main source of Exploits, so building its own prviate bridge solution removes 3rd party dependency:

And of course, the deployment of Optimism has been recently announced by the team early July.

3. LST on Optimism

As of today, only few liquid staking tokens are available on Optimism.

Only wstETH from Lido, rETH from rocketpool & sfrxETH from Frax are deployed on Optimism. And remember, there are currently 28 protocols offering ETH liquid staking.

So in view of the above ETH staking metrics, and the steady growth of Optimism TVL, making it a solid #2 place as DEFI layer 2.

4. What’s next Some speculations

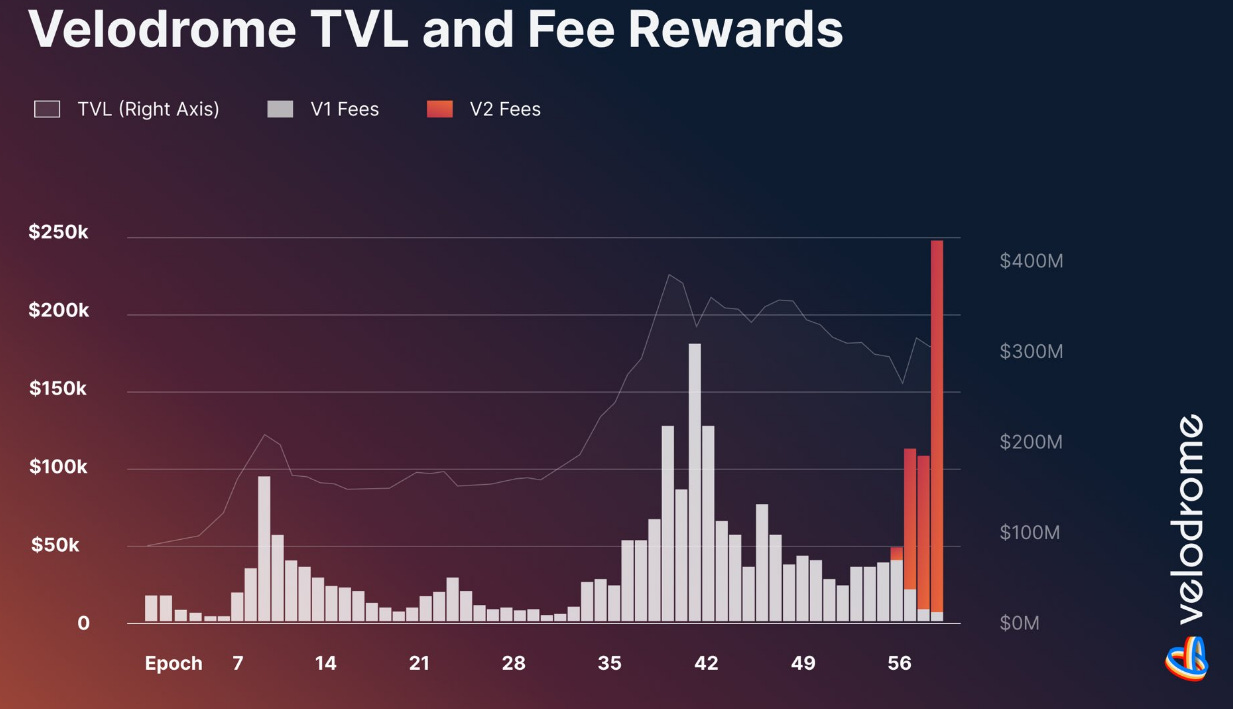

So as you may know the best place to seed liquidity is currently going on Velodrome Finance. Their V2 has been sky-rocketing fees, resulting in a new ATH of rewards (fees+voting incentives) towards VELO lockers.

ANKR has been a long partnership with Pendle on their ankrBNB LST. With Pendle having received a grant (see section above about cycle 13 grant winners), why not speculating about an Optimism pool ankrETH/wETH on Pendle?

Extra Finance has been achieving impressive growth too (10m$ TVL in 2 months). Built on top of Velodrome V2, Extra Finance allows user to leverage their yield. Imagine a ankrETH/wETH pool on Extra finance?

And imagine how Juicy this could be thanks to Extra fi grant…

5. Tips: How to find the best yield

The ANKR staking website is trully amazing and enhance the user experience. Clicking on the DEFI tabl allows user to access an aggregator of yield, where you can filter per LST type (ankrBNB, ankrETH, etc….), chain & type of pools (stable, volatile, etc…). Don’t hesitate to have a look at their website & follow them on Twitter.

Dashboard link: https://www.ankr.com/staking/defi/

Twitter: https://twitter.com/ankrstaking

Spotlight Project: Extra Finance

Subli_Defi is an Ambassador of Extra Finance & is presenting some of the latest news about the protocol.

Since the launch early May 2023, in about 2 months, the team reached amazing milestones & keep shipping new features:

TVL: 10m$ TVL milestone exceeded

Early users airdrop open. Expires Date of Claim: October 7th, 2023 00:00 UTC

Integration of Velodrome V2 Pools

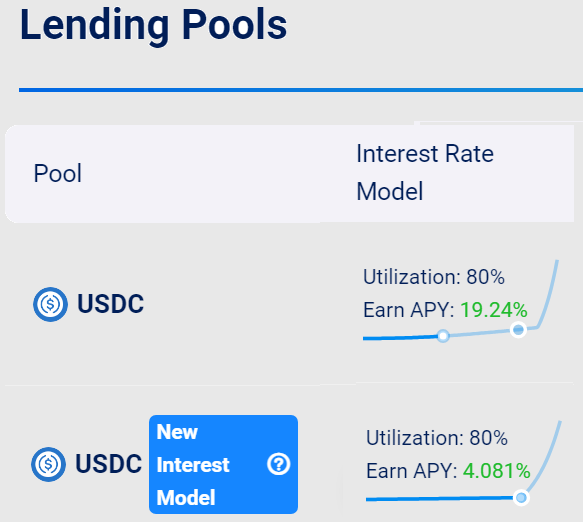

22 LPs & 18 lending pools currently available. Lending pools are incentivized in $EXTRA

New stable pools featuring new interest model for lenders/borrowers.

Extra Finance is part of Seasaon 4 - Cycle 13 winner with 104k OP grant to be received. More details in the Governance article above.

$EXTRA has been listed on Velodrome, and yield set currently at 423% (yield will fluctuate based on Voting incentives & TVL)

Staking has been allowed. Stake $EXTRA before Thursday 00:00 GMT to receive next epoch rewards. Epoch 1 Yield: 1300% APR.

Revenue sharing: 25% approx 50k EXTRA

$EXTRA inflation: 75% approx 150k EXTRA

Extra finance website: click here

🟢Crypto market review & Learning Tips

Crypto Market Review

Bitcoin

We have not seen any evolution since the previous newsletter. The price is still fluctuating between $29,000 and $31,000.

Bullish signs: The uptrend represented in green is maintained.

Bearish signs: We have a forming weekly divergence, and the volume continues to decrease.

The situation is clear for us. As long as we remain below $31,000, we do not find it interesting to play the market, and we will be patient until the market provides us with more visibility.

Once again, if Bitcoin corrects more strongly, altcoins will follow because Bitcoin is the king. For now, it's essential to preserve the uptrend represented in green.

DXY

The DXY index continues to make lower lows, which is the definition of a downtrend. The index appears weak to us, and we believe that the decline of the dollar will continue in the coming weeks.

CME gap

Since the previous newsletter, we have not witnessed any new gaps. As a reminder, the remaining open gaps are at $20,000 and $35,000.

Altcoins

We observe that altcoins need accumulation time before their explosion. During the previous bull market, it took 2 years of accumulation before experiencing parabolic movements.

However, at the moment, we are only at 400 days, so we must exercise caution with our risk management.

As a result, we may notice some rebounds in certain altcoins, but these movements are difficult to predict, and profits should be taken quickly to secure gains, as the altseason is not yet in effect.

Conclusion

The lack of volume, the emerging downtrend on Bitcoin, and the market's lack of visibility push us to be cautious and avoid risking our money unnecessarily while waiting for real market opportunities.

Trading: After the profit zone around $31,000, a correction is setting in on Bitcoin. We must remain patient and available for the next opportunities.

Investing: We are still at interesting levels for altcoins, but we keep in mind that this period could continue with lower prices. Therefore, our plan is to slowly Dollar-Cost Average (DCA) for the coming months. As for Bitcoin, it would be more relevant to wait for a retracement below the green line and continue our Dollar-Cost Averaging strategy.

Educational tips:

What means “Hedging a position”?

Hedging involves holding two positions on the same asset to reduce risk by offsetting losses from one position with gains from the other. This helps limit losses in the event of a bad investment or unfavorable market conditions, similar to an insurance. It is a risk management tool.

This technique is particularly suitable for investors with a long-term view and is useful for protecting their investments in the short and medium term. The goal is not to make a profit but to minimize losses.

The advantage of opening a second position is to remain exposed to the market instead of closing the initial position at a favorable entry price.

Example:

Suppose you bought Bitcoin between $15,000 and $20,000.

After carefully reading the Optimism newsletter 🔥, you believe the market has reached a local top around $31,000. However, you also think that in the medium or long term, the price will continue to rise. But you don't want to sell immediately because your entry price seems attractive.

In this case, you can protect yourself by opening a short position for the short term on Kwenta or Polynomial for example.

If BTC price goes up or down, your loss will be almost equal to your gains, hence removing your asset exposure, waiting a better time to take a one-sided position.

🟤Farming Strategy: >60% on ETH

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

The below farming strategy is proposed by Complete Degen (you must give him a follow if you want degen play :) ) using Leverage Yield farming on Extra Finance.

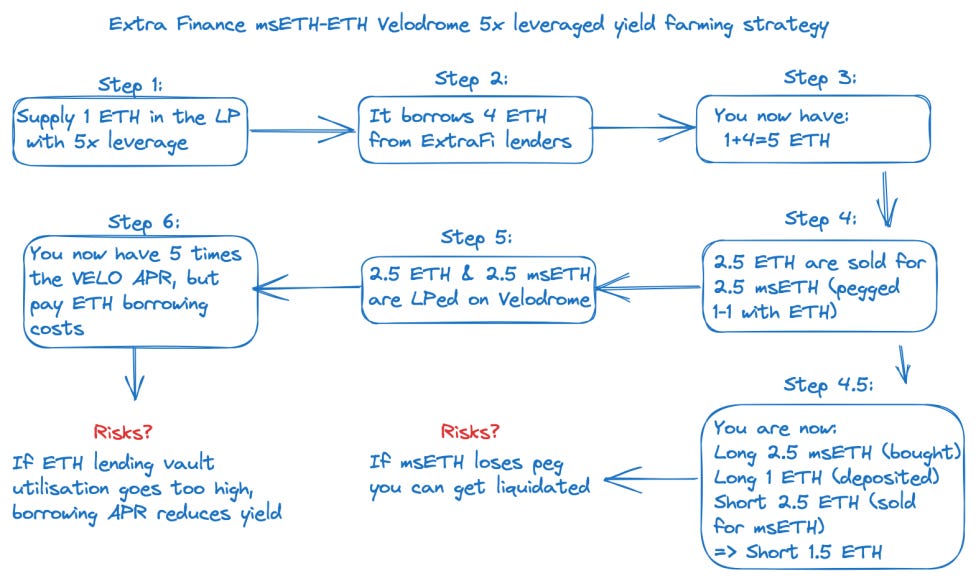

msETH-ETH Leveraged Yield Farming strategy on Extra Finance on Optimism:

This farming strategy relies on three protocols:

Velodrome Finance, the main DEX on Optimism

Extra Finance, which allows people to both lend assets to leveraged yield farmers, and yield farmers who want to leverage specific liquidity pool positions

MetronomeDAO, which provides a synthetic version of ETH called msETH

Today’s focus will be on the msETH-ETH liquidity pool, as explained in the diagram below:

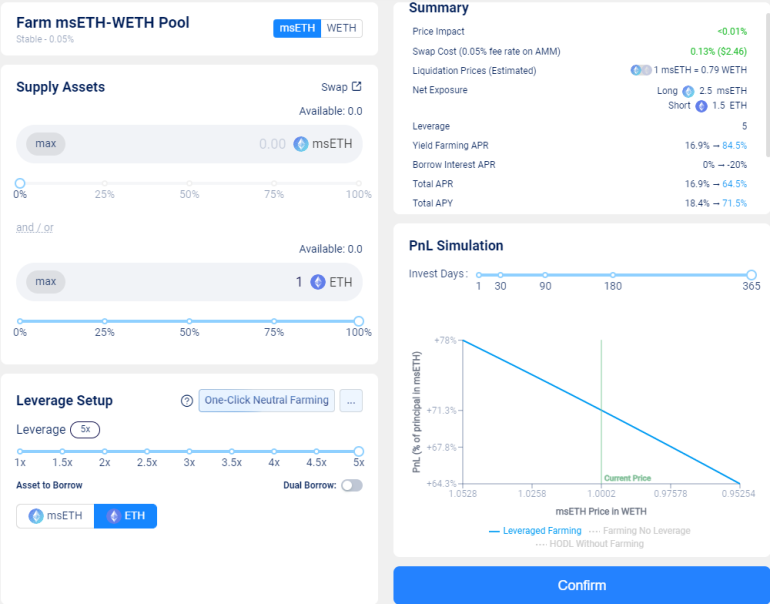

As explained above, a user can choose to leverage a liquidity position up to 5x on Extra Finance.

Risks:

Nonetheless, there are risks and these will vary depending on the type of liquidity pool chosen:

A LP with a stablecoin and a volatile asset (ex: USDC-VELO)

A LP with two volatile assets (ex: OP-VELO)

A LP with two pegged volatile assets (ex: msETH-ETH)

Most pools should allow you to decide which asset you want to short/long! Some will also allow you to directly choose a neutral position! These factors depend on the amount of lent assets available on Extra Finance!

Make sure to understand precisely the exposure you are taking after leveraging, as excessive leverage can be very risky if you do not monitor your positions frequently!

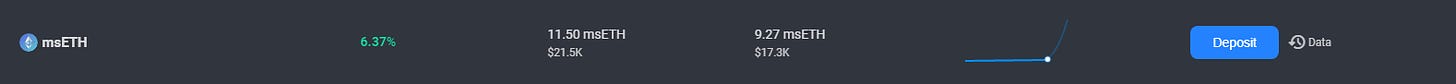

Regarding the strategy shown in the above diagram, here’s how it looks on Extra Finance:

Tips:

In order to cover yourself, as pegged assest have more tendency to loose their peg by the South (price decrease) than the North (price increase), the best solution would have been to borrow msETH. While msETH is available in the Lending Pool on Extra Finance, the TVL of lent msETH is really too shallow to play with:

Once, msETH TVL will hit a min of 6 digits in $, then we could expect to borrow some msETH to reduce our risk.

Yield:

As you can see from the screenshot above, the APR goes from 16.9% for regular farming, up to 64.5% for 5x leverage farming! Borrowing fees will vary depending on supply/demand mechanics explained in the documentation (there are various interest rate models)! All of this, while remaining long 1 ETH (if we assume a constant 1-1 peg with msETH)!

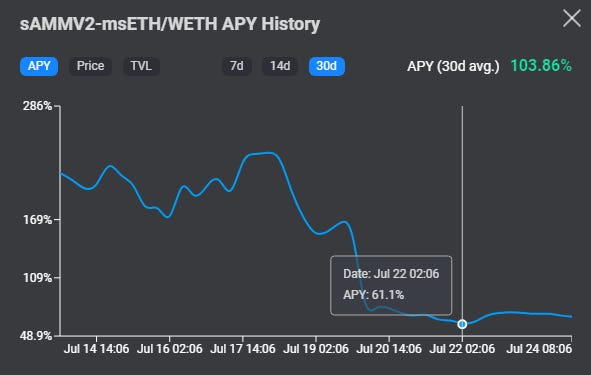

The yield on this strategy has never been lower than 61% since the last 30d, so we could expect to stay it like this:

Alpha🔥:

Extra finance + Metronome + Velodrome grants that could work all together:

Thanks to Complete Degen for this analysis :)

🟠Podcast:

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of some of the podcasts. Access granted to Revelo members.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

Subli_Defi Social accounts:

Discord Handle: Subli#0257

Twitter: Subli_Defi

Lenster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.

great

Good Job👍