The 🔴🔵Optimistic Newsletter #5

The unique DEFI Newsletter on OP Superchain written by Defi Users for Defi Users

First of all, i’d like to express my thanks to you, for your comments, support, likes on this 🔴🔵Optimistic Journey. Big 👏 to my 4 teammates as all this work could not have seen the light without them.

And finally, welcome to the 740 new subscribers to this newsletter.

Thanks to volunteers, this news letter is now available in different languages. Please click your flag to be directed to your native language (link will be updated in the coming days if not available at the time of this release). Overtime, translations will be available at the time of release.

Chinese - French - Japanese - Korean - Filipino - Persian - Russian - Thai - Turkish - Vietnamese

Before you go over the agenda of this newsletter, i’d like to share the results of the poll to explain you why you saw this blue pill appeared on the newsletter title. YES, i’ll be covering the Superchain made up by, as of today, Base & Optimism. Enjoy the reading!

On this release, we are going to cover the following topics

1. Tech updates: OP Superchain with 🔵BASE

COINBASE just announced the launch on a new Layer 2 blockchain under the code of BASE, built on the OP Stack. This announcement has a lot of implications for all of us (builders & users). I’ve read hours of contents about this subject and gathered this in a nice article, only for you.

2. Governance updates: $ OP Grant winners for Cycle 10 & List of Active grants

Cycle 10 ended up on March 1st, and the Grant Council voted for the following projects to recieve $OP grants. Let’s break it down and see how we, as users, can benefit from it. And yes, the 🔴🔵Optimistic Series (for which the newsletter is part of) has successfully received a grant 🎉

I will also share an executive summary of the Active & Coming grants.

3. Project Update: Pooltogether

PoolTogether might be the best definition of Decentralized Application targeting mass adoption. Directly accessible through COINBASE wallet, and boosted by OP rewards, let’s dive into the basics of the one & only Decentralized No Loss Prize Savings.

4. Macro-Analysis: BTC / SP500 / DXY

Bi-weekly update on the Crypto Market.

5. Interactive Community Section: Farming Strategy

I had the chance to test a new product from Perp protocol. Deposit ETH or USDC into the Hot Tub vault and earn yield coming from Arbitrage between Dexes on Optimism & Perp Protocol market.

6. Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live Show:

Beethoven_X

Sonne Finance & Angle Protocol

AAVE

Podcast available at the end of the newsletter.

REMINDER: GOVERNANCE TIMELINE

1. TECH UPDATES:

If you were in vacation, or somewhere without connection, you may have missed The NEWS of 2023, Coinbase launching its own L2 chain named BASE, built on the OP Stack, and forming with Optimism what is called the SUPERCHAIN. Let’s dig into all these topics.

🔵BASE

“BASE”, one word only but with a entire meaning that will change How we define blockchains interoperability. I was, since months a cross-chain maxi, looking at all these Layers 2 racing for TVL, while not even competing to 10% of Ethereum TVL, minimum requirement for institutions to put money in without suffering lack of liquidity.

But Vitalik predicted it one year ago “The Future will be *multi-chain*, and not *cross-chain*.

That feeling was also shared by COINBASE:

In particular, we started this process with the thesis that a single L2 would emerge as “dominant” and gradually absorb all activity, creating a near monopoly. With this vision, we were initially coming at the problem as “picking the right one,” where if we picked “wrong,” we risked cutting Coinbase dapps and users off from the majority of activity in the ecosystem. We ended the process with a very different thesis: that there would be many L2s that would have significant activity, serve as “hubs” for different ecosystems, and gradually increase their interoperability until they formed a “mesh” or “superchain” that jointly scaled Ethereum.

So Welcome to 🔵BASE.

BASE is the new layer 2 blockchain incubated by COINBASE, built on what is called the OP STACK, a set of software allowing a fast and easy solution to develop a Layer 2 chain having the same characteristics than Optimism. During the Testnet launch announcment they displayed the Project Partners that are building onto Base, for which you can recognize major project such as Chainlink, Aave, Hop protocol, Balancer, …

BASE will not have its own token, and $ETH will be used to pay Gas Fees.

And currently, BASE & OPTIMISM are now together what is called the SUPERCHAIN.

Finally, if you are interested to join BASE testnet, Layer3 has opened up a quest to min the first^BASE NFT on Ethereum mainnet, bridge & putting your first step on BASE:

https://layer3.xyz/quests/intro-to-base

Tips: If you need Goerli Testnet $ETH, go to this link and sign up on Alchemy to get some $ETH Faucet: https://goerlifaucet.com/

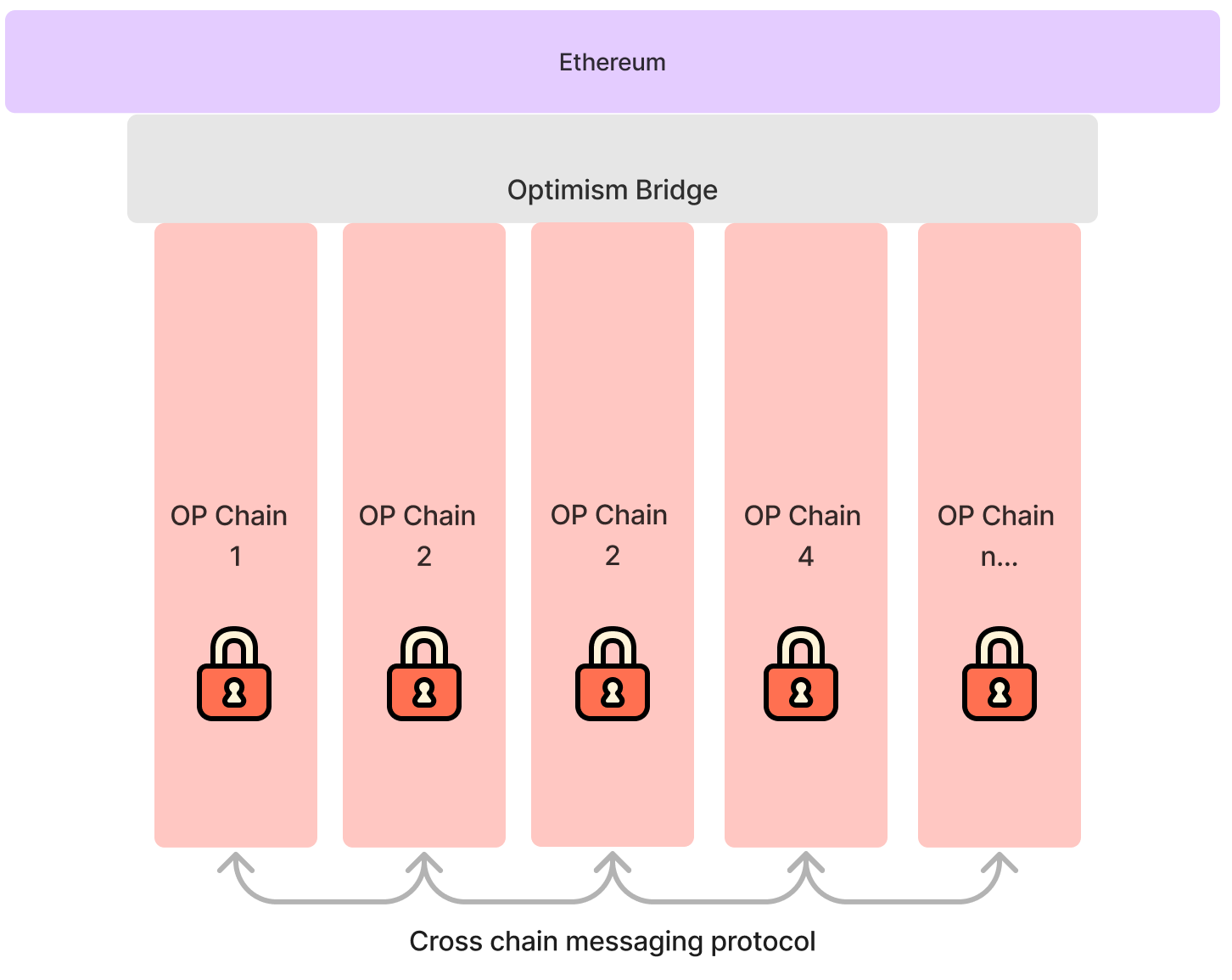

🦸♂️⛓SUPERCHAIN

A Superchain is a network of chains that share bridging, decentralized governance, upgrades, a communication layer and more—all built on the OP Stack. All chains will share the same properties which means that it will ease significantly interoperability accross these chains. If one Decentralized Application is built on Optimism or BASE, it can be deployed in an instant on all chains of the Superchain.

The main objective of this technology is to first address the major problems in Crypto being Scalability & Velocity. Look at what BASE is trying to achieve:

As a user, we will see what is called “Chain Abastraction”, meaning we will be able to use Protocol of chain X while having liquidity on chain Z without us, Defi users, bridging our liquidity from chain X to chain Z.

If it’s not the dream of all of us, it’s definitively mine!

↪OINBASE IMPACT ON THE SUPERCHAIN

I think it can’t be minimized the importance of Coinbase moving to its own chain, and the benefit for the Superchain. Let’s review some metrics about COINBASE.

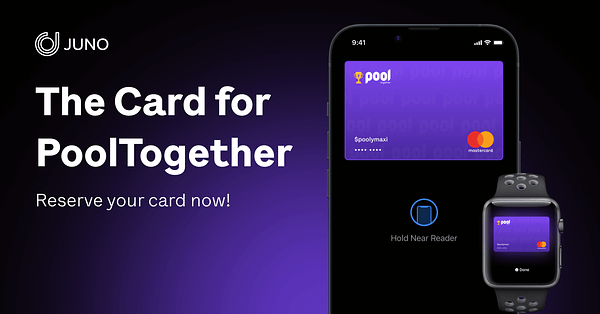

But BASE has set a new objective: 1Billion users!

COINBASE is also joining the OP STACK Team as the 2nd contributor. The first one being the OP Labs himself. Coinbase is providing his technical expertise, his highly skilled devs & managers that will all drive in the same path, towards the development of a Highly scalable, fast, cheap SUPERCHAIN.

🔴OPTIMISM

In the short term we may end up seeing some TVL flow in & out of Optimism chain, going to Base once launched on Mainnet. But, don’t get blind on the short term view, the long term goal is that Base, Optimism and all other chains from the Superchain will start attracting massive amount of users, institutions and large volume of money. So the pie will get bigger, and we will all be able to enjoy this new narrative.

Just listen to this 94sec video:

This news is great for Optimism for two reasons. One because a portion of Base chain revenue will be sent back to the Retroactive Public Goods Fund (RPGF) to support the development of the OP Stack.

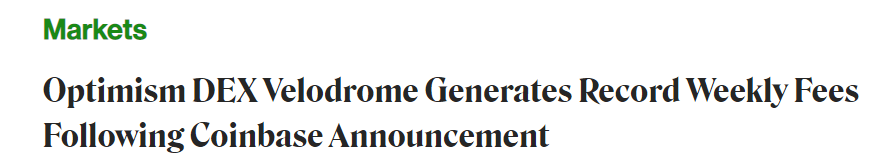

Secondly, you can just check how big was the impact of that news on the Exchange volume: the usage of Optimism during the day of the announcement quoted by Coindesk:

But it will also be a HUGE opportunity for native protocols to be able to get easily deployed on BASE. Just imagine COINBASE converting only 10% of its users to jump on BASE, that will be 11millions users while Optimism sees approx only 50k users per day!

Looking for a synthetic & Global Overview of Defi? Rektdiomedes has you covered with The Daily Degen Newsletter! You’ll be able to find News, events, data & alerts. I recommend you subscribe to it.

2. Governance updates: OP Grant winners

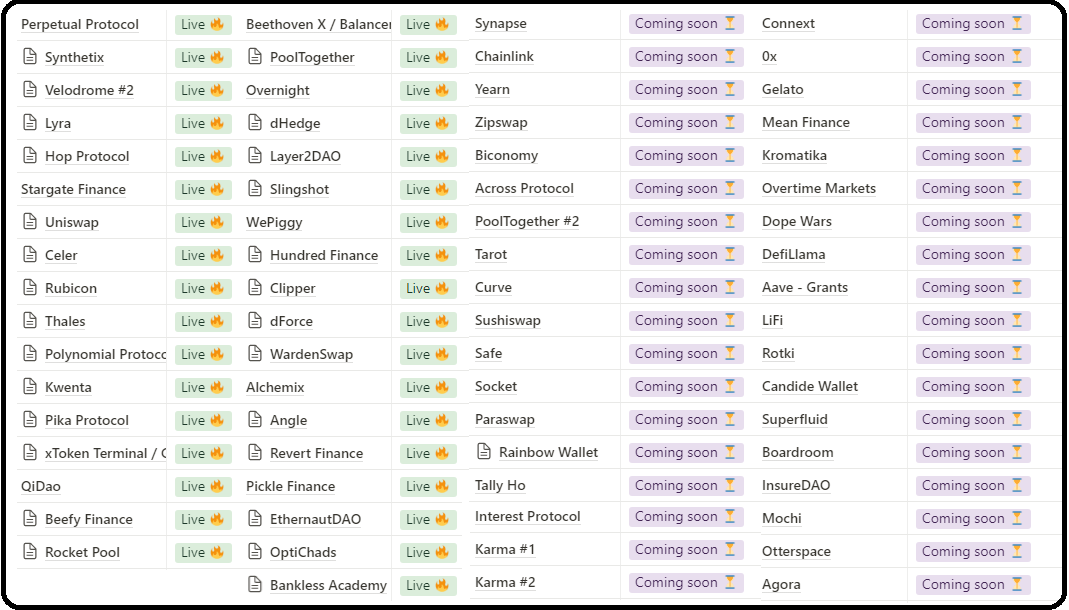

2.1 List Active & Coming Grants :

As a reminder, here are the on-going and future OP incentives per project.

2.2 New active grants:

Angle Protocol & Bankless Academy

Just click on both protocols to access the official project announcement.

2.3 Awarded Projects from Cycle 10:

12 Winners on the Growth Experiment Category totalizing 2m+ of OP tokens to incentivize use of the awarded projects. Let’s see the Winners:

🔥The 🔴🔵Optimistic Series: newsletter, podcast and research database focused on Optimism DeFi content. GRANT : 30k OP

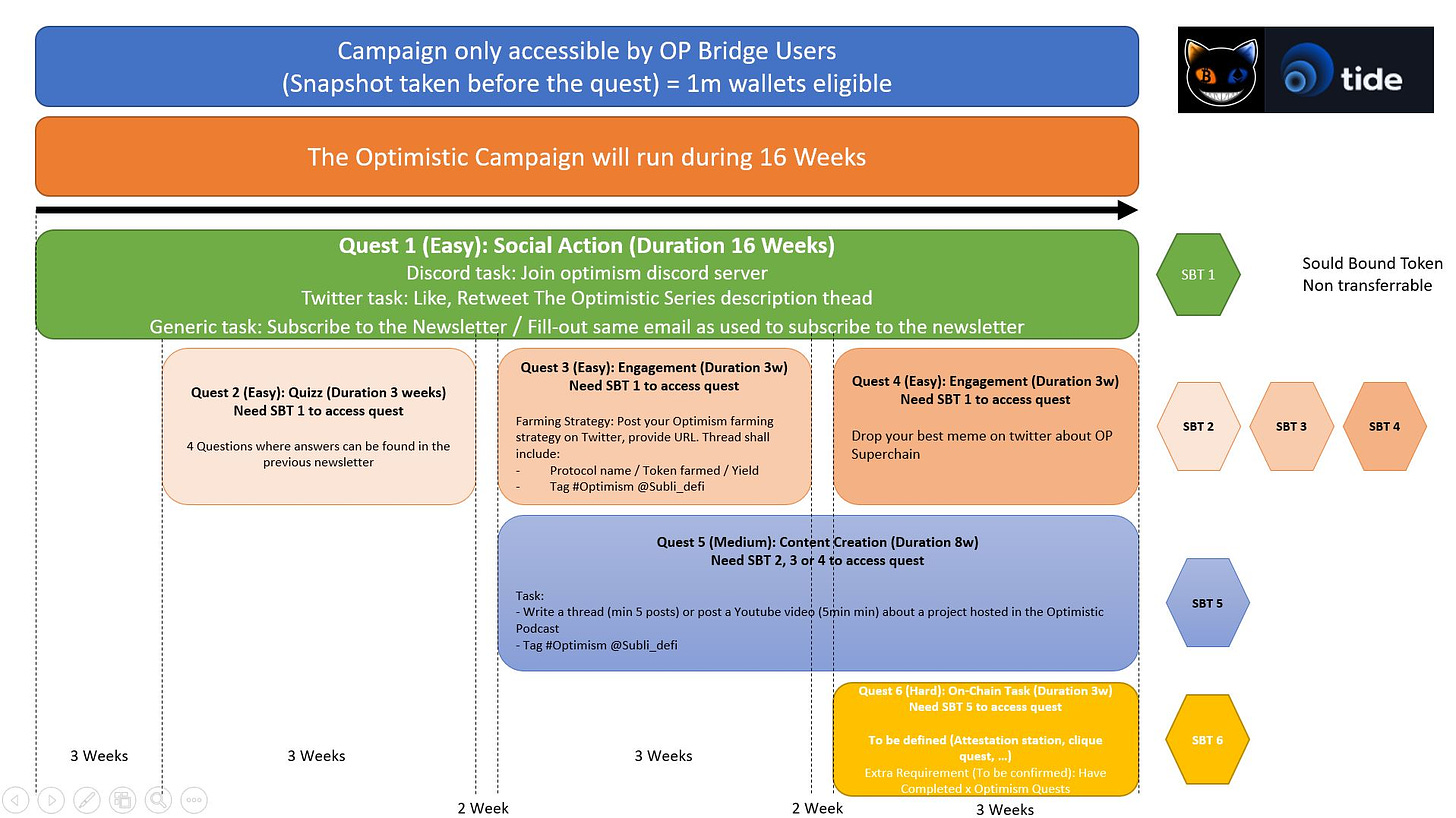

100% will be distributed to Subscribers to this newsletter through a series of quests that will run on Tide Protocol website. Quests will increase in terms of engagement & difficulty levels & questors will be able to claim a Soul Bound NFT (non transferrable) at the end of each quest.

The purpose of this journey is to create & reward engagement about Optimism while making it fun for everyone.

The start of the quests will be announced on Twitter and will last four months.

At the end of the quests journey, OP will be airdropped based on your Earned #NFT.

Finally, the total amount of OP to be distributed is subject to some milestones as described below:

At start: Received grant = 10k OP

Milestone 1: 1,5k Subscribers + consistently released bi-weekly newsletters (dead line 30-July) = +10k OP

Milestone 2: 2k Subscribers + consistently released bi-weekly newsletters (dead line 01-Sept) = +10k OP

I will publish on twitter a full description of how the quests will work in the coming 2 weeks. Be Optimisticly prepared, Think out of the Box, and hope you’ll enjoy it!

Crypto LDFM: educational video series on how Optimism works and the basics of Optimism. GRANT : 10k OP

Kyberswap: Dex aggregator and liquidity platform. GRANT : 250k OP

Mux: DeFi protocol suite that will offer optimized trading cost, deep liquidity, leverage options and diverse market options for traders. GRANT : 250k OP

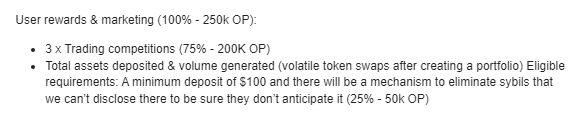

Nested: non-custodial DeFi trading platform that enables users to create NFT representations of their portfolios and earn royalties. GRANT : 250k OP

We have some great news to share! Our @optimismFND grant application has been successful and we have been awarded the full 250K $OP we applied for 🔥 We are feeling very Optimistic right now.

We have some great news to share! Our @optimismFND grant application has been successful and we have been awarded the full 250K $OP we applied for 🔥 We are feeling very Optimistic right now.

100% will be distributed during Trading incentives & volume generated on the platform:

By the way, i’ve made an Index wallet called “Optimism Maxi”, you can copy (Just click on the picture):

OPWeave: blog and podcast focused on the Optimism community. GRANT : 8,633 OP

No distribution to users/listeners, however i strongly recommend to follow them as they already provide an awesome weekly summary of Synthetix Governance, so expect the same quality of work for the Optimism coverage.

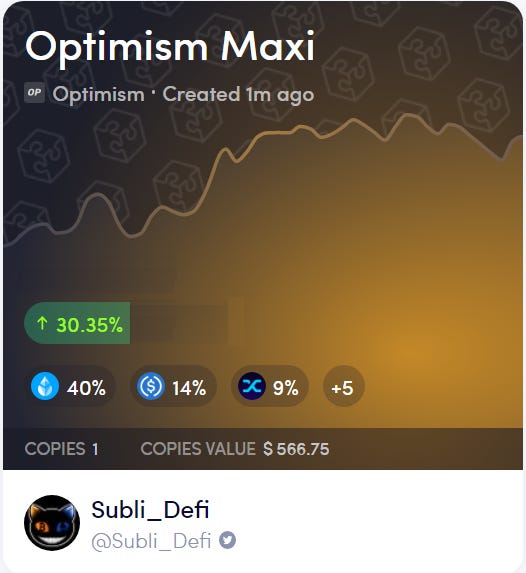

Parcel: marketplace that enables users to buy and sell in-game items including rare collectibles, land, and other NFTs. GRANT : 150k OP

The grant will be distributed twoards trading rewards during specific game NFT collection launched on the platform:

Premia: decentralized options protocol that will provide educational content through Learn to Earn program. GRANT : 235k OP 🔥 Co-Incentivized with 450k PREMIA tokens 🔥

Premia V3 is planned to be released in April 2023. The grant distribution will be:

75,000 Learn to Earn (36%)

160,000 OP Call Liquidity (64%)

Rubicon: order book protocol that implements fully on-chain order books and a matching engine for peer-to-peer trading of ERC-20 tokens. GRANT : 200k OP

Grant will be distributed as follows:

Market Maker Incentives: 70% (140,000 OP) :

Liquidity Pool Incentives: 30% (60,000 OP)

Sonne Finance: an EVM-compatible lending/borrowing protocol that launched on Optimism that Finance provides p2p lending solutions that are fully decentralized, transparent, and non-custodial. GRANT : 250k OP

Thales: protocol that allows for creation and participation in novel on-chain automated parimutuel markets. GRANT : 250k OP

Usage Incentives 100,000 OP - Direct pro rata emissions for Volume Drivers across Thales products on a round based system and targeted campaigns.

Gamified Staking 60,000 OP - Additional Usage-based bonus rewards for Thales stakers that are also actively driving volume across products. Aligning THALES token with the usage of the products creates a positive feedback loop with leveraged effect of adoption.

THALES token on-chain liquidity bootstrap incentives 60,000 OP - Conservative direct emissions as LP rewards for THALEs token liquidity providers until the protocol incrementally builds a strong POL position in the background.

Sub-grants/Builders/Marketing 30,000 OP - Incentivize additional third party builders to consider expanding on top of the Thales protocol

Via Protocol: cross-chain liquidity aggregator that offers a suite of tools, including Router and an SDK. GRANT : 250k OP

Congratulations to all the winners and good luck to everyone to grab those incentives and test these protocols, applications.

Berachain Project, The Honey Jar, has made the news as the most traded NFT collection on Opensea, on Optimism. The project has released its first NFT collection on Ethereum, The Honey Comb. Next generation of Honey Comb will be available on few L2, and ofc on Optimism. Stay tuned!

3. PROJECT UPDATE: POOL TOGETHER

PoolTogether is a Decentralized No-Loss Prize Savings Protocol.

PoolTogether takes that premise and executes it on a massive scale. It might be the best example on How Decentralized Finance applications could attract million of users: Fixed yield, super easy UI/UX, Safe, On-Ramp with 44 different currencies, Mobile APP, partnership with Coinbase. Let's get into it!

3.1 Description

Users deposits capital into Pooltogether which are then farmed into decentralized DEFI protocols such as Compound, Yearn, AAve, and others…interest earned is distributed randomly to depositors using Chainlink “Verifiable Random Function” which is a proven, fair and verifiable random number generator.

With its combination of simplicity and utility, the protocol has become the front door to Decentralized Finance.

3.2 Prizes

The protocol supports small daily prizes, and large infrequent prizes.

The largest prize is $5,000 and is awarded every ~30 days. This prize is the same across all networks (Ethereum, Polygon, Avalanche, and Optimism)

The remaining prizes are optimized for each network based on users specificities:

Ethereum has the largest prize range but lowest chances of winning

Optimism & Avalanche have medium prize range

Polygon has the smallest prize range but more frequent

All networks offer a higher expected return than the yield source!

3.3 How many chances to win?

Pooltogether calculates automatically chances to win when you deposit your funds:

The more you deposit funds, the greater will be your chance to win =>

1 in 14362 to win with 100USDC deposit

1 in 1436 to win with 1000USDC deposit

1 in 143 to win with 10000USDC deposit

1 in 14 to win with 100000USDC deposit

3.4 $OP rewards

Pooltogether received a Partner Fund grant of 450k OP to distribute to users.

In addition, late November, PoolTogether secured another grant of 550k OP, letting the project to ensure an extra OP yield until end of March. So don’t fade it.

3.5 Multi-currency support 💱

Did you know that there are a whopping 180 currencies circulating that are recognized as legal tender? As a globally accessible protocol, PoolTogether’s users are from all around the world. Most of them are non-native to the US dollar. 👀

This is why 44 of these currencies are now featured in the PoolTogether app! You can choose your preferred currency in the settings:

3.6 Protocol Statistics:

Mcap circulating supply at 2.76 millions, TVL 46 millions => TVL/MCAP ratio = 0.06

The ratio Mcap/TVL is one of the lowest you will find on Optimism, which means that either the TVL is low, or the MCAP really overvalued. To our mind, the project succeeded to attract large amount of TVL thanks to the OP Incentives.

87% of the total TVL is on Optimism mainly driven by the OP token boost which ends at the end of March. Most likely, the TVL will be rebalanced after that period.

3.7 Poolygotchi

Poolygotchi (a gamified frontend to achieve savings goals) was recently released on a Pooltogether grant: https://poolygotchi.com

Poolygotchi is a community project that provides a fun, alternative way of interacting with the PoolTogether savings protocol.

When you hatch a poolygotchi, you are making a promise to your new digital pet to meet your savings goal with the PoolTogether protocol. While you are meeting your goal, your poolygotchi will be filled with joy, but if you start falling behind, it will reflect in your poolygotchi's mood!

Hatch a poolygotchi of your own by defining a personal savings goal and making your first deposit onto PoolTogether! Check in on your poolygotchi to check for daily prizes and keep depositing regularly to keep your pooly healthy!

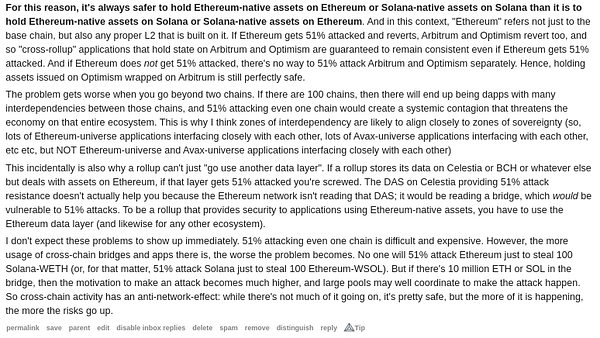

3.8 PoolTogether is BASE(d)

Since September 2022, Pooltogether is accessible to users of Coinbase, through the Coinbase app. Remember our above article about Base & Coinbase, do you see the catalyst?

Pooltogether supports Coinbase pay for fiat onramping.

And finally, PoolTogether has already applied to be part of BASE testnet (The L2 of Coinbase if you didn’t read the 1st article).

What’s Next?

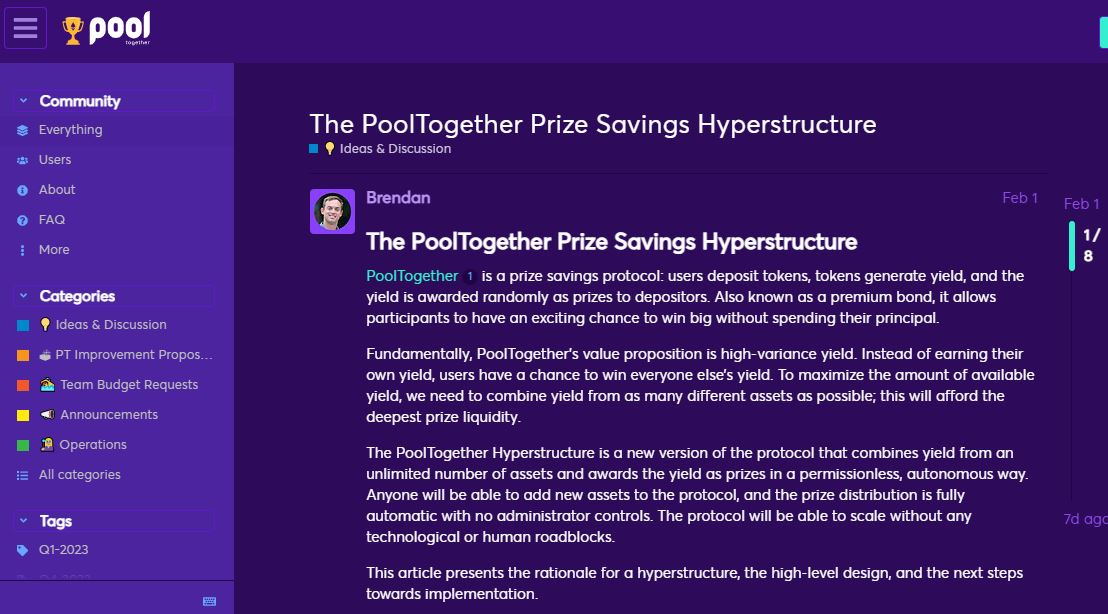

3.9 Hyperstructure

“Crypto protocols that can run for free and forever, without maintenance, interruption or intermediaries.”

https://jacob.energy/hyperstructures.html

Pooltogether is now the one and only Decentralized No-Loss Prize Savings protocol of the crypto ecosystem, and to continue surfing on this pace for success, PoolTogether leaks what will be the next step “Hyperstructure”, their next upgrade which could potentially be out in 3-4 months.

The team describes the future of Pooltogether, as a protocol fully decentralized, permissionless, with a variety of stablecoins ($GHO from AAVE, $LUSD from liquity, and why not $ERN from Byte Masons). It reminds me what project such as AAVE, or Yearn Finance are trying to achieve, meaning being a liquidity hub and letting 3rd party providers to build their own interface on top of Pool Together.

More details about the future of Pooltogether and Hyperstructure:

https://gov.pooltogether.com/t/the-pooltogether-prize-savings-hyperstructure/2753

3.10 Credit card

A PoolTogether Credit Card is coming (early access: https://juno.finance/pooltogether)

3.11 Conclusion:

Pooltogether protocol is fully deployed in the Defi ecosystem (Ethereum mainnet and L2s (and Celo)). Using innovative business model, PoolTogether lets users to earn safe and easy yield in Decentralized Finance.

Continuous development, security and strong community give the most comfortable and friendly experience for Defi users.

With Optimism and Coinbase (& Base) as Partnerships, the scalability of the protocol can be exponential, and won’t require anymuch effort from the team going towards the Hyperstructure upgrade, so no doubt it will succeed to catch millions of users in the coming years.

4. MACRO-ANALYSIS: BTC / SP500 / DXY

If you read the previous newsletter, then you were able to anticipate this downward movement on Crypto. In fact, we showed previously that the DXY index was moving upwards due to a bullish divergence, and that the SP500 and Bitcoin were approaching an important resistance level. In addition, Bitcoin had a daily bearish divergence. Our position, lead by proper risk management, was to be careful by taking some profits but still playing the music on Alt coins with stop losses.

As of today, Bitcoin has retraced only 13% from its local top, nothing to be afraid of and no indication of a reversal trend. Remember, the market never goes straight, so far what we are witnessing seem to be a correction to the last impulse which started in January.

What will be the next buying zone?

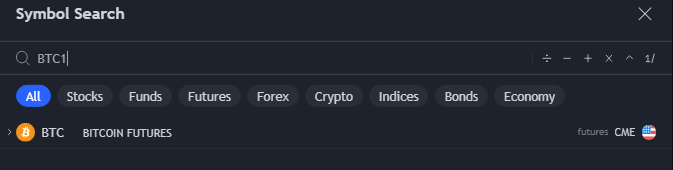

It's difficult to say, as everyone would like to have a crystal ball. Nevertheless, this week we propose to focus on CME Gaps.

First of all, the CME (Chicago Mercantile Exchange) Group is a derivative marketplace. What you need to know is that they have Bitcoin futures, and they are closed on the weekends. Sometimes there are gaps between the Friday close and the Monday market open.

It has been historically noticed, these gaps have always been filled and provide us with a target for buying or selling. You can find the Bitcoin futures curve on TradingView under the name BTC1!

We observe that there is an open gap around $20k. But there are also gaps to the upside towards $28k and $35k. These gaps are not supports or resistances, but demand zones where the price will need to be revisited.

What should we do? Patience is key. We must let the market breathe. Personally, we’re not interested in timing the exact bottom. We prefer to be patient, let Bitcoin find his bottom, and surf the next bullish wave.

Wise traders say: “Money flows from the impatient to the patient”

Trading: Short term, we are going Short on the market, but the previous impulse makes us bullish in the medium term, and we will wait for the right buying opportunity ito long the market.

Investing: We continue to DCA-in as part of our long terme strategy and hope for a slightly lower retracement than the current price.

INTERACTIVE COMMUNITY SECTION: FARMING STRATEGY

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

Today i’m pleased to present you a new strategy provided by Perp Protocol: Hot Tub Vaults

These vaults will be conducting spot-perp arbitrage on spot DEXes on Optimism and Perpetual Protocol, for ETH markets. Users can either deposit ETH or USDC. Both vaults have undergone live tests over the past month or so, with the ETH vault delivering an APR of 10.97%, while the USDC vault realized an APR of 6.61%.

For the timebeing, this strategy is exclusively limited to whitelisted wallets. Get your chance to join the Hot Tub by signing up on the protocol landing page.

PODCAST:

Following the Twitter Poll, from now on, the podcast will be shared together with the newsletter and not anymore in advance.

Beethoven_X

Sonne Finance & Angle Protocol

AAVE with Marc Zeller (Aave Chan Initiative Delegate)

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Discord:

https://discord-gateway.optimism.io/

Subli-Defi Social accounts:

Discord Handle: Subli#0257

Twitter: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Hello, for me layer 0 and superchain can be seen as similar. However, the OP Superchain is a L2 so is also solving blockchain trilemma:

- Security: Using Ethereum mainnet

- Velocity

- Scalability

Layers 1 built on Layer 0 might not offer this to my mind.

La traduction devrait arriver d'ici 1 à 2 semaines maxi. Mais on va réduire petit à petit la durée des traductions ;)

Merci pour ton soutien en tt cas