The Optimist Newsletter #18

The one & unique Newsletter on the Optimism Superchain written by Users for Users

First of all, i’d like to express my thanks to you readers, for your comments, support, likes on this Journey. Big 👏 to the team for making The Optimist the go-to Media for everything about the OP Stack.

And finally, welcome to the 149 new subscribers to this newsletter.🚀🚀

⭐⭐⭐Help us to improve the newsletter ➡ Leave your feedback here ⭐⭐⭐

Subscribe for free to not miss anything on the Optimism Superchain.

Click in your preferred language to access the translated document:

Chinese - Filipino - French - Japanese - Korean - Persian - Russian - Spanish - Thai - Turkish - Vietnamese

TOPICS OF THE WEEK - LISTEN TO VITALIK

🔴Governance:

Welcome to the last 7 winners of the Grant cycle #15, ending Season 4. Next grant cycle will start beginning of 2024, time for some reflection time and grant council renewal.

🟣Projects Research : Decentralized Insurance with Open Cover

Ever Lost Money in DeFi? Here's How I Farm with Peace of Mind & feel more secure in my DEFI journey.

🟡Onchain Analysis of OP Superchain

How OP Mainnet & Base are doing against Arbitrum? It seems OP Holders are doing much better than Arbi ones. Let’s look at the onchain data using the amazing report from IntoTheBlock.

🟢Crypto market review

Bi-weekly update on the Crypto Market.

🟤Tips: Copy Trading

Let me present you The leading tool to analyze and copy the best on-chain traders on Kwenta (Optimism) & GMX (Arbitrum)

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live :

Synthetix

Omni-X

Podcasts available at the end of the newsletter

Spotlight project: Ethos Reserve

Ethos Reserve is an official Sponsor of The Optimist Newsletter

Ethos Reserve is for me the most simple leverage position available on Optimism. Deposit ETH, wBTC or OP and mint ERN stablecoin with only a fixed fee on your borrowed amount, no more variable interest.

Ethos Reserve has recently revealed its roadmap to scale ERN usage in three phases: init, advance, and evolve - ERN omnichain, staked ERN, support of Liquid Staking Tokens assets, … Curious on what it says? Give it a read by clicking here.

Try the most decentralized stablecoin NOW!

⚫The Optimistic series Campaign is live - Engage to Earn 30k OP

Questoors, come, engage about #Optimism by completing this series of quests, and earn OP token.

https://www.tideprotocol.xyz/users/spaces/258

Timeline:

Quest #1: 🟢Live - End on 30-September

Quests #2 to #5: 🔴Closed

Quest #6: 🟢Live - End on 02-October (submission ends on 30-September) - 6,000 OP Prize pool

GOVERNANCE TIMELINE

Cycle 13 : Ended / Cycle 14: Ended / Cycle 15: Closed

❤ RPGF 3 sign-up is live too ❤

Spotlight Project: Overtime

Overtime Markets is an official Sponsor of The Optimist Newsletter

Join the thrill of the game with Overtime, your premier onchain sportsbook, offering heavy incentives on select sports markets.

With our new player prop feature and innovative parlays, why just watch when you can earn?

The NFL season is here, try Overtime Now!

🔴Governance: Season 4 - Cycle 15 - Grant Winners

by Jiraya_OG

The Grants Council reviewed the Cycle 15 proposals for the builder and Growth Experiment categories and published the list of finalists, marking the end of Season 4 of Optimism grant applications. Mission accomplished!

The Council has noticed a consistent increase in the professionalism of the proposals and the proposers which makes Season 4 a great success.

Cycle 15 - List of finalists (Experiments)

Here is the list of the 7 finalists of Cycle 15, in the category “Experiments”. Total grants in this category reached 1,205,000 $OP. The finalists are:

Beefy (210k OP)

DRPC (75k OP)

Immunefi (210k OP)

Kwenta (210k OP)

Lemon Cash (80k OP)

Lyra V2 (210k OP)

Velodrome (210k OP)

You can find the full list of results as well as the full summary of Cycle 15, via the source link Optimism below:

Cycle 15 Final Grants Roundup — ✨ General — Optimism Collective

Here we are going to cover what we think being the best source of future yields we will watch out.

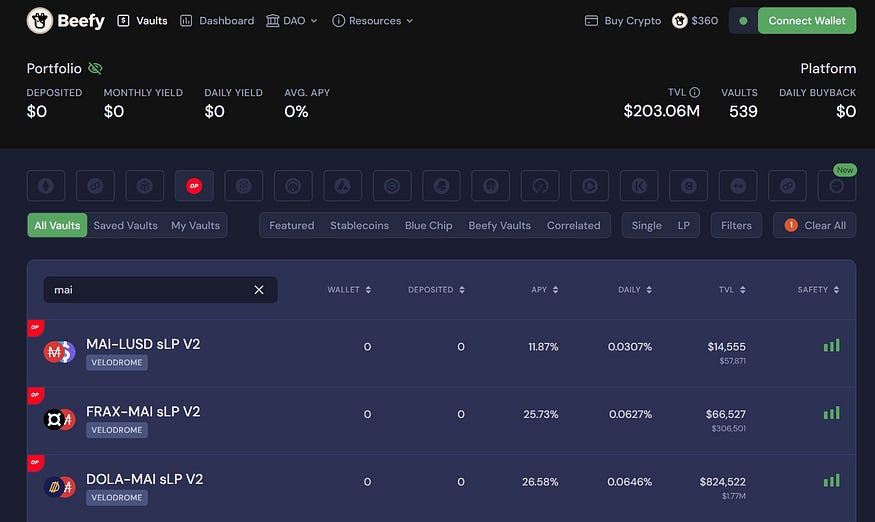

Beefy - 210k OP 🔴

Beefy, is a yield optimizer with autocompound option extremely used in the world of DeFi, with about $30 million in TVL on the OP chain (and picked up to $80 million) Beefy’s initial application was for 250k OP.

Project Details

Beefy focuses its work on cross-chain technology by developing “universal zap”, smart contracts and associated interfaces that facilitate the entry and exit of any protocol or smart contract, from any asset on any chain in a single transaction. proposal aligned with Optimism’s Superchain vision.

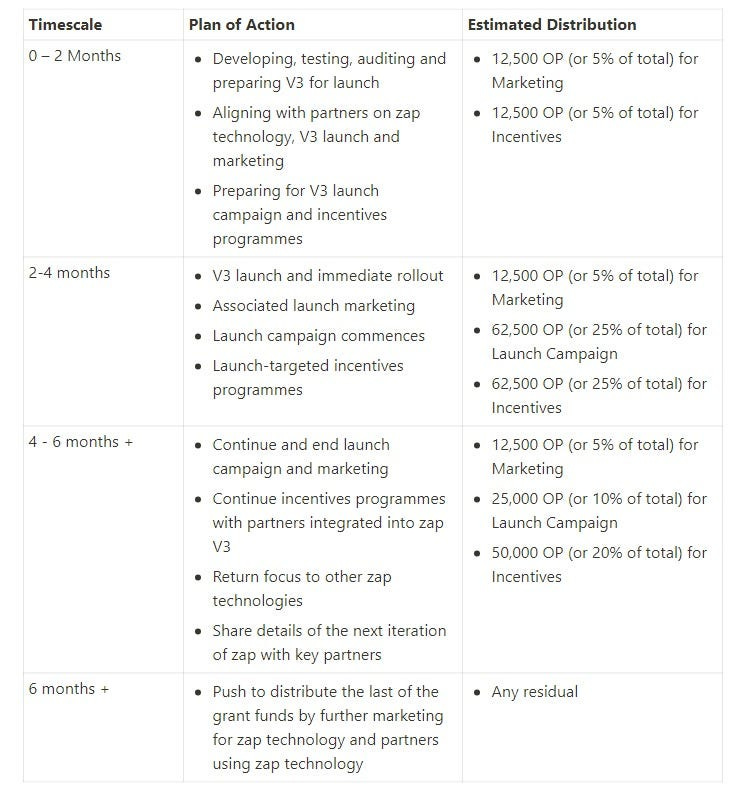

Grant Distribution Plan

Beefy plans to spread the distribution of grants over aperiod of 6 months.

The initial plan is composed of the following key discrete steps:

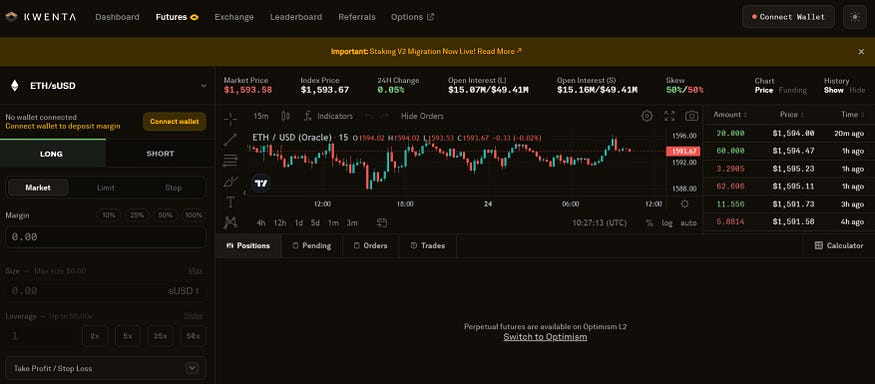

Kwenta - 210k OP 🔴

Kwenta is a decentralized derivatives trading platform powered by Synthetix, offering perpetual futures and options on Optimism.

Kwenta offers exposure to a wide variety of assets with up to 50x leverage and significant liquidity. A important actor in the Optimism universe.

Note: Save 15% on your trading fees by using the above referral link.

Project Details

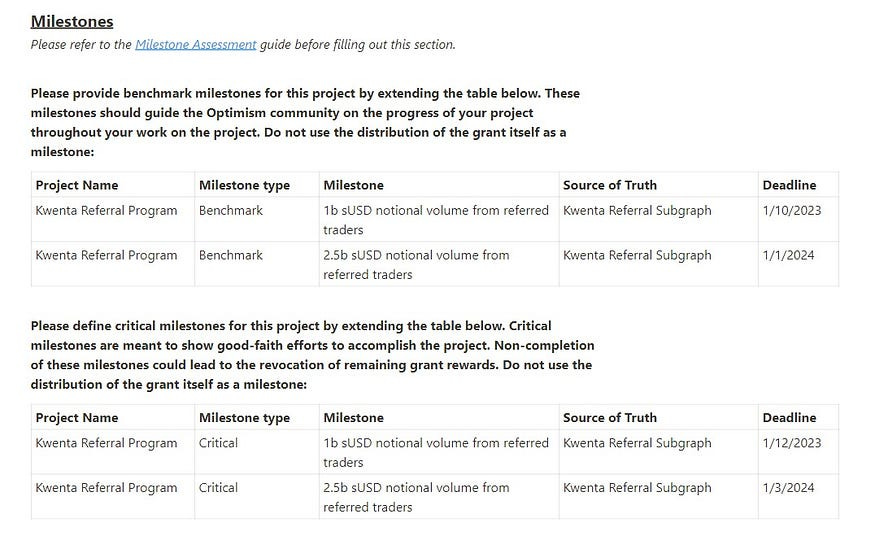

Kwenta’s strategy will essentially be based on the establishment of a large referral program called the “Kwenta Referral Program” on Optimism.

The main objective of this incentive initiative is to enable existing Kwenta users to obtain OP rewards while participating in the growth of the number of active users on the protocol. A good initiative for Optimism.

Grant Distribution Plan

The current distribution plan is 100% user rewards.

80% being allocated to regular distributions in proportion to the volume generated by their referrals, and 20% being allocated to referral competitions which reward user performance over discreet time periods.

Kwenta’s target is approximately 0.7 OP of rewards for every 10 sUSD of fees generated by new referred traders. OP will be distributed weekly.

The program will last between 3 and 4 months and can be renewed by Synthetix if the results prove satisfactory (continuous version program).

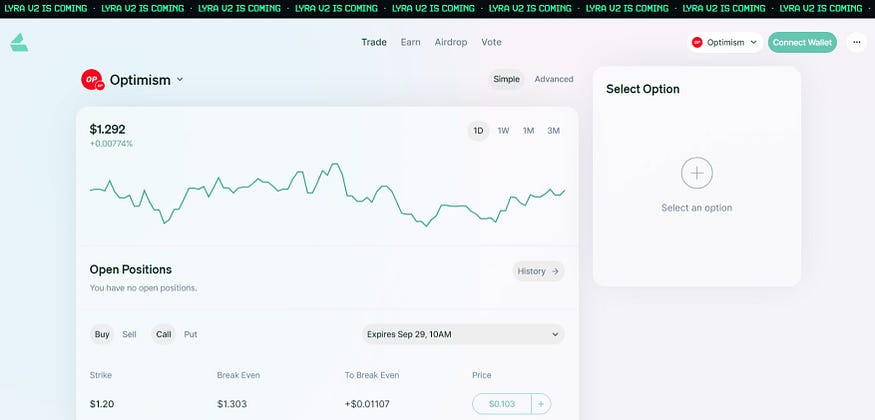

Lyra V2 - 210k OP 🔴

Lyra is an option automated market maker (AMM) that allows traders to buy and sell options on cryptocurrencies against a pool of liquidity with two key user groups: liquidity providers and options traders. a big actor!

Project Details

The main objective of Lyra, is to develop their version V2 (Lyra V2)

Lyra V2 describes itself as a self-custodial, modular, performant platform for on-chain derivatives trading built on the OP Stack. Its 3 elements are:

LYRA CHAIN: An Optimistic roll-up built on the OP Stack, secured by Ethereum mainnet. Governed by the Lyra DAO.

LYRA PROTOCOL: A settlement protocol that enables permissionless, self-custodial margin trading of perpetuals, options, and spot, deployed to the Lyra Chain. Governed by the Lyra DAO.

LYRA EXCHANGE: An order book that enables performant and efficient matching of orders and settles them to the Lyra Protocol.

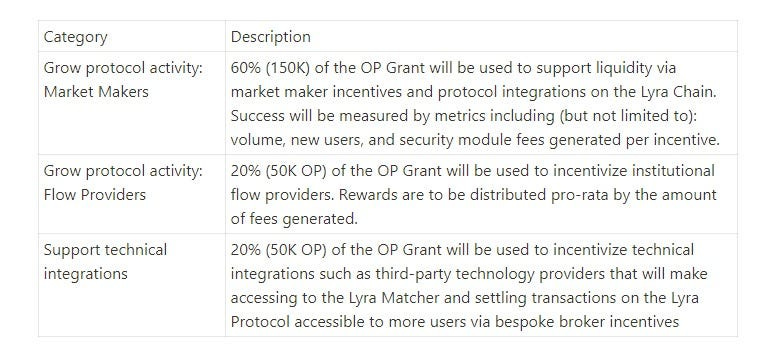

Grant Distribution Plan

The 210k $OP Optimism grant will be used to attract the top market makers and flow providers to the protocol, which will directly increase the volume on the Lyra chain and thus the value for the Optimism collective.

The distribution plan should, according to Lyra, be spread over a period ranging from 6 months to 1 year (distribution in monthly epochs)

Here is the distribution chart of Lyra’s grant for its V2 (screenshot below):

🟣Project Research : Decentralized Insurance - OpenCover

By Subli

I suffered 3 exploits:

I've always been a Decentralized Finance advocate. My journey in Defi began in 2021. But recently, the rising tide of Hacks and Exploits has clearly got me PTSD trauma. And let's not even get started on Centralized Exchanges. Case in point: FTX, Celsius, Coinex (hit with a whopping $52.8m exploit in Sep-23).

Over the past few months, I've been directly affected by three DEFI exploits:

The first one? Thankfully, funds were recovered.

The second? I pulled out my funds just an hour before a staggering 40% price impact.

The third? A total loss. What's worse, I only discovered this a month later since Debank didn't display the position. It was like a punch in my face, to say the least.

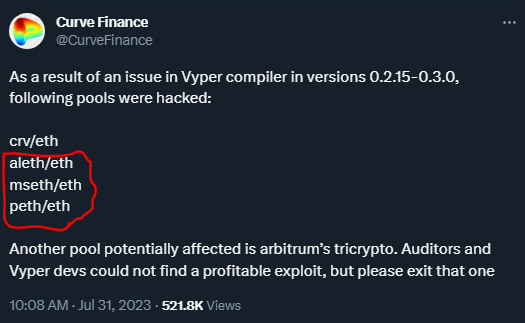

Losses in the crypto world aren't always direct. At times, you're just caught in the crossfire. Take the Curve Finance exploit as an example:

The exploit led to a depegging of several Synthetic assets. Notably, alETH took a sharp -36% hit to its peg in just a few hours, and it's yet to bounce back as I write this. Now, here's the twist: alETH is also on OP Mainnet. So, even if you weren't actively farming on Curve Finance (Ethereum mainnet), this exploit might've still affected you if you were farming wETH/alETH on Velodrome.

Risk vs Yield

To navigate DEFI's waters, users need to ask himself: Is it possible to eye a +10% yield on stables or $ETH, yet face the sharp reality of losing it all in under a day?

Talk about morning alerts! How can you safely yield farm in DEFI without waking you to these nerve-wracking notifications every day?

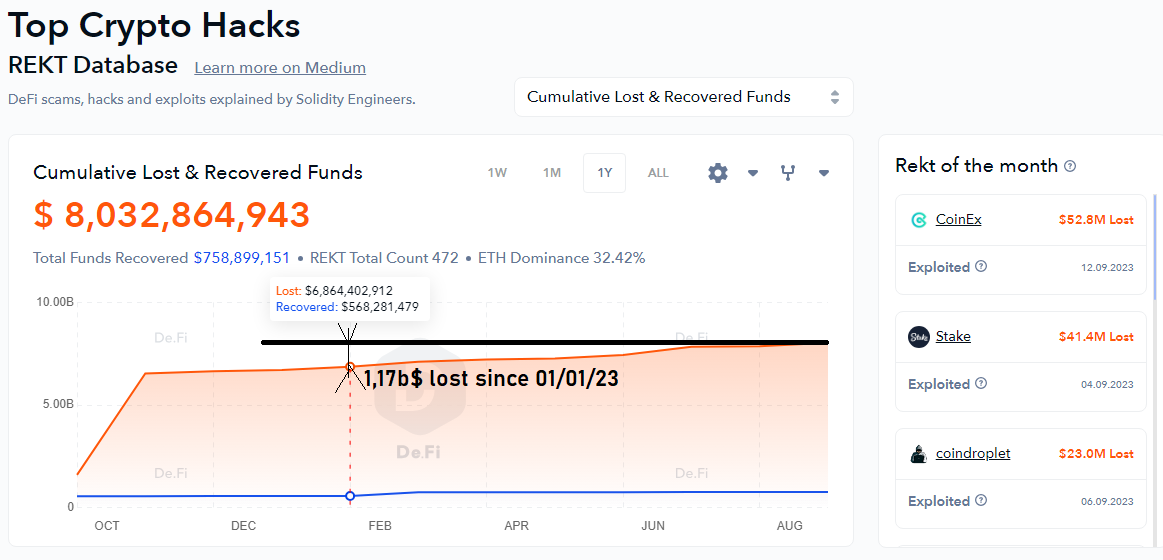

Especially when you know that 1,17b$ (which 792m$ in DEFI) has been stolen since 01/01/2023:

Or that you can click on a phishing link and lose your funds in a moment:

The solution: Onchain Insurance Alternative

There is no ZERO risk. NOTHING is too big to fail.

But first and foremost, let’s make clear the meaning of Tradfi/Defi words:

The term “Insurance” is heavily regulated in different ways all around the world

Cover is the onchain word, so not regulated as such. We will therefore speak about Cover instead of Insurance in this article.

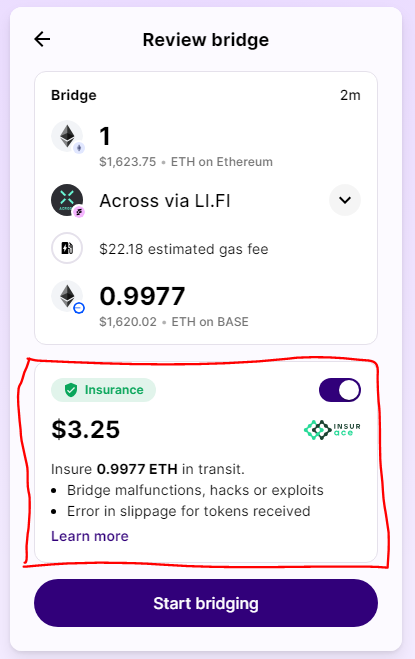

My 1st user experience of buying a Cover was back in April 2023 when bridging through Jumper Exchange using InsurAce (Onchain cover protocol). Buy just paying a few dollars, I could get my funds covered and avoid a situation like Multichain where you can find your funds stuck and not recoverable.

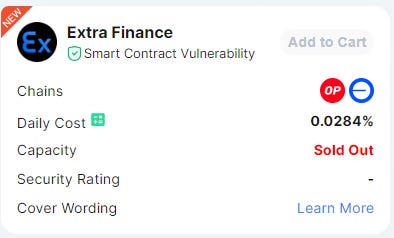

My 2nd experience was when InsurAce whitelisted Extra Finance by offering coverage for liquidity providers (unfortunately sold-out at the time of writing but vault capacity is likely to be increased SOON).

And i must admit, I sleep far better right now 😴!

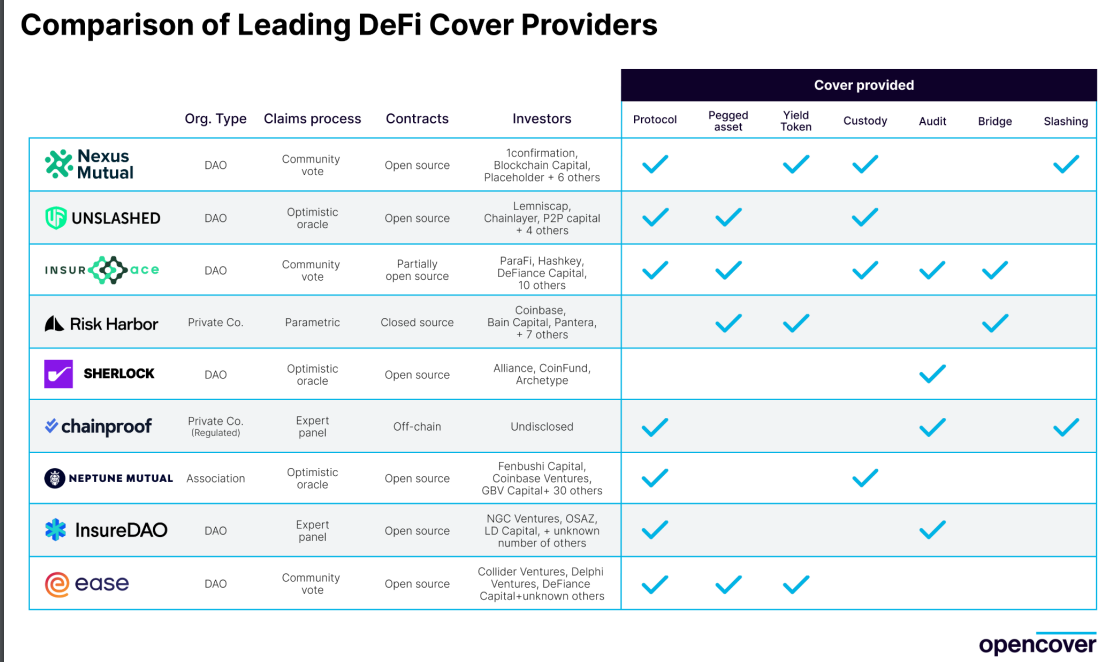

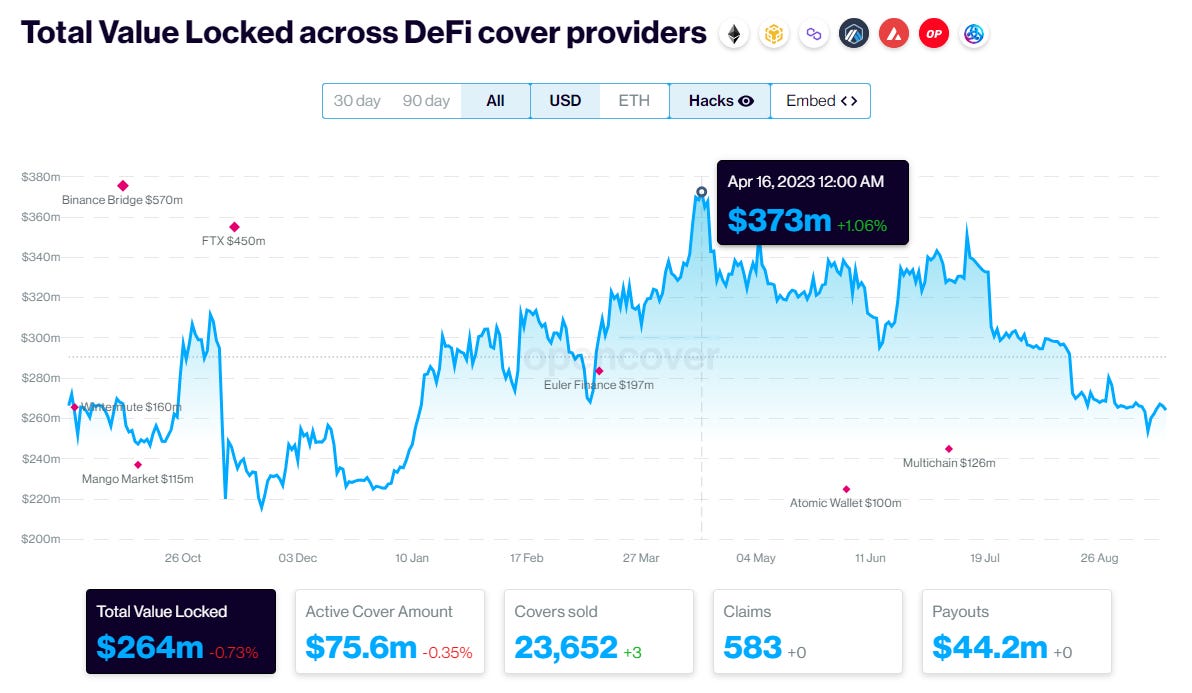

Here is the landscape of the onchain Cover providers as of March 2023:

OpenCover started as a research company, and released an amazing report in March 2023 about The State of DeFi Insurance Alternatives (DeFi Cover) 2023.

Here are the 5 takeaways of this report:

DeFi Economic Risks: DeFi can function correctly but still lead to significant economic losses.

Future Outlook of DeFi: DeFi's focus on security is growing, but the lack of scalable DeFi cover options is a bottleneck for both retail and institutional DeFi adoption

DeFi Exploit Attack Vectors: Five main attack vectors exist, with protocol logic and infrastructure leading in fund losses. Private key compromises are a major loss source, but many cover solutions exclude them.

DeFi Cover Growth: As DeFi's popularity rises, the demand for coverage is expected to surge.

DeFi Cover Products: Various DeFi cover products exist to mitigate different risks (Protocol Cover, Stablecoin and Other Pegged Assets Depeg Cover, Yield Token Cover, Custody Cover, Bridge Cover, Audit Cover, Slashing Cover, and Custom Cover)

Metrics

First, let’s get things right:

What is underwriting capital = Total value that can be covered (264m$)

What is Active cover amount = Total value that is currently covered (75.6m$)

Underwriters deposit funds & earn yield whenever people buy cover. These underwriting funds are then used to cover other users’ assets and, if a loss event occurs, those underwriting funds are used to pay covered users who lost funds during an exploit or another type of attack.

So far, only 28% of the available available coverage capacity is being used ▶ Capital inefficiency, and it’s not a product well known by the Optimism community.

So why OpenCover ?

OpenCover has used its intensive research in the onchain cover ecosystem to develop the first cover aggregator on Layer 2. [They are cover distributors ~ broker in traditional insurance]

It is the First onchain cover provider (currently available on Base & OP Mainnet). Here are the most significant news about of OpenCover:

1st onchain cover provider on Base & OP Mainnet

Recently backed by Coinbase Ventures

Read the article here Built on top of Nexus Mutual V2 (largest underwriter = cover capacity and TVL)

Nexus Mutual works as source of liquidity for other projects

Ability to develop new cover products

Proof of cover in the form of a NFT

Aims to cover up to 40 projects (looking forward to seeing this on Aerodrome, Velodrome, Extra FInance, etc…)

Will develop its own unique cover product (undisclosed)

Cover period: 7d or 30d

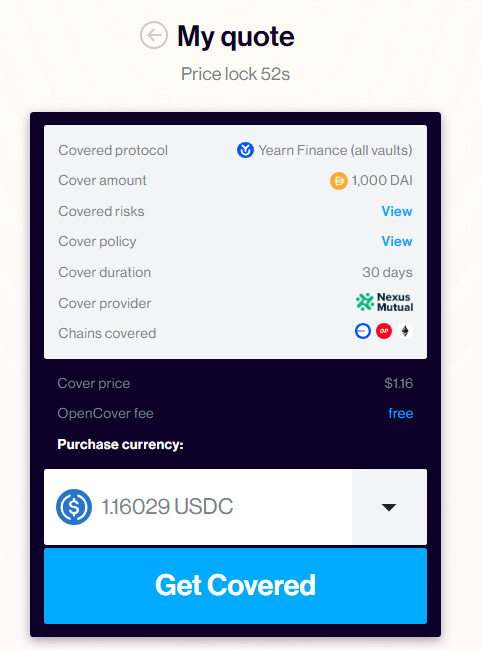

How to cover your funds?

But what about DEFI? Go to OpenCover website, select the whitelisted protocol and state the value of your funds you would like to cover stated in $DAI (so if you want to cover 1x ETH, put 1700$ for example). As you can see, you can cover your funds for a 1.4% annual cost, which is pretty amazing compared to traditional insurance.

What are the Covered risks & exclusions?

You can read the full Terms & COnditions from Nexus Mutual by clicking here or read the below TL;DR.

What is covered (Financial losses that result from any of the below are covered)

Protocol smart contract code bug or error (i.e., hacks or exploits)

Economic event outside intended protocol operation caused by either:

a. Oracle manipulation or failure

b. Liquidation failure

c. Governance takeovers where a malicious upgrade is forced through

What is not covered (Financial losses that result from any of the below are not covered)

Phishing, private key security breaches, malware, miner behaviour or any other activity where the protocol continues to act as intended.

Events that occurred before the cover period began

Market price movements of assets used or relied upon by the covered protocol, except when the price movement qualifies as oracle manipulation.

Depegs of any asset that the covered protocol generates (depeg exclusion).

Protocol owners or controllers confiscating or stealing funds in line with the permissions of the protocol ("rug pull" exclusion).

User interface or website errors where the protocol continues to act as intended.

Failures in components used to bridge assets between different blockchains.

Conclusion:

There are still a few cover products i’m looking forward to see as an End User such as:

Rug Pulls coverage of whitelisted protocols

Phishing attacks

Depeg of assets (an existing alternative is to use Y2K finance on Arbitrum for info)

While Onchain Cover is a “Sleeping Giant” according to OpenCover, I deeply think Institutions and Retail users will start using this ASAP and at large scale, which will benefit these cover protocols by increasing revenue and increasing the number of covered user funds.

OpenCover seems to be leading the way as a cover provider on Layer 2s. I will be curious to see how far they go, but in my opinion, OpenCover is worth keeping an eye on.

I will conclude by quoting Vitalik:

🟡Onchain Analysis of OP Superchain

by Subli & Intotheblock

After the L1 wars back in 2021/2022, we are living in the middle of the L2 wars. Who is leading the race during this bloody market? Who between OP Mainnet, Base or Arbitrum is seeing the greatest user retention, number of transactions?

Let’s dive in and see what the on-chain data reveals.

(This article has been writen in collaboration with IntoTheBlock, data analytics platform where you can access all the below charts/data).

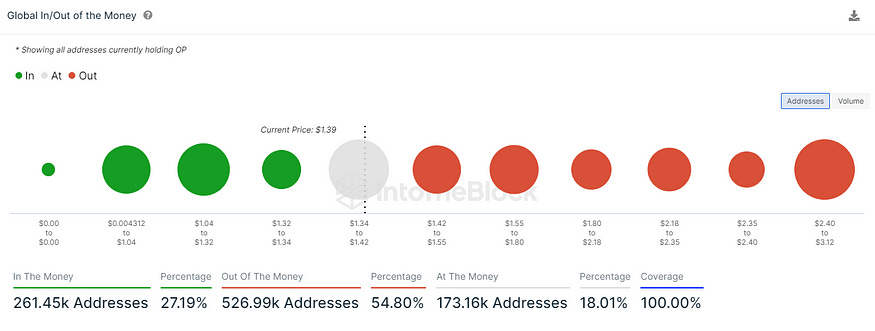

Understanding OP holders Position

Ever wondered how OP holders are doing? The “In & Out of the Money” indicator gives us a clue on their financial health. It shows the price at which holders got their assets. Right now, 27% of OP holders are in profit. Might sound modest, but when you compare it to ARB, where a whopping 96% are at a loss, OP holders are drinking champagne.

My assumption is that this is governed by the Superchain, and the revenue sharing from Base as explained in our last article The OP Stack adoption.

User Dynamics: What's it about?

Throughout the year, the market's been too rude in welcoming newbies. However, despite this, Optimism saw 11k new OP addresses late August.

Early September? Another 7.2k.

And mid-September? A massive 88k in a single day! This is most likely due to XEN mint:

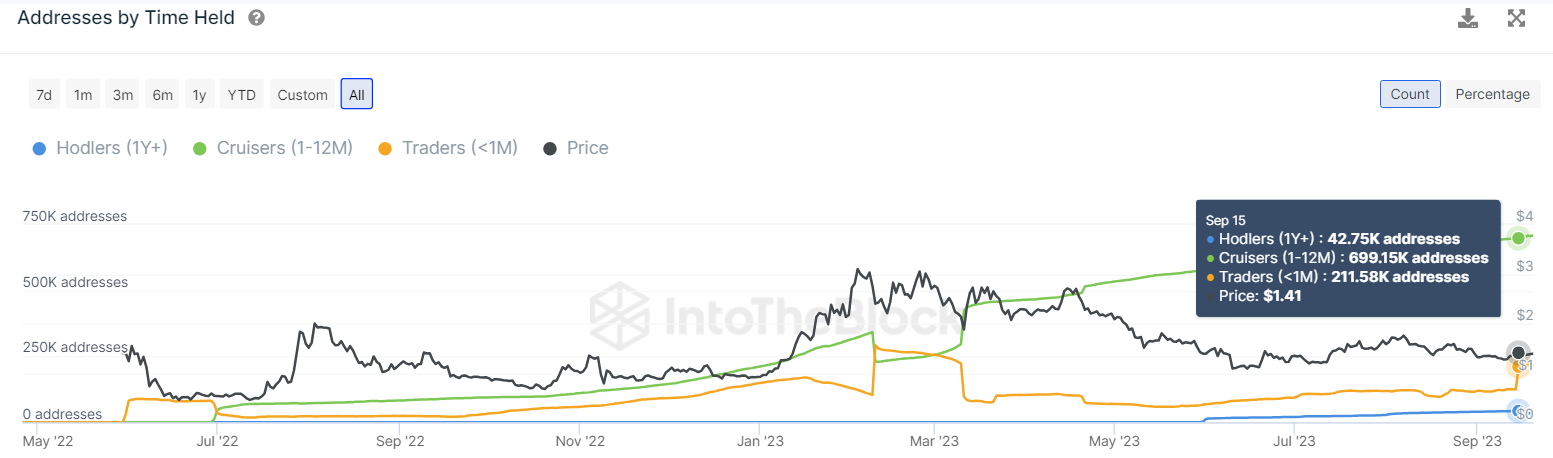

Peeking into OP Holder Trends

“Ownership” data reveals a rise in long-term holders since June. Since October 2022, we can observe more traders accumulating OP. So, expect many to soon join the "long-term" club. And while whales still dominate, retail's share has doubled from 5% to 10% since the year's start. More retail means healthier network economics. Good news!

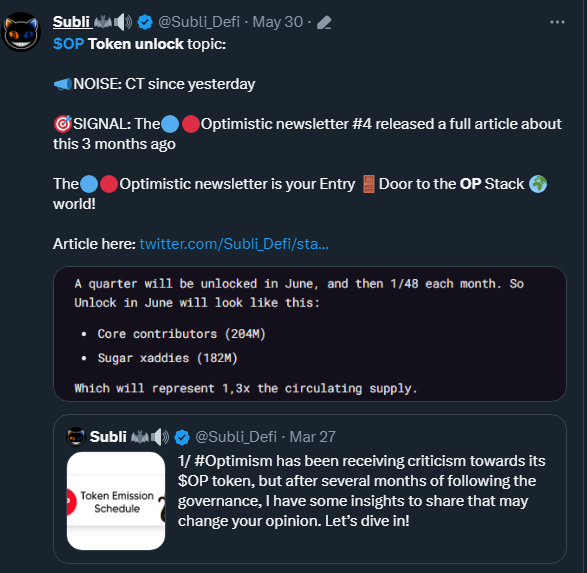

And remember the FUD few months back, completely legit by the way, about the largest OP token unlock ever. Find this article about the real unlock schedule here. A huge amount of tokens was released on 31 May, and we can see that matches the date when the number of OP holders increase, and OP price stabilizes, finding an equilibrium between monthly token release and holders, between sellers & buyers.

How Does OP Mainnet Compare to Other L2s?

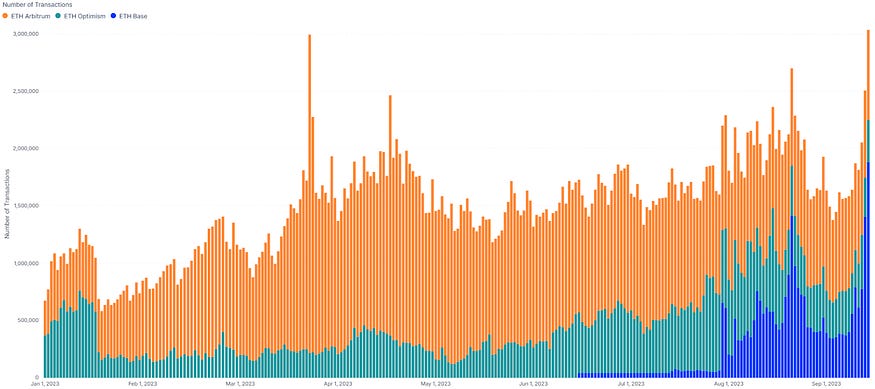

Comparing OP Mainnet against other Layer 2s like Arbitrum and Base, we can observe some trends.

Arbitrum led in transactions till August, especially when Optimism quests ended mid-January. But in August, Optimism usage increased significantly. And when Base Launched in August, Coinbase L2 chain, has very quickly taken the #1 position ahead of Optimism & Arbitrum.

Orange: (💙;🧡) Arbitrum

Green: 🔴 Optimism

Blue: 🔵 Base

Conclusion

So, where does OP Mainnet stand? I think the real question should be: where does the OP Superchain stand (OP Mainnet + Base) ?

While only a fraction of OP holders are currently in the green, holders are doing what they are supposed to do : HOLD. In my opinion, this is most likely due to the Superchain narratives, expectation of future airdrops.

Base usage is due to an amazing Onchain Summer event, bringing Huge WEB2 companies like Coca-cola, artist like Cozomo-de-medici & Deekay, etc… Together with OP Mainnet & Base grants, this will continue to attract builders & users.

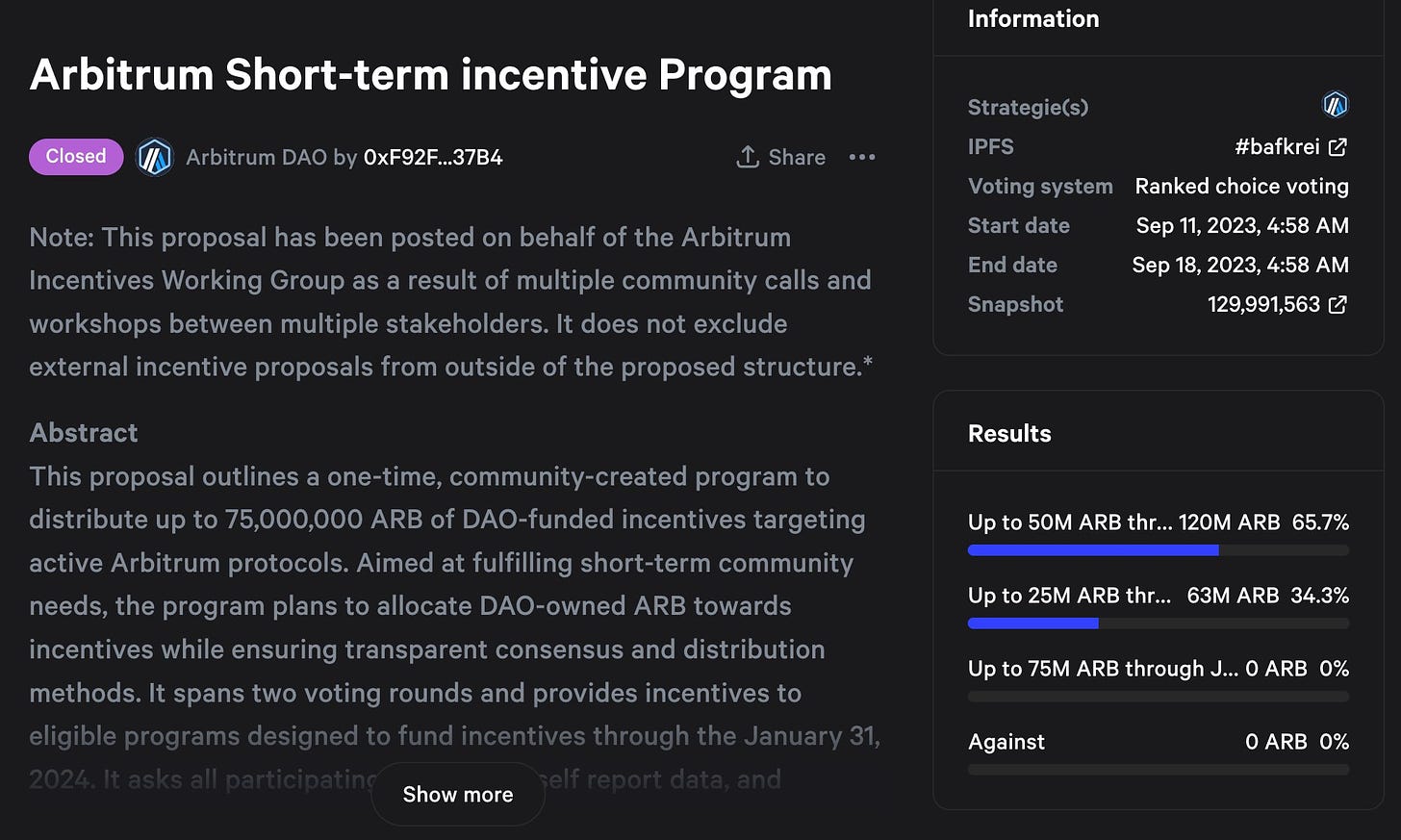

But, Arbitrum DAO has recently voted the use of 50m ARB tokens to propel Arbitrum to the same level to the 🔵&🔴 chains, with its own L3 layer:

In the crypto world, the only constant is change. The war is just at its beginning, and no one can predict the future. So stay tuned and keep exploring! 🚀🌟

Note: Thanks to into the block for their amazing article which was used and slightly amended by bringing some personal information & insights. You can find their full article by clicking here.

🟢Crypto market review

by Axel

Bitcoin

We have seen little movement in the markets since the previous newsletter. We continue to move within a range between $25,000 and $31,000.

Bullish signs: The daily divergence is still present and can still be played. The support has not been broken. We are at the lower end of the range.

Bearish signs: A daily correction is underway. The support could be broken to the downside.

It will be either interesting to buy at the bottom of the range or wait for a breakout from the range to re-enter a position.

DXY

The bearish divergence mentioned in the previous newsletter did not materialize. Nevertheless, the fundamental analysis around the dollar remains the same. The BRICS countries no longer exclusively use the dollar as their exchange currency.

CME Gap:

Since the previous newsletter, no new gaps have appeared. As a reminder, the remaining open gaps are at $20,000 and $35,000.

Altcoin:

As mentioned earlier, we are awaiting either a depression phase or a breakout from the range on the TOTAL3 ticker.

A breakout with a retest of the downward trend represented by the blue line would be a first bullish signal.

Conclusion:

What was presented in the previous newsletter is still relevant.

The analysis is straightforward: we must continue to consolidate within the range to sustain the uptrend. Otherwise, a range breakout would imply a correction and an even longer consolidation period. We are currently in a slowly evolving market. We must remain patient, conserve our attention and protect our capital while waiting for better market clarity.

Previous Bitcoin price increases have always been preceded by halvings. The next halving is expected to occur in mid-April 2024. And since then, don’t forget to look at the global economy health which doesn’t look good according to Genevieve.

🟤Trading Tips: Copy trading

By Subli

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

Today, i’d like to provide some insights of a new tool I discovered that gives you the capacity to ANALYZE & COPY the best traders on the 2 top PERPs protocols :

Welcome to Copin Analyzer. Copin is a leading tool to analyze and copy the best on-chain traders. It works by connecting investors with these traders and automatically copying their trades in real-time.

Few reasons why I’m curious about it:

Tracked the Top 2 decentralized Perpetual platforms → GMX V2 and Synthetix V3 (aka Perps V3) will be a huge catalyst for 2024/2025, so building on promising projects is promising.

Different type of filters to rank the traders:

PNL

Win rate ❤

Number of trades

Volume, etc…

Traders analysis - Curriculum-Vitae of traders: I love the Heat Map

Favorites: Put your best traders into your Fav list

Backtest your strategy before using your own funds

Copy-trade following your own settings

Free & Premium access

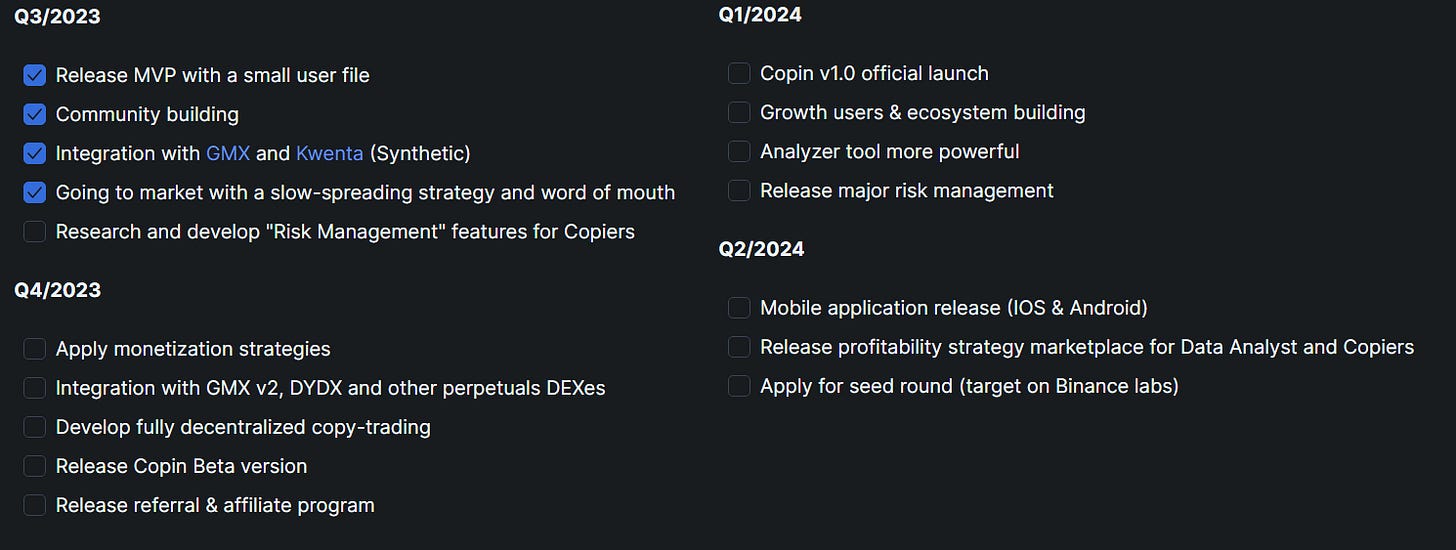

Interesting RoadMap ahead:

The product is currently in Beta, meaning that:

Copy trade is only available through GMX traders

Copy trade uses BingX as CEX to perform the trades…looking forward to get the trades directly routed to a Perps Aggregator

After only 3 months the project is live, COPIN is already doing 1m$ of monthly volume.

Here are some useful links related to the project:

🟠Podcast:

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of some of the podcasts. Access granted to Revelo members.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

The Optimism Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.