The 🔴🔵Optimistic Newsletter #6

The unique DEFI Newsletter on OP Superchain written by Defi Users for Defi Users

First of all, i’d like to express my thanks to you, for your comments, support, likes on this 🔴🔵Optimistic Journey. Big 👏 to my 4 teammates & all the translators as all this work could not have seen the light without them.

And finally, welcome to the 237 new subscribers to this newsletter.

Click in your preferred language to access the translated document:

Chinese - French - Japanese - Korean - Filipino - Persian - Thai - Turkish - Vietnamese

Thanks for reading The🔵🔴 Optimistic Newsletter (by Subli_Defi)! Subscribe for free to receive new posts directly into your mailbox.

Banking crisis in US, USDC depeg, Insane crypto market movement… That was an emotional 2 weeks period. Let’s take a step back, raise the head, take a big breath. We are pleased to introduce you the subjects of today newsletter:

1. Gov. update: Coinbase Wallet quests - Full tutorial & Earn OP

What’s the best way to drive 110 million users into DEFI? Make a simple step by step quest to make their first transaction in the blockchain, aka the OP Stack. We are here to guide you on these 2 quests.

2. Project update: Nested - Your Portfolio Management App

Nested allows anyone to buy a basket of crypto in one click. But if you are a trader, how do you manage your portfolio? I will show you how to do it on my Nested Portfolio, how I took profits and rebalanced it based on performance of each crypto.

3. On-Chain Analysis: State of Perpetual Protocols on Optimism

Perpetual protocols offer leverage trading. A lot of things happened recently on Optimism, new protocols have just been deployed. So what is the current state of Perps, which protocol manage to attract new users, or break its own trading volume ATH? Even if you don’t like statistics, give yourself a chance to discover all Perp protocols on Optimism.

Tips: Read the full article to learn more about the coming 4m OP incentives🔥

4. Macro-Analysis: BTC / SP500 / DXY

Bi-weekly update on the Crypto Market.

5. Farming Strategy: Funding Rate Arbitrage

Earn insane yield on Funding Rate Arbitrage on different perp exchanges. This time, how to earn 60% APR/year on ETH using Kwenta & GMX.

6. Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live Show:

Overtime & Thales, with my friend Dynamo_Patrick

Perpetual Protocol

Podcast available at the end of the newsletter.

Spotlight Project

Kwenta is the leading Perpetual Protocol on Optimism, allowing users to perform Options & Leverage Trading up to x25 (soon x100) at very low fees. With currently 23 assets available (Forex, Commodities, Crypto), and more to come in the near future, come to discover a seamless trading experience similar to Centralized Exchange.

By staking $KWENTA, you can also benefit from trading fees rewards, and soon Synthetix & Kwenta will launch, both, $OP trading incentives: double gift for Kwenta traders.

What could be better than CEX? Click HERE to discover.

REMINDER: GOVERNANCE TIMELINE

1. Coinbase Wallet quests - Full tutorial & Earn OP

Expanding the Optimism ecosystem involves reaching out to new crypto communities. It's important to note that simply reading or hearing about Optimism may not be enough to fully comprehend it. As we always say, and confirmed from the feedback on the previous Optimism quests that ended up mid Januray 2023, one of the most impactful ways to learn is through direct experience. Hence, we are thrilled to announce that Coinbase Wallet users can now participate in quests that enable them to discover Optimism, and earn OP Token.

This article will guide you step by step to complete these quests to earn approximately 10$ of OP, while spending less than 1$ of gas in ETH.

Nota: All quests are mobile-only, first come, first serve, and OP rewards may deplete quickly🏎🏎!

What is Coinbase Wallet?

Coinbase Wallet is a self-custodial wallet offered by Coinbase, which gives you complete authority over your cryptocurrency, and is able to support hundreds of thousands of tokens and dapps. See Coinbase Wallet as Metamask, but 100x more efficient, user friendly and with embedded apps.

So first, you need to create your coinbase wallet. This application is both available on iOS and Android. To avoid scam website, i put you the official link here to download the APP:

https://www.coinbase.com/wallet/downloads

Once downloaded, you have 2 options:

1- Create a new Web3 address → You will then generate a new wallet address with a new SEED phrase.

2- Import your web3 address into Coinbase Wallet by importing your SEED phrase

🚧For both options, you will have to link your wallet with a Coinbase account, which will ask you for KYC.

What are quests on Coinbase Wallet?

These quests are carefully crafted to introduce you to the essential aspects of Optimism, a layer-two scaling solution for Ethereum. By completing these quests, you can learn how to use Optimism in a simple and interactive way, all while earning rewards in the form of OP, Optimism's governance token. So, in short, quests on Coinbase Wallet are an excellent way to take your first guided steps towards the future of finance!

Again, all quests are on mobile only, so don’t look for any website link in this article, however, we have you covered. We did a full tutorial with screenshot to help you out.

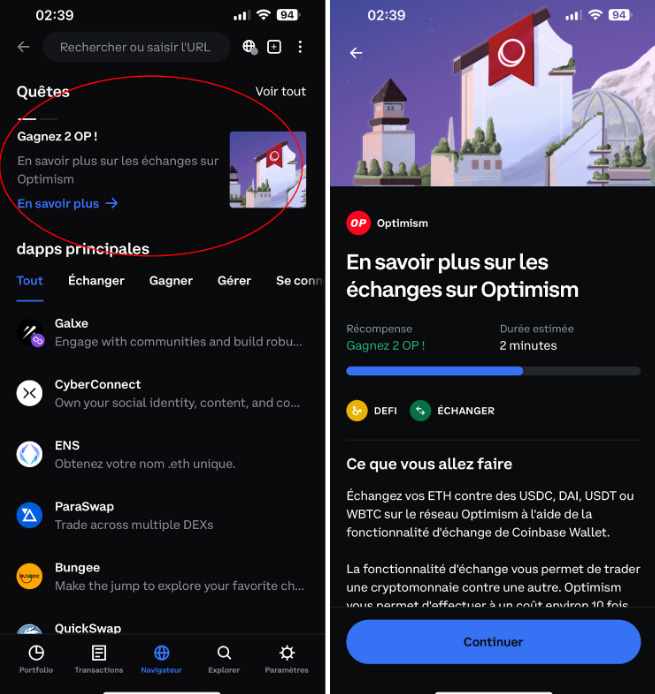

Quest #1

The initial quest on Optimism Coinbase Wallet is to facilitate an ETH-to-USD stablecoin swap on the Optimism network. Upon completing this quest, you will be rewarded with 2 OP, Optimism's governance token. In order to complete your swap you will need some ETH on the Optimism network. If you chose option 1) when creating your Coinbase Wallet, there are a few ways to accomplish this (transfer from your coinbase account, buy with your credit card, transfer from another Web3 address. Put 5$ of ETH, that is more than sufficient for these quests and potential future use.

Nota: For any transaction, don’t forget to keep some ETH in your wallet for the gas fees!

Once you’ve set up your Coinbase Wallet with some ETH, you’re ready to start your quest.

Nota: Coinbase Wallet language being automatically setup based on your living country, screenshots are in french but preceeded by an english traduction.

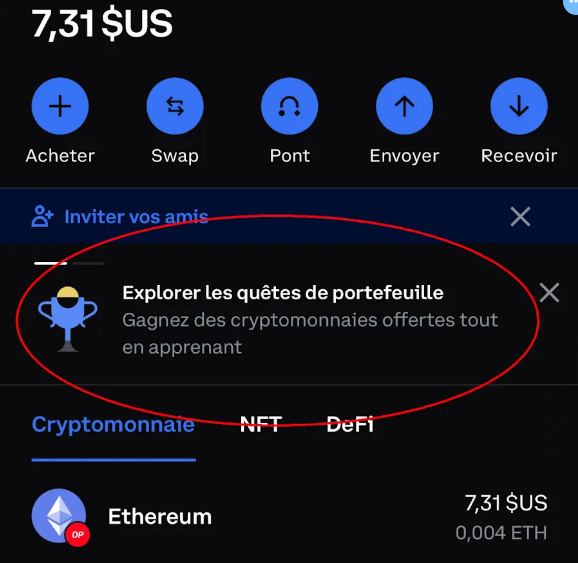

Click on : Explore Wallet Quests

By clicking on the Learn more button and selecting ‘’Continue’’ will take you to the Swapping on Optimism Coinbase Wallet Quest flow!

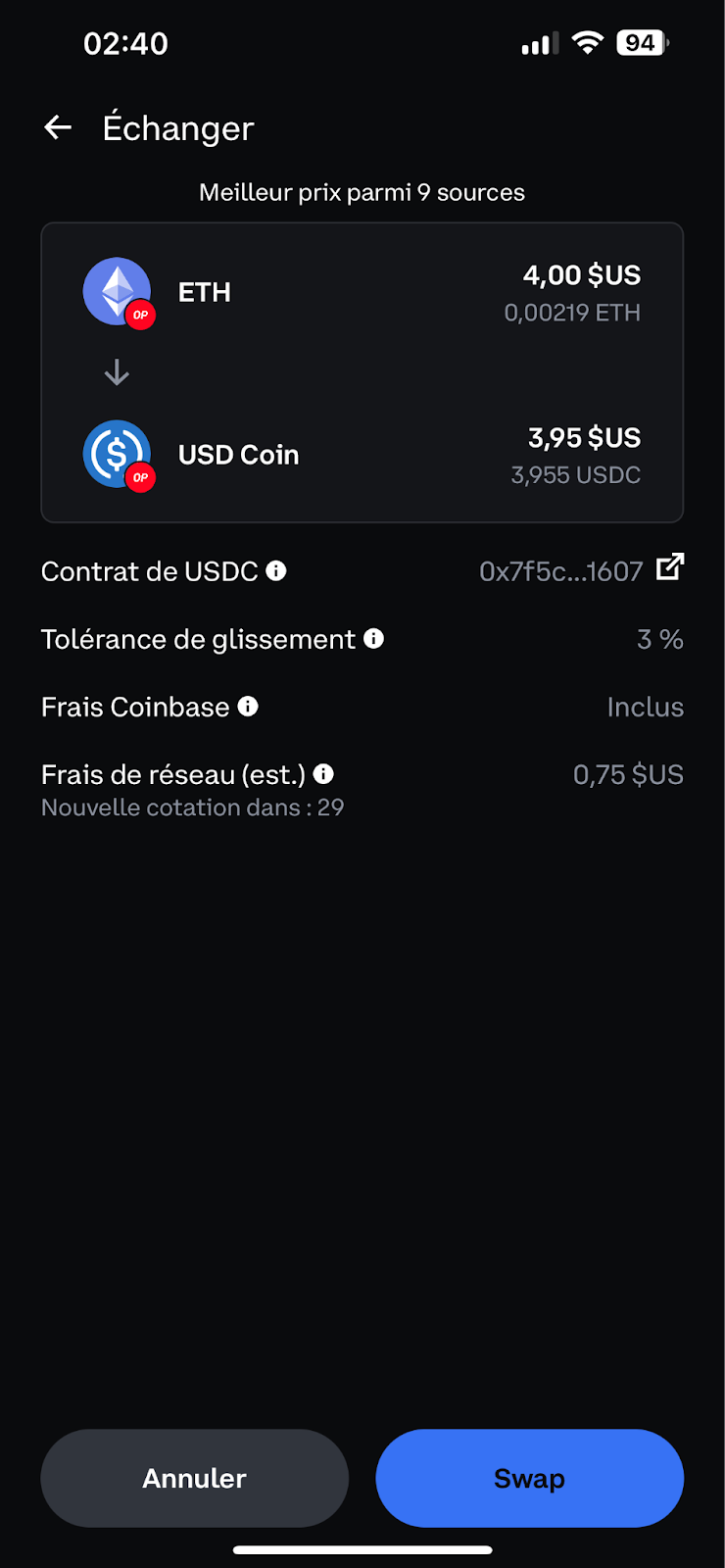

At this point, you’ll be asked to confirm your humanity by connecting to your Coinbase account. After doing so, you can choose the type and amount of assets you’d like to swap.

After clicking Find the best price you’ll then be shown all the details of your planned swap. Once you’re satisfied, click Confirm.

And voila! You successfully made a swap on Optimism and your 2 OP reward is on its way. When you receive it, directly on your Coinbase wallet, you can use it to participate in Optimism governance!

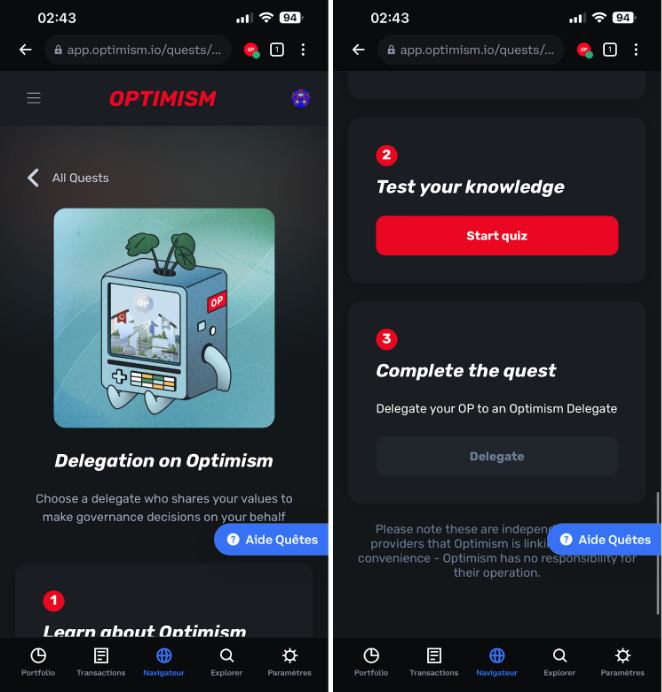

Quest #2

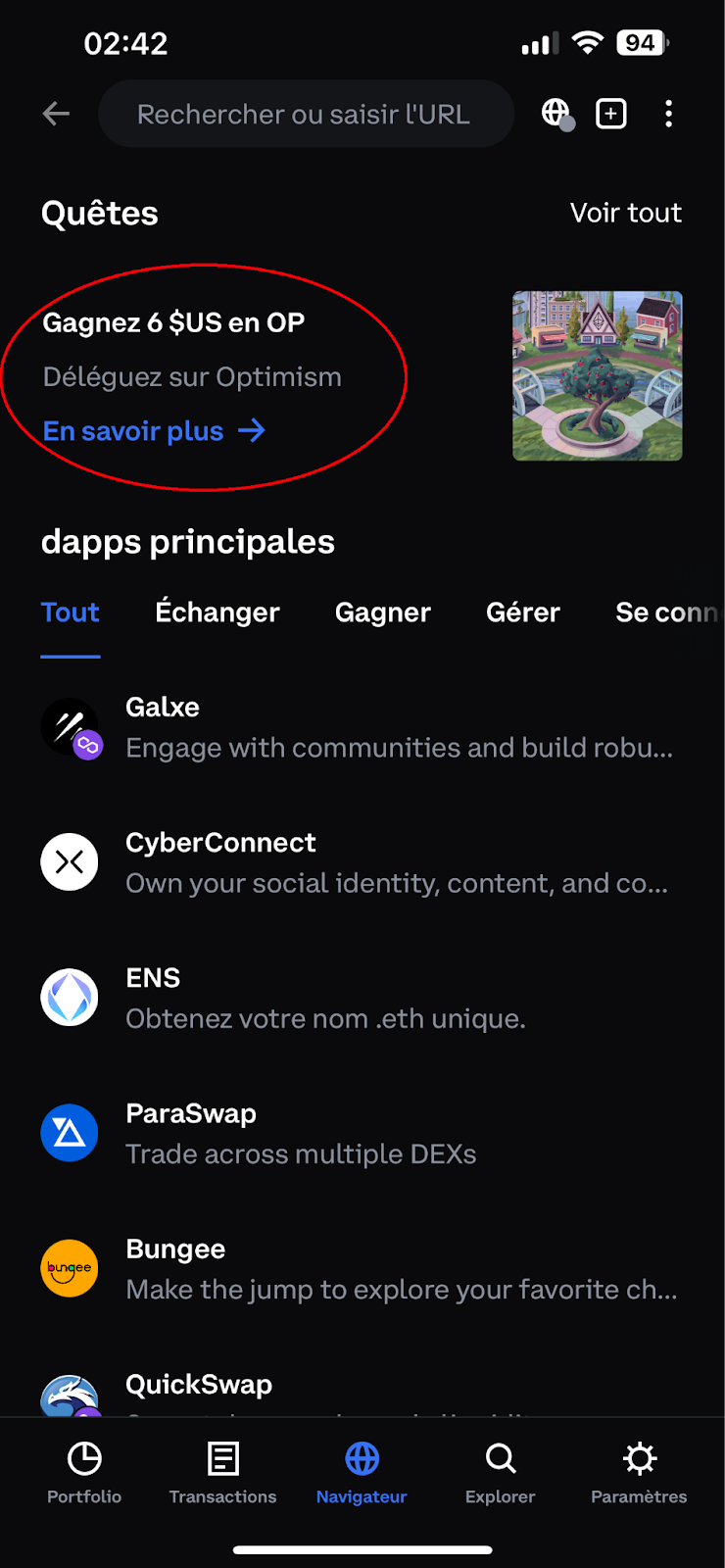

The second quest on Optimism Coinbase Wallet consists of delegating your OP to someone and winning some rewards while they use your voting power. Upon completing this quest, you will be rewarded with 6$ worth of OP, Optimism's governance token.

By clicking on Earn 6$ in OP, Delegate on Optimism:

You can learn more about Optimism and you will need to answer a quiz with 2 easy questions in order to delegate your OP and win your rewards.

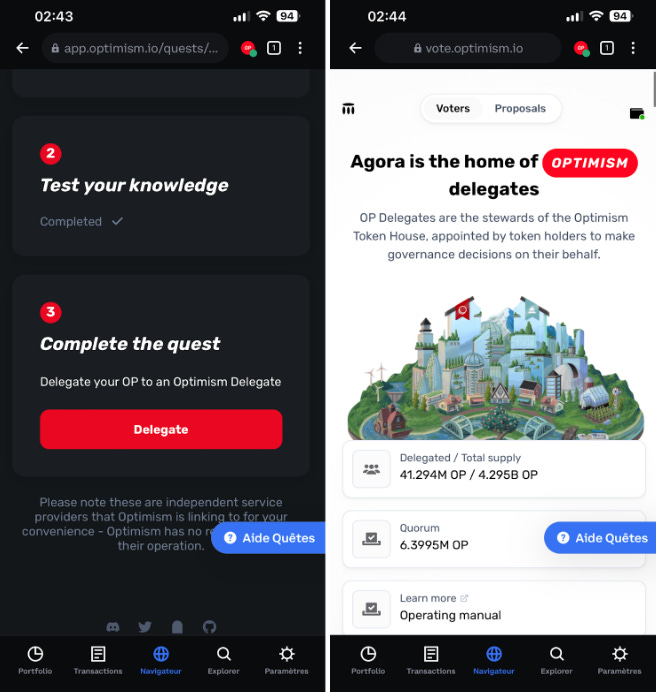

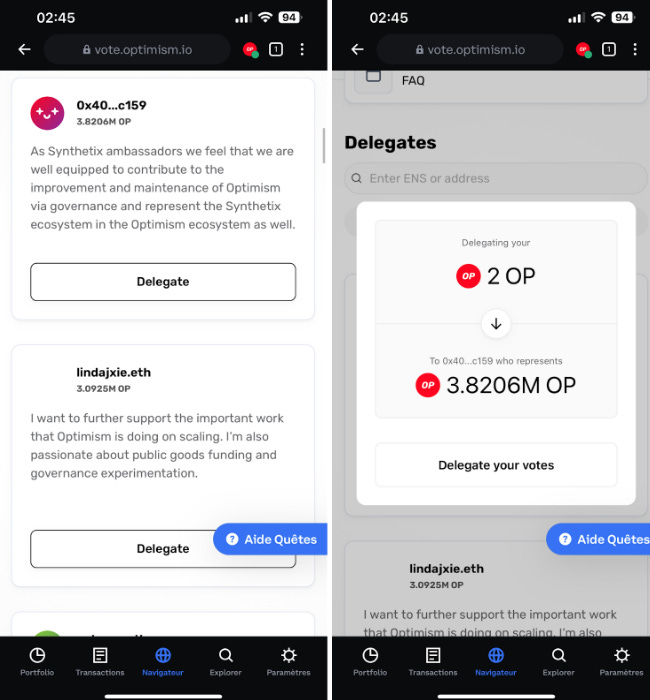

Once the quiz is completed click in the ‘’Delegate’’ button and you will be redirected to the Optimism Vote section.

Delegating your OP means handing the voting power of your OP to someone. This can be yourself or someone else as a Delegate. Any Delegate to delegate your OP to, you will win rewards by delegating your voting power and you will participate on the governance of Optimism (remember how this was important for Airdrop #2 - check our newsletter #4)

Reminder: Snapshot is being taken at the beggining of the next voting cycle. The next one is planned on 23-March.

Once you complete this quest, 6$US worth of OP will be dropped into your wallet => Even more OP to delegate 😍

Congratulations, you just completed the 2 onboarding quests from Coinbase wallet.

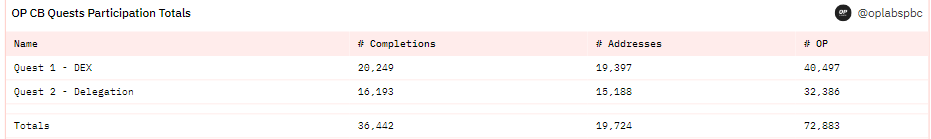

On-Chain statistics

Here are some stats on users having already completed these quests. Make sure you do it, you never know if this could, one day, make yourself eligible for a future aidrop.

Finally we would like to apologize for the screenshots in French, we did not manage to change the language, so we decided to leave you here with a happy baguette for you to forgive us 🤝

If you want to sail to financial freedom by:

Getting a free research toolbox PDF

Getting educational treasures

Getting aggregated alpha

Then it is time to join the Seven c Newsletter delivered directly to your email box by my fren Crypthoem

2. Project update: Nested, your Portfolio management App

Nested is a french project, that i already covered in a previous thread to present all the project features with the Pitch being: “Create a portfolio of Crypto assets in 5min and send it to your Dad or Mother”. Today, we are going to see together how you can manage your portfolio like a Pro, stick to your risk management and take your first profits.

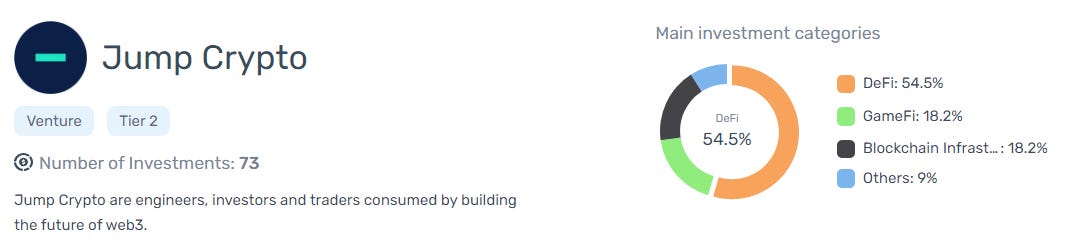

Before moving on, i’d like to remind you that Nested is backed by industry leaders such as the famous British investor and businessman Alan Howard, a legend of the investment world, but also Jump Crypto, a very well known VC, leader in the Defi ecosystem:

2.1 Portfolio

Creating your portfolio is as easy as ABC. Check this thread:

2.2 Risk management = Portfolio management

Portfolio management is key in your investment thesis. Why?

You won’t be able to time the top or bottom of the Crypto Market

You won’t be able to follow 100 different projects you aped in

You won’t be enough diversified if you go all-in in one project

In this thread i gave you a complete overview of how i manage one of my portfolio. This covers:

Building a Smart Crypto Portfolio: many thanks to Edgy for his wonderful thread delivered 1 year ago

My own selection of projects in Nov 2022 (non financial advice)

Investment thesis change based on Macro, project update/Deliverables, etc…

Managing my Portfolio without any emotion

2.3 Rebalancing Strategy

Let’s start by presenting you my first strategy: Rebalancing Strategy.

Definition: Rebalancing is the process of adjusting a portfolio's asset allocation to maintain the desired level of risk and return. This involves periodically buying or selling assets to restore the original allocation percentages.

Rebalancing your portfolio is not something Crypto specific and is a strategy widely used in any investment plan. Here is a concrete example:

Assuming you hold a basket of 4 crypto, your original allocation was 25% for each.

The crypto market goes up and you see your tokens getting a significant price increase: ETH +10% / SNX +30% / OP +50% / VELO 100%

Your allocation becomes then: ETH 19% / SNX 22% / OP 25% / VELO 34%

This results in a portfolio that is over-weighted in VELO and under-weighted in ETH, OP, and SNX. To restore your original allocation percentages, you would need to rebalance your portfolio as follows:

Sell 25% VELO to bring its allocation back down to 25%

Use the VELO sale to buy mpre ETH and SNX to restore their allocation percentages

No need to change the OP allocation since it represents already 25% of your portfolio

After rebalancing, your portfolio should once again be evenly distributed with 25% of each cryptocurrency. By rebalancing in this way, you can potentially achieve better long-term returns and minimize your overall portfolio risk.

2.4 My Nested PF case

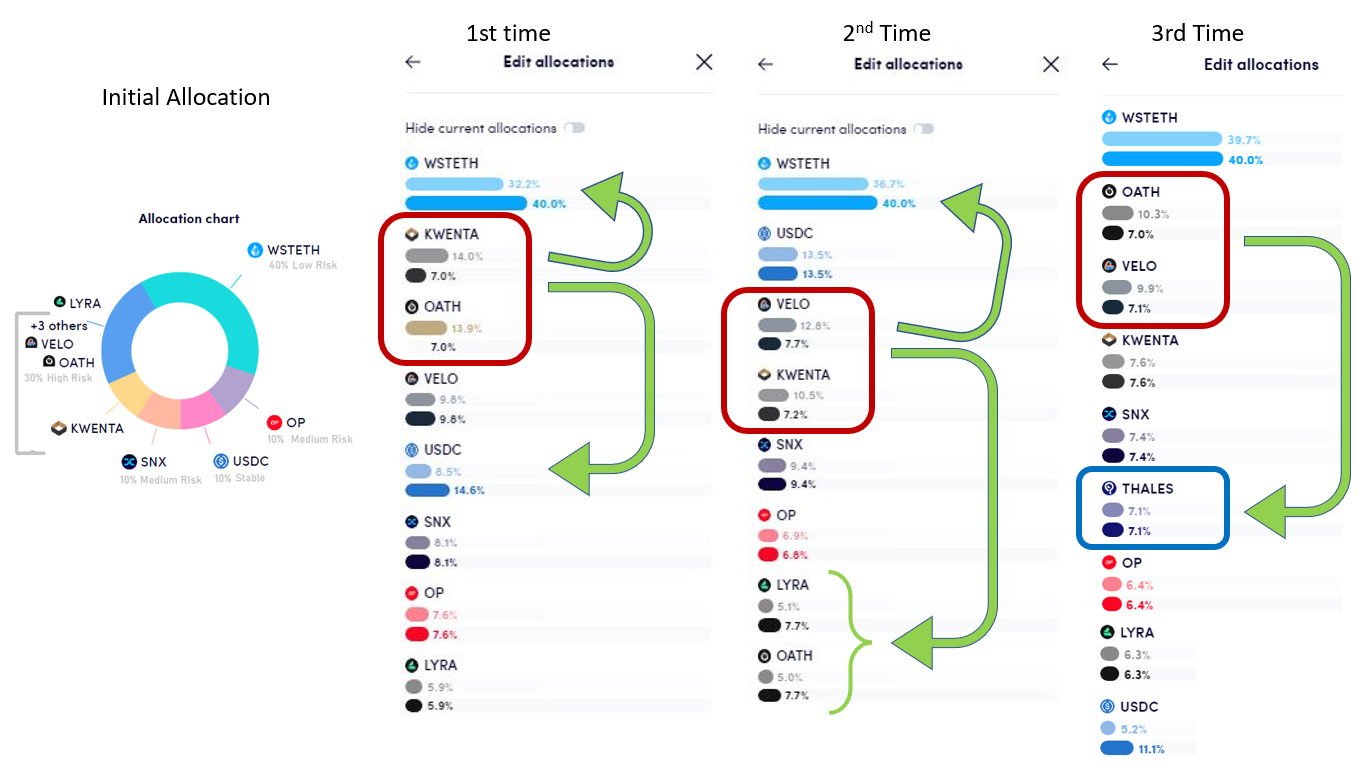

As you have seen in the thread above, i’ve created my own Crypto Index, of course, dedicated to Optimism bluechip. If you haven’t opened the thread, i won’t be offended, and as a gesture of kindness, you can find here my portfolio (if you wish to copy it, click on the picture to go to my PF Nested page).

I created this PF on Feb 2, 2023

Since then, and thanks to the crypto price increase i rebalanced 3 times my PF. You may say it’s too often, but i have a '“Take Profit" strategy i keep using since years which has shown great performance for me. Do you know what this could be? I’ll tell you maybe later… if you end up reading this article :-)

1st time: Took profits on Kwenta & Oath to buy more wstETH & USDC

2nd time: Took profit on Velo & Kwenta again to buy more wstETH & add Lyra & Oath

3rd time: Took profit on Velo & Oath again to add one more token in the basket Thales

TLDR on oath token: SELL HIGH, BUY LOW. How?

1st TP at +130%, Buy at -25%, 2nd TP at +42%! Never been a so good trader since a long time LMAO!

The best thing with Nested, is that if you follow my PF on the application itself, you will get notified of any change i’m making on my PF and you can also set up telegram bot notification. More options will come such as notification via email.

2.5 Trading Competition & Airdrop $NST

Nested received an OP GRANT worth 250k OP tokens. The plan is to conduct 3x Optimism specific trading competitions with some great $OP & $NST incentives. Doing this kind of rebalancing strategy will increase your trading volume and so your chance to be eligible. Check the previous newsletter for more information about the trading competition.

1.75% of the total $NST supply is being airdropped to users based on their trading volume. You can find more information about Airdrop information here: https://docs.nested.fi/general-information/airdrop

It must be noted that $NST claim is not avaiable yet as the token is not yest listed

2.6 Conclusion

This rebalancing strategy can be difficult to do when you have several tokens on several chains. You need to nice Spreadsheet, and half a day to do it properly, without thinking how much gas you may spend.

But i must admit i deeply love Nested product as it takes me less than 5 minutes to apply this strategy, while at the same time earning trading incentives in $NST now, and later on will earn also OP.

Get familiarized with Nested by clicking on this link: Nested

My personal tip for taking profit: Take 50% out of the crypto when price makes 2x. Easy, i’m sure you know it. It has always been very successful for me.

3. On-Chain Analysis: State of Perpetual Protocols on Optimism

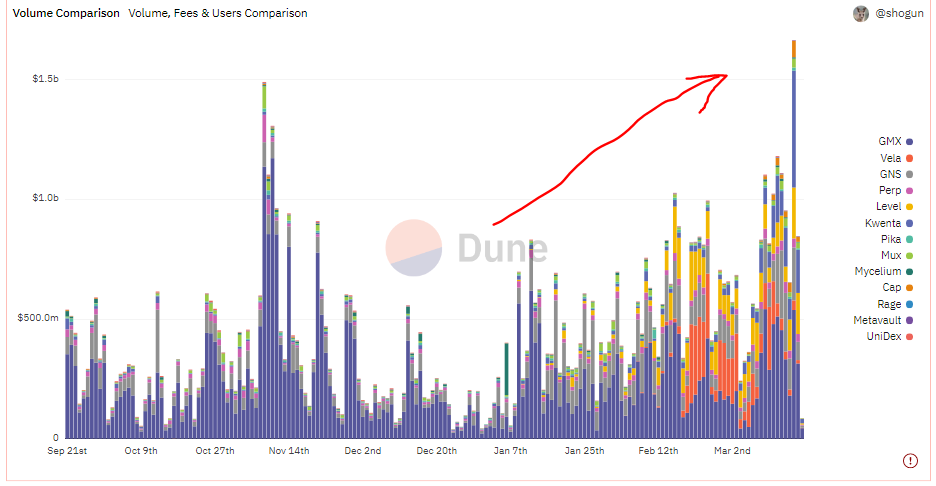

We have already covered several times here in this newsletter and on Subli_Defi twitter account the increase of usage of Defi protocols allowing leverage trading on Perpetual contracts with top leaders being GMX on Arbitrum, GNS on Polygon and Kwenta + Perpetual Protocol on Optimism.

As you can see, since beginning of 2023, the trading volume of all main Perp protocols (on All chains) keeps increasing.

At the same time, trading volume on Optimism has also significantly increased thanks to the growth of new & existing Perps protocols. So let’s dig into it, and review some on-chain data to see if one protocol stands from the others. In this article, we are going to review the following protocols (alphabetical ranking):

Mummy Finance

Perpeptual Protocol

Pika Protocol

OPX Finance

Synthetix Perps V2 with all its front ends (Kwenta, Conduit, Decentrex, Polynomial, and… one surprise you won’t believe it)

Unidex

3.1 Perp protocols introduction

Mummy finance:

Assets / Leverage: 5x assets available / Up to x100

Real Yield: Trading fees 60% to Liquidity providers, 5% treasury, 30% to MMY stakers

Leading Edge: Largest TVL fork of GMX. No price impact thanks to the MLP pool.

Perpetual Protocol:

Assets / Leverage: 18x assets available / Up to x10

Real Yield: Trading fees 80% to Liquidity providers, 5% treasury, 15% to vePERP holders

Leading Edge: Native Optimism Perp protocol. New passive farming solutions, introducing the Hot Tub vaults for price arbitrage between Perp market and Dexes on Optimism (Check Newsletter #5 for more info about this).

Pika Protocol V3:

Assets / Leverage: 25x assets available / Up to x100

Real Yield: Trading fees 70% to Liquidity providers, 30% to the protocol. But it is also said that after $PIKA token is launched, 30% will go to token holders, 50% to LPers and 20% to the protocol.

Leading Edge: Crypto & Forex trading. No token yet. Who is farming potential $PIKA airdrop?

OPX Finance:

Assets / Leverage: 3x assets available (BTC, ETH, OP) / up to x30

Real Yield: Liquidity providers earn 60-70% of platform fees in WETH, $OPX holders earn 15-30% of platform fees.

Leading Edge: Fork of GMX, no price impact thank to the OLP pool, Gov token $OPX deflationary

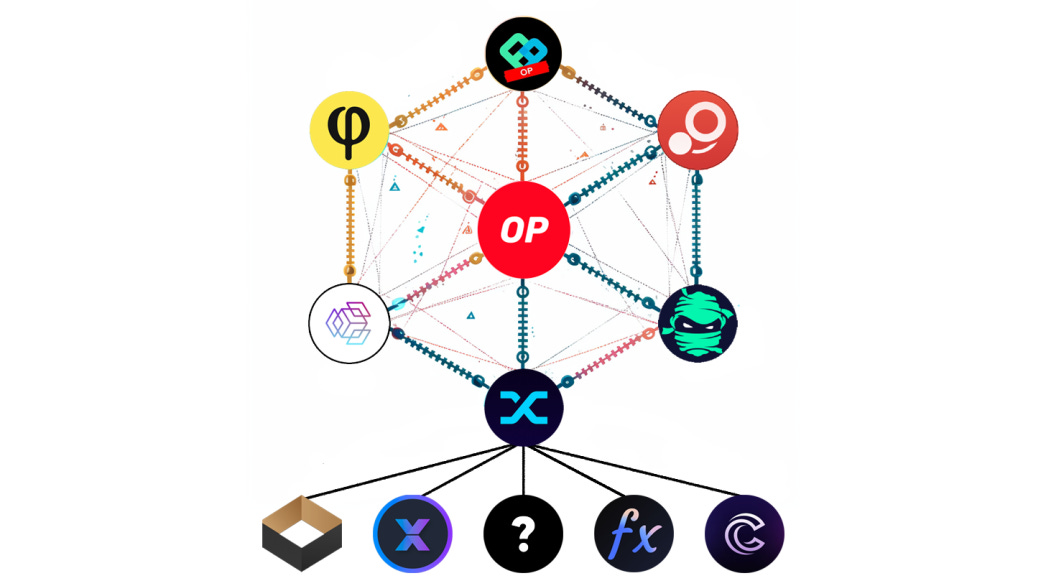

Synthetix Perps V2:

First of all, we need to understand that Synthetix is acting as a liquidity/technology provider. Several projects have been built or are currently building on top of Synthetix such as Kwenta, Decentrex, Conduit, Polynomial Perp (live on 27/03), and another one which i can’t reveal yet (but i keep talking about it, any guess?). These projects provide Front End features for users/traders. For more information about Synthetix Perps V2, we have done a full article on the Newsletter #3, we recommend you give it a read.

Assets / Leverage: 23x assets available (Crypto, Forex, Commodities) + 9 currently under new governance proposal SIP298 / Leverage x25, up to x100 on Forex

Real Yield: Part of the trading Fees go to SNX Stakers, the other part go to Front End protocols.

Leading Edge: Deep liquidity, large choice of assets, efficient mechanism, Price feed given by multi oracles (Chainlink & Pyths), low fees

Unidex:

Assets / Leverage: 10x assets available (Crypto) on Optimism / Up to x100

Real Yield: 60% of trading fees go to Liquidity Providers, 20% to $UNIDX holders and 20% to protocol.

Leading Edge: Swap multi-chain aggregator and soon Leverage Trading aggregator (V3). And the best for the end:

Could it be a side chain of the 🔴OP Superchain?

3.2 On-Chain data

3.2.1 Volume

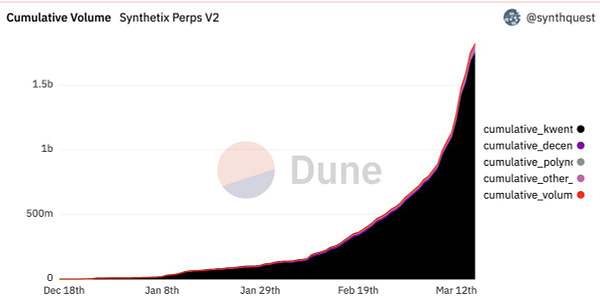

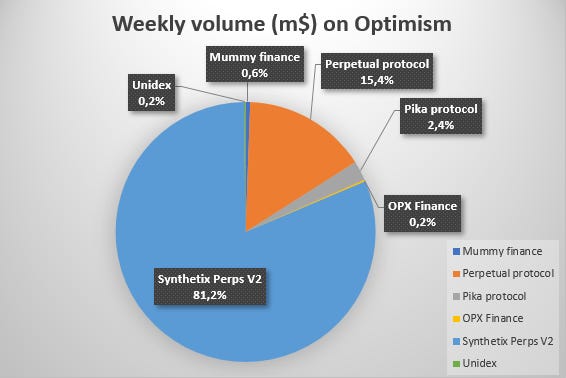

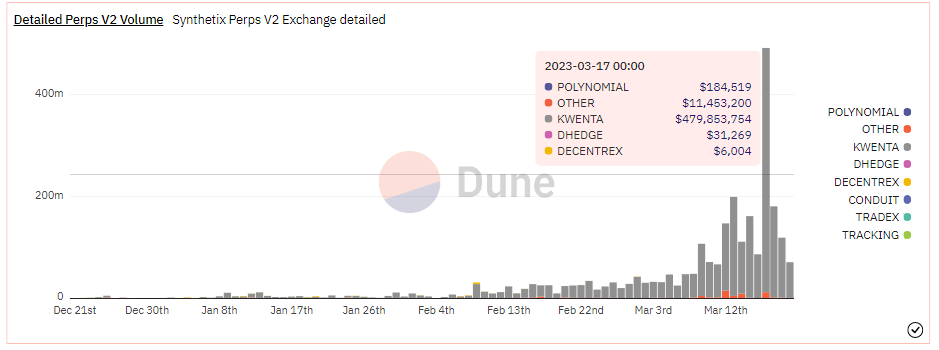

Average weekly trading volume chart of different perps protocols on Optimism (data taken in March-2023):

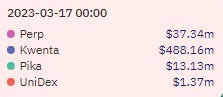

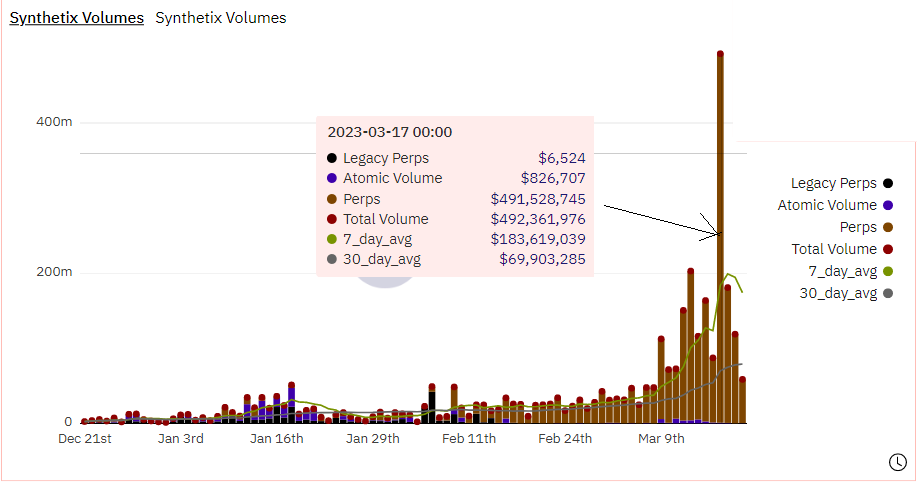

The largest daily trading volume done by Perps protocols on Optimism was on 17-March with an ATH at 540m$.

We can clearly see that Synthetix Perps protocols are leading the path, with an average weekly trading volume of 1.4b$, with almost half a billion $ of trading volume done in one day, almost 13x more volume than Perp Protocol.

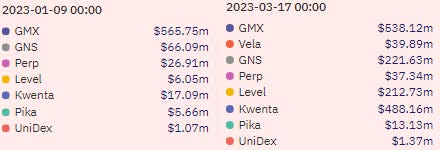

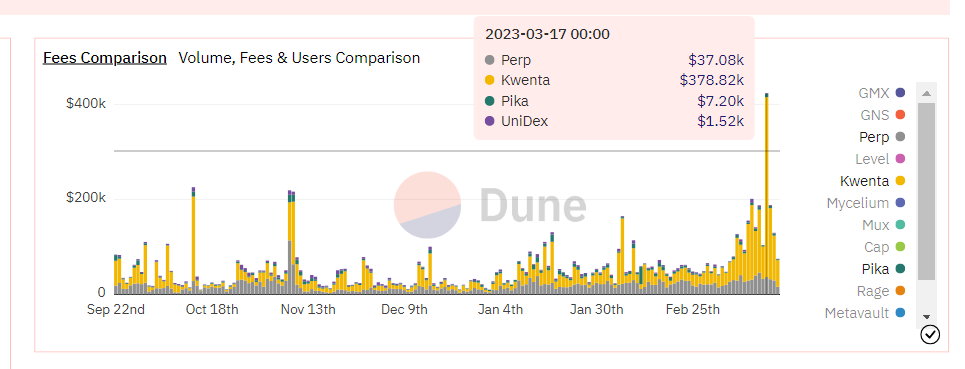

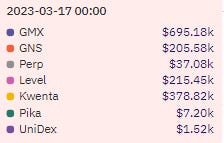

How does it compare to the Giant Perps protocols being GMX & GNS?

On March 17, total volume of the Main Perps protocols (accross all chains, without DYDX) was 1.55b$. So, perps volume on Optimism represents a nice share of 1/3 of the total trading volume, although, GMX volume equals the total Optimism volume on that day.

However it must be noted the steep increase of volume since the beginning of this year. In January 9, the total trading volume on Optimism was about 51m$, and represented only 7,4% of the total trading volume of perps protocols. So in only 2 months, Optimism has increased by 5x its market share on the generated trading volume.

Now let’s dive into Synthetix Perps protocols:

Without surprise, Kwenta is the undisputable winner for now which can be easily explained as the other protocols listed previously, built on top of Synthetix, are either not live yet (like Polynomial who will be live on 27-Mar) or very little marketing have been done so far that could have helped to promote the platform.

3.2.2 Fees

Synthetix Perps V2, let’s assume until the end that it is mainly represented by kwenta, is indeed accruing more and more fees since 2022. Something we actually expect since the platform sees increase of trading volume. Kwenta makes 13x more volume than Perpetual Protocol but “only” 10x more fees, why?

Easy: Kwenta offers, as we said above, the lowest trading fees from the protocols listed above.

On the same day, 17-March, GMX has accrued almost twice more fees than Kwenta, while remember volume was pretty similar on both platforms. The reason is mainly because of the high fees on GMX.

So the final question is why people are ready to pay more fees on GMX than on Kwenta?

Firstly, we think it’s just a matter of time before traders know about Kwenta and move there. Secondly, Kwenta is still developping the key set for the average traders being limit order, stop loss, market order.

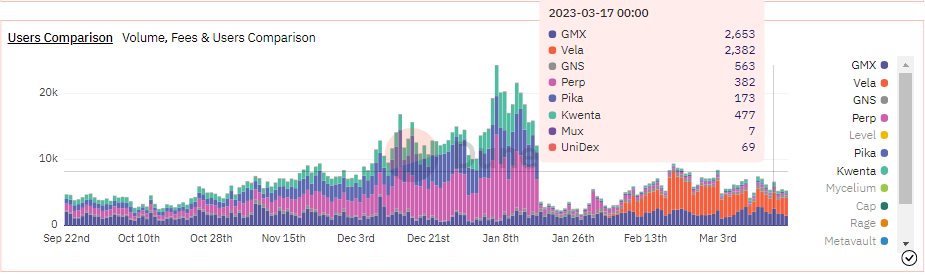

3.2.3 Users retention

First thing we can observe on the above chart is the massive drop of users on 17-January, which was the end date for the Optimism Quests on which Perpetual Protocol, Kwenta and Pika participated.

On Optimism only, Kwenta is now the most used platforms, follow closely by Perpetual protocol. However, considering all chains, we can see that Vela, and GMX are driving 6x more users than Kwenta. But, with 6x less users, Kwenta generates the same volume than GMX, so Kwenta is currently attracting bigger whales/traders which is a positive thing as these persons can really battle test the platform before retails come in.

3.3 Conclusion

We used to say that competition drives innovation, and perps protocols on Optimism fit perfectly this statement. It seems that perps protocols on Optimism manage to find their own niche or product market fit, which in our opinion could be split in 4 different categories:

Passive farming vaults like Perpetual Protocol is offering

GMX forks like OPX Finance or Mummy Finance

Front end protocols built on top of Synthetix Perps V2 such as kwenta, offering seamless and low fees trading experience

Leverage trading aggregator like Unidex

In our opinion, each of these 4 type of projects can be used by different user profiles.

Passive farmers looking for new farming strategy

Traders who are familiar with GMX on Arbitrum and move to Optimism, with interesting yield for token holders

Big whales / traders

Everyone who wants to optimize their trades

We are very bullish on what Unidex V3 can bring as a perp aggregator and really looking forward to their forthcoming testnet that is planned to come by end of this month, beginning of April we have heard.

At the same time, Synthetix continuous development will offer to Optimism users a large choice of front ends with low fees, specific funding rate curve, large choice of assets which are all the features one can find today on Centralized Exchanges and were not available in 2022 in DEFI.

Note: I'd like to thank Synthetix Community for this dashboard: https://dune.com/synthetix_community/synthetix-stats

And Shogun for this one about Main Perps overview: https://dune.com/shogun/perpetual-dexs-overview

3.4 Trading incentives by Synthetix & Kwenta

We though that reading this article this far would require Alpha leak! So here it is:

🔥Synthetix has recently approved a Trading Incentives program of 3.65m OP Tokens (around 10m$ at the time of writing) to be distributed over the course of 20 weeks, starting….. in APRIL!! 🔥

This incentive program will go towards all protocols built on top of Perps V2 , and SNX stakers will be even more rewarded if they trade, with up to +15% premium. The allocation of the rewards towards all protocols is likely to be dependent on the volume generated by each platform, but let’s see what Synthetix will say on Twitter.

🔥🔥At the exact same time, Kwenta is also launching a trading competition, worth 600k OP tokens (1.6m$ at the time of writing) that will boost the activity on the platform, which should generate more volume, and maybe a bigger share of the OP incentives provided by Synthetix.🔥🔥

Hope you liked this article Traders. Play Safe, Trade Safe.

4. Macro-Analysis: BTC / SP500 / DXY

In the previous newsletter, we identified a reload zone for BTC at 20k$ that was triggered the day after the previous newsletter was released.

4.1 Where are we now?

We can see that the reload zone at 20k$ worked pretty well. Since then, Bitcoin price increased by +44%, while some altcoins saw a price increase >200%. However, we are now observing a bearish divergence on the daily chart. Our risk management requires us to be cautious if we do not want to lose our gains from this previous bullish movement.

The past few weeks have been emotional. We have seen SVB Bank collapse while Bitcoin bounces back with confidence. Is this resulting from an overall acceptance of Bitcoin being a reserve asset, or is it due to the money printing that is planned to resume to save the whole banking system? Indeed, the FED is launching a $2 trillion rescue plan for American banks.

In any case, we are all enjoying those good times for the crypto market.

4.2 Why altcoins didn’t pump ?

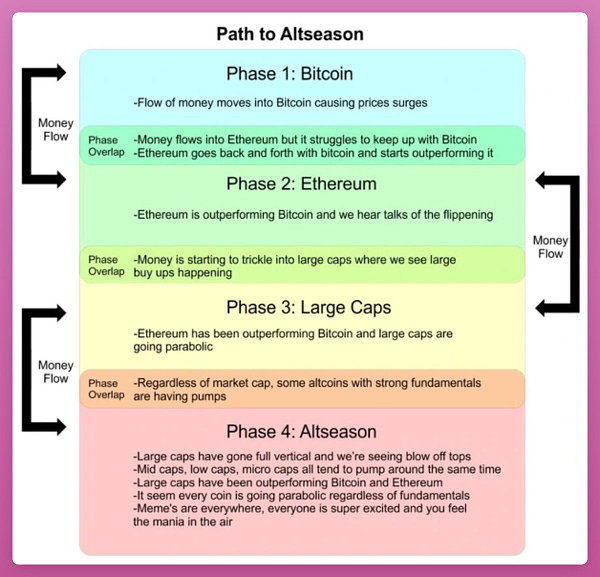

During the BTC rise, we observed that most of the liquidity was directed towards BTC due to the increase in BTC dominance.

BTC dominance (ticker BTC.D on Tradingview) indicates the share of BTC market cap compared to the rest of the crypto market, in other words, whether money is invested into or disinvested from BTC.

BTC dominance is currently heading towards the upper end of the range (sitting around 48%), this is why altcoins didn’t benefit significantly from the current bullish movement. The BTC.D is worth watching because if it shows signs of reversal or reaches the upper end of its range, a drop in BTC dominance is very likely, and liquidity will move towards altcoins. The Daily RSI is currently overheated and overbought.

This means that it is not too late to position ourselves on altcoins. On the contrary, it is a period of opportunity because BTC's bullish impulses are a precursor to the overall health of the crypto market and can subsequently lead to a rise in prices on other projects.

We can compare the movement of liquidity between altcoins and BTC using the chart of the total market cap of the crypto market excluding BTC to have a more precise idea (ticker TOTAL2).

This confirms the BTC dominance data: while on its last impulse BTC increased by 42%, the total crypto market excluding BTC increased by only 24%.

4.3 Conclusion:

Trading: Despite the uptrend, we are going to take profits on our open positions or position a stop loss in profit to avoid being caught off guard by BTC making a retracement of the last impulse or a possible reintegration of its previous range, crossing downwards the 25k$ threshold.

Investing: Below $28,000, we are still in an accumulation zone for BTC. DCA-in is still relevant for long term Holding.

Now it’s also an interesting period where we are going to position ourselves on ETH, mid cap and other altcoins to just follow the money. Keep in mind, it’s always the same cycle:

5. Farming strategy: Funding Rate Arbitrage

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

Today we are pleased to present you a new strategy inspired by Kwenta: Funding rate arbitrage.

Strategy taken from this thread, but we are here to provide a TLDR and a concrete example of this strategy.

Funding rate: Funding is similar to an interest payment. Funding is a % of your position size (after leverage is applied) that you either pay, or get paid at regular intervals. If funding is positive, longs pay shorts. If funding is negative, shorts pay longs.

Funding rate is used to incentivize long/short position to find a proper balance and avoid breaking the bank (i.e liquidity in the protocol).

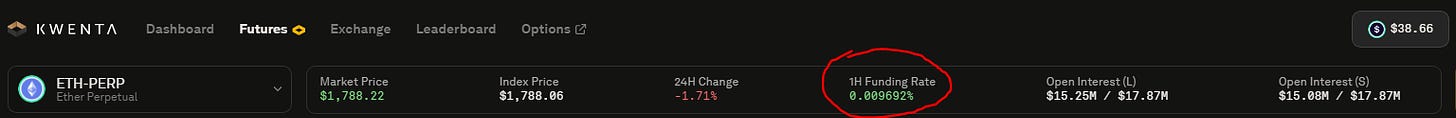

At the time of writting, funding rate for ETH-PERP on Kwenta was at 0.009692% per hour, so 85% interest rate per year. Yes, funding rate shall not actively controlled, as this is applied to your notional trading volume.

In the above example, Long traders pay for short traders. How can we benefit from it?

Let’s take an example now on $ETH traded on Kwenta & GMX:

Open a short position on ETH-PERP on Kwenta, and receive 0.009692% per hour of your total trading volume (remember positive funding rate means long pay short)

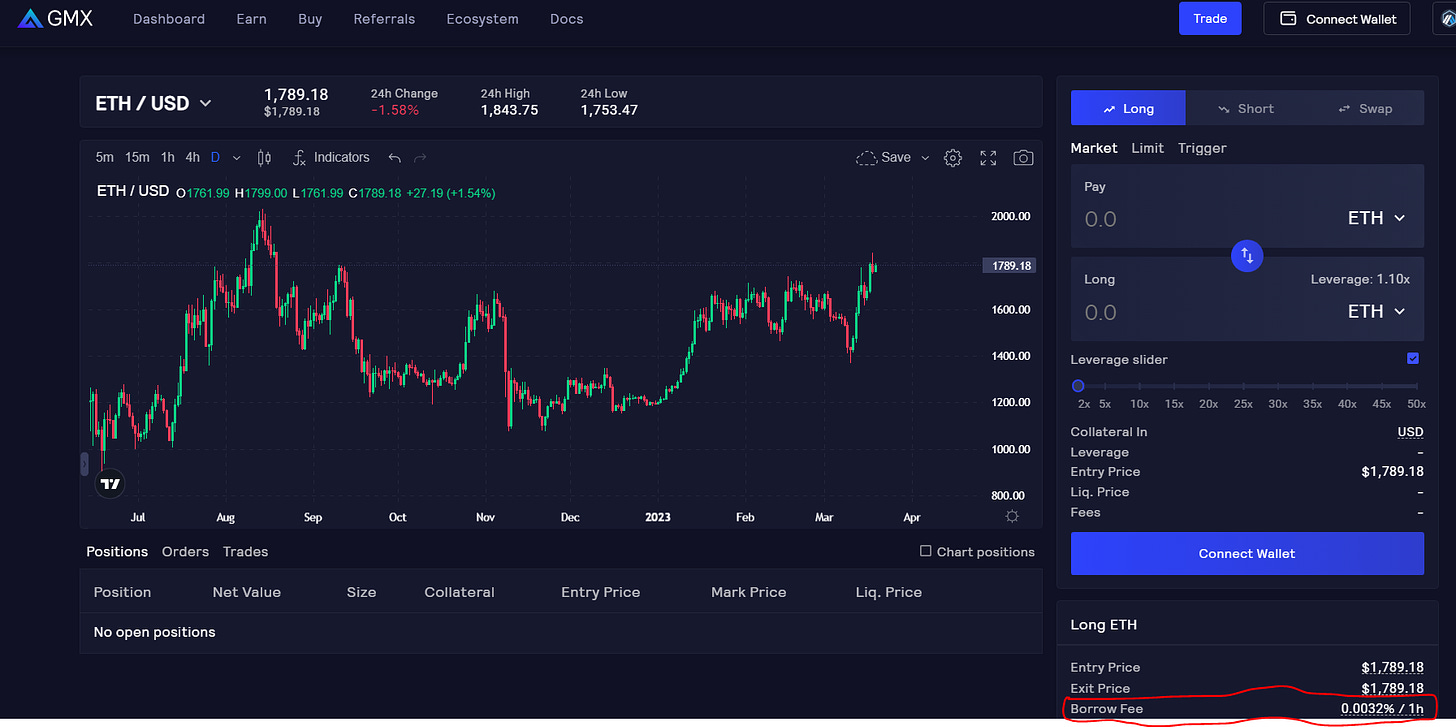

Open a long position on ETH-USD on GMX and pay 0.0032% per hour of interest rate

You have now a delta neutral position on $ETH, and are earning 0.006492%/hour, 0.15%/day, 60%/year! Yes, Insane!!

As we used to say: High Risk, High Reward. This position shall be actively monitored as funding rate can change quickly based on market condition, but again, it comes with huge benefit with no exposition to the underlying traded asset.

Note: This yield doesn’t take into account high trading fees on GMX (approx 0.2%). But this strategy is totally applicable to low fees platforms like CEX or DYDX.

Now, as a user, the only thinkg we are waiting for is someone building a Vault doing all the above automatically, and cross chain. Who will build this?

Enjoy traders!

6. Podcast:

Following the Twitter Poll, from now on, the podcast will be shared together with the newsletter and not anymore in advance.

Thales & Overtime

Perpetual Protocol

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of all podcasts, some of them are granted to paid members, but today, Revelos is kind enough to make the Perp Protocol Podacst notes available to anyone for free. Check above.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Discord:

https://discord-gateway.optimism.io/

Subli-Defi Social accounts:

Discord Handle: Subli#0257

Twitter: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Thanks a lot for your kind words !

💪