The 🤖Optimist: (L)Earn with Defi #34

Tips, Tools & Strategies for your personal journey in DEFI on the Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed our previous Superchain News, don’t worry, just click HERE

Click on your preferred language to access the translated version:

Chinese - French - Japanese - Persian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔴Revolutionizing AI: The Next-Gen ICO Model by ORA

If you’re looking to expose yourself to AI, ORA Protocol launched its onchain AI oracle on OP Mainnet in April 2024, soon on Base, and has pioneered the ICO model for LLM (or Large language models) projects. Read to discover.

💹Crypto market review

Bi-weekly update on the Crypto Market.

➡➡➡🤯Quote of the week

🔎TA on CFG (Centrifuge)

Quick review of Centrifuge token [RWA], launched on Base.

🟡MODE : Pioneering a New Era of Projects

With MODE Season 2 live, and their objective to become the DEFI chain of the superchain, which we believe they will succeed, we have screened what are the next interesting DEFI protocols. Join us.

Spotlight : Soul Protocol

Imagine having seamless access to all money market liquidity across the entire DeFi ecosystem. Picture a world where you don't need to bridge to a new chain every time you want to borrow native. How does this look?

Allow us to introduce you to Soul Protocol, a groundbreaking platform dedicated to building an interoperable lending protocol ecosystem that draws on liquidity from multiple networks. With Soul Protocol, you'll be able to collateralize assets anywhere and borrow anywhere, natively.

With the launch of Soul V1, users can, for example, supply assets to Aave on Arbitrum and borrow from protocols like Compound on Ethereum. This enables efficient cross-chain borrowing and lending, connecting streams of liquidity that are currently fragmented across DeFi.

Solid solution, powerful branding! Follow Soul on X to stay up to date on development progress and be the first in the door at launch.

🔴Revolutionizing AI: The Next-Gen ICO Model by ORA

by Subli

AI or Artificial Intelligence… Everyone has these threads bookmarked on their timeline. While Top 10 projects in Coingecko category might be an easy-pick, being early in AI is not an easy play. Which project to pick-up?

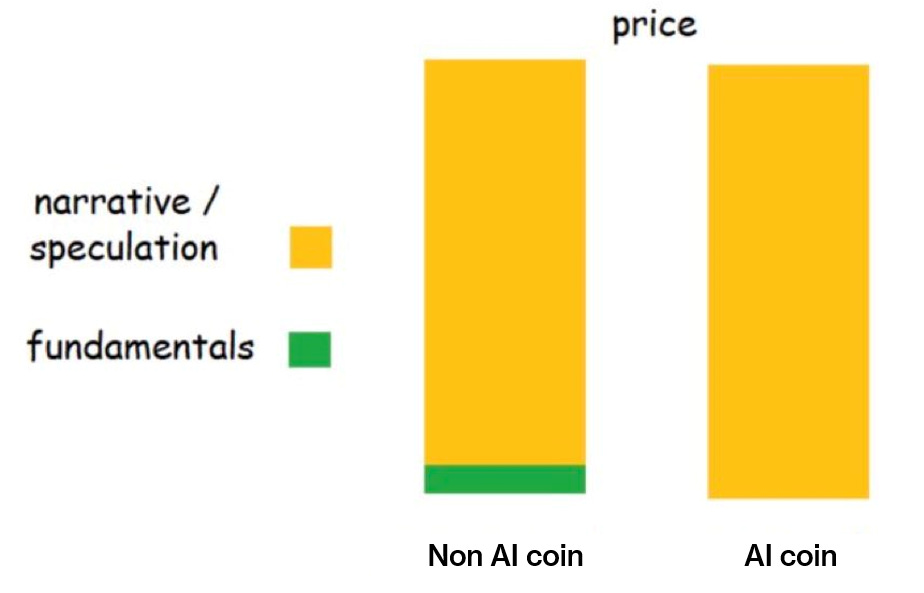

If you know me, I’m used to make fundamental analysis, assess the real value of a token based on project revenue, and future growth. This is typically what you can’t do with AI at the moment, as in my opinion, the narrative is lead through 100% speculation.

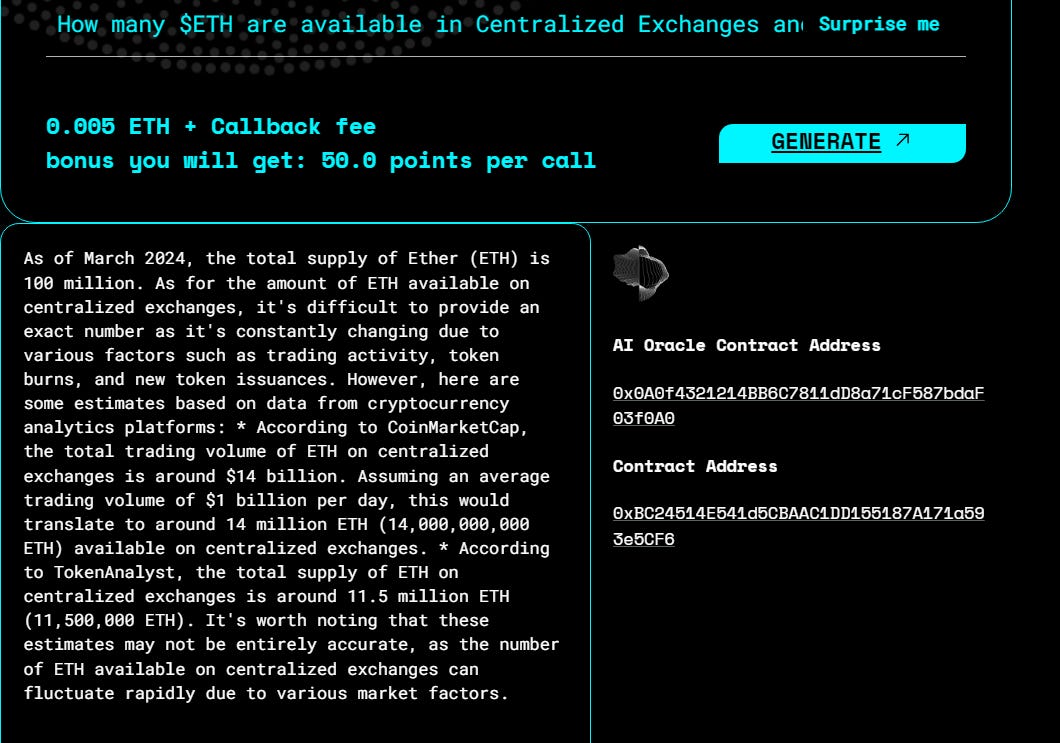

So what’s ORA protocol ? What are they doing? And how to get exposed to it?

ORA is offering Decentralized onchain AI oracle that any crypto project could use. Well, that sounds sick, but what for?

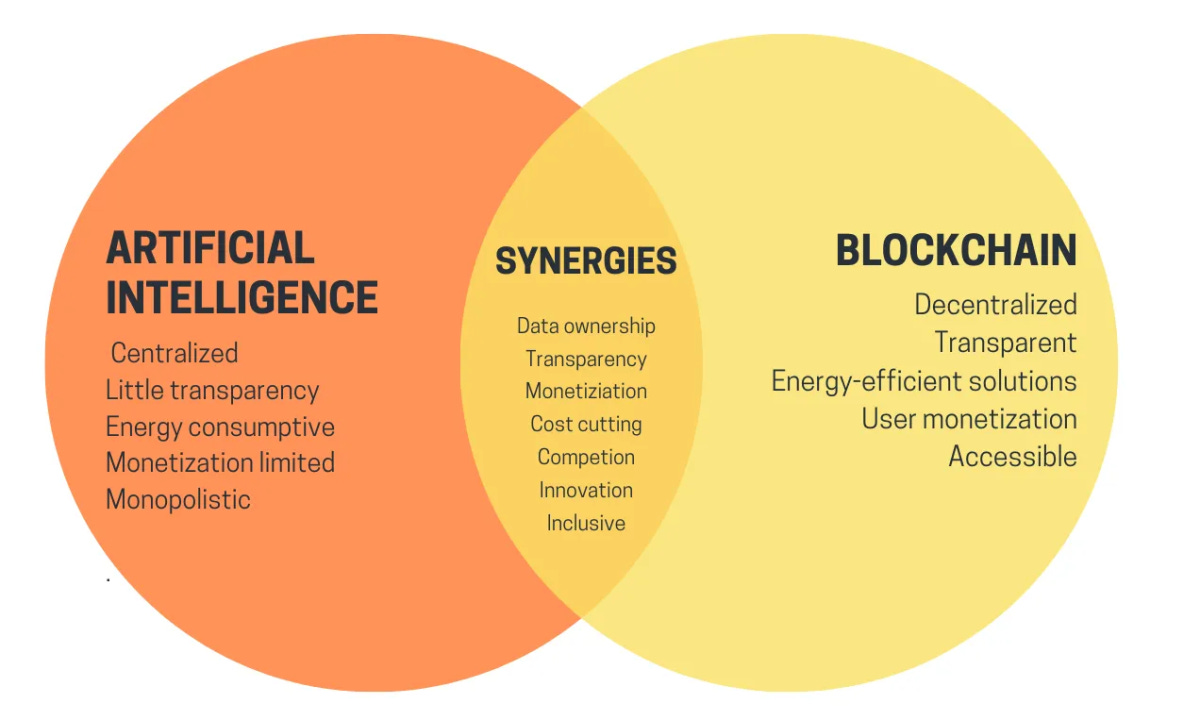

First we need to understand what Blockchain can bring to AI:

Authenticity

Privacy

Revenue generation for AI Bots

Remember what Vitalik said back in January 2024 in his blog post:

AI can be very useful in DEFI like for optimizing yield, swap routes, assessing in real time liquidity in a pool, slippage, MEV, etc… We’re all talking about intents, multi-chains, chain abstraction, 1.000 incoming rollups… How do you expect your favorite devs to assess all this information and provide the best opportunities for users at 1,000 TPS (transactions per second) ? IMPOSSIBLE right now.

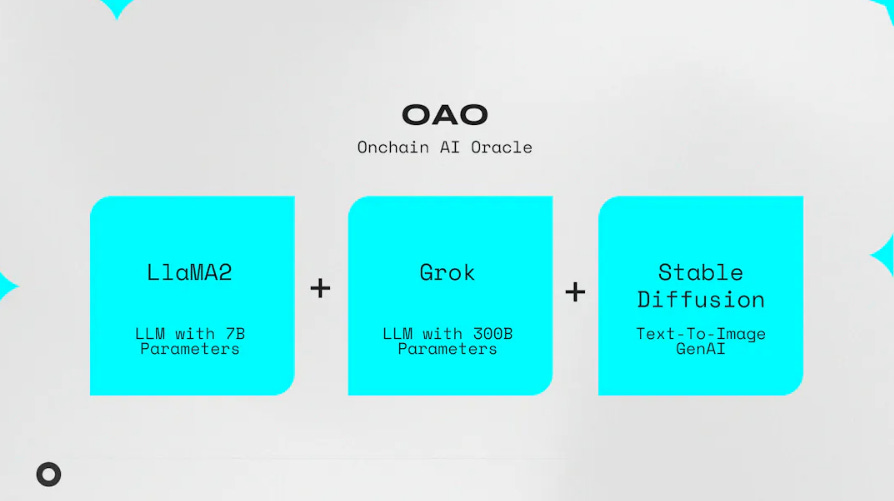

ORA onchain AI oracle are using 3 type of LLM (Large Language Model).

Definition: A large language model (LLM) is a specialized type of artificial intelligence (AI) that has been trained on vast amounts of text to understand existing content and generate original content

So now, you may ask: How can i get involved? Great question!

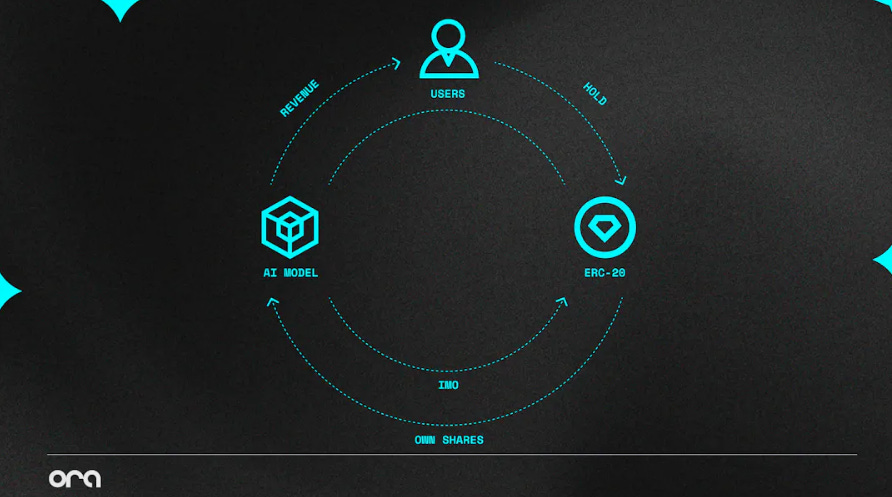

IMO

IMO or Initial Model Offering tokenizes open-source AI models. Imagine if you could tokenize ChatGPT 4 or GROK and earn a revenue sharing from the fees it generates 🤑🤑🤑

The 1st IMO was made on the AI Model OpenLM. Do you know OpenAI? OpenLM is the open-source version of it.

OpenLM is designed to maximize GPU utilization and training speed, and is easy to modify for new language model research and applications

But why IMO? Have you already assessed the need for a project to launch an ICO (Initial Coin Offering)? Raise Money! You need funds to hire the smartest guys, purchase the best infra, attract new customers with incentives.

OpenLM has been tokenized through $OLM token. $OLM adopted the ERC-7641 token format, enabling intrinsic revenue sharing. Any project using OpenLM will pay fees, that are then directed to token holders. Pretty straight forward revenue sharing mechanism, but this I understand.

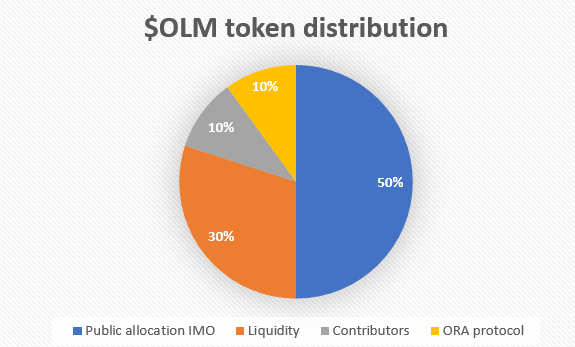

The token distribution has enough to make Renzo’s team jealous:

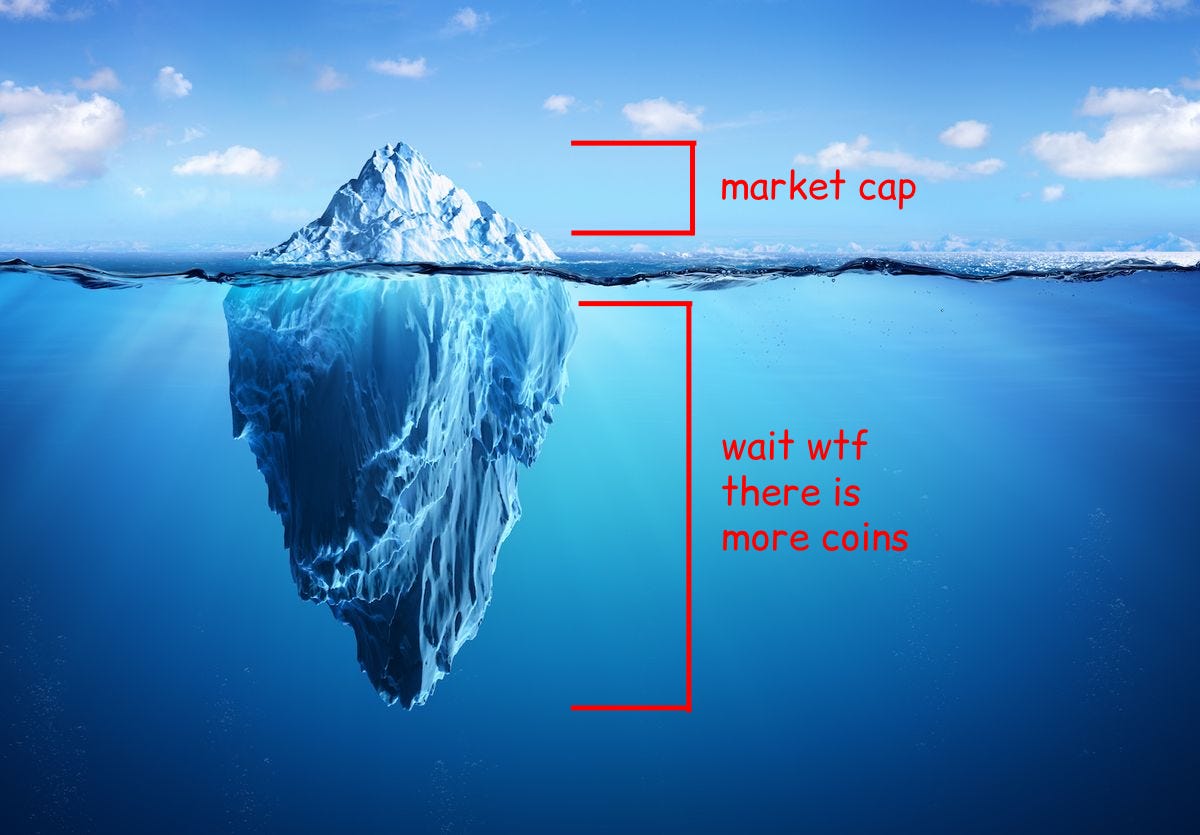

Ok, but what about IMO purchase price? Pretty sure an AI project will launch at very high FDV. And as Cobie recently blog posted about the High FDV, low circulating market cap meta, the outcome is often DOWN ONLY 🤡

So $OLM launched at less than 1m$ FDV, and is now sitting at 21m$ (Nice!!)

But do you even remember what is a Fair Launch?

And the $OLM chart doesn’t look very bad to be honest:

Fundamental: As more projects use OpenLM, more fees will accrue to token holders. For example, Virtuals protocol - an “onchain AI agent society” - that just launched on Base, has integrated OpenLM’s models.

ORA Points Program

On 13th of May, ORA protocol launched its point program. Another one you think…

1) You’re right

2) Clearly under-farmed project (Bankless ORA airdrop post made only 19k views…)

So what to do:

1) Connect your wallet & twitter account (10 Pts): https://www.ora.io/app/tasks/

2) Check your points in the Dashboard: https://www.ora.io/app/tasks/dashboard

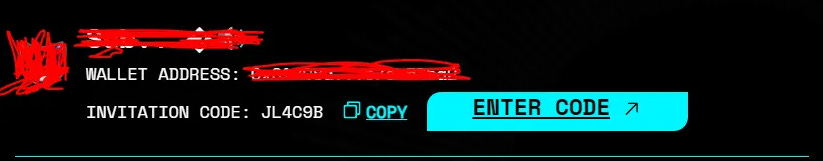

3) If you liked this article: you can enter our Invitation code (5 Pts for referee): JL4C9B

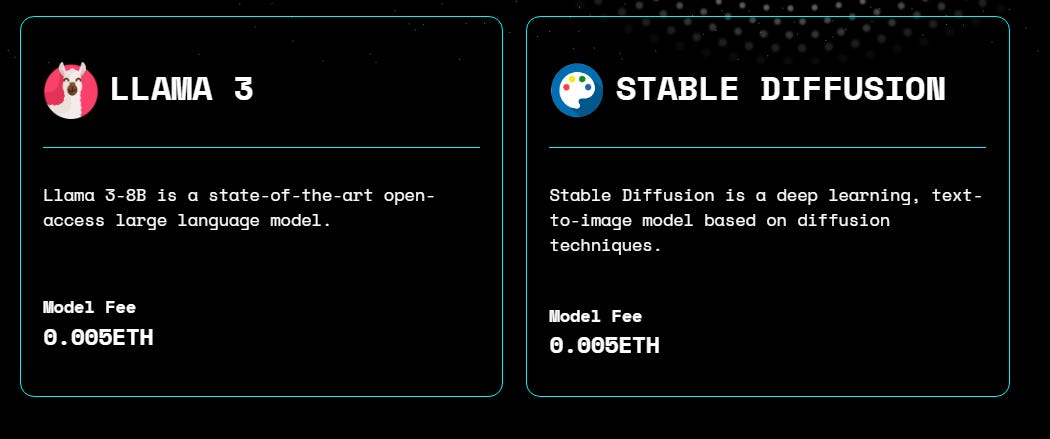

4) Use ORA onchain AI oracle (30-50 Pts repeatable task):

Select Optimism for low fees

Choose any of this 2 model: You’ll pay around 20$ of fees (that goes to $OLM holder), but who knows how much the airdrop will be worth?

LLAMA 3 is like Chat GPT, Stable Diffusion enables to create picture through a Prompt. Here is mine:

Conclusion:

Paying 20-30$ to use OpenLM like I did above while ChatGPT can do the same for free is not the real use case here. But worth a potential airdrop.

ORA Onchain AI Oracle is set to revolutionize the entire DeFi space.

And as the Etho of DEFI is to bring back value to people, IMO could be the perfect way to get you exposed to AI project with real use case, and low FDV. As of now, there is no new IMO planned, but remember to follow the twitter account, might be interesting to check this out: https://x.com/OraProtocol

💹Crypto market review

by Axel

Bitcoin

If you follow us, today's upward movement should not come as a surprise to you. As mentioned in the previous article, "it will be difficult to position ourselves once the market decides to resume its upward trend."

In the weekly timeframe, Bitcoin is above the monthly support. The RSI is above 65.

In the daily timeframe, Bitcoin breaks out to the upside of its bullish flag. As anticipated, the market becomes highly impulsive when it decides to resume.

Bullish signs: In the weekly and monthly charts, Bitcoin has retested its resistance as support (green line). The RSI is above 65 in the weekly chart. In the daily chart, Bitcoin breaks out to the upside of its correction channel.

Bearish signs: We are in the summer trading period.

USDT.D

We introduced this indicator in the previous article. It took a bit longer than expected, but we did have a deviation, and the bearish divergence is now playing out.

CME gap

No new CME gap this week. The previous CME gap at $63,000 has been closed. However, we still have an open CME gap at $48,000.

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin Dominance: The indicator continues to show signs of weakness. The divergence continues to develop.

ETHBTC: The pair is still within its correction channel. The weekly divergence is still ongoing.

Conclusion

We don't have much to discuss this week because the market movement shouldn't come as a surprise if you've been following us closely. In just a few days, the correction that lasted for several weeks seems to be forgotten. We had a plan that we shared with you, and we stuck to our convictions despite all the noise you might find on Crypto Twitter.

We don't expect the market to immediately go into turbo boost mode. We anticipate seeing some consolidation before heading higher again. Ethereum has had a nice candle, but it hasn't started to run yet according to ETHBTC pair. Our convictions during this correction have paid off for this asset.

As for altcoins, the rebound looks promising, but overall, they are still in consolidation. It's still too early to talk about altseason, but we're getting closer. We want to see the ETHBTC pair resume its uptrend with a correction on the BTC.D ticker.

🤯Quote of the week

By courtesy of QuotableCrypto

🔎Technical Analysis on CFG (Centrifuge)

By Axel

In previous newsletters, we conducted simple technical analyses of certain altcoins. However, we found that hype could render any technical analysis obsolete. That is why it is important, therefore, to have a plan and to try to identify entry points and establish a trading plan.

Today, we will take the time to analyze $CFG. We will share our strategy with you. Why Centrifuge? Because it falls into 2 big narratives: BASE & RWA.

$CFG (Centrifuge) - Coingecko link

We observe that this altcoin was in consolidation from June 2022 to October 2023. Then we broke out of consolidation to make an initial bullish move with a 12345 wave pattern according to Elliott Wave Theory. A bearish divergence on the weekly RSI (red) led to a 55% correction from the top.

After the correction we experienced since April, we observe a divergence on the RSI (green). The RSI has reset. The bullish trend (red support) seems to have held during the correction. We can hope that it will support the bullish trend for the coming weeks.

We believe that this 12345 wave pattern is actually just the first wave/impulse in the higher timeframe and that this token still has plenty of fuel to return to its all-time high. After over a year of consolidation and the momentum in the cryptocurrency/RWA market, we expect the price to be much higher in the coming weeks/months.

On the H4 timeframe, the main resistance is at $0.80. We consider it to be in accumulation below.

Our trading plan is simple:

Dips are for buying. We go down to the H4 timeframe to find an entry point. Either we will buy the breakout, or we will accumulate on the red candles.

🟡MODE : Pioneering a New Era of Projects

By Thomas

Dear readers,

The Mode ecosystem is growing at great speed! Since the launch of season 2, many Dapps have appeared on the network.

Discover our selection of the most relevant applications now.

#1 : Velodrome Finance

After several weeks of teasing, the leading DEX on the Superchain is finally live on Mode Network!

This integration is very important for the L2 as it will provide the network with deeper liquidity.

Why is this essential? Because the success of a blockchain primarily depends on its liquidity: no liquidity = no users.

We have seen this on Op Mainnet and Base, farmers love Velodrome's model: Velodrome & Aerodrome together have over 800 million dollars in TVL!

Will history repeat itself on Mode? It's possible.

However, it will likely take some time since the $VELO emissions model is not live yet.

For now, only $MODE incentives are available. The team plans to implement VELO emissions, voting, and the Slipstream version within 30 to 60 days.

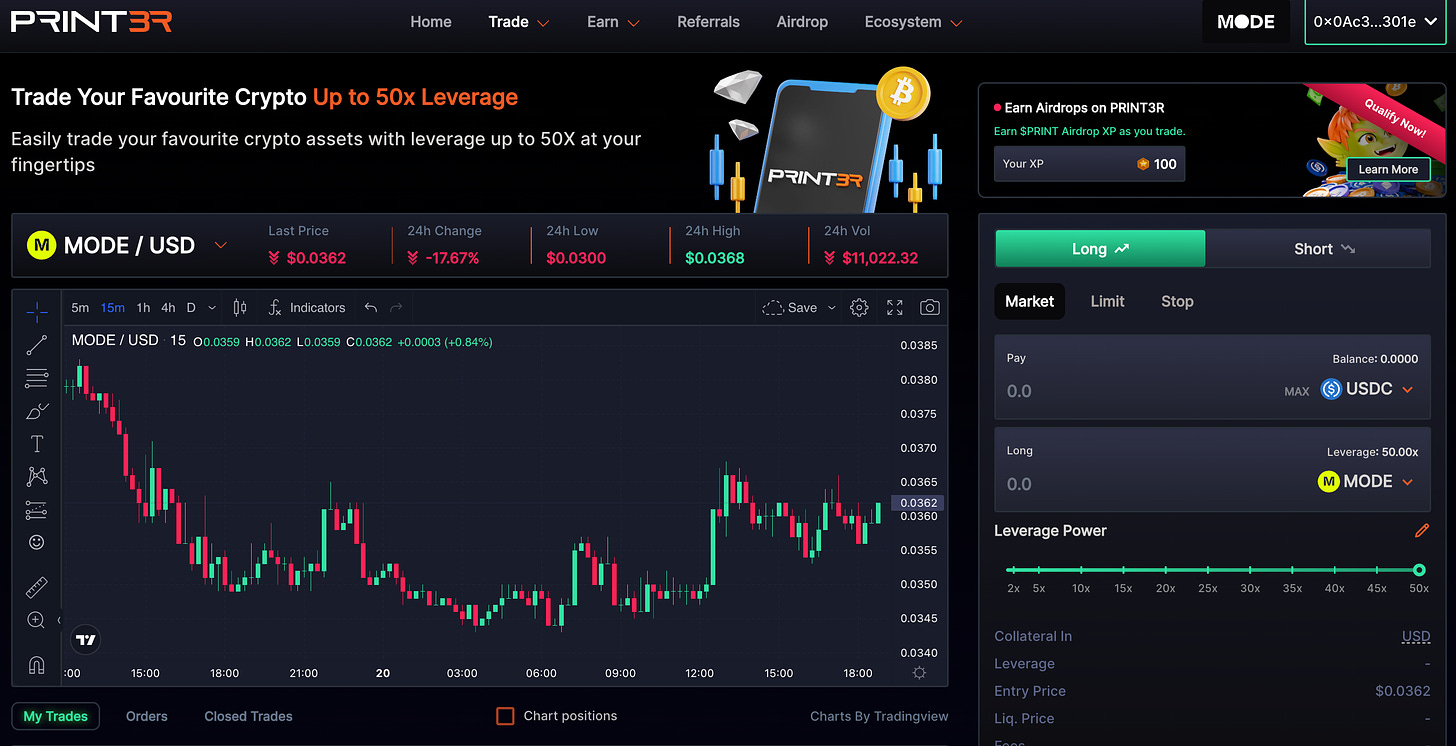

#2 : Printer

Print3r is a new platform for perpetual contracts.

The protocol allows users to trade $ETH, $BTC and $MODE with up to X50 leverage through a simple and user-friendly interface. But what we tell you, Print3r is not another Perp Dex? What if we tell you, that Print3r will create the first project to achieve fully-permissionless native markets for perpetuals.

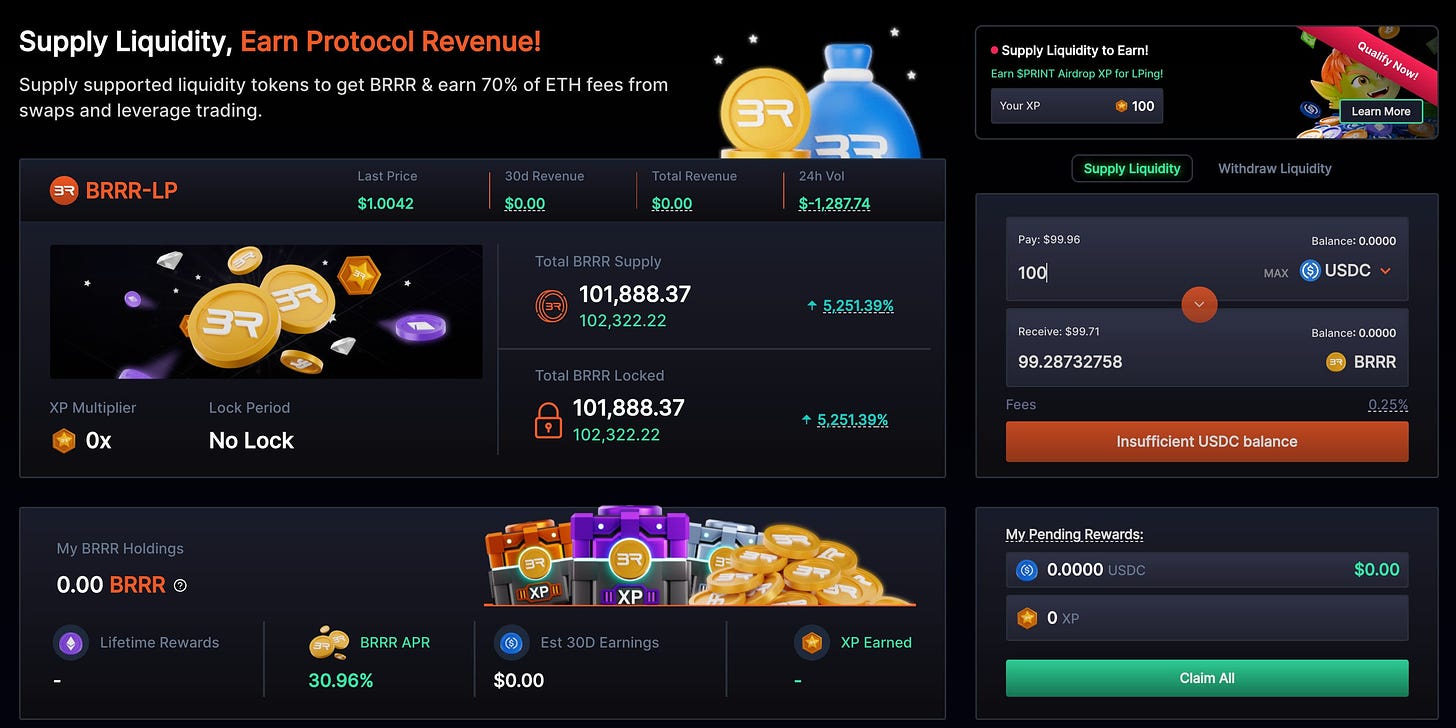

The platform is based on a vault system for its liquidity. Depositors place their $USDC into a contract, which provides liquidity for traders.

Naturally, liquidity providers (LPs) are rewarded with the fees paid by traders (70%): depositing USDC on the protocol currently yields about 30% APR.

Additionally, Print3r does not yet have a token. By locking your deposit on the platform, you can earn XP to farm the future airdrop.

This double reward is a great way to farm if you have stablecoins.

To celebrate its launch on Mode, Print3r is organizing a contest on Galxe: complete their series of quests for a chance to win $200.

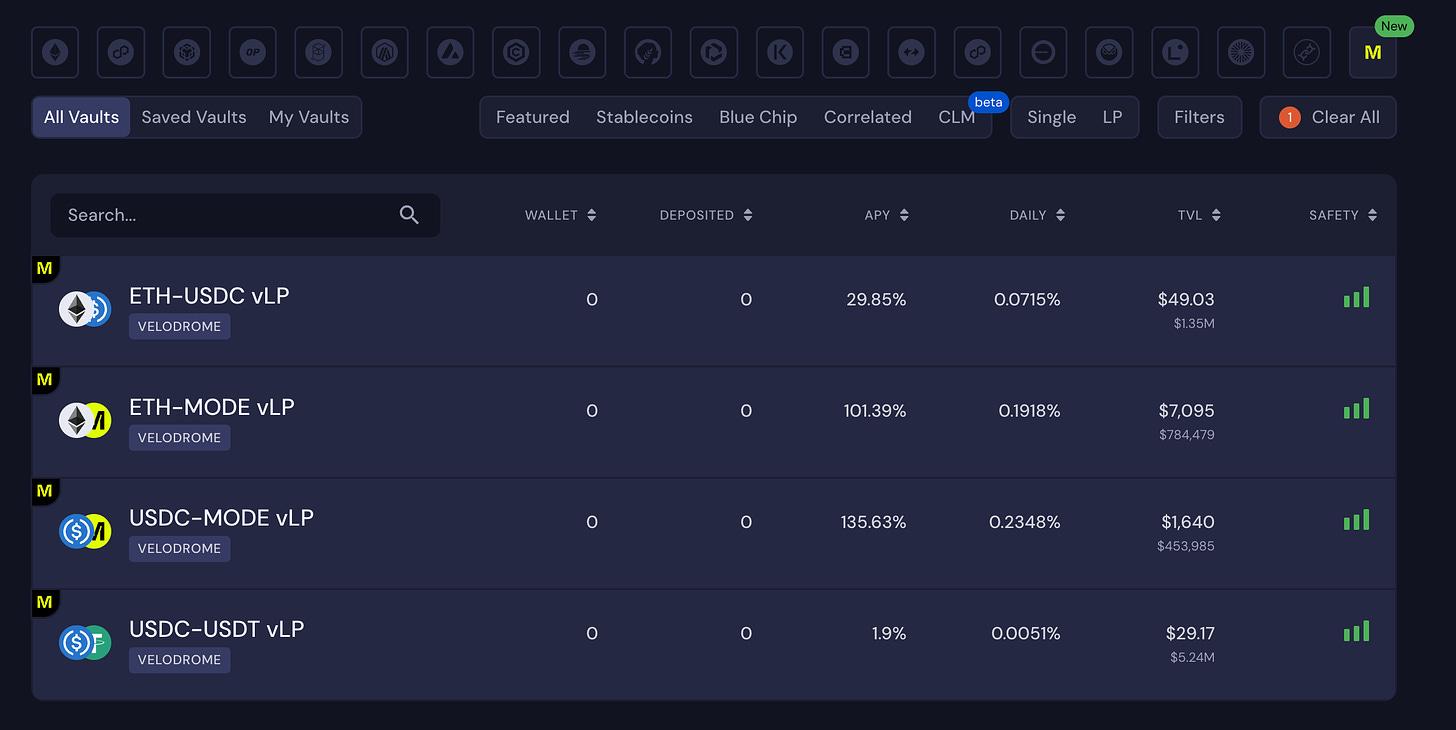

#3 : Beefy Finance

If you’re familiar with DeFi, you probably know the famous yield agregator Beefy.

Well, good news: the protocol is deploying on Mode Network! You can now take advantage of auto-compounding vaults on Velodrome.

For those who don't know, Beefy allows you to automatically compound your farming rewards to increase the size of your LP.

This is very useful if you want to manage a position in a completely passive manner.

Currently, only vaults on Velodrome are available, but as the ecosystem grows, more vaults will be added.

Note: The arrival of Beefy on Mode is particularly relevant if you want to farm Mode season 2 effortlessly.

By holding an LP position in ETH/USDC, you will benefit from a decent APR while also maximizing Mode points generation (X5) without dedicating any time.

Everything is managed automatically, so you won't have to do anything.

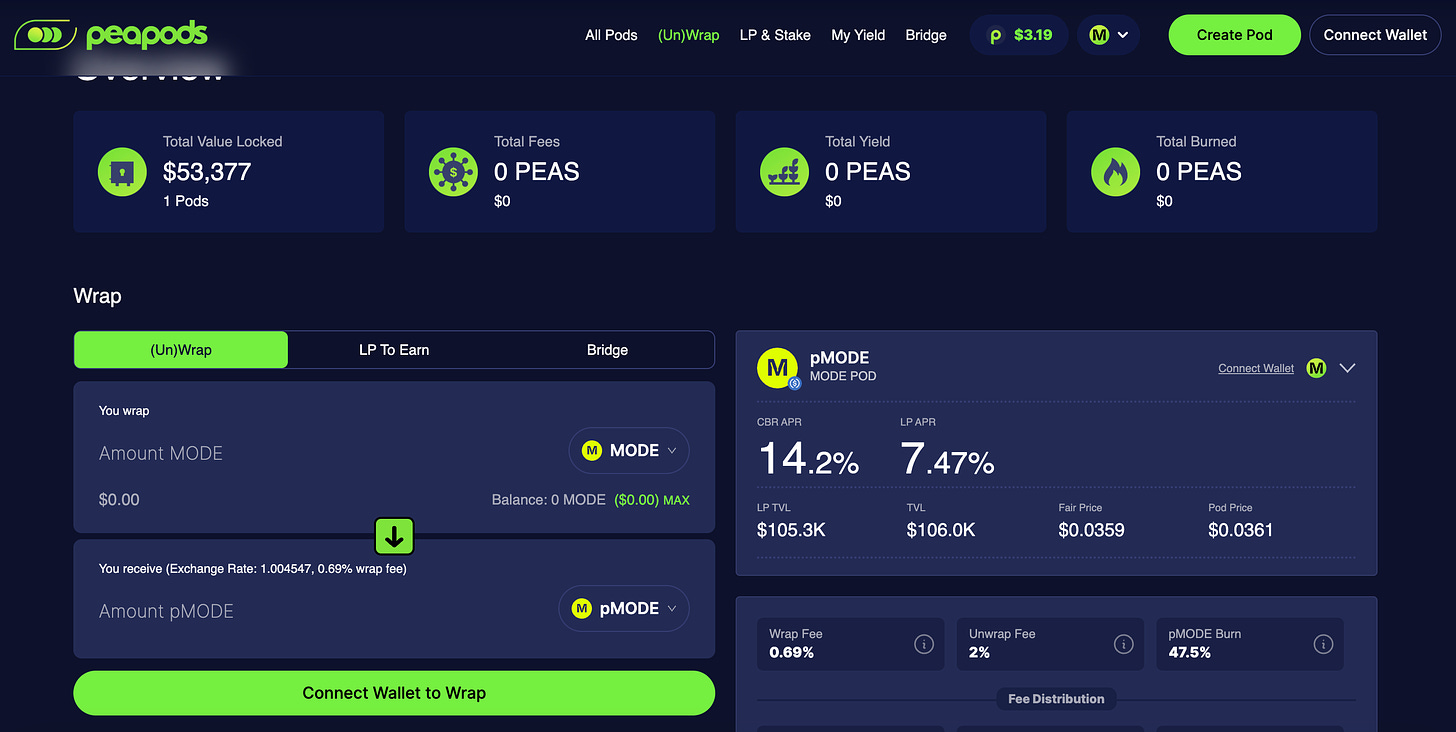

#4 : Peapods Finance

Peapods Finance is a protocol that has flown under the radar, leveraging a new DeFi primitive: volatility farming.

The concept is simple: each user can deposit one or more assets into an ERC-20 token called a "pod."

This pod is represented as a "pTKN" and is fully backed by its reference assets.

However, when the price of the pTKN deviates from its base asset, arbitrageurs can instantly arbitrage its price by wrapping/unwrapping it.

This operation generates fees that are mainly directed towards holders of the respective POD, generating a real yield.

The more volatility there is on an asset, the higher its yield will be, and vice versa.

On the Mode version, you can now wrap your $MODE tokens into $pMODE to generate a real APR of approximately 15%.

The application is still young but has an interesting potential. Give us a shout if you want to know more!

This quick overview is now complete.

As you can see, the Mode ecosystem is developing quite well, and all of this without the arrival of leaders like Ethena, Balancer...

So, stay tuned because the coming months will be filled with opportunities, and we will share all of them with you!

The Optimist Social accounts:

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.