The 🟠Optimist: (L)Earn with Defi #33

Tips, Tools & Strategies for your personal journey in DEFI on the Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed our previous Superchain News, don’t worry, just click HERE

Click on your preferred language to access the translated version:

Chinese - French - Japanese - Persian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🟡Mode: Airdrop claim, Token Launch, Season 2

This week has been a hell of a week for Mode. Let’s dive in!

💹Crypto market review

Bi-weekly update on the Crypto Market.

➡➡➡🤯Quote of the week

🔎TA on $OP, $CYBER, $WLD

Quick review of superchain tokens

🟠BOB Mainnet: Road to Fusion Season 2

BOB mainnet is now live. Bridge your funds, access 20+ dAPPS, and start farming SPICE (it’s point season baby).

Spotlight project: Stake Together

Stake Together is a Liquid (Re)Staking Protocol on Optimism that offers the highest yield on the market, and can also fund public good projects by directing a share of the protocol fees to fund whitelisted projects.

Soon, their ReStaking solution will launch on OP Mainnet and will grant ETH stakers cheap fees to restake on EigenLayer as well as all the following rewards.

Ready to 🥩? Visit StakeTogether now.

🟡Mode: Airdrop claim, Token Launch, Season 2

by Subli

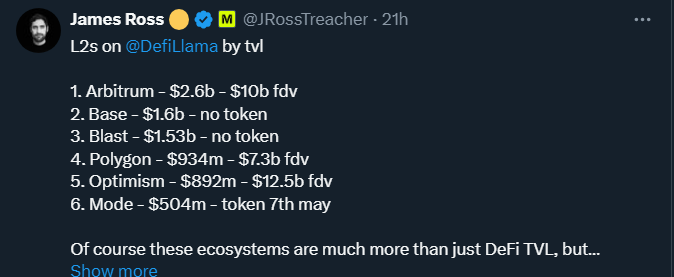

Mode mainnet launched 3 months ago. From O to 600m$ TVL, it is now ranked top 10 chain in TVL according to L2 Beat.

What differentiates Mode from the other L2 chains? The Onchain Cooperative vision we presented to you in the newsletter #25. As James, founder of Mode, said: “The success of a chain is made by the success of the dAPPs of that chain”. And with his background, he knows how to lead the way for success:

Onchain Cooperative

Airdrop Seasons 1 & 2

DevDrop

10m$ Yield Accelerator program

1,000,000 OP incentives

All the above initiatives aim at incentivizing projects to build, deploy & grow on Mode. And guess who will benefit from it in the end? US….yes, us, USERS!

Airdrop Season 1:

550m $MODE can now be claimed on this website: https://claim.mode.network/ Claim will be open until 07 June 2024! Don’t miss it.

The top 2,000 wallets by points will receive 50% MODE at launch and 50% MODE after 90 days

Important: User who bridge funds out of MODE will loose their vested amount

As per our previous research, MODE points were greatly accrued through TVL over TIME. We expect the same formula to be used for Season 2.

The thing I loved the most was to farm ETH at 50/60% APR & easily farm 2 or 3 projects at the same time while farming Mode.

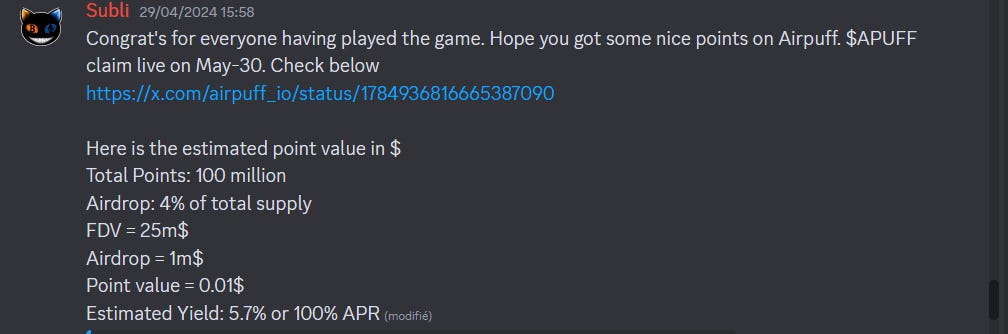

Airpuff has been printing a lot even if you joined the party late (at FDV 25m$…it’s now 15m$):

But there was some hiccups too: the thing i disliked were:

Lack of liquidity and innovative protocols

Lack of liquidity

Over looping on LRT while no onchain liquidity

But this will be resolved by Season 2 (more below).

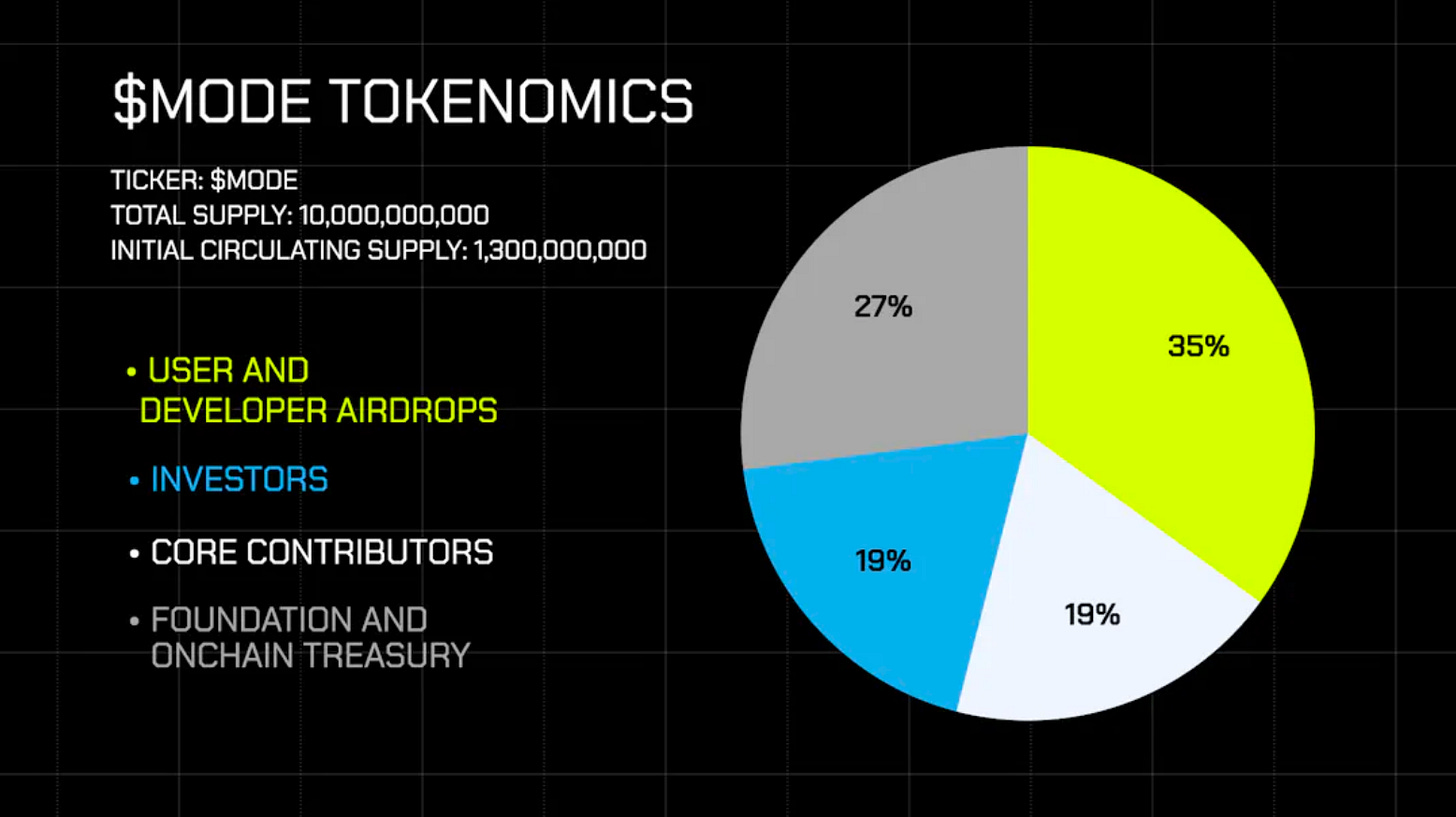

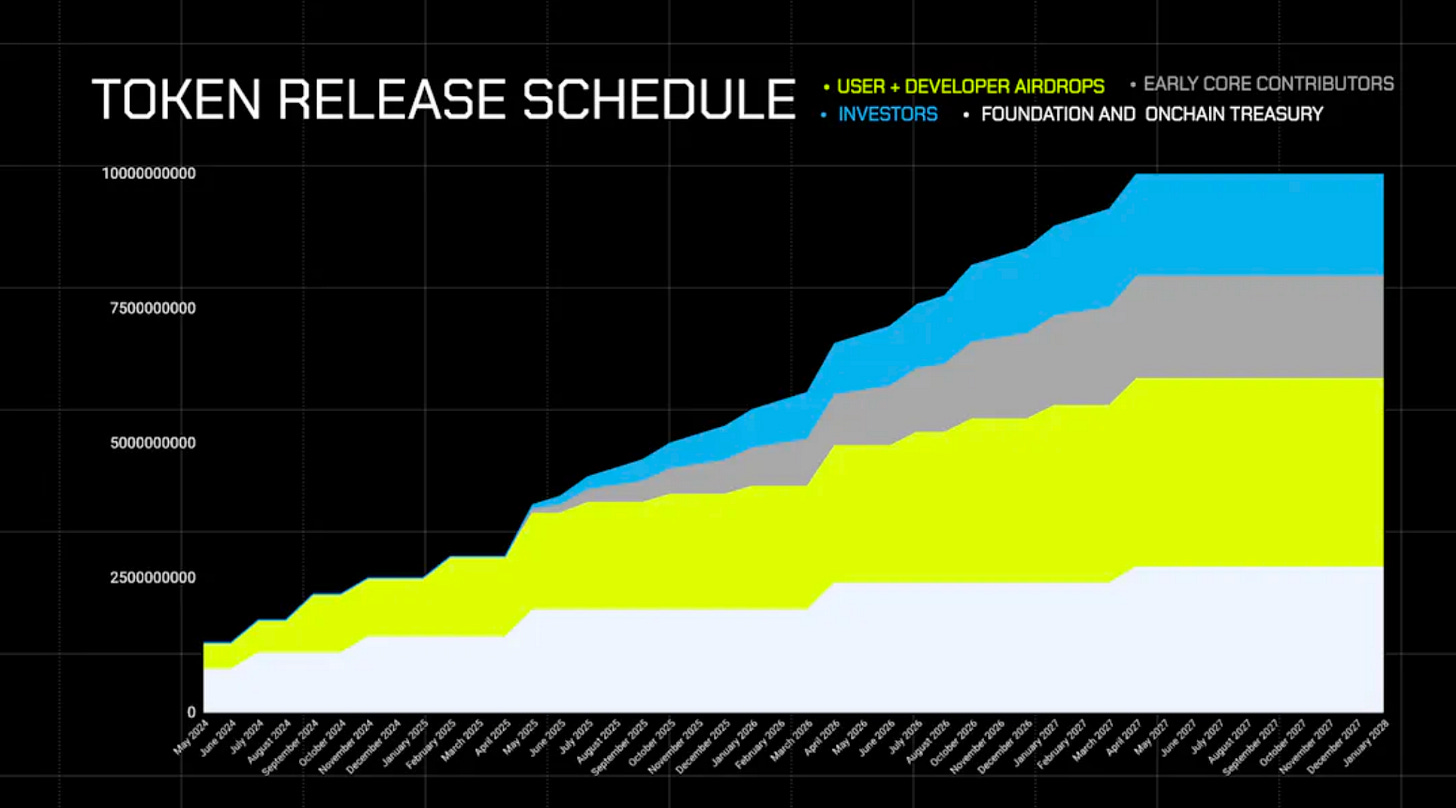

MODE tokenomics & TGE

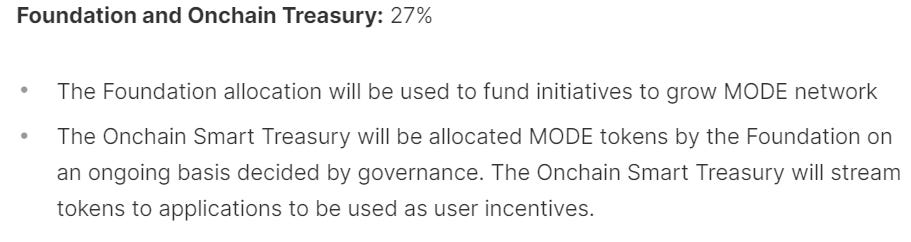

My first thoughts were to find the foundation & treasury part becoming very high since TGE (Token Generation Event). But by reading the description, it feels that this will get accrued but not sold on the market instantly.

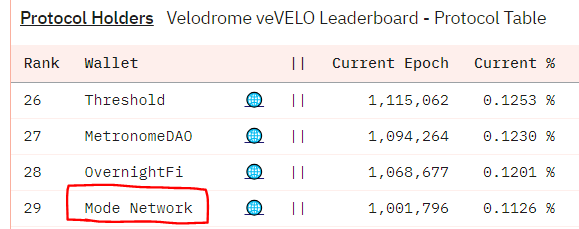

MODE is most likely going to be listed on several CEXes (Bybit, Bitfinex, MEXC, …), and expect as well some DEXes such as KIM Protocol, SwapMode, and of course Velodrome.

And Mode has been accumulated & locked 1,000,000 VELO to deepen onchain liquidity. So might expect some interesting yields.

How do you estimate $MODE token price?

Conservative: FDV 1b$ => $MODE = 0,1$ => Points = 0.025$

Optimistic: FDV 3b$ => $MODE = 0,3$ => Points = 0.075$

MODE SEASON 2

Why playing Season 2 game? Same as for season 1, earning YIELD on top of your ETH and farm new protocol airdrops. MODE season 2 has started on 05/05/24 and will end on 06/09/24, and will allocated:

500,000,000 MODE tokens

1,000,000 OP tokens

That’s a lot of millions $!

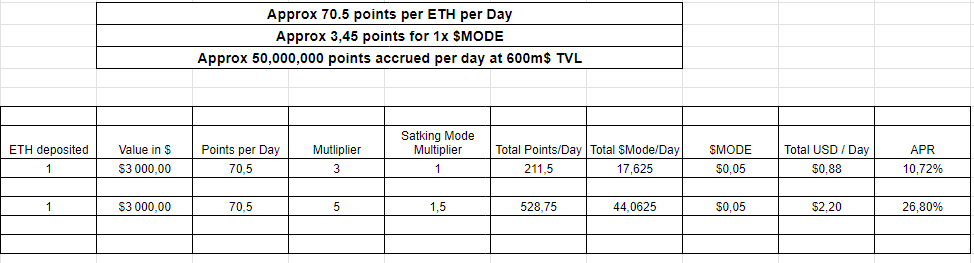

Thomas has made a spreadsheet to estimate the possible Yield for this new season (estimate done at 600m$ TVL):

What’s 🌶 for Season 2?

Launch of new protocols

Velodrome superchain expansion has started this week

Ethena Labs, and maybe Redacted Cartel with DINERO too? => Remember once launched, bridged-in assets will generate yields that will fund the chain treasury

MODE staking “earn points multipliers and ecosystem airdrops”

There will be as well some other interesting projects:

Astaria: oracle-less, Intent-based, fixed-rate lending protocol - No token

Atlendis Labs: Revolving credit line [RWA] - No token

LRT such as Etherfi, Renzo (when withdrawal will be enabled towards end of May) & Kelp DAO: This will allow anyone to get exposed to these protocols Season 2 airdrop + EigenLayer => As native withdrawal/restaking is now live, expect more looping effect

As Velodrome is coming, i don’t see why Extrafi will not join the party too

And do not fade STURDY. Sturdy just launched their subnet on Bittensor (the AI blockchain). Sturdy offers several isolated lending pools. Aggregator vault allows use to get exposer to all these pools to maximize earning, but reallocation is currently done manually. With Bittensor subnet, reallocation and yield maximizing will be done in a decentralized way. Something, i’m really exciting on.

As season 2 will continue, expect some nice plays to come. Just check Mode announcement & continue reading our newsletter, I’ll continue sharing with you what are mine.

💹Crypto market review

by Axel

Bitcoin

We've experienced a lot of volatility in recent weeks. We had mentioned that Bitcoin was taking a breath before new highs. Indeed, after 7 consecutive months of growth, even the halving announcement was not enough to reignite the cryptocurrency market.

Let's take a look at the signals that the market is giving us to manage our portfolio effectively.

In the monthly timeframe, Bitcoin is retesting its previous high from late 2021 (green). Bitcoin is also retesting its upward diagonal trendline as support (red). Finally, the monthly RSI is holding above 65. These three signals are bullish.

In the weekly timeframe, Bitcoin continues its consolidation. The RSI has reset on the weekly chart, and we are at similar levels as the previous correction (green line). Additionally, the RSI remains above 65, which is bullish.

We have a weekly candlestick pattern known as a Hammer. This doesn't necessarily mean that the bottom has been reached, but it indicates that buying pressure is present. We will need more confirmation to assert that a reversal is imminent.

As long as we are trading within this orange channel, we consider that Bitcoin is still in its bullish trend.

In the daily timeframe, Bitcoin continues to evolve within the bull flag pattern mentioned in the previous newsletter. We will aggressively re-enter positions once it breaks to the upside. It will likely require being responsive because the market will be very impulsive when it decides to resume its uptrend.

To date, Bitcoin has corrected by almost 23%. Typically, Bitcoin corrections during bull markets range from 20% to 25%.

Bullish signs: All monthly signals are bullish. Bitcoin is still trading within its bullish channel in the weekly timeframe and forming a bull flag in the daily timeframe. Bitcoin has already corrected by 23%, and the weekly RSI has reset.

Bearish signs: No one can definitively say if the bottom has been reached yet. We are entering the summer trading period.

USDT.D

This week, we'd like to introduce a new indicator that we can incorporate into our trading routines. The USDT.D chart represents the dominance of the USDT stablecoin in the cryptocurrency market. When the indicator pumps, the market dumps, and vice versa.

In the weekly timeframe, we observe a candle that appears to be forming a deviation. The indicator is making a lower high than the previous one, which is indicative of a downtrend. Additionally, we observe a divergence on the RSI, suggesting that the indicator is likely to continue its decline.

This divergence on the RSI is also evident in the daily timeframe => Bullish catalyst for the crypto market.

CME gap

We have an open CME gap at $63,000 (filled on 08/05/24).

However, we still have an open CME gap at $48,000.

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin Dominance: The resistance has been retested as support (blue). We observe a bearish divergence forming, but this may take some time to play out as the signal is on the weekly timeframe.

ETHBTC: The pair continues to diverge on the weekly timeframe. The consolidation is still ongoing. We maintain our convictions and remain patient, waiting for the market to decide its next move.

TOTAL3: The indicator has revisited the weekly demand zone. We can observe that the RSI has reset with a divergence.

Conclusion

After 7 months of upward movement, Bitcoin needs to consolidate. It is still too early to confirm that the bottom has been reached. No one has a crystal ball. However, the weekly hammer candle is a very good sign as buyers are strongly present in the market.

We haven't discussed the DXY, but it is at the top of its range. The USDT.D indicator seems to be weakening. This reinforces our convictions that Bitcoin should continue to rise.

As for altcoins, they have already experienced significant corrections. Fundings are very low. However, we remain cautious as the BTC.D ticker does not seem to have topped yet. The trend reversal has not yet occurred. However, the ETHBTC pair and TOTAL3 seem to be at the bottom.

Therefore, we must remain patient, especially during this often quiet period called summer trading. After such a correction, the market needs time. Stay in Motion! We must remain attentive to the recovery as it will be difficult to position ourselves once the market decides to resume its upward trend.

🤯Quote of the week

By courtesy of QuotableCrypto

🔎Technical Analysis on $OP, $CYBER, $WLD

By Axel

In previous newsletters, we conducted simple technical analyses of certain altcoins. However, we found that hype could render any technical analysis obsolete.

It is important, therefore, to have a plan and to try to identify entry points and establish a trading plan for the following altcoins: $OP, $CYBER, and $WLD. We will share our strategy with you.

Optimism: $ OP

Technical analysis:

We covered this altcoin in a previous newsletter. The token was then in consolidation, possibly in waves 0-1-2 according to Elliott Wave Theory. As presented, once the price broke out of consolidation, the movement became more impulsive. Wave 3 allowed for a breakout above the blue resistance. Wave 4 retested this resistance as support. Finally, Wave 5 completed the upward cycle with bearish signals:

The price touched the red resistance, which marked the top during previous rallies;

A weekly divergence formed (green).

As of now, the price appears to have corrected in an ABC wave to retest the red dashed lines as support. However, it is still early to confirm. So we are either in Wave 1 of a new impulse wave, or the correction might be greater than expected.

Our trading plan is simple:

Either we will buy again around the red dashed lines, around $1.80.

Or we will buy when the price breaks out of consolidation. It is still a bit early to determine a buying level, but we must be patient and wait for the price action to develop.

Fundamental analysis:

The superchain is growing at a fast pace. In less than 9 months, it has now 18 chains, and 13b$ TVL. Expect things to accelerate in the coming months:

And soon, we should have thousands of Layer 2 joining the Superchain. Optimism is the governance layer of the superchain. OP is the governance token. How do you value a governance token that can direct incentives to these thousands chains?

Cyber Connect: $ CYBER

Technical analysis:

Since we have less historical data on this altcoin than on $OP, we will study the chart in daily timeframe.

Here the Elliott Waves are less obvious. However, Fibonacci numbers strongly influenced the price. After breaking out of consolidation (orange), the price became impulsive. Once again, the price topped with bearish signals, as we had a divergence between price and RSI (light blue).

Then the price corrected to retest all supports:

Uptrend line (in Red)

Breakout-out price (Orange line)

Fib 0.382 (Green line)

Currently, the price is developing a bearish divergence (dark blue), and we can expect a pullback/price accumulation.

Our action plan is simple:

Buy on support (red, orange, and Fib 0.382).

If the price breaks these supports in daily timeframe, we will sell 50% of our position to buy again on Fib 0.236.

Often, Fib 0.382 and 0.236 are important buying zones.

WorldCoin / World Chain: $ WLD

Technical analysis:

Once again, we will study the chart in daily timeframe for the same reasons.

We observe a nice movement in waves 12345. Once the resistance was broken to the upside (red line because the orange line was not traceable before the retest of this correction), the movement became impulsive and tripled from $4 to $12. The market topped with a bearish divergence.

Then we had a correction in waves. The orange support was retested several times with a bullish divergence on the RSI. This is already in play.

Here is our plan:

Dips are meant to be bought. In this case, we will go down to the 4-hour timeframe to look for a consolidation point and enter.

Otherwise, wait for the price to develop to find a more satisfactory entry point.

Conclusion

Patience makes us a lot of money. As you can see, waves 1-2 can take a lot of time compared to waves 3-4-5 which are more impulsive.

An investor will prefer to enter on waves 1-2 while a swing trader will look for an entry point in wave 3.

Each top on these altcoins has been accompanied by bearish signals. That's why a daily routine is important.

🟠BOB Mainnet: Road to Fusion Season 2

By Thomas

Dear readers,

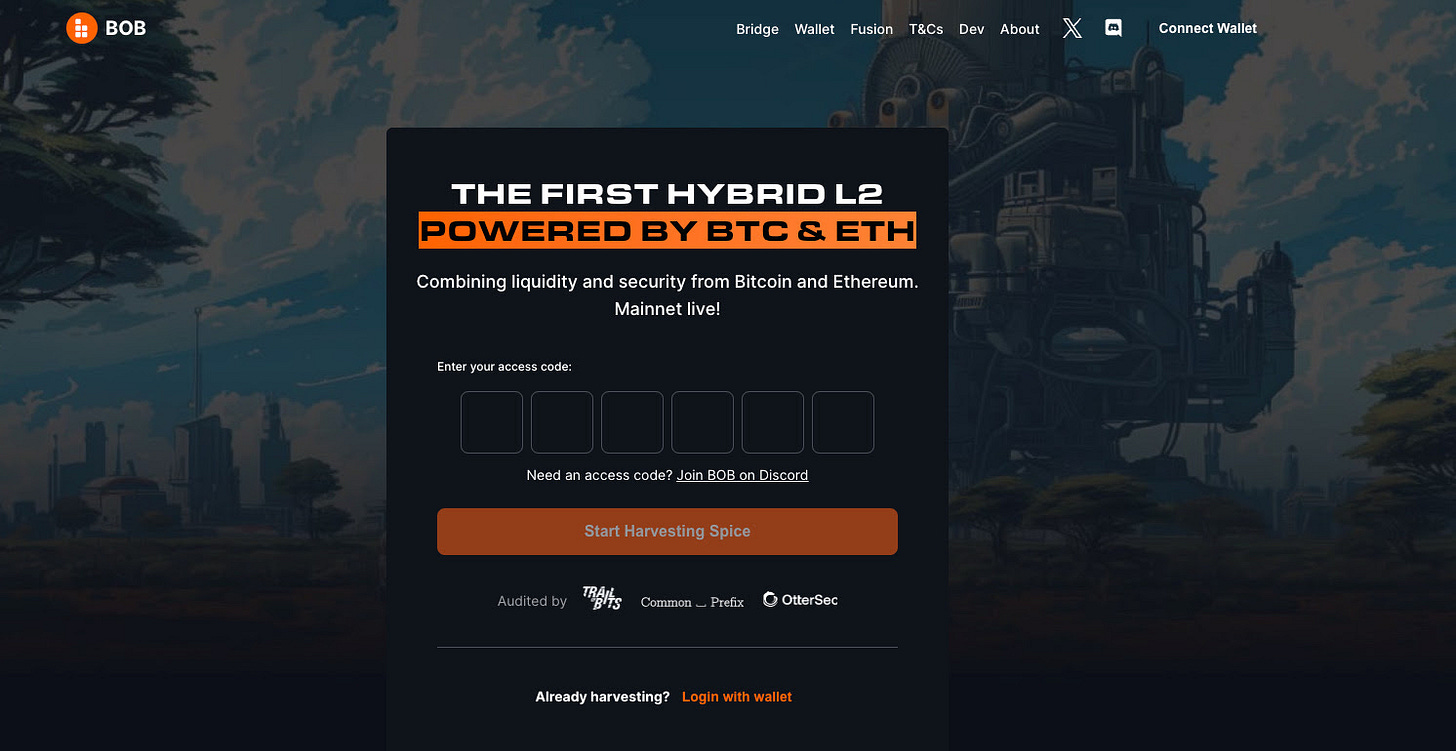

The BOB mainnet is finally here! This launch heralds the beginning of season 2 of their points program, which will bootstrap liquidity on the network.

How does this season unfold and how can you benefit from it? Discover our farming strategy within this article.

Reminder of the context

If you're accustomed to reading our newsletter, you're familiar with what BOB is and how to participate in the network (you might have even farmed season 1 already).

But in case you missed our article, here's a brief reminder:

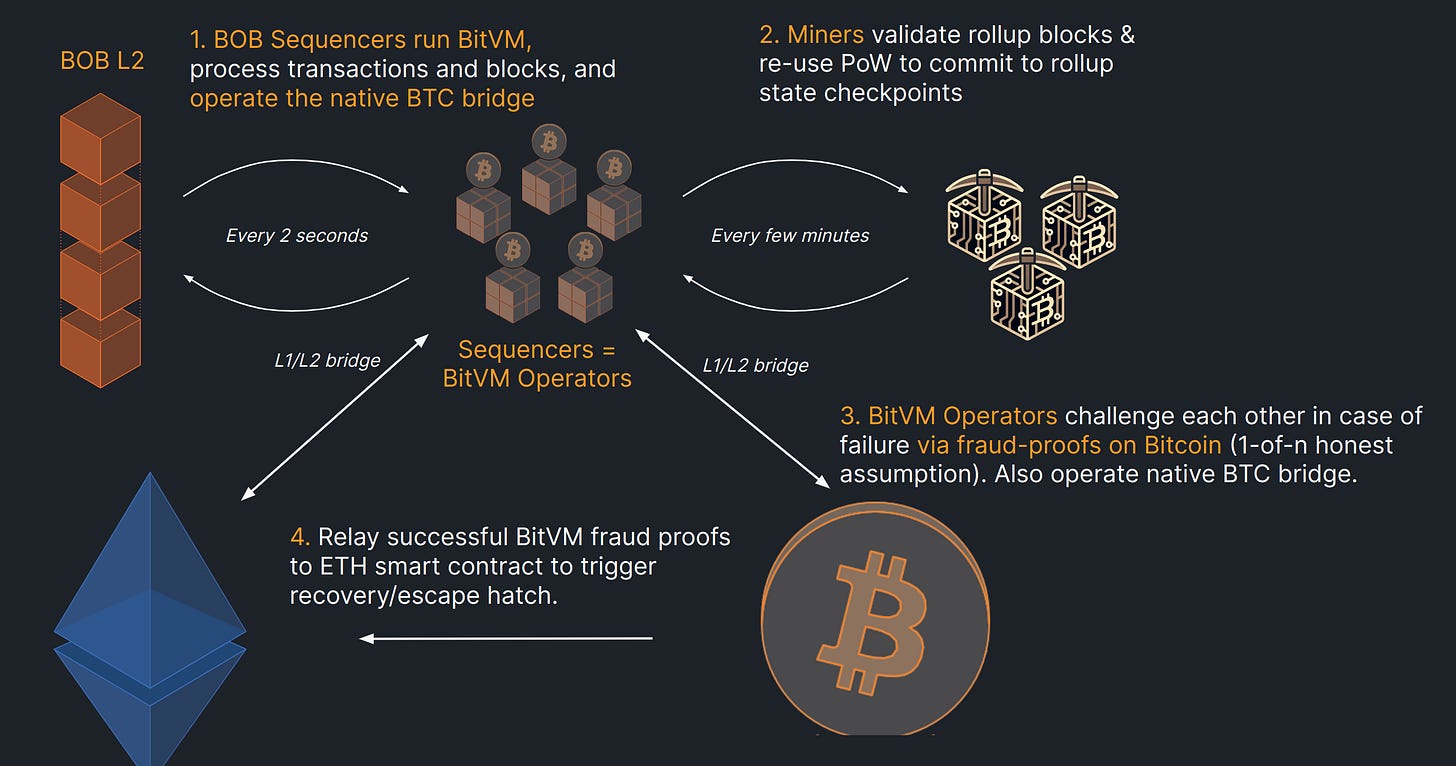

BOB is a hybrid L2 built on the OP Stack. Its aim is to leverage the security of Bitcoin and the Ethereum ecosystem.

BOB has launched a points program to bootstrap liquidity on its network.

This system is divided into two seasons: season 1, which ended on May 1st, and season 2, which we are currently in (and has no end date).

To earn points (called Spices) and maximize your future allocation of "BOB" tokens, you need to deposit liquidity on the network's protocols and interact with them.

As a reminder, BOB has raised over $10 million from investors and currently has very few users.

We believe it is relevant to participate in this season through optimized strategies.

How to maximize your Spices farming

Since the BOB points program is quite extensive, it's necessary to know it well enough to adapt your DeFi strategies accordingly.

The majority of generated Spices are distributed to protocols, which then redistribute the points to users according to their conditions (similar to Blast).

The more TVL a protocol holds, the more significant its Spices generation is. Here are the 5 ways to generate points:

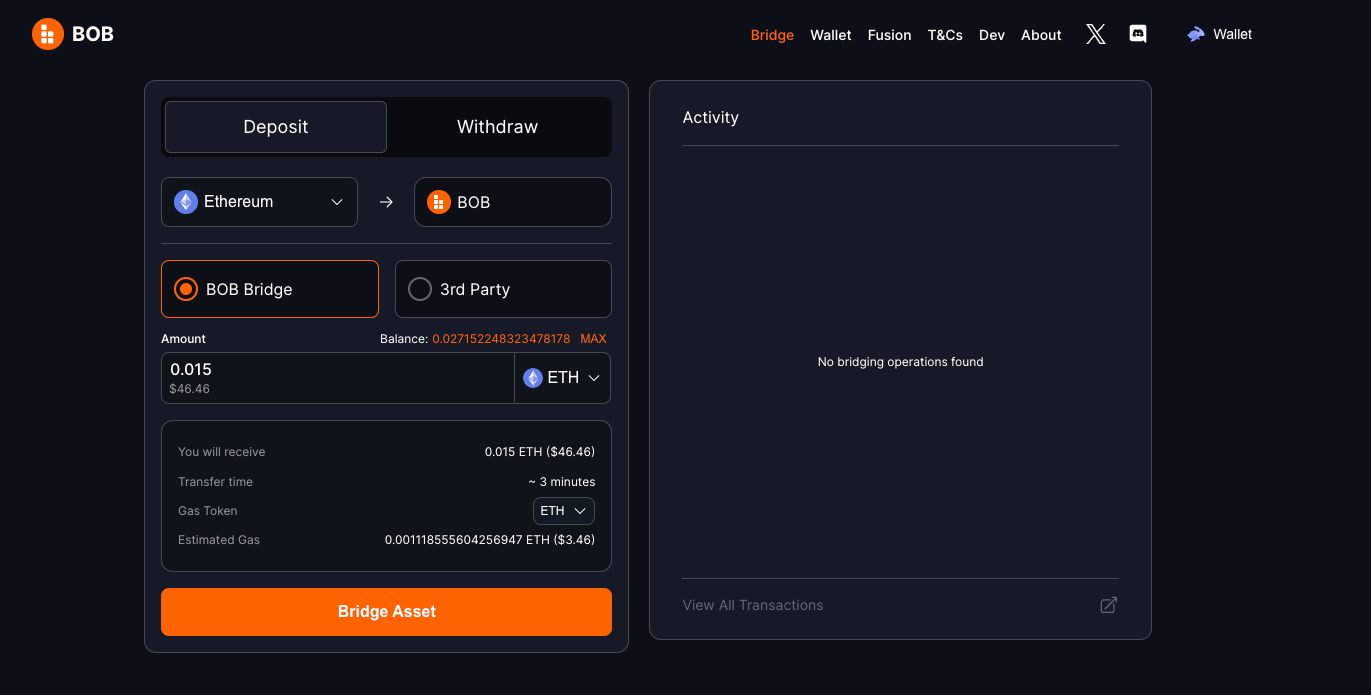

1: Bridge assets to BOB

Bridging cryptocurrencies to BOB allows you to generate a small number of Spices automatically.

To do this, it's very simple: you just need to bridge assets via the official bridge or an alternative bridge (Orbiter, Meson, Relay, or Owlto Finance).

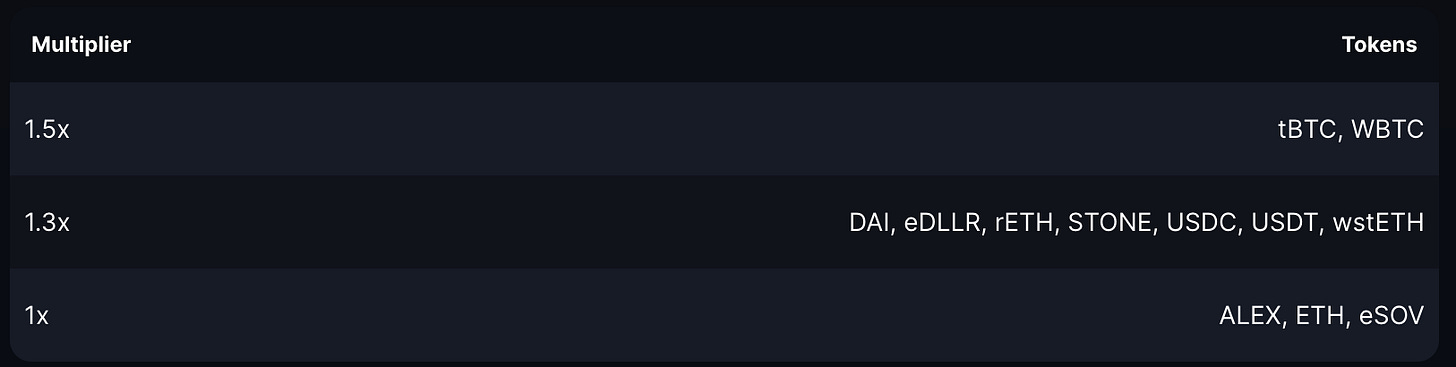

The assets you can bridge to BOB each have a points multiplier.

So, it's more relevant to bridge the cryptocurrencies with the highest multiplier (such as tBTC/WBTC).

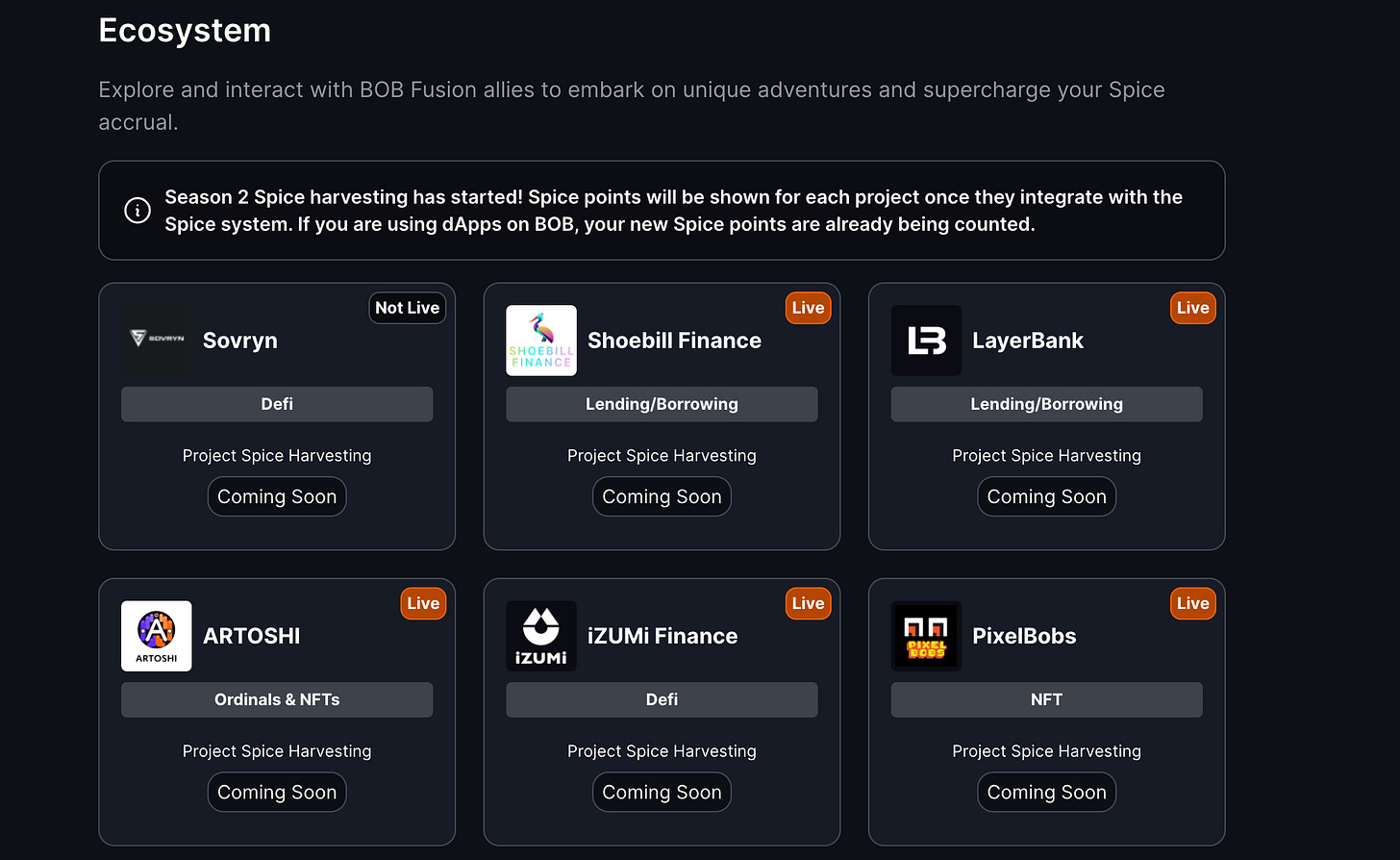

2: Providing liquidity on protocols built on BOB

The more liquidity you provide on Dapps, the greater your Spices generation will be. Remember MODE points farming: 1) Be Early 2) Deploy liquidity 3) Keep liquidity onchain

This method is crucial because providing liquidity on protocols is how you earn the most points.

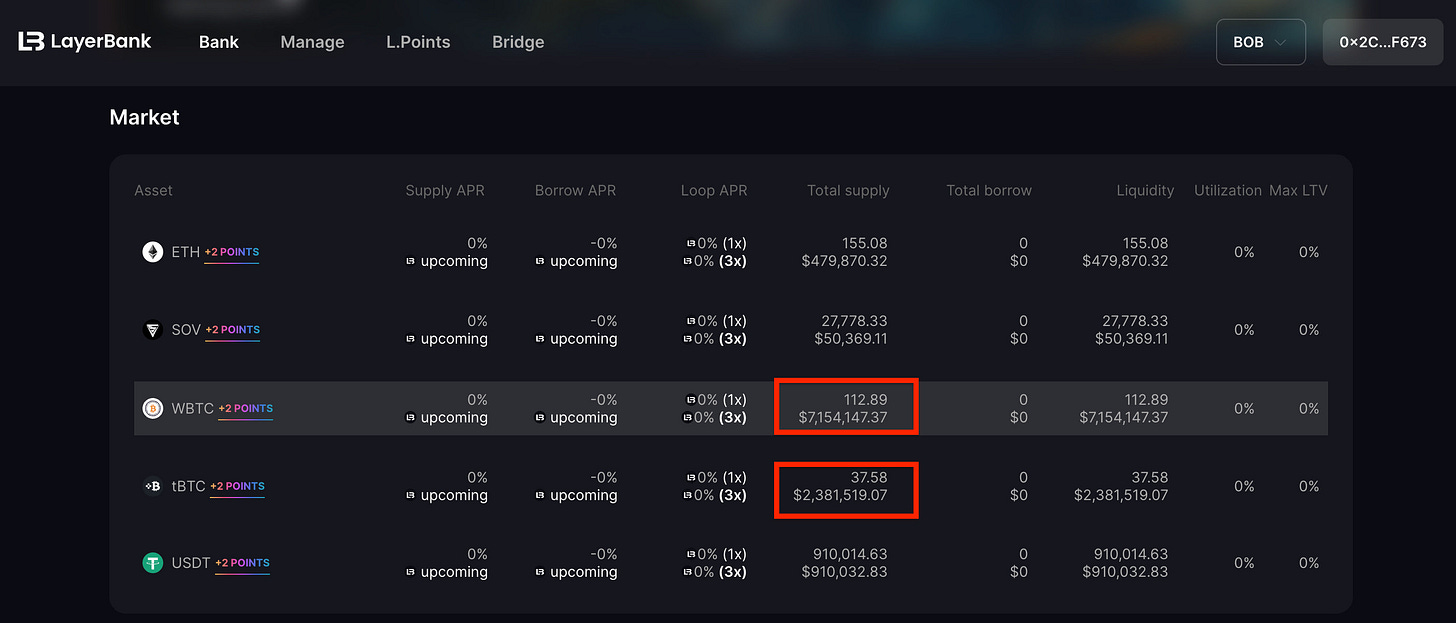

To maximize your farming, we recommend leveraging money markets to leverage your capital: currently, LayerBank would be the perfect protocol for this.

A simple strategy to maximize your Spices generation is to loop on LayerBank with WBTC or tBTC (watch out for liquidation).

You can see that farmers are gearing up to implement this strategy ..

For now, LayerBank has disabled borrowing due to a lack of liquidity, but it will enable borrowing when the situation improves.

The best current solution is to lend your funds.

Given that BOB has just been deployed, we recommend not touching protocols other than LayerBank and Shoebill for liquidity/security reasons.

However, it will be relevant to start diversifying your strategies when more robust protocols appear on the network (e.g., Velodrome).

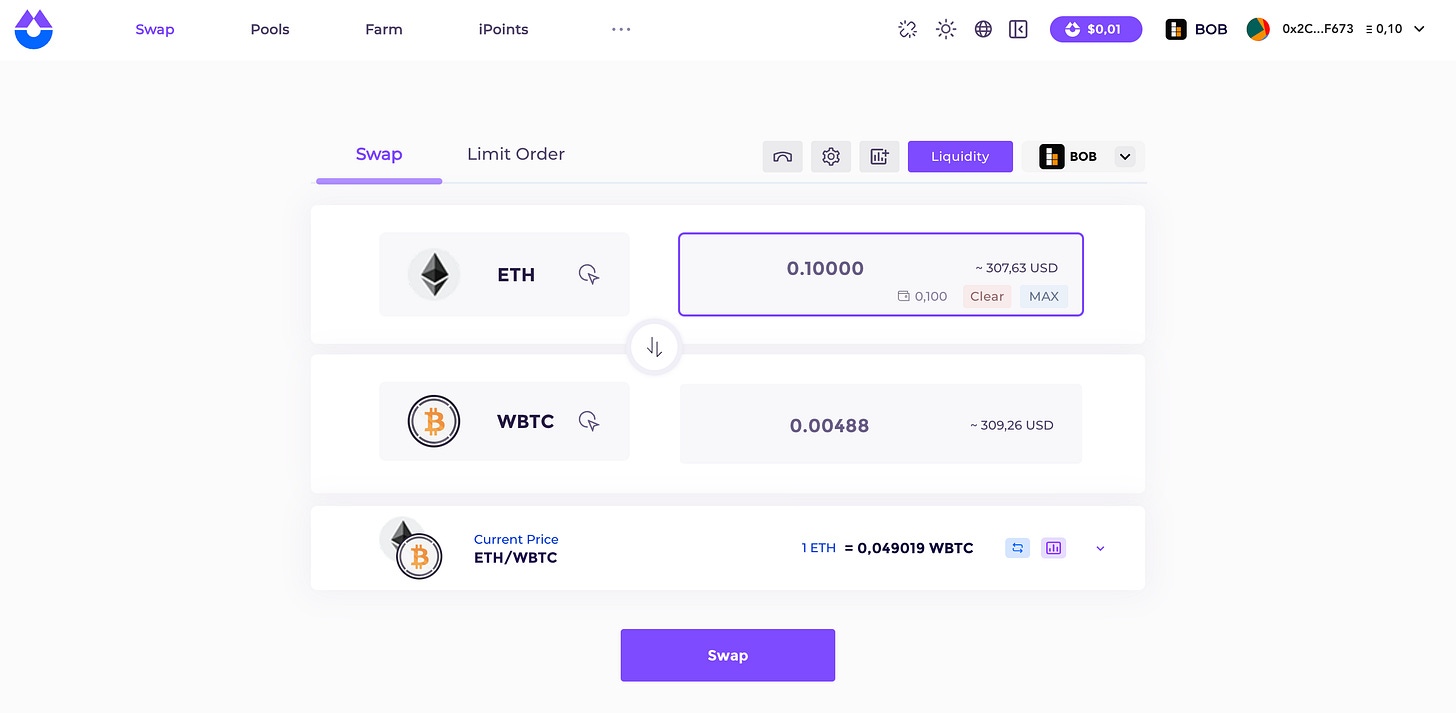

WARNING: At the time of writing these lines (06/05/2024), BOB does not have deep liquidity.

It is therefore not recommended to perform swaps on the network at the moment (make sure to bridge the assets you need directly).

If you have accidentally bridged a non-liquid crypto to BOB, you can simply bridge it back to the original chain or wait for the arrival of a liquidity pool for that asset.

3: Engage in transactions on BOB's Dapps

Engaging in transactions on the protocols also generates Spices (they are distributed directly to you).

It is therefore quite relevant to establish a routine for making regular transactions and maximizing your points harvest.

We currently advise making small regular swaps on Izumi Finance and setting up LP positions if you wish.

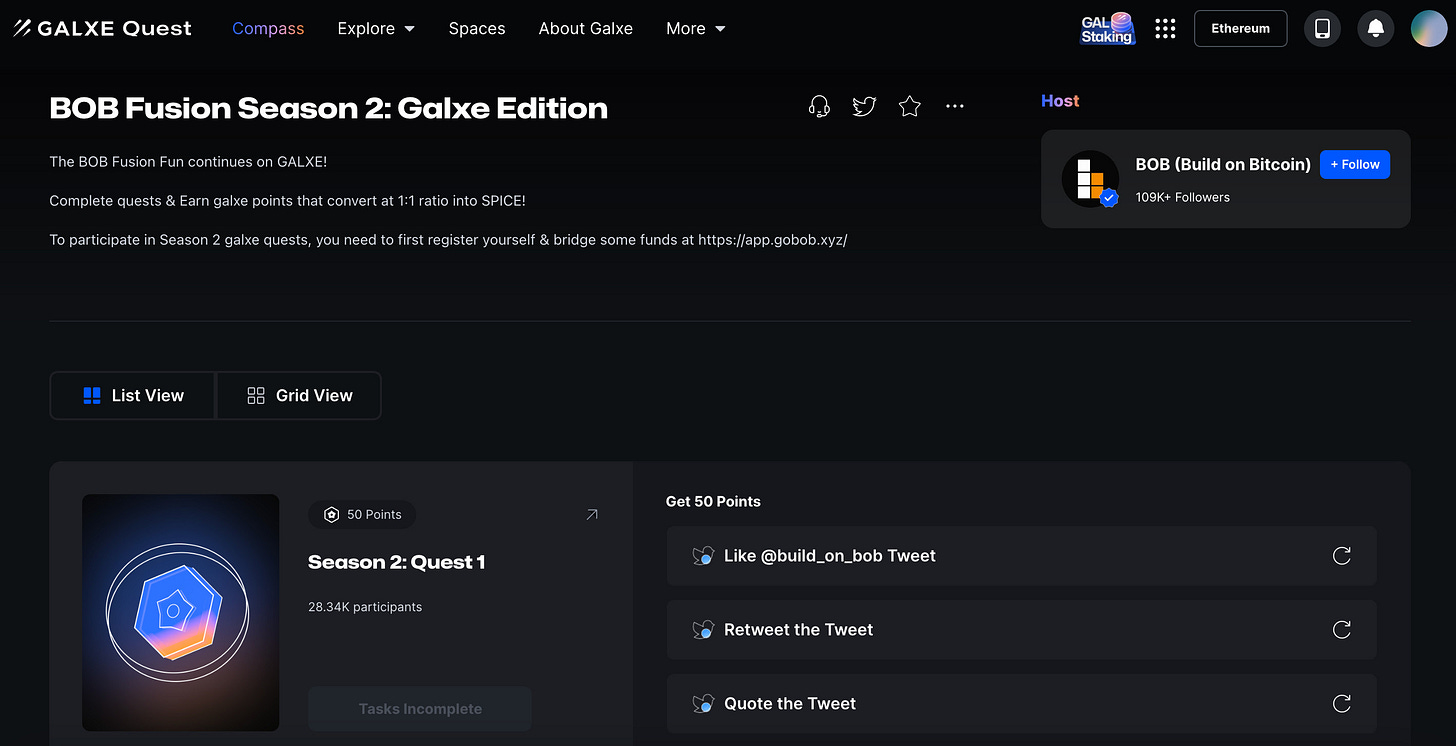

4: Participate in community quests

A series of Galxe Quests has just begun: each quest yields a distinct number of points.

We advise participating, especially if you have limited funds, as some quests do not require depositing cryptocurrencies on the network.

5 : Refer users

Finally, this last method of generating Spices is very important:

Every new user wishing to access BOB must be sponsored by someone using a code.

When someone uses your code, you earn 15% of their generated Spices, and if that user sponsors someone in turn, you will also receive 7.5% of their Spices.

So, it's very important to sponsor as many people as possible, especially before everyone has a code.

If you'd like to support us, feel free to use our code: https://app.gobob.xyz/fusion code: cn0pfw

Here's how to maximize your Spices farming on BOB!

Please note that the strategies presented are subject to change depending on the arrival of protocols on the network, but you can count on us to keep you informed of the best points farming opportunities on the network especially when Velodrome & Sovryn protocols will be live.

The Optimist Social accounts:

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.