The 🔴Optimistic Newsletter #3

The unique DEFI Newsletter on Optimism blockchain written by Defi Users for Defi Users

- Governance/Tech updates: Attestation Station

Decentralized Identity could be the next narrative in Crypto. Use case could be either to check eligibility criteria for future airdrops or to check solvency/user behavior for undercollateralized loan. Attestation Station is an initiative that fits in this category and is run on Optimism Blockain.

- Project Update: Synthetix Perps V2

Perpetual/Future Trading is a high volume activity on Centralized Exchanges. How Perps V2 upgrade on Synthetix manages to offer users similar access in a completely Non-KYC and Decentralized way, and still being as efficient as on CEX? Low trading fees, more markets available, Liquidity as a Service, something to not miss!

- On-chain analysis: Are Institutions/Smart Money back?

Comparing Stablecoin Market Cap & Crypto Market Cap can give you an insight if the Smart Money is back in the market. Let’s compare on-chain data to define if Institutions are back.

- Macro-Analysis: Crypto vs Gold

Here is our bi-weekly macro-update. This time, instead of comparing $BTC with $DXY, we will put some interest in the GOLD chart. You might be surprised…

- Interactive Community Section:

Liquid Staking is in all Crypto Twitter. What about maximizing $rETH staking yield with a layer of Optimism farming strategy?

- Podcast: Project interview (Updates & Roadmap)

Find the link to the Podcast of the last 2 weeks

These last 2 weeks i got the chance to have on stage Justin Bebis & Samson from the Byte Masons Team, and also to be invited by Alluo to talk about Defi on L2.

Subscribe to The 🔴Optimistic Newsletter to receive the latest updates about DEFI on Optimism Blockchain

GOVERNANCE / TECH UPDATES:

GOVERNANCE TIMELINE

ATTESTATION STATION

The Optimism blockchain is constantly exploring new and innovative ways to improve the user experience. One of the latest developments in this direction is the Attestation Station smart contract, designed to simplify and streamline the process of verification for users.

What is The Attestation Station ?

The Attestation Station smart contract is a decentralized application that enables users to verify their identities, assets, and other important information on the Optimism blockchain. The process is simple and straightforward, with users only needing to provide a few key pieces of information to get started.

Once the information has been verified, it is stored in a decentralized manner on the Optimism blockchain. This means that the information is not controlled by a single entity, and can only be accessed by authorized parties. The information is also encrypted, adding an extra layer of security and privacy for users.

What are the benefits of using Attestation Station ?

The Optimism Attestation Station smart contract provides several key benefits for users, including:

1. Simplified Verification Process: The Attestation Station streamlines the verification process, allowing users to verify their information once and use it across multiple dApps on the Optimism blockchain.

2. Secure and Tamper-Proof Storage: The information stored on the Attestation Station is encrypted and stored in a decentralized manner on the Optimism blockchain, ensuring that it is secure and tamper-proof.

3. Enhanced Privacy: The information stored on the Attestation Station can only be accessed by authorized parties, providing enhanced privacy for users.

4. Time-Saving: By eliminating the need for users to provide the same information to multiple dApps, the Attestation Station saves users time and reduces the risk of errors.

5. User-Friendly Interface: The Attestation Station has a simple and straightforward interface that makes it easy for users to submit their information and track the status of their verification.

6. Compatibility with Multiple dApps: The Attestation Station is compatible with a wide range of dApps and platforms, making it easy for users to access and use their verified information in multiple contexts.

7. Cost-Effective: The Attestation Station is a cost-effective solution for users, as they no longer need to pay fees to verify their information with each individual dApp.

In summary, the Optimism Attestation Station smart contract provides a secure, convenient, and cost-effective solution for verification on the Optimism blockchain, and is a valuable addition to the platform.

Use Case

Now that you learn the basics, what are the real applications of Attestation Station?

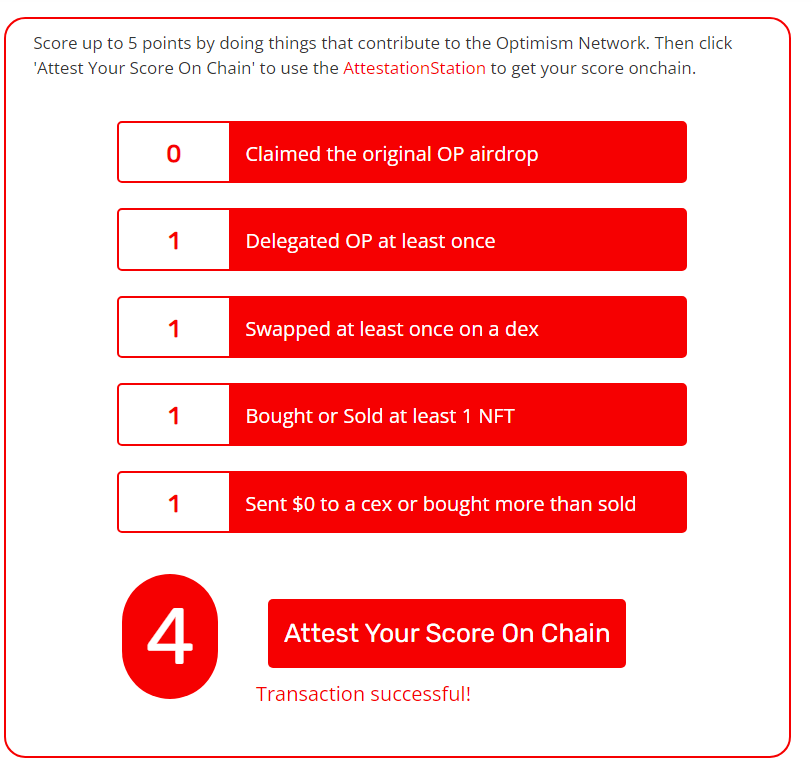

Flipside has created an on-chain scoring: Could be interesting for an $OP airdrop, no?

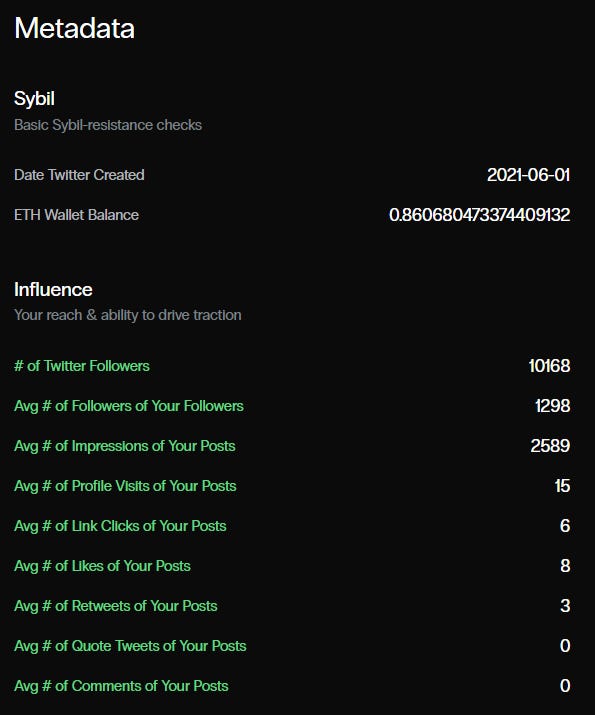

Clique is an identity oracle that bridges web2 user identity and behavior data to web3. They just used Attestation Station to authentify your social activity on Twitter for the last 30 Days. See mine below:

Decentralized identity might become a new narrative, either for avoiding sybil attacks on Aidrop farming, for undercollateralized lending, or for private access to certain groups. Attestation Station is ONE tool on which people/projects will be able to build on Optimism Blockchain. We will keep an eye on this for sure!

Looking for a synthetic & Global Overview of Defi? Rektdiomedes has you covered with The Daily Degen Newsletter! You’ll be able to find News, events, data & alerts. I recommend you subscribe to it.

PROJECT UPDATE: SYNTHETIX PERPS V2

Before, we dig into the new generation of PERP Protocol (allowing leverage trading), let’s Introduce Synthetix, one of the primitive DAPP in DEFI, founded in 2017 by Kain Warwick.

Synthetix is what we call a CDP project: Collateralized Debt Position

By depositing Assets as Collateral into the protocol ($SNX for now - The governance token of Synthetix), you are able to “mint” a synthetic stablecoin, called “SYNTH”, $sUSD. Users are then allowed to either swap it for another SYNTH sBTC or sETH (which price is pegged to $BTC or $ETH), or use $sUSD into different protocols built on top of Synthetix V3. The current Synthetix ecosystem is currently made up of the following projects:

Today, new projects are coming up and showing intentions to build on Synthetix. Why? Which Project? Let’s dig into what brings the exciting upgrade of “Perps V2”, released end of 2022.

First of all, we need to understand that for a Perp protocol to be sustainable, you need deep liquidity.

GMX ($GMX) incentives Liquidity Provider through the GLP Pool, Gains Network ($GNS) through the gTrade pool. So basically, one pool, one product. Synthetix vision is totally different.

As Synths are being minted when exchanged against $sUSD, Synthetix is offering deep liquidity for these SYNTHS, allowing a wide range of protocols to build on top of Synthetix => SYNTHETIX is now becoming a Liquidity As A Service (LAAS) protocol.

One Pool => Infinite number of projects!!

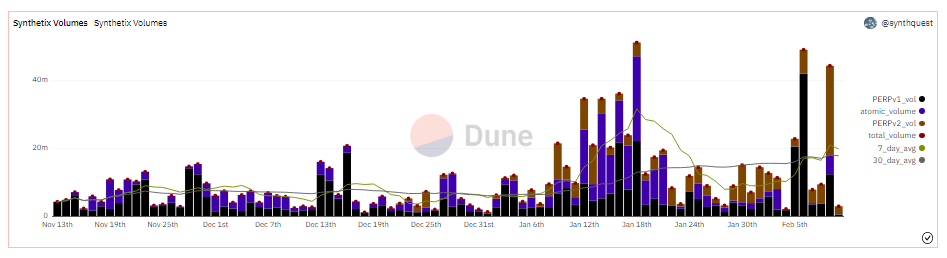

The main feature of Perps V2 is the use of Off-Chain oracles that will significantly reduce frontrunning events, as well as trading fees down to 0.05%, very similar to what you can find on Centralized Exchanges. Since Perps V2 has been live in December 2022, a number of projects have already launched using this new upgrade, and trading volume keeps increasing as shown on the official Synthetix Dashboard:

https://dune.com/synthetix_community/synthetix-stats

Here is the list of projects that have officially communicated about launching a Perp protocol on top of Synthetix Perps V2:

1- Kwenta:

Original Perp project, incubated by Synthetix Team, launched its Alpha Release end of 2022. Currently with limited features, the team is planning to implement all the basic features you can find on a Centralized Exchange within the coming weeks.

For the ones who don’t, I suggest you listen to the Podcast held with Burt Rock, Marketing PM of kwenta, on how he sees Kwenta within 6 months from now:

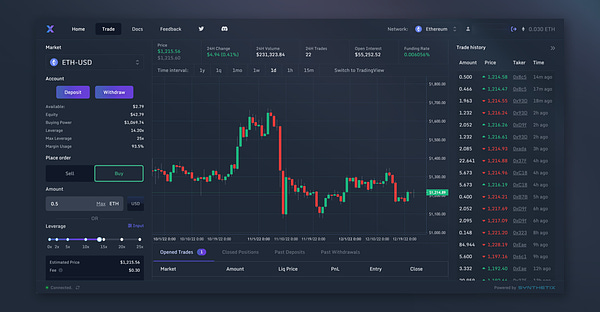

2- Decentrex:

Decentrex just launched end of 2022 also, promoting the main features of Perps V2 back end, having fees as low as 5 to 10 BPS. For info, the team has no token yet.

3- Polynomial:

A Decentralized Options Vault (DOV) protocol, built on top of Lyra Finance, just recently hinted that they planned also to build a Perp protocol on top of Perps V2. For info, the team has no token yet. I also had the pleasure to host a Space with Polynomial where they expressed their vision about Perps protocol, that should be released in 2023. So Welcome to Polynomial Trade:

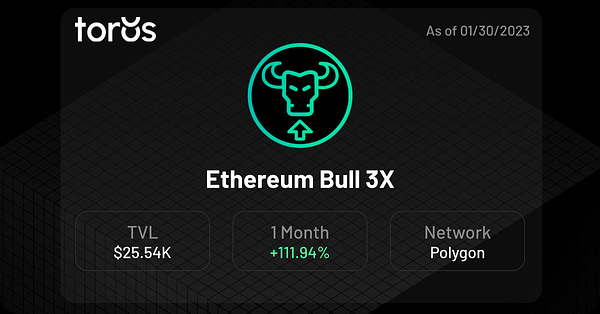

4- Toros Finance:

Presented in the previous newsletter (#2), leveraged token from Toros Finance an be launched on top of efficient and low cost perps protocol, such as Kwenta.

So what’s next now? First, getting more assets available on Perps V2 is key. A recent proposal to include additional assets for Perps V2 (only ETH-PERP available Right Now) just passed and 22 new PERP markets have juste been released:

Open Interests are currently capped to make sure the product is battle tested before unlimited OI.

But once you have the technology, even if you have the best one, in order to generate volume, you need to attract users, and preferably, outside of Optimism Blockchain. So how do you get this done?

Few solutions are available and discussed at Synthetix level, but also at project level.

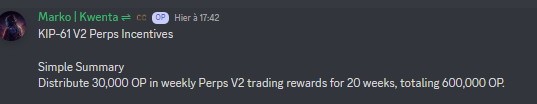

🔥Project grant from Optimism Foundation that grants $OP to project to incentivize users

🔥🔥Trading Competition: Kwenta hosted a trading competition in November 2022 with + 3k $KWENTA (500k$ at today price), but more to come.

🔥🔥🔥Synthetix co-incentives: Synthetix is also discussing to support project growth/launch. A New proposal is under discussion at Synthetix (SIP 2003) to allocate 3,5m $OP to all Perps Protocols built on top of Synthetix!

As a conclusion, FTX and other CEFI collapses are just pushing users, traders, funds, institutions to move to DEFI. DEX/PERP protocols are still the on-going narratives, and now the main goal will be for projects to offer the same seamless User Experience than one can find on Binance, or other CEX. Optimism, thanks to its unicorn Synthetix, is perfectly placed to provide the most efficient back end infrastructure for this. And geeting incentives as listed above will just be the catalyst for this adoption!

The $BTC printed a montlhy candle of +40% in January, and is +60% since previous Bottom from Nov 22. We hope you did take benefit of this new upper trend. But let's try to define if New Money from Institutions, smart money, whales, really came back into the Crypto Market. We are going to analyze different on-chain data which hopefully will lead to a firm conclusion at this question.

Total Value Locked (TVL) Vs Market Cap (MC):

TVL on DeFiLlama sits at 59b$ at 08/Feb, Increasing by +34% since the TVL Bottom Begining of January.

On the other hand, crypto total market cap is just above the 1b$ threshold, so +37% since the pico bottom. As you can see the increase of TVL is most likely linked to the Price Increase of the overall crypto Market, that tells me there had not been any big movement in or out since the start of this move-up.

Stablecoins:

Let’s remind what is the basic flow wheel of money in crypto :

Let’s try to use on-chain data to define what is the current state of Stablecoins in Crypto.

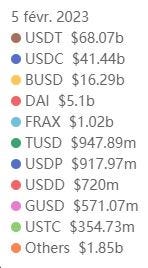

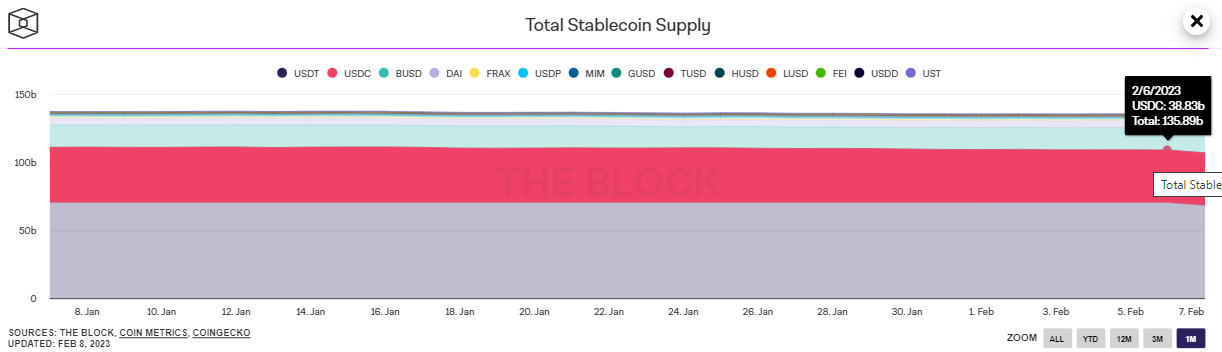

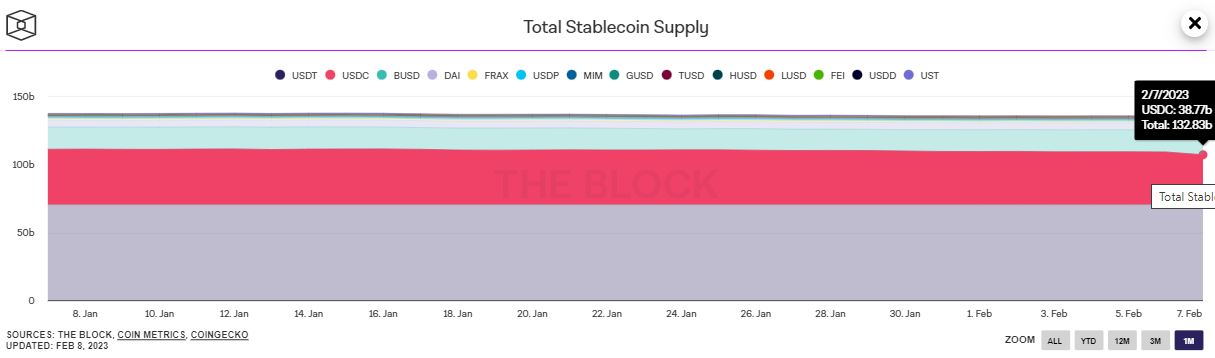

Total stablecoins marketcap is 137.27B according to Defillama.

Centralised Stablecoins USDC, USDT, and BUSD, are use for massive inflow/outflow of cash from smart money, and represent 91% of the Total Stablecoins Market Cap

After the massive expansion of all the crypto market last two years especially for Defi, NFT and MEME seasons, the incredible crash of Luna and FTX, and the actual instability of the macro economy, the Total Stablecoins Market Cap decreased since June 2022, indicating that stables were removed from the Crypto Market.

Now according to @TheBlock, you can see an amazing decreased of 3 billions (3%) in the Stablecoin supply in only 3 days this month. Again for us, that means a removal of stables from the market.

Inflow centralized exchanges:

Despite us being DEFI Maxi, Centralized Exchanges are still the places where volume/capital is the largest. Let’s have a look at Stables inflow/outflow from CEXes, provided thankfully by Defillama…Again!!

There were 2,6 billions dollars inflow last month on the major cex Binance, it’s about 4% of their total assets. This can be considered as a Proof that Smart Money came back into Crypto.

In terms of chains, L222 season, lead by with Arbitrum and Optimism, continues swallowing TVL from other chains with the 2 quoted chains in the Top 10 of chains in TVL.

Do the institutions long $BTC ?

Grayscale Bitcoin Trust (BTC) was made for an institution’s easy entry of the volatility of “asset risk”, GBTC stock quotes at a discount price of 50% than bitcoin (orange line), so smart money doesn't seem interesting for long stock bitcoin. And i remind you as well that the not ended story between Genesis, DCG & Grayscale:

In conclusion, we can see that Stablecoin is on a steady state whil Overall Market is getting on an upper trend, that means for us that no new money is entering the crypto market. If these smart guys/institutions didn’t decide yet to switch to risk-on Mode to invest in Crypto, then we better consider this in our Risk Management of our Portfolio.

But as every degen crypto guy, we know FED and Centralbank printed massively USD and EUR without collateral during the covid, and for sure the value of fiat money is decreasing.

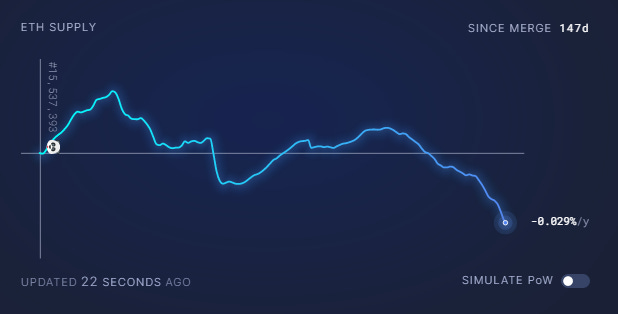

EIP 1559, The merge, POS on Ethereum resulted in getting $ETH deflationary. When we are not yet in the next Bull Run cycle.

And what happens when an asset faces high demand but availability is limited?

MACRO-ANALYSIS: Only-Up?

Follow the trend

In the previous two newsletters, we highlighted the importance of monitoring the DXY index as it has an inverse correlation with Bitcoin, which serves as a reference for the health of the crypto market.

We explained that a daily divergence was underway in the DXY, but this divergence has evolved from strong to weak.

And look at the evolution of the DXY on a daily basis:

The strong daily divergence (in green) is ongoing and calls for a DXY rebound towards North. Is that so simple? Maybe not.

We also now have a hidden bearish divergence (in red). The index made a lower high compared to the previous high but is now making a higher high on the RSI indicator.

A hidden divergence is a sign of continuation and I believe a new low is possible for the DXY, leaving room for cryptocurrencies to rise. The index would then follow the green arrow, meaning that crypto could see an higher high.

What must be done?

-Swing traders: The risk-reward ratio is no longer good for entering into large positions for many altcoins. However, some coins are just leaving their consolidation and can be played. The DXY index must be monitored daily to avoid risk.

-Investors: Same as the last newsletter. Either wait for red candles or continue the DCA strategy.

Portfolio Diversification:

In an unstable international economic context, the creation of the BRICS, inflation, recession, etc… It seems important to talk about gold. In fact, gold has played several crucial roles throughout history. Why would it be good to have in a portfolio?

Only few assets have proven to be safe during former recession & inflation periods are gold and other commodities. And we know that physical gold demand is very strong these days. Central banks are increasingly storing more physical gold (Real proof of reserve). Russia has reinstated the gold standard. Some countries (BRICS) are coming together to create a currency backed by gold and counter the petrodollar.

For all these reasons, we invite our readers to follow the gold and silver prices, and why not expand their portfolio outside of cryptocurrencies? The interest of following the gold price is that there is a correlation between gold and bitcoin. Below is a graph of BITCOIN together with the GOLD price in orange:

In the past, Bitcoin's upward movements have been preceded by an upward movement in gold that preceded it by several months. This time, the situation seems to be repeating itself and this is an additional indicator to observe.

Currently, the gold price is still bullish in the medium and long term:

In the short term, the price is consolidating in a range at the level of the ATH from the previous bull market in 2011. Volatility can be expected on this asset. Could there be a correction in the middle of the range before a break to the upside?

In the mid term, we are in a consolidation phase, which is probably a distribution zone before new highs. We consider this range as a continuation pattern.

In the long term, we are still in a bull market, initiated in 2000. Since then the value of gold has multiplied by 7. A break to the upside from this consolidation in the range will be a strong buy signal for retailers, but also for institutions.

Finally, if you want an exposure to Gold ($XAU) or Silver ($XAG), you will be able to do this by trading on Perps protocol built on top of Synthetix (refer to my section above).

INTERACTIVE COMMUNITY SECTION: FARMING STRATEGY

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

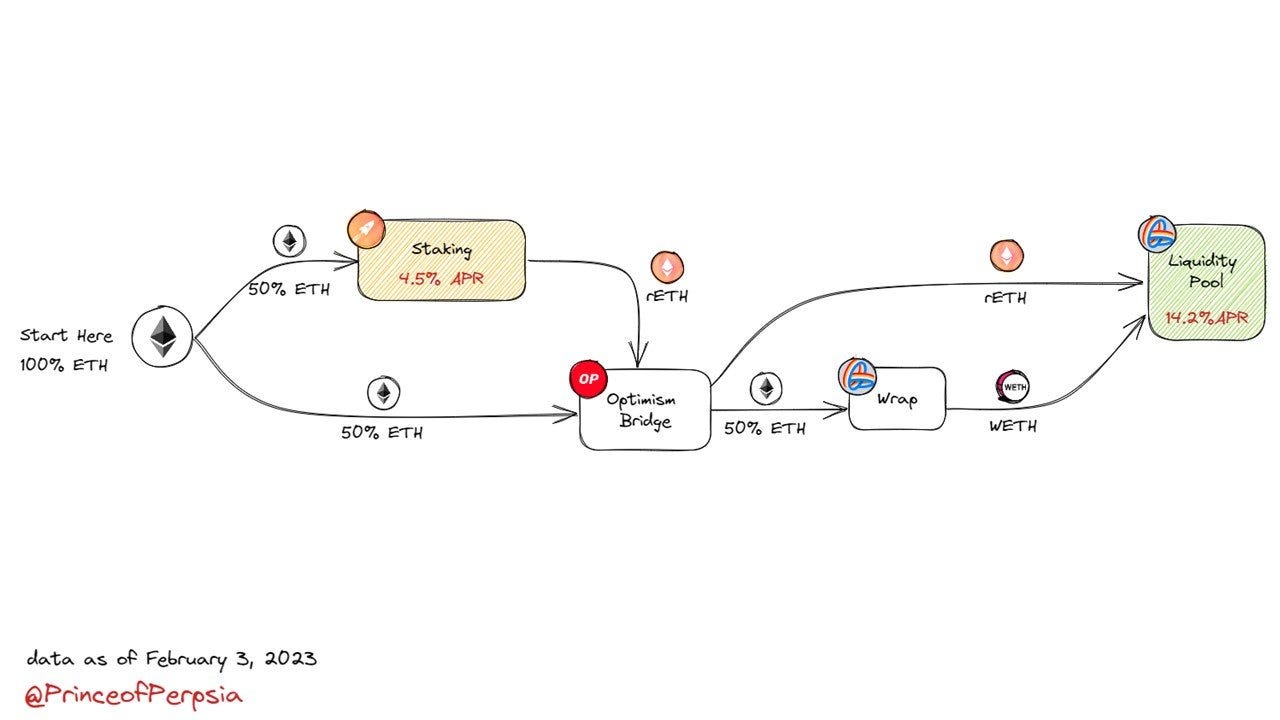

LIQUID STAKING - STAKE & FARM: courtesy of @PrinceofPerpsia:

A moderately complex and involves low liquidity on ETH L2. The process includes staking 50% of ETH on @Rocket_Pool (4.5% APR). Then, bridge ETH and rETH to the Optimism, and provide liquidity in the rETH-WETH pool on @VelodromeFi , which offered 14.2% APR.

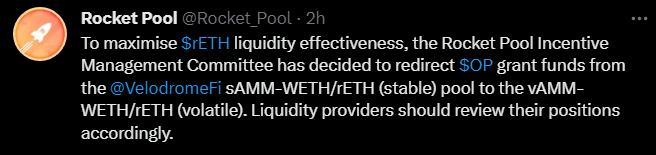

And by the way, make sure you deposit in the vAMM pool as Rocket Pool is moving his Incentives to the volatile pool.

If you want to have a read to the really good thread made by him:

PODCAST:

Subli <> ByteMasons

ALLUO <> Subli

ALLUO invited me to discuss the battle between Arbitrum, Optimism & Polygon. If you wish to read the summary of this live:

And if you wish to listen to the live:

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Discord: https://discord-gateway.optimism.io/

Discord Handle: Subli#0257

Subli-Defi Social accounts:

Twitter: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi