The 🔵Optimist: (L)Earn with Defi #35

Tips, Tools & Strategies for your personal journey in DEFI on the Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed our previous Superchain News, don’t worry, just click HERE

Click on your preferred language to access the translated version:

Chinese - French - Japanese - Persian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔵RWA (Part 1) : The incoming revolution on Base

By approving spot ETF for $ETH, SEC gives legitimacy to the whole crypto space. This may lead to bring Real World Assets onchain at an unseen pace. I’m going to cover in few different articles, the connections between Blackrock, Coinbase, Circle, Base and the RWA landscape. Buckle up!

💹Crypto market review

Bi-weekly update on the Crypto Market.

➡➡➡🤯Quote of the week

🔎Technical Analysis: Ondo Finance ($ONDO)

🔴Optimism Airdrop #5 (Part 1) : Are you a Superchain Defi user ?

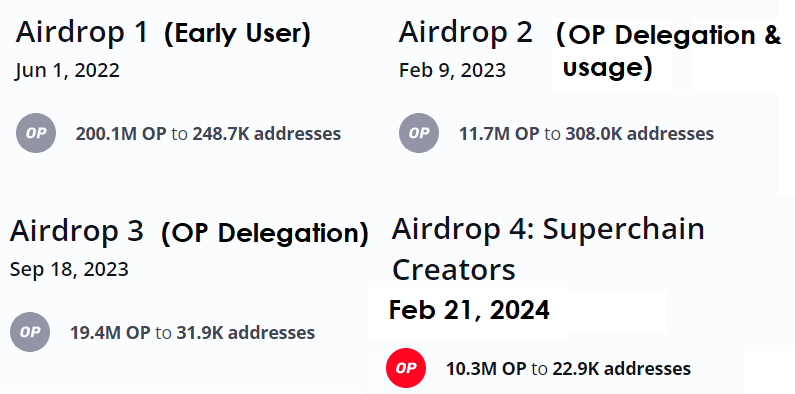

Optimism airdrops have been pretty lucrative for the REAL users: onchain user, NFT creator, OP Delegator. The last 3 airdrops were in Feb-2023, Sept-2023, Feb-2024, maybe the next one is in Sept-2024. If so, we believe that Superchain users will be rewarded. Here is your complete tuto in a 2 parts series. Here is your part 1!

Spotlight : Cyber

Get ready to shape the future of social with Cyber! This Layer 2 rollup, built on the OP Superchain, is now live on the Mainnet. Imagine your favorite social apps, but supercharged for web3.

That's what Cyber unlocks. Want to join the action? Start by easily bridging onto the network from Base or OP Mainnet, and remember to bring some $ETH for gas. The web3 social revolution starts here!

🔵RWA: The incoming revolution on Base - Part 1

by Subli

Dear readers,

It’s been a while i wanted to cover RWA, and not only Ondo Finance, so this series of articles will summarize months of research and aggregation of information, and most likely you’ll be very surprised on how every piece fits together.

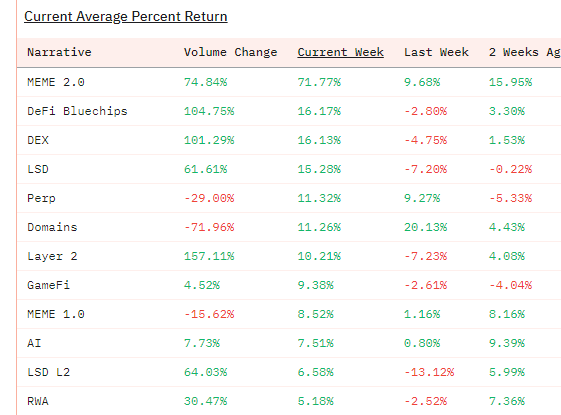

As for every cycle, your PF should be exposed to the ongoing narratives. As of today, here is what i see from high to low hype:

Ethereum: Easy play, but really don’t fumble the ETH ETF inflows that will come

RWA: Topic of the day!

AI: Have you heard about Elon Musk’s company xAI raising 6b$? Not valued at, but raised 6b$! Park your money where there is money.

DEFI: No real innovation except Restaking that is fueled by Speculation right now (no real yield), number of projects going up, liquidity dilution going up

Gaming: Still a niche, & waiting Gaming studio to produce killer game like Paralell

NFT: I think people start realizing that buying a Rock for 7-figures of US dollards doesn’t make sense

Big shout out to CryptoKoryo for his amazing dune dashboard spotting the % of return based on the different narratives:

So why I’m bullish on RWA now?

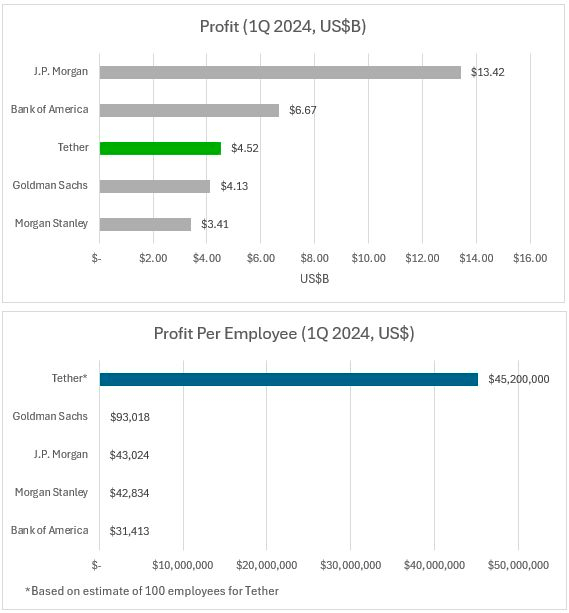

It’s all about cost efficiency. I’ll give you one example, and the largest RWA category is of course FIAT currency tokenization: $USDC, $USDT

Tether is making 500x profit per employee than Goldman Sachs!

RWA put on chain will offer:

Lower transactions costs

Faster transactions

Transparency

But the problem remains there is no standard for bringing RWAs onchain. This is where, in my opinion, Base fits in.

But why I’m bullish on RWA on 🔵Base ?

It’s all about the small signs you see on CT or news. By removing the noise, let me share you the signal i’ve seen:

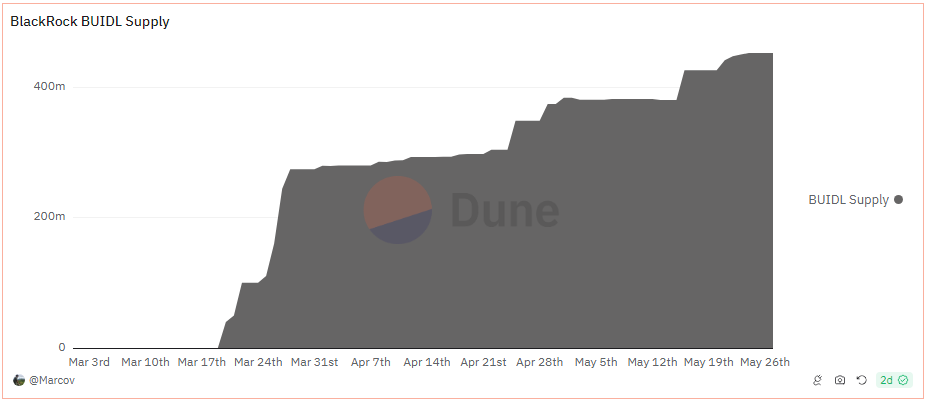

1. Blackrock has set a precedent by setting up the 1st tokenized fund “BUILD” on Ethereum, and liquidity keeps increasing. I see this as a pilot program for Blackrock.

2. BUILD is backed by RWA assets such as Treasury Bills, Cash & repurchase agreements. The company assisting in the tokenization process & framework is SECURITIZE. Securitize announced a 47m$ funding round, led by… Blackrock! Following a Series B funding round of 48m$ in 2021, and a Series A funding round backed by… Coinbase in 2018

3. Coinbase has been choosen by Securitize & Blackrock as key infrastructure provider for BUILD tokenized fund.

What does it mean? Coinbase will provide:

Custody services

Trading & Transactions

Compliance & Security (via coinbase Attestation)

Blockchain expertise

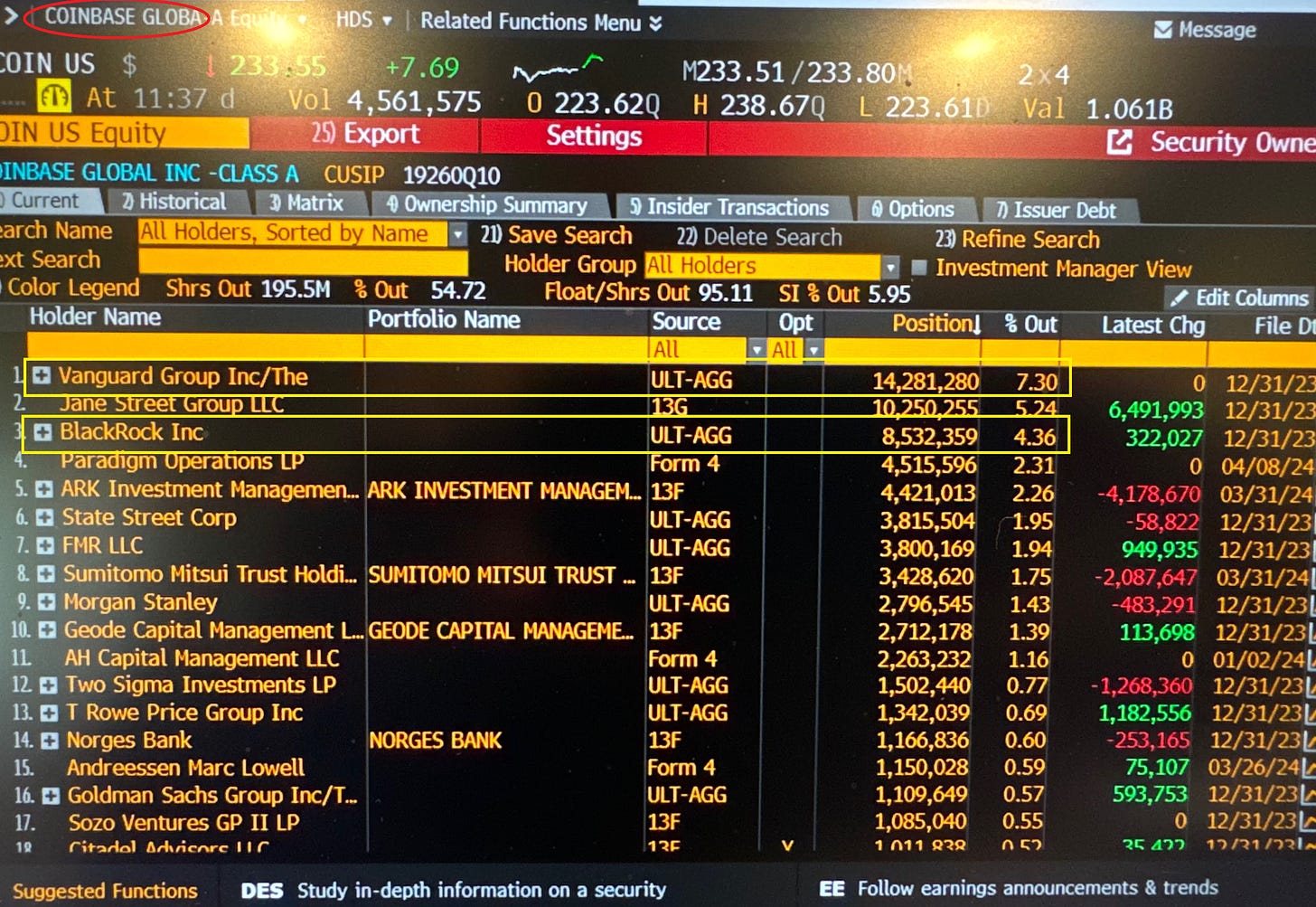

4. Coinbase is owned by BlackRock (#1 investment fund) & Vanguard (#2 investmenet fund). Both firms managed a total of 19,000 billions $, and own close to 12% of Coinbase.

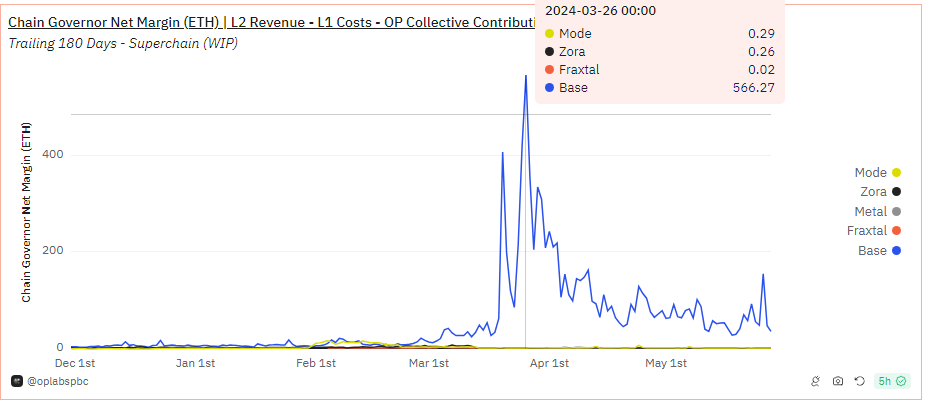

5. Base is owned by Coinbase. Base profit soars to 566 $ETH with an average of around 120 ETH/day, estimating an annual profit (revenue - L1 cost - OP collective contribution) around 200m$/year.

6. Base will bring the whole economy onchain. I’d advise to watch this video: https://x.com/jessepollak/status/1782103178273788251

7. Coinbase has taken an equity stake into Circle in 2023

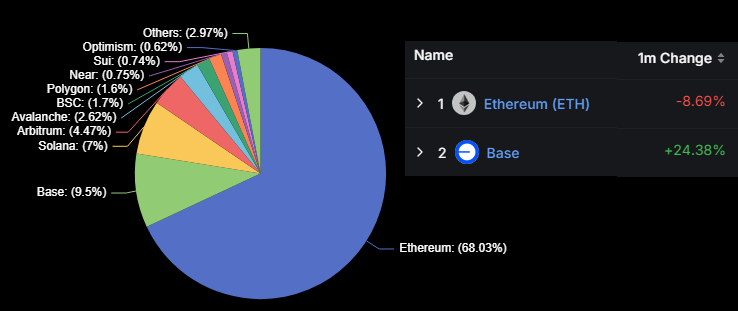

8. Stablecoin is the essence that fuels a chain. Base is now the 2nd chain in $USDC MarketCap after Ethereum, and growing at an impressive pace.

9. Finally, Coinbase is one of the founding member of the Tokenized Asset Coalition (TAC) set up in 2023, alongside Base, Circle, and other projects.

10. And finally, no one can talk about RWA without mentionning Chainlink. Chainlink CCIP is one of the core module of RWA tokenization. From a recent collaboration with Circle to expand usage of $USDC & $EURC

to the Smart NAV pilot program, marking the framework to tokenize Funds.

So what’s next you’ll probably ask?

Few weeks ago, I asked my friend Aylo how did he manage to position himself so early on AI project such as Bittensor $TAO, gaming with Paralell $PRIME and Solana $SOL. One of his answer hits me very hard:

Aylo: Choose the narrative that is able to change the world, and pick the Leader!

In the next articles, I’ll then present, for each RWA category, the Project Leaders with a specific focus on the ones backed by Coinbase and/or available on Base. RWA category are:

Tokenized Treasuries & Securities

Commodities, Equities & Funds

Private Credit

Real Estate

Infrastructure

Stablecoins

2025 and beyond will be RWA! So make sure to get some reading slot over the Summer, cause i’m going to go deep in the narrative.

💹Crypto market review

by Axel

Bitcoin

The market has seen little change since the last technical analysis. Bitcoin continues its accumulation phase. We are far from the excitement experienced during Q1 2024. Let's take a look at the market together to make decisions for the coming weeks.

In the monthly timeframe, Bitcoin has tested its support and continues to consolidate above it.

In the weekly timeframe, Bitcoin is consolidating below the middle of the range. A breakout to the upside would be a strong signal for the market.

In the daily timeframe, Bitcoin is retesting its bull flag and continues to consolidate.

Bullish signs: In the weekly and monthly charts, Bitcoin has retested its resistance as support (green line). Consolidation below the middle of the range on the weekly chart. In the daily chart, Bitcoin breaks out to the upside of its correction channel et consolidates.

Bearish signs: We are in the summer trading period.

DXY

The indicator is still trading within its range. After touching the upper bound of the range, it is normal for it to be rejected. We have repeatedly stated that we have been bearish on this indicator since the creation of the BRICS.

Altcoin

Bitcoin Dominance: The indicator is still trading above its blue support. The resolution of the ongoing bearish divergence formation may take some time.

ETHBTC: Ether has broken above its blue resistance from the bottom of its range. The weekly divergence is still ongoing.

TOTAL3: The indicator is still consolidating above its green support. The RSI is diverging.

Conclusion: Patience

The market has seen little evolution in recent weeks. As we mentioned before, the summer period tends to be quieter than the rest of the year. However, this doesn't prevent Bitcoin from slowly climbing while consolidating. This price action helps exhaust sellers and lays the groundwork for the next bullish momentum. In the meantime, we need to remain patient.

We observe many weekly divergences on the indicators. This indicates that the consolidation is bullish; however, weekly divergences can last for several months. We must remain patient.

Regarding altcoins, you need to keep a cool head and avoid checking your portfolio every day. Doing so can make you emotional and lead to poor decisions like overtrading. It's common during these market phases to buy green candles and sell red candles. We've already discussed this topic in depth. Patience is key.

For those who still have liquidity on the side:

An investor should already be buying. The vast majority of altcoins have bottomed out, and each red candle becomes a buying opportunity. It's essential to always keep the big picture in mind. We believe it's beneficial to position oneself today to avoid being sidelined when the market resumes its upward trend.

For a trader, patience is key, and monitoring for consolidation breakouts is crucial. Futures and margin trading should be avoided due to the high volatility in this market. While this type of position might yield profits, few will survive in the long term.

We recommend staying in spot positions. We are positioning ourselves as investors here. Indeed, we do not want to be sidelined when the market takes off again.

🤯Quote of the week

By courtesy of QuotableCrypto

🔎Technical Analysis on Ondo Finance ($ONDO)

By Axel

In previous newsletters, we conducted simple technical analyses of certain altcoins. However, we found that hype could render any technical analysis obsolete. That is why it is important, therefore, to have a plan and to try to identify entry points and establish a trading plan.

Today, we will take the time to analyze $ONDO. We will share our strategy with you.

Ondo Finance is the leading RWA protocol, backed by Pantera & Coinbase. Ondo Finance issues a yield bearing stablecoin USDy which is backed by tokenized note secured by short-term US Treasuries and bank demand deposits, and offer a risk-free yield of 5.3% APY.

$ONDO (Ondo Finance)

We have limited historical data to conduct a complete technical analysis as we did in the previous article with $CFG. This altcoin was launched in early 2024 and already has a market capitalization exceeding $2 billion.

We observe two consolidation periods. After the breakout of the first consolidation in February, the price returned to touch the support in green (orange point) after a 100% increase.

During the current Bitcoin correction, this altcoin has consolidated. Once Bitcoin started consolidating, ONDO surged by 70% after breaking out of consolidation.

Today, we observe that the price is just below the 1.618 level, which is a profit-taking indicator we presented in NL #21. Additionally, the RSI is diverging on the daily chart. Indeed, the RSI forms a double top while the price makes a higher high.

On the H4 timeframe, we clearly observe a loss of momentum on the RSI. The divergence between the RSI and the price forces us to be cautious and favors taking profits rather than initiating a position.

Conclusion:

It's worth noting that each altcoin has its own cycle. Indeed, it may be rising while most others are finishing their correction or consolidating. However, patience is key as we aim to buy during consolidation periods or on support levels.

Thus, the obvious supports on $ONDO are the psychological support at $1 and the retest of the green support. These will be important buying zones, and it will be easy to exit the position if these supports are broken to the downside.

🔴Optimism Airdrop #5 (Part 1) : Are you a Superchain Defi user ?

By Thomas

Dear readers,

As the Superchain is rapidly expanding, it wouldn't be surprising to see users of this ecosystem being rewarded...

Discover today how to speculate on the next $OP airdrop through two yield strategies.

Context

A few weeks ago, the Optimism Foundation shared its intentions (strategics goals) for Season 6, which will take place in the coming months.

We learn quite a bit in this report, including the fact that the collective is focused on 3 main goals:

Develop its decentralization

Bring new chains to the Superchain

Onboard new developers

But by looking at the document a little more closely, we can read this:

Will the next OP Airdrop be airdropped to Superchain users? It's possible. Especially given Optimism's communication around this ecosystem.

For reference, Season 6 starts on June 27, 2024, and ends on December 11, 2024.

Since Optimism performs a airdrop every 5 months or so, it would coincide with the date of the next airdrop (the last one was on February 20, 2024).

How to farm the airdrop effectively ?

If Superchain users are indeed rewarded, then it will be necessary to maximize your footprint in this ecosystem.

At the moment, the top 4 OP DeFi chains are:

🔴OP Mainnet

🔵Base

🟡Mode Network

⚫Fraxtal

The goal will be to have maximum activity on these networks. Discover the two farming strategies we have concocted for you based on TVL deployed on those chains. These are advanced but really easy strategy to implement. We advise to put a minimum of 300$ for each strategy to maximize your chance to get eligible in case there is a TVL criteria deployed on these decentralized applications.

Any question, ping us on X or Discord.

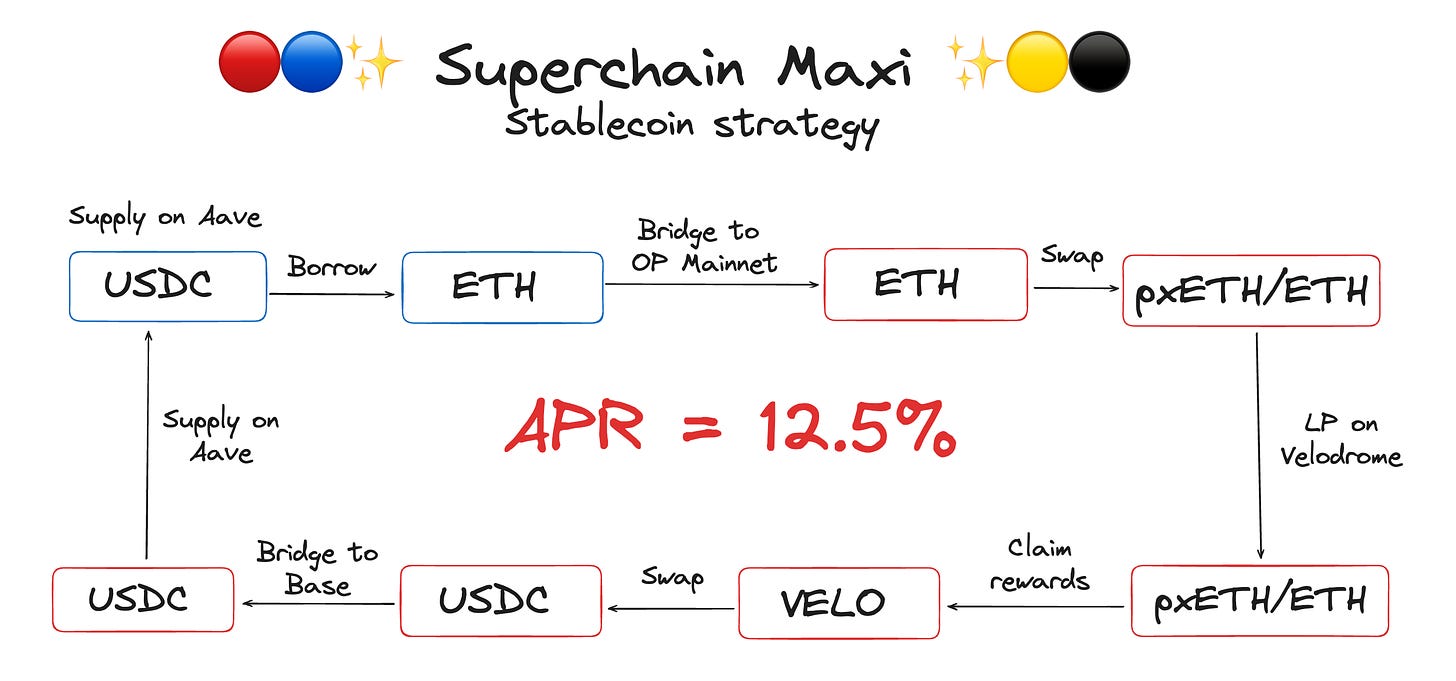

Strategy #1 : Farming stablecoins on OP Mainnet and Base

The blue squares represent actions on Base and the red squares on the OP Mainnet

Here is the first strategy.

The aim of this one is to generate a decent yield on your stablecoins (12.5% APR) by maximizing your footprint on the OP Mainnet and Base.

Through an $ETH loan on Aave (on Base), you will be able to seek yield on the pxETH/ETH pool (16%) on Velodrome (on the OP Mainnet).

Of course, there are more interesting yields on $USDC. There are many opportunities today. But what is interesting here is that this strategy allows you to expand your capital to farm from everywhere. By implementing it:

You deposit liquidity on Aave on Base (very important)

You interact with bridges (farm Jumper Exchange Airdrop - check our previous article about it)

You deposit liquidity AND make volume on the OP Mainnet (very important)

And all that with the minimum capital possible

Note: Borrowing on Aave exposes you to a liquidation risk.

We recommend not borrowing more than 50% of your collateral if you do not actively monitor your position.

The APR of the strategy was calculated with a loan of 42% of the collateral

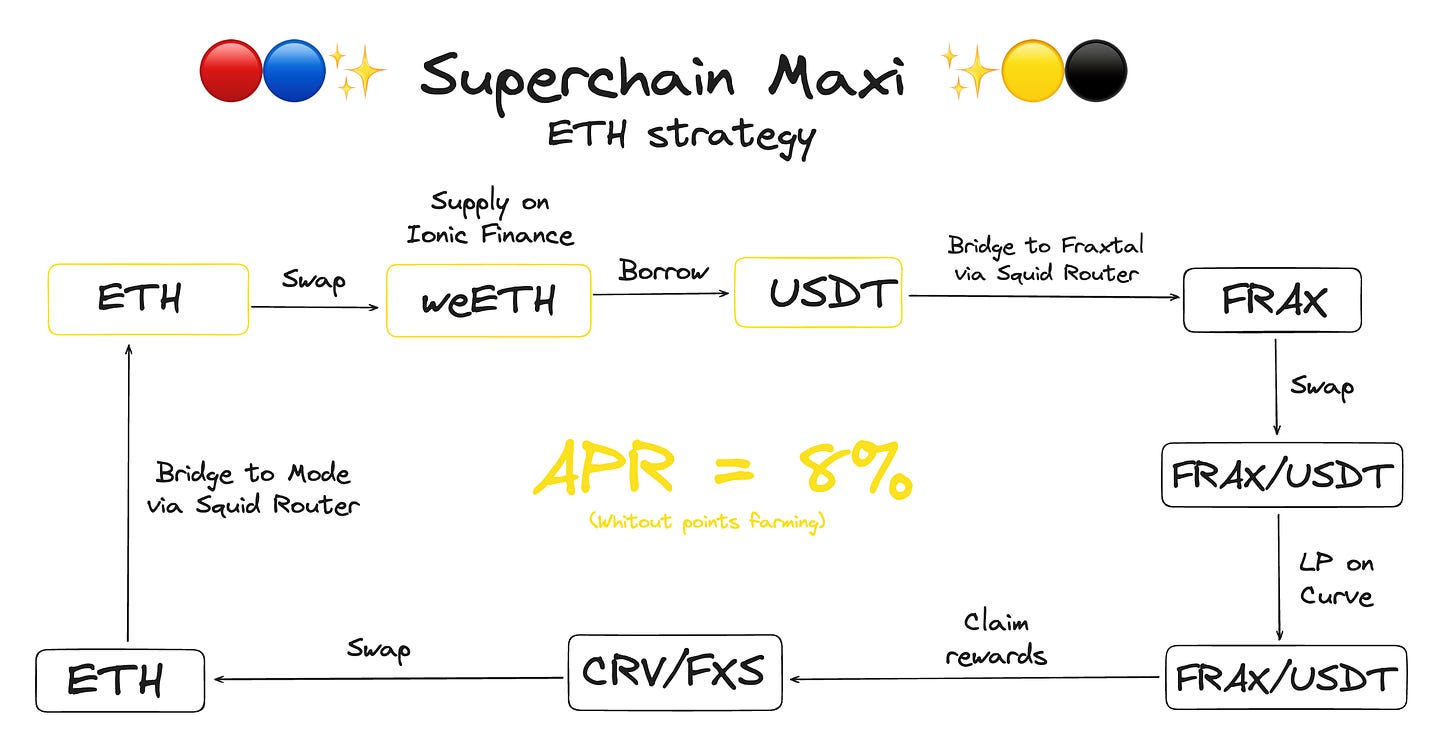

Strategy #2 : Farming ETH on Mode and Fraxtal

The yellow squares represent actions on Mode and the black squares on the Fraxtal

This second strategy is based on ETH. It will allow you to maximize your activity on Mode and Fraxtal.

The indicated APR of 8% is not really real, as in reality, you also get a significant number of points:

Etherfi points

Ionic points

Mode points

FXTL points (from Fraxtal)

According to our estimates, the real APR would be around 15-20%.

And if you're observant, you might have noticed that the logic of this second strategy is similar to the first.

Instead of simply depositing funds in LP, we're going to borrow USDC on Ionic to get additional capital to farm elsewhere.

The main source of yield comes from the USDT/FRAX pool on Curve Finance. If this yield was to decrease, you could switch to a USDC/FRAX or crvUSD/FRAX pool.

Note: As with strategy 1, there is a risk of liquidation on this one.

We invite you to monitor your position to avoid any issues.

The APR of the strategy was also calculated with a loan of 42% of the collateral.

Conclusion

If you implement these two strategies, you will get:

Approximately 12.5% yield on your stablecoins

Approximately 15% yield on your ETH

Activity on Base/Op Mainnet/Mode/Fraxtal

An allocation for the Mode and Fraxtal airdrop (via the points)

And a little bit of volume on the bridges

And all this while farming the hypothetical OP airdrop!

Although the strategy requires a little time to deploy, it is certainly worth it, especially if your funds are not already farming somewhere else.

And if you have any questions, don't hesitate, we'd be happy to answer them.

Stay optimistic!

The Optimist Social accounts:

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.