The 🔴Optimist: OP Superchain News #31-1

The Superchain Knowledge Hub: Optimism, Base, Mode, Lyra, Ancient8, Redstone, Cyber & many more

First of all, i’d like to express my thanks to you readers, for your comments, support, likes on this Journey. Big 👏 to the team for making The Optimist the go-to Media for everything about DEFI on the Superchain.

Did you miss the latest newsletter about DEFI opportuniteis? Grab it here

Click in your preferred language to access the translated document:

Chinese - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔥Hottest news

Your bi-weekly breakdown of the most juicy news about the Superchain

🔴 Cycle 19 OP Grant: new grantees

This season 5, cycle 19, brought granted incredible projects such as Ether.fi, Kelp DAO, Gearbox, Thales, Synthetix & Velodrome. See a summary of what they are cooking.

➡➡➡🦄Meme of the week

🔵When Bitcoin L2 meets EVM : Build-On-Bitcoin

BOB chain is built on the OP Stack, the 1st Bitcoin Layer 2 that will connect the Bitcoin chain with the EVM chain. Wanna learn more about it & the FUSION season 1 point program? Read this.

➡➡➡✒ Post of the week

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, we were pleased to receive on Stage :

Coinbase Wallet: Putting the 110m users from Coinbase ONCHAIN

DefiSaver: the go-to platform for leveraging DEFI

GOVERNANCE & VOTE TIMELINE

If you wish to delegate your OP Tokens to Subli => Go to this page, and click on DELEGATE. Delegate Address: 0x3b128c6c1207d72092a8b3f6d651dfe54682a404

Spotlight project: Extra Finance

What is you could Long, Short, take a Delta Neutral position, while leveraging Liquidity Pool? Built on top of #1 dex of the Superchain VELODROME, and of Base AERODROME, Extra Finance offers incredible yields for Lenders & Borrowers.

As the Velodrome will expand to the other chains of the Superchain like Mode, expect Extra Finance as well.

Ready to EARN ? Visit https://app.extrafi.io/ now.

🔥Hottest news

💙Base season kicked-off with chain TVL reaching 3.5b$, Daily tx ATH, Active users ATH, Network revenue ATH

📢Arcadia Finance is now live on Base, and is inviting users in earning Arcadia Points

🎮Wanna play a survival game on Base? Only one will survive, and win the pot. Welcome to Crypto The Game season 2, now live on Base

💙Zora is now sharing minting fees with Base chain and Higher collectives, using the Rewards & Split new features

💲Blackrock created the 1st institutional tokenized fund through a stablecoin $BUILD (USD Institutional Digital Liquidity Fund) on Ethereum, already reaching 280m$ Market Cap (check contract)

🗻Lisk announced its new Grants program & opened its Hackaton initiative from 2-April till 14-May

🚴♂️Mode reached 240m$ TVL and announced Velodrome deployment together with 1m$ incentives

🔴Optimism announced a new way to deploy dAPP on the Superchain taking few minutes only, thanks to the Superchain Developer Console

💲1️⃣, the 1st superchain launchpad, announced Ionic IDO (#1 lending protocol on Mode)

🎁Optimism announced RPGF #4, which will be split over 2024 through 4 categories: Onchain builders, OP Stack, Governance, Dev tooling

🪂Alchemix is going to deploy its 250k OP grant on Optimism. Watch out for announcement.

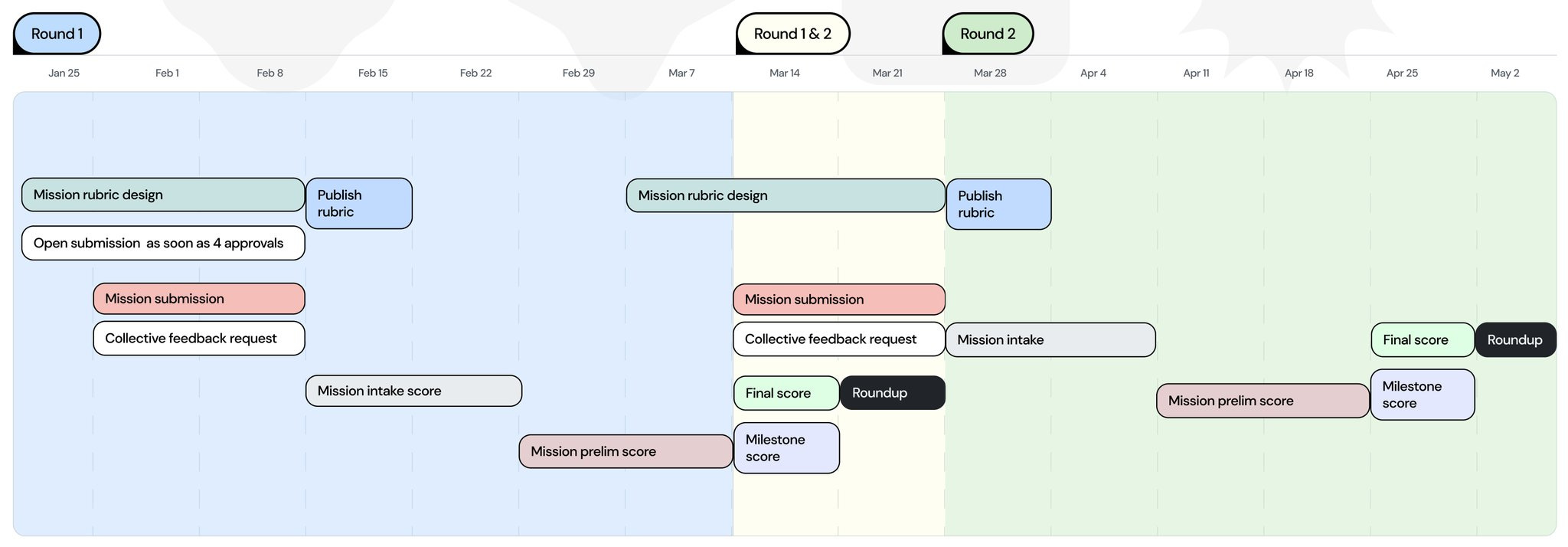

🔴 Cycle 19 OP Grant: new grantees

by Nataliii

On March 22, the list of new grant recipients was announced. It was 40 elected grantees from the 106 finalists of Cycle 19.

And I admit that among them there are very interesting projects for which we are in a bullish mood. Let’s focus on those projects that, in our opinion, look particularly bullish [Ether.fi, Kelp DAO, Velodrome, Synthetix, Gearbox):

Ether.fi

For info, Ether.fi recently raised 23m$ from various investors in Feb-2024.

Ether.fi is the #1 Liquid ReStaking Protocol with 3.3b$ TVL & with their own LRT $eETH. If you wish to learn more about Ether.fi, listen to our previous podcast with the founder, Mike: Podcast.

50k OP Grant

Ether.fi got approved for a grant under the “Making Optimism a primary home of liquid staked eth” mission request. And this is their plan:

Grant approved: 50k OP, distributed as follows:

Enable minting eETH on OP Mainnet

Build & Track Ether.fi points (season 2 is now live until June-30)

Direct existing DEFI partners to OP Mainnet

Very exciting to see them developing this new feature on OP Mainnet, which once live, could be easily deployed on any of the Superchain chains.

KelpDAO

Kelp DAO is the #4 Liquid Restaking Prtocol with 740m$ TVL & their own LRT $rsETH.

If you wish to learn more about it, listen to our previous podcast with the founder, Amit: Podcast, and read our article here.

50k OP Grant

Kelp DAO got approved for a grant under the “Making Optimism a primary home of liquid staked eth” mission request. And this is their plan:

Grant approved: 50k OP (out of 40k dedicated for growth), distributed as follows:

Enable minting rsETH on OP Mainnet

Partner with key DEFI protocols

Incentivize Bridgers & Holders on OP Mainnet in KELP miles (program still live)

Bridge $KEP (liquid token representing Eigen Layer points) to OP Mainnet

Very exciting to see them developing this new feature on OP Mainnet, which once live, could be easily deployed on any of the Superchain chains.

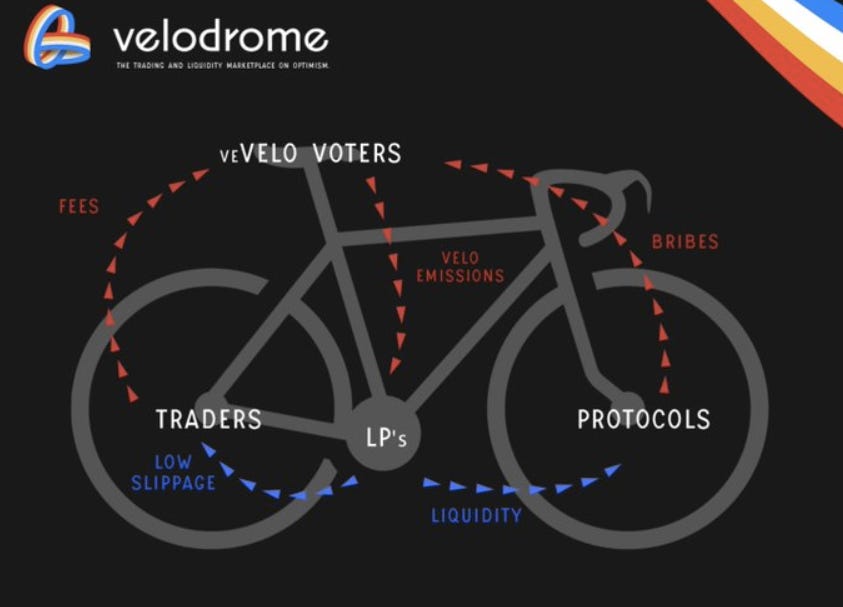

Velodrome Finance

Velodrome has been approved on 3 grants this time totalizing 400k OP (total master class by the Velodrome team):

Making Optimism a primary home of liquid staked eth: 100k OP

Growth: 200k OP

Deliver a Best-in-Class Perp Dex: 100k OP

Let’s go through each of them:

1. Growth Experiment: 200k OP distributed like this during 10weeks:

20k for incentivizing voting incentives

5k as lock bonus

2. Velodrome Best-In-Class Perp Dex:

If you read this, you may wonder if Velodrome is launching its new Perpetual protocol? NO! Velodrome will use this grant to build everything that Perpetual protocols need to exist: DEEP LIQUIDITY. SlipStream, the new Concentrated Liquity Pool architecture, will offer:

Deep liquidity that can be used to access Perp trading protocols

Oracle updates that can feed the price of an asset on the other platforms

50k OP will be used to incentivize Slipstream pools as follows:

8k OP/Week for perp DEX required tokens like sUSD

2k OP/Week for tokens used as trading incentives like Kwenta & Lyra

3. LST support:

Deployment of LST/LRT on OP Mainnet wasn’t project’s priority due to large incentives offered on other L2s like Arbitrum. Velodrome will use this grant to convert projects like Ether.fi, Kelp DAO, Stader, Renzo, Redacted Cartel to build deep liquidity on OP Mainnet. The 100k OP grant will be distributed during 10 to 15 weeks by matching up to 15% to 20% voting incentives deposited by these projects up to a max of 12k OP per week

Synthetix

We intensively cover Synthetix, so search here using Synthetix as key word to read our previous articles: https://sublidefi.notion.site/List-of-Articles-Podcasts-edc48f2f00354cbeaf555f3a224eb997

Synthetix received 2 grants: Growth (200k OP) & build Best-In-Class Perp Dex (400k OP)

Growth Grant (100k OP)

Enhancing sUSD Liquidity: 150k OP, over 6 months , used to incentivize deep liquidity on Velodrome & Curve

Mini-Trading Competitions: 50k OP, over 6 months as well

Best-in-class Perps DEX

One of the main problem of Perp protocols is the low latency to approve a transaction leading to delays in receiving the final execution price. The proposal includes the creation of an advanced orderbook, various order types such as take profit, stop loss, open-source relayer, and relayer infrastructure that will enforce these advanced trading rules.

An open-source order matching engine operated by relayers.

An on-chain settlement contract that will incorporate matched orders as Synthetix v3 positions, allowing users to trade through relayers or AMM at any time.

Advanced order types, including take profit, stop loss, trailing stop, and one-cancels-other.

Is Synthetix building an intent-based protocol?

Gearbox Protocol

Gearbox Protocol brings you composable leverage. It allows anyone to margin trade on Uniswap, leverage farm on Curve, leverage liquid stake on Lido, and use 10X more capital on protocols you already love. Making decentralized leverage a reality thanks to Credit Account abstraction, bringing together lending and prime brokerage in the same protocol!

50k OP Grant, which plans Gearbox has?

Step 1: Launch Margin Trading dApp on Optimism called PURE, see here:

Step 2: As soon as the first OP distribution is received, they will activate the farming and referral incentive programs, to amplify usage and trading activities

Step 3: Launch Farming on Optimism

Step 4: Work with Optimism protocols to enable and co-grant different teams and devs on Optimism to build basis trading strategies, no-liquidation leverage farming, and other ideas.

They will distribute 80% through the Farmer Program and 20% through the Trader Referral Program.

Thales Protocol

250k OP Grant:

From receiving this grant, Thales Protocol will instantly kickstart the planned incentive programs that will be designed as such to leave no room for riskless passive farming of rewards:

Fee Rebates, Gas Tank subsidies for Account Abstraction, Loss Rebates for AMM Liquidity Providers, Active Usage Incentives and Event-based incentive buckets.

With this grant, Thales Protocol will target sports fans (Thales Sports Markets), option traders (Thales Digital Options) and crypto day traders (Thales Speed Markets). This grant will also passively grow the acquisition of additional integrators on Optimism that will use Thales API to build dapps and as such be eligible for OP rewards.

This will be distributed as follows:

20% to sponsor gas fees through the new to come account abstraction account

20% as trading fees rebate

60% to traders

That’s it for cycle 19, glad to see LRT/LST finally arriving on OP, and seeing flagships protocols Velodrome & Synthetix building the future of the chain.

🦄Meme of Week

🔵When Bitcoin L2 meets EVM : Build-On-Bitcoin

By Thomas

Dear readers,

As you know, rollups are popping up like mushrooms today: new solutions emerge every week, often without necessarily bringing real innovations.

But there are still a few projects that stand out! This is the case with Build On Bitcoin, a hybrid L2 secured by Bitcoin and connected to Ethereum via the OP Stack.

What is Build on Bitcoin ?

Launched a few days ago, Build on Bitcoin is a rollup that aims to leverage the best of both worlds: the security of Bitcoin combined with the liquidity/ecosystem of Ethereum.

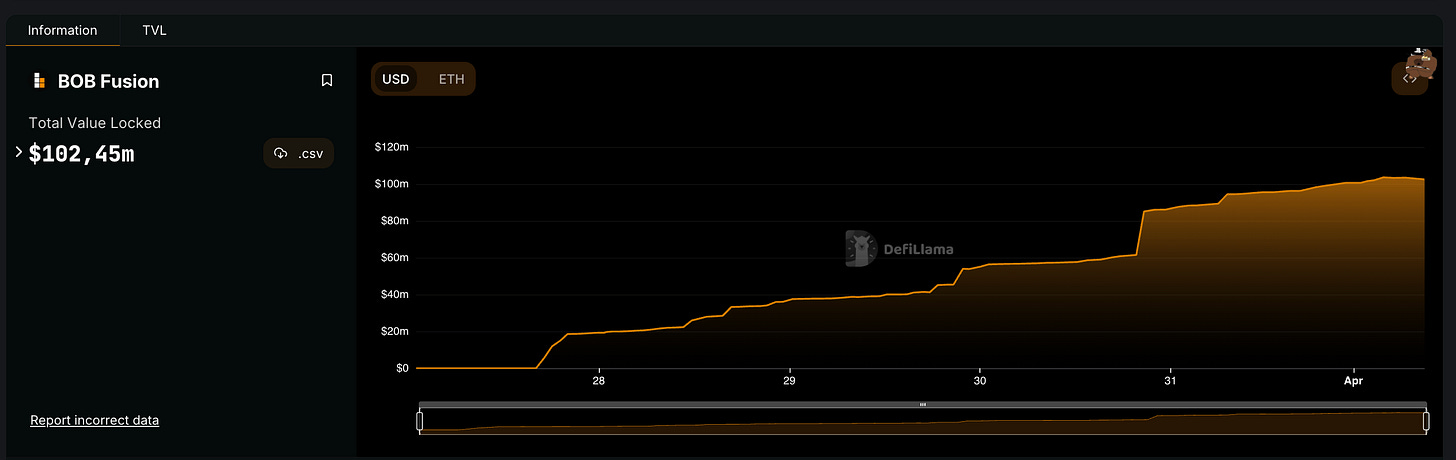

Following a Seed Raise of 10m$ with very famous Ventures Capital, the chain has already garnered over $100 million in TVL in less than a week: this is quite impressive and demonstrates the enthusiasm for this kind of solution.

(The mainnet has not been launched yet, but users can already deposit assets into a time-locked BOB contract - more information in the continuation of the article)

The main objective of BOB is to use Bitcoin as a settlement layer for its rollup.

However, EVM compatibility is essential: on one hand, to have access to all application development tools, and on the other hand, to leverage Ethereum's large community.

To achieve this technical challenge, the team has divided its roadmap into three main phases.

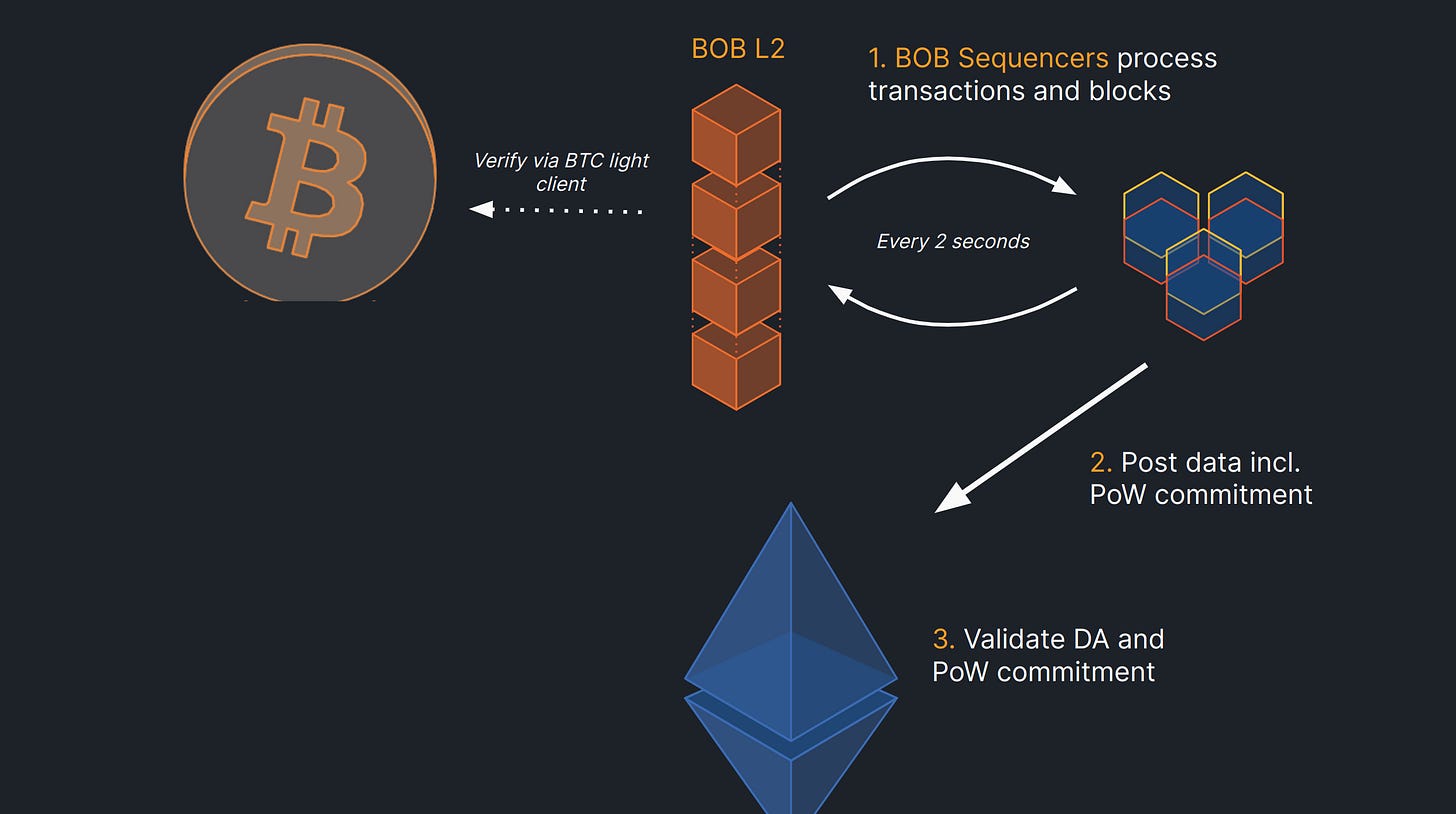

Phase 1: Optimistic BOB

During this first phase (which we are currently in), BOB has been deployed on the Ethereum ecosystem as an OP Chain.

The Rollup relies on Ethereum for data availability and uses a light BTC client to enable smart contracts to process Bitcoin transactions.

This allows for trustless execution of cross-chain contracts.

This first phase is important because it is here that the chain will begin to bootstrap its liquidity (we will discuss this a little further down).

Deploying via Op Stack allows for a straightforward execution, while also benefiting from the marketing and business development support of the Optimism ecosystem.

Note: BOB is not an integral part of the Superchain: the Rollup uses its own sequencer and also has its own governance. However, after discussion with the team, the question is wide open, and it may be possible that it will join the superchain.

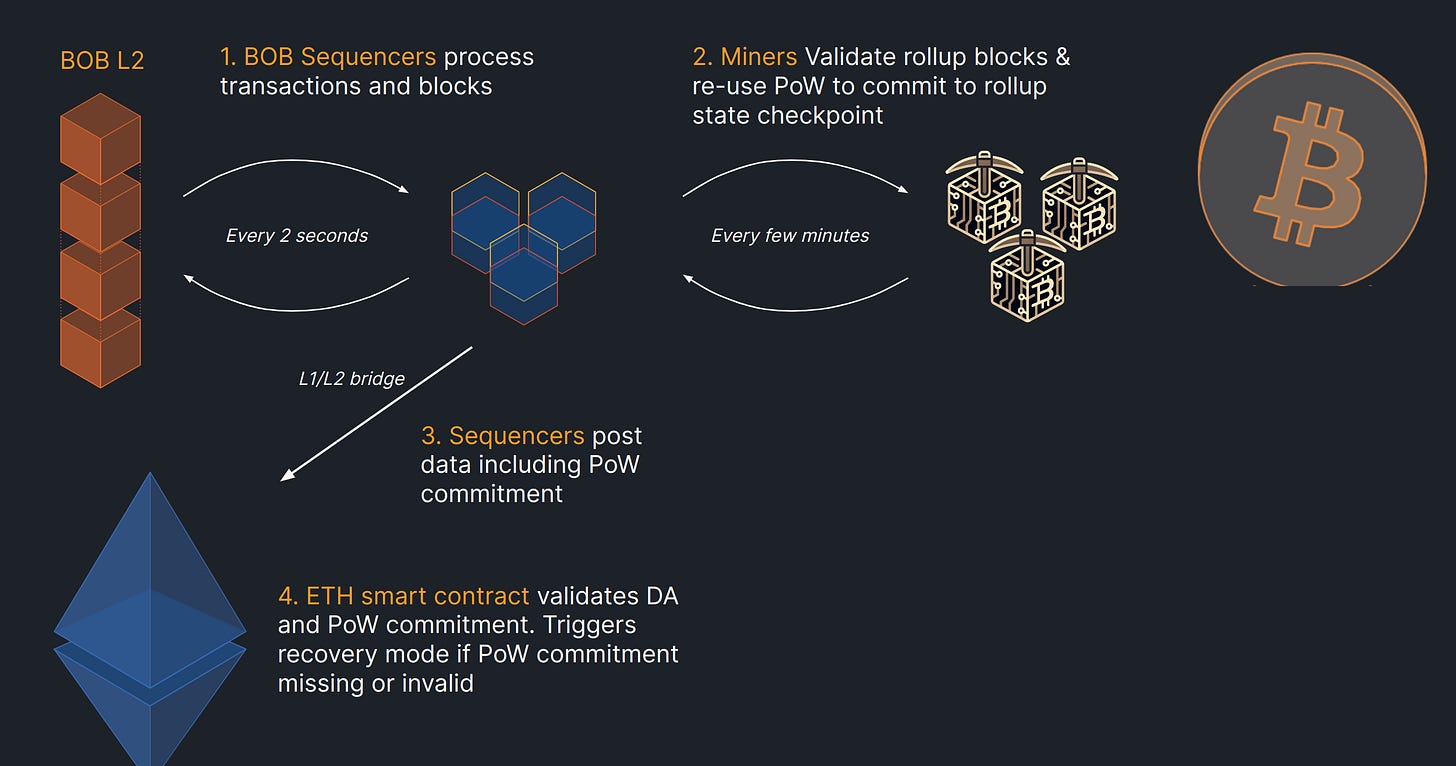

Phase 2: Bitcoin PoW Security + ETH Optimistic Rollup

It's in this second phase that BOB L2 will leverage the security of Bitcoin:

Through a technology called "merged mining", the blocks assembled by the BOB sequencer are finalized by Bitcoin miners running a BOB L2 node.

For more details on merged mining, please refer to this page.

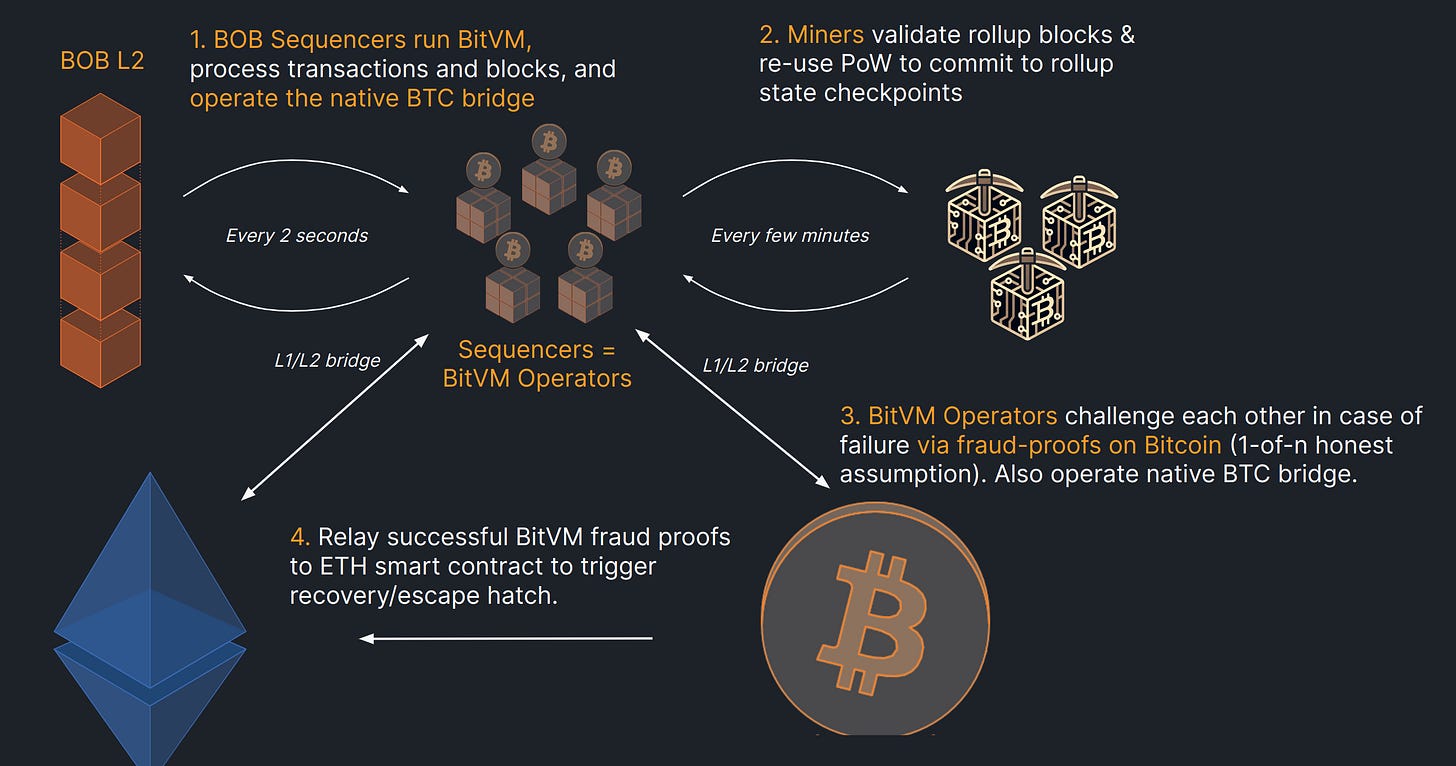

Phase 3 : Bitcoin Optimistic Rollup + ETH ZK/Optimistic

Finally, the last phase aims to integrate Bitcoin as a Settlement Layer through fraud proofs in Bitcoin.

For this, the team will rely on BitVM by creating a bidirectional bridge, as well as a ZK mechanism to handle fraud proofs.

Once this final phase is completed, BOB L2 will be 100% hybrid: Bitcoin assets on the Rollup will be secured by Bitcoin, while Ethereum assets will be secured by Ethereum.

How to get involved in Build-On-Bitcoin

As mentioned earlier, Build On Bitcoin is currently in its first phase.

Therefore, the team has decided to launch a points campaign (another one!!) to bootstrap liquidity on the rollup.

This event is called BOB Fusion and is divided into several seasons:

Season 1: Currently open

Season 2: When the mainnet launches on the day of the Bitcoin Halving

The first season operates like most traditional points campaigns. To earn points (called "Spice"), all you need to do is:

Transfer assets to a locked smart contract (until the mainnet). Once BOB is launched, the assets deposited there will be directly available.

Refer people.

The weighting of assets is different: you earn more points by transferring "Orange Spice" assets as well as "Blue Spice" assets.

Here's the list:

tBTC/wBTC : X1.5

rETH/wstETH/STONE/USDT/DAI/USDC/eDLLR : X1.3

ETH/eSOV/ALEX : X1

Given that the point generation is linear until the mainnet launch, the earlier you join, the more points you will earn.

By the way, if you're interested, feel free to use our link to support us:

https://fusion.gobob.xyz/ & Referral Code: cn0pfw

As you've seen, the technical challenge of BOB is significant, but the solution has a lot of potential.

Could this be the precursor to a next wave of Bitcoin-based L2s? For now, it's hard to say. We'll see in the coming months.

And last piece of the puzzle: Yes, you hear it right, after Mode integration, Velodrome will deploy to BOB:

But as explained in previous newsletter, all is about the narratives. And Bitcoin L2 are in this bull run narrative, with the First Mover being Stacks rollup. But in the mean time, here is a snapshot of the current Bitcoin L2 landscape:

✒ Post of the week

🟠Podcast:

Podcasts are the source of Alpha🔥. And what if you can transform 1h of listening into 5min of reading? The 🔴Optimist Podcast partnered with Revelo Intel to provide written notes of all podcasts for FREE.

The Optimist Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.