The Optimist Newsletter #17

The one & unique Newsletter on the Optimism Superchain (OP Mainnet, Base, Zora) written by Users for Users

First of all, i’d like to express my thanks to you readers, for your comments, support, likes on this Journey. Big 👏 to the team for making The Optimist the go-to Media for everything about the OP Stack.

And finally, welcome to the 315 new subscribers to this newsletter.🚀🚀

As the newsletter is made for you, we’d like to ask you to help us to improve its quality (it’ll take you <1min to answer few questions) - Click here to support us 🙏

Thanks for reading The Optimist Newsletter. Subscribe for free to not miss anything on the Optimism Superchain.

Click in your preferred language to access the translated document:

Chinese - Filipino - French - Japanese - Korean - Persian - Russian - Spanish - Thai - Turkish - Vietnamese

TOPICS OF THE WEEK - ANTI-DEPRESSION PILLS

🔴Governance: Season 4 - Cycle 14 - Grant winners

10 projects were granted a total of 1m OP tokens. How to benefit from it and farm some rewards? We provide you the full details here on some of the major projects.

🟣Projects Review : Aerodrome Bull Case

Aerodrome launch has been a real catalyst for Base. But, to avoid FOMO, we looked at onchain DATA, and compared them with Velodrome (success) and Chronos (Failure), for you.

🟡Onchain Analysis: the OP Stack adoption - A Catalyst for Optimism's Growth

15+ projects are currently being built on the OP Stack, resulting in being the largest framework currently used in Crypto. Tech is one thing, metrics such as TVL is another. All you need to know about the OP Stack adoption.

🟢Crypto market review & Learning tips

Bi-weekly update on the Crypto Market + educational tips: Learn how cycle repeats itself

🟤Farming Strategy: Pendle & Its Convex-type layers (Equilibria & Penpie)

Pendle, Equilibria & Penpie has just launched on Optimism. Do you want to know how to Get a fixed ETH staking Yield OR Leverage your ETH staking yield OR even earn 18% APY on your ETH? This is the right place to stop by.

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live :

Pendle

BloctoApp

Podcasts available at the end of the newsletter

Spotlight project: Ethos Reserve

Ethos Reserve is an official Sponsor of The Optimist Newsletter

Ethos Reserve is for me the most simple leverage position available on Optimism. Deposit ETH, wBTC or OP and mint ERN stablecoin with only a fixed fee on your borrowed amount, no more variable interest.

Ethos Reserve has recently revealed its roadmap to scale ERN usage in three phases: init, advance, and evolve - ERN omnichain, staked ERN, support of Liquid Staking Tokens assets, … Curious on what it says? Give it a read by clicking here.

Try the most decentralized stablecoin NOW!

⚫The Optimistic series Campaign is live - Engage to Earn 30k OP

Questoors, come, engage about #Optimism by completing this series of quests, and earn OP token.

https://www.tideprotocol.xyz/users/spaces/258

Timeline:

Quest #1: 🟢Live - End on 30-September

Quest #2 to #5: 🔴Closed

Quest #6: 🟢Live - End on 02-October

GOVERNANCE TIMELINE

Cycle 13 : Ended / Cycle 14: Ended / Cycle 15: On-Going

Spotlight Project: Overtime

Overtime Markets is an official Sponsor of The Optimist Newsletter

Join the thrill of the game with Overtime, your premier onchain sportsbook, offering heavy incentives on select sports markets.

With our new player prop feature and innovative parlays, why just watch when you can earn?

The NFL season is here, try Overtime Now!

🔴Governance: Season 4 - Cycle 14 - Grant Winners

by Natali

In Cycle 14 of the Optimism Grants program, a total of 97 grant applicants participated, showcasing sustained interest and enthusiasm for innovative projects. The program emphasizes fostering innovation within the Optimism Collective to support the growth of public goods.

In this article, we will present you the finalists & how us, as users, could benefit from their OP Grants.

Here's an overview of the winners in the Experiments categpry:

Experiments:

Clearpool (150k OP)

Clique (100k OP)

Idle (150k OP)

Invest in Music (5k OP)

Let’s Get Hai (100k OP)

Liquity (150k OP)

Mutual (35k OP)

Octav (45k OP)

Qubit Wallet (50k OP)

Wombat Exchange (150k OP)

Let’s know about the biggest of them.

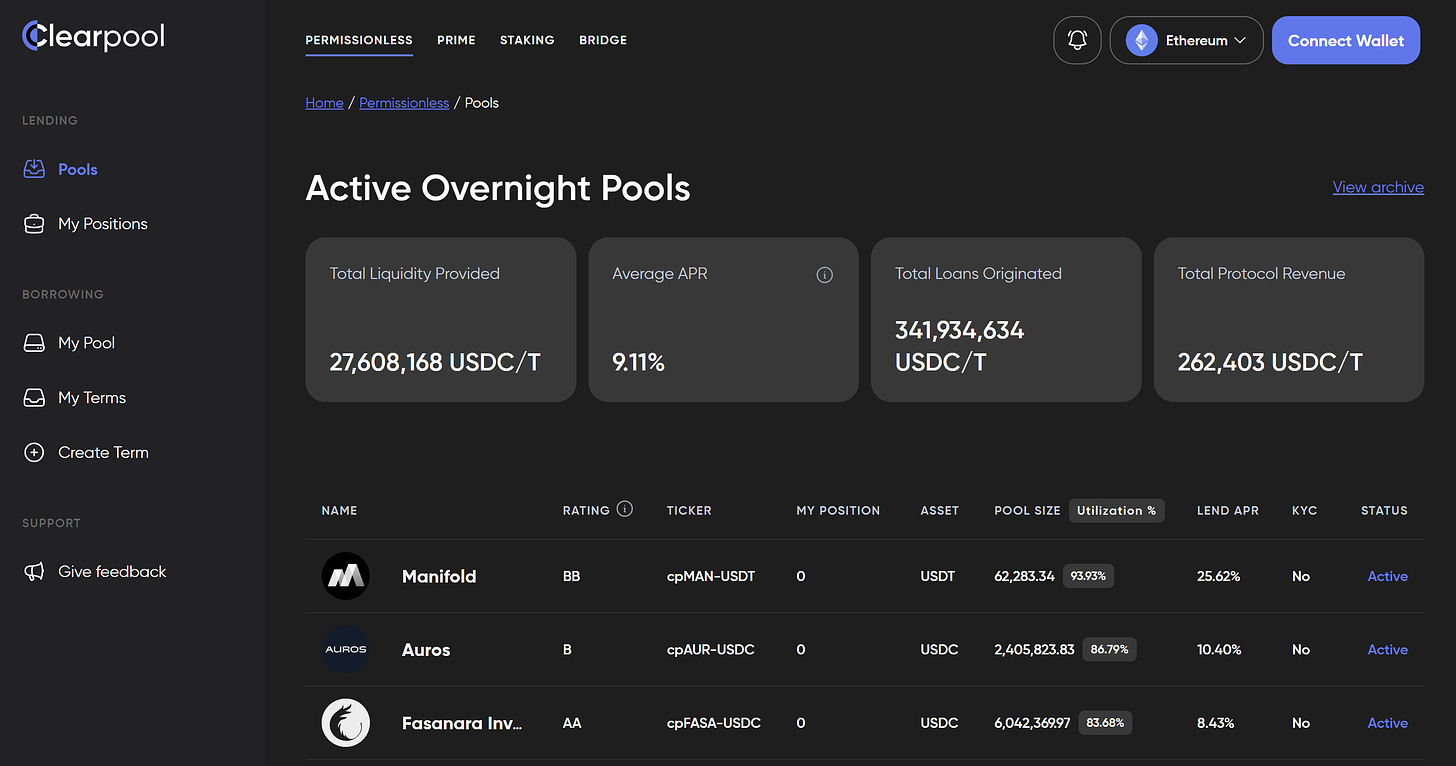

Clearpool (150k OP)

Clearpool is a decentralized finance ecosystem incorporating the first-ever permissionless marketplace for institutional liquidity. Driven by market forces of supply and demand, Clearpool’s single-borrower pools enable institutions to raise short-term capital while providing DeFi lenders access to risk-adjusted returns based on interest rates derived by market consensus.

The first decentralized credit marketplace.

422,674,843.59 loans originated.

How you can use it:

- Crypto lending

Earn compounding interest on every block by lending to vetted institutions.

Dynamic risk-adjusted interest rates

No lockup – withdraw anytime

Autocompounding yield

- Staking

Stake CPOOL to help secure Clearpool's interest rate mechanism.

Stake CPOOL to a Clearpool Oracle pool

Share your opinion on interest rate voting

Earn a yield on your staked CPOOL

- Bridge

Securely transfer CPOOL between Ethereum & Polygon chains.

Ethereum & Polygon supported

Single transaction operation

Secure & audited technology

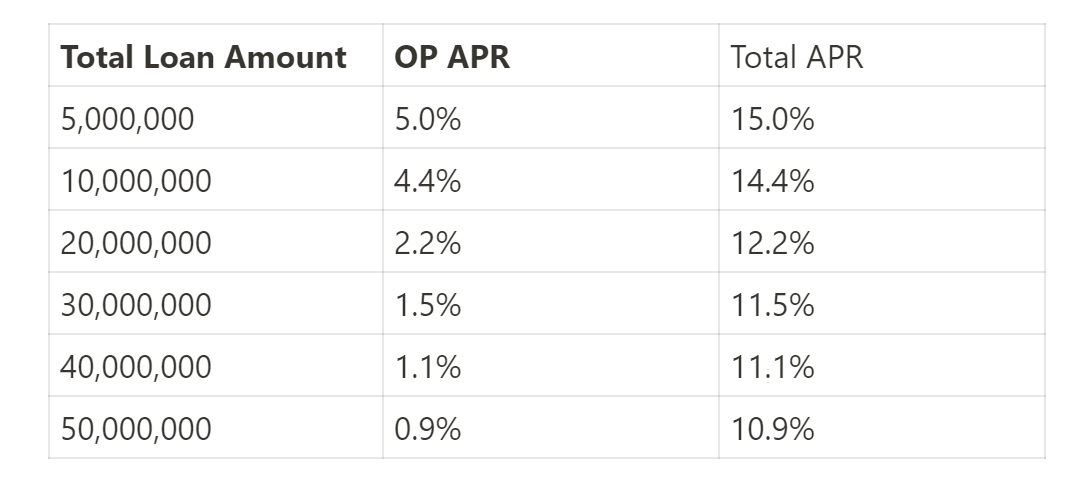

They are distributing the grant via liquidity mining incentives across different dynamic borrower pools (trading firms + fintechs), over a period of 6 months. They aim at achieving $25m+ TVL on Optimism. They aim to distribute 25k OP per month over 6 months, which at current price would result in an additional 2.2% OP APR at $20m and 1.5% at $30m TVL (see table below)

Clique (100k OP)

Clique is building a new type of primitives, identity oracles, that bring arbitrary private web2 data on-chain in a trust-minimized way. This includes end users’ personal identity and behavior data, institutional private financial data, AI inference results, or any other private API data and off-chain computation output. Underneath, we built a modular oracle stack composed of ZKP, TEE, and MPC, with the former ensuring identity anonymity and data confidentiality, and the latter two ensuring data integrity and provenance.

Currently, our Oracles support 200+ distinct oracle pipelines from 15+ web2 platforms (social media, content platforms, games, KYC/fintech API providers) with highly customizable trust assumptions. In addition, our customers can use our oracle SDK to develop arbitrary web2 API integration and off-chain private computation modules with a few lines of code.

100% of tokens will be distributed to users.

Distribution Strategy:

Multiple Prize Pools:

Main Prize Pool = Sum of every leaderboard to recognize the true Optimism DeFi Power Users.

Each Action-Based Competition will have two confirmed prize pools.

a) The top 20% will get the reward split between them in terms with regards to the Event’s main leaderboard.

b) Everyone including the top 20 % will be eligible to take part in a competitive raffle where there will be a fixed number of winners.

c) [TBD] Partnership with protocols, where protocol will set up two reward pools where the top 10% are distributed the rewards w/ regards to EXP & also a competitive raffle where there will be a fixed number of winners ONLY for those who participated in that protocol’s task.

Feedback Pool - we will provide the data to the individual protocols & work with them on a survey.

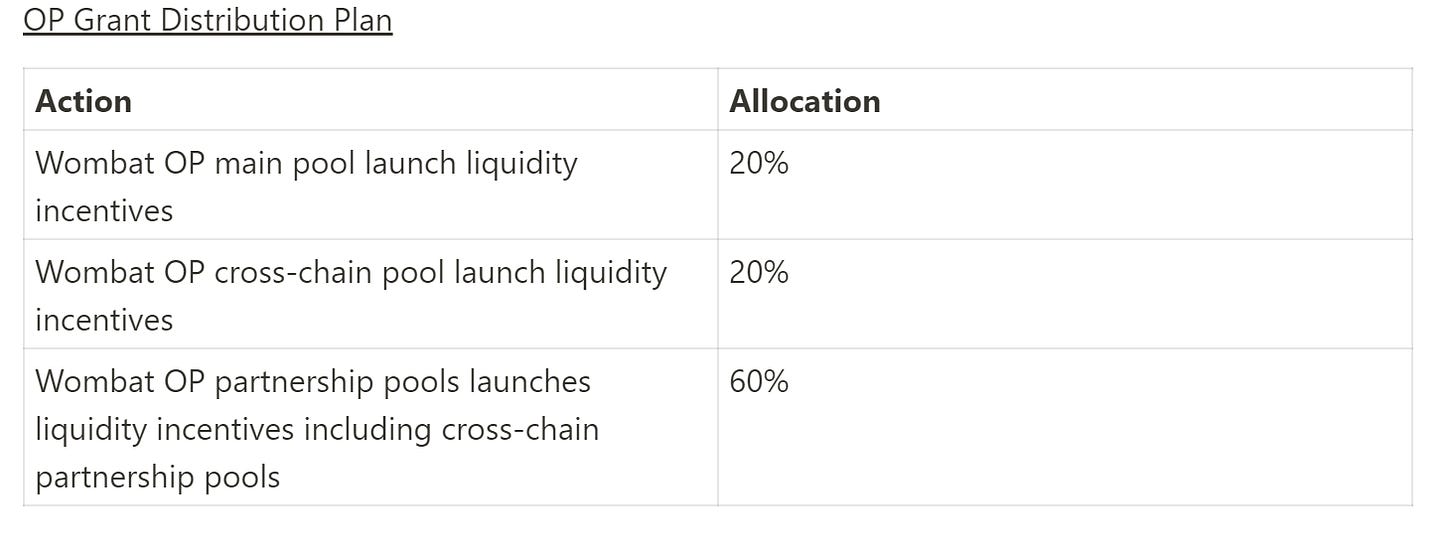

Wombat Exchange (150k OP)

Wombat Exchange - swap stablecoins at minimal slippage and stake at maximum yield. Just one stablecoin currency to earn it all.

Wombat Optimism plan:

Launch of Wombat main pool on Optimism for beta testing with the initial pools being USDT, USDC and DAI with a pre-launch marketing campaign (with incentives to try liquidity provisions, swaps and social engagements funded by Wombat) with liquidity provision incentives (funded with the grant).

Launching of partnership pools once beta testing is complete with Wombat’s existing partners such as Stader and Frax, and our ecosystem projects such as Wombex, Magpie and Quoll, with a full launch marketing campaign (funded by Wombat and/or ecosystem projects) with liquidity provision incentives (LP incentives funded by the grant).

Launching Wombat cross-chain OP pools with a full marketing campaign (funded by Wombat) with liquidity incentives (funded by the grant) with Wormhole.

Launch quests on learn-do-earn and marketing platforms to educate users into trying to provide liquidity and perform swaps on Wombat and cross-platforms through our ecosystem projects to educate new users to try Wombat OP (funded by Wombat).

These grant recipients represent a diverse group of innovative projects that have been deemed well-suited to receive support within the parameters of Season 4 governance. The Council looks forward to supporting these projects as they continue to grow and contribute to the Optimism ecosystem. Congratulations to all the grant winners!

🟣Project Review : Aerodrome Bull Case

By Subli

In the world of cryptocurrency, the adage "Follow the builders" has often proven to be a wise approach. Projects that continue to deliver results even during the challenging times of an 18-month bear market are the ones poised for substantial growth when bullish market conditions return. With that in mind, welcome to Aerodrome, where we aim to present our own bullish perspective. It's important to note that this is our personal opinion, which may contain errors or inaccuracies, and should not be considered financial advice.

1. Successful take-off ✈

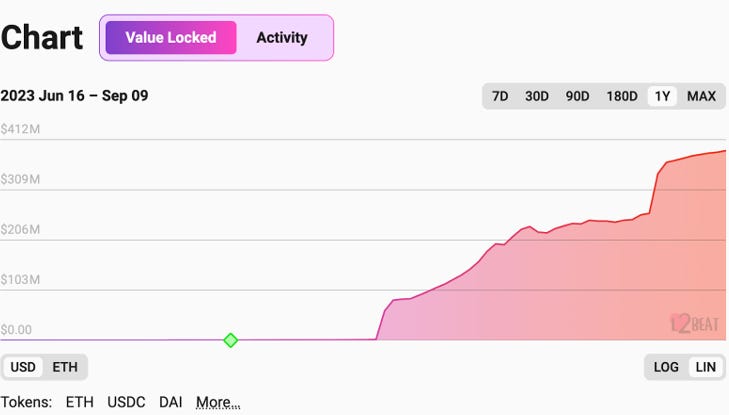

Despite the presence of several other decentralized exchanges (DEXes) that had been launched either before or shortly after Base's official public launch, Aerodrome managed to double Base's total value locked (TVL) in just 48 hours.

Aerodrome has now claimed the top position as the leading protocol with an impressive TVL of $160 million.

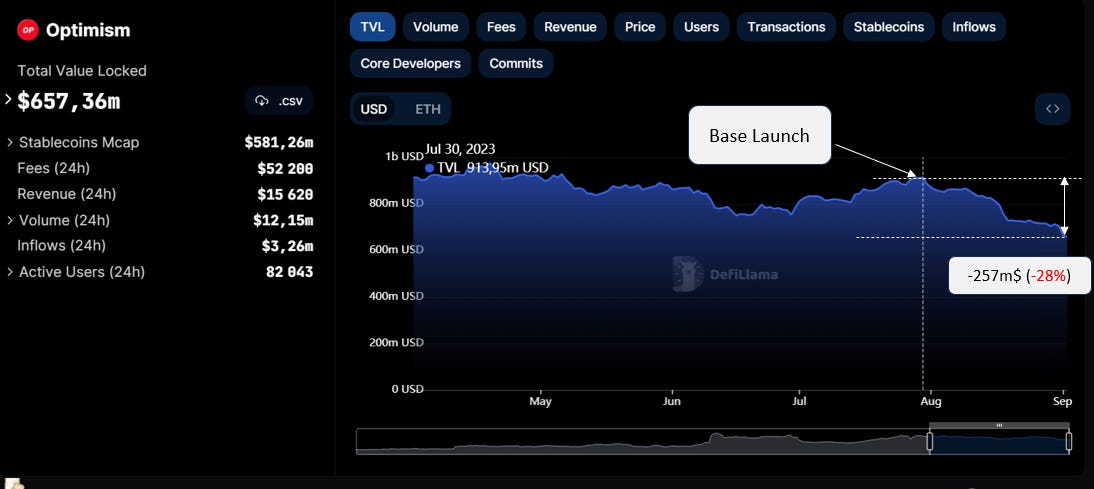

However, it's worth investigating where this increase in Base's TVL came from. Did it come at the expense of Velodrome and OP Mainnet?

Examining the chart below, it becomes evident that OP Mainnet's TVL has experienced a decline of 28%, which is likely due to funds migrating to Base. On the other hand, Velodrome's TVL has decreased by 26%, representing a reduction of $50 million.

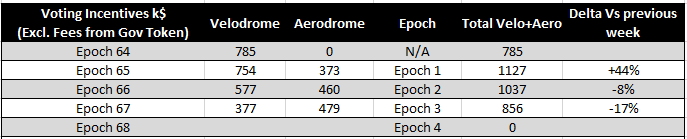

2. Voting incentives at start

My own expectation was that bribes or voting incentives wouldn't be significantly high initially. I anticipated the competition for attracting $Aero emissions would be relatively low at the outset.

However, it turns out I was mistaken!

Epoch 0: 373k$ as voting incentives

Epoch 1: 460k$ as voting incentives

As of the time of writing, Epoch 2 promises to be even greater, with substantial accrued fees totaling 280k$. This leads me to anticipate a sustainable revenue stream of over 700k$/week for veAERO holders in the coming weeks, so at the same level of ATH revenue of Velodrome.

I'll also be closely monitoring the distribution of voting incentives between Velodrome and Aerodrome as i’m not forgetting Velodrome and i’m interested to see how it will become along side Aerodrome.

3. Tokenomics

The tokenomics of Aerodrome are indeed quite intriguing, particularly at its inception.

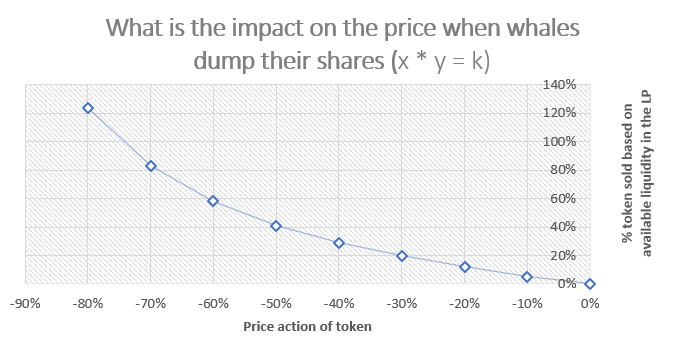

For those considering an investment in $AERO, it's crucial to comprehend the tokenomics and assess the potential sell and buy pressure. Here's a brief overview of the upcoming $AERO supply:

Initial liquid supply: 10m $AERO distributed as voting incentives for epoch 0 => very shallow liquidity on the LP at start

Weekly emission from 10m to 15m per week in the coming 14 weeks =>

Epoch 0: 10m $AERO

Epoch 1: +10m (+100% weekly Inflation)

Epoch 2: +10,3m (+50% weekly Inflation)

Epoch 3: +10,6m (+35% weekly Inflation)

… Epoch 13: +14,3m (+9% weekly Inflation)

The inflation rate is indeed very high. It's essential to understand the potential impact on the pool price if a significant amount of these newly emitted tokens is dumped into the market:

4. Bull Case

Now, let's explore the bullish scenario:

Sustained Voting APR: The voting APR appears to be holding steady, at least during the first two epochs. We anticipate that the voting incentives will continue to be substantial.

Surging Swap Fees: Aerodrome has seen a remarkable increase in swap fees. In the 1st week, it has accumulated 280k$ in fees. These swap fees will be integrated into the voting incentives starting from epoch 2.

Remaining Voting Incentives: There's still the potential for up to 40 million $AERO to be utilized as voting incentives by the team, as indicated in their recent article titled "Prepare for Lift-Off"

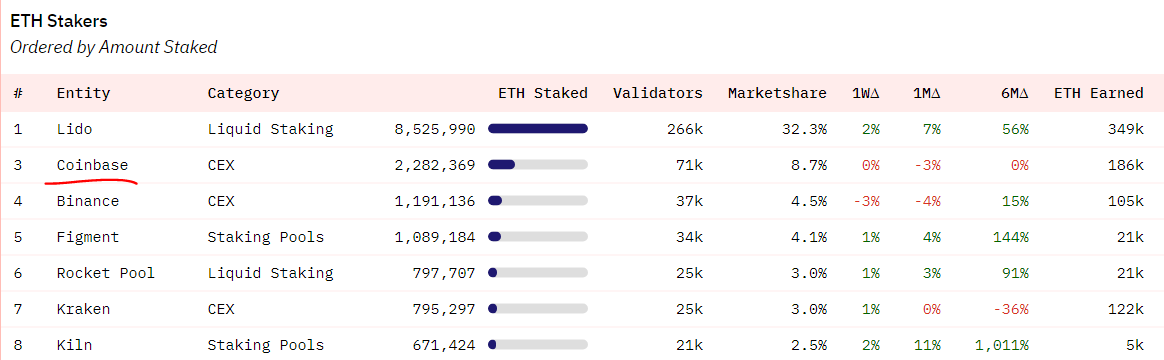

Coinbase Liquid Staking Token ($cbETH) Dominance: Aerodrome has become the primary hub for Coinbase Liquid Staking Token $cbETH, boasting a pool TVL of $25 million and offering a 9% APR (at the time of writing). Coinbase seems to be actively competing in the Liquid Staking Token landscape, aiming to maintain its second position, just behind Lido and ahead of its primary rival, Binance.

It's reasonable to assume that Coinbase will take strategic steps to ensure the competitiveness and attractiveness of its offerings on its own Base blockchain by sustaining a competitive APR on the cbETH pool.

How?

Coinbase could use its significant financial power to market buy $AERO either to sustain price or to build a significant locking position.

Base might be the leading L2 for the forthcoming months & years. With their mission to onboard billion of users, their amazing marketing campaign with #onchainsummer, plus the fact that any successfull dAPP might see themselves on the Coinbase Wallet or even better be part of Coinbase Ventures portfolio, Base will attract DEFI builders, that will attract users => TVL => Volume & Fees => More revenue

You can feel this during this live space between Jesse Pollack (Base Project Manager) & Alex Cuttler (Aerodrome/Velodrome co-founder). Twitter space here

5.Things to watch out

Before any investment, one needs to understand the pessimistic case so that one is prepared for the worse & understand when the flywheel doesn’t kick off.

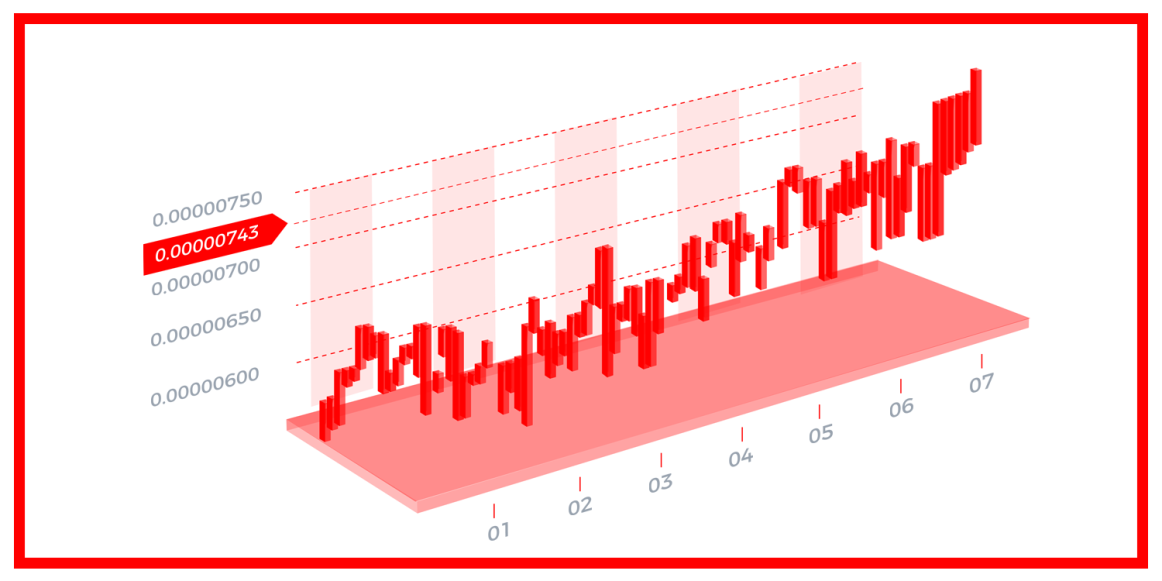

Price action vs Voting incentives

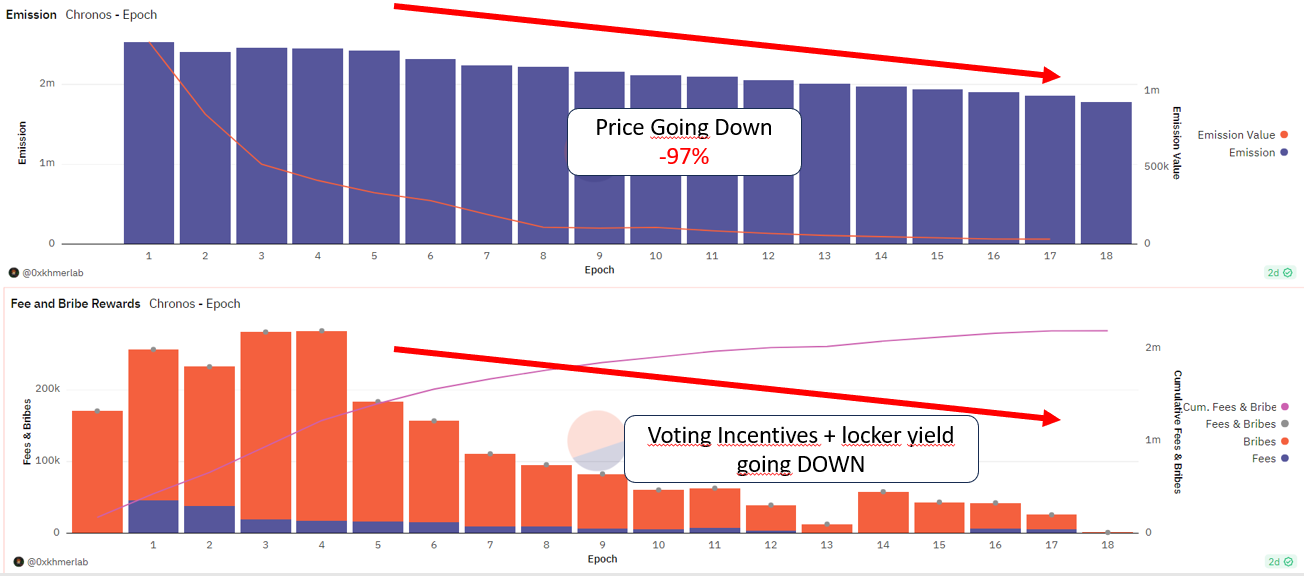

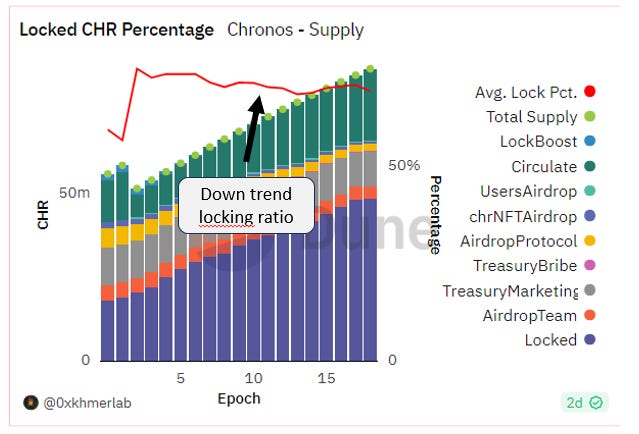

We definitively don’t want to live again the Chronos Journey (-97% in price):

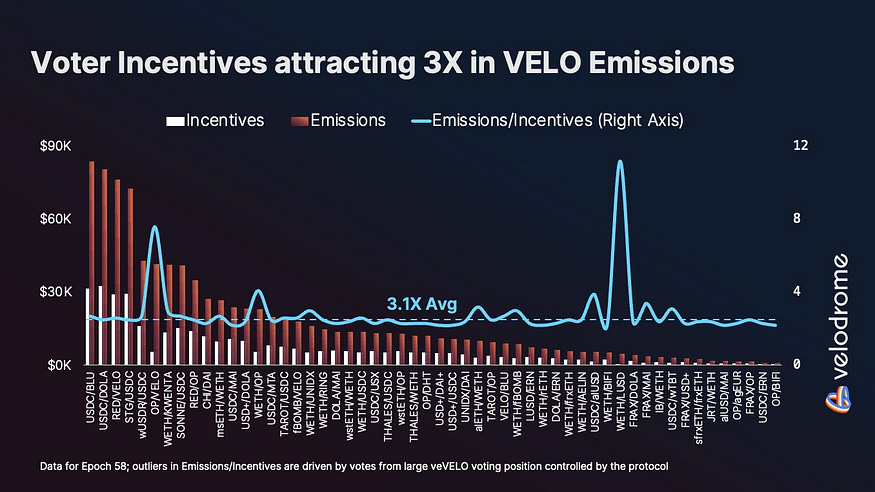

The spinning flywheel concept mandates that, for every $1 allocated as a voting incentive, a redirection of more than $1 in emissions, specifically in this context $AERO tokens, should be channeled into the liquidity pool.

Despite a robust start, the underlying problem became evident during Epoch 14 when the leverage factor dropped below 2. This, coupled with intense competition from other decentralized exchanges (DEXes), the prevailing bear market conditions, contributed to a decrease in voting incentives, leading to the price going to Goblin Town.

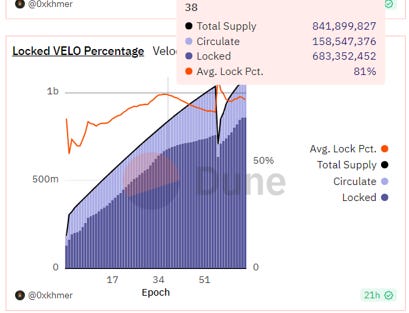

Compared to Velodrome, where the leverage ratio has been about 3x (data taken at epoch 58), and locking ratio steady increase up to epoch 38:

For Aerodrome, I will also look at voting incentives & fees but without considering:

AERO/USDC swap fees

The use of the remaining 40m AERO by the team

And in terms of price action, i’d like to wait for a flat price action, due to the facts explained in the above Tokenomics section. I’ll be waiting for an equilibrium between buyers & sellers like we had twice on Velodrome before the massive 10x.

Locking Ratio

The principle at play here is that the more tokens are locked, the fewer tokens are available in the market.

A crucial metric to monitor in this context is the locking ratio. On Chronos, this ratio appears to be gradually declining. This indicates that a significant portion of the weekly emissions is not being locked but is instead sold on the open market.

While on Velodrome, the locking ratio keeps increasing.

For Aerodrome, i will keep an eye on the locking ratio to see how it’s trending. For the time being, the amount of AERO locked is insignificant (2m AERO out of 20m AERO emitted).

6. Conclusion

In conclusion, the Aerodrome project presents an intriguing opportunity within the crypto landscape, but early entry may entail substantial risks. It is essential for potential investors to thoroughly understand the project's flywheel dynamics and carefully assess the relevant metrics before making investment decisions.

Aerodrome, much like Velodrome, offers a range of investment strategies based on their preferences and risk tolerance:

Full Locking: This strategy involves locking assets while simultaneously earning voting incentives and fees.

Providing Liquidity: Investors can choose to provide liquidity to the pool, earning $AERO.

Swing Trading: Trading

It's important to note that this article reflects my personal insights. However, it is strongly advised not to blindly follow any individual's advice or recommendations, including those provided in this article.

🟡Project Review : The OP Stack adoption - A Catalyst for Optimism's Growth

by Stacy Muur

OP Stack adoption is on the rise, and it's reshaping the landscape of Optimism. Chains built with OP Stack are approaching $3 billion in cumulative TVL, a testament to the technology's appeal. It's truly incredible considering that the OP stack is relatively new and only started to become a plug & play infrastructure after the Bedrock upgrade in early June.

But what's even more exciting is the growing list of protocols choosing to build on OP Stack.

In this article, we'll explore the reasons behind OP Stack's popularity, the unique selling points of its first adopters, and how this adoption is propelling Optimism's growth.

Why OP Stack?

Developers are increasingly drawn to OP Stack because of its unique design that enhances interoperability within the Ethereum community. It empowers developers to create bespoke blockchains tailored to specific user requirements efficiently. OP Stack represents the initial phase of a rapid expansion of compatible Layer-2s and Layer-3s, collectively referred to as op-chains within the Optimism ecosystem.

These op-chains are not standalone entities; they are building blocks for a more integrated future. As they evolve, the boundaries between them will blur, giving rise to a unified Superchain. While not all op-chains will become part of the Superchain, some may emerge as competitors, like Binance's opBNB offering. Nevertheless, this Superchain will enable shared resource utilization among multiple op-chains, fostering collaboration.

Base: The First Big Success Story

Let's take a closer look at Base, one of the notable adopters of OP Stack.

In the past month alone, Base has generated over $4 million in revenue. With 15% of these earnings contributing to the Optimism treasury, this amounts to nearly $6 million per year. And remember, that Optimism revenue will be shared among Optimism builders through Retroactive Public Good Funding (RPGF) => Positive flywheel.

Protocols Building on OP Stack

In addition to the chains live on the mainnet and testnet, several protocols have already their mainnet leveraging the OP Stack technology:

Zora: Zora is a decentralized marketplace for minting, buying, and selling NFTs. By adopting OP Stack, Zora aims to enhance its scalability and user experience, making it easier for artists and collectors to engage with NFTs.

Zora’s current TVL is $5.58M

Aevo: Aevo is a high-performance decentralized options exchange which uses a layer-2 Ethereum optimistic rollup based on the OP Stack combined with a cloud-hosted sequencer operated by Conduit, a third-party infrastructure provider (check newsletter #13 where we covered a detailed article about Aevo)

Aevo’s current TVL is $5.88M.

Public Goods Network: PGN is both a digital schelling point and the world’s first L2 that works to create durable and recurring funding for public goods. Public Goods Network is being built using the OP Stack, meaning that it can become part of the proposed “Superchain” that will include Optimism and Base networks.

PGN’s current TVL: $380K.

Kroma: Kroma aims to develop an universal ZK Rollup based on the Optimism Bedrock architecture. Currently, Kroma operates as an Optimistic Rollup with ZK fault proofs, utilizing a zkEVM based on Scroll. The goal of Kroma is to eventually transition to a ZK Rollup once the generation of ZK proofs becomes more cost-efficient and faster.

Kroma’s current TVL: $38K.

Additionally, there’s a number of protocols who have already launched their OP Stack-based testnets:

opBNB by Binance (actually a fork of Optimism)

Mode network

UniDex Finance

Kinto

Manta Network

To be deployed:

Celo

DeBank

Magi by a16z

Lyra

Lattice

Clave

Pika Protocol

Worldcoin

Synthetix app chain…

Potential deployment on OP Stack:

Fraxchain (yes you read right…)

The Law of Chains v0: Towards the Superchain Future

The introduction of the Law of Chains v0 represents a pivotal moment in the evolution of OP Stack. It lays the groundwork for defining the Minimum Viable Product (MVP) of the Superchain. Currently, each OP Stack chain operates independently, without a straightforward way to share standards and improvements. This poses challenges for users and builders who must evaluate multiple chains based on security, quality, and neutrality.

The Law of Chains paves the way for OP Stack chains to transition from independent blockspaces to a unified collective committed to open, decentralized blockspace. This framework sets guiding principles for Optimism Governance and the Superchain, transforming governance from a single chain to a standard shared by many.

Key Benefits of the Law of Chains:

Homogeneous, Neutral, and Open Blockspace: Chains within the Superchain commit to providing a blockspace that is homogeneous, neutral, and open. Optimism Governance ensures these properties, regardless of the chain's size.

Constant Improvement: Shared upgrades mean that all Superchain chains can access the best technology without the hassle of self-maintenance.

Enhanced Infrastructure: Superchain collaboration ensures the availability and affordability of essential services like indexing and sequencing.

In conclusion, OP Stack adoption is reshaping Optimism's ecosystem, and the growing list of protocols building on it is a testament to its appeal. With first adopters like Base leading the way, Optimism is set to experience substantial growth.

Introducing the Law of Chains v0 is a critical milestone on the path to the Superchain future, ensuring that Optimism's expansion is not only rapid but also built on a foundation of open, neutral, and constantly improving blockspace. The Ethereum community's commitment to permissionless innovation is paving the way for a brighter future in the world of blockchain technology, where collaboration and interoperability reign supreme.

Spotlight Project: Extra Finance

Subli_Defi is an Ambassador of Extra Finance & is presenting some of the latest news about the protocol.

Extra Finance is now on Base with some crazy APR

veAERO holders or AERO lockers can also vote for EXTRA LP and receive voting incentives on Aerodrome. Same on Optimism vor veVELO holders.

In addition, Extrafi has started to use its OP grant by incentivizing lending pools on Optimism.

Extra finance website: click here

🟢Crypto market review & Learning Tips

by Axel

BITCOIN

During the summer, not much happens. Bitcoin continues its correction and has broken the bullish trendline presented in the previous newsletter. What should be done now? We will share our scenario, but first, let's take a look at the markets.

Bullish signs: Bitcoin is retesting a high-timeframe support. A bullish divergence is forming on the daily chart (see the chart below).

Bearish signs: Bitcoin is undergoing a daily correction, and the price could easily break the support. Refer to newsletter 9 regarding Elliott Wave Theory.

As explained earlier, we remained neutral as long as we didn't surpass $31,000 and turned bearish when the green trendline was broken to the downside. The retest of the trendline at point B of the Elliott Wave correction could have been a short opportunity (around $28,000).

However, an important rule in trading is always to trade in the direction of the trend. Indeed, we believe we are in the second wave (Wave 2 of Elliott Wave Theory, a consolidation period) of the bull market. Therefore, our trading style will be to be patient and take a long position when the market provides us with visibility.

DXY

A bearish divergence is currently underway on the DXY index in the weekly timeframe. The dollar is losing its hegemony with the creation of BRICS. Indeed, global exchanges are no longer exclusively conducted in dollars, and the index could be significantly impacted to the downside.

CME gap

Since the previous newsletter, we have not witnessed any new gaps. As a reminder, the remaining open gaps are at $20,000 and $35,000.

altcoin

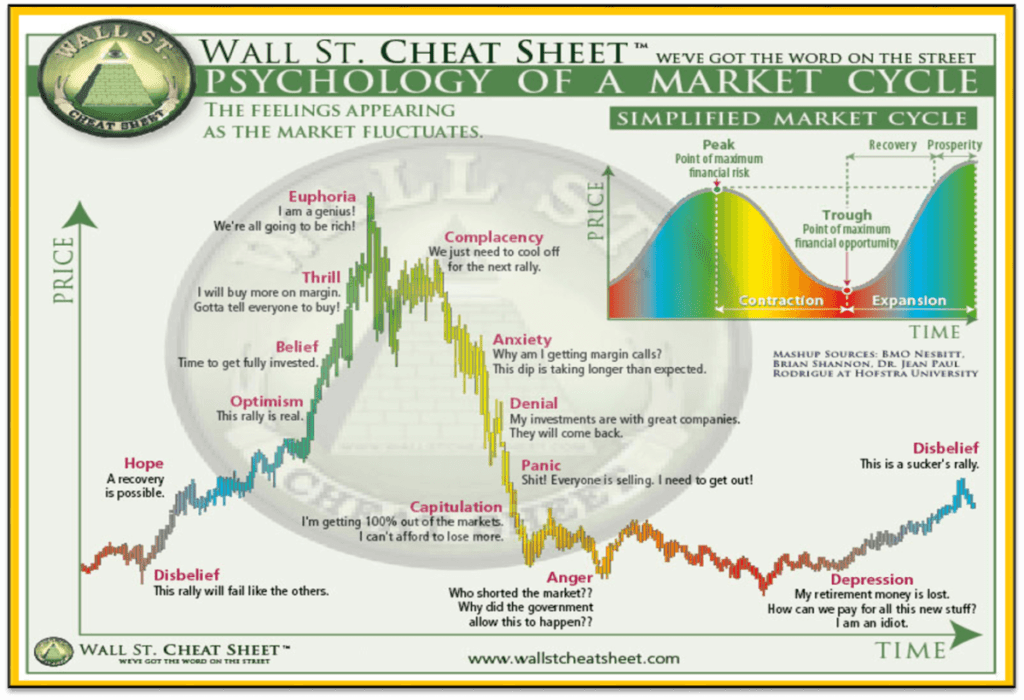

Nothing new on altcoins, some of them haven't found their bottom yet. However, we believe that we should have a bottom soon. Indeed, we are approaching the depression phase according to the Wall Street cheat sheet. We will detail this in the educational section and present you with fractals and the psychology of bubble markets that repeat themselves.

Conclusion

As explained in the previous newsletter, the market conditions didn’t invite taking a position. This choice was confirmed during the summer as Bitcoin showed no signs of good health.

Currently, we have a bullish divergence in progress on Bitcoin on the daily chart. Additionally, we are at a significant support level (~$25,000), the DXY index is bearish with an ongoing bearish divergence, and market seasonality suggests taking a position with a stop loss below the support. We strongly believe that market makers are currently accumulating Bitcoin. We will explain this theory of flows in another newsletter. These are the reasons why we are taking a position.

Finally, if Bitcoin breaks the support, we will cut our positions, and the CME gap opened at $20,000 appears to be the target.

As for altcoins, we will need to wait for the consolidation to resolve before gaining more visibility. A breakout above the downward trend represented in purple on the TOTAL3 chart above will be a strong signal.

For investors, we recommend to listen to this video about Insttions accumulating Bictoin:

Educational:

You might have already heard that "history doesn't repeat itself but it often rhymes" (Mark Twain). This simply means that time has proven to us that mistakes repeat themselves, and human psychology doesn't change.

Are you familiar with the Wall Street Cheat Sheet?

It highlights the psychology of crowds during market bubbles in general. We can see that this price evolution and the generated emotions also apply to Bitcoin and the cryptocurrency market. This is referred to as a fractal.

Below is a chart of the TOTAL3 altcoin ticker:

We can observe that the bubble bursting psychology of the Wall Street Cheat Sheet applies to the cryptocurrency market.

So, a fractal is a repetitive pattern in which the same configuration repeats itself. They help traders identify market reversals and develop trading strategies. For a trader, fractals can be a very useful tool. The rules are simple and easy to follow.

In our applied case above, the depression phase is missing before the disbelief phase where the crypto market would be in a bull market again.

In practice, as long as we are in consolidation, patience will be required. We may still see market rebounds, but the real signal will be the breakout from the consolidation range.

If you enjoy this trading style, we recommend checking out the excellent work of TechDev_52 on Twitter (https://x.com/TechDev_52?s=20).

Below is a chart of the Bitcoin price evolution since its creation:

We can observe that the price has evolved in the same way since its creation. The same conditions are met before each rapid price movement: consolidation before the bullish explosion.

"History doesn't repeat itself but it often rhymes."

🟤Farming Strategy: Pendle & Its Convex-type layers (Equilibria & Penpie)

By Subli

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

Do you know Pendle? Well, if not, get out of your Cave and listen closely as you could earn double digits APR on your $ETH.

TL;DR: Pendle allows you to split a yield bearing asset like wstETH (staked ETH by Lido) in two tradable assets:

The underlying asset: native $wETH → Principal Token (or PT)

The yield asset: staking ETH yield → Yield Token (or YT)

What can you do with Pendle?

1. Fixed yield:

When? When yield is high. And avoid yield volatility on your ETH.

=> Buy PT or swap your YT into more PT

PRO TIP:

Timing is important in executing a PT trade. As people buy and sell PT in Pendle, the fixed rate will fluctuate up and down. If you can wait and enter the PT trade right when PT is oversold (due to volatility or mispricing), you will have locked in a high fixed rate all the way until maturity.

2. Longing yield:

When? When yield is low. Benefit from a local low on the yield to leverage your yield by longing Yields => Buy YT or swap your PT into more YT

PRO TIP:

Buying and holding YT = longing yield

Profits = future yield - YT cost

3. Provide liquidity for PT/YT liquidity pool:

In order to enable PT <> YT swap, Pendle has an integrated AMM with PT/YT pool. The system works as Curve, as Pendle lockers, aka vePENDLE holders, has a boosted yield on the voted Pool to distribute PENDLE token emission.

2 Convex-Type layers have been builts and are following Pendle on Optimism:

Equilibria: Already available on Optimism, enjoying a 2.5x Boost

Penpie: Already available on Optimism, enjoying a 2x Boost

🟠Podcast:

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of some of the podcasts. Access granted to Revelo members.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

The Optimism Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.

Nice; thanks for the insights and best to this community!