The 🔴Optimistic Newsletter #4

The unique DEFI Newsletter on Optimism blockchain written by Defi Users for Defi Users

First of all, i’d like to express my thanks to you, for your comments, support, likes on this 🔴Optimistic Journey. Big 👏 to my 4 teammates as all this work could not have seen the light without them.

And finally, welcome to the 254 new subscribers to this newsletter.

On this release, we are going to cover the following topics

1. Governance/Tech updates: $OP tokenomics analysis

Tokenomics provides information with regards to token emission and underlying value. I received tons of questions recently about this. Hope you’ll find some answers here.

2. Project Update: Velodrome Finance V2

Velodrome Forks season just started on every chains with around 15 forks launched so far. To keep its edge as being the Number 1, Velodrome Finance revealed in December ‘22 & January ‘23 its new roadmap for 2023 integrating Velodrome V2, Velodrome Relay & Velo Fed. You don’t want miss it.

3. On-chain analysis: Airdrop #1 & #2

You may have been disappointed with Airdrop #2. But remember, announced/farmed airdrops are not the best ones. Sespite Aidrop #2 was only 0.27% of the token Supply, what could you have done differently to earn 10k $OP?

4. Macro-Analysis: BTC / SP500 / DXY

Here is our bi-weekly Crypto macro-update where our traders are bringing you a new indicator related to SP500.

5. Interactive Community Section: Farming Tips

How to look for the best farms in terms of Yield accross all DEFI protocols on Optimism? The Llamas🦙have you covered.

6. Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live Show:

Alchemix & Yearn Finance

Velodrome Finance & Liquity

Podcast available at the end of the newsletter.

Have a good read!

Subscribe to The 🔴Optimistic Newsletter to receive the latest updates about DEFI on The Optimism Blockchain

GOVERNANCE / TECH UPDATES:

GOVERNANCE TIMELINE

All right, i’ve heard so many things about Optimism, and most critics are currently towards the $ OP token itself that is being given by the Optimism Foundation for Dump => Meaning, there is no intrinsic value of this token.

After several months in Optimsim, and following the governance, i will bring you some insights that will give you another opinion. These insights are based on facts and also my own takes. So take them as it is, and make your own opinion out of it. Let’s stop wasting time! Buddy check…Dive!!

1. Token Supply

Max supply: 4,294 millions tokens to be distributed over 4 years

Circulating supply (@ March 2023): 300 millions tokens (7%) here is the breakdown:

Airdrop#1: 214M allocated (161M claimed, 53M unclaimed)

Airdrop#2: 11m

Ecosystem: around 65M

RetroPGF: 10M in March on retroPGF#2

2. Token Distribution

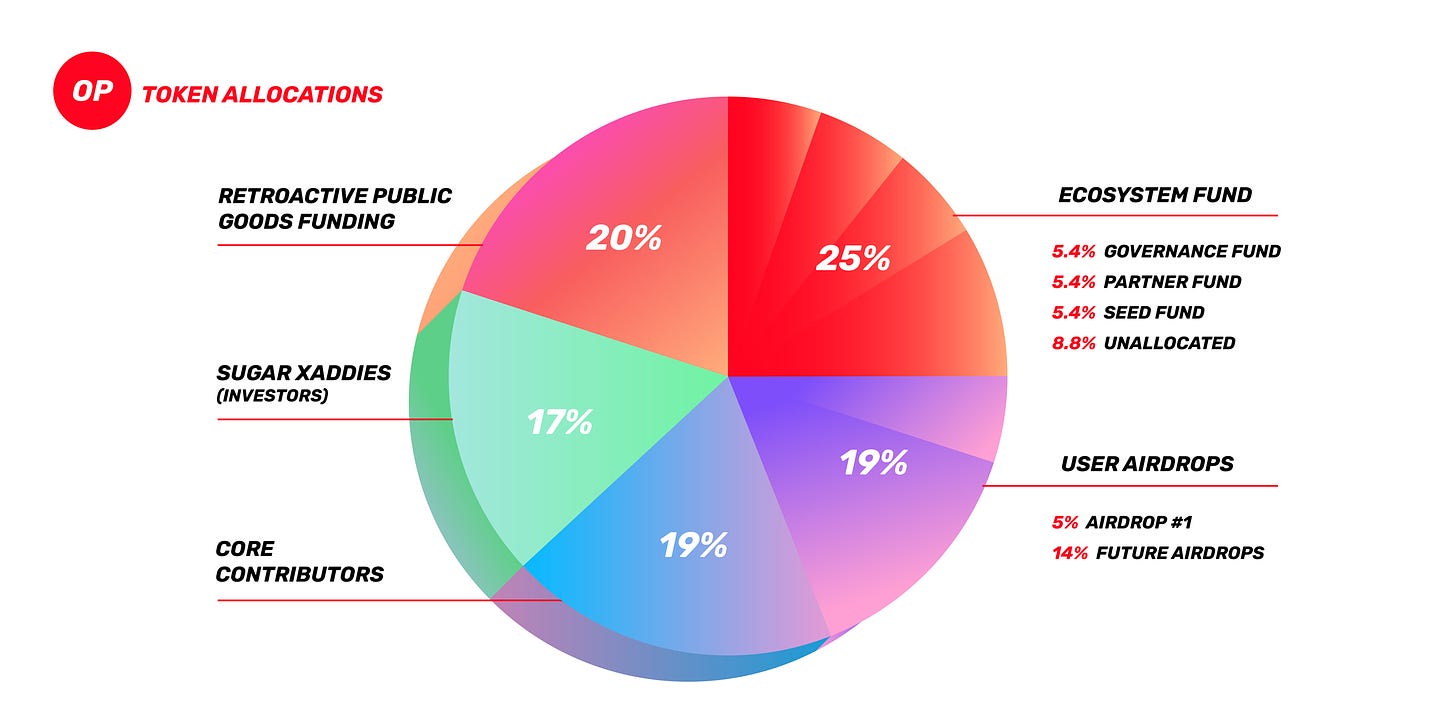

You probably all have seen this pie chart, but let’s refresh it for those who don”t remember it:

As you can see, 19% of the total supply is allocated to Users Airdrop. Airdrop 1 + 2 just represents 5,2%, meaning 13,8% remain to be airdropped. With regards to the 2 airdrops, please check the On-Chain analysis section for more details on what were the main criteria of eligibility.

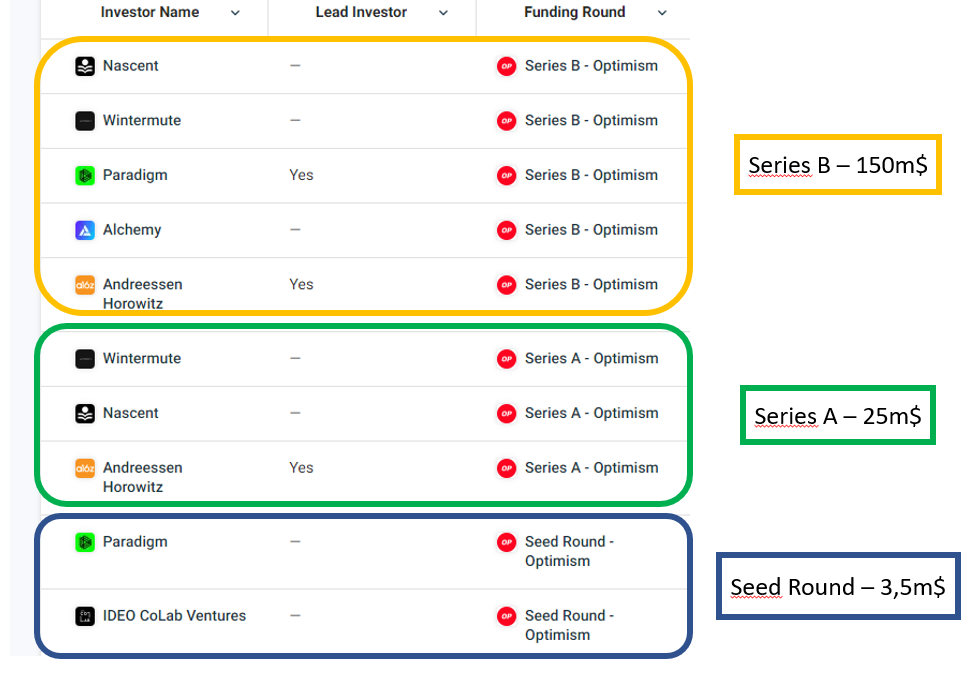

3. Funding Rounds

Who are the Investors aka Sugar xaddies?

4. Emission Schedule

You probably have also seen the below token emission schedule taken from the official documentation, and where Token Unlock is pointing a circulating supply greater than 1 billion tokens, which is, as seen previsouly, incorrect. The team admitted that the information was not taken from on-chain data, but only from the documentation.

However, it is interesting to mention that in June a big unlock will occur for Core Contributors & Investors:

A quarter will be unlocked in June, and then 1/48 each month. So Unlock in June will look like this:

Core contributors (204M)

Sugar xaddies (182M)

Which will represent 1,3x the circulating supply.

Finally, interesting to say, that in Year 1, 30% of the initial token supply will be made available to the Foundation for distribution. After the first year, token holders will vote to determine the Foundation’s annual OP distribution budget. The Foundation expects to seek the following annual allocations:

Year 2: 15% of the initial token supply

Year 3: 10% of the initial token supply

Year 4: 4% of the initial token supply

That’s a hell of a governance rights, no?

5. Token Value

If you are familiar with Defi, then i’m pretty sure you’re very bullish on veTOKEN model, and on system that drives project emission such as $CRV, $VELO, etc… Of course, in this system you get also a share of protocol revenues as well.

Now, what about $ OP token?

As we’ve seen above, $ OP holders drive OP token emission through the different available funding initiatives (1)

And, the more you build on Optimism, the more transactions will occur through the Sequencer, the more revenue the Sequencer will generate, the more OP will be used to retroactively reward the builders, the users. And how do you drive this vote? Through token holders. So I can see this as an indirect revenue sharing model.

6. Conclusion

Optimism is a great DAO experiments and a first of a kind for chain token emission. If you question yourself about the high emission, first don’t look only at the original emission schedule chart which is now outdated. All informations are available publicly so you can make your own opinion out of it. Of course, personally, i’ll be very focused on the June unlock for contributors/investors to see what will be the reaction of the market, and for the long run, if the Optimism chain manages to not just become a Layer 2 but succeeds in providing a dedicated framework on which Builders can Build, then this DAO experiment could become a reference to others.

Looking for a synthetic & Global Overview of Defi? Rektdiomedes has you covered with The Daily Degen Newsletter! You’ll be able to find News, events, data & alerts. I recommend you subscribe to it.

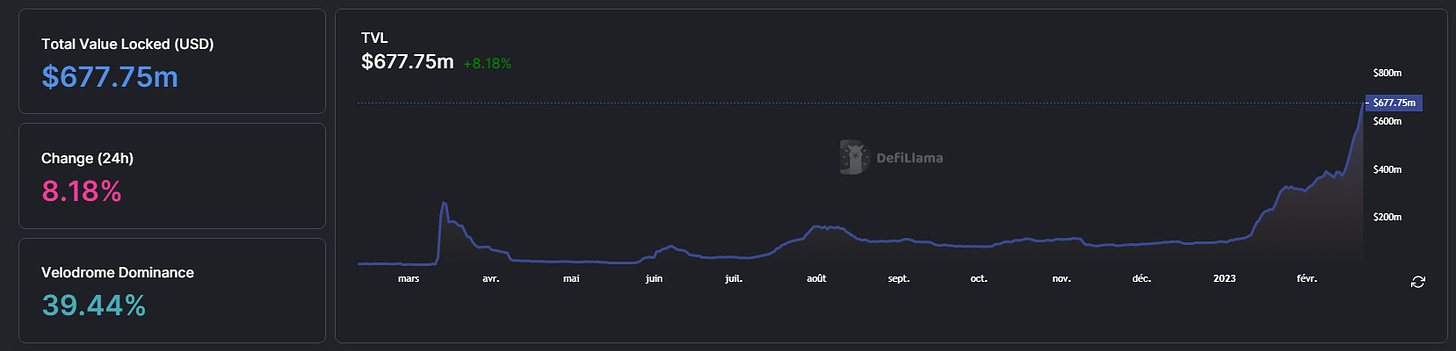

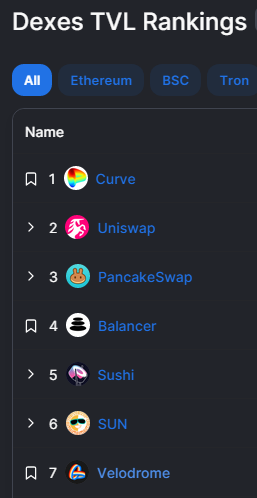

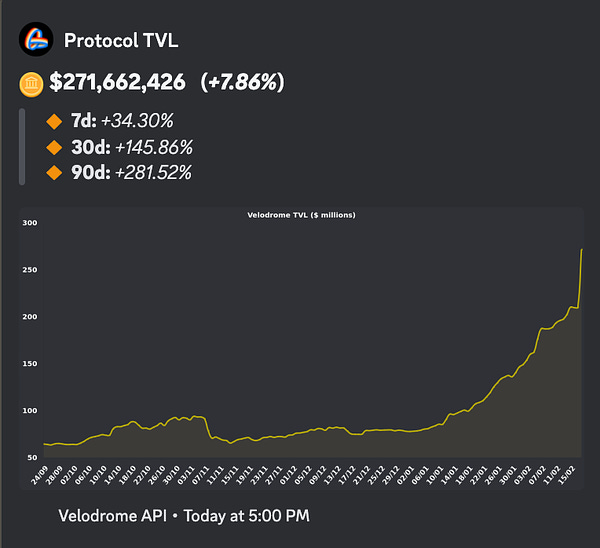

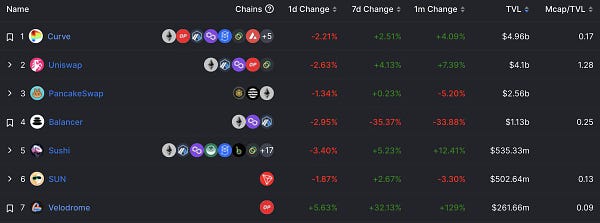

No need anymore to present you Velodrome Finance, which has been in everybody mouth since January after the price of $ VELO did an impressive x10 since the local bottom in January 2023. Some metrics are better than a long story :

Velodrome has set the paths for what i call the Velodrome Fork Season. Defillama calls it Solidly Fork, but as Solidly had a number of flaws that brought the protocol to its own death, the first real successful project built on top the vision of Andre Cronje was Velodrome Finance.

But if you follow me on Twitter, you know what i’m saying: “A company that doesn’t innovate, is a company that will die soon”, and this is even more applicable to the Crypto industry. The team behind Velodrome knows this Slogan, and as such as revealed through Decembre ‘22 & January ‘23 what will be the foundations of VELODROME V2 & some hints about a novelty in DEFI, VELO FED (simply click to access the links to the official release post).

1. Velodrome V2 :

Velodrome V2 has been scheduled in different milestones, and the team revealed in the podcast (see the link at the bottom of the page) audit started beginning of February and we should expect the release in the coming weeks.

The first one is called “Night Ride” UI. Nothing related to the night mode already available on Velodrome V1. This upgrade is focused on the User Experience. If you were a user from the early Velodrome days, then you may have experienced some UX/UI troubles.

The second release will be “Velodrome Relay”, this one bringing complimentary functional features that will lead Velodrome to keep its edge against his competitors.

1.1 Night Ride - List of upgrades:

Complete UI/UX overhaul

Updated light / dark mode support

New dashboard view of all positions

Embedded user education / guidance

Custom swap slippage toggles

Improved, friendlier error messaging

Improved wallet integrations

Reduced errors / issues

veNFT artwork + stats → The last pieces is the most interesting one. As of today, to sell your NFT is a very hard work and result in loosing one voting round. I have made a full tutorial on this for the ones interested:

1.2 Velodrome Relay:

Let me do a paralell with the Curve Ecosystem before going into the details:

Curve Finance: DEX

Convex Finance: Yield Protocol built on top of Curve

Votium: Bribes delagation (someone else is voting for you, and usually optimizes bribes rewards)

Union: Auto-compounder of your bribes into one selection token

Velodrome Relay will natively integrate the 4 components:

Delegate your veNFT voting power to Relay

Relay optimizes voting for maximal rewards

Relay auto-claims bribes, fees, rebases

Relay compounds rewards into single asset ($VELO, $ETH, Stable, $veVELO)

But do you think that’s all? It’s like riding the Alps, you don’t know you’re at the tip until you see the other side of the moutain!

1.3 New Features

Custom pair support (for UniV3 + Curve-style pair implementations) → This will be the foundations to take the best feature of UniV3, concentrated liquidity, to Velodrome.

Named pair support (e.g., Balancer-style pairs) → New Optimism Tri-Crypto coming!

Votium-style voting upgrades

Gasless transactions / meta transactions support

LP delegation / voting support for tokens such as OP → Wonder how to be eligible for Airdrop #3 while earning passive yield on your $OP? Stake OP/USDC LP token on Velodrome and delegate your voting power.

veNFTs tradable even while staked / voting → Don’t loose one bribe round!

veNFT splitting → Good for whales!

Native zapping support → If you know how Beefy Finance is easy to use thanks to this feature, then you’ll love it. Deposit/Withdraw $USDC in/from the pool OP/VELO, Velodrome will take care of all the steps on your behalf

Improved contract APIs

1.4 Timeline

All these 3 upgrades will be released starting straight after the audit conclusion and potential code improvements, starting in March and will continue over Q2 2023.

2. VELO FED

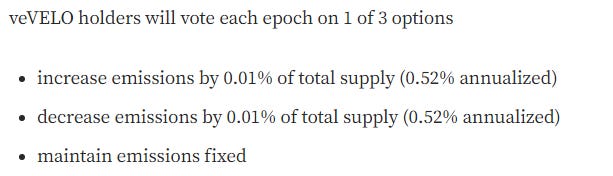

Not trying here to compare with the members of the Federal Open Market Committee (FOMC) have been discussing new strategies for conducting monetary policy, but the Velodrome Team presented in January 2023: VELO FED. A new economic model, lead by governance, to set up the long-term vision of the protocol when $VELO will reach its tail emission (i.e. when $VELO emission will come to an end).

The idea behing VELO FED is that it will replace the existing tail-emissions and allow veVELO holders to set the VELO emission rate within a key set of parameters.

In the podcast with Velodrome & Liquity, a question was raised being: If i’m a protocol i will certainly increase the emission value in order to generate more rewards on my farmed Protocol Owned Liquidity (or POL).

Alex, co-founder of Velodrome, replied to this saying that it will be in the interest of everybody (protocols, whales, project team) to set-up the right emission parameters so that $VELO emissions & $VELO price can be both sustainable.

There is not point of having low emission with a very high price

There is no point of having high emission with a very low price

The best deal is in the middle

I brought the idea during this live that a Velodrome committee could be set-up, formally or not, to align the interests of all stakeholders.

3. Conclusion - The Recipe:

1- Take the best version of Solidly vision DEX: Velodrome

2- Take the best features of the 3 major Dexes: Curve / Uniswap / Balancer

3- Connect the incredible Biz Dev team with protocols / blockchain Team

4- Don’t forget to add Big Brains team members & leaders who have been in the space since Years

5- Mix this all together & let it cooked for couple of months/years

This should give you the taste of what could be the Top 1 Dex in the future.

1. The Optimism Collective Airdrop 1#

The Optimism Foundation plans to distribute a portion of the OP token allocation, amounting to 19%, to members of both the Optimism and Ethereum communities. This distribution will take place in multiple waves.

Optimism's first airdrop allocated 5% of token supply to deserving users. Recipients were chosen based on their positive-sum behavior, community contributions, and exclusion from the Ethereum network. The foundation rewarded over 250,000 addresses to build a supportive community and promote equitable blockchain access.

1.1 Tokens allocations / Eligible users

On June 1st 2022, with over 200 millions tokens allocated for this airdrop, users received a min allocation of 555.92 tokens up to a max of 27,532.98 tokens per address based on six different categories of participation and overlap bonuses awarded. At that time the OP token was worth on the average 1$.

Optimism Users: Early adopters and newer users, but narrows down to a group that has used Optimism multiple times.

92,157 addresses were eligible to receive 776.86 OP tokens per address.

Repeat Optimism Users: Most active Optimism users, who repeatedly come back to use applications in the Optimism ecosystem.

19,174 addresses were eligible to receive 1,692.49 OP tokens per address, in addition to the 776.86 OP tokens already received in the Optimism Users category.

DAO Voters: Addresses who match this criterion have actively chosen to actively contribute by participating in governance.

84,015 addresses were eligible to receive 271.83 OP tokens per address.

Multisig Signers: Multi-sig signers are entrusted with larger pools of capital or control over key protocol functions. They are often the present (and future) DAO leaders and builders.

19,542 addresses were eligible to receive 1,190.26 OP tokens per address.

Gitcoin Donors (on L1): Gitcoin donors have chosen to behave in positive-sum ways by funding public goods. These addresses may also align with Optimism’s goal to build sustainable funding sources for public goods through retroactive funding.

23,925 addresses were eligible to receive 555.92 OP tokens per address.

Users Priced Out of Ethereum: Rewarding curiosity and exploration of active users of dapps on Ethereum.

74,272 addresses were eligible to receive 409.42 OP tokens per address.

Finally, the "Overlap Bonus" is an extra reward given to early Optimism users who also match multiple Ethereum criteria. The criteria for this group are that the address matches an "Optimism Early Adopter" criterion and matches at least 4 criteria sets in total (including Optimism criteria). The overlap bonus increases as more criteria are matched.

1.2 Bonus

4 Categories and OP user : 2,707 addresses were eligible to receive 4,180.54 tokens per address.

5 Categories and OP user : 627 addresses were eligible to receive 13,330.16 tokens per address.

6 Categories and OP user : 45 addresses were eligible to receive 27,534.98 tokens per address.

1.3 $OP claimed & delegated to vote

For this first airdrop, only 162,033,665 millions $OP tokens (75.45%) were claimed out of which approx 22millions $OP tokens (24,55%) were delegated to vote. And you know what is funny? Those who didn’t dump their token and delegated them have been eligible for airdrop 2.

Still crazy to see that 50m+ OP tokens are still not claimed, especially with this price increase!! But coming back on the above dashboard, why is it relevant to talk to you about this today? Follow us on the Airdrop 2, all will become clearer.

2. The Optimism Collective Airdrop 2#

Optimism has achieved significant growth since its first Airdrop, with over 1.5 million addresses sending 64 million transactions and spending almost $15 million in fees. 293k addresses delegated their voting power to the governance system, demonstrating a commitment to the network's success.

Airdrop #2 was released on Feb-9. As you can see on the chart above, the day before only 22millions of $OP tokens were delegated, and following the eligibility criteria of the 2nd airdrop, this has surged up to 39m tokens (+77%) => I guess it’s a massive WIN for the foundation team.

2.1 Incentivizing Positive Behavior

Optimism Airdrop #2 rewarded 307,965 unique addresses with 11,742,277.10 OP tokens, users received a min allocation of 2.35 OP tokens up to a max of 10,462 OP tokens per address based on two eligibility criterias of participation and four bonus attributes. The community's ongoing support and engagement has been essential to building a strong and sustainable ecosystem.

Before we move on, it’s important that it’s difficult to reward human behavior in favor of the growth of the Optimism ecosyste. Some many people farmed this airdrop by completing the quest, me the first. Arkham did a great thread about this, i encourage you to give it a read:

2.2 Tokens allocations / Eligible users

Governance Delegation Reward : to qualify for this reward, users must have delegated at least 2,000 OP for a minimum of two days. The reward is calculated based on the cumulative amount of OP delegated per day, with a maximum of 5,000 OP per address.

The total number of qualifying addresses for this reward is 57,204.

Gas Usage Reward : to qualify for this reward, users must have spent more than the average cost of one L1 transaction on Ethereum, which was measured during the period between the first airdrop snapshot and the second airdrop snapshot.

The reward is 80% of the gas fees rebated in OP, up to a maximum of $500 of gas fees rebated per address. The total number of qualifying addresses for this reward is 280,057.

2.3 Bonuses

Optimism has introduced new attributes that offer bonuses to community members who meet certain criteria based on governance delegation, total OP delegated, active app transactions, and gas fees spent on Optimism. These bonuses aim to encourage community members to stay active on the network and participate in governance, ultimately strengthening and growing the ecosystem.

The four attributes have different bonus levels ranging from 5% to 100%, and there are over 300,000 qualifying addresses. For instance, an address must have had an active delegation of at least 20 OP to qualify for the governance attribute, while the usage attribute requires making app transactions on Optimism or spending at least $20 on gas fees.

⚠⚠The airdrop is distributed directly to eligible wallets. Do not trust any website or twitter account pretending to help you claim your tokens.⚠⚠

If you have been eligible, the tokens were sent directly to your address on 9/02/20233.

3. Conclusion / Airdrop 3

Optimism has successfully completed its first two airdrops, with over 225 million OP tokens distributed to adding value users. The remaining 13.73% of the token allocation, equivalent to 590 million OP tokens, will be distributed in future airdrops.

Some activities that might be criteria for future airdrops for:

Users must actively use the Optimism ecosystem

Vote or delegate in the DAO

Prepare for Optimism NFT’s

Optimism Quests #1, round #2?

Over 450,000 users have completed the famous 18 quests, while some believe that completing these quests will make them eligible for airdrop 3, no official announcement has been made yet.

However, if the previous airdrop criteria are anything to go by, users should expect the unexpected and think out of the box to become eligible.

Starting on 24-Feb, Angle Protocol is going to allocate its 250k $ OP grant to incentivize the following pools:

agEUR - USDC (0.05%) on Uniswap V3 directly through Merkl

agEUR - MAI on Velodrome, through bribes

agEUR - OP on Velodrome, through bribes

MACRO-ANALYSIS: BTC / SP500 / DXY

1. DXY

Let's continue our market analysis by looking at the situation on the DXY: hesitating in a downtrend channel while diverging during our last analysis, it has now broken out of this channel to the upside and is currently consolidating there with a hidden bearish divergence.

We often told that BTC is inversely correlated to DXY. This statement has a high probability to be true but remember the market doesn’t follow our analysis, support/resistance and do whatever it wants. Trading and anticipating the market has always been a question of probability and in that case $BTC moving in the same upper trend than $DXY had actually a lower chance to occur.

We would like to introduce a new indicator called the correlation coefficient, allows us to analyze this situation. It is used in statistics to measure the correlation between two sets of data. A correlation coefficient close to 1 indicates a total correlation. Conversely, a coefficient close to -1 indicates an inverse correlation.

On the chart above, we can clearly see that before 2018 no real correlation could be observed between DXY & BTC. While after 2018, the Correlation coefficient is much more negative than positive, meaning the DXY is more often inversely correlated to BTC.

We keep thinking that for long term price action, DXY and BTC will keep being inversely correlated, and that the frequency to have DXY and BTC going towards the same direction will reduce overtime.

Our analysis will keep running on the highest probability case, but we are also prepared to be surprised, as you should be.

2. SP500

What impact on traditional markets?

To have some food for thought, it is relevant to refer to the SP500 (SPY) which is the index representing the 500 largest companies listed in the US. SP500 has often followed the same trend as Bitcoin.

The SP500, which has been in a downtrend for over a year, recently broke out its trend and seems to be correcting above, increasing the chances of a continuation of the bullish rebound in the short term the breakout. However, we are approaching an important zone that has served as support and resistance in the past (red horizontal line): at its contact, the SP500 could be rejected.

So, is it a good time to buy or sell Assets (Stocks or Crypto)?

A derivative index of the SP500 allows us to examine opportunities to buy or sell on the stock market via the S5TH ticker. S5TH represents the percentage of stocks in the SP500 that are above their 200-day moving average. We can easily identify zones in which historically the market has turned around, which is important information to take into account in investment decisions on risky assets: it allows us to know if we are in an opportune moment to take long or short positions and make investment decisions or, conversely, take profits.

The best opportunities for taking profits or opening short positions on the SP500 occur when the stocks that are above their 200-day moving average are above 78% for this index. The best investment and long position opening opportunities occur when the stocks above their 200-day moving average are below 23%.

Currently, about 70% of SP500 stocks are above their 200-day moving average, which means that this is not a buying opportunity zone and caution should be exercised as we are approaching a historical market reversal zone.

By comparing SP500 (in green) to S5TH (in white), we can see that the S5TH's low points are good buying opportunities for the SP500. Taking profits is a little less relevant because there may be a time lag after the signal.

3. BTC

So what about Bitcoin?

Since our last analysis, Bitcoin broke the top of 25.200$, achieving a new higher high in 8 months. Through this movement, BTC indicates that the downtrend may have come to an end and the likelihood of a continued bullish movement over the next few months is increasing.

Conclusion: What should we do?

Firstly, we’ve seen the DXY is moving in the same direction than BTC but, as stated, a similar correlation will end at one point. But who knows which one will diverge?

Secondly, we’ve seen that the SP500 is getting close to overbought zone, and risk reward for traders is much lower than few weeks ago.

4. Conclusion

As a conclusion to the above, this what we will do (Non Financial Advice of course):

Trading: We won’t be too greedy, won’t over trade and start taking a bit of profits on our positions. We will play AltCoins till the time music does not stop. But, we are also prepared for a reverse price action, by setting up stop loss.

Investing: We continue DCA-in, but we keep some stables in our portfolio to be prepared for a potential reverse price action aka “Buying the Dips”.

INTERACTIVE COMMUNITY SECTION: FARMING TIPS

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

How to find the best yield opportunity accross multiple protocols on Optimism? Use Defillama website to sort the type of farms you are looking for:

And awesome feature, you have the past APY (we know APY’s are highly volatile), and even an outlook from the Llamas:

PODCAST:

Alchemix + Yearn Finance

Velodrome + Liquity

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Discord:

https://discord-gateway.optimism.io/

Discord Handle: Subli#0257

Subli-Defi Social accounts:

Twitter: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi