First of all, i’d like to express my thanks to you readers, for your comments, support, likes on this Journey. Big 👏 to the team for making The Optimist the Superchain Education Center.

Did you miss the latest (L)Earn with Defi newsletter? Read here.

What a time to be alive, we are all Ethereum Family! Congrat’s if you’re here since 2022, and welcome to the newcomers, you’re early!

Click in your preferred language to access the translated document:

Chinese - French - Japanese - Persian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

➡➡➡Governance timeline

🔥Hottest news

Your bi-weekly breakdown of the most spicy🌶 news about the Superchain

🔴 Season 5 grant winners

Another Grant season closing, another round of winners. Let’s discover them and how you can benefit from it.

➡➡➡🦄Meme of the week

🟣 Metal: The banking layer of the Superchain

Metal is the new layer 2 incubated by Metallicus team. With a vision to connect tradfi & end users onto the blockchain, come to discover the chain & its ecosystem, with Velodrome Finance already announcing their deployment there

➡➡➡✒ Post of the week

🟠Podcast: Project interview (Updates & Roadmap)

Ancient 8: The gaming chain of the superchain

Nick Drakon: Crypto investor & Revelo Intel/Ventures founder

GOVERNANCE TIMELINE

RPGF 4 is around the corner & aims at rewarding builders on the Superchain. Now split in 4 rounds, here is the detail for Round 1.

Round 1 rewarded builders: Drive demand for blockspace (more info here)

Total grant: 10,000,000 OP

Timeline:

Sign up: May 23rd - June 6th → Sign up here

Application Review Process: June 6th - June 18th

Voting: June 23rd - July 8th

Results & Grant delivery: July 15th

Spotlight: Mummy Finance V2

Mummy Finance is one of the OG onchain Perp Dex and has just launched their V2 on OP Mainnet. Liquidity providers can deposit DAI, USDT, USDC into the stablecoin-only liquidity pool, and earn 80% of protocol fees.

While traders will be able to enjoy a CEX-like experience, low fees, to trade Crypto, Forex and Metals such like Gold & Silver up to 250x leverage.

Powered by Pyth Network oracle, Traders can also participate in the ongoing trading contest and earn 5k$. Join now by clicking here.

🔥Hottest news

🪒Splice Finance, a fork of Pendle, has launched on Mode

⚫ Fraxtal is launching its hackaton with 7-figures prize & long-term support from angles & VCs

⚪ Cyber mainnet is now live

🟡 Ironclad Finance announced its $ICL tokenomics, with 5% airdropped to the community

✈ Arcadia Finance announced its partnership with Aerodrome. Take a long, short, delta-neutral position & earn Arcadia points (boost for veAERO holders)

🍀 The liquid restaking project behind rsETH, Kelp DAO, has raised 9m$ in private sale

🔥 Farcaster raised 150m$ at a valuation of 1b$, led by Paradigm. WOW!!!

🚴♂️ Velodrome is now live on Build_On_Bitcoin, and will launch on Metal_L2

🆕 Entangle has integrated Velodrome & Aerodrome

🌶 VelarBTC is the 1st Perp Dex on Bitcoin, launched on Build_On_Bitcoin

💲 A16z invested 90m$ in a private deal with Optimism foundation

☸ Pyth Network released Entropy on Base, specific for Casino, Gaming, & Prediction market allowing projects to secure a source of onchain randomness

🔴 Season 5 grant winners

by Nataliii

The recipients of the Season 5 grant have recently been announced and it's time to find out more about them.

A little bit about the scale of Season 5:

530 applications were submitted and reviewed, which is a 73.2% increase from last season.

In total, we can congratulate 87 finalists on receiving grants, but let's focus in more detail on the most interesting category for us, in which there were 15 winners - Growth and experiments grants program.

Here is the list of grant recipients:

Pike (protocol currently not live after end-of April exploits, will be refactored and live after being audited by another auditing firm)

Supercharge OP Mainnet (Layer 3)

Let’s talk about first five of them.

Contango: 50,000 OP

Contango is built on top of lending/borrowing protocols. It lets you loop anything onchain. For a complete article about Contango, read our in-depth article here.

Otherwise here is a TL;DR - So with Contango, you can:

create leveraged positions just like perps with low funding

lever up on the yield of liquid staking and restaking assets, like stETH or eETH

lever up on the fixed yield of Pendle's PTs

create delta neutral plays to farm funding rates

arbitrage rates differentials on stablecoins

farm rewards, airdrops, points on leverage

What advantages will users get from the fact that this project has received a grant?

100% of the OP tokens will be rewarded to the end users. Contango plans to host a 12-week rewards campaign that will incentivize its 4 Optimism markets (Aave, Sonne, Granary, Exactly). Rewards will be distributed weekly (around 4,385 OP / week).

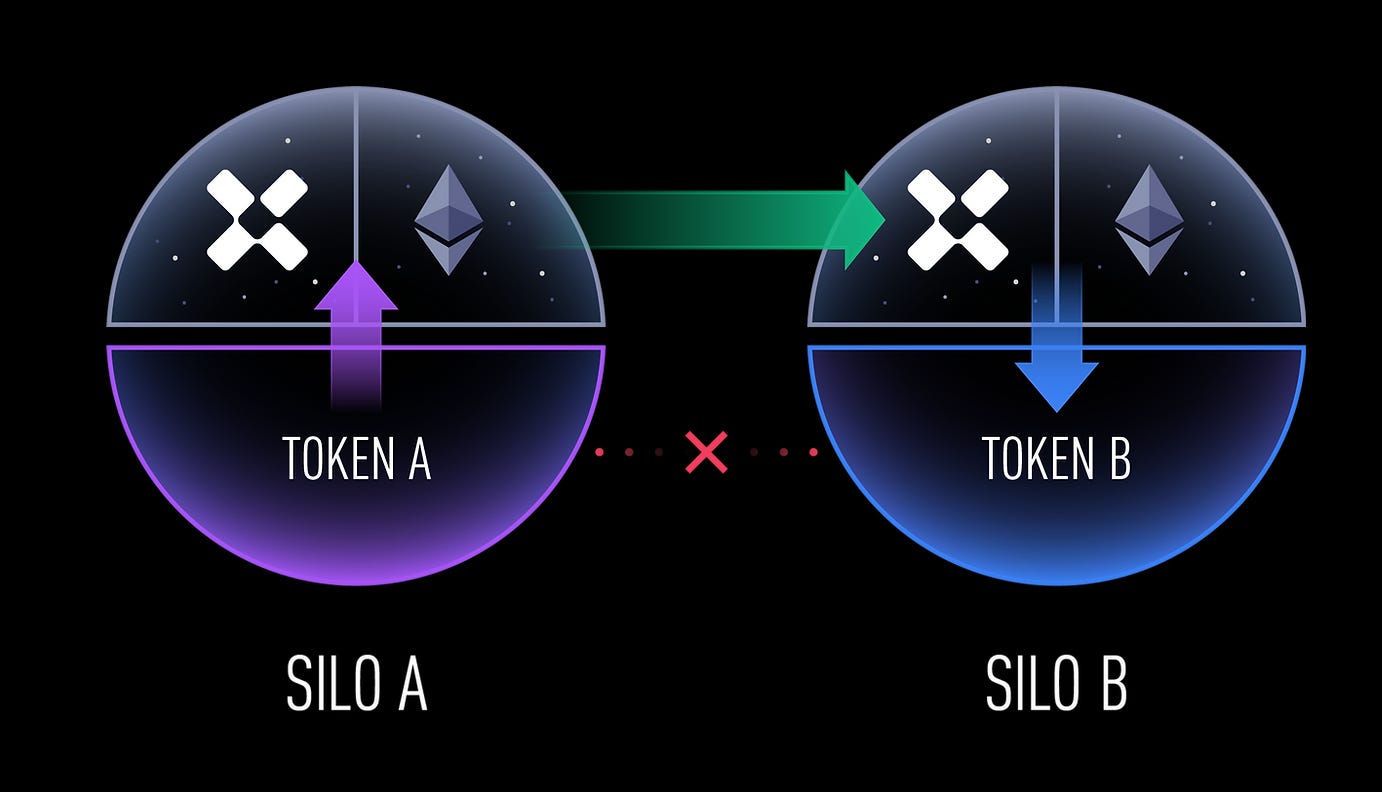

Silo Finance: 249,000 OP

Silo is a risk-isolated lending market that allow users to deposit tokens to earn interest or as collateral to borrow other tokens.

What makes Silo different from other lending markets?

Risk-Isolation

By creating individual lending markets for each base asset, each Silo market is completely separated from every other Silo market. This means lenders only take on the risk of the market they choose to deposit into i.e. the base asset.

Markets for any Token

Silo can create markets for any token where there are willing lenders. This allows for lending markets for esoteric assets like Curve LP Tokens and Pendle PT tokens.

What advantages will users get from the fact that this project has received a grant?

The project plans to distribute 33,33% of the total grant every 30 days to exist within 3 months after receiving the grant to participants in Silo Optimism’s lending markets, both users and dApps integrating with the markets, to attract lenders and borrowers alike seeking to earn yield passively or leverage via borrowing.

Interest Protocol: 10,750 OP

Interest Protocol is a borrow-lend protocol on Ethereum and Optimism. Interest Protocol issues a stablecoin called USDi, which is a liquidity provider (LP) token that represents a one-to-one claim on the protocol’s USDC.

USDi can be minted by either depositing USDC in to the protocol or borrowing USDi from the protocol. Interest Protocol generates revenue from interest paid by borrowers, and this revenue is distributed to all USDi holders.

What advantages will users get from the fact that this project has received a grant?

The project will distribute tokens among two categories of users:

1. Quest participants (~19% of grant)

Interest Protocol will create quests on Rabbithole or similar platform(s) that educate users about how to delegate OP tokens and guide them through that process using Interest Protocol's user interface.

2. Delegation Program (~81% of grant)

For users to delegate their OP through Interest Protocol. Incentives amount is denominated in OP tokens. Users will be eligible for a minimum of 5% annualized incentives and a maximum of 8%, as budget allows.

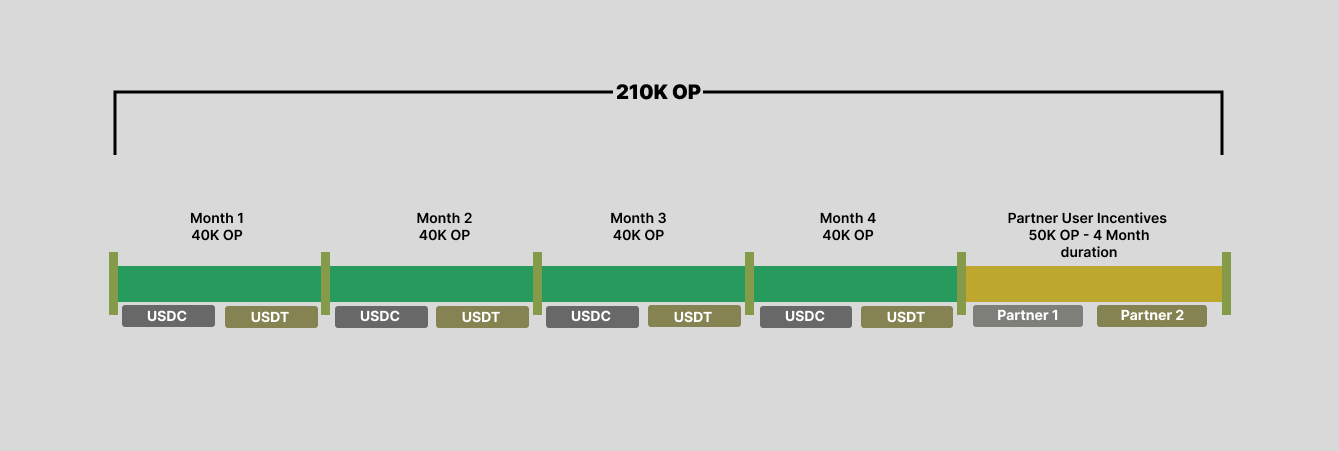

Compound Finance: 210,000 OP

Compound is an OG Lending & Borrowing protocol that enables supplying of crypto assets as collateral in order to borrow the base asset. Accounts can also earn interest by supplying the base asset to the protocol.

The initial deployment of Compound III is on Ethereum and the base asset is USDC.

What advantages will users get from the fact that this project has received a grant?

Distribution will be divided into two parts:

1. General Market Liquidity Incentives for USDC and USDT (160K OP)

40K OP will be used every month to incentivize user activity on the platform, this will be distributed over two markets - USDT Market and USDC Market.

2. Partner Specific Liquidity Incentives (50K OP)

It will be distribution by Defi wallets with Compound market integrations on the Optimism network. These incentives will also be divided between USDT & USDC markets.

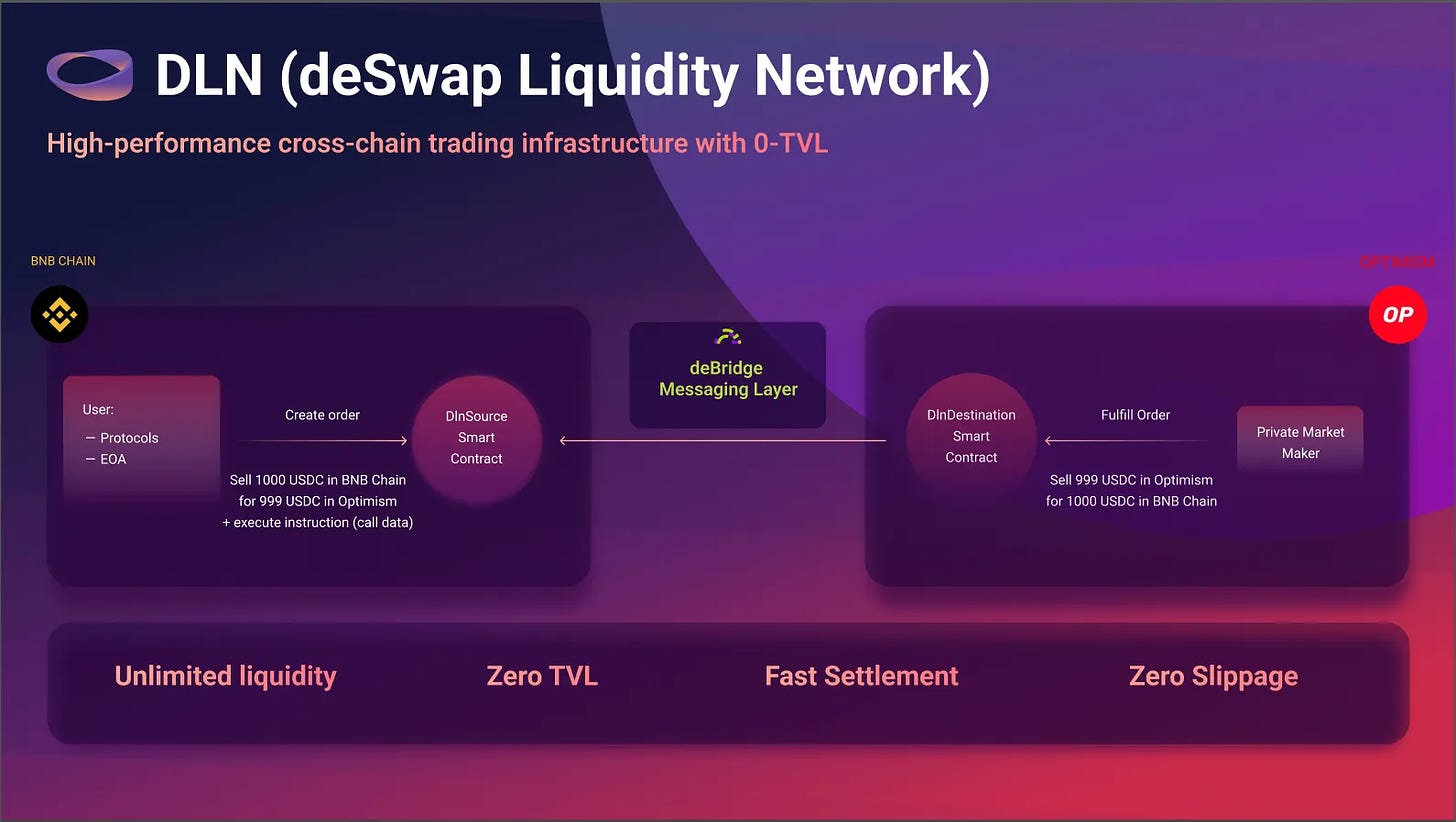

deBridge: 150,000 OP

deBridge is a high-performance and secure interoperability layer for Web3 that enables decentralized transfers of arbitrary messages and value between blockchains.

The deBridge protocol is an infrastructure platform and a framework for:

decentralized transfer of arbitrary data and assets

cross-chain interoperability and composability of smart contracts

cross-chain swaps

interoperability and bridging of NFTs

What advantages will users get from the fact that this project has received a grant?

The deBridge protocol will distribute tokens to the following groups:

Makers — users who bridge liquidity through Optimism. Users bear gas costs + deBridge fees.

Takers — on-chain market makers and solvers who fulfill cross-chain trades/intents.

How it will be distributed?

Every two weeks they’ll generate a snapshot of all deBridge market orders to/from the Optimism ecosystem, calculate their USD equivalents at the moment of trade, and rebate the protocol fee + gas cost to makers and spread + gas cost to takers (the total rebate for the transfer shouldn’t exceed 2% of its USD equivalent).

End note: Debridge just revealed their token launch $DBR with future snapshot to users.

Layer 3: 35,000 OP

And quite a bit at the end I will add about another recipient of the grant - the well-known quest platform Layer3.

Layer3 will use the entire grant as incentives to drive user activity across Optimism Mainnet. Layer3 will also allocate 50% of RetroPGF allocation (25,000 OP) to draw more users to OP Mainnet.

Over a 6-month period, they will deploy approximately 74 quests. So stay tuned and don’t forget about Layer3 quests.

Congratulations to all the winners, and we invite you to dig into all the other projects, which will bring interesting development on OP Mainnet.

I hope that the information in this article was useful to you.

And little reminder: Season 6 begins on June 27th and runs through December 11th. Grant applications open on July 18th and run every 3 weeks through December. You can find all dates on the public governance calendar. See Get a Grant to learn more about applying for grants.

End note: Link to cycle 22 winners: https://gov.optimism.io/t/cycle-22-final-grants-roundup/8086

🦄Meme of Week

🟣 Metal: The banking layer of the Superchain

By Thomas

Dear readers,

On May 9th, the blockchain technology group Metallicus announced the launch of their L2 network, named "Metal L2".

This new network, built on the OP Stack, integrates into the Superchain alongside Base, Zora, Mode Network, and others...

Discover how this project is structured in this article.

What is Metal L2

Metal L2 is a banking L2 solution that hosts financial applications within its network.

It is part of Metallicus, a group aiming to “build the world’s most customer-centric digital asset banking network”.

To achieve this, Metal L2 is part of a broad ecosystem of financial products: let's quickly review them.

Metal Pay: The on-ramp solution for public

Metal Pay is a mobile application that allows users to buy and sell crypto easily.

The app is reminiscent of Coinbase: it is quite intuitive and offers a wide selection of currencies.

You can purchase cryptocurrencies via credit card or bank transfer, either through one-time purchases or recurring purchases.

Important point: There are no trading fees when using $USDC. Keep this in mind if you use the app!

Metal Blockchain

The Metallicus group has also created its own network, named "Metal Blockchain".

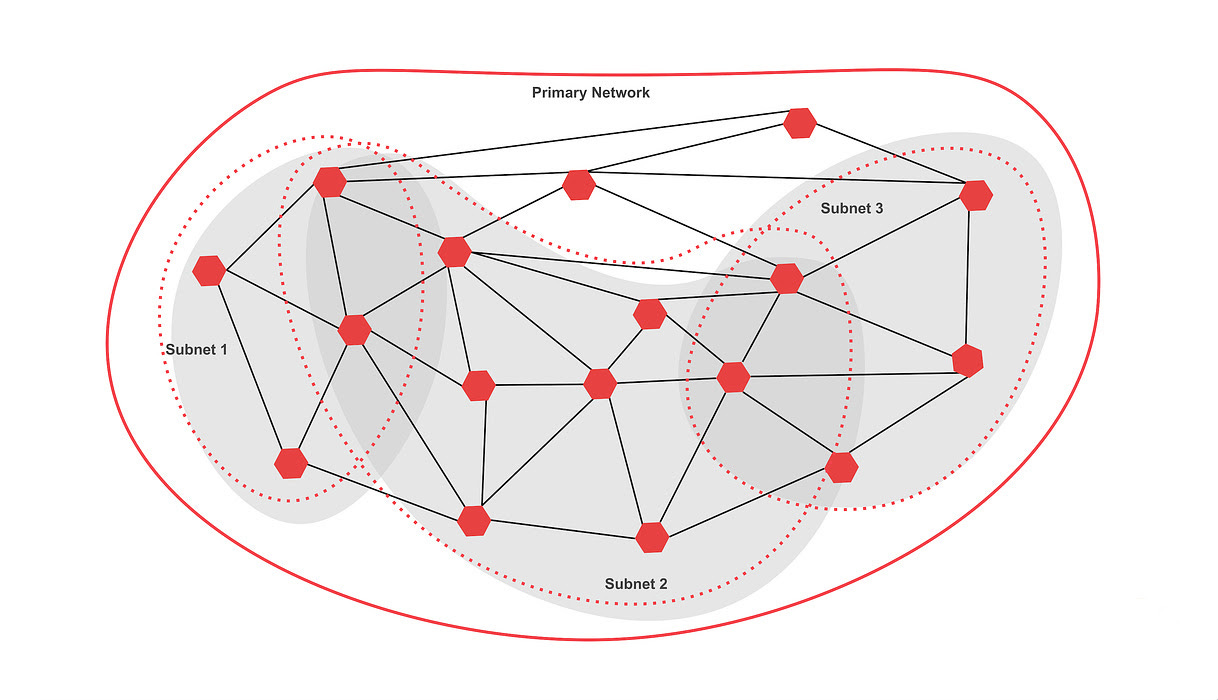

Unlike Metal L2, which is more retail-oriented, Metal Blockchain is a layer 0 network designed for financial institutions.

The blockchain is inspired on Avalanche's "Snow" protocol and features a similar multi-chain architecture.

Each institution can create its own subnet, which is interoperable with others networks.

Note: Metal Blockchain is BSA compliant (Bank Secrecy Act)

This allows entities building on it to comply with financial regulations, particularly concerning anti-money laundering issues.

If you want to build on Metal Blockchain, don't hesitate to check out their innovation program right here.

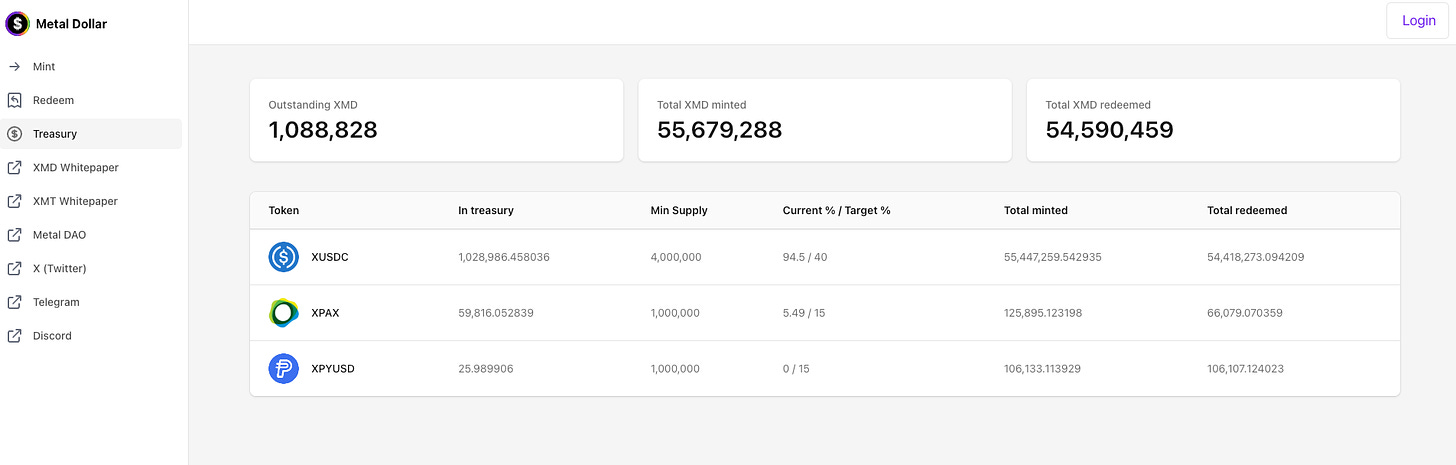

Metal Dollar, the stablecoin on Metal

The latest major product from Metallicus is “Metal Dollar”, the Metal stablecoin.

Metal Dollar ($XMD) is an over-collateralized stablecoin backed by a basket of stablecoins selected by the team. There are currently approximately 1,100,000 XMD in circulation.

Anyone can mint XMD and use it in Metal's products. To do so, simply visit the "Mint" page on the website.

It's possible that XMD could benefit from interesting integrations on Metal L2...

Note: If you want to use Metal's products optimally, don't hesitate to check out their governance token.

$MTL is at the heart of the Metal ecosystem: by obtaining it, you can benefit from reduced fees on certain ecosystem products.

How do you access the network?

As mentioned earlier, Metal L2 is part of the Superchain, so accessing it is quite straightforward:

The easiest way is to use the official bridge.

However, you can also use an alternative bridge/UI (such as Superbridge).

Once on the network, you'll be able to access the applications built on top of it.

Since Metal L2 has just launched, there isn't much to do yet. However, significant protocols will soon be deployed there (like Velodrome ).

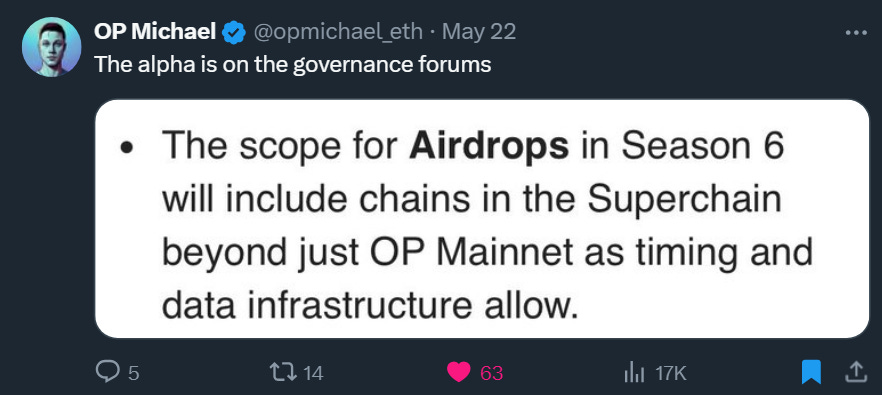

We believe it's important to test the new L2s on the Superchain because if the next $OP token airdrop is related to this, you might be rewarded.

This is an excerpt from the intentions for season 6 of Optimism.

Keep clicking, friends!

✒ Post of the week

🟠Podcast:

The 🔴Optimist Podcast partnered with Revelo Intel to provide written notes of all podcasts for FREE.

The Optimist Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.