The 🔴Optimist: (L)Earn with Defi #21-2

Learn & Earn with DEFI on Layer 2 chains / OP Stack / Optimism Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed part 1 [OP Superchain News], don’t worry, just click HERE.

Click on your preferred language to access the translated version:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Turkish - Vietnamese

KEY TAKEAWAYS

🔵Which Stablecoin is SAFU?

In 2021/2022, I was doing fundamental analysis on Alt coins. Now in 2023, I have spent more time doing FA on Stablecoin and assess which one is the best to hold & farm. Hopefully, I recently Discover BlueChip, an independent, nonprofit stablecoin rating agency.

🟢Crypto market review

Bi-weekly update on the Crypto Market

🟩Trading/Investment Tips

When to take profit?

🟤Farming strategy: Money market or loan service: which platform should you choose?

There are few different ways to borrow assets. The 2 most known protocols are Maker [CDP or Loan Service] & AAVE [Money market or Lending protocol]. Which one is the best? Let’s find out, with a special Alpha about Ethos Reserve.

Spotlight project: Oath Ecosystem

The OATH ecosystem is changing the world of DEFI by setting up new standards for security, capital efficiency and real yields.

With Ethos Reserve V2 coming soon and updated tokenomics on the way, OATH is set to shake things up on Optimism in 2024. You can find $OATH on Velodrome and check out their site at oath.eco.

Follow Oath Foundation on X & Turn on notifications.

🔵Which Stablecoin is SAFU?

by Subli

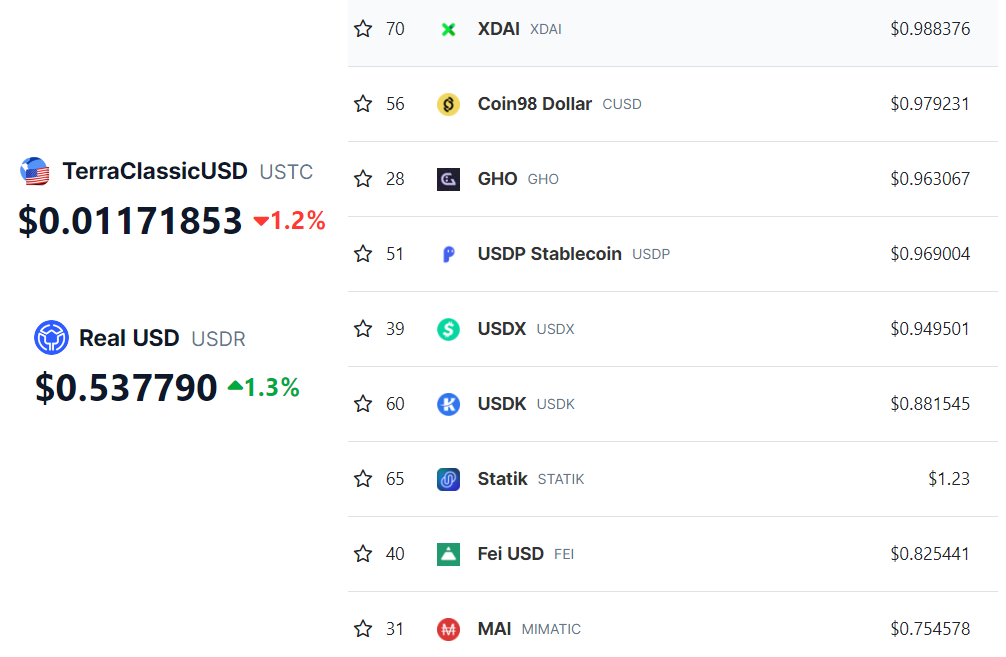

What’s the common feature between $UST, $USDR & $MAI?

These 3 stablecoins lost their PEG to 1$.

What if we could rate & rank stablecoins and choose the safest one? Welcome to BlueChip, an independent, nonprofit stablecoin rating agency.

Introduction

Stablecoins are the backbones of DEFI because it’s the only asset that has deep liquidity in Crypto and no volatility, that you can hold at any time without being exposed to the market. It’s also the easier way to enter crypto as from now.

Centralized or decentralized, immutable or upgradable contract, backed by liquid or illiquid assets, there are so many stablecoins on the market, which one to pick?

But, you may wonder, why this choice is so important? Cause it’s VERY frustrating to keep or farm a stablecoin at 10% and see its value loosing 10% in couple of hours due to a depeg event.

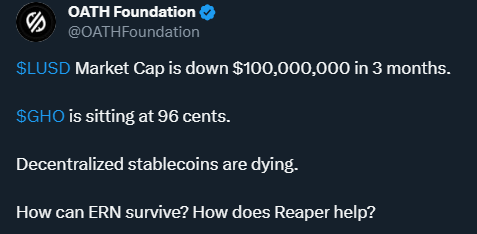

Even the most robust protocols are subject to this phenomena like AAVE with their $GHO stablecoin:

So which Stablecoin to HOLD? 🤯

Stablecoin Rating Agency

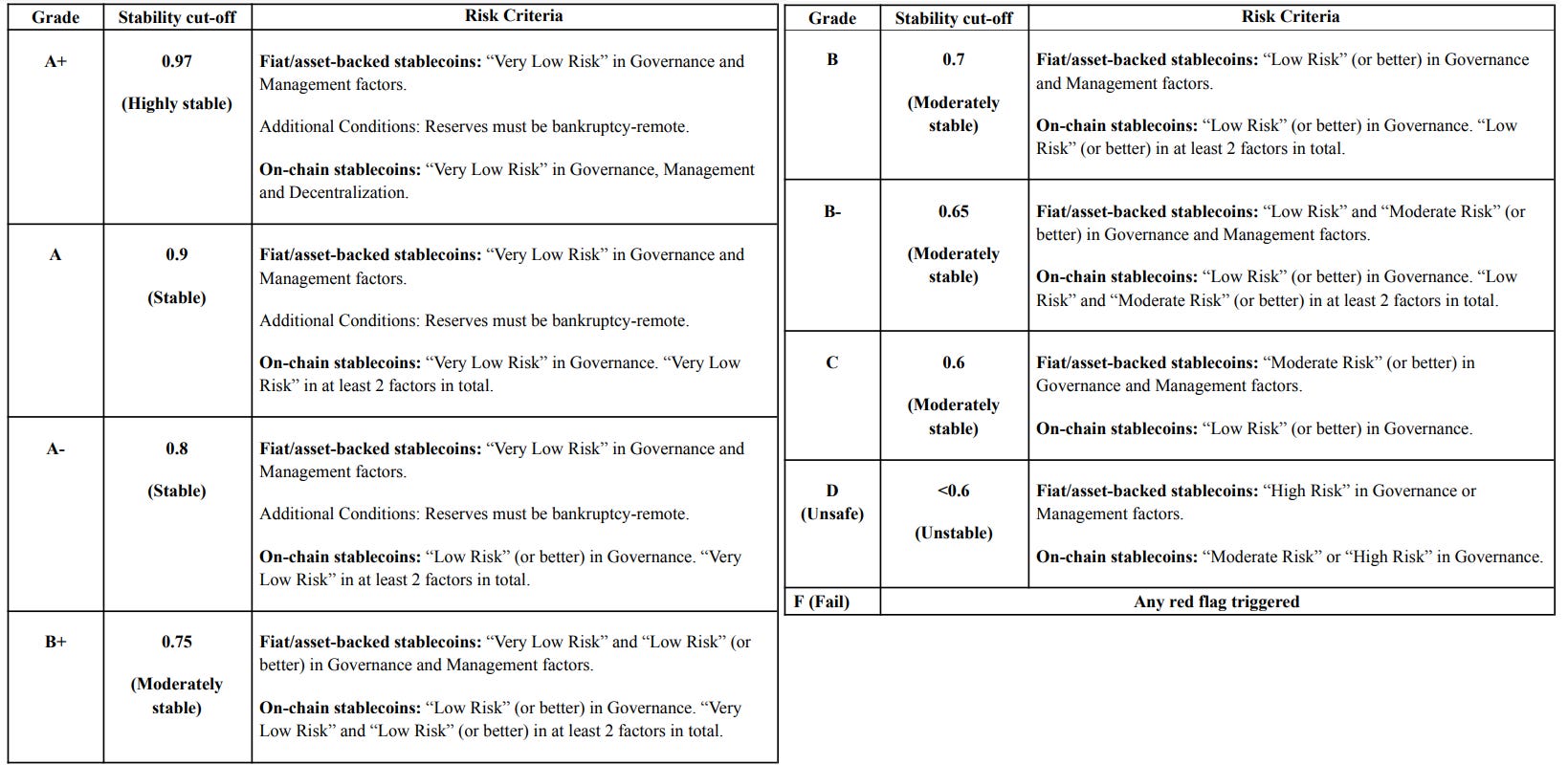

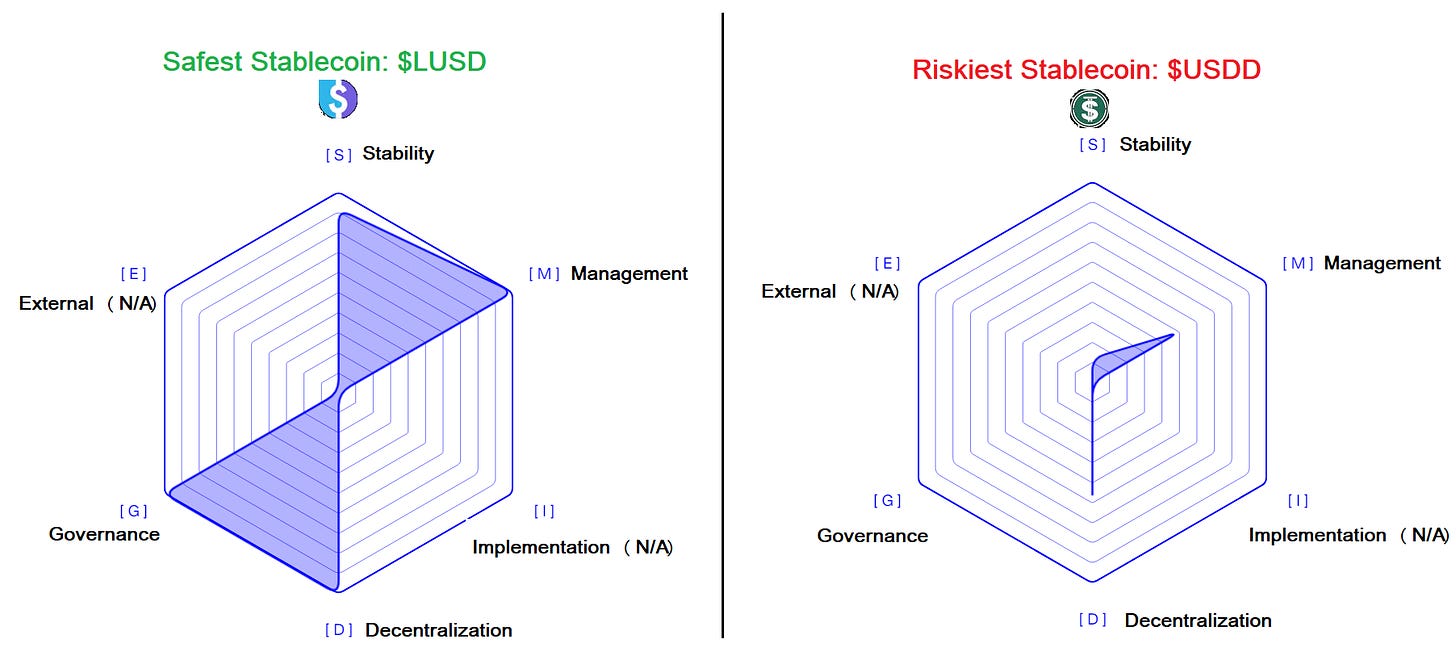

This is where I find very recently BlueChip, an independent organization assessing the risk of each stablecoin & ranking them based on the outcome of this assessment. BlueChip used the SMIDGE framework:

Stability: Reserves, mechanism, Peg management

Management: Assessment of team

Implementation: Audits, Test, Exploit history, Oracles

Decentralization: “ability to transact and control their assets without needing to trust a counterparty or intermediary”

Governance

Externals: Market & Social sentiment

After the assessment is conducted, the stablecoin gets issued a safety-score:

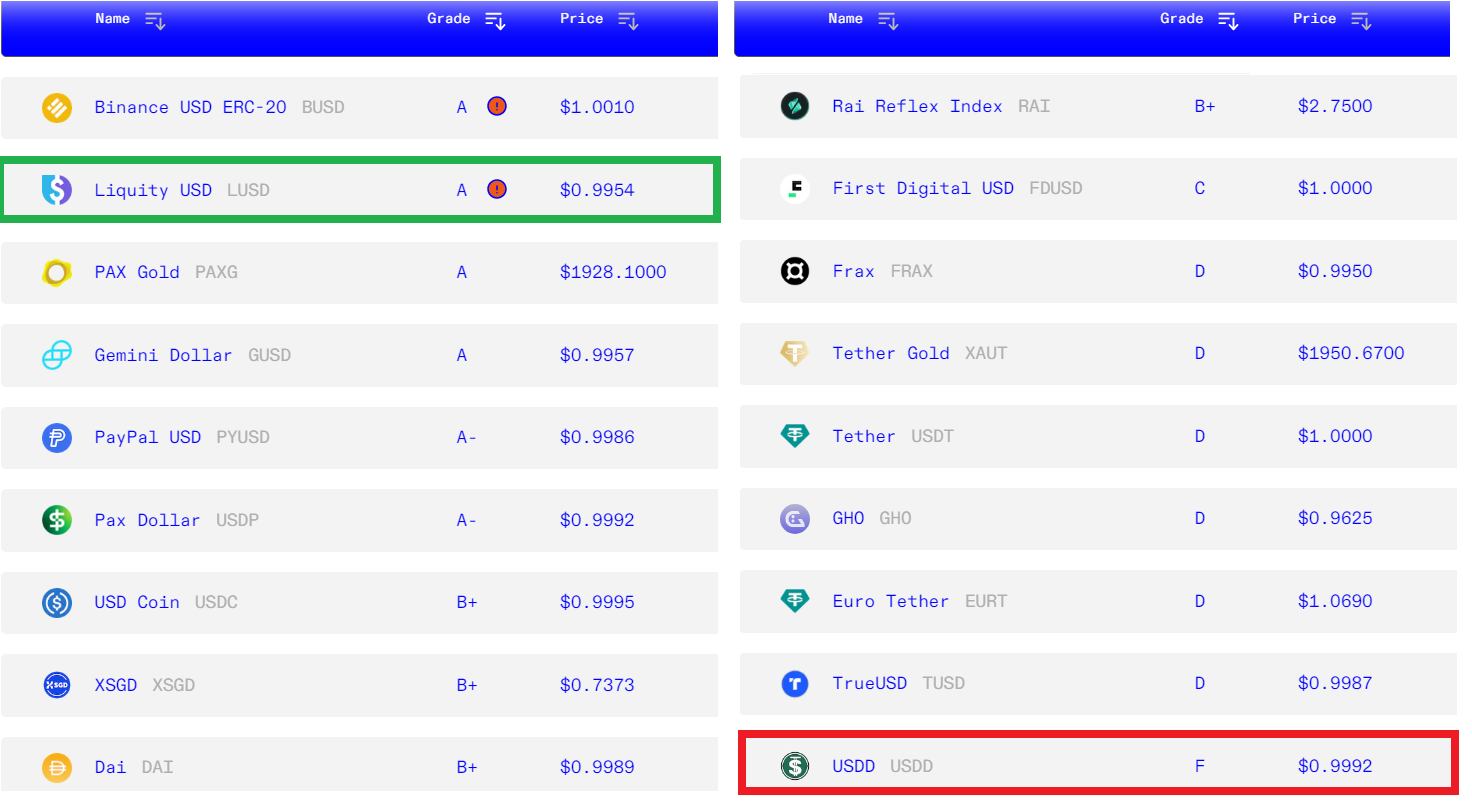

Stablecoins rating:

Among the centralized stablecoin, interesting notes: USDC is rated B+, USDT is rated D.

How to choose a stablecoin?

1] First thing first, RISK ZERO never exists in Crypto, this is my own take, and nothing is too big to fail. So my First tip will be “DIVERSIFICATION”. I’m holding the following stablecoins: $sUSD (from Synthetix), $ERN (from Ethos Reserve), $LUSD (from Liquity), native $USDC (from Circle - not the bridged USDC).

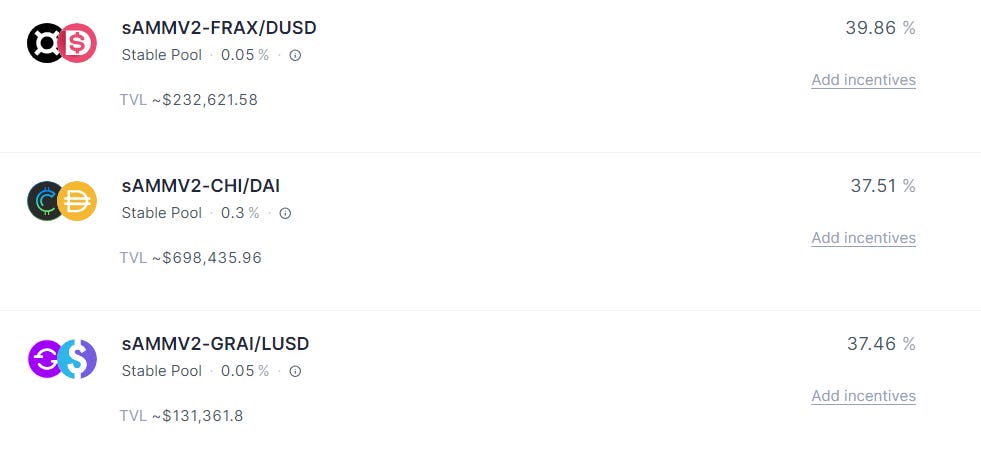

2] Second tip, do not get over attracted by high APR. Doesn’t mean the yield is not REAL, but make your own assessment on the underlying assets. Example, taken few days ago on Velodrome Finance:

I notice here some new stables:

$DUSD: From Davos Protocol, never heard of it

Stability: Above 1$ since the past 3 months, with an ATH at 1.09$ => Bad https://www.coingecko.com/en/coins/davos

Fork of Maker DAO

Market Cap: 320k$, very low

Collateral: LST + yield bearing asset from Venus for example

My rating? Fail❌

$ CHI from Essence Finance

Not listed on Coingecko

Deposit DAI, mint CHI. Typical CDP, but no dashboard to check the reserve health

Market Cap: 3m$ according to Optimism.Scan

Collateral: DAI

Alert: No docs, website too light, no team information.

My rating? Fail❌

$GRAI from Gravita Protocol

Stability: Not that great. Rangle between 0.975$ & 1$, with a ATL at 0.897$ https://www.coingecko.com/en/coins/grai

Fork of Liquity with some tweaks.

Known team

Very recent (5 months ago)

Market cap: 12m$

Collateral: Liquid Staking Tokens

My rating? B🟡

This is the type of quick research you can do in few hours.

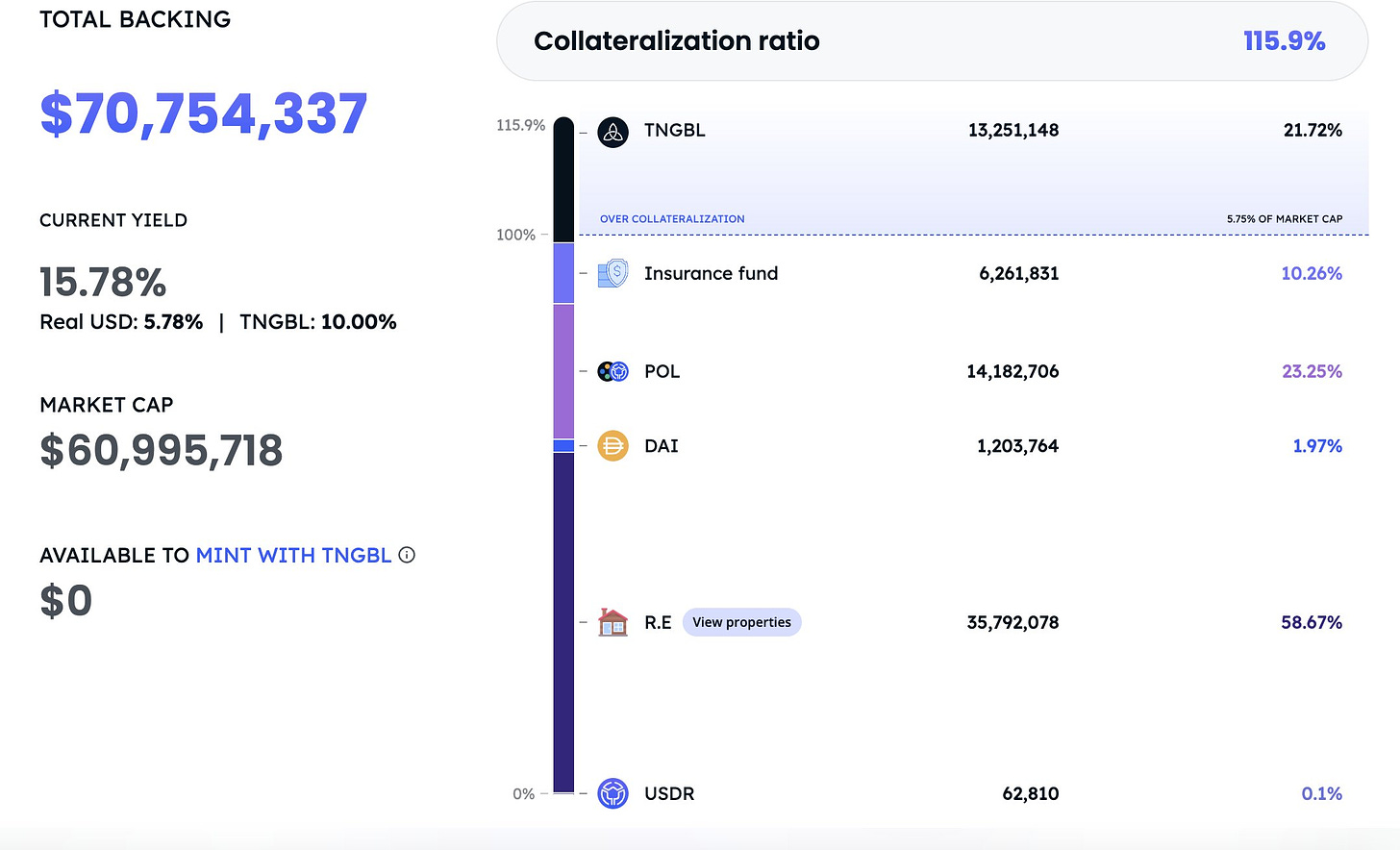

If you remember $USDR from Tangible protocol, the yield on Velodrome was INSANE. You could have checked on their website, how the stablecoin was backed:

59% was backed by Real Estate (RWA), so illiquid assets.

23% from POL (Protocol Owned Liquidity) deployed on Velodrome => If $USRD goes to 0, POL goes to Zero, so you should never take this into account, (remember FTX was backed by $FTT => do you remember how it ended up?).

Only 2% was backed by $DAI. That was the alarm and triggered a severe depeg event, since redemption (redeeming 1 CHI to 1 DAI was not anymore possible after all DAI has been distributed)

How to be alerted in case of DEPEG event?

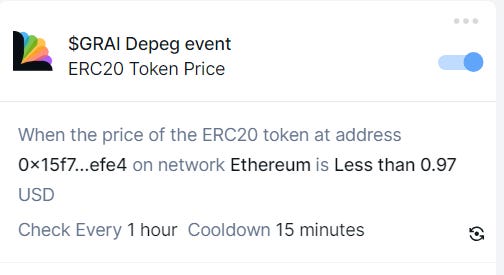

Set up alarm => I’m using LORE dAPP to set up notifications on ERC-20 tokens price

In that example, as $GRAI has its deepest liquidity on Ethereum, i’ve set up the following alarm:

When the price of $GRAI on Ethereum is Less than 0.97USD => Send me an email (but you can also receive notifications on Discord, Telegram, SMS).

Note: Base & OP mainnet are coming by end of the year on Lore.

*********************************************************************************

I hope the above provides some more information in order for you to make the right choice when choosing a stablecoin to hold & farm. Stay safe!

Meme of the week

🟢Crypto market review

by Axel

Bitcoin

It's a relief for everyone to see the market in such good health. As explained in the previous newsletter, we were bullish as long as the $31,500 support was defended, and altcoins were the play. We detailed how to enter the most explosive altcoins, and we hope it has been profitable for you.

Bullish signs: Bitcoin is currently consolidating above the bullish channel. The movement is accelerating.

Bearish signs: None at the moment, as long as Bitcoin remains above the bullish channel.

Bitcoin is currently driving the entire market upwards.

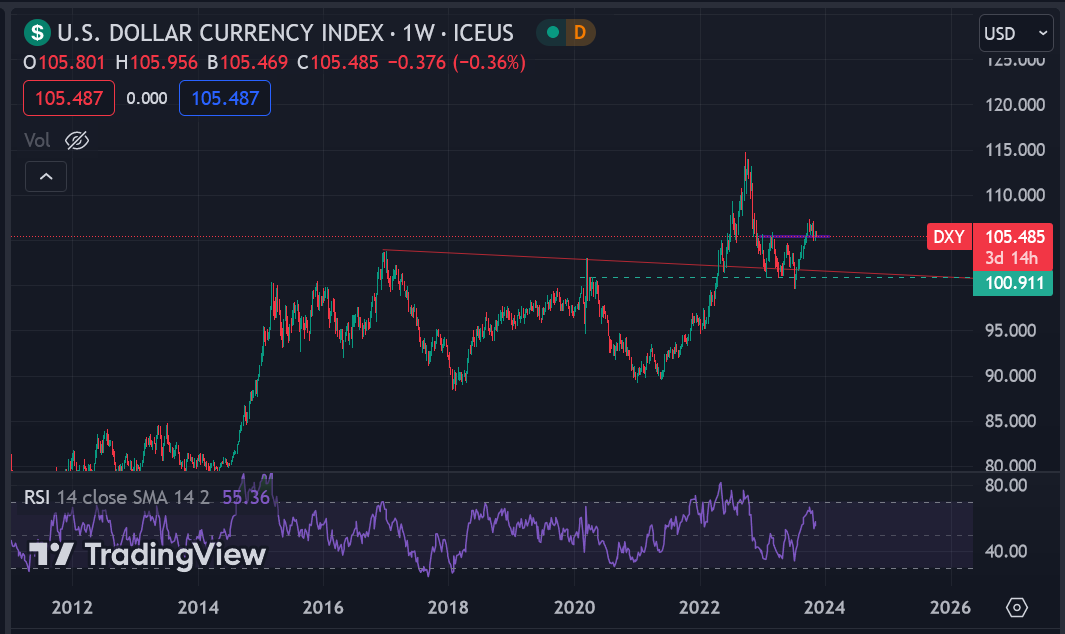

DXY (U.S. Dollar Index):

The index continues to show signs of weakness, which is a positive signal for the cryptocurrency market. As we've reiterated multiple times, we maintain a bearish outlook on this index.

Feel free to refer to NL #1 to understand how to interpret the DXY index.

CME gap

The currently open CME gaps are at the following price levels:

$31,600

$29,800

$27,000

$26,300

$20,500

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin dominance: the breakout of the 53% level described in the previous newsletter appears to be a fakeout today, leaving space for Alts to go up.

The TOTAL3 ticker is at resistance with a bearish divergence on the weekly chart.

Conclusion

The market is very dynamic. Bitcoin must stay above the bullish channel for a new bullish momentum.

We've witnessed impressive rebounds in altcoins. Currently, the TOTAL3 ticker is at resistance with a bearish divergence. Don't forget to take profits at resistance. We can re-enter positions when the resistance turns into support.

Educational content: How to take profit?

When? Why? How can you make life chaning money if you haven't planned for taking profits?

Why?

It's crucial to take profits even if the end of the bullish movement seems distant. In a bull run, we can experience corrections of 25-50%, which can shake even the most experienced traders/investors among us. Having available liquidity (aka stables) allows for buying backat lower price and rebalancing your portfolio.

Moreover, can you time the end of the bullish cycle? No one has a crystal ball, and if you think you can buy the bottom and sell the top, you have a 99% chance of failing. You need to have a plan and a risk management to survive in this market but, most importantly, preserve your gains at the end of the cycle. You might make less money than a hodler, but I can assure you that you'll have retained your gains at the end of the bear market.

How? When?

You need to establish rules. Let’s make a concrete example on $OP:

Identify significant daily resistances when we have a price history.

We observe that the price has struggled to easily surpass these price levels.

Applying Fibonacci retracement in HTF (High Time Frame) (0.236):

The number 0.236 is a significant resistance. It is advisable to take the majority of profits when the 0.236 level is reached. Above the 0.236 level, a new bullish momentum begins, and it becomes possible to re-enter a position. You may not capture all the gains, but this approach allows for a secure and reassuring trade.

Here are the results of the Fibonacci retracement on the previous $OP move:

Applying Fibonacci retracement in HTF (1.618):

The number 1.618 is a significant resistance. As observed below in the previous move of the $OP token when it was in price discovery.

It is always advisable to place the take profit slightly below because it's not an exact science. We can re-enter a position if 1.618 becomes a support.

Having a well-established rule:

Example: Withdraw 10% of the position every 50% gain or withdraw 50% as soon as the price doubles.

We recommend this, especially for small caps with little history. When a coin is in price discovery, we lack data for analysis.

What I do as a Trader ?

Personally, I use all these techniques mentioned above. I use daily resistances to take profits. I buy back if the resistance is validated as support, even if it means leaving some gains. If the price goes down, I can buy at a lower price or find another coin (there are more than 10,000 cryptocurrencies today).

I use the number 0.236, where I exit 80% of my position. I re-enter if this number is validated as support. Sometimes I enter only if the 0.236 levels are crossed because at that point, the rise is explosive, gains are quick, and can be invested elsewhere.

I use the number 1.618 on mid and large capitalizations coins (>500 million dollars).

Finally, for small caps, my ruls is to take out as profit 25% of my position for every x2 in price.

I hope this chapter will be useful to you in the coming weeks and months.

🤯Quote of the week

🟤Farming strategy: Money market or loan service: which platform should you choose?

By Thomas

There are few ways to take a loan or borrow assets: Money Market like Sonne Finance / AAve / etc… Loan Service or CDP (Collateral Debt Position) like Maker, Liquity or Ethos Reserve. Which one is the best to use? Let’s dive in by starting with a little story about the recent FUD on Liquity. Threat or Trick, let’s find out.

What’s happening @ Liquity?

Since few weeks now, Liquity users have been experiencing unexpected closures of their positions.

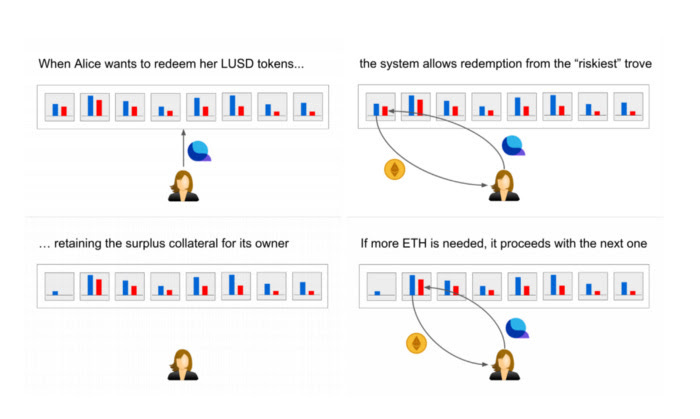

If you were farming on Ethereum Mainnet, you might have even been affected by this phenomenon, which is called "Redemption”. It occurs when the price of $LUSD is below $1.

Indeed, Liquity has a function that allows anyone to exchange 1 $LUSD for $1 worth of $ETH. These $ETH are taken from users' positions (troves).

When LUSD falls below $1, arbitrageurs activate this redemption function: they exchange a fixed number of LUSD for the equivalent in $ of Ether and make a profit if the price of LUSD is low enough.

But there's a problem here: it's the protocol users who suffer from it, as the ETH recovered by arbitrageurs come directly from the riskiest positions of the users.

If you have an open trove that is not well collateralized, your position may suddenly close: your debt is canceled (you don't need to repay your created LUSD), and your ETH goes to the arbitrageur.

But why $LUSD is dumped on the market? Can this happen to Ethos Reserve, built on Liquity standard?

With low yields available for LUSD hodlers, farmers use Liquity's low fixed fee of 0.5% to open a position and swap LUSD for yield-bearing assets ($sDAI or $sFRAX) that are offering higher yield.

Ethos Reserve, with its $ERN stablecoin, is currently not affected by this issue because there are numerous yield opportunities for $ERN, which makes it more interesting to HOLD than swapping for sDAI or sFRAX.

To avoid massive redemptions, protocols have two main solutions:

Increase the borrowing cost to reduce yield opportunities (as done by Gravita and Prisma Finance).

Provide incentives to hold the borrowed stablecoin through better APRs for farmers (as done by Ethos Reserve).

For example, about liquity even Tetranode (very famous whale) said he exited his positions because of this.

So is Liquity still interesting? Spoiler: YES, but the protocol is not meant for everyone.

In this comparison, we will be looking at loan services (Liquity model) as opposed to money markets (Compound - Aave model). Find out which protocol to use based on your strategies.

What's the difference between a loan service & a money market?

If you're an advanced user of DeFi, you may have already heard these terms. Back in the day, DeFi content creator "TokenBrice" discussed them in his article on Liquity.

A loan service in DeFi is a protocol that allows you to create your own debt. When you deploy your borrowing position, you create debt from the protocol.

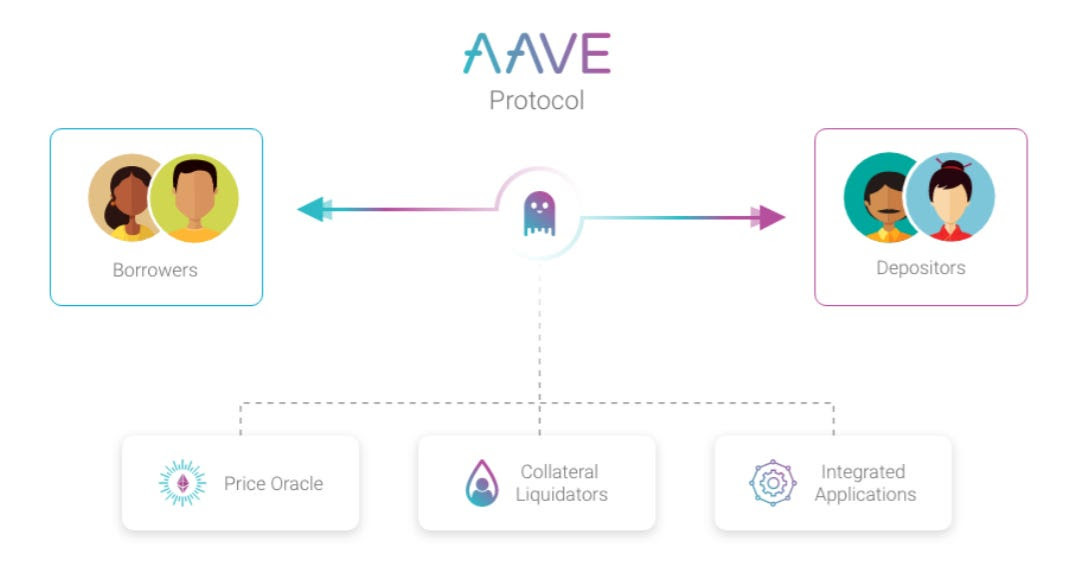

A money market, on the other hand, depends on multiple stakeholders: lenders and borrowers.

Lenders deposit cryptocurrencies in the money market, which are used for loans. In return, lenders receive a portion of the interest paid by borrowers.

Borrowers, in turn, borrow cryptocurrencies from lenders and pay interest on them.

This difference is very interesting because it has several specificities :

The borrowing rate is theoretically lower in loan services because the system is designed to eliminate as many stakeholders as possible.

The volatility of the borrowing rate is generally lower in loan services (or even fixed in Liquity-like systems) than in money markets. Why? Because borrowing rates in money markets are adjusted in real-time based on the amount of assets deposited against the assets borrowed.

During an exceptional period, if an asset is overborrowed, its borrowing rate will skyrocket, and vice versa

This is not the case in loan services since your debt does not depend on other actors (you create debt from the protocol).

So here's how to adapt our strategies to these different mechanisms.

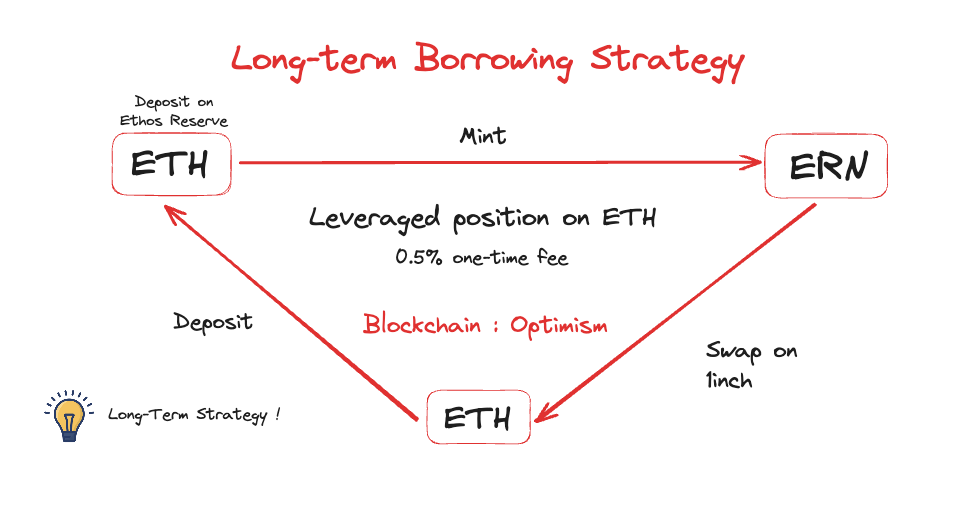

For long & “safes” loans

If you want to take out long loans while minimizing the risk of liquidation to the maximum, we invite you to use Ethos Reserve. Because you will only pay a single fixed fee of 0.5% when deploying your position.

This kind of long loans can be viable in a basic leveraged strategy.

To deploy this strategy, all you need to do is:

Open a trove on Ethos Reserve

Mint ERN (0.5% fee)

Swap it into ETH

Deposit ETH

Leave your position as is or re-borrow, depending on the desired leverage

Minimum investment amount: ≈ 0.06 ETH (minimum debt of 90 ERN)

Risks: Ethos Reserve smart contracts, Liquidation (recommended minimum health factor: 2.5)

We recommend holding such positions for several years because this is where you can save a lot on borrowing fees (remember, only a fixed fee of 0.5% is charged).

But please still check your position from time to time to inspect your collateralization ratio, that of the protocol, and the price of ERN to avoid redemptions.

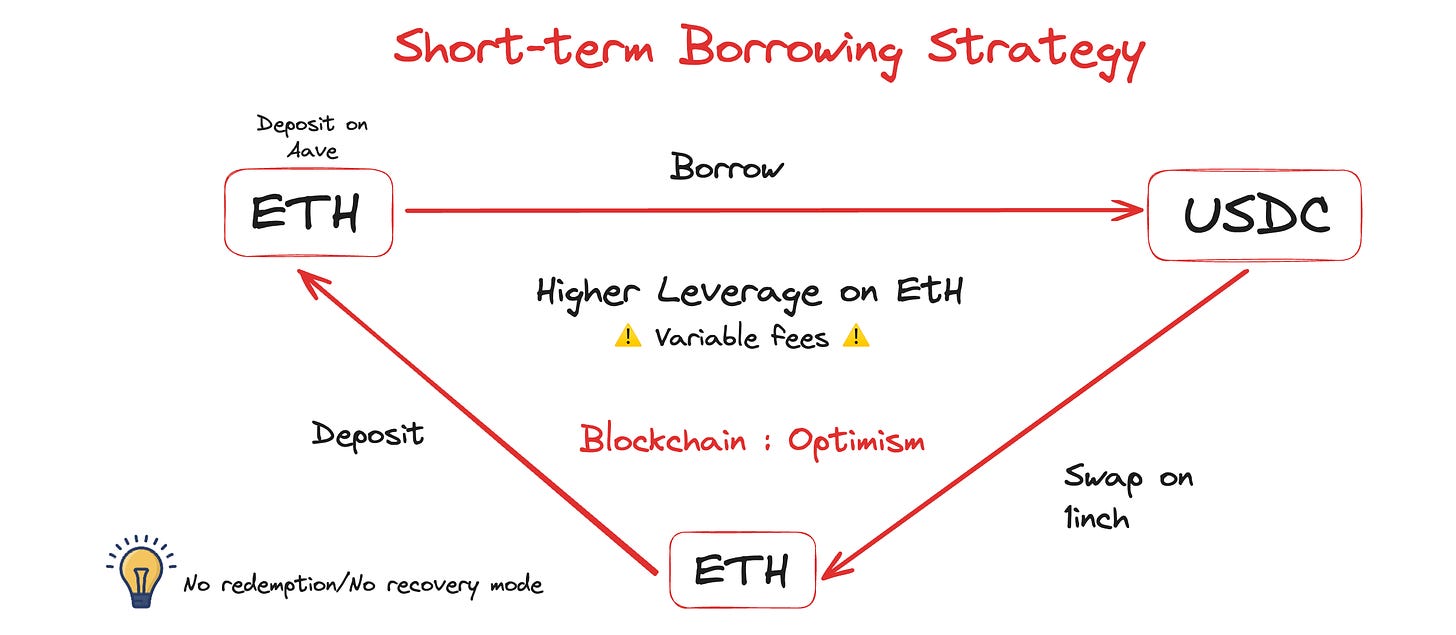

For fast & “risky” loans

On the other hand, if you're a degen looking to take advantage of significant leverage on a short-term position, money markets would likely be more relevant.

While borrowing rates are higher (around 5% at the time of writing this ), there are no additional mechanisms that might prematurely end your position.

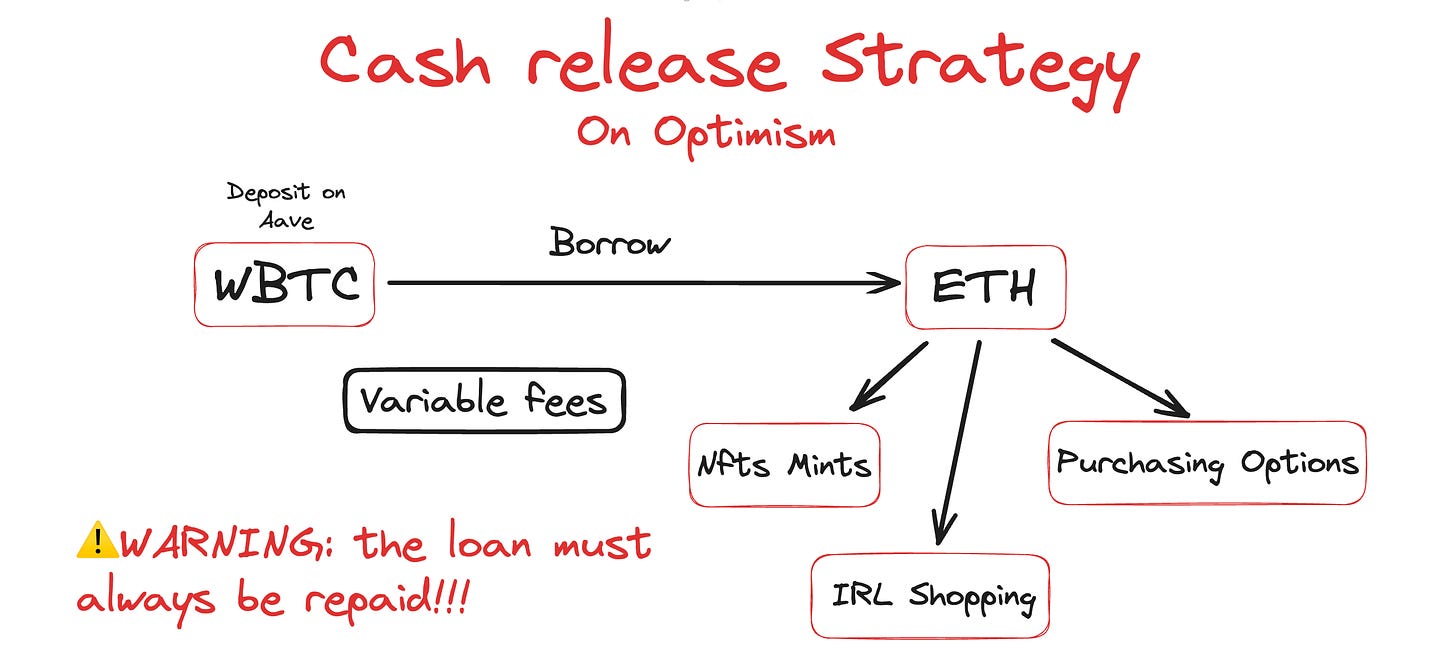

Taking a loan from a money market can also be useful if you want to unlock liquidity quickly. So here are two strategies that we have devised:

Short loan

Same principle as for the long-term position.

Minimum investment amount: None

Risks: Aave smart contracts, Liquidation (recommended minimum health factor: 1.4)

Unlock Liquidity

Minimum investment amount: None

Risks: Aave smart contracts, Liquidation (recommended minimum health factor: X)

The Loan MUST always be repaid!!!

Tips: If you borrow on Aave, make sure to always borrow the asset with the highest risk of depeg (only if it is not already depegged and if the borrowing rate is normal).

In the event of a depeg, you could repay your debt with a significant premium

Conclusion

You now know the difference between loan services and money markets! Which protocols would you use?

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

The Optimism Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.