The 🔴🔵Optimistic Newsletter #7

The unique DEFI Newsletter on OP Superchain written by Defi Users for Defi Users

First of all, i’d like to express my thanks to you, for your comments, support, likes on this 🔴🔵Optimistic Journey. Big 👏 to my 4 teammates & all the translators as all this work could not have seen the light without them.

And finally, welcome to the 1753 new subscribers to this newsletter.

Click in your preferred language to access the translated document:

Chinese - French - Japanese - Korean - Filipino - Persian - Spanish - Thai - Turkish - Vietnamese

Thanks for reading The⚫🔵🔴 Optimistic Newsletter (by Subli_Defi)! Subscribe for free to receive new posts directly into your mailbox.

Welcome on this new of the 🔴🔵Optimistic Newsletter. Let see what we cooked for you this time:

0. The Optimistic series Campaign Launch: Engage to Earn

The Optimistic quests campaign has been launched on 3-April and will last until 31-July. Questoors, come, engage about #Optimism by completing this series of quests, and earn OP token. More info here:

Timeline:

Quest #1: 🟢Live - End on 31-July

Quest #2: 🟢Live - End on 30-April (Must complete quest #1 to participate)

1. Tech. update: What is Bedrock

Bedrock upgrade has been approved through a governance proposal during voting cycle 11. This will be the first protocol upgrade of Optimism Mainnet. This upgrade aims to provide unprecedented modularity, simplicity, and Ethereum equivalence to the L2 network, with positive impacts on performance and security. More info in this article.

2. Project update: ⚫Unidex creates its own APPchain MAGMA

Wow! Unidex, Perpetual & Trading prototocols on Optimism, announced recently the launch of the MAGMA chain, a Side Chain built on the OP Stack, and thus being the 5th Side Chain of the OP Superchain. Why did the team decide to move this way, what does it consist in? We’ve made contact with the team and digest hours of research to provide this summary.

3. RPGF#2 & Cycle 11 - Project Grants winners :

Two major milestones have been achieved these past 2 weeks:

Retroactive Public Good Funding round #2 has delivered 10m OP tokens to 170 projects

Cycle 11 Project grants have delivered xxx OP tokens to the Growth Category

Either you are looking for being eligible for the next grants, or you want to benefit to farm the airdrop of Project winners, this article is for you.

4. Macro-Analysis: BTC / SP500 / DXY

Bi-weekly update on the Crypto Market.

5. Farming Strategy: Counter Party Vaults

Do you know how to earn 40% in Stable on Perps Protocols by being a liquidity provider ? Welcome Counter Party Vault.

6. Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live Show:

Tarot Finance

Tide Protocol

Podcast available at the end of the newsletter.

Spotlight Project: Polynomial

Polynomial has become The 🔴Optimism House for Derivatives products. After providing Derivatives Vaults built on top of Options, Polynomial Trade has just been released allowing users to perform leverage trading on Perpetual Contracts. Low fees, smart wallet, cross margin wallet, limit orders, mobile friendly, up to x25 leverage, no KYC… Try it and you won’t leave it. Access your seamless trading experience here: https://trade.polynomial.fi/

REMINDER: GOVERNANCE TIMELINE

1. Tech Update: What is Bedrock

Hey there! We'd be happy to explain what Optimism Bedrock Upgrade is and why it's such an exciting development in the world of blockchain!

Optimism Bedrock is the current iteration of the OP Stack. But do you know what is the OP Stack? The OP Stack is the standardized, shared, and open-source development stack that powers Optimism Mainnet and all other App Chains like BASE. We recommend you to watch this video (16min):

1.1. Layer 2

First off, let's talk about what Optimism is. Optimism is a Layer 2 scaling solution for Ethereum, which means it's built on top of the Ethereum blockchain to help it handle more transactions more quickly and cheaply. Optimism achieves this by grouping multiple transactions together into a single "batch" before submitting them to the Ethereum blockchain. This process is called "rollup."

1.2. Optimism Bedrock

Now, Optimism Bedrock is a network-wide upgrade for Optimism nodes. In simple terms, it's a big improvement to the technology that makes Optimism work better, faster, cheaper. But what makes it so special? Well, first of all, it's designed to be the cheapest, fastest, and most advanced rollup architecture available. That means it should be able to handle even more transactions than before, and do so even more quickly and cheaply.

But that's not all. Optimism Bedrock also supports multiple fault-proof and client implementations. In other words, it's more flexible and versatile than previous versions of Optimism. This makes it easier for developers to build applications on top of Optimism, since they can choose the implementation that works best for their needs.

1.3. What are the benefits of Optimism Bedrock for the Optimism network?

The Optimism Bedrock update is designed to improve the performance of the Optimism scaling solution by increasing its throughput and reducing the latency of transactions. Here are four main changes and improvements that you should know:

Faster deposit transactions: Optimism Bedrock will reduce the time required for deposit transactions to 2.5 minutes by using a smaller confirmation depth of 10-12 L1 blocks. This will be a significant improvement compared to the current estimated deposit time of roughly 10 minutes.

Reduced gas fees: Optimism Bedrock is designed to reduce the cost of transactions by introducing new changes such as calldata compression. Transactions are sent via a "non-contract address" approach to Ethereum by implementing EIP-1559.

Improved block production: With the new Bedrock sequencer, the network is expected to be able to produce blocks every two seconds, compared to the current rate of one block per transaction, is also expected to improve the predictability of block production, which will help ensure that transactions are processed in a timely and reliable manner.

Ethereum equivalence: One of the key design goals of the Bedrock upgrade is to make it as seamless and compatible with Ethereum as possible. This means that all of Ethereum's code, infrastructure, and design patterns have been incorporated into the design of Bedrock, ensuring a smooth transition between the two platforms.

In addition to these technical improvements, the bedrock update also includes several user-friendly features, such as an improved user interface and better documentation for developers. This will make it easier for users and developers to interact with the network and build new applications on top of it.

If you're interested in learning more about the Bedrock update, I recommend checking out the Optimism Docs, clicking in this link : https://community.optimism.io/docs/developers/bedrock/explainer/

1.4 Timeline

The Bedrock upgrade proposal has been voted with a large “YES”. The upgrade timeline has been defined by the OP Team as follows:

2 weeks of testnet stability on a feature and consensus-frozen Goerli

Followed by at least 3 weeks of notice to the community

Finally, deployment of Bedrock on Mainnet (so this should lead to May 2023)

1.5 Conclusion

The Bedrock update on Optimism is a significant development in the world of blockchain technology. This update will enable faster, cheaper, and more efficient transactions on the Optimism network, making it a more attractive option for developers and users alike.

The Bedrock update addresses key issues such as scalability, security, and user experience, which have been major barriers to wider adoption of blockchain technology. With this update, the Optimism network is poised to become a leading player in the rapidly growing world of decentralized finance (DeFi) and other blockchain-based applications.

And what if we are telling you that one project is waiting for Bedrock deployment to deploy his own APPChain? Look at article #2 of this newsletter!

As a Senior Research Analyst, Crypto_Linn is one of the Few persons on CT provinding real & non biais analyses. If you are looking for Alpha Aggregation, Trends & Early Insights, then it’s a no brainer to subscibre to her newsletter

2. Project update: UNIDEX creates its ⚫APP chain (MAGMA testnet live)

No, it’s not April’s Fool, even though the team released this HUGE announcement on April 1. Unidex reveals the launch of an APP chain, or Side chain, built on the OP Stack where users will be able to access all UNIDEX products. The testnet name of this chain is MAGMA, however the mainnet name has not been revealed yet, well… if you look closely on the twitter wall of UNIDEX, you may find it 🧐.

This new UNIDEX APP Chain is becoming the 5th App Chains of the🔴 Superchain:

The time i’m preparing this article, a new APP chain was just born: Welcome to Aevo Chain

2.1 What is UNIDEX

Unidex is a DEFI Hub deployed on 14 different chains and offering users the best rates for any financial instruments within the UNIDEX ecosystem. Unidex has set forthcoming objectives to become the One Stop place for Derivatives:

Options Aggregation

Swap Aggregation

Perpetual Aggregation

Cross-chain trading

Exotic leverage trading pairs

Advanced analytics

I had the pleasure to discuss with the founder Krunal Amin about the launch on the MAGMA testnet, and the main reasons they moved were to provide a dedicated infrastructure for the whole UNIDEX ecosystem (Order Book DEX, AMM Dex, Perps, Swap aggregator, Options, etc…), with the following features:

Chain gas modified to fit higher frequency trading

Cheaper storage for data availability

Liquidity Layer for all UNIDEX products

Aggregate all chains where UNIDEX is present in one unique layer

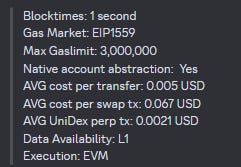

Here are some specifications of the testnet for the readers who are in Crypto only for the tech:

So let’s dive in the UNIDEX ecosystem and see what we, as users, can do.

2.2 SWAPSV3

SwapsV3 is the improved version of the Multichain swap aggregator. How does it work:

You have two available modes:

Instant swap mode: Aggregator of Dex Aggregator → The former version

Gasless Mode: This is the new Aggregator engine

0$ Tx cost

Auction order during a choosen time to obtain the best swap rate on several Dex aggregators & also on multiple chains

When the user signs for an order, they submit it to a shared crosschain orderbook that can plug into aggregators, amms, external orderbooks, whatever…

This system allows to find better rate than approved (slippage), which is then partially given back to the user and partially paying gas cost (hence 0$ tx fee)

Offers MEV protection

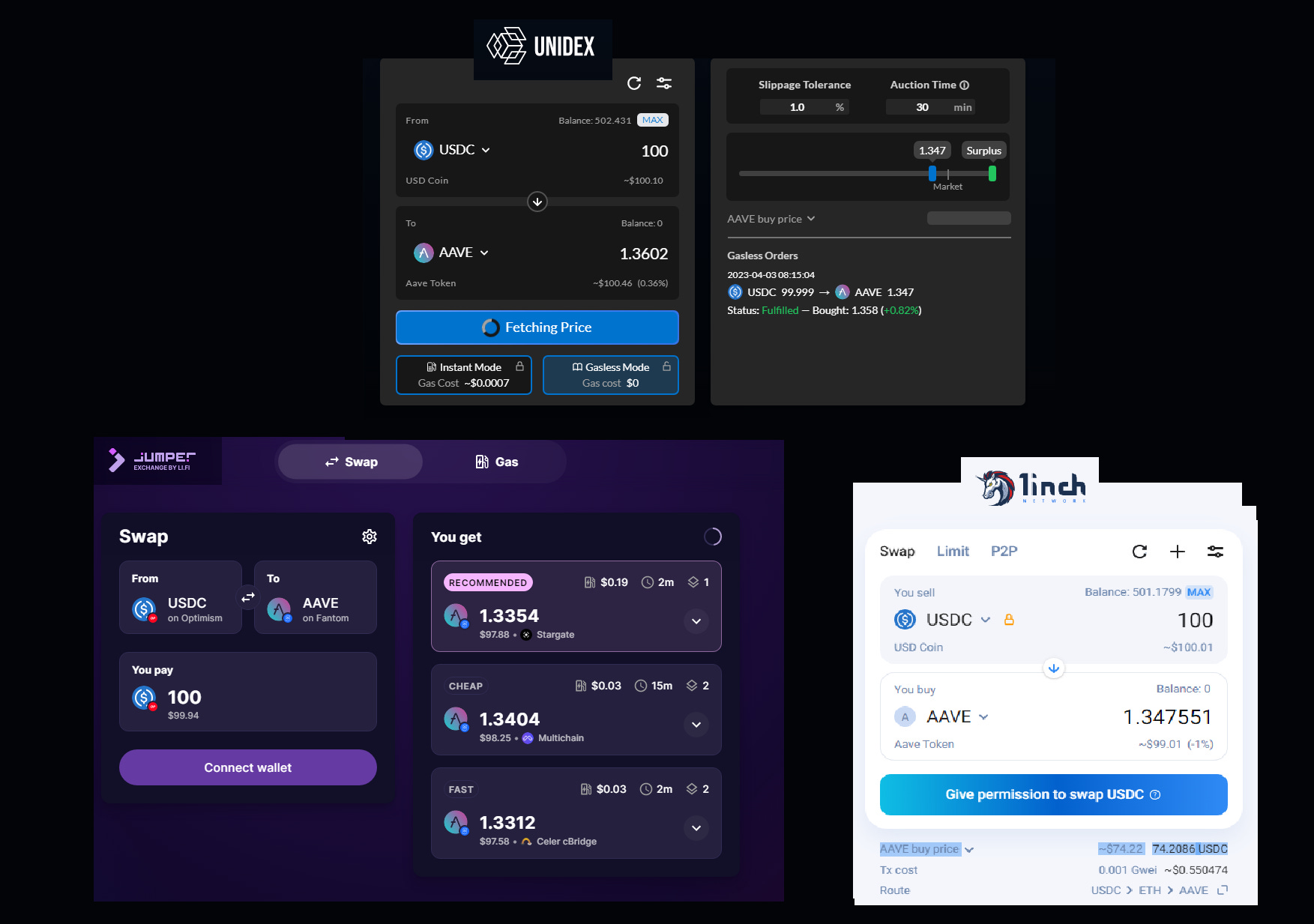

We have done an example with 3 Aggregators i’m very often using:

Jumper Exchange: Cross chain DEX Aggregator

1Inch: Dex Aggregator

You can see on this example, that while the rate was similar between 1inch & Unidex, Unidex through SWAPSV3 offered a better swap rate than the 2 others.

SWAPSV3 is available here: https://app.unidex.exchange/

2.3 From Leverage Trading to Perpetual Aggregation

Leverage trading is available on 6 different chains right now. And on Optimism, 14 different markets are available for leverage trading. However, while the solution is deployed on different chains, and the fact you can also find multiple Perps protocols on one chain, Liquidity Providers can suffer from Liquidity Fractionalization. We recommend you to have a look at the previous newsletter where we covered the State of Perps Protocols on Optimism (just click the link).

So next step for Unidex will be to leverage their product to become the 1st Perpetual Protocols Multichain Aggregator. How this will work?

Unidex will act as an unique Front End to access several Perps Protocols, automatically selected based on Users preferences (price, funding rate, assets, etc…)

Trades are placed on Unidex, routed through Unidex Liquidity Pools, and then flow into to the other protocols.

User preferences could be minimizing funding rate, better price rate, a mix of both

No extra fees is charged for this Perp Aggregation

Opportunity on another chain is notified to traders, and birdge and trade opening/close is then managed through Unidex interface

While Perps aggregation is not live yet, leverage trading is available at: https://leverage.unidex.exchange/

2.4 Roadmap & Conclusion

Unidex is building what we feel could be the replacement of Centralized Exchanges. One unique place where users can trade, swap with the best possible rate you could find on several chains. The amount of products/features to be released in 2023 is impressive as stated in this roadmap:

While Q1 2023 is behind us, there is no doubt the team will continue delivering in 2023.

It must be understood that all the features listed previously (except SWAPSV3 which is already live) will be made available after Mainnet launch, which requires Bedrock Upgrade to go live first (read the above article to know more about Bedrock). But in the mean time, you can access Testnet and play with the available Apps. For more information about how to access testnet please join Unidex Discord and get in touch with the team to get some testnet tokens.

A complete rebranding is also planned to better fit the position of this new ecosystem supported on this new APP Chain.

After DYDX moving to a Cosmos Side chain, it’s the turn of UNIDEX to create its own chain. The OP Stack is really meant to ease Project life by creating a standardized infrastructure that eases the deployment of a new chain, while enjoying the same features of Optimism Mainnet, layer 2 of Ethereum.

Finally, and this is not an investment advice, do your own research as always, the governance token of Unidex, $UNIDX, will be the chain coin used to pay for gas fees…

We let you make your own conclusions, but in the end, the OP Stack has never been so bullish in the course of only few weeks.

3. RPGF#2 & Cycle 11 - Project Grants winners

3.1 RPGF#2

RPGF stands for Retroactive Public Good Funding. It means to reward entities, projects, individuals who contribute to the OP Stack with one word: Impact = Profit.

This #2 round, a total of 10m of OP tokens were distributed to 195 projects split in 3 categories: Education / Tooling / Infrastructure. Check the full article here.

https://optimism.mirror.xyz/Upn_LtV2-3SviXgX_PE_LyA7YI00jQyoM1yf55ltvvI?rpgf=2

How can you benefit from it? It’s pretty simple:

Start contributing & share on twitter, reddit, discord in your own expertise field

Check Out Optimism twitter account announcement about the next RPGF (not announced yet)

Nominate yourself if someone else has not already nominated you

I give you 3 perfect examples on how you could contribute and earn retroactive support from the OP foundation, without even knowing you can be eligible for it:

Education: ZachXBT is an onchain specialist who has tracked several hackers and support individuals and project teams to recover stolen funds. He receives 188.5k OP tokens.

Infrastructure: ProtocolGuild is a collective of Ethereum Core Developpers

Tooling: Defillama is the MUST TO USE tool for any Defi users

3.2 Project Grant winners for Cycle 11:

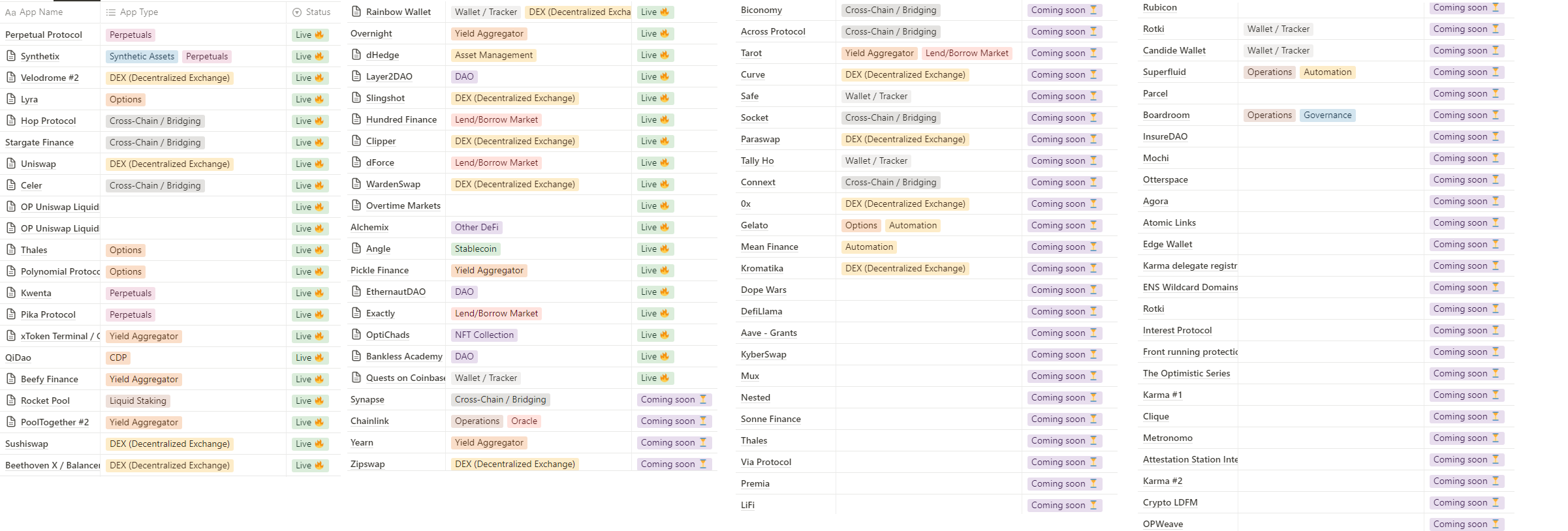

3.2.1 List Active & Coming Grants :

As a reminder, here are the on-going and future OP incentives per project.

3.2.2 Awarded Projects from Cycle 11:

The final results are just published, that's why we werz all waiting to release this #7 newsletter. This cycle, 14 Winners on the Growth Experiment Category for a total of 1,6m+ of OP tokens to incentivize use of the awarded projects. Let’s see the Winners:

Growth Experiments

Another World 4 (50k OP): a cross-NFT-community open-world game with playable L1/L2 (Optimism) NFTs. Distribution: 100% to players holding certain NFT.

Bored Town (50k OP): art-focused Free Mint NFT project that is planning an art competition. Distribution:

30% for Bored Town Art Contest prizes.

20% for promoting the art contest partnering with Quest3 and Superposition to create a series of quests that require users to bridge their ETH to Optimism.

50% Incentivize Bored Town community and voters to mint, trade, and participate in quests by offering rewards.

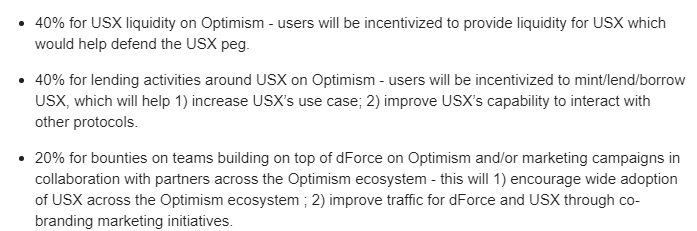

dForce (200k OP): a set of DeFi protocols covering assets, lending, and trading, serving as DeFi infrastructure in Web3. Distribution, over a priod of 3 months for each:

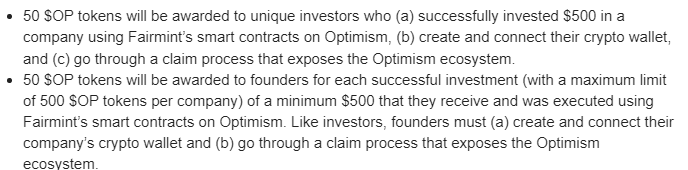

Fairmint (250k OP): a software stack that empowers founders to passively receive investments from their biggest fans and grant equity to anyone that adds value

Geo Web (2k OP): public consensus for geospatial augmented reality, distributed to users claiming Parcels.

Giveth (40k OP): open, non-hierarchical global initiative empowering social, environmental, and humanistic impact projects with modern technologies

16k OP distributed to the 1st 640 projects listed on Giveth with an OP address

24k OP used to increase Protocol Owned Liquidity GIV/OP

Metalswap (30k OP): decentralized hedging swap protocol that provides a tool for protecting assets from market volatility, distributed in 10k OP to Liquidity Providers, and 20k OP for users of Hedging Swap tool, co-incentivized with XMT.

Galxe (Oat) (200k OP): aims to build an open and collaborative credential data network that is accessible to all developers in Web3 by providing infrastructure for community members to curate and contribute digital credentials to a data network. 100% will be used to provide Gasless mint to Optimism Users.

Optiland Quests (20k OP): learn-to-earn program integrated with Optiland NFT community that is designed to educate Optimism users on Optimism dApps. 100% will be used to reward questoors over a 16 weeks quest campaign.

Paytrie (50k OP): stablecoin on/off ramp serving users in Canada. 100% will be used to payback protocol fees.

Rabbit Hole (248.5k OP): token distribution platform that enables users to earn ERC20 tokens for completing on-chain tasks in various protocols. 100% will be used to reward participants to the following quests:

ShapeShift (200k OP): community-governed multi-wallet, multi-chain app is architected for complete decentralization, and is powered by an open-source stack. Distribution will done over 6 months as-follows:

82,5% - On-chain task rewards

10%: Liquidity mining

7.5% Marketing

Threshold (200k OP): decentralized, permissionless, and censorship-resistant Bitcoin bridge. 100% will be used to incentivize users to Mint/Briudgt tBTC on Optimism, as well as deepening liquidity on Curve and Velodrome, usage with Sonne & Euler '(once deployed on OP).

Vesper (75k OP): multi-chain yield aggregator offering users secure opportunities to generate yield on their crypto assets in a non-custodial manner. The distribution will be:

To vault depositors (80%): 25%/25%/50%, 1 month each on vaults USDC, ETH, wstETH, OP

To 3rd party integration (20%)

4. Macro-Analysis: BTC / SP500 / DXY

Two weeks have passed since the previous analysis. We observe that BTC price has not evolved, and we are in an accumulation phase before a bigger movement. Up or Down 🧐?

4.1 BTC Range: Be patient

It is important to remind beginner traders not to rush into impulsive positions and to stick to their trading plan. Accumulation periods can be emotionally challenging, but it is crucial to remain disciplined and patient.

These periods tend to make us overtrade, meaning that stop losses are repeatedly hit at a lower price than the purchase, and we re-enter at a higher price.

It is preferable in uncertain times to let the market do its thing. Remember, money goes from the impatient to the patient. Thus, we will be patient until the king (bitcoin) gives us the direction of the market.

We are currently in a range between $26,700 and $28,900. However, we observe a strong daily divergence. It must be taken into account for our risk management, and in case of a break below the range, we will switch to stable coins to preserve our previous gains and be able to buy lower.

Consolidation under resistance is common in a bull market and is bullish. The situation is therefore neutral. In any case, the longer the accumulation period, the more explosive the movement will be. We will need to react when we have a clear direction.

4.2 Altcoins direction

Regarding altcoin dominance, we can observe on the BTC.D chart that it is approaching a strong resistance that has rejected BTC.D during the last 18 months.

It is wise to closely monitor the resistance and the bearish divergence to make informed decisions. Altcoins often tend to follow bitcoin's movement, so it is important to keep an eye on its evolution.

If the resistance is crossed, we will have a strong bearish signal on altcoins. Conversely, a rejection of the resistance down to support would allow altcoins to move higher.

4.3 Conclusion:

Trading: in these uncertain times, we tend to change our minds from day to day (bull or bear). Let the market hit the stop losses and then re-enter when we observe a higher low. Be patient and wait for bitcoin to exit the range.

Investing: Below $28,000, we are still in an accumulation zone for BTC. DCA-in is still relevant for long-term holding.

Do not forget that bitcoin is the main market indicator. Sometimes not trading is a trade, which avoids overtrading. Sit on your hands and wait for a clear direction.

5. Farming strategy: Counter-Party Vaults

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

Today the farming strategy is brought by Stephen from Defi Dojo, who presented the Counter Party Vaults, aka Liquidity Providers yield farming on Perp Protocols. I advise you to watch his fantastic video:

During the last newsletter we have talked a lot about the State of Perp Protocols on Optimism. These protocols work thanks to Liquidity Providers who earn a share of trading fees, while also playing against traders (they win if traders loose). You may already be aware of GLP pool from GMX, or gDAI pool for GNS, but what are the yield farming opportunities on Optimism Perps Protocols. Here is a short list of the possibility we explored:

Note: eTOKEN stands for escrowed token, token locked for a certain period of time

Mummy Finance (MLP vault): 113,7% (ETH APR 17,3% + eMMY 96,4%)

OPX Finance (OLP vault): 23,8% APR in ETH

Unidex (Dai Pool): 40.9% APY in DAI

Synthetix (Debt Pool): This vault is more complex as you need to stake SNX, to borrow sUSD. Your rewards are proportional to your debt. APR: 23.6% paid in eSNX (inflation) + sUSD (trading+liquidation fees)

Note: Before depositing funds into those farms, make sure to understand how these vaults are working, and check the traders behavior (the house always wins at the casino). Non financial advice, do your own research.

6. Podcast:

Following the Twitter Poll, from now on, the podcast will be shared together with the newsletter and not anymore in advance. If you want this to be changed, let me know in the comments.

Tarot Finance

Tide Web 3

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of all podcasts.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Discord:

https://discord-gateway.optimism.io/

Subli_Defi Social accounts:

Discord Handle: Subli#0257

Twitter: Subli_Defi

Lenster: Subli_defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi