The 🔵Optimist: (L)Earn with Defi #28-2

Learn & Earn with DEFI: Optimism, Base, Mode, Zora, Frax, Lyra, Ancient, Redstone, Worldcoin, Mint, Lisk

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed part 1 [OP Superchain News], don’t worry, just click HERE.

You have a problem, questions you don’t find the answer or you’d like to make a suggestion. Leave a comment, and we’ll get back to you.

Click on your preferred language to access the translated version:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔵How to set up a private wallet

“To live happily, let's live hidden”. While the Etho of Blockchain is transparency, some users would like to keep their onchain actions private. Welcome to The Enclave.

🟢Crypto market review

Bi-weekly update on the Crypto Market. ETH broke 3k$ last week, it’s more a psychological milestone than a technical one. Where are we now?

🍀Technical & Fundamental Analyses: ETHER (ETH)

Ethereum is the chain, Ether is the coin… Yes i know, you didn’t know it! With a mix of FUD and so highly expected catalysts, let’s analyze $ETH.

🟤Farming Strategy: How to use Lyra V2

Lyra V2 is now available on Lyra chain, and the least we can say is that the team has shipped what makes for us the best UX ever for trading options & perps. Take the green 💊 & follow us through.

Spotlight project: Stake Together

Stake Together is a Liquid Staking Protocol that offer the highest yield on the market, and can fund public good projects. Indeed a share of the protocol fees will fund the project of your choice.

Soon, you’ll be able to buy ETH with a supra-efficient on-ramp solution from 186 different countries, and earn restaking rewards. Stake ETH, receive stpETH and earn up to 5% APY.

🔵How to set up a private wallet

by Subli

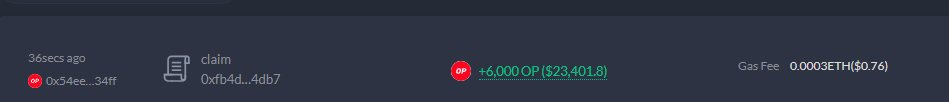

How easy is to find someone wallet? Let’s find out in 30seconds. In that case, a well-known influencer posted on X his latest OP Airdrop.

Go to this Dashboard on Dune, and insert Tx Has beginning & End (you need some credits to RUN the dashboard).

The holder wallet is the wallet with the 10m OP grant. Copy/Paste this address into Optimism Scan

Download all the data in CSV Export (bottom & right button), and search for the Tx hash.

Find the wallet owner, paste it in Debank.

Here you are: SPOTTED. you can now easily track his actions.

Privacy has become more & more important for few reasons:

Staying anonymous

Avoid linking your multiple wallets (airdrop farming, liability, etc…)

So far, most of you are using a Centralized Exchange which keeps your KYC well stored in their database. As you know, I’m a DEFI Maxi and have refused to use a CEX since summer 2022. But how can I fund a fresh wallet then?

Thanks God, i have found an amazing solution, provided by a team/project, i’m having an eye on.

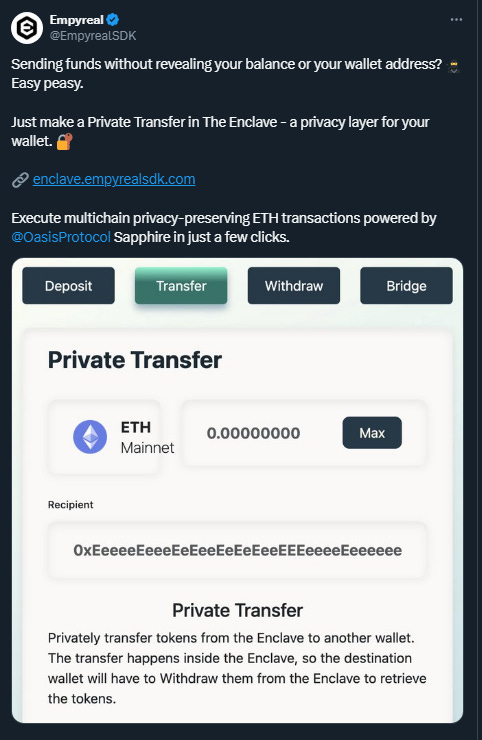

Empyreal: The Enclave

The Enclave allows you to send funds completely anonymously. The whole process is currently available on ETH Mainnet & Arbitrum.

How does it work:

Create an encryption Key linked to both your wallets (Sender & Receiver)

Deposit ETH in The Enclave dAPP from the Sender Wallet

Transfer ETH using The Enclave from the Sender Wallet

Withdraw ETH using The Enclave from the Receiver Wallet

1. Create encryption keys for both wallets

Do the below for both wallets.

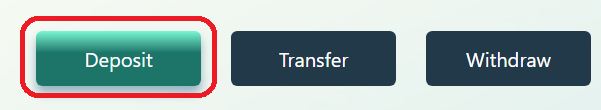

2. Deposit ETH

Select the amount of ETH to be deposited and click SUBMIT.

Fee: 0.0002 ETH ( 0.6$)+ 0.3%

And if you click on the contract, you’ll see only this:

3. Transfer ETH

Transfer ETH from the Sender wallet to the Receiver wallet. Use the Receiver wallet number as the “Recipient” wallet, not the generated encryption Key. Click Submit.

Fee: 0.0001 ETH ( 0.3$)+ 0.1%

4. Withdraw ETH

Connect with your Receiver wallet. For a perfect privacy, i suggest that you withdraw in 2 or 3 transactions, making it very full proof. Select the amount & Withdraw.

Fee: 0.0002 ETH ( 0.6$)+ 0.3%

And here are the records from your tx. If you click on the contract, tx hash, you won’t see any link between the Sender & the Receiver wallets.

Hackaton winner

Empyreal solution, The Enclave, wins at Oasis’s Hackathon 2023 as “Best use of Oasis Sapphire for scaling privacy”.

This practical use-case allows one thing: Delegate your private key to a their party that can approve transaction, within a certain perimeter the user is setting, on your behalf.

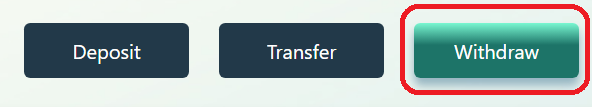

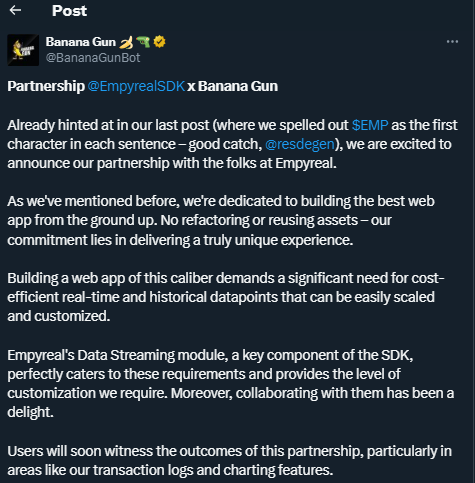

When you understand that Empyreal is also using AI to aggregate & process data for third party projects like Banana Bot, you understand that both products can be easily combined into a very powerful toolkit for DEFI solutions (AI automated yield management) for example.

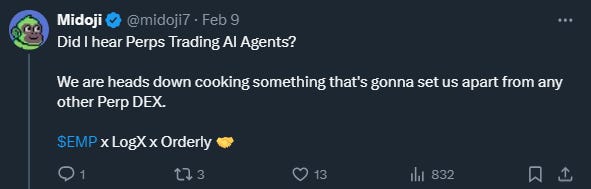

And more recently, they announced a partnership with LogX & OrderlyNetwork. So expect a podcast soon with these guys.

Recommending reading: updated roadmap

🟢Crypto market review

by Axel

Bitcoin

As anticipated in the previous newsletter, Bitcoin continues its ascent, currently trading around $56,000. Its strength is surprising and may cause frustration among those who are still sidelined.

Bullish signs: Bitcoin is above the three significant HTF resistances previously mentioned.

Bearish signs: The weekly RSI is high, but we don’t have any divergence.

Bitcoin continues its ascent after consolidating below the resistances.

CME gap

There have been no changes in the CME gaps. They remain open at the following price levels:

$48,000

$31,600

$29,800

$27,000

$26,300

$20,500

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin Dominance: As previously announced in the last newsletter, we need to monitor the breakout to the upside or downside of the range. The weekly RSI has cooled off and dropped low enough for a possible run again.

ETHBTC: After over a year of consolidation, the ETH/BTC pair has broken out of its compression triangle. We can be bullish on Ethereum in the coming weeks and months (check our fundamental analysis below).

Conclusion

We are bullish as long as we stay above $48,500 on the daily. If a correction occurs, a weak level at $48,000 is not excluded, with an open CME gap at that level.

The breakout of the ETH/BTC pair is a very positive sign for altcoins. We believe that when Bitcoin cools down a bit, altcoins will be the play.

If you follow us diligently, the plan remains unchanged, and we will continue to be bullish until the charts indicate otherwise. It is crucial that we maintain control over our emotions.

🤯Quote of the week

By courtesy of QuotableCrypto

🍀 Technical & Fundamental Analyses: ETHER (ETH)

By Axel & Subli

ETHER (ticker: ETH) has seen a lot of FUD the past few months, lead by BTC over performing ETH during 17 months (check ETH/BTC chart). Despite typical crypto market cycle (BTC → ETH → High Cap → Altcoins → Stable → BTC), Ethereum End Game is a lot more bullish that what you think. Here is our very humble analysis as there are plenty greater experts out there.

Technical Analysis

$ETH/USDT

After breaking out of consolidation at $2000, Ethereum is showing strong upward momentum. The price is approaching the 0.618 Fibonacci level, which is considered a significant HTF resistance. However, similar to Bitcoin, we can hope for a bullish breakout.

$ETH/BTC

We have been monitoring this pair for quite some time now. It's great news for altcoins to see this breakout. It will take time before we witness a parabolic move, but Ethereum always moves first before the entire altcoin market follows suit.

$VELO/USDT

Quick update on VELO since recent price action.

We took the time to analyze this pair in the newsletter 26-2. The price needed to consolidate after a fakeout from the consolidation breakout. Today, we have an impulsive candle on this altcoin. The price reenters the bullish channel and could be the beginning of Wave 3 according to Elliott Wave theory.

We were waiting for a bullish market reversal signal, but the momentum is so strong that you can’t deny the bullish trend.

As a reminder: Here is what we wrote in newsletter 26-2: Technical & Fundamental Analysis:

In such case, I will start building slowly a position on Velodrome

And it feels good to be right sometimes.

Conclusion:

The probabilities that Ethereum will outperform Bitcoin in the coming weeks are high. The market operates in cycles, and after Bitcoin, it's Ethereum's turn to run. Altcoins will follow.

For Altcoin trading, It will be essential to consider the ETH pair when conducting technical analysis cause you want your Alt to over perform ETH.

Fundamental Analysis:

Just remember one important thing: Fundamentally, price action is set based on Speculation + Buy versus Sell pressure.

But let’s start with the most FUD-ish post ever read days ago:

I could write tons of statement why I’m bullish on Ethereum. But, I don’t want to make it boring, so here are couple of catalysts from the past & the future.

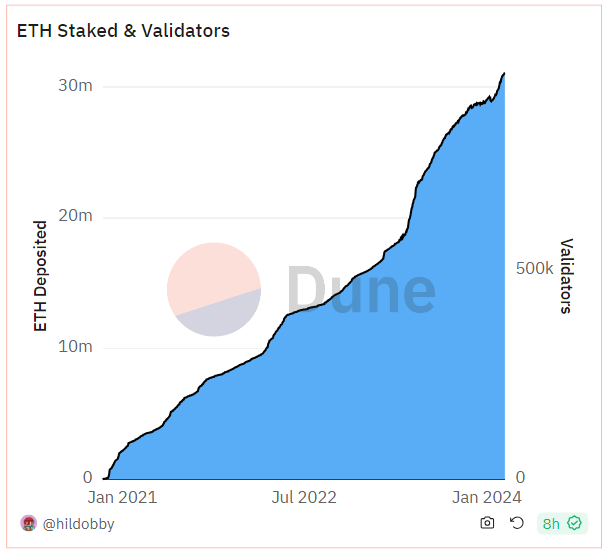

The Merge: In Sep-2022, Ethereum moved from Proof-of-Work to Proof-of-Stake. As of today, 26% of total ETH in circulation is currently staked, at an amazing pace of 2x per year. At this rate, without taking into account inflation, we could have 50% of ETH staked by end of 2024.

Together with EIP-1559 (a share of the fees is being burt), ETH is currently deflationary

ETH is the “Internet Bond”. What makes Bond different from other assets like Bitcoin or Gold? Generate passive Yield. Something that Tradfi likes so much!

Ethereum is the Internet of Value. The security of the chain is now worth 93b$ (31millons ETH staked), making it the greatest shared security system ever.

Scalability - Layer 2:

2021 was the year of L1 war. 2024 is the year of L2 war. There will be as much as L2 than internet websites. ZK-proof, Optimistic Rollup, ZK-EVM, all of these will be built on top of Ethereum.

EIP-4844 planned for mid-March 2024: Proto-Danksharding will reduce fees by at least 20x

Rollup launch is now a one-click button thanks to RAAS (rollup-as-a-service) protocols such as Conduit (powering Mode) or Gelato (powering Lisk)

Modularity thanks to Celestia or Eigen DA for Data availability (representing a large fraction of the cost L2 are paying to L1) are now live

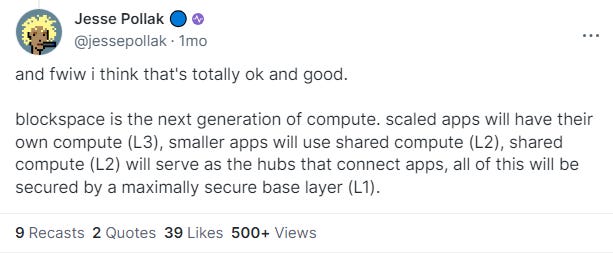

Scalability - Layer 3:

Ultra high-throughput Layer 3 are now available to scale APP chain requiring a large number of tx per second. Look now at the technical efficiency of this tech:

So all in all, Jesse Pollack from Base summarized it well:

Restaking: Lead by Eigen Layer, who just raised 100m$, restaking will be another source of yield, getting more users.

Superchain: Interoperability layer will avoid liquidity fragmentation & will bring chain abstraction to the end users. Finally this concept originally brought by Cosmos, should see lights in 2024.

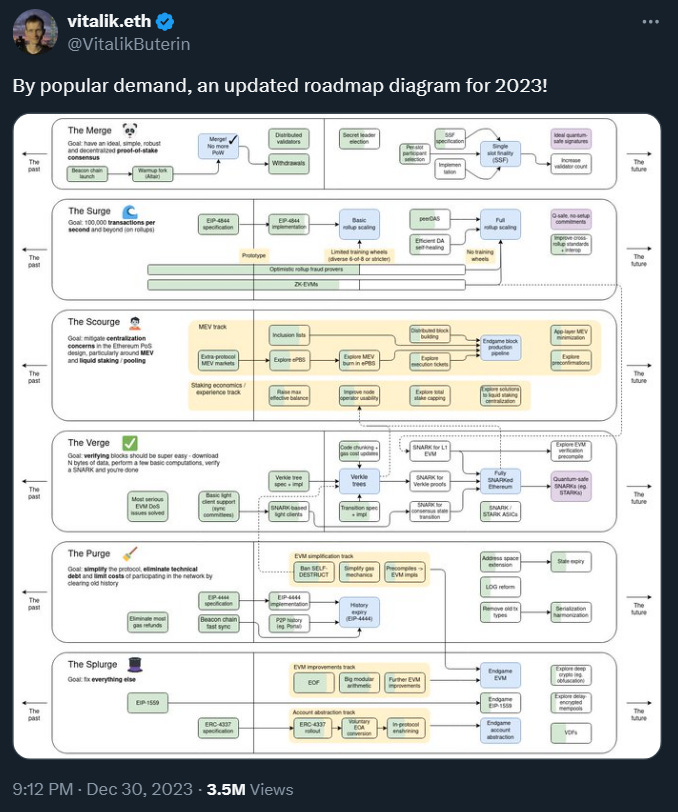

And finally, i cannot end this part without talking about the Ethereum roadmap shared by Vitalik:

If you wanna read a summary of this roadmap, please read this excellent article from Third Web.

Trying to have a non-biaised thought now. There are several competitors to Ethereum Solana, Monad, SEI, Cosmos etc… and it’s great. Innovation can only come from competition. But hwy i think Ethereum will win compared to another L1, it’s because Ethereum will be able to offer any kind of modularity to Layers 2 & 3, making it the perfect place for people to build, innovate, adapt.

For example, I’d not be surprised to see Visa having its own Layer 3 blockchain built on top of Base for example.

Conclusion:

Ethereum is a long-term asset in our portfolio and we hope that all the reasons detailed above gave you one insight that can be crossed or compared with many other people, much brighter than us.

Note: I think I (Subli) can proclaim myself Ethereum-Maxi together with Sassal.

🟤How to use Lyra V2

By Thomas

Dear readers, Lyra V2 is now fully released.

This new version brings a host of innovations, both on the technical and user fronts. Discover how to make the most of the platform's full potential.

Note: Connect to Lyra using our ref link to save fees.

New Architecture

Before diving into the heart of the matter, we couldn't overlook the biggest improvement in the protocol: Lyra is becoming an OP Chain!

Indeed, formerly deployed on OP Mainnet & Arbitrum, Lyra now has its own L2. Named Lyra Chain, this new rollup is built on the OP Stack & Celestia for data availability.

This change in architecture allows, among other things:

To drastically reduce transaction costs

To offer a more pleasant user experience

To improve Lyra's profitability (via Celestia)

Account abstraction & Free deposit

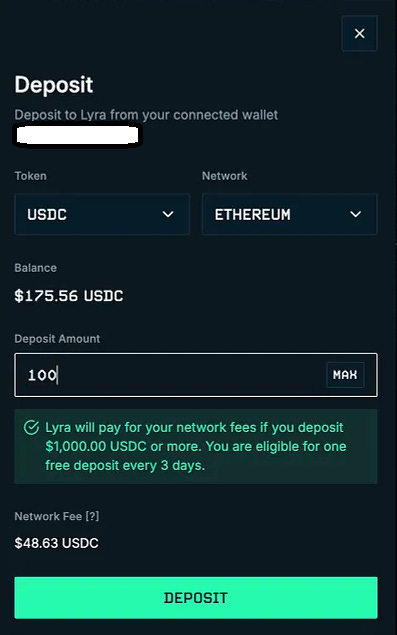

From the user's side, you will now need to deposit funds into the Lyra chain to use the protocol.

You can deposit USDC/ETH/WBTC from Optimism, Arbitrum & Ethereum by logging into the application.

Note: if you deposit at least $1000 at once on the chain, Lyra covers your network fees!

Quite handy, especially if you're depositing funds from Ethereum.

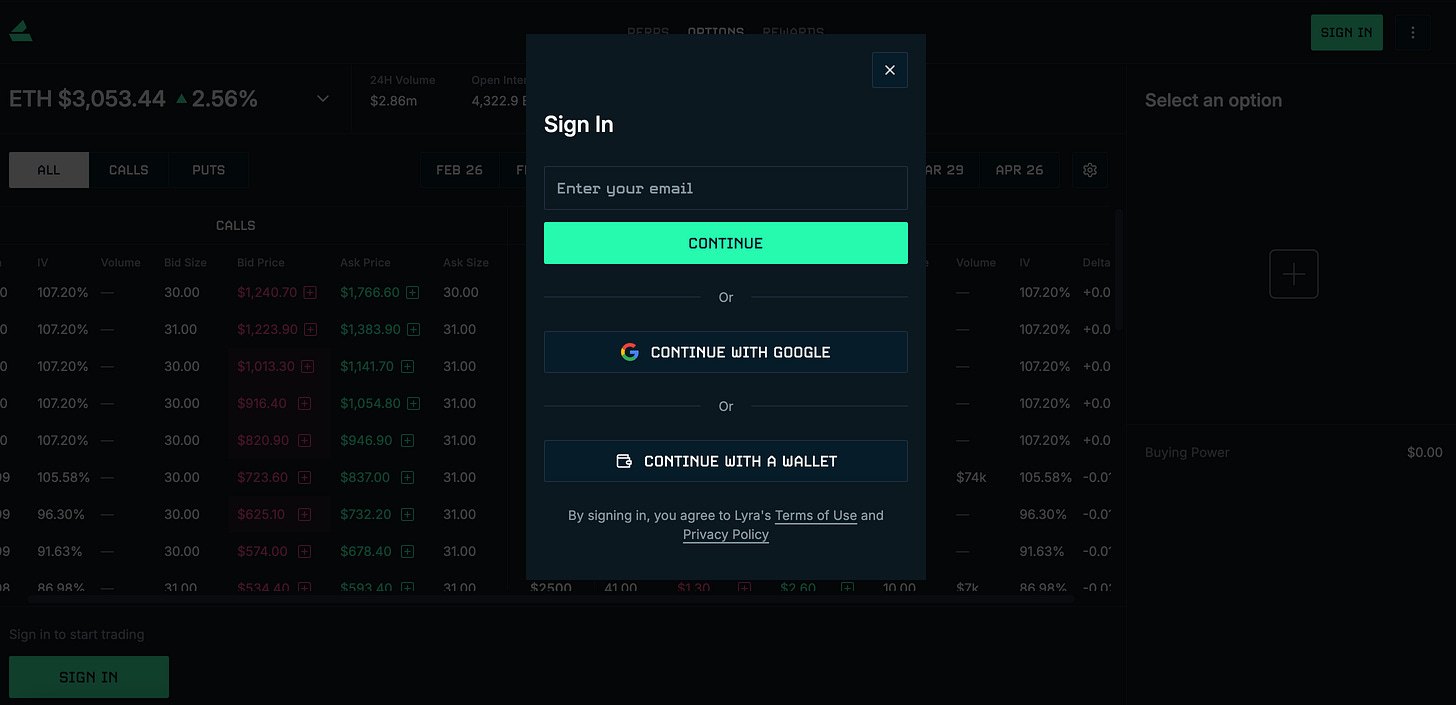

Lyra has also created Lyra Wallet, a wallet that allows users to sign up for the platform via email or a Google/Apple account.

Powered by Coinbase Cloud, this wallet offers a web2 experience and greatly simplifies the onboarding process for users who are not familiar with the platform.

New Products

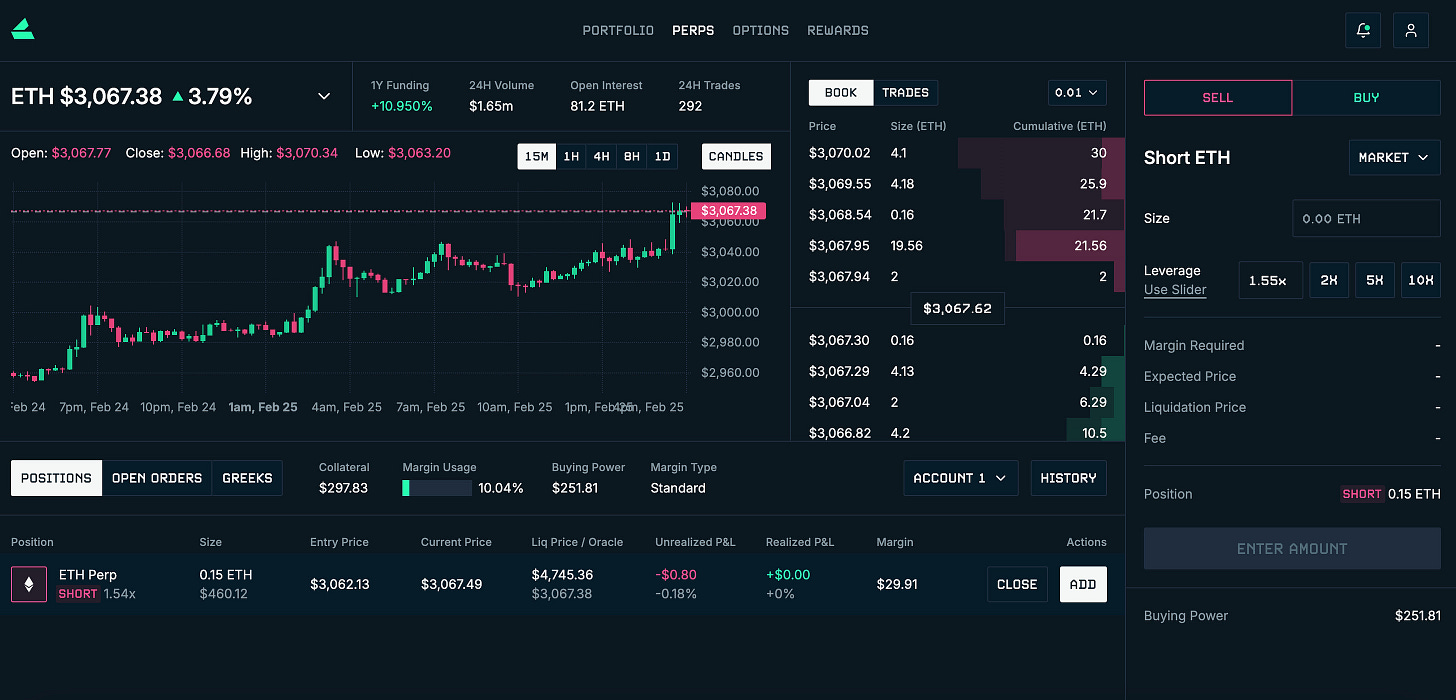

In addition to the options trading already present in V1, V2 introduces the arrival of a product designed for perpetual trading.

This product is similar to what you can find on CEX and will allow you to expose yourself to BTC and ETH through leveraged positions. The interface is clear, intuitive, and pleasant to use.

If you have already traded on an exchange platform, you will not be out of your depth because all the essential trading options are within reach.

On the options trading side, the interface has been expanded to allow for a more precise market analysis.

We also still appreciate the profit/loss simulator present in V1.

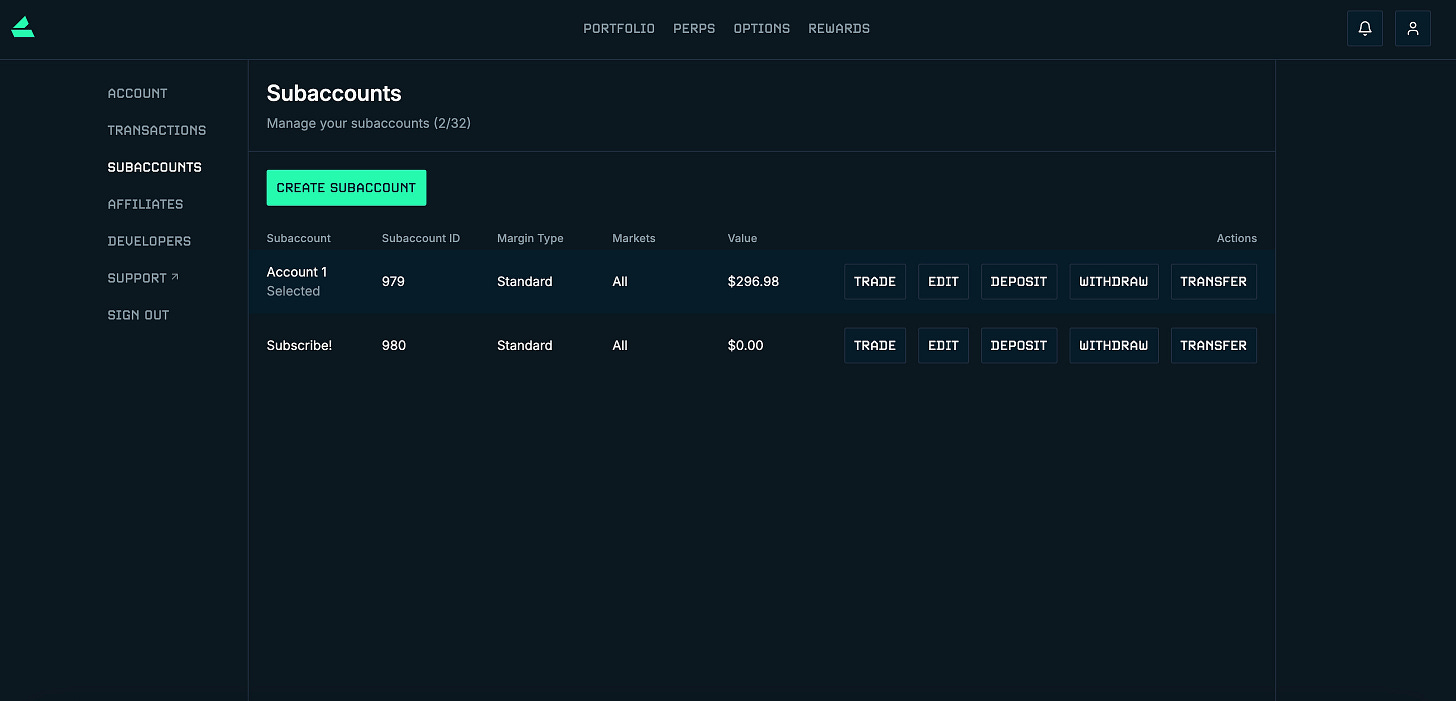

In addition to revamping the interface, Lyra brings new important functionalities such as:

Cross-asset collateral & portfolio margin

The introduction of sub-accounts (up to 32 sub-accounts)

These features allow you to divide your accounts to split your risk and to create and manage more advanced strategies.

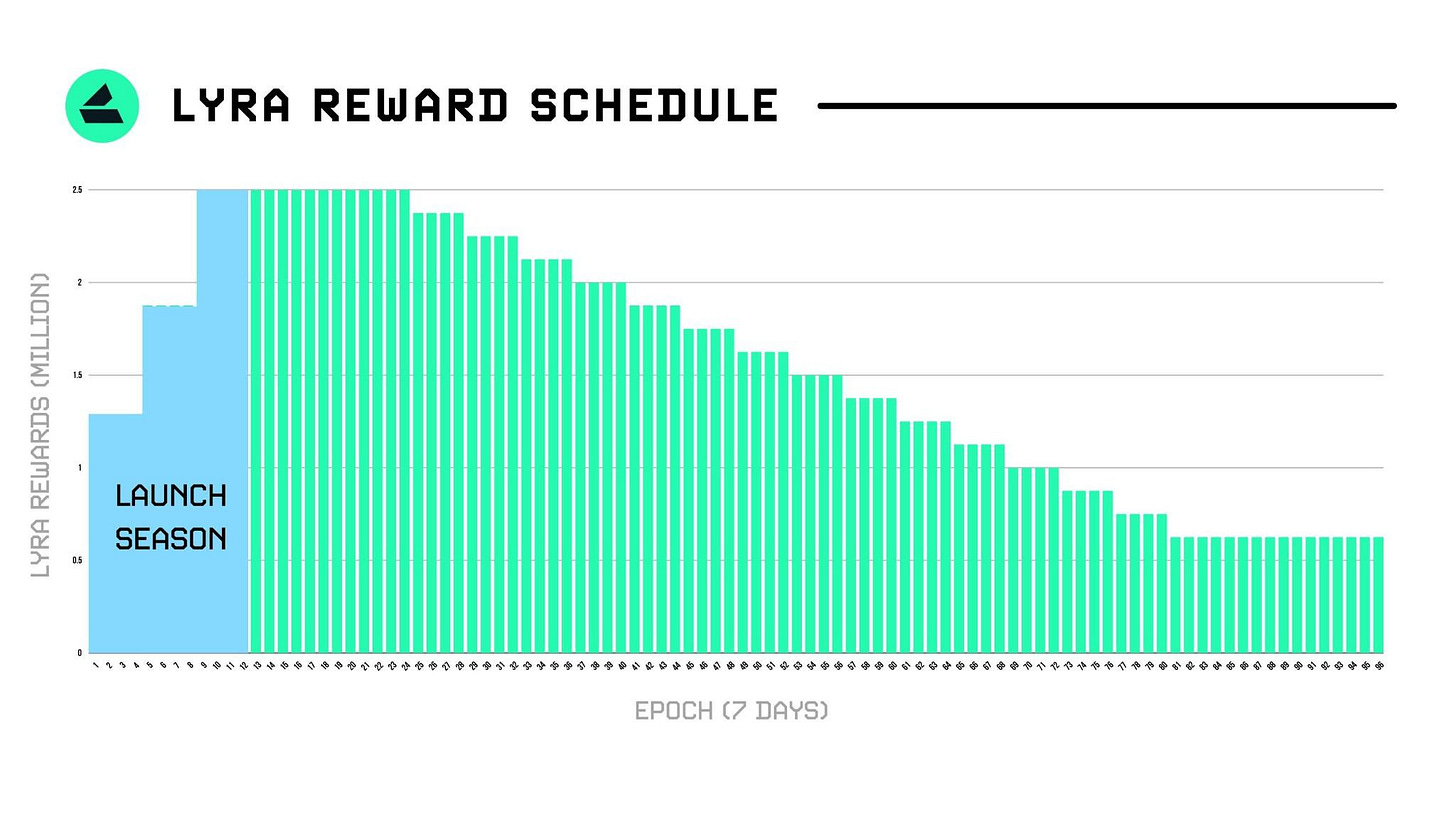

Rewards Program

To celebrate the arrival of its V2, Lyra has implemented a rewards program dedicated to users: 150,000,000 $LYRA tokens will be distributed to traders over 96 weeks (worth 15m$ at the time of writing).

To take advantage of this, it's very simple: just trade on the platform. Users who have spent the most fees will collect the most LYRA tokens.

Regarding the distribution of rewards, 1,239,669 tokens will be distributed each week until March 3th.

After this date, the number of rewards will increase by 10% each week until April 24th and then gradually decrease until the end of the program.

To recap: you now have a user-friendly, optimized platform where you get paid to trade. What more could you ask for?

And it's not over yet: Lyra plans to integrate other products such as spot trading.

Of course, you can count on us to keep you informed of all the protocol-related updates.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council updates

The Optimist Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.

سلام

ممنون ، به کار خوبتون ادامه دهید