Thank you for reading this freshly cooked newsletter. Your continuous support means a lot for me, and keeps fueling me to dig into Base and the surrounding ecosystem for you.

If you missed the previous newsletter, it’s just one click away from you HERE.

————————————— This Week Menu ——————————

🦸♂️ Weekly News on the Superchain

📈 Superchain Stats

🔵 VFAT: Yield Aggregator

Why VFAT / Your best friend for yield farming / Yield opportunities / Airdrop

🏈 Post of the Week

🔓 Token unlock in the next 7 days

Sponsor : Segment Finance

Discover Segment Finance, your top-tiers lending and borrowing protocol on 🟠BOB chain. The team is planning to launch by the end of 2024, $USEF - new omnichain token - that will entitle stakers to protocol revenue distribution, and a new LST backed stablecoin which will power their LST credit card. Connect to https://app.segment.finance/

🦸♂️ Weekly News on the Superchain

🥇Midas RWA just launched “The first regulated on-chain investment products in Europe” on Base with 2 new products:

💲$mTBILL offers onchain exposure to short-duration U.S. Treasury Bills

⚖$mBASIS tracks a delta-neutral crypto basis trading strategy

👏Stripe is now accepting Crypto Payment in $USDC. Great job by Circle!

😱World Liberty Financial (WLFi), the Defi Protocol launched by the Donald Trump sons, is building a friendly AAVE V3 fork. WFLi released a proposal on the governance forum of AAVE that’s worth reading: The AAVE DAO will receive 20% revenue of WLFI & 7% of total circulating supply of $WFL token. $WFL public sale on 15/10.

🦄Uniswap launched Unichain, the new L2 on the Optimism Superchain with Fast blocks (250ms), cross-chain interoperability, a decentralized validator network, and sequencer revenue sharing for $UNI stakers

🟡Mode season 2 ends on 18/10 and Season 3 is starting right after with a new staking mechanism and 2m$ incentives to reward users. Season 3 kicks off Phase 2 that will see Mode focusing on AI-enabled infrastructure and interfaces to power the DeFi ecosystem.

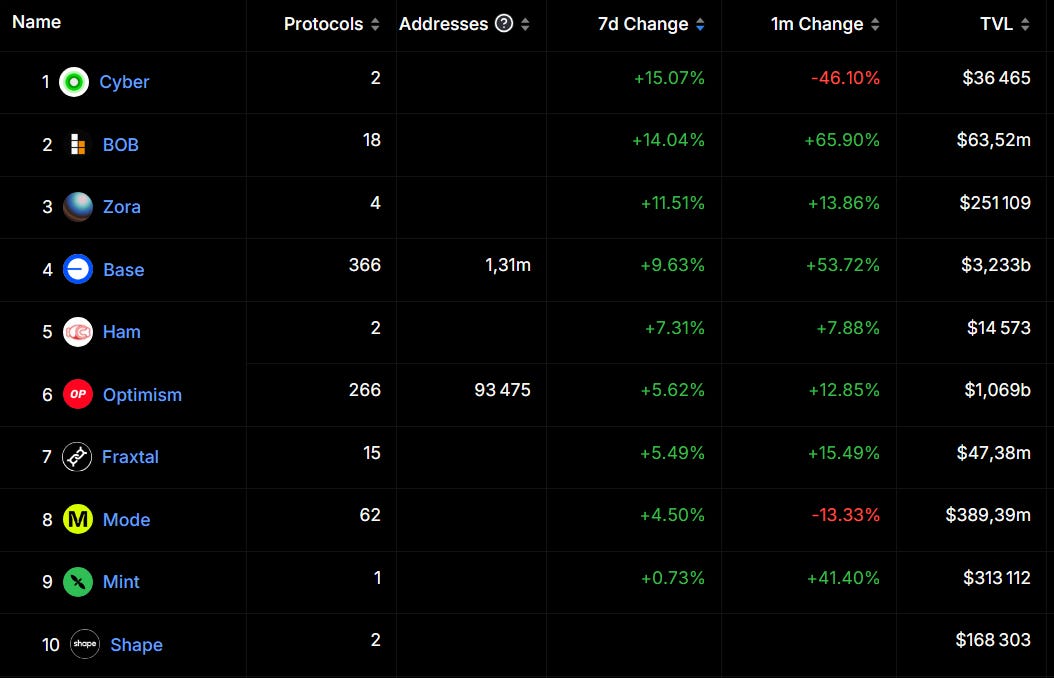

Superchain Stats - TVL Change Leaderboard

Source: https://defillama.com/chains/Superchain

🔵VFAT: Yield aggregator

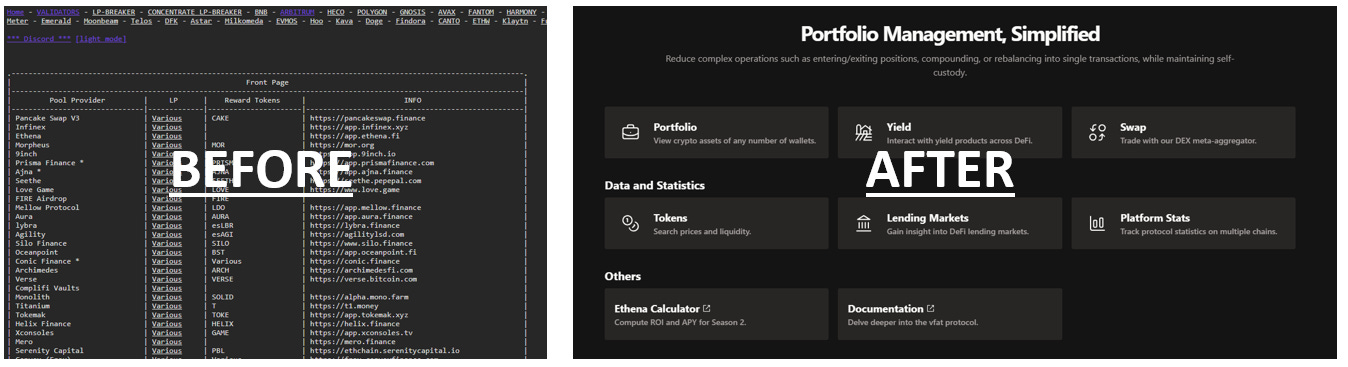

Only OGs remember VFAT.Tools at the time of Solidly, Solidex & co. It was the only tool, with a windows 3.1 User Interface, able to give you the right yield for every liquidity pool.

VFAT is one of the smartest person in Crypto, and it seems that he went from a DATA NERD UI to a Brand New retail Yield Aggregator:

Let’s start with a quick introduction:

Protocol Type: Yield Aggregator

Tokens: No (Not Yet ? 👀)

TVL: 36m$ (which 90% on Base) -> Rank #15 protocol on Base

Today, I’m going to cover:

Why VFAT?

Why CLAMM?

Your best Friend for yield farming

Tutorial

Airdrop

Why VFAT?

I must be honest with you. I didn’t know VFAT made a brand new protocol, with a very sick UI for non NERD like me. And when scrolling through the different features it offers, it quite solves a lot of problems i have currently such as:

Depositing into a Concentrated Liquidity Pool

Managing this position

VFAT is a legend in the DEFI space, so I want to trust that things have been made considering all the security requirements that involve a DEFI protocol. At least, the project is not audited by CERTIK…

Project has been audited by yAudit, which is an auditing collective made up of the best auditors hand-selected from the Yearn Academy Academy (incubated by Yearn Finance) training program.

And the project currently has a projected annualized revenue of 3m$, not bad at all! Let’s go deeper.

VFAT offers some automations to manage your liquidity pool position. By depositing your LP token into SICKLE smart wallet on VFAT, you can ask the protocol to:

Auto-Harvest: automatically harvests earnings and optionally converts them to a different token.

Auto-Compound: automatically compounds earnings into each position.

Auto-Rebalance: automatically rebalances a concentrated liquidity position once it is out of range.

Why CLAMM?

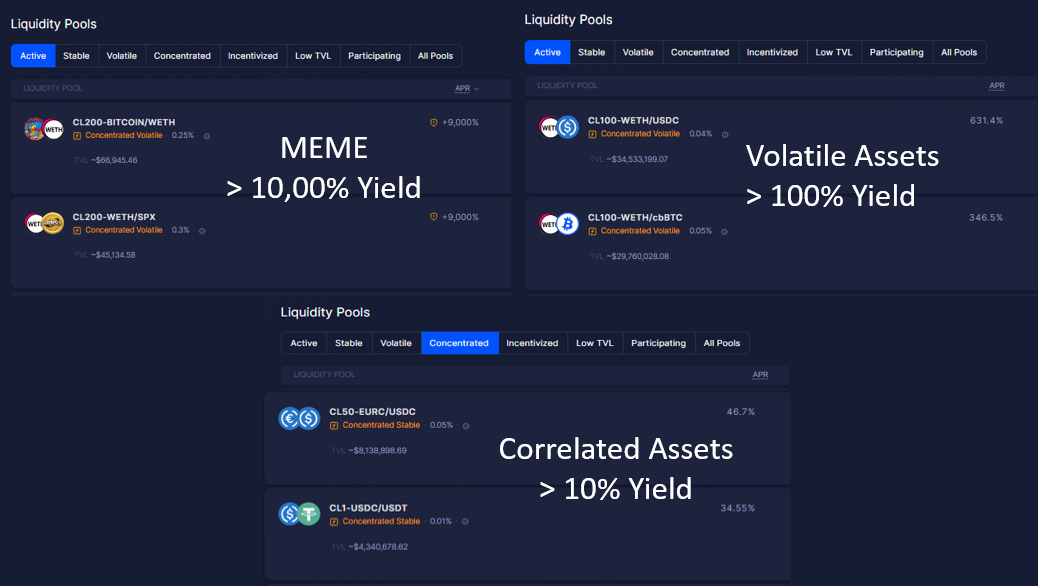

Concentrated Liquidity AMM, or Concentrated Liquidity Pool, offer the best yield you have on the crypto space. Check an example on Aerodrome, on Base.

We have already covered a tutorial on how to use CLAMM on Velodrome. Read it here. I know what you’re going to say:

Concentrated pool is too difficult for deposit → Well VFAT is here to help

Concentrated pool is too difficult to manage → Well Beefy, Mellow ALM are here to help

Concentrated pool can get you rekt → Well, it’s like everything. Learn first, practice, master!

Again, CLAMM offer the best yield in the space. No Pain, No Gain.

VFAT is also listing all other type of pools, such as Stable Pools (sAMM) and volatile pools (vAMM).

VFAT is your best friend in Yield Farming

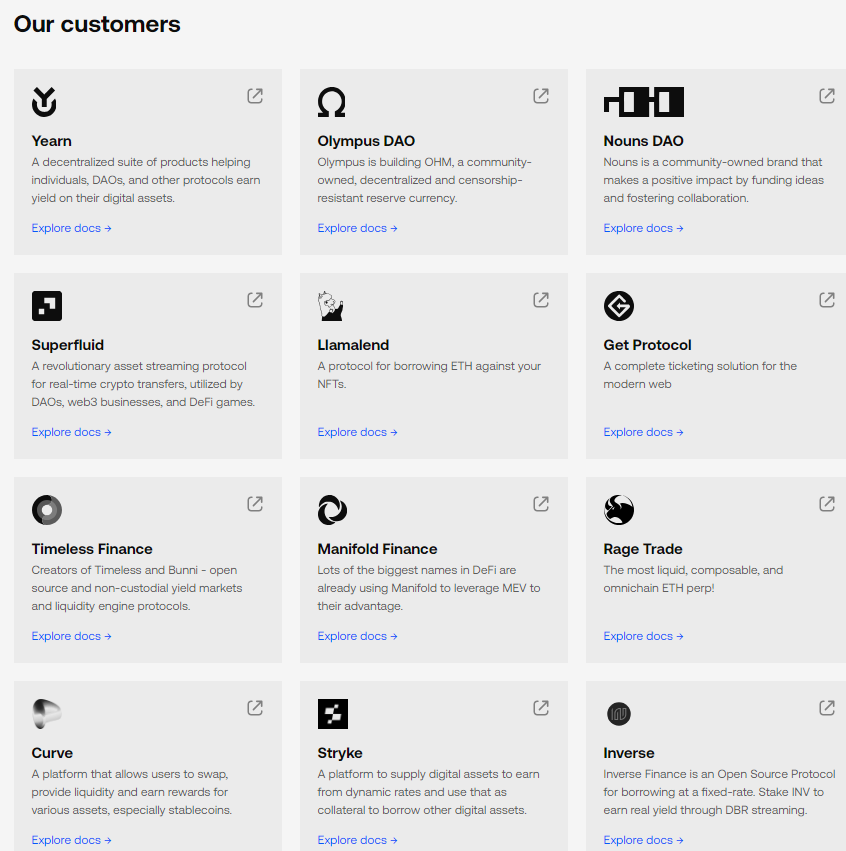

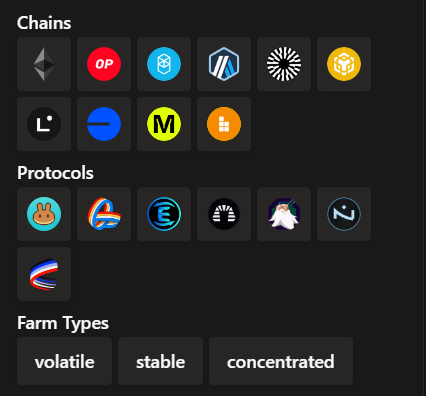

VFAT is available in 10 chains, and integrates the following protocols:

Pancake Swap, Velodrome, Equalizer, Ramses, Trader Joe, Nile, Aerodrome

VFAT very interesting features are:

Search by token

Filter by Pool TVL

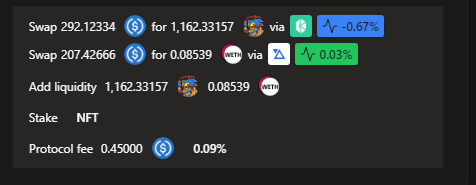

Deposit any token in the pool (VFAT takes care of swap into the pool tokens, split, deposit & stake in the DEX)

Automate the management of your position (claim reward, compound, rebalance your position within the pool)

Tutorial

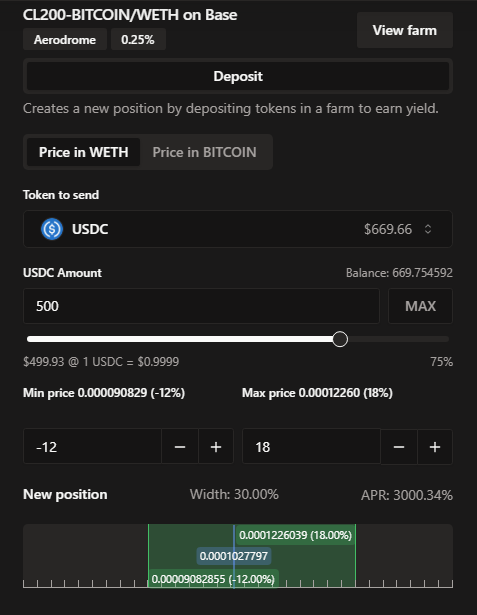

Here is a quick example I have made on a concentrated liquidity pool $BITCOIN/$wETH. My constraints:

I only have $USDC in my wallet

I don’t want to manage my position (claim rewards, make sure to be within the active price range, etc…)

First Step: Set-up

Select the token to be sent, and the price range (width of 30% seems good enough), yield is about 3,000% APR.

Then, VFAT simulated what it will do in the background on your behalf.

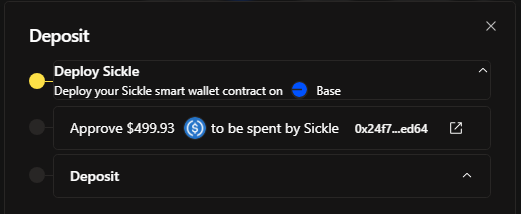

Second Step: Approve

By approving the transaction, you will first approve the creation of the smart wallet where your funds will be deposited into.

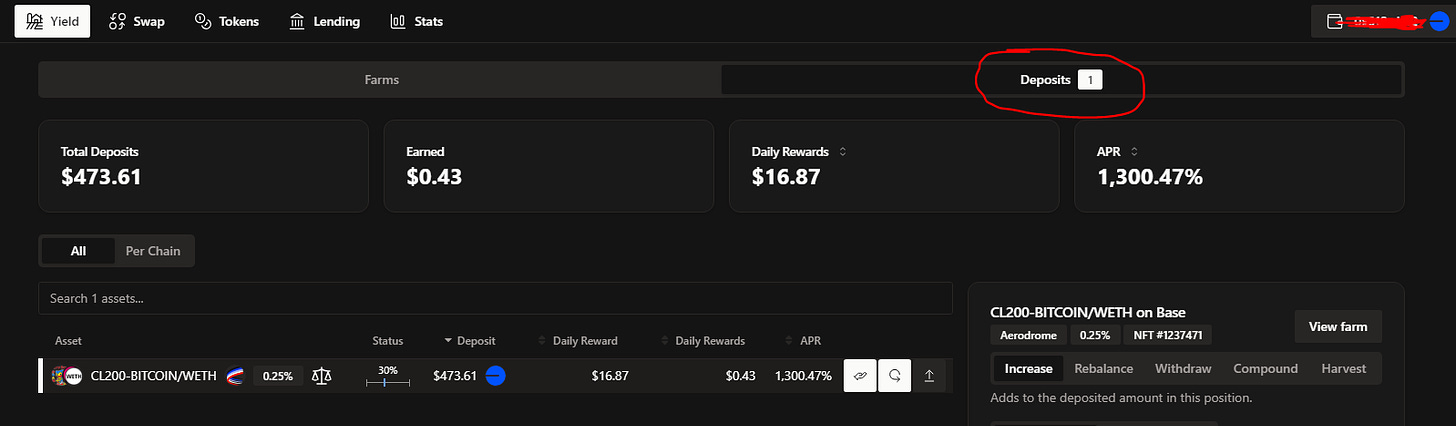

Once funds are deposited, you will be able to see them in the YIELD page, under the “DEPOSIT” tab:

Step 3: Automate your position

On the right hand side of your position, you have access to different functions:

Increase / Rebalance / Withdraw / Compound / Harvest

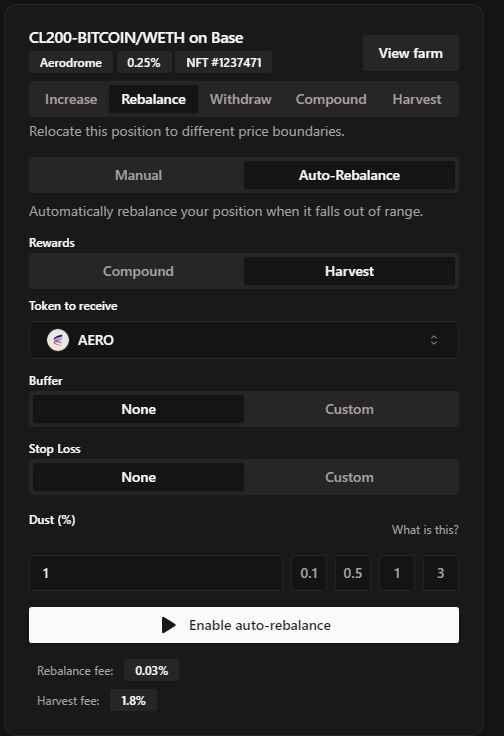

So in this example, I want to rebalance my position as soon as it is out of range. So the Rebalance function should not be considered as an Automatic Liquidity Management position like Beefy or Mellow ALM is doing, but more of an automatic trigger of withdraw/swap/deposit/Stake once your position is out of range.

Click on “Enable auto-rebalance”, and that’s it. You’re all set-up!

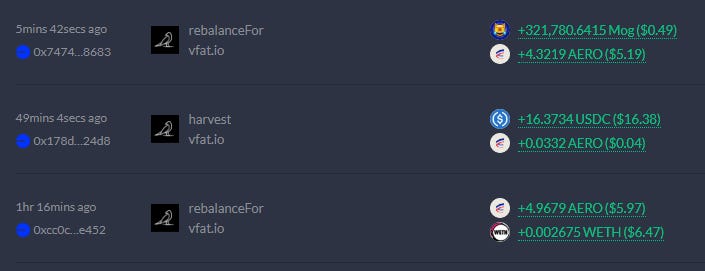

Now let’s VFAT work for you: Claim / Rebalance / Compound

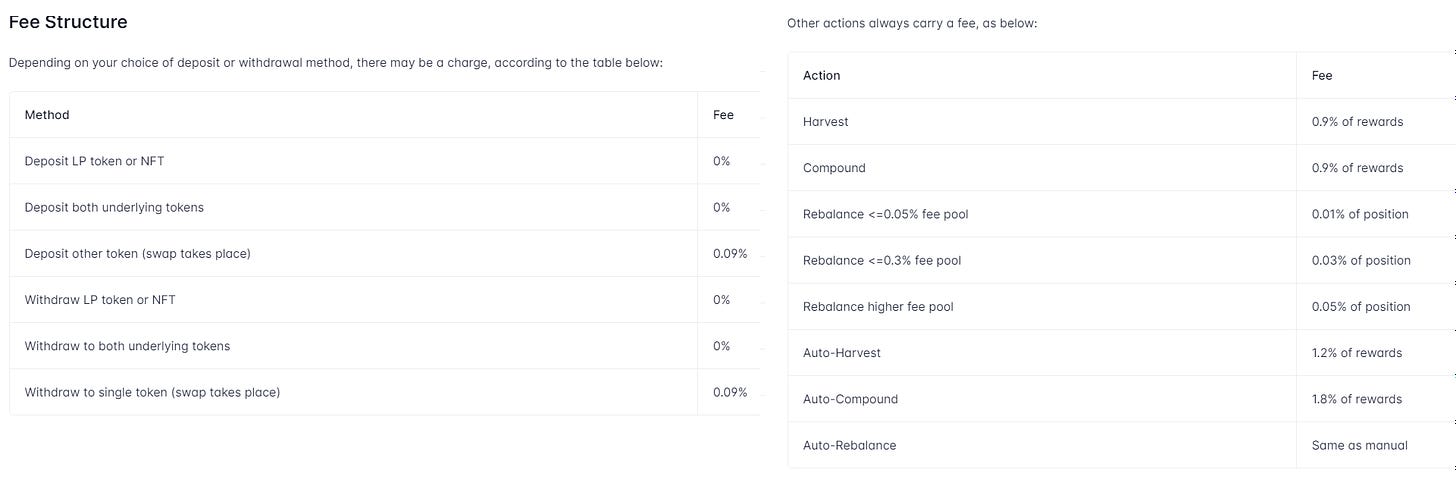

FEES:

As I told you earlier, VFAT is making around 3m$ annualized! Great, but we pay that! So is it worth it? Yes, but your deposit should stay a couple of days so that yield > fees.

If you wish to have a look at the docs: https://docs.vfat.io/

What’s Next?

The future of VFAT looks bright as the management & aggregation of liquidity pools starts being a real headache for yield hunter & farmer that we are.

So VFAT is planning to extend his product in the following ways and is currently getting their new contract audited as the time i write this article:

More auto-rebalance features

A new auto-exit option (exit the position at a given price) => I love this feature, it’s like a limit order but at a given price, while your funds can still generate yield during the idle period

With regards to a potential token, it would make sense to redistribute a share of the revenue to the users, but shouldn’t a project work out its PMF (Product Market Fit) first? This is the ETHO of VFAT, and i couldn’t agree more

🏈 Post of the Week: Arthur - Founder of Defiance Capital

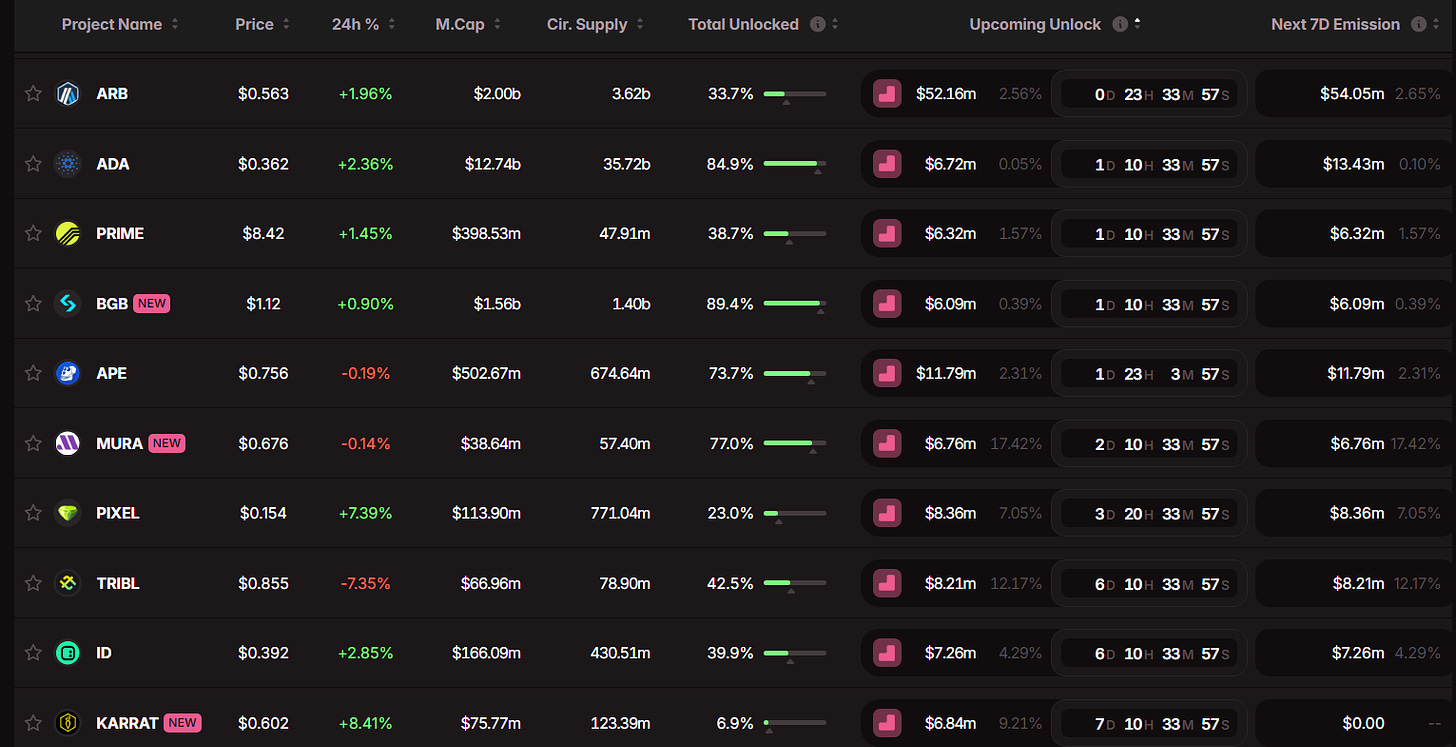

>5m$ UNLOCK IN THE NEXT 7 DAYS

I’ve partnered with Tokenomist to offer discount PRO plan: https://token.unlocks.app//?aff=Subli or Code SUBL1

Benefit: 15% discount on PRO subscription

Disclaimer: Nothing in this content is financial advice. I may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky. Be ready to loose everything you invest in.