The 🔵Optimist: (L)Earn with Defi #26-2

Learn & Earn with DEFI: Optimism, Base, Mode, Zora, Lyra, Ancient, Redstone, Worldcoin, Mint, Lisk

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed part 1 [OP Superchain News], don’t worry, just click HERE.

Click on your preferred language to access the translated version:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

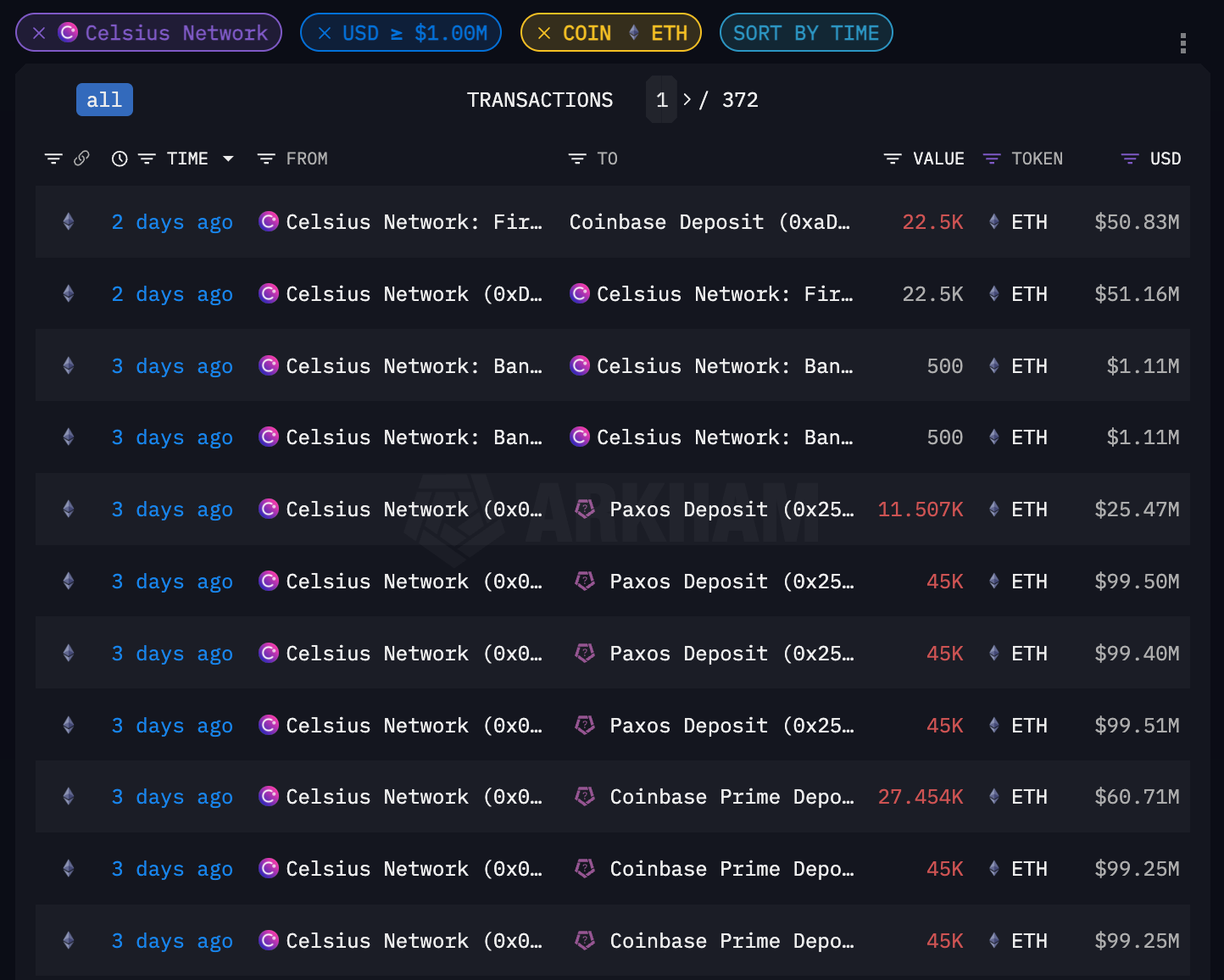

🔵CELSIUS: ETH sell-off tracking

It has been advertised on X since weeks now that CELSIUS is dumping ETH onto the market through CEX (centralized exchanges) and this could result in a negative price action of ETH. We have uncovered what really happens ONCHAIN

🟢Crypto market review

Bi-weekly update on the Crypto Market. Some bullish sign that could lead to an ETHEREUM + ALT Season.

🍀Trading Tips: VELO & AERO - Technical & Fundamental Analyses

One of the most powerfull skills is to have both TA & FA knowledge when sizing your investment. Most of us have only one of both, that’s why teaming up with the right friend is important. In this article, Subli & Axel will give their analysis on VELO & AERO tokens.

🟤Farming Strategy: 30% fixed yield on ETH

With the restaking narratives & traders putting all their efforts to maximize LRT & EigenLayer points, what if we could benefit from this & maximize our ETH Yield? Welcome to fixed yield strategy on Pendle.

Spotlight project: Oath Ecosystem

The OATH ecosystem is changing the world of DEFI by setting up new standards for security, capital efficiency and real yields.

With Ethos V2 now live, bringing new features such as 1-click leverage & LST as collateral, and updated tokenomics on the way, OATH is set to shake things up on Optimism in 2024. You can find $OATH on Velodrome and check out their site at oath.eco.

Follow Oath Foundation on X & Turn on notifications.

🔵CELSIUS: ETH sell-off tracking

by Thomas

Chain never lies. The best DATA are ONCHAIN DATA, no matter what. So when you want to go HARD on buying an asset, you’d rather have made some analysis to plan your entry. And this is the case with ETH as well.

So here is a New development in the Celsius case.

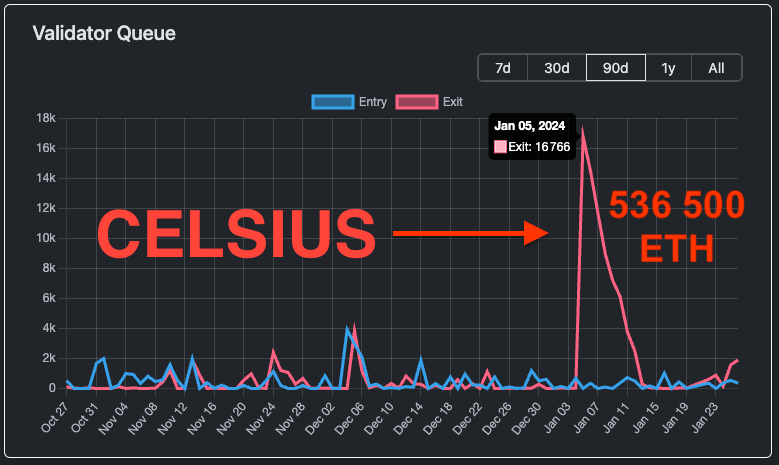

A few weeks ago, the company suddenly unstaked and transferred over a billion dollars worth of ETH to exchanges.

Mass sales or simple adjustments? Discover our analysis on the subject.

Company's Situation

More than a year after Celsius' bankruptcy in July 2022, Judge Martin Glenn, presiding over the case, announced on November 10, 2023, the approval of a creditor repayment plan.

This decision has been welcomed by the community and indicates that the company is on track for exiting Chapter 11.

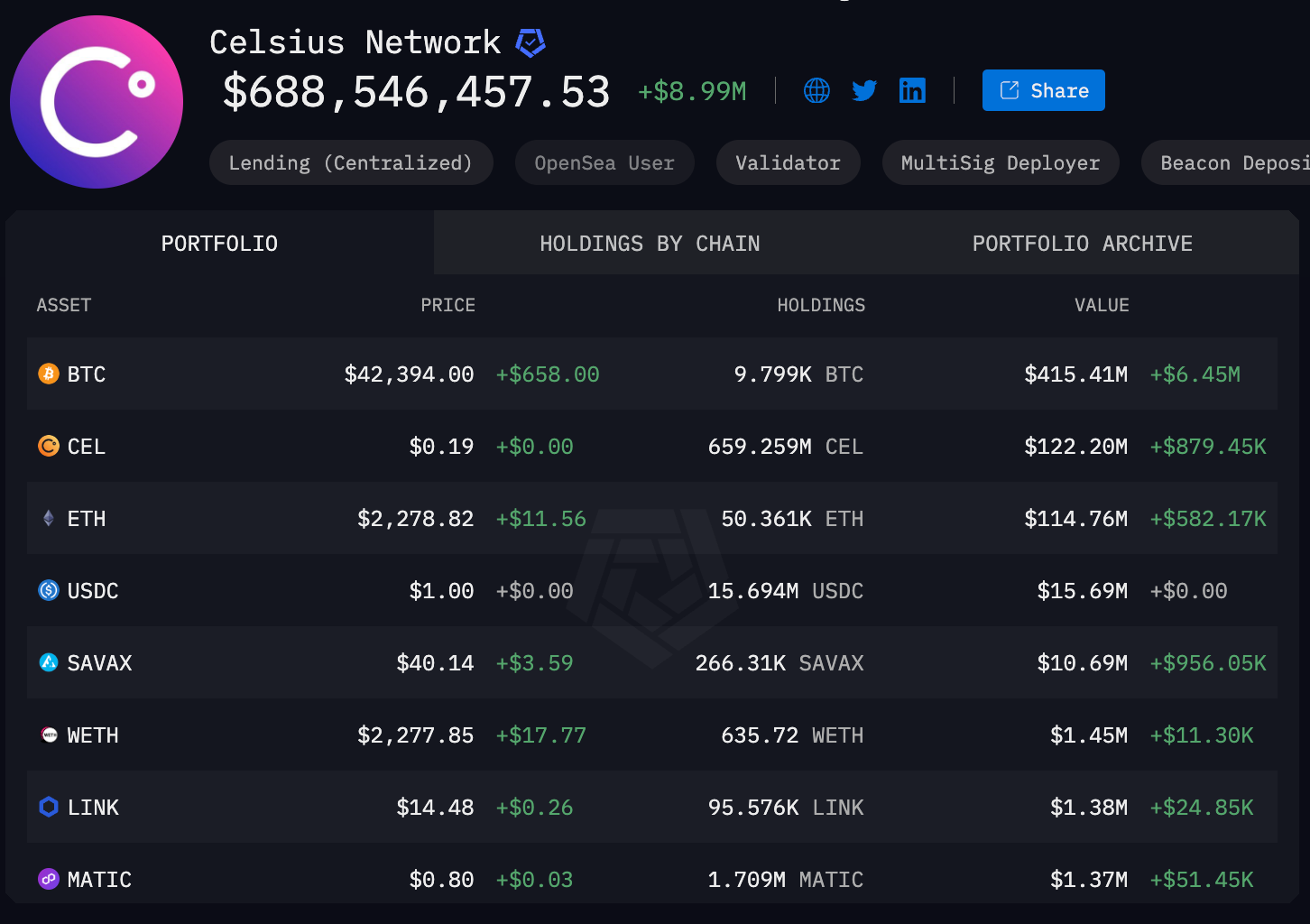

Several billion dollars worth of assets are about to be returned to the creditors.

What does the repayment plan consist of?

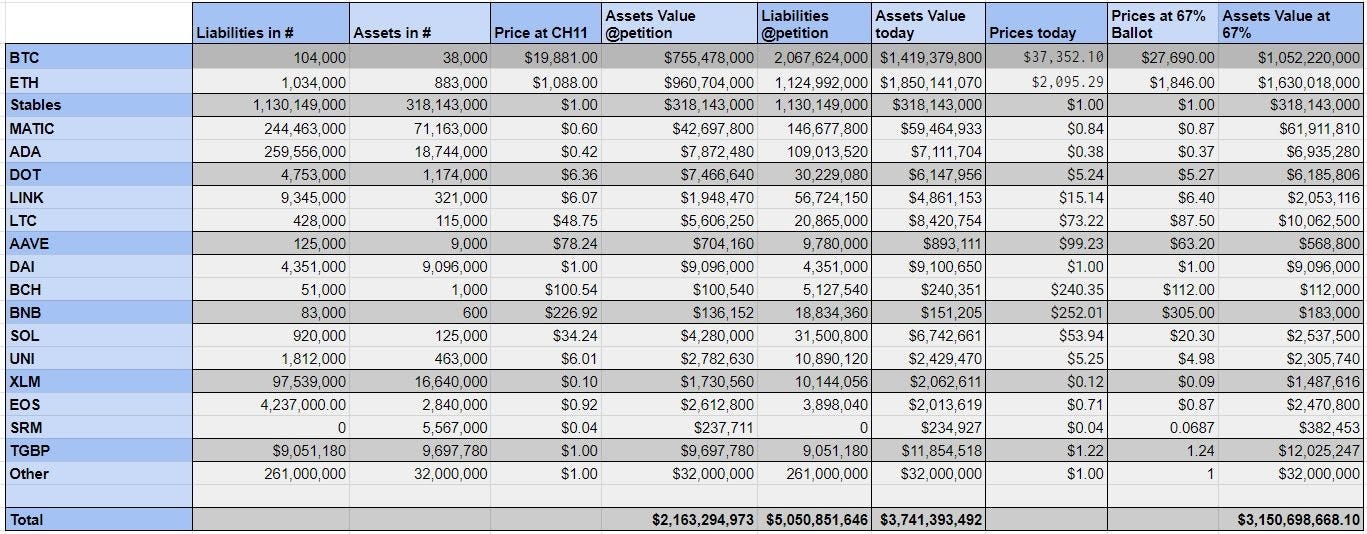

According to our information, Celsius's debt amounts to approximately $5 billion. As for the total value of their assets, it has been accounted for at around $2.16 billion.

However, the prices of the largest assets held by Celsius (ETH-BTC) at the time of the initial balance sheet have changed: the "actual" value of the company's liquidity is now estimated at around $3.74 billion.

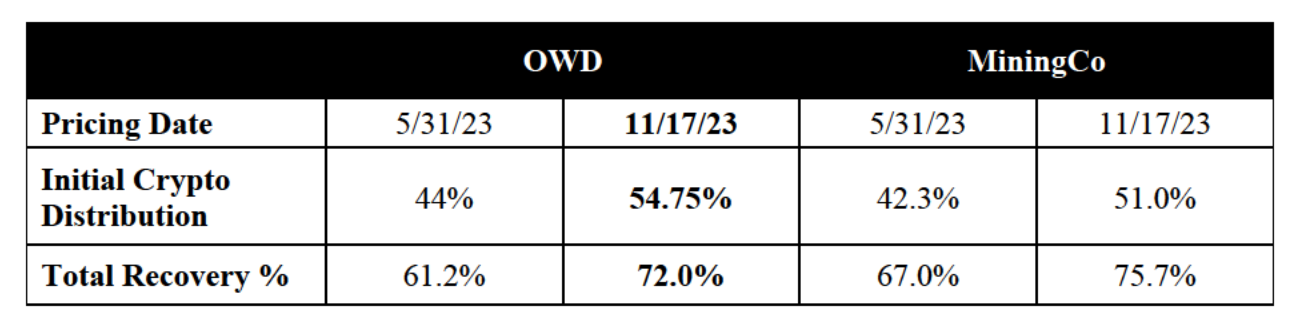

By simple calculation, it is estimated that the recovery rate is around 74%. This aligns with the recovery rates of OWD & MiningCO.

If you are a client of the platform, you may potentially recover your funds at a similar rate: unfortunately, it is difficult to state this figure with certainty as the case is still ongoing.

Note: the distribution of funds will be carried out in BTC & ETH rather than in dollars, which is rather positive given the overall state of the crypto market.

If you had purchased your cryptos several years ago, it is possible that the value of your assets in $ may therefore be higher than at the time of your initial deposit.

(Although the sum in crypto will always be less than what you initially deposited on the platform).

Here are also some important pieces of information about the distribution of funds to Celsius creditors:

The distribution will begin on January 31st

It will be conducted through Coinbase & FalconX

Some clients may not have direct access to their tokens due to compliance issues: this delay is estimated to be between 30 & 90 days

Are the on-chain movements concerning?

If you're a daily Twitter user, you've probably seen dozens of alerts about large ETH transfers from Celsius to exchanges.

But are these transfers indicative of sales? Probably not.

As mentioned earlier, these funds are primarily allocated for customer reimbursements. The significant unstaking also stems from this.

In the end, the only transfers identified as sales were justified to finance operational expenses.

According to our sources, it is estimated that Celsius sold approximately 89,000 ETH (≈ $202 million) to cover various costs. The remainder is held for creditor reimbursement.

At the time of writing (28/01), the company reportedly holds only about $700 million, primarily in BTC, CEL and ETH (the rest has been sent to CEXs). These tokens are expected to be moved soon.

Now that we have more clarity on this matter, another question arises: once Celsius creditors are reimbursed, what will they do with their cryptos?

It's something difficult to determine, but our hypothesis is based on the fact that the selling pressure will certainly not be significant enough to influence the market in any way.

Because these sellers:

Will not have access to their cryptos at the same time (recall the compliance delay of 30 to 90 days)

Will be split between BTC & ETH

Nevertheless, a new chapter is unfolding for Celsius: the distribution is approaching, and clients will finally regain access to their valuable cryptocurrencies.

If you are involved in this matter, check out this unofficial document to estimate the amount you could recover (from the Twitter account "CelsiusFactsNumbers").

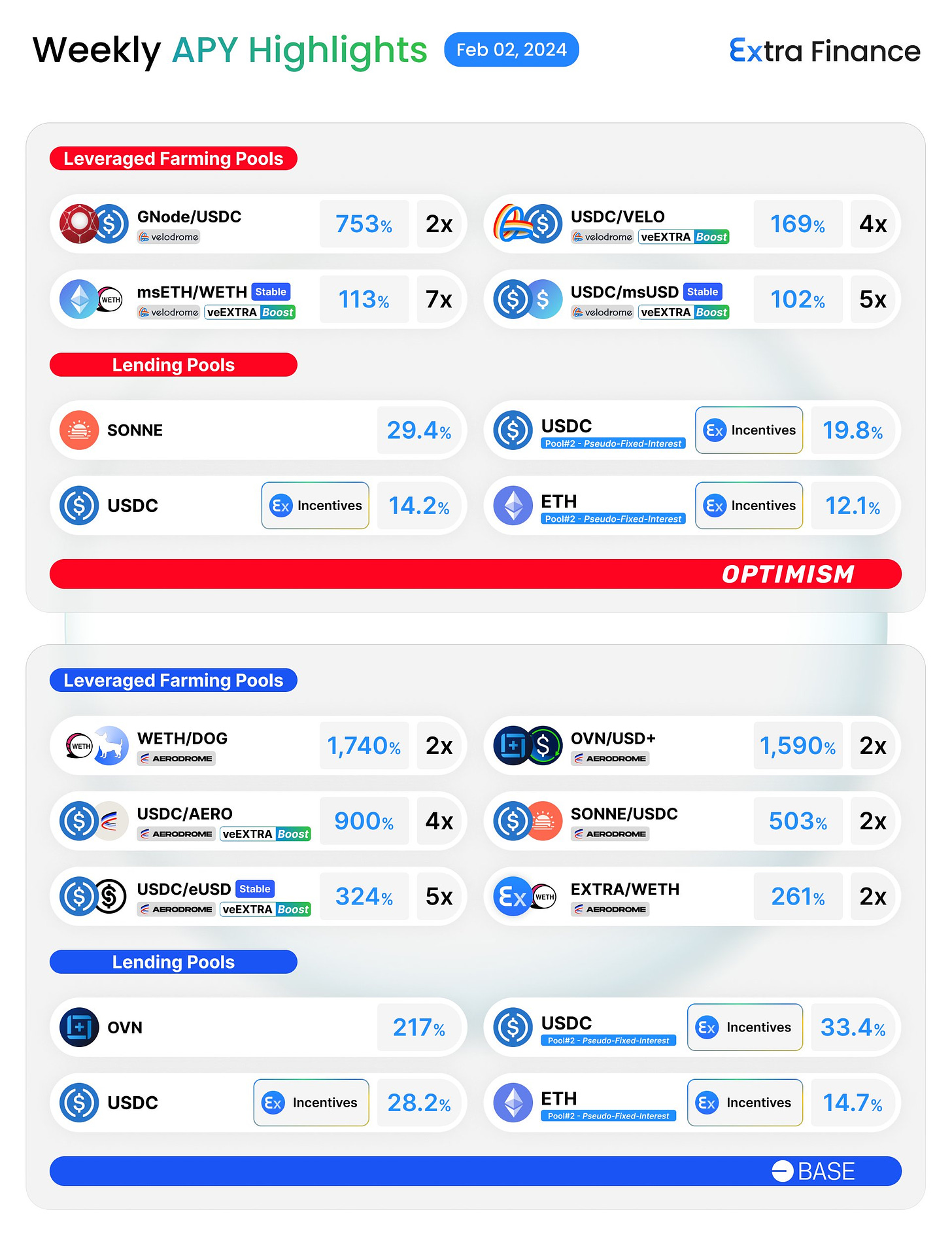

Spotlight project: Extra Finance

Extra Finance is a community based Leverage Yield farming protocol built on top of Velodrome & Aerodrome. Every week you can: leverage your LP position & your yield, deposit ETH or stable in the lending pools, vote on Aerodrome/Velodrome to receive voting incentives, stake EXTRA token to access Delta Neutral position & increased leverage.

Here are some weekly yield on Extra Finance, access the App here:

🟢Crypto market review

by Axel

Bitcoin

The Bitcoin is still consolidating under three significant resistances, as outlined in the previous Newsletter. Should we take a bearish or bullish stance? Let's examine the market together to draw the necessary conclusions for our upcoming actions.

Bullish signs: We are currently in an uptrend; resistances are meant to be broken.

Bearish signs: Bitcoin is currently encountering three significant resistances. (FIB 0.618 in green, the previous bullish channel in orange, and resistance in red).

DXY (U.S. Dollar Index):

The divergence highlighted in the last analysis seems to be in play. This index is turning bullish in short term.

Feel free to refer to NL #1 to understand how to interpret the DXY index.

CME gap

The recent price action of Bitcoin has led to the closure of two CME gaps.

The currently open CME gaps are at the following price levels:

$31,600

$29,800

$27,000

$26,300

$20,500

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin Dominance: We are witnessing a rebound on the BTC.D ticker. However, we are in a range. It will be crucial to closely monitor the breakout, whether it's to the upside or downside.

Ethereum: Ethereum is still in consolidation relative to Bitcoin. We should expect a resolution of this pattern soon.

Conclusion

The Bitcoin is below several weekly resistances, indicating that the resistances have not been breached. Indeed, the risk-reward ratio is not favorable. If the price surpasses these resistances, they will then act as support, providing a viable stop loss and an attractive risk-reward ratio for traders.

Additionally, the DXY index is bullish and poised for a rebound, which is not favorable for cryptocurrencies. While we are not bearish, the Bitcoin could potentially consolidate.

There is hope for a resurgence in altcoins as Bitcoin dominance might break out of its channel to the downside, and the ETH/BTC pair could exit its compression to the upside. This is something important to monitor for altcoins.

However, it's crucial to bear in mind that Bitcoin is the king. If it corrects, Bitcoin is likely to take the entire market down with it. If it consolidates, the focus will then shift to altcoins.

🤯Quote of the week

By courtesy of QuotableCrypto

🍀 Trading Tips: VELO & AERO - Technical & Fundamental Analyses

By Axel & Subli

As you know, I (Subli) have been living the 1st Velodrome year close to the team as a contributor, working on media contents to explain how the Solidly flywheel is working for everyone who discovered it through Velodrome. Since then, I haven’t really removed my eyes from Velodrome & Aerodrome. I’ll share with you today my on-going research on these 2 protocols. Together with the Technical Analysis run by Axel, you can then plan your investment thesis.

I have shared my research frame in The Aerodrome bull case thesis article, read it HERE if you wish.

Here are the kind of metrics I’m keeping an eye on:

Voting incentives: Competition in between protocols to attract liquidity is key for protocol fly-wheel

Swap fees: TVL is a meme, what I’m looking at is onchain activities/volume. Idle liquidity doesn’t generate revenue and sucks / dumps protocol token released through liquidity mining

Locking rate: Price action is based on Sell Pressure Vs Buy pressure. The more lockers, the less liquid tokens are in circulation

Financial metrics

Other META

Voting incentives & Swap fees:

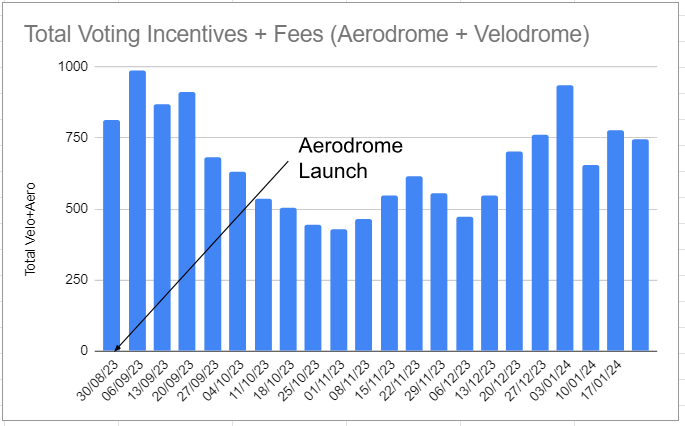

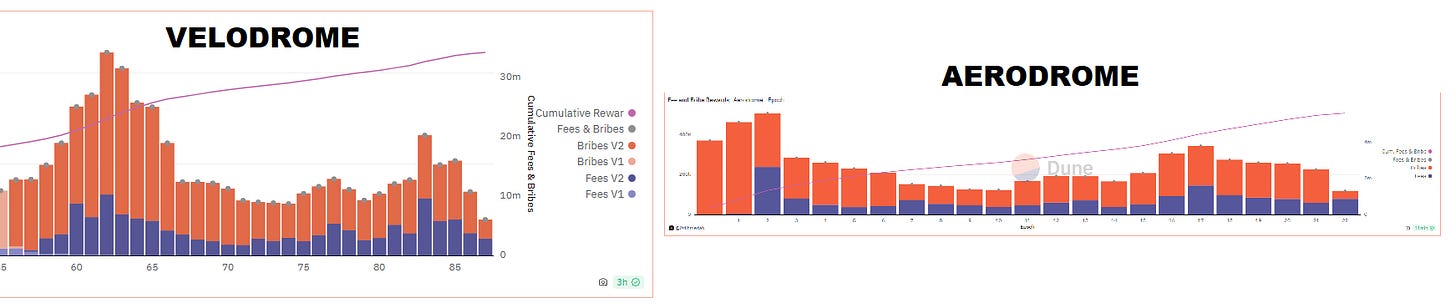

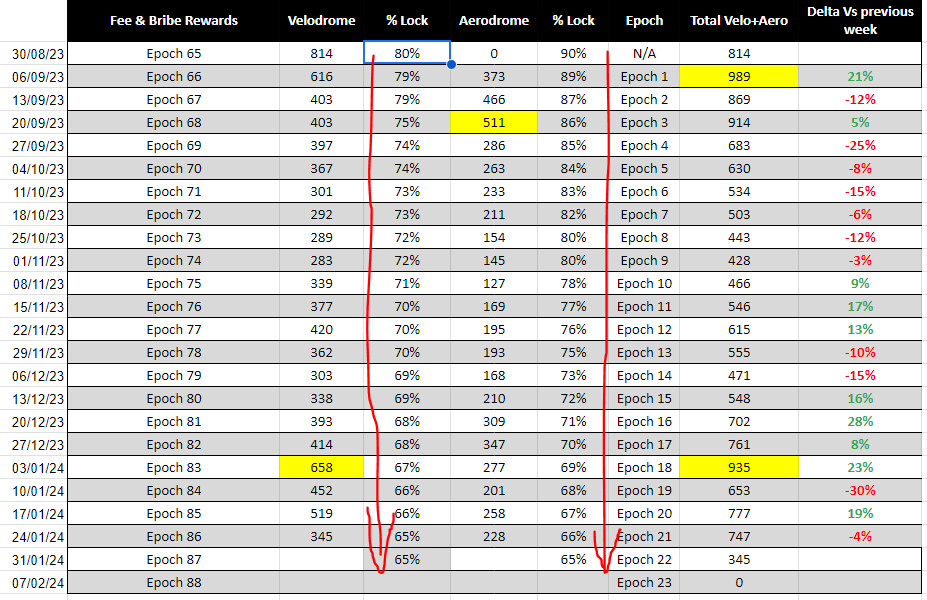

When Aerodrome launched, everyone thought Aerodrome will vampire attack Velodrome On the table below, I have gathered the protocols revenues of both Aerodrome & Velodrome over 5 months.

Analysis: Protocol revenue is ramping up globally which is a sign of good health. Last epoch of 2023 was outstanding especially on Velodrome with revenue achieving a 5 months high.

On Velodrome, on the overall, voting incentives tend to reduce since summer 2023. But fees increased Q4 2023, implying an increased of onchain activity.

However on Aerodrome, after the launch euphoria, we can see that voting incentives tend to increase a stabilize while fees are globally ramping up but with more volatility.

Locking rate:

Locking rates keep decreasing from 80% (Velodrome) & 8% (Aerodrome), to both at 65%. Very surprising to see both protocols having the same locking rate. What I want to see is an inflexion point with then a flat curve or locking rate going up.

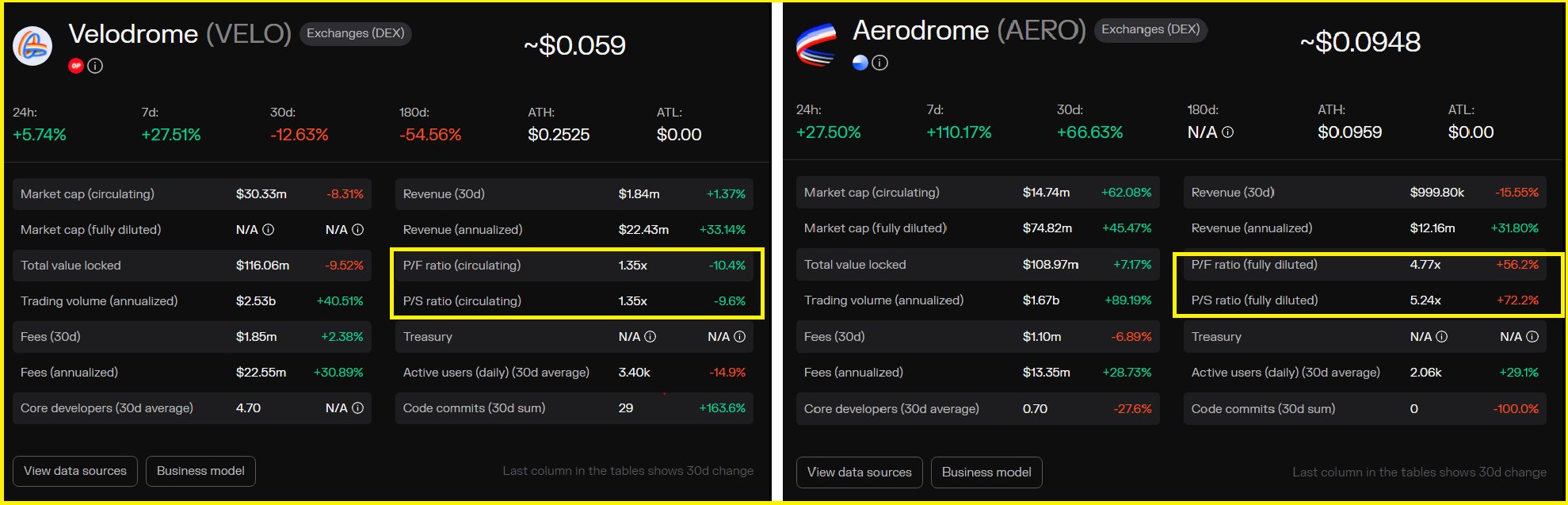

Financial Metrics:

I’m looking at the P/F ratio: P/F ratio (fully diluted) is fully diluted market cap / annualized fees.

And you can see that this ratio for both protocols are close to the lowest ones which means:

Either FDV market cap is low

OR annual revenue is high

In both cases this is very bullish.

Other META:

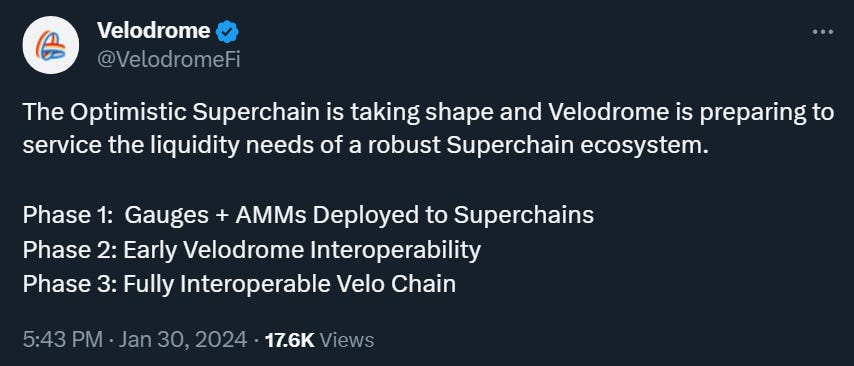

Velodrome:

1st DEX on Optimism by far

Team very close to the OP Team

Managed to onboard a large number of projects (amazing BD)

Team members are very active in the collective (Jack, Alex)

Concentrated Liquidity (Slipstream coming Q1 2024)

VELO Chain

Aerodrome:

1st DEX & 1st protocol in TVL by far

Has been very close to Jesse Pollack since day 1

Concentrated Liquidity (Slipstream coming Q1 2024)

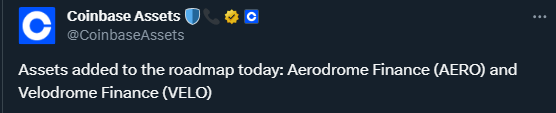

And finally, major announcement, COINBASE added VELO & AERO in their Roadmap (dedicated for early projects):

For info, VELO &is listed on Tiers 2 exchanges only, and Aero is not listed anywhere at the time of writing, according to Coingecko.

Now, let's technically analyze two tokens: $AERO and $VELO. Is it the right time to enter? Let's see what the charts tell us.

$AERO

Let's analyze each indicator:

Volume: The volume is decreasing while the price continues to rise. This is a bearish sign.

Price Action: The price is below the blue resistance. This is a bearish sign.

RSI: The recent peak is lower than the previous one, despite the price being higher. This indicates a divergence, which is a bearish sign.

We currently lack bullish signals for this altcoin. If the price breaks above its blue resistance, then a long position could be considered with a stop loss placed below this new support.

Otherwise, it would be prudent to wait for the price to revisit the demand zone in violet or touch its channel support.

$VELO

We observe that $VELO is still in consolidation between 2.8 and 6.9 cents.

Price Action: The price attempted to break out of horizontal consolidation (deviation 2) but reintegrated the green channel. This is called a deviation, which is a bearish sign.

In the short term, we are leaning towards bearishness as the support of the blue channel is being retested as resistance on the daily chart.

The situation could evolve rapidly to the upside. As described in the market analysis, Bitcoin dominance appears to be waning, and the ETHBTC pair is on the verge of reversing its trend.

To build a position, there is still time to Dollar Cost Average (DCA) or wait for a breakout from the consolidation channel to the upside, i.e., above $0.69.

As you can see above, deviations are strong reversal signals:

During deviation 1, the price broke down the support only to quickly reintegrate it and reach the top of the blue channel. In this case, it is assumed that market makers were hunting for stop-loss orders, leaving only buyers.

During deviation 2, the price broke above the consolidation resistance, only to quickly reintegrate it and has been in correction since. In this case, it is assumed that market makers were hunting breakout traders, leaving only sellers.

Thus, false signals can be significant reversal indicators.

Conclusion:

You are not here to time the top or bottom. If someone is shilling you this, block him. Here, Axel & I, explained our analysis that if combined could be really powerful. In such case, I will start building slowly a position on Velodrome 1st and Aerodrome after when Price Action will move in up or down as explained. My position will increase or decrease based on the metrics shown above.

Of course, nothing above is a financial advice, this is our method, and we acknowledge being wrong and loosing our trade/investment.

🟤Farming Strategy: 30% fixed Yield on ETH

By Subli

Currently farming $ETH has been incredible, and things don’t seem to stop. I’ve been covering the Liquid Restaking narratives since couple of newsletters now, with a focus on one of our partners KELP DAO (this article is not sponsored by the way, I’ve been saying loudly that 'I’m a restaker on KELP DAO, and I trust the team behing the project). If you still' don’t know what the above means, here is a TL;DR:

Deposit Staked ETH on KELP DAO

Mint rsETH , Liquid Restaked Token (LRT)

Staked ETH is deposited on EigenLayer by KELP DAO

Farm EigenLayer & Kelp DAO Points

For more info on the above, check our previous newsletter.

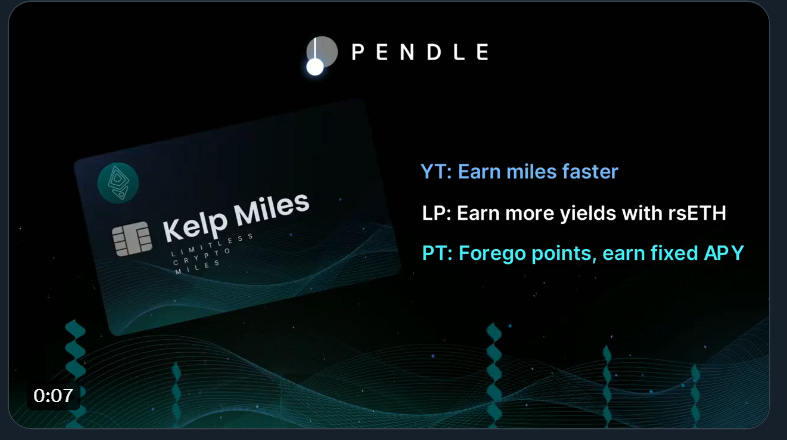

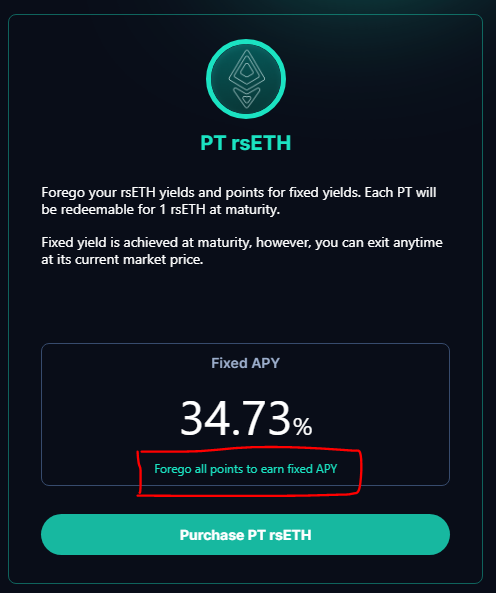

The hype doesn’t stop since now LRT has now accessed DEFI composability and can be used on alternative protocols. Today, I’m going to show you how much it costs to generate a 30% fixed yield on your LRT through Pendle, and what’s the minimum deposit to be allocated to generate enough rewards to cover fees.

PENDLE FINANCE

We have covered Pendle farming strategy in the newsletter #17, I suggest you give it a read if you don’t know how Pendle works.

Pendle Finance has seen TVL doubling in couple of days due to LRTfi narrative:

LRTfi farming

Pendle allows different strategies on top of LRT, such as rsETH:

Swap your rsETH into YT-rsETH and maximize points farming on EigenLayer => On this strategy your YT-rsETH will be equal to 0$ at the end of the maturity period, people expecting higher airdrops than the deposited funds. I recommend to read this thread from Pendle that explauns in details this strategy: https://x.com/PendleIntern/status/1750459008610410619

Swap your rsETH into PT-rsETH and go for a fixed yield

A well-known crypto investor chose the following strategy:

I’m a cautious farmer. Exploits, derivatives token depeg, volatile yield, impermanent loss are all the reasons that push me to use safe & steady yield farms.

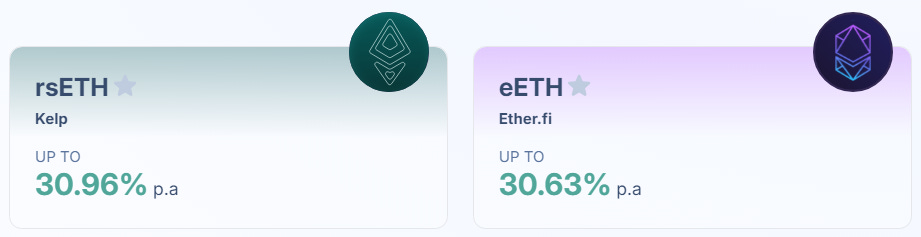

So when i see this, as a long term ETH holder, i can’t resist:

You can get 30,96% fixed APR on rsETH for the coming 150days (so 12.7% of yield over this period). Only drawback, you let go all your EigenLayer point & Kelp Miles:

How? Honestly, it’s pretty amazing as simple it is.

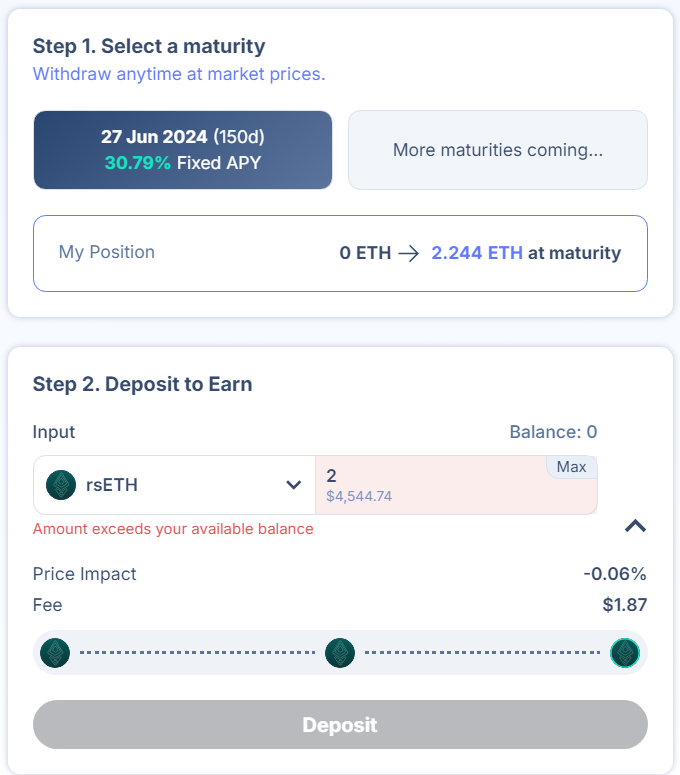

Step 1: Select maturity date

As time of writing, there is only one option showing what’s the annual yield over the set period of time.

Step 2: Deposit to Earn

I suggest you mint rsETH on KELP DAO first to earn KELP points, and then deposit on PENDLE (total approx fees on a sunday <50$)

Deposit your rsETH on PENDLE, and you can see that your holding will be worth 2.244 ETH at the end of the maturity period (12,2% yield over 150days so equivalent to 29.7% APR) (fees on a unday <5$)

Step 3: After having deposited

Check the transaction on Debank, you will see you have received the following asset in your portfolio: “PT-rsETH-27JUN2024

Minimum PF Size

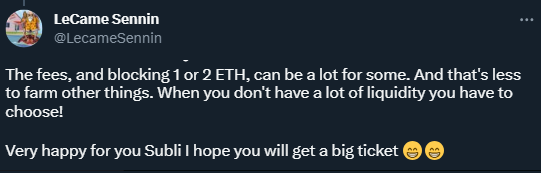

Too many times, i’m reading this:

But, if ETH is part of your long term investment, and you can allocate a small part of it into this derivative aka rsETH, then you should do it.

Total fees for Steps 1 to 3 + claiming your rsETH after maturity date will be less than 50$ if you select the right timing (under used network over a week-end).

So if you deposit 500$ of ETH, 12.2% of yield = 61$ of rewards > paid fees. And this is without taking into account KELP & EigenLayer Airdrop 😱.

But keep in mind of some underlying risks of this strategy:

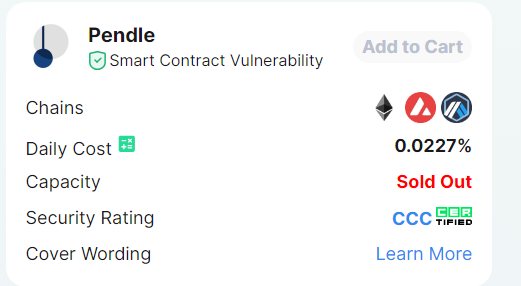

Smart contract x3 (Pendle, Kelp DAO, EigenLayer) => You can buy an onchain cover on Insurace to cover for Pendle Smart Contract exploit (sold-out at this moment….). Nothing exists yet for EigenLayer & Kelp DAO as far as i know.

rsETH is a derivative asset, and could un-peg => However this is mitigated due to the redeem function

DEFI Composability

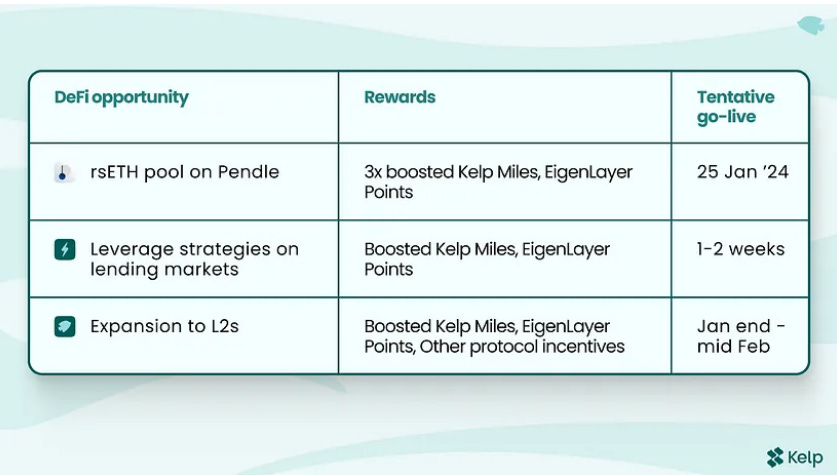

Many more DEFI opportunities are coming in the coming weeks & months for rsETH & expect for all the others LRTs. For rsETH here is what has been announced:

I would suggest all of you to listen to the Podcast with KELP DAO held this week, this will tell you where you will be able to find rsETH on L2.

In the end, I’m an exciting ETHEREUM farmer, farming also KELP & EIGENLAYER points. What could be better?

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

The Optimist Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.

very comprehensive, gg!