The 🔵Optimist: (L)Earn with Defi #22-2

Learn & Earn with DEFI on Layer 2 chains / OP Stack / Optimism Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed part 1 [OP Superchain News], don’t worry, just click HERE.

Click on your preferred language to access the translated version:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Turkish - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔵Forget Metamask, welcome Rabby wallet

Using Metamask is like driving an old car, while your car seller proposed you to replace it by the brand new one for FREE

🟢Crypto market review

Bi-weekly update on the Crypto Market

🟩Airdrop Tips: CHeck your unclaimed Airdrop

There are many airdrops... You use many wallets. Are you sure you haven't lost a few thousand $ ? Here we present 2 tools to check unclaimed Airdrops

🟤Farming strategy: Funding Rate arbitrage Vault

Earn +20% on your stablecoin using this strategy on Optimism through Polynomial & Toros Finance.

Spotlight project: Oath Ecosystem

The OATH ecosystem is changing the world of DEFI by setting up new standards for security, capital efficiency and real yields.

With Ethos Reserve V2 coming soon and updated tokenomics on the way, OATH is set to shake things up on Optimism in 2024. You can find $OATH on Velodrome and check out their site at oath.eco.

Follow Oath Foundation on X & Turn on notifications.

🔵Forget Metamask, welcome Rabby wallet

by Subli

Metamask was the first crypto wallet to be widely used. Even though there are better wallets available now, it still remains the most used crypto wallet. This is because anyone who wants to enter the world of crypto, the first thing they find on Google or YouTube is Metamask. I was even surprised that some of the old-timers in crypto are still using Metamask in 2023.

However, Metamask has many issues in terms of user interface/user experience, slowness, transaction simulation, automatic chain changing, unacceptable ramp-off fees, and more. This list is very long.

Today, I intend to introduce you to the best wallet I’m currently using and explain why I can no longer go back to Metamask.

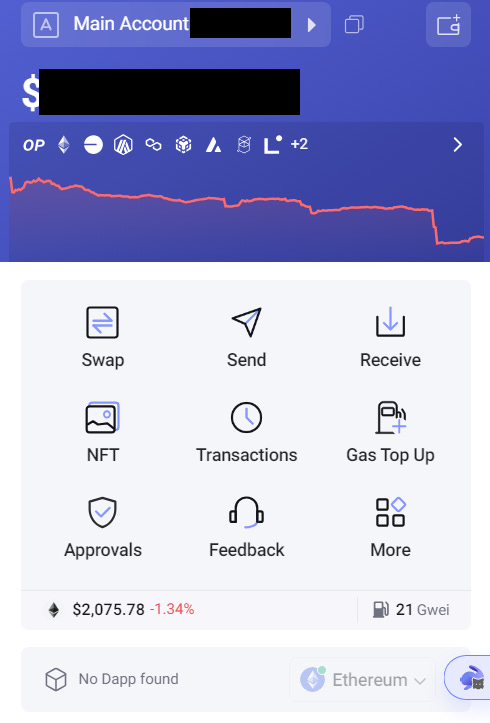

Welcome to the RABBY wallet, a non-custodial, multi-chain, and most user-friendly wallet available for computers and soon for mobile. If you are interested in comparing our mobile wallet, please click here.

Who is behind Rabby Wallet?

The team behind the Rabby wallet is the same as the team that developed Debank. If you have read our previous newsletter about the comparison of mobile wallets, I had already recommended that Debank should be your daily friend for viewing your crypto portfolio on any EVM chain.

Why RABBY is better than 🦊?

1. Automatic chain detection & change accross 122 chains (mainnet & testnet)🥳

Rabby wallet will automatically detect the chain you’re interacting on, so there is no need for the user to go back to the wallet APP and change manually. When you’re doing 10 to 20tx a day in DEFI, i can tell u it’s like going from a manual gear car to an automatic one.

2. The most friendly wallet APP you can ever have

SWAP: You can swap token on one chain (I’m expecting cross-chain swap very soon). Swaps are being routed through CEX and DEX of your choice (OKX, Coinbase, Binance, 1Inch, 0x, Paraswap, OpenOcean)

NFT: Finally a wallet where you can see all your NFT recognized by OpenSea, with pictures, floor price, and qty. You can also easily click on one NFT and send it to another wallet address in one click (very useful)

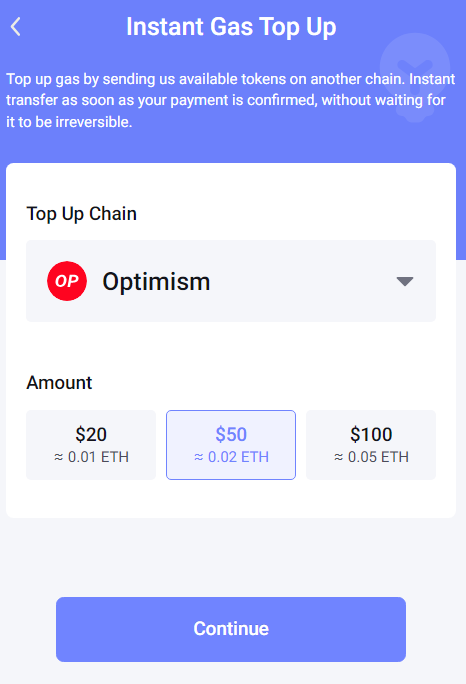

GAS TOP UP: You’re missing $ETH on Optimism, Arbitrum, Base or Ethereum Mainnet. Just few clicks to get some gas tokens

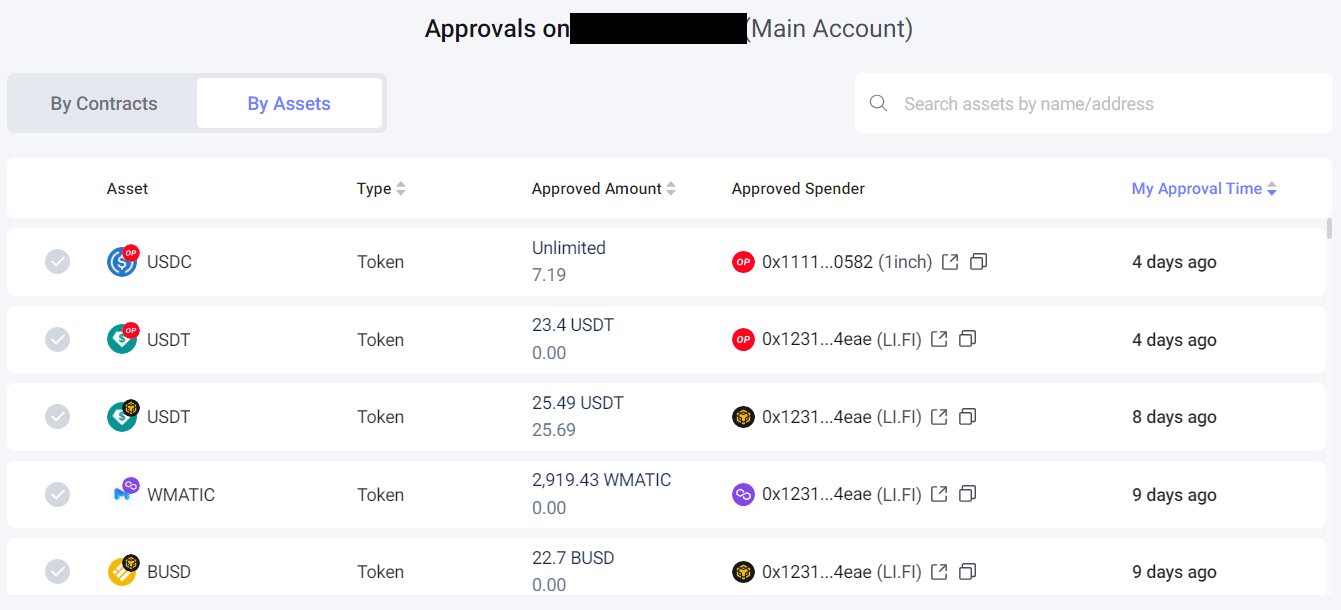

APPROVAL: Rabby has also the best way to revoke contracts approval. Why it’s so important? Keeping token approvals put your wallet funds at risk in case the protocol for which you approved a transaction is getting exploited.

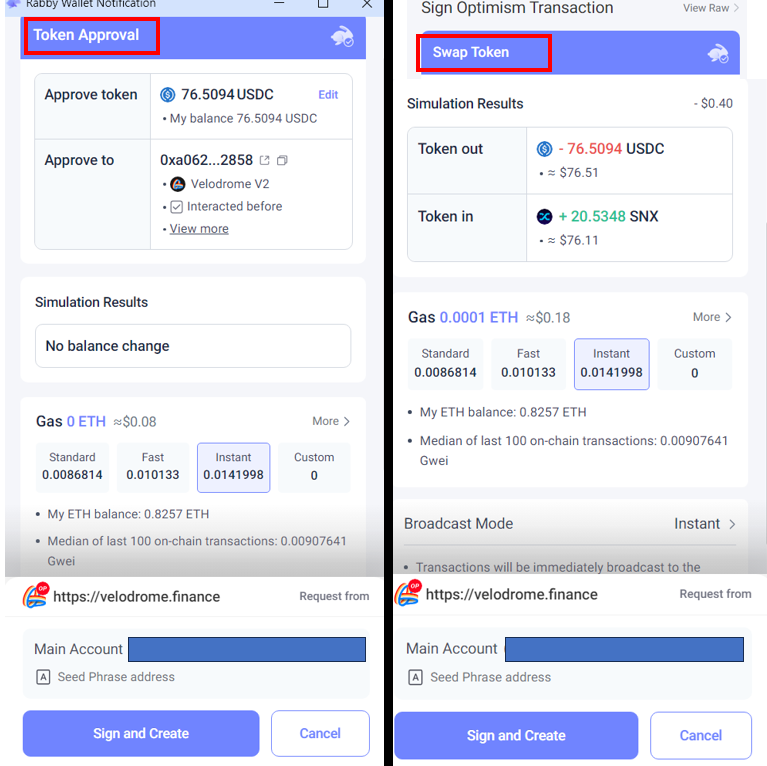

Transaction simulation: For every tx you will do with Rabby, you’ll have a simulation stating what the tx will actually do. This is a MUST-TO-HAVE feature to protect your fund and avoid clicking a phishing link that can drain all your funds

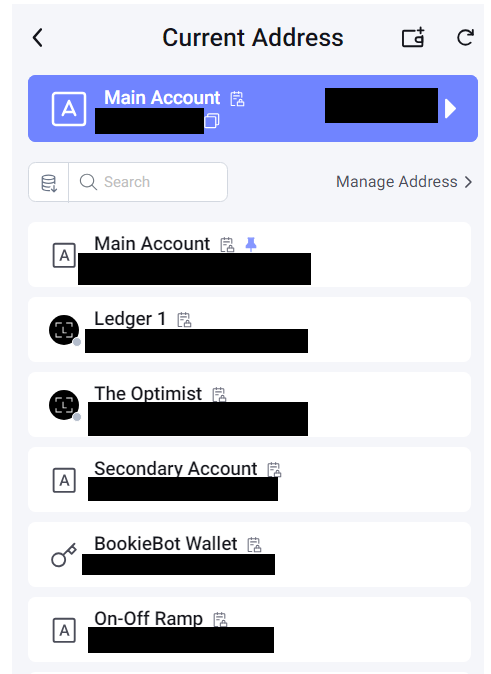

MULTI ADDRESSES WALLET: You can create or connect an impressive number of accounts, and you can switch from one to the other one in one click. You can:

Import an existing wallet using your seed phrase or private KEY

Connect a cold wallet to Rabby

Create a brand new wallet

Debank Chain

But that's not all! Following its $25 million fundraising by Sequoia VC at the end of 2021, Debank has announced that it will build its own social chain program on the OP Stack.

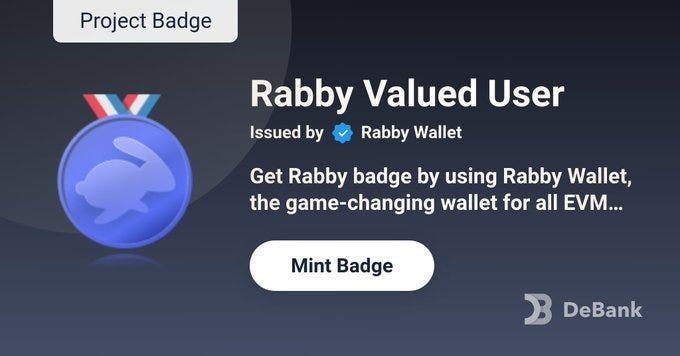

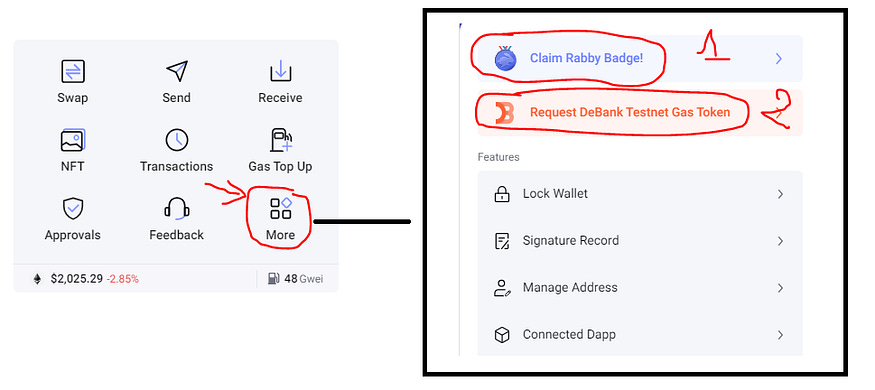

As expected from any new chain, you can easily anticipate a significant airdrop for those who use Debank and Rabby. How to qualify? Get the badges.

The first badge that you can easily acquire is by using the Rabby Wallet SWAP feature and minting the Rabby user badge.

On Rabby wallet, click on “MORE” and “CLAIM RABBY BADGE”. You can also request Testnet gas tokens daily (Testnet is not yet available) and accumulate them until D-Day.

By the way, if you are interested in the Debank airdrop, we plan to cover various things in a future newsletter and provide tips to make you eligible for it.

How to access Rabby?

Rabby wallet is a browser extension that you can add to Google Chrome, but it's also a computer application available on both MAC and WINDOWS operating systems. Go to their main page and download what's more suitable for you at https://rabby.io/

I'll say it again, Rabby is my best DeFi tool. Since I started using this tool, my experience in the DeFi area has greatly improved. I am very happy to share this news with you, my dear readers.

Post of the week

🟢Crypto market review

by Axel

Bitcoin

After this rebound in the cryptocurrency market, what can we expect from Bitcoin for the end of the year? We had discussed to remain cautious in the previous newsletter. Let's see how prices have evolved.

Bullish signs: Bitcoin is currently consolidating above the bullish channel.

Bearish signs: We have not had any significant correction since breaking the $30,000 resistance. The RSI is high.

In the daily timeframe, we have a double divergence (in green). It's interesting to note that the price stabilizes above the support (in red). As long as this support is not broken to the downside, we remain bullish for a new uptrend.

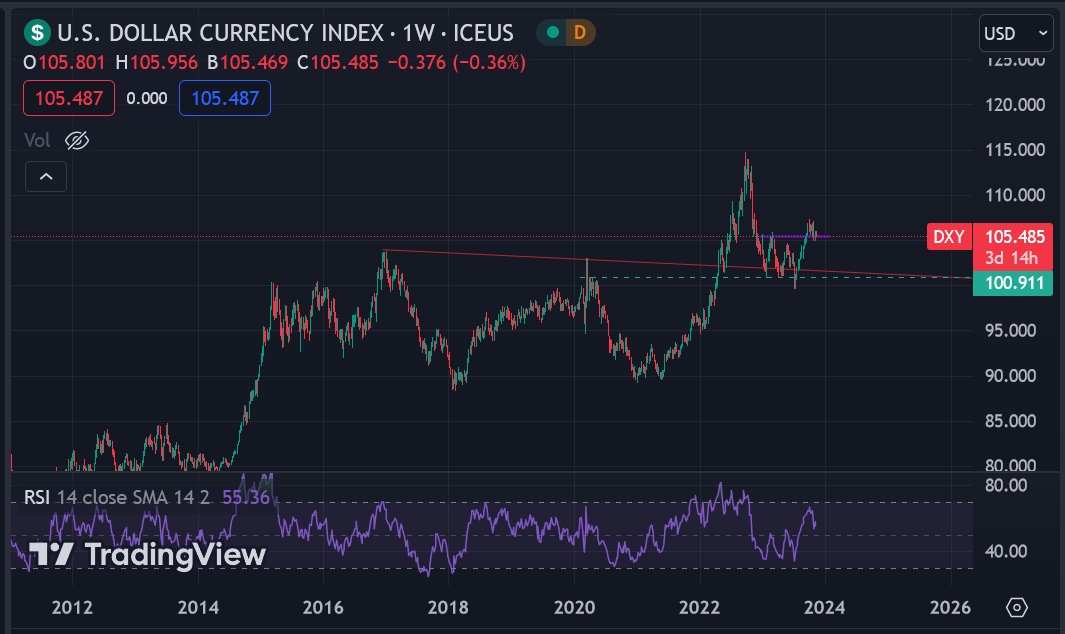

DXY (U.S. Dollar Index)

The index continues to show signs of weakness, which is a positive signal for the cryptocurrency market. As we've reiterated multiple times, we maintain a bearish outlook on this index.

We have nothing to add this week. There will be rebounds, as in all markets, but the overall trend in the higher time frames is bearish.

Feel free to refer to NL #1 to understand how to interpret the DXY index.

CME gap

The currently open CME gaps are at the following price levels:

$31,600

$29,800

$27,000

$26,300

$20,500

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin Dominance: As discussed earlier, we experienced a fakeout of the 53% resistance. The price consolidated below and appears ready for a new leg up.

The higher timeframe trend remains bullish.

Ticker TOTAL3: We previously highlighted the divergence on the TOTAL3 ticker that appeared on the resistance. This divergence should come into play to cleanse the market before a breakout, likely in the early part of next year.

Conclusion

Bitcoin appears to be running out of steam and needs to catch its breath (double divergence). We must stay above the red support on the daily chart to hope for a new bullish move. We remain bullish as long as this support is defended.

Remember, it's crucial to trade based on what we see rather than what we want.

In the case of a correction, the $30,000 support seems obvious. We may see certain CME gaps getting filled. We consider any correction as an opportunity for the coming months.

We are seeing red signals on altcoins. We are on resistance on the TOTAL3 with a weekly divergence. Bitcoin dominance is still bullish. It's always wise to have stop-loss orders in place under these conditions.

$OP Trade

Let's continue to monitor this asset together. Have we witnessed the long-awaited breakout? Is it still time to accumulate or take a position? Let's explore how to manage this trade.

Firstly, we observe that the most significant resistance is at $1.84. We've seen numerous reactions around this value. Since the breakdown in May 2023 below this support, the price has been consolidating underneath with higher lows, defining an upward trend.

This trendline is more evident to draw on the daily timeframe.

We observe that the price is still evolving below this resistance. We had a fakeout in early November. However, we were starting to see red flags on altcoins (TOTAL3 ticker below resistance) and the RSI was overbought.

In this case, we only buy 30% of the desired position following the daily close above $1.84. Our stop loss is the reintegration below the support on the daily chart. Unfortunately, this was the case from the second day, so we exited our position with a loss of less than 3%.

We would have increased our position if:

The RSI continued to make new highs;

The TOTAL3 ticker broke its resistance to the upside.

It is interesting to note that on the weekly chart, the price did not close above the resistance. In the weekly timeframe, the signal arrives a little later but is more reliable than the daily. Similarly, in the daily timeframe, the signal is more reliable than on the H4.

It is important to have a trading plan, and we hope this analysis can be useful to you before entering a position.

🟩Airdrop Tips: Check your unclaimed Airdrops

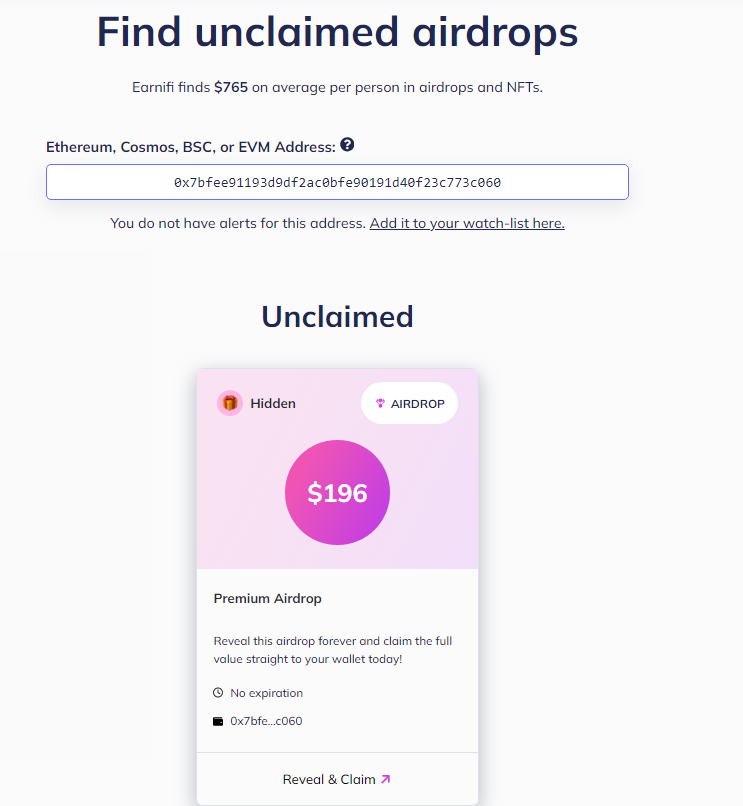

Today we are going to present you 2 tools to check any unclaimed Airdrops. Both check if your wallet is eligible for Airdrop and you can access the unclaimed ones with a private membership around 230$/year. Welcome to Earnifi & Earndrop.

Welcome to Earnifi, which was acquired by Bankless a year ago in December 2022. This website allows users to check for unclaimed airdrops and also enables you to set notifications for the release of new airdrops. Since 2024 is likely to be a year of airdrops, it might be interesting to turn on “Notif ON”.

The process is very simple, just enter your wallet address in the search bar and see if there are any unclaimed airdrops. The catch is that to claim these unclaimed airdrops, you must pay the subscription fee of the program offering the airdrop. This fee could be $250 annually or $21 monthly."

An alternative solution offered by Olimpio Crypto is Earndrop. With the same wallet, you receive many more unclaimed airdrops, and although the membership fee is about $216 per year, in this particular case, it's a win-win situation.

Enjoy readers!

🤯Quote of the week

🟤Farming strategy: Funding Rate arbitrage Vault

By Thomas

If you're a loyal reader of this newsletter, you know that we've already introduced a funding rate arbitrage strategy in episode #6.

But as we love these types of positions, we're back today not with one, but TWO similar strategies

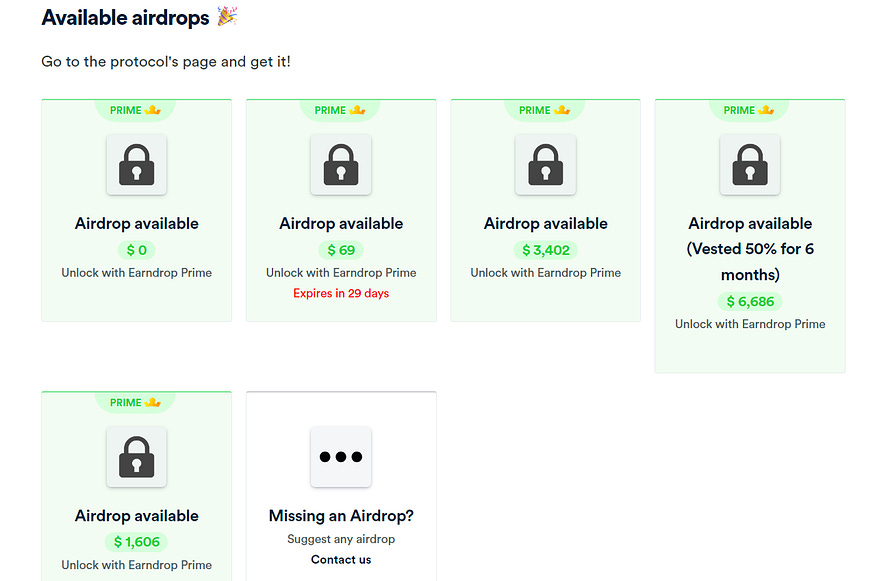

Before we begin: a funding rate arbitrage strategy involves capitalizing on the differences in funding rates across platforms to create a delta-neutral position (long+short) and take advantage of a yield asymmetry.

The simplest example is as follows: If you get paid 70% to go long on ETH on Kwenta and pay 10% to short on GMX, you just need to initiate a long and a short to combine these two returns and benefit from a high APR.

#1 : Polynomial

A few weeks ago, Polynomial implemented a funding rate arbitrage strategy.

However, instead of users manually seeking the best rates and executing trades, Polynomial streamlines this process through an automated strategy.

The protocol proactively identifies the best yield opportunities and simplifies trade management.

Here's how it works :

When you deposit $sUSD into their strategy, your capital is divided into two parts:

The first part is utilized on Polynomial through a long or short position on the asset with the most profitable funding rate.

The second part is used to take an opposite position on Aave via a flash loan.

This formula works quite well because the cost of long/short on Aave is not substantial. This means you will benefit from a significant spread between what you earn on Polynomial and what you pay on Aave.

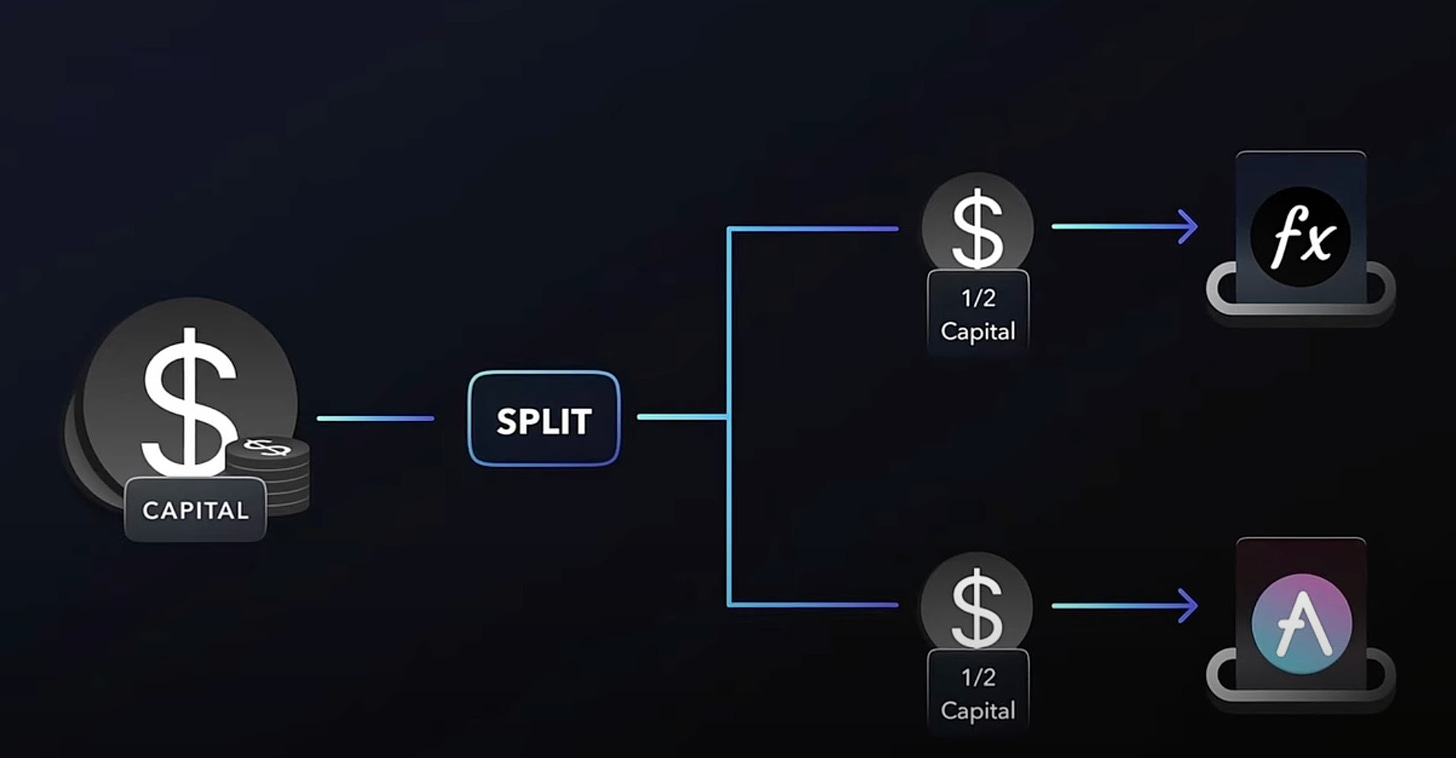

Here's how to easily implement this strategy.

Step 1: Fund your Polynomial smart wallet

First, you need to deposit sUSD into your Polynomial smart wallet.

A minimum of 100 sUSD is required.

Step 2 : Open your position

From the 'Strategies' tab, you can set up your yield position:

Simply deposit your sUSD into their vault, choose the desired leverage, and confirm.

Note: Funding rate arbitrage strategies carry liquidation risks (via your long-shorts on Polynomial & Aave).

The higher your leverage, the more yield you generate, but your position becomes liquidatable more quickly.

Always monitor your strategy carefully

At the top left, you have various information, including the most profitable funding rate on Polynomial (ETH here) and the borrowing cost on Aave.

The total yield of your position is displayed at the bottom right.

Once you have everything set up, just open your position!

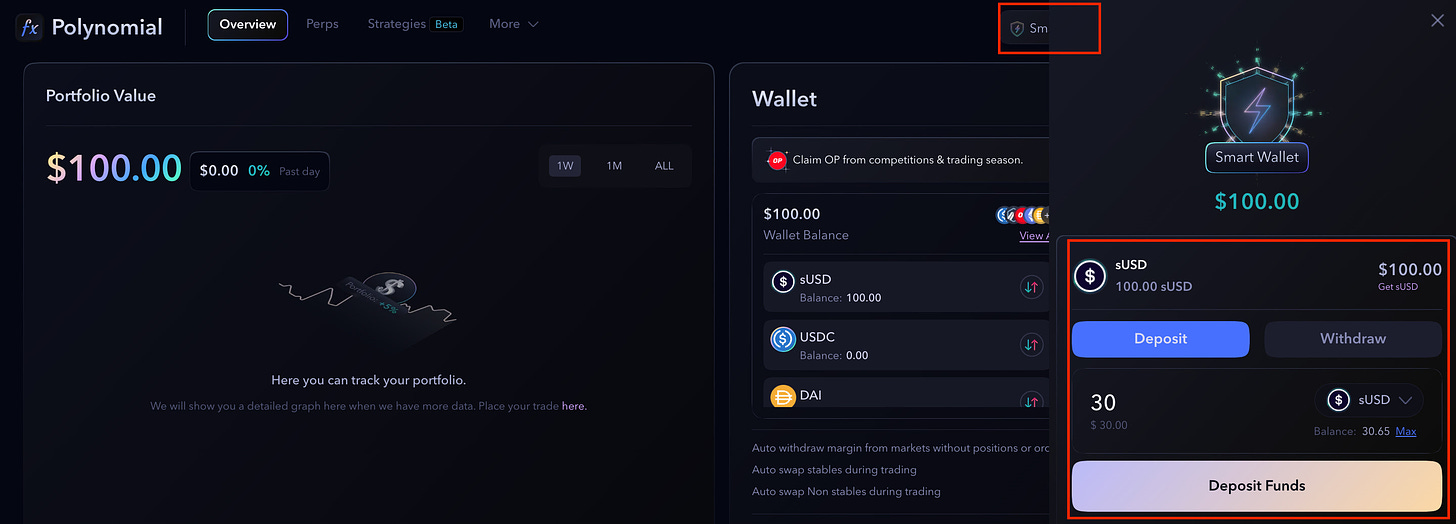

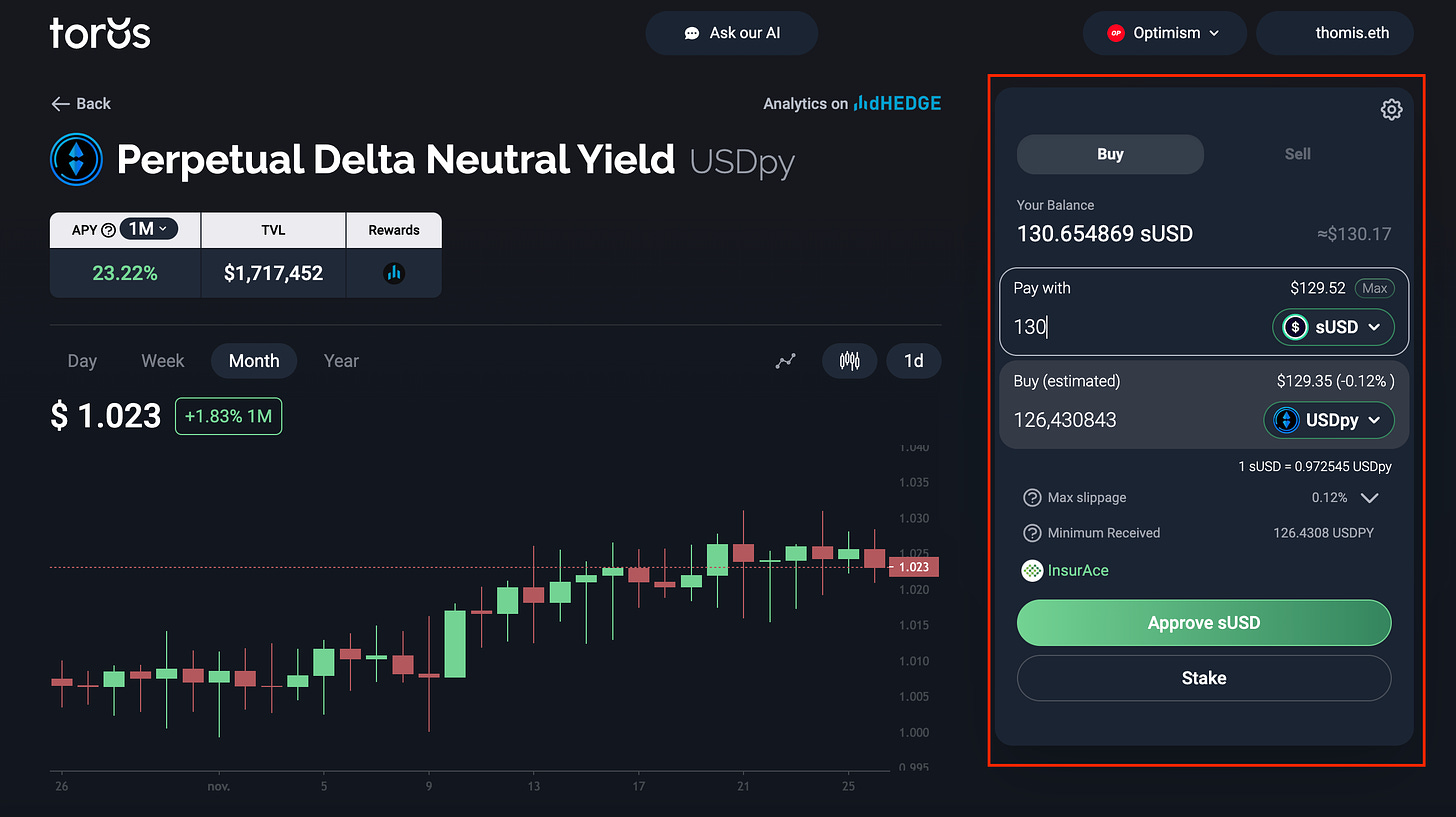

#2 Toros Finance :

Toros Finance also offers a funding rate arbitrage strategy.

We believe it's important to present it to you because it has interesting specifics.

Unlike Polynomial's:

Toros's strategy is expressed through a token called $USDpy, representing the strategy's performance.

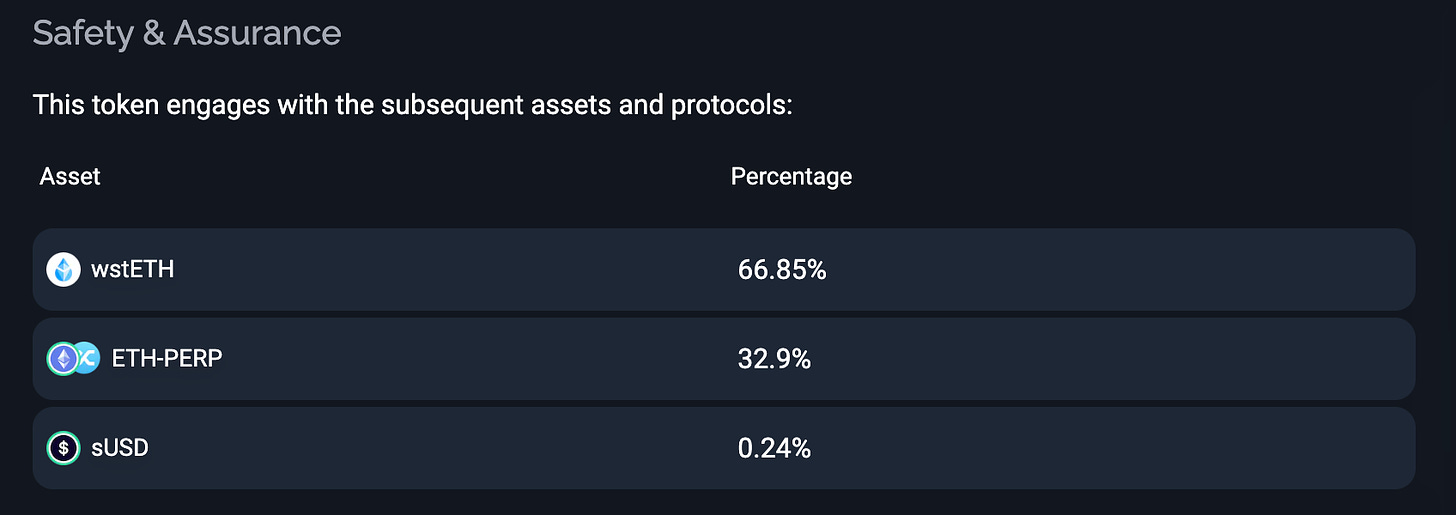

To enter the strategy, you simply buy $USDpy with $sUSD. Its value naturally increases based on the strategy's yield, and the token can be exchanged for ETH at any time.It does not use Aave: assets are divided into 66.74% in spot/hold and 33.26% in long/short.

In terms of risk, this allows you to reduce the number of leveraged positions to 1 (compared to 2 on Polynomial).

So, which strategy do you prefer? Feel free to share your feedback with us

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

The Optimism Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.