Thank you for reading this freshly cooked newsletter. Your continuous support means a lot for me, and keeps fueling me to dig into Base and the surrounding ecosystem for you.

if you missed the previous newsletter, it’s just one click away from you HERE.

————————————— This Week Menu ——————————

🦸♂️ Superchain news

📈 Superchain Stats

🌊 Ozean: RWA chain by Clearpool

What is Clearpool / Why Ozean / Tokens / Yield opportunities

🏈 Post of the Week

🔓 Token unlock in the next 7 days

Spotlight: OpenCover

OpenCover is an onchain insurance (=cover) provider working with the leading insurance protocol Nexus Mutual as underwriter. This week, OpenCover launches the 🛂Base Pass: 1 produc - 9 protocols.

Special event on Product Hunt: Get your first insurance up to 10k$ deposit for FREE here: https://www.producthunt.com/posts/the-base-defi-pass

Remember: Security must be your priority #1.

Disclaimer: This post is not sponsored. Just wanted to share with you this amazing product i’m using since weeks now thanks to a private access.

🦸♂️ Superchain news

🥇World Chain, by Worldcoin, is now live. World chain is launching on the Optimism Superchain

👾Kraken has launched its wrapped BTC, $kBTC, on Ethereum & 🔴OP Mainnet, expect some liquidity to come on Velodrome.

🤖Sturdy announced the integration of Morpho into their Bittensor Subnet (SN10) to optimize yield through Sturdy decentralized AI-powered infrastructure

🟡Mode is one of the founding member of the AIFi Alliance, alongside Sturdy & Allora and 8 other companies, aiming at increasing adoption of AI into Defi

🚴♂️Velodrome & Hyperlane partnered to launch Superlane, the interoperability layer to make Superchain interoperability. Audit planned end of October for a launch in November

👀Contango raised 3m$ in few hours during their public sale at 45m$ FDV $TANGO. The sale was conducted at the same FDV as early investors/VCs/Angels. How is it possible to avoid sell pressure once the token goes live ? Worth reading this post

🌊Clearpool is launching WaveMaker, Ozean chain's accelerator and end-to-end solution for tokenizing RWA

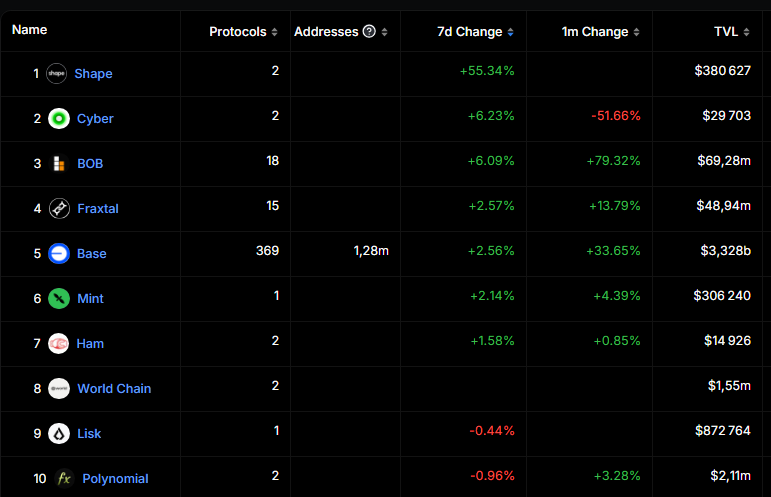

Superchain Stats - TVL Change Leaderboard

New L2 Shape leading the board. BOB & Cyber in the top 3 for the 2nd consecutive week. Fraxtal growth in % > Base. OP Mainnet & Mode out of the top 10 ranking this week.

Source: https://defillama.com/chains/Superchain

🌊Ozean: RWA chain by Clearpool

You start knowing my thesis now:

Base

Optimism Superchain

RWA

So, today, I have picked up a project that fits the 2 last points Superchain + RWA, named CLEARPOOL.

Let’s start with a quick introduction:

Protocol Type: Undercollateralized Lending

Tokens: $CPOOL

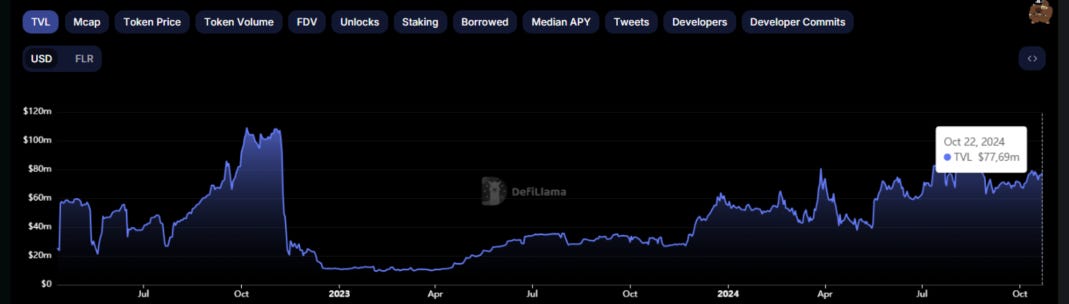

TVL: 78m$ ($CPOOL staking = 26m$)

Today, I’m going to cover:

What is Clearpool ?

Why Ozean chain ?

Yield opportunities

What is Clearpool?

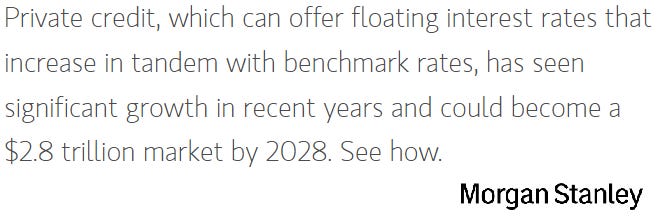

Clearpool is a Defi protocol offering private credit to institutions. Do you remember the article about Anzen Finance when we talked about Private Credit? Check this here. But as a reminder:

Private Credit refers to lending to companies by institutions other than banks.

The private credit market is booming, and according to Morgan Stanley the market can double in Tradfi (currently at $1.5 trillion in 2024) in the next 4 years:

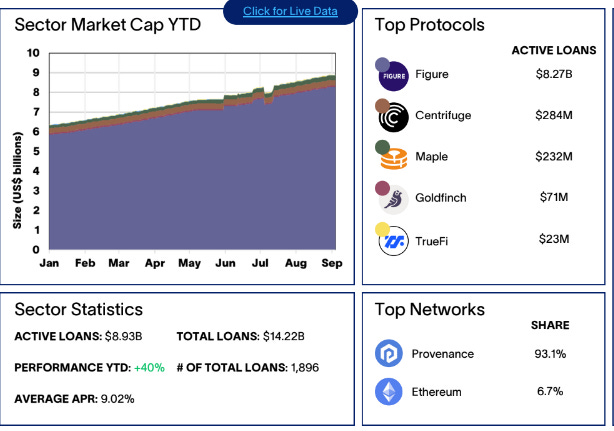

But the above is offchain. So what is the current state onchain of the Private Credit sector ?

Figure is one of the largest private credit firm, and embraced the Fat APP thesis in June 2024: “Figure Technology Solutions Launches Blockchain-based Marketplace of Private Credit Loans”.

Clearpool, still waiting to be registered by RWA.xyz, should be ranked #5 with 29m$ active loan.

And if you look at the above chart, the size of Active Loans has made +40% over the last 12 months, showing a steady growth, mainly through the amazing performance of Figure. More precisely about Clearpool, the TVL (not related to active loan, as lenders are included), made 6x since the ATL in Feb-2023.

Why Ozean chain ?

If you are wondering what’s the Fat App Thesis or Why an application should launch its own Chain? I recommend you listen to this:

So Clearpool is launching its own application chain, named OZEAN, powered by the OP Stack, and part of the Optimism Superchain. This chain has a lot of interesting features, and this development is supported by Hex Trust (Institutional Digital Asset Custodian), SEED investor into Clearpool back in 2021. Note who are the most recent investors back in 2022 👀:

Ozean specificities:

Goal: The 1st RWA yield chain

Architecture:

Stack: OP Stack & Part of the Superchain

Operation: Powered by RaaS (Rollup as a Service) Caldera

Native Stablecoin: USDX issued by Hex Trust backed by T-Bills

Ozean native wallet

Tokenomics:

Yield Bearing Stablecoin: Lock USDX for ozUSD to earn the underlying yield

Gas token: USDX, no need for $ETH

Gov token: $CPOOL. Stake it and earn:

Sequencer fees

a share of Yield from staked USDX

Enhanced yield on ozUSD by staking both CPOOL & USDX

Buy-Back from Clearpool protocol revenue will continue

A new liquidity layer made up of RWA, Blue Chip assets, Stablecoins called O2 (Oxygen Pool) → It seems to be very similar to GLP pool from GMX

The assets of these pools will be used by Ozean Team to solve cold start liquidity problem on protocols such as Dex, Perps, Lending/Borrowing, stablecoin issuance (rehypothecation)

The pool will be auto-rebalanced

Yield generated by rehypothecation will be reinvested

Compliance layer for institutions with KYC requirements

Key Partners:

Launching a chain is not a catalyst by itself. You’re just a launchpad of decentralized applications. But, if you are an application, it makes sens to launch your chain to capture sequencer revenue, and set up your chain with your own parameters. But, it can only work if you have users.

This is where Hex Trust has for me a big role in this new pathforward as they will have to onboard their 270+ institutional clients like banks, funds, exchanges, financial institutions, protocols, dApps, and foundations.

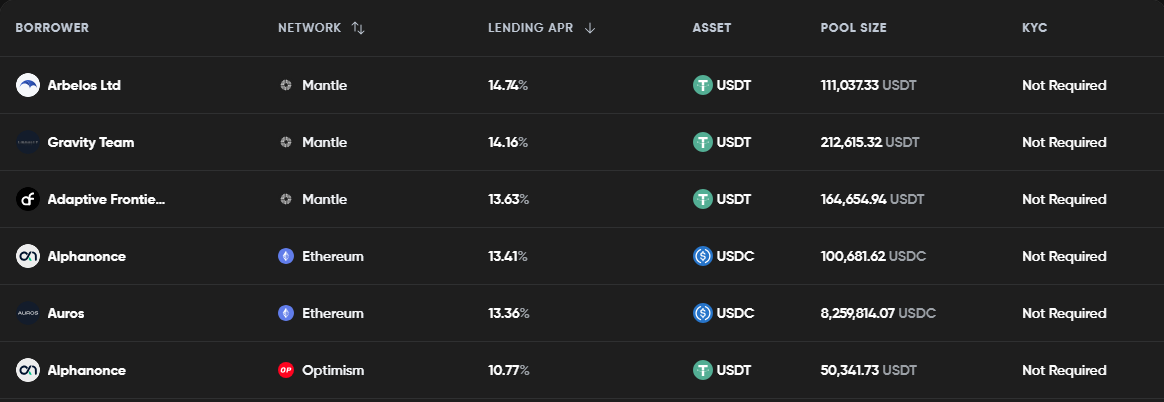

Yield Opportunities: 2 digit yields on your Stable

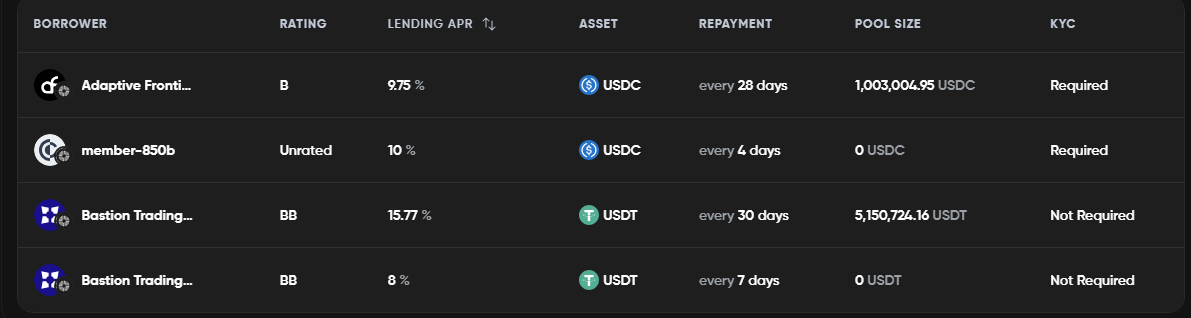

No risk, no Reward. Private Credit is an under-collateralized lending meaning that the borrower collateral is less than the borrowed amount, so very different from AAVE which is an over-collateralized lending protocol.

Each borrower on the Clearpool app is rated through the Credit Risk Scoring method managed in real-time by CREDORA. The methodology scores all borrowers out of a total score of 1000. Ratings are expressed as letter grades from AA to D, indicating the relative level of credit risk.

Credit risk assessment is not new. The most famous one is assessing Credit Risk for countries, like the company COFACE is doing:

Back to clearpool 👇

There are currently 3 type of lending pools:

Clearpool Prime → Only for institutions (KYC & AML compliance)

Credit Vaults → Fixed repayment schedule and fixed withdrawal window

Dynamic Pools → Withdraw anytime - subject to pool liquidity

Check all available pools here: https://clearpool.finance/lending

Conclusion:

Clearpool with Ozean has a clear Product Market Fit, and with the rise of Private Credit, most likely we will see more RWA products onchain.

The price action of $CPOOL has been quite strong the past few weeks. We already made a Technical Analysis of this token in July last year where we finally got our ABC correction completed before this move up that started in August 2024.

I want to thank Jakob (Founder & CEO) and Sam (CMO at Clearpool) for answering all my questions. And be sure, i’ll continue to follow them up closely.

Disclaimer: I have a position in $CPOOL, and Clearpool is a partner of The Optimist. However, this article is not sponsored and was planned way ahead of this recent partnership.

🚑 Post of the Week:

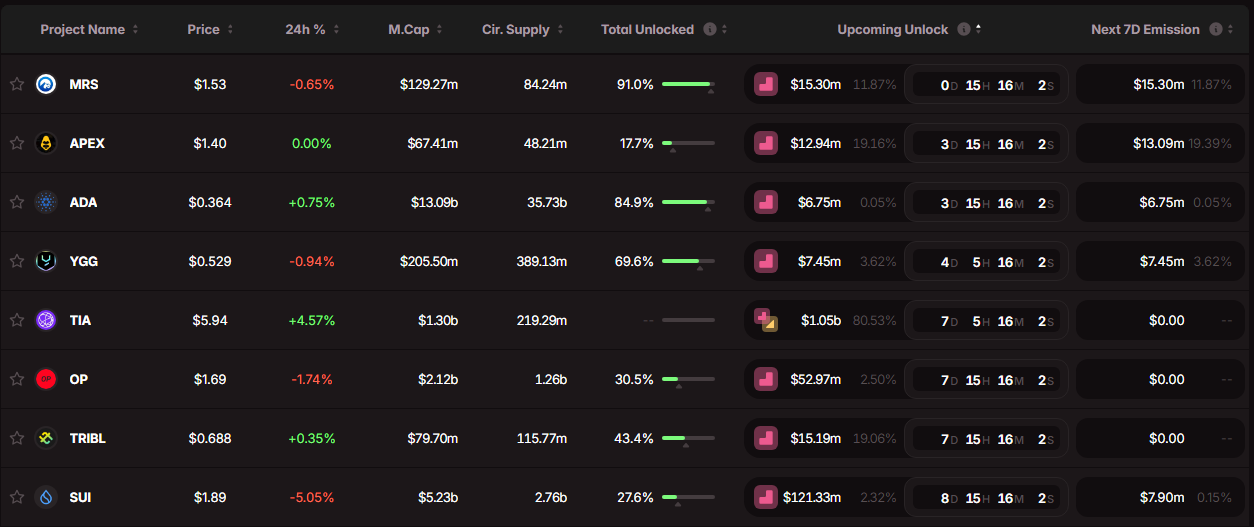

>5m$ UNLOCK IN THE NEXT 7 DAYS

I’ve partnered with Tokenomist to offer discount PRO plan: https://token.unlocks.app//?aff=Subli or Code SUBL1

Benefit: 15% discount on PRO subscription

Disclaimer: Nothing in this content is financial advice. I may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky. Be ready to loose everything you invest in.