The Optimistic Newsletter #2

The unique Newsletter covering DEFI on Optimism blockchain written by Defi Users for Defi Users

- Governance/Tech updates

In this #2 Newsletter, if you are an educator or a builder on the Optimism ecosystem, i’m going to show you why and how you might be able to apply for a grant on these 2 incoming events:

Project Grant Season 3 starting on 26th January

RPGF Round 2 started, ending on 31st January

- Project Update: dHedge

dHedge launched its $OP incentives on his protocol, with a possibility to increase your Yield of your position up to +20%.

In addition, dHedge introduced me Leveraged Token “ETHBULL3X” 🐮Leveraging your position without risk of being liquidated. Soon on Optimism?

Sorry, can you repeat Subli? Let’s get into this!

- On-chain analysis: Arbitrum Vs Optimism

Layer 2 seasons started during Summer 2022, so where are we now? Trying to disregard CT sentiment, let’s have a look at on-chain data & see which chain wins 🥇

- Crypto Market Macro-Analysis:

Finally, some Green candles in Crypto. BTC printed a nice +30%, that didn’t happen since March 2022. Feels refreshing right? But what are the charts telling us?

- Interactive Community Section: Farming Strategy

For each release, i’ll present one farming strategy on Optimism protocols presented by one Optimism Community Member. Make a thread on twitter and send it to me via DM.

This week, i’ll present you not one but two farming strategies that I selected.

- Podcast: Project interview (Updates & Roadmap)

Find the link to the Podcast of the last 2 weeks (Kwenta & dHedge / Lyra & Polynomial)

Subscribe to The 🔴Optimistic Newsletter to receive the latest updates about DEFI on Optimism Blockchain

GOVERNANCE / TECH UPDATES

Listen-up Projects, Contributors, Content Creators: The Optimism Foundation recently launched Two programs you can benefit from it. Let’s analyze who, How and When you should apply ?

Season 3 $OP Grant: Builders & Growth Experiments

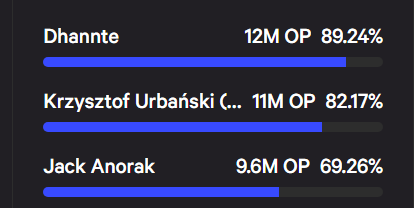

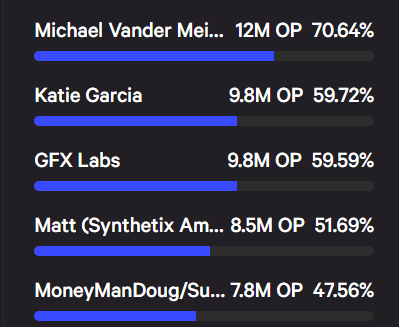

New Grant Council Builders & Growth Experiments committees have been nominated. From now on, only the reviewers will vote for Project Grants, that will start on 26th of January. Welcome to the new GC members:

Builder Committee: 3x Reviewers

Growth Experiments Committee: 5x Reviewers

Builders are mainly for projects. But what fits-in the Growth Experiments Grant?

Initially focused on onboarding new users, and maximizing interactions on Optimism chain. You can find all the below information in the dedicated post inside the Governance forum -> https://gov.optimism.io/t/request-for-grants-growth-experiments/4374

And here is a summuary of the Grant Specification:

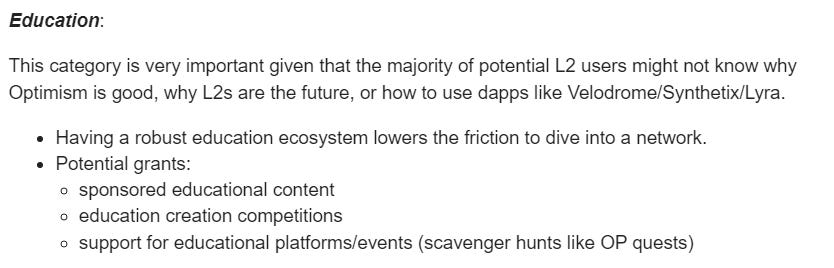

Michael Vander Meiden, a Content Creator, and TOP 1 vote as GC member, added also the fact that Education is also key and could be sponsored through this grant:

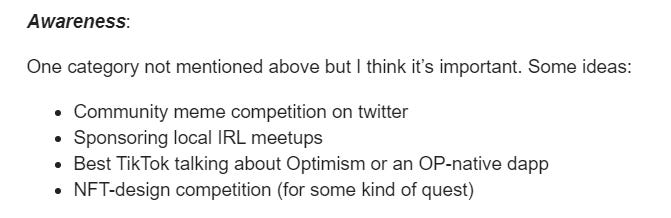

And suggested to fund also Awereness initiatives:

So, if you have imaginations, talents in such field, don’t hesitate to show up and apply for an $OP grant. Rules for applying:

1- Use the application template here: https://gov.optimism.io/t/grant-proposal-template/3233

2- Submit your application here, GC members will start reviewing it starting on January 26th: https://gov.optimism.io/c/proposals/38

Retroactive Public Good Fundings (RPGF)

Did you participate to the growth of Optimism in 2022? If so, read carefully the below as you could receive some $OP for your hard work.

In February 2023, 10M $OP will be distributed to the people and projects powering the public goods that make Optimism possible.

The different eligible categories are:

Infrastructure + Dependencies: Software used to build or deploy the OP Stack; contributions to protocols or standards the OP Stack depends on run; experiments that support future development of the core OP Stack protocol

Tooling + Utilities: Work that helps builders create applications on Optimism mainnet, build on the OP Stack, interact with governance of the Collective, or use applications built on Optimism

Education: Work to spread awareness and knowledge of how Optimism works, whether technically or socially

Let’s have a closer look at the Education category & how you can apply to it.

What you need to do:

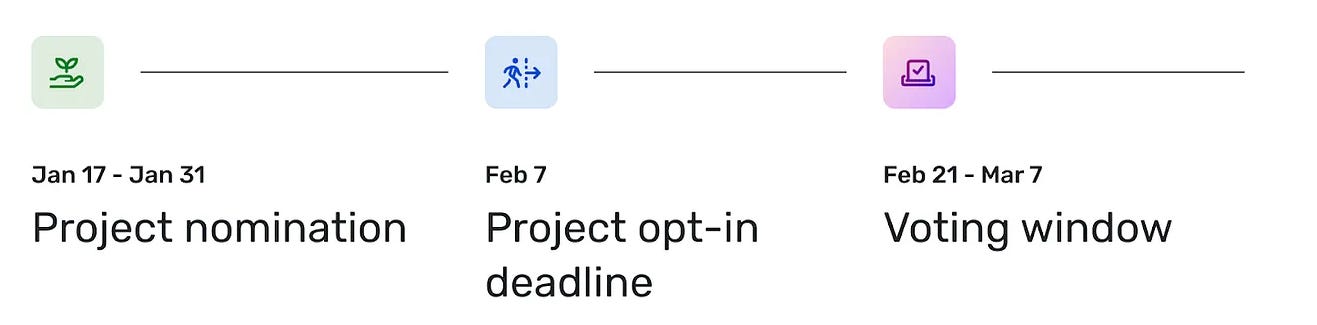

Before January 31st, nominate yourself or check if someone else already did it on the Governance Forum following the process described here: https://gov.optimism.io/t/nominations-for-retropgf2/4636

By End of January, you will be able to provide more information and resources relating to your project by Opt-in via the Optimism Application Manager

Vote will take place between Feb 21 - Mar 7 by Badge Holders only

Tips: No need to spam the channel to ask everybody to say you’re the best on earth. Spamming will likely drive your nomination down.

Timeline is as follows:

You can find more information about it here:

Here's a manual for projects with more info on this: https://oplabs.notion.site/Optimism-RetroPGF-2-Project-Manual-0a2e741133cd49b0b005ff759934b998

On the Nominations: https://gov.optimism.io/t/nominations-for-retropgf2/4636

Looking for a synthetic & Global Overview of Defi? Rektdiomedes has you covered with The Daily Degen Newsletter! You’ll be able to find News, events, data & alerts. I recommend you subscribe to it.

PROJECT UPDATE: dHEDGE x TOROS FINANCE

dHedge is a decentralized fund management protocol and is working closely with Toros Finance who, on their side, provides All-In-One vaults, built on top of dHedge.

Launch of $OP Incentives:

During the last Optimistic Podcast, dHedge has been granted 350k $OP (around 700k$ at current OP price) that will be distributed as follows:

210k $OP for Vaults Incentives, who started on 18-Jan for a period of 6 months

105k $OP for $ DHT liquidity

35k $ OP for trading competition

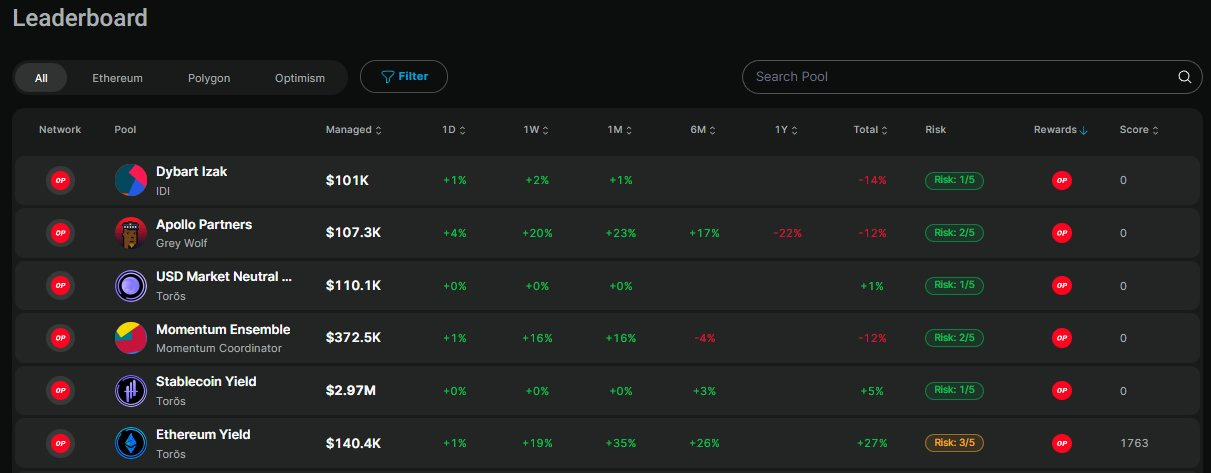

TVL of dHedge (so incl. Toros Finance) without Protocol Treasury is approx 4m$, which means an estimated additional 20% Yield on top of any vault (vaults are earning yield thanks to the underlying strategy).

Example: Vault 1 strategy= LPIng on Velodrome Finance ETH/wstETH at 10% APR. With $OP incentives, you will earn 10%+20% = 30% APR during 6 months.

Current available vaults are:

In addition to this, as the protocol is permissionless, any user can build his own vault on dHedge and requests $OP incentives. In that case you’ll earn:

Management/Performance fees on other deposited funds (if vault performance is positive)

$OP Incentives + Vault performance on your own deposit

How to apply:

Go to the dHedge discord , “Application for OP Incentives” and fill in the template

Vault eligibility criteria:

Minimum AUM of $10k (Asset under management),

Vault creation date at least 4 weeks old,

Recently active,

Be a public vault, and

Vault must include a fee, a minimum of either 5% performance fee or 1% management fee.

Happy farming guys!

Leveraged Token: What’s this sir?

⚠This product shall be used by experienced traders⚠

Currently only available on Polygon, dHedge is investigating the possibility to bring this type of strategy on 🔴Optimism. But let’s introduce you ETHBULL3X🐮 & ETHBEAR3X 🐻 aka Leveraged Tokens.

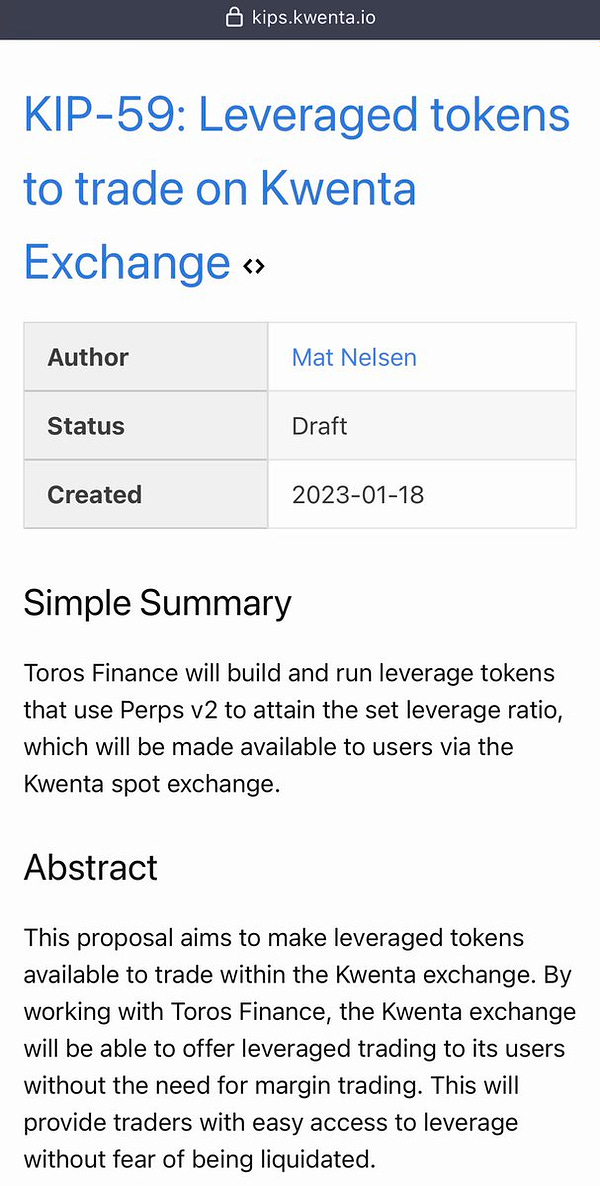

And what if i tell you that Kwenta is strongly thinking to integrate leveraged token on his Dapp ? That definitively deserves a bit of Education on this “Leveraged Token”.

Definition:

Leveraged token allows users to obtain on-chain leveraged exposure for multiple assets. The strategy automatically manages and monitors leveraged loans, and abstracts away the active management.

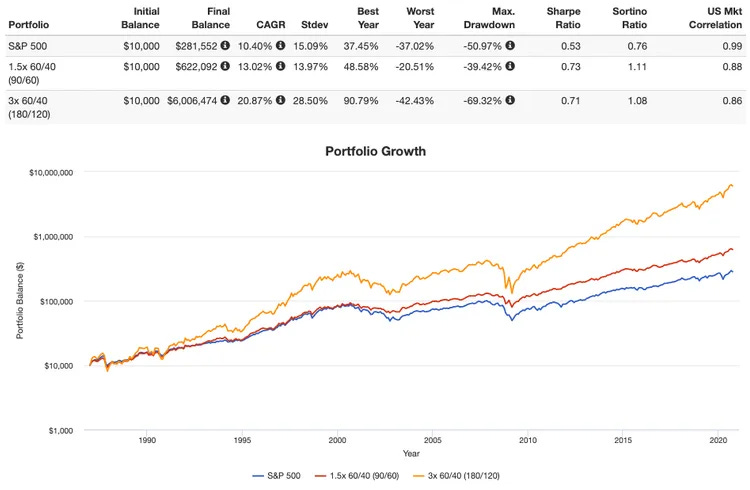

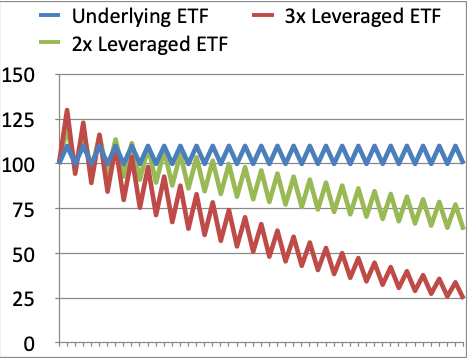

Leveraged funds are well known in the Traditional Finance where it is applied to ETF (Exchange-Traded fund) to amplify returns of an underlying Index or set of assets.

Strategy:

Leveraged tokens are named either ETHBULL3X or ETHBEAR3X. How does it work?

ETHBULL3X:

$ETH is deposited into a lending protocol as collateral, such as AAVE

Stablecoin is borrowed against this collateral, and swapped for more $ETH

The process is repeated until the target leverage is achieved, 3X in that case

In other words, ETHBULL3X amplifies Ethereum price change by three times. If Ethereum climbs 5% in price, ETHBULL3X goes up 15%. The token does not liquidate and maintains constant leverage to achieve higher growth potential than a regular 3x long.

As more rewards come with more risks, for ETHBULL3X, a price decrease of 5% will also result in a loss if 15% of your deposit.

For ETHBEAR3X deposits are in Stablecoin and $ETH is borrowed, looped 3 times.

Use Case & Risks:

It’s a very interesting product that needs to be used in the right case and during a short period of time:

1- Uptrend/Downtrend market → Use BULL/BEAR Leveraged token

2- During volatile and side-line market, Leveraged token show usually negative results as volatily will have a negative impact due to the frequent rebalancing mechanism:

Hopefully this Leveraged token will attract new traders on dHedge / Toros Finance on Optimism. For more information, i recommend you to do some research on the web and to look at the below ressources:

https://intrinio.com/blog/breaking-down-the-danger-of-leveraged-etfs

https://docs.toros.finance/leveraged-tokens/leveraged-tokens

ON-CHAIN ANALYSIS: ARBITRUM VS OPTIMISM

Arbitrum and Optimism L2s monsters launched one year and half ago. They are now essential in the Defi Ethereum ecosystem, teams are working hard to compete with polygon for the next bullmarket, let’s dig into some on-chain data to see if there is a clear winner:

thanks for the Data on @DuneAnalytics, made by @defi_mochi and @blockworks_research)

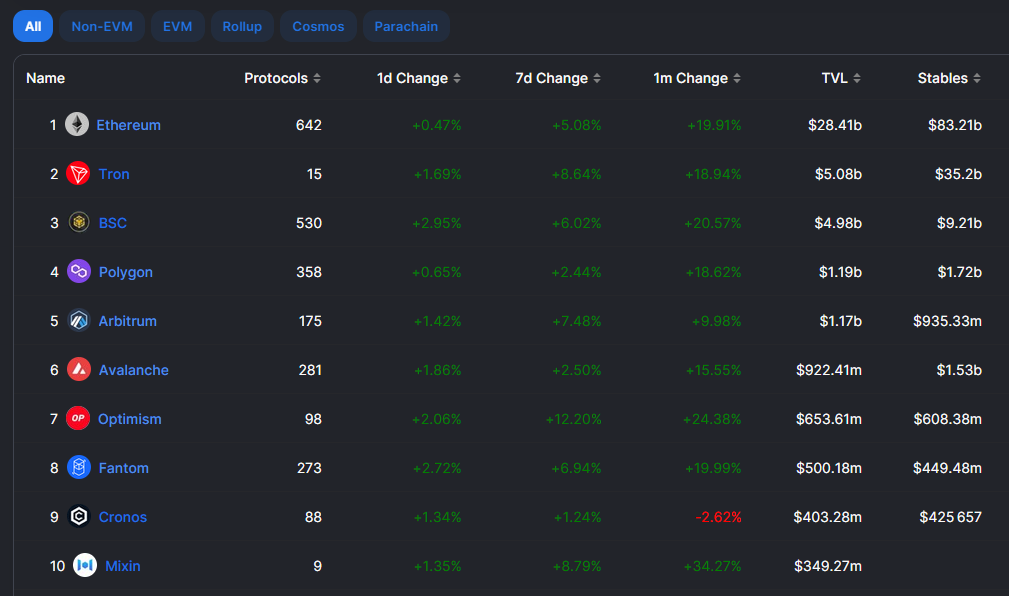

TVL (Absolute value / Growth) :

TVL of Optimism increased of 28% last month, 2,8x times more than Arbitrum, but still isbelow Arbitrum, ranked at Top 7 chains.

TVL of Arbitrum increased of 10% last month, 5th place in the ranking.

Percentage Defi Dominance:

Total L2 TVL is now around 6% (Polygon, Arbitrum, Optimism) Of Total Defi, and 10% of the total TVL of Ethereum (remember ETH was launched 8 years ago). L2 adoption becomes clearly exponential.

Total Value Locked:

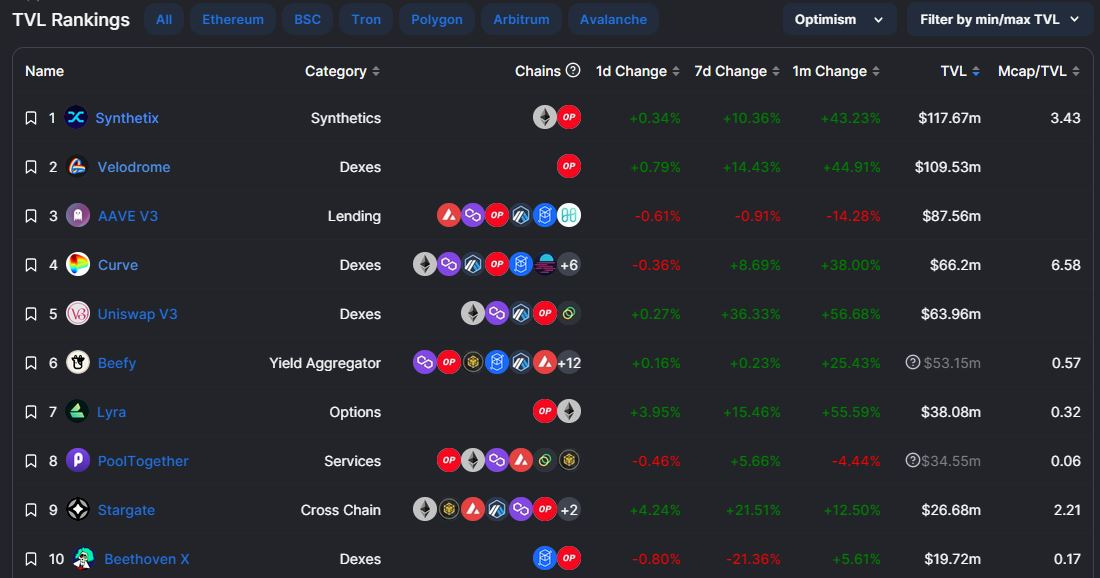

Protocol ranking:

Arbitrum:

Only GMX, with an impressive 440m$ TVL, represents a large part of the chain TVL with 38% of the Total TVL of Arbitrum.

The catalyst came mainly from restrictions in some countries (like in France) where Future Trading has been prohibited, as well as CEFI drama with FTX collapse tthat resulted in directing leveraged traders to trade with low fees on GMX.

And in addition to this, there are some big whales like Arthur Hayes, and others who showed support to this perp dex.

Optimism:

On Optimism however, there is no “Locomotive” protocol that attracts the majority of the chain TVL, but instead it’s homogeneously spread accross different protocols, with Synthetix, Velodrome Finance & AAve being the Leading Trilogy. While AAVE TVL has reduced significantly due to the end of the $ OP incentives, the TVL monthly increase is just impressive on Synthetix & Velodrome.

Conclusion: Arbitrum has its own locomotive that drives the whole Defi being GMX. Who that will be on Optimism? Synthetix or Velodrome? Future will tell.

Total Ecosystem coins by Marketcap:

Interesting to see the similarity not in term of TVL but in terms of Total Ecosystem coins by Marketcap.

Conclusion: Optimism projects has a greater ratio MC/TVL. Does it mean there are overpriced or just

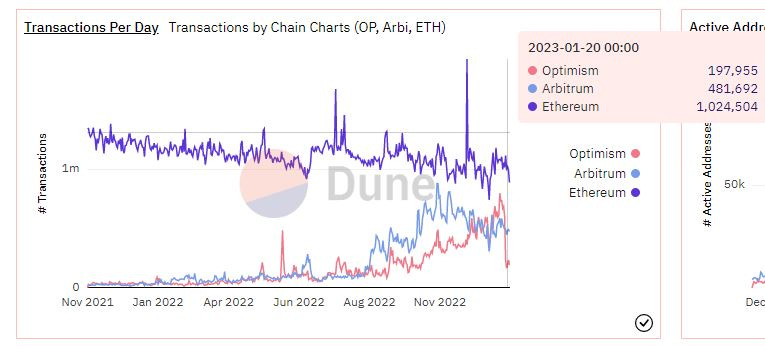

Transactions per day & active adresses:

Both chains have seen the number of Tx following an exponential curve, both driven by airdrop farming expectations.

Interesting fact of L2 adoption, nb of Tx on Polygon still exceed the nb of Tx on both Arbitrum + Optimism.

Transactions and active adresses on Optimism flipped Arbitrum in December, but with the Optimism quests that ended on 17th January, the number of transactions reduced by half in few days. It will be interesting to see how many people will stay on the chain.

The future launch Q1 2023 of Optimist NFT could get the number of transactions back to its previous ATH.

Average transaction Fee:

Transaction fees are slightly lower on Arbitrum than Optimism, but globally both are extremely cheap, and give freedom for Defi users, compared to DEFI on Ethereum mainnet where fees are closer to 15$ for a standard swap.

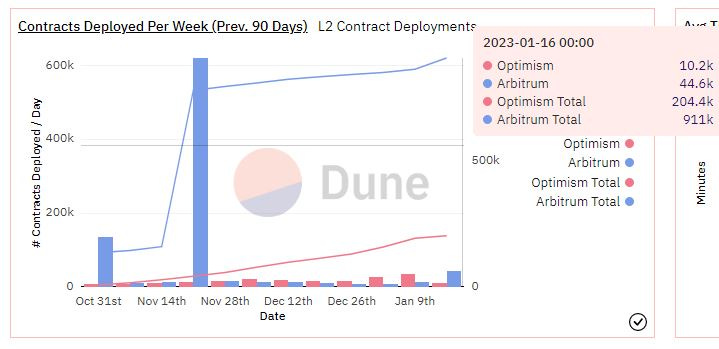

Contracts deployed per week:

The total number of contracts deployed per week on Arbitrum is 5 times higher than Optimism with punctual high peaks, probably due to the airdrop loading of Arbitrum.

Wallets >100k USD on Arbitrum are 75% higher than OP, with a concentration on GMX.

Conclusion:

Exciting statistics about the progress of L2s during this bear market. Both Optimistic Rollups see their own DEFI growing, and it feels like that the battle between the 2 rollups to become the One & Unique DEFI Central Place on a Layer 2 has just started.

While Arbitrum has definitively an edge on Defi (Higher TVL = Deeper Liquidity, larger number of protocols), Optimism remains for me the perfect entry door for any newcomers in DEFI as it gathers all the primitive financial products anybody should start using to learn how DEFI works, and invest wisely.

Finally, 2 locomotives will see major upgrades on Optimism that could be the catalyst for another Defi Sprin/Summer on Optimism:

Velodrome Finance: Leading Dex of Optimism, central place for deep & capital efficiency liquidity, will see its V2 upgrade in 2023

Synthetix: Liquidity as a Service, and leading derivatives protocol on Optimism, will also see its V3 to be released in the coming weeks/months that will attract an incredible amount of projects that will be built on top of it (Perps, Options, etc…)

1/7 Here is a TLDR about @noahlitvin blog post about @synthetix_io V3, update, roadmap and ideal world of DEFI shared several times by @0xmillie_eth recently, and i now understand why 🫡 👇🧵Here’s an update on @synthetix_io, our progress with V3, and where the protocol could be headed in 2023: https://t.co/VD8weVTVzn

1/7 Here is a TLDR about @noahlitvin blog post about @synthetix_io V3, update, roadmap and ideal world of DEFI shared several times by @0xmillie_eth recently, and i now understand why 🫡 👇🧵Here’s an update on @synthetix_io, our progress with V3, and where the protocol could be headed in 2023: https://t.co/VD8weVTVzn noah @noahlitvin

noah @noahlitvin

Future is bright, and opprtunities will continue. Stay tuned!

CRYPTO MARKET MACROANALYSIS:

Before we dig into the chart, it’s necessary we think to tell you WHY we’re looking at the DXY, and what it is.

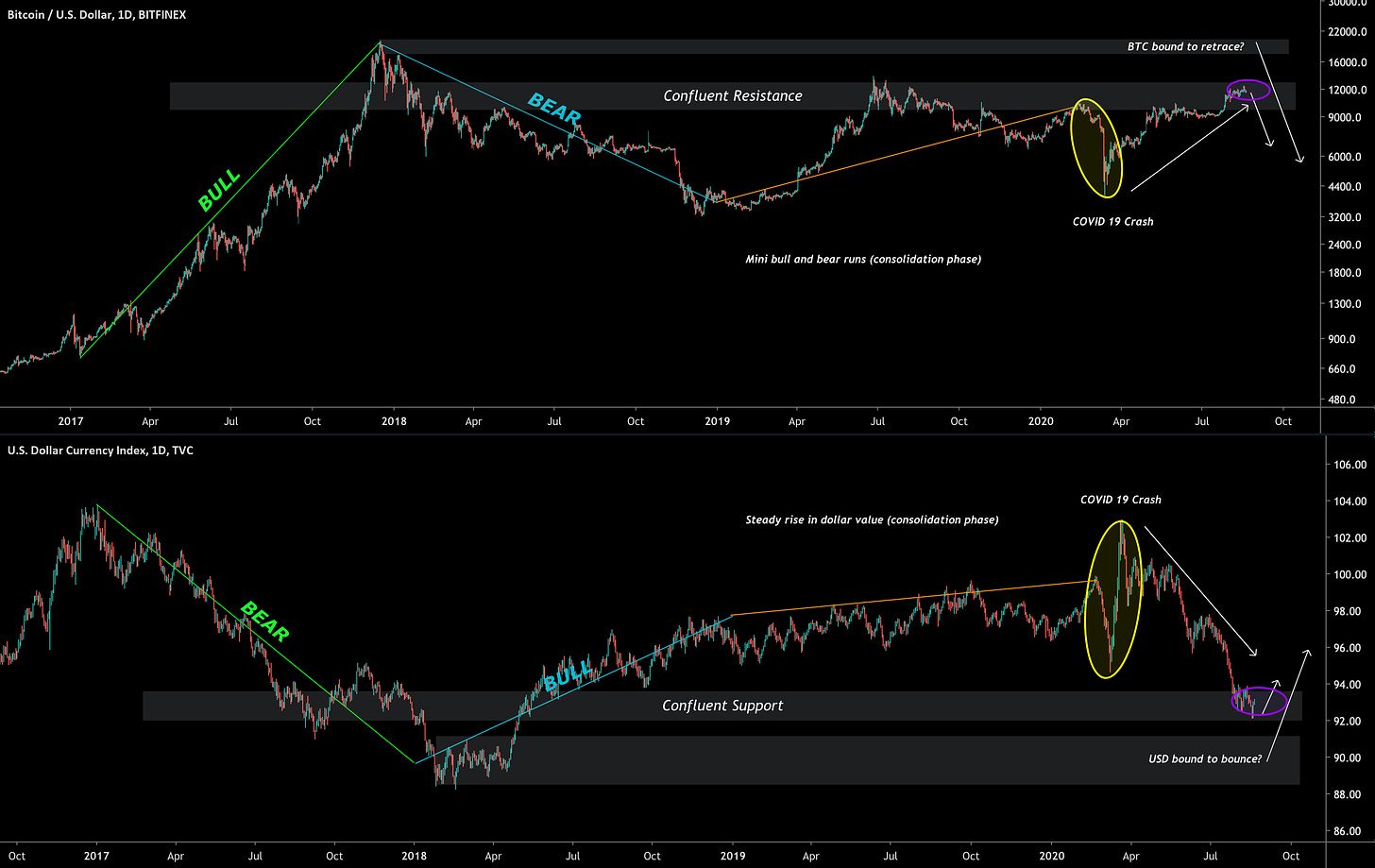

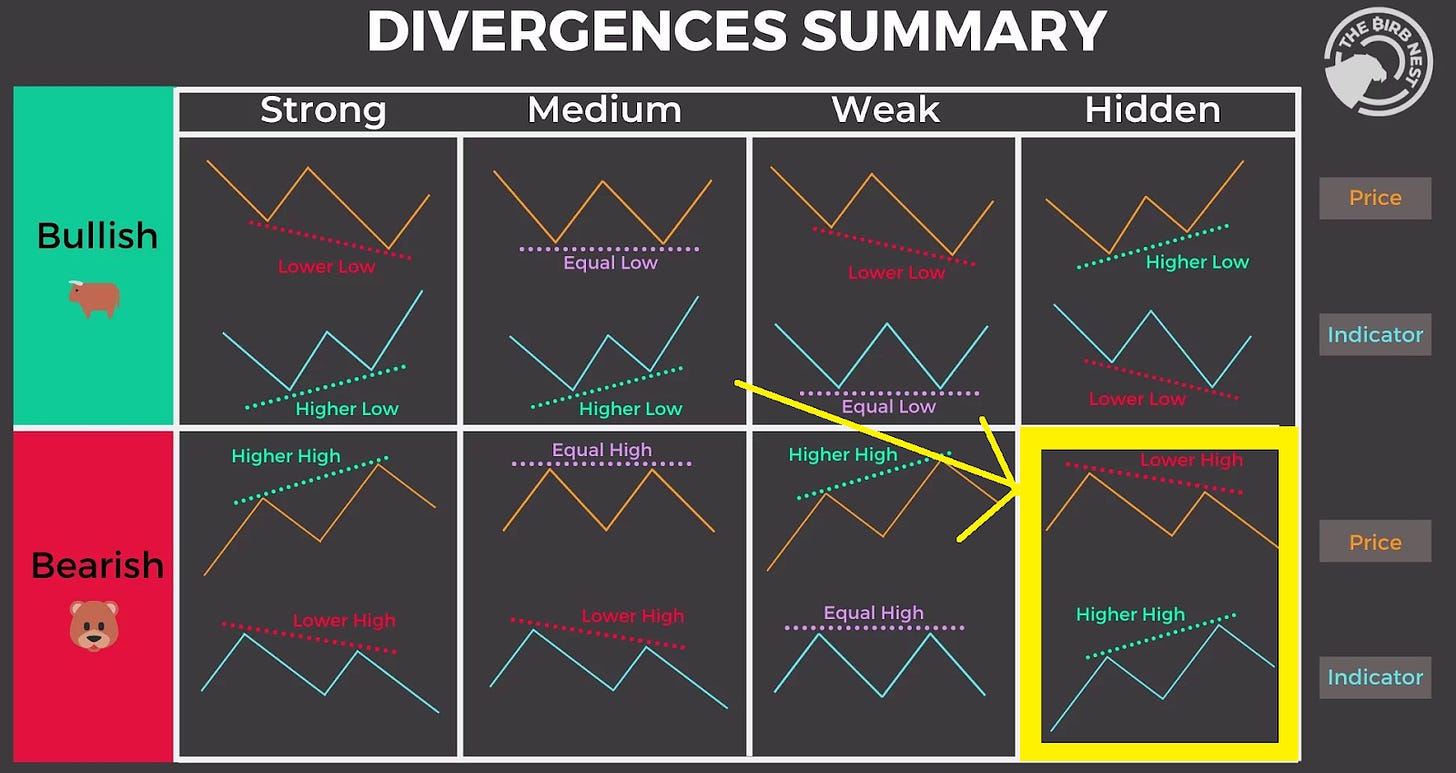

For info, the DXY tracks the dollar's (USD) relative strength against a basket of foreign currencies (EUR, JOY, GBP, CAD, SEK, CHF), and always moved in the Opposite of Bitcoin, so the overall crypto market. That’s why our analysis will often refer to DXY and BTC. See example below on BTC chart on top and DXY chart at the bottom, moving in a complete opposite direction.

Now that we made the presentation, we must admit that having $BTC riding on a +30% local uptrend, that did not happen since March last year, is refreshing and put some smiles on us, don’t you?

But, don’t be blind at Price Action, it never goes up in a straight line. Where are we right now?

Following the logic of the previous macro analysis, we see that DXY has continued its decline approaching a key level. The continuation of this decline is positive for risky assets such as stocks & cryptocurrencies.

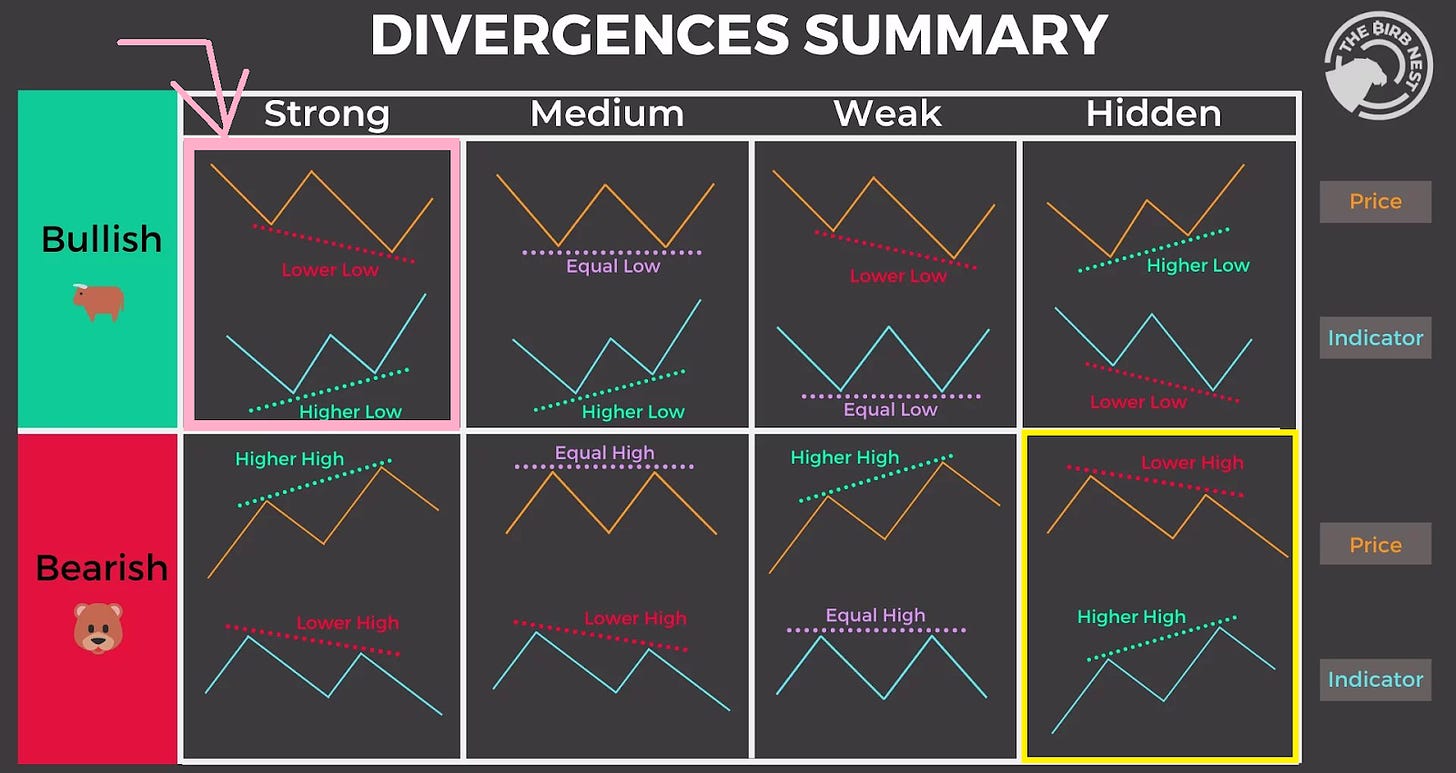

Despite the bearish momentum and the new low printed, the daily divergence on RSI is still present. So at any moment the ongoing divergence could play out and propel the dollar on a corrective bullish movement that may result in consolidation or a drop of risky assets.

We can see that Bitcoin, which dictates the overall Price Action of the crypto market, just printed at the moment a lower high during the recent impulse. However, the Daily RSI just printed a Higher High. As long as there is no a Higher High for $BTC, the daily bearish divergence on RSI is not invalidated and a new low is possible.

A candle weekly close above 21500 and even more 25000 will induce a higher high and thus increase the chances of a bullish reversal to retrace some or all of this year's decline. Let's not forget to notice the Daily RSI level which is currently overbought >70, a retracement of the impulse is highly possible in the next few days.

As a trader, I believe that the movement is soon coming to an end. Currently, altcoins are the game to play. Every low point can be bought as long as BTC is in a range or in an upward trend. Once BTC breaks the range on the downside or makes a lower high, we should be prepared to exit the market.

Indeed, the probability of Bitcoin taking the whole market with it is high and we should protect our capital at that time.

As an investor, there are 2 strategies. Either you wait for red candle for new buying opportunity knowing that timing the real bottom is hard, or you invest a little every month, strategy named DCA (Dollard Cost Average).

INTERACTIVE COMMUNITY SECTION: FARMING STRATEGY

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

Thanks to my fellow community for providing two farming strategy available on Optimism. See below and pick the right one!

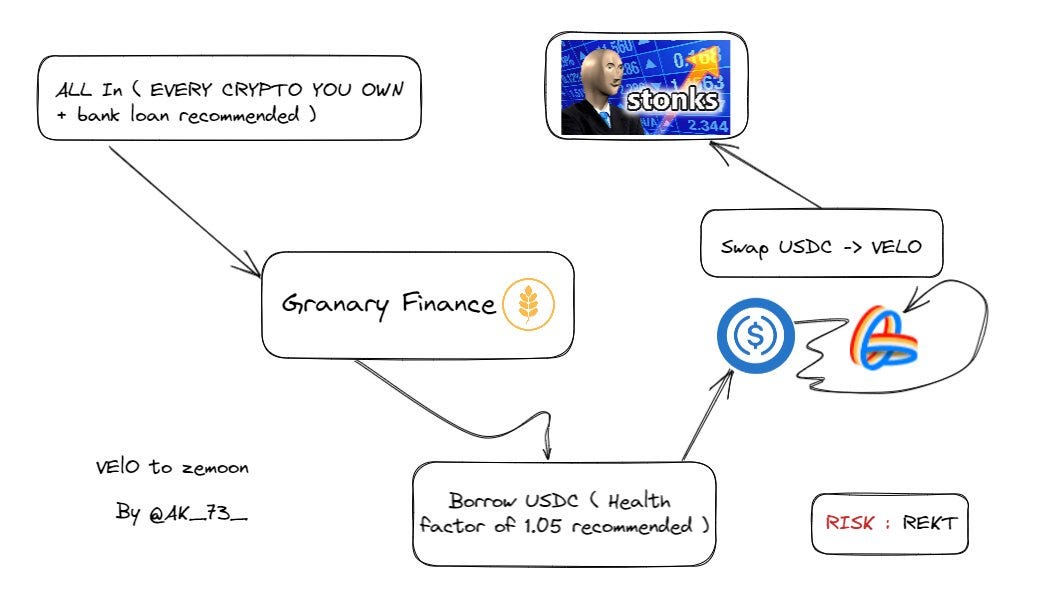

What you MUST NOT do: Courtesy of @AK_73_

Risk: GET REKT

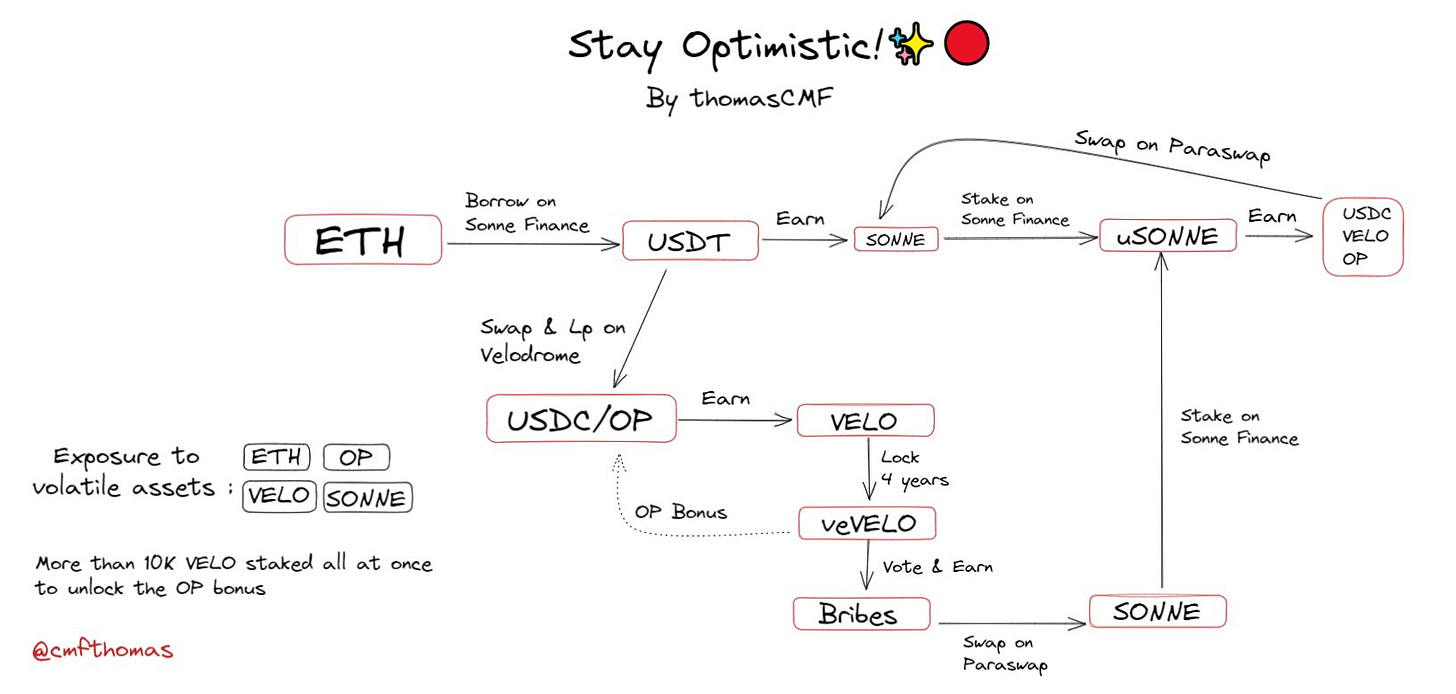

What you can do: Courtesy of @cmfthomas

Min. Initial investment for up to LP OP/USDC (w/o locking $Velo): No requirement - Overall Yield: 23%

Min. Initial investment for the whole loop: 55k$ - Overall yield: 25%

Risks: Smart contracts (Sonne Finance, Velodrome Finance), Liquidation (health factor min 1.8 recommended by ThomasCMF)

PODCAST:

Subli <> Kwenta + dHedge

Subli <> Lyra + Polynomial

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

Optimism Discord:

https://discord-gateway.optimism.io/

Discord Handle: Subli#0257

Subli-Defi Social accounts:

Twitter:

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi