The 🔵Optimist: (L)Earn with Defi #30-2

Tips, Tools & Strategies for your personal journey in DEFI on the Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed part 1 [OP Superchain News], don’t worry, just click HERE.

Click on your preferred language to access the translated version:

Chinese - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔵Base: Memecoin Mania

Trading memecoin can send you to Valhalla or get you rekted (most likely the 2nd). But if you’re ready to Gamble, as the meme season is coming to Base, we have used onchain data to show you what whales are buying.

🟢Crypto market review

Bi-weekly update on the Crypto Market.

➡➡➡🤯Quote of the week

🍀Trading tips: When to get out of the market

🟤Farming Strategy: Extra Finance - Tutorial

Extra Finance allows users to leverage yield farming on top of Velodrome & Aerodrome. Long or shot one asset, Implement a Delta Neutral strategy earning huge but real APY, here is a tutorial on how to use Extra Finance.

Spotlight project: Stake Together

Stake Together is a Liquid (Re)Staking Protocol on Optimism that offers the highest yield on the market, and can also fund public good projects by directing a share of the protocol fees to fund whitelisted projects.

Soon, their ReStaking solution will launch on OP Mainnet and will grant ETH stakers cheap fees to restake on EigenLayer as well as all the following rewards.

Ready to 🥩? Visit StakeTogether now.

🔵Base: Memecoin Mania

by Charles

If you’ve ever dabbled in the world of DeFi, chances are you’ve encountered memecoins. These little bundles of volatility make Bitcoin look like your grandfather’s 401k – they represent the absolute pinnacle for risk-loving financial nihilists.

The reality of investing in memecoins is harsh: for every moon-bound meme, there is a graveyard filled with losers ready to blow up your account faster than a slot machine in the basement of your neighborhood pub. Memecoin markets are mercilessly unforgiving, and if you aren’t equipped with every informational edge possible, you are positioning yourself as exit liquidity.

So how does one gain an edge? Where could I possibly find an upper hand in a market driven by sentiment? Well, I’m glad you asked my darling neophyte, because I’m about to show you how you can discover the next behatted dog before the masses catch on.

Memecoin activity on Base has recently exploded, creating a frenzy of users scrambling to catch the next parabolic price action. If you’re an active crypto Twitter/X (CT) member, you’re probably following a few accounts that always seem ahead of the pack when it comes to catching big memes early.

A two-week-old coin pulls a 50x, and you’re left questioning your life decisions as the usual band of suspects posts PnL charts that make Steve Cohen look like an amateur. However, unless you get extremely lucky, simply following these accounts on CT will always result in the same outcome – by the time you see their posts, it's already too late.

But what if you could see their entries the moment they happen? The beauty of decentralized finance is that, whether they like it or not, the transaction history of every successful trader is fully public; you just have to know where to look.

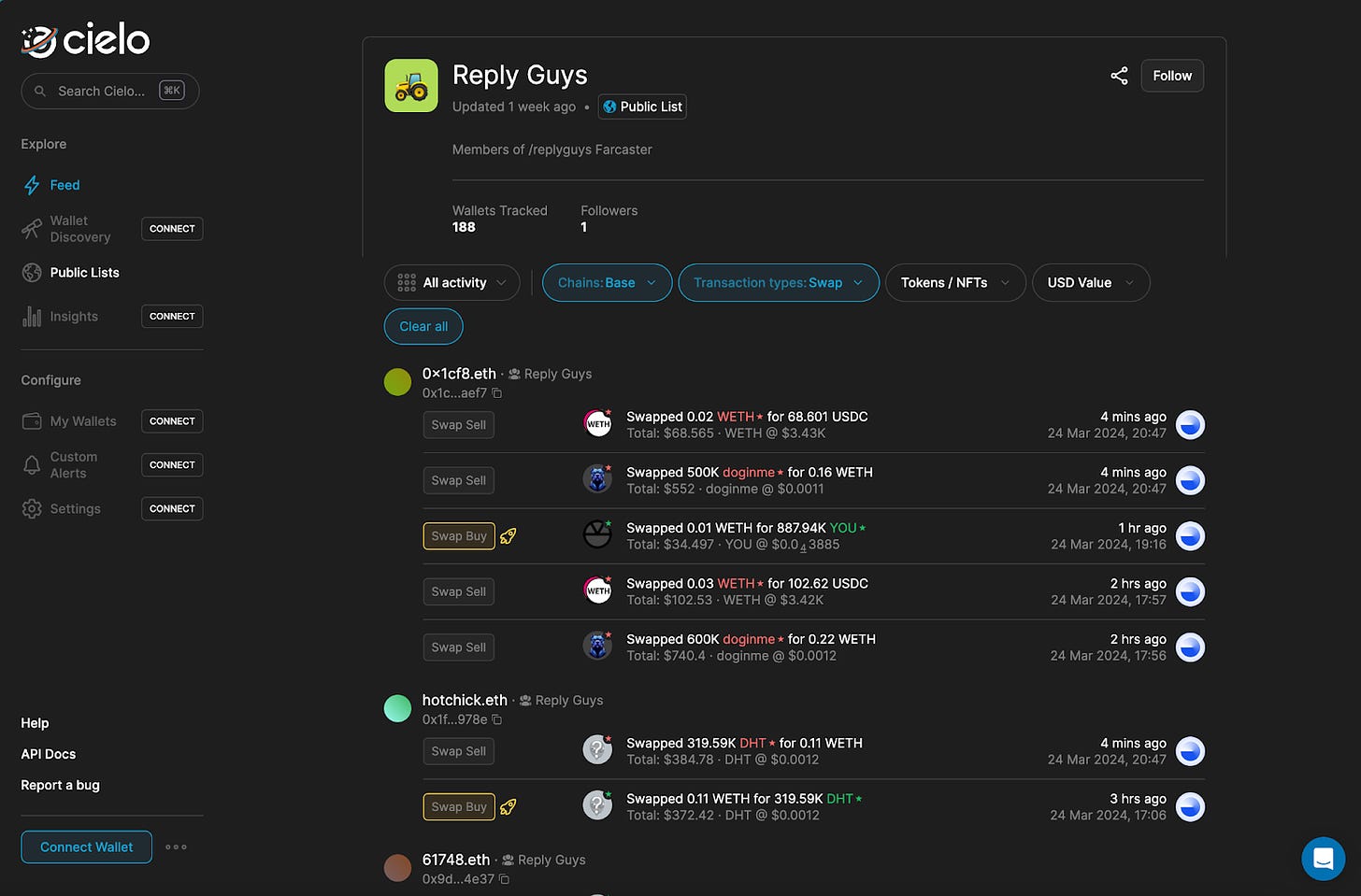

Cielo Finance

Allow me to introduce you to Cielo Finance, an aggregator of on-chain activity that provides you with the necessary tools to track the wallets of your favorite traders and witness their trades as they occur. With Cielo, you can create a personalized feed of trader activity, presented in a user-friendly interface that even your 401k-holding granddad could navigate effortlessly. Whether you want to add your favorite trader’s wallets or select from an existing database of the most successful players in the game, Cielo has you covered.

Let's dive into a few success stories from the Base ecosystem using Cielo:

Ansem the Kingmaker

Ansem has been on a historic run over the past year, executing on some legendary trades while amassing over 250k followers on X, solidifying him as one of the few key players who have an outsized influence in the memecoin space. By tracking Ansem’s public wallet (via FriendTech) we can view some of the Base memecoins he has aped into in real-time:

$NORMIE - up 15x (still holding)

$DOGINME - up 50x (still holding)

$DEGEN - up 3X (sold it a 50% less)

Source:

The Reply Guys

If you’re looking for a feed of on-chain activity involving multiple top memecoin traders, look no further than one of the top channels on Warpcast – the Reply Guys. These degens are trading absolutely everything on Base, from NFT mints and gaming coins to, of course, the freshest memecoins on the market.

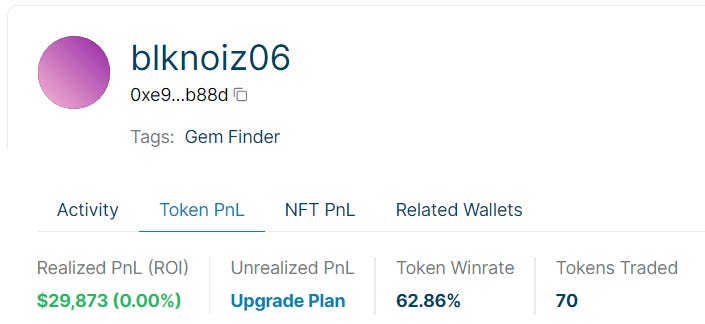

Using Cielo, we can track transactions in real-time from all the wallets tracked on the Reply Guys list using filters to focus on what we’re interested in. Tracking specific wallets also enables you to see their PnL history for every asset on every chain. For example, here is a user followed by the Reply Guys who has been especially successful on Base, netting over $66k in profits on the network across over 100 tokens traded. Their most significant wins on the chain to-date have been $BPS, $DEGEN and Fren Pet.

FriendTech 2.0

There is a popular Canadian saying that I like to bandy about from time to time: “Skate to where the puck is going, not where it has been.” This is extremely good advice for anyone involved in financial markets, especially crypto. Success requires foresight and commitment – repeatedly chasing the current trend will only end in disaster. So what’s the next trend? That’s the million dollar question…

We mentioned FriendTech earlier, and many have forgotten about it. But FriendTech 2.0 is coming this spring, and rumor has it, memes will be involved. The latest 2 ETH transfer is the famous CoopahTroopa sending ETH to their FriendTech wallet. While it’s hard to predict what will come of FT 2.0, Coopah is extremely well-informed when it comes to SocialFi, and we are paying attention.

If FT 2.0 takes off, scooping undervalued keys may yield outsized returns, but it's all pure speculation at this point.

And finally, check out this live dashboard to find out what’s happening on Base: https://app.cielo.financefeed/preview/3925-🔵-Top-150-Base-User-Activity

Stay safe.

🟢Crypto market review

by Axel

Bitcoin

In the previous newsletter, we explained that we were entering a period of high volatility. Since then, Bitcoin has still not closed above its all-time high (ATH) on a weekly basis. Is it time to be bearish or bullish?

Bitcoin is consolidating below its weekly ATH. The price is hovering around the middle of its bullish channel (orange dashed line).

Bullish signs: Bitcoin is retesting the middle of its bullish channel and consolidating below resistance.

Bearish signs: The weekly RSI is high, and the movement is parabolic.

CME gap

We have a new CME gap open between $64,000 and $66,000. They remain open at the following price levels:

$65,000

$48,000

$31,600

$29,800

$27,000

$26,300

$20,500

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin Dominance: We continue to monitor the breakout, whether it's to the upside or downside of the range. The weekly RSI has cooled off and dropped low enough for a possible run again. We also observe that the RSI is starting to break out of its downtrend channel.

ETHBTC: Ethereum needs to consolidate a bit before starting its bullish run.

TOTAL2: We believe that we are at the orange point compared to the previous bull market. We still have a long road ahead of us, but we have not yet seen the altseason.

Conclusion

As announced, we are experiencing much more volatility. Bitcoin is still bullish. It has retested the middle of the range as support and is now heading towards the top of the range. If this support were to be broken on the weekly timeframe, we could expect a retest of the bottom of the range, and Bitcoin would still be in its bullish trend.

Regarding altcoins, we must continue to be patient. Attention is focused on the strongest narratives such as AI and RWA. The entire market will move when Ethereum begins its run on the ETHBTC pair. Let's be patient; we still have a long way to go before the market tops. We invite you to read the second part to know which signals will make us exit the market.

🤯Quote of the week

By courtesy of QuotableCrypto

🍀 Tips : When to get out of the market

By Axel

Like many, we are primarily investors and swing traders. Our goal is to ride the biggest wave of the movement and exit with maximum gains. Indeed, the market is at its all-time high less than 1% of the time, so you cannot time the top or bottom.

So, do you have an exit strategy? What signal will make you exit the market?

Real story:

In the previous bull market, a friend sold his Ethereum when the price reached $3500. He made a handsome profit since he bought them at $250. Then the price surpassed $4800, and he felt he had exited the market too early, causing great frustration. Eventually, he was able to buy back at less than $1200.

Having an exit scenario allows you to have confidence during corrections. It provides a vision of the endpoint and helps avoid changing your mind too much and getting stuck in market sentiment ping-pong. During consolidations, the biggest mistake to make is overtrading. Selling on red candles and buying on green candles. Even in a bull market, a beginner can lose money.

Below, we will present some indicators that help us determine if the market is near the top or not.

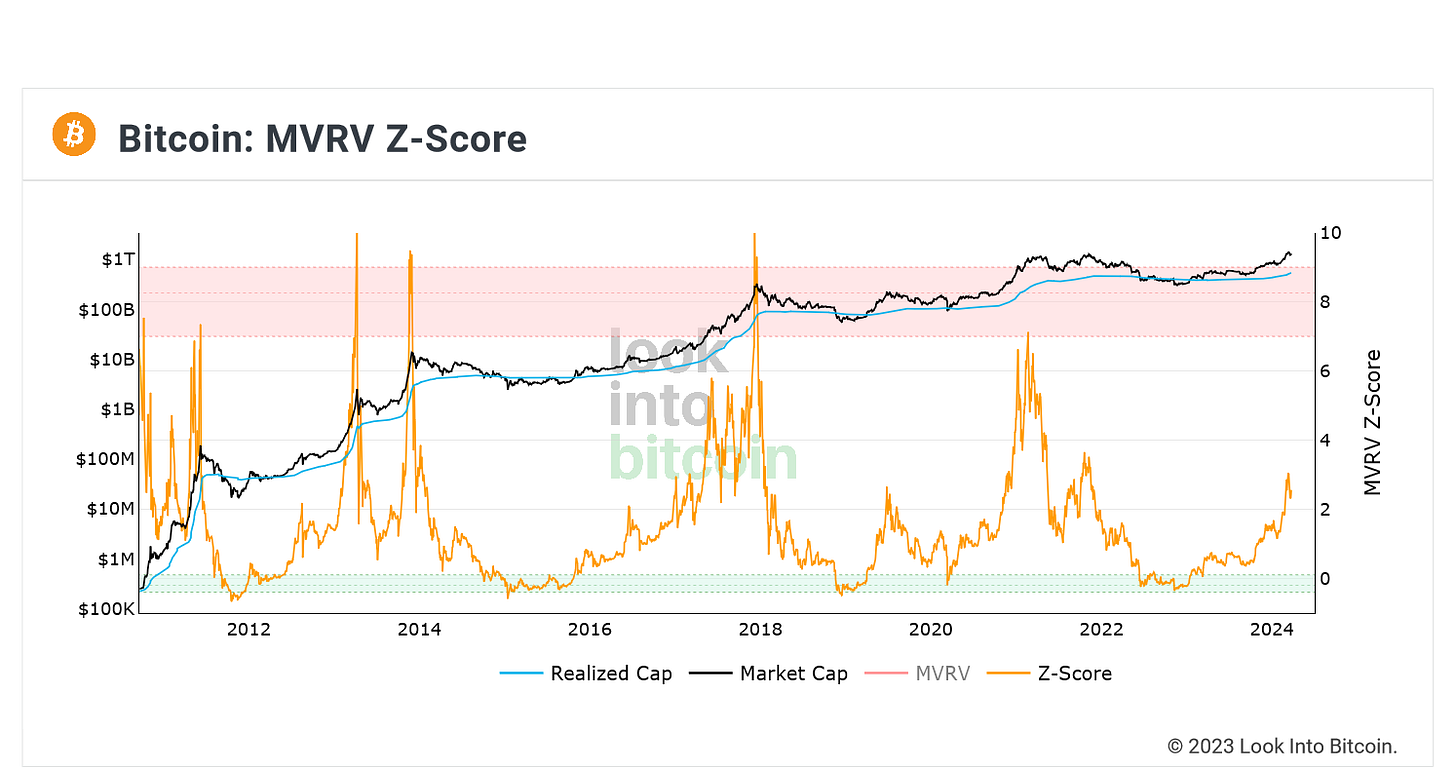

MVRV Z-score

As you can see, every time Bitcoin tops, this indicator touches the red band, indicating a selling zone. When the market bottoms, it touches the green band, which then becomes a buying zone.

Website: https://www.lookintobitcoin.com/charts/mvrv-zscore/

111 DMA cross fib 2

Here we observe that the market tops each time the orange curve surpasses the green curve, as represented by the red dashed lines. We also notice that the green curve acts as a strong resistance on the daily chart, and once this resistance is broken, the movement becomes parabolic.

This indicator was created by a community member, hikmetsezen, whom you can find on TradingView.

Thank you to @CryptoxHunter for bringing this indicator to our attention:

https://x.com/CryptoxHunter/status/1766674692591472679?s=20

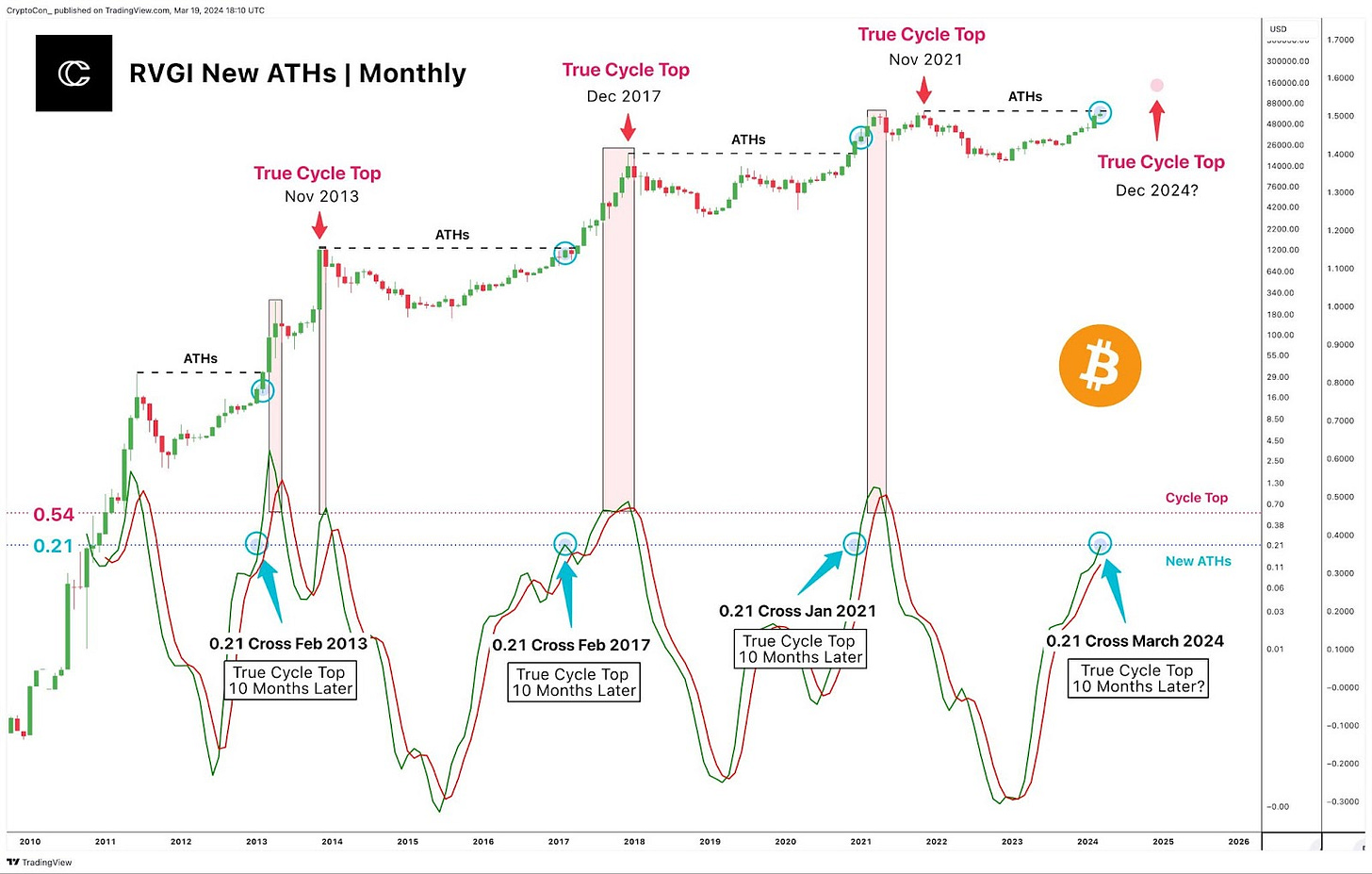

RVGI indicator

We notice that when the indicator approaches 0.21, Bitcoin reaches its previous all-time high (ATH). When the indicator approaches 0.54 on the monthly chart, Bitcoin tops out.

You can find this indicator on TradingView under the name RVGI.

Thanks to @CryptoCon_ for highlighting this indicator:

https://x.com/CryptoCon_/status/1770153433427063204?s=20

Conclusion:

Once again, you won't be able to exit at the exact ATH. These three indicators wouldn't have prompted you to exit at $70,000 but rather at $60,000. However, you would have had plenty of cash to buy back into the market after it corrected by 50% before a new uptrend. This would also prevent you from seeing your portfolio melt day by day when the entire market corrects for over a year.

In any case, it's essential to continue taking profits and stick to your exit plan to preserve your gains.

🟤Farming Strategy: Extra Finance - Tutorial

By Thomas

Thanks to the bullish market, there are numerous high-yield agriculture opportunities: it is now easy to generate a double-digit APR on USD or ETH.

But what if you could amplify your Yields 🌾 through leveraged positions?

That's what Extra Finance enables you to do.

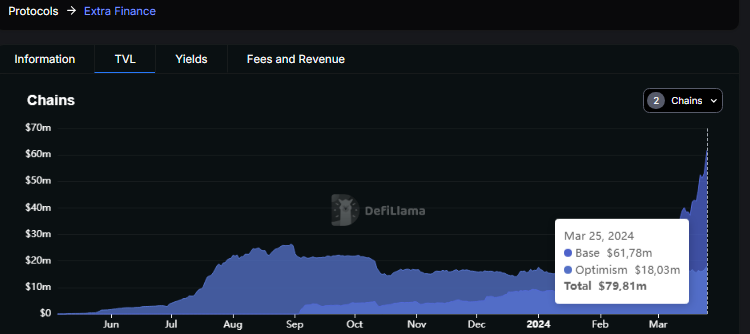

What is Extra Finance ?

Extra Finance is a leverage farming protocol built on OP Mainnet & Base. It offers users the opportunity to implement novel farming strategies on top of the largest DEX LP positions on each chain being Velodrome & Aerodrome.

If you've never heard of leverage farming, you're in the right place:

It's a concept that involves borrowing cryptocurrencies to reinvest them in an LP position, thus increasing exposure to these assets as well as overall APR.

In practice, leverage farming is relevant for:

Taking a long or short position on an asset in a pool.

Amplifying your returns on a stable pool (Stablecoins or LST).

Implementing delta-neutral strategies while earning high yields

To achieve this, the protocol is divided into two parts: the "Farm" part and the "Lend" part.

Farm

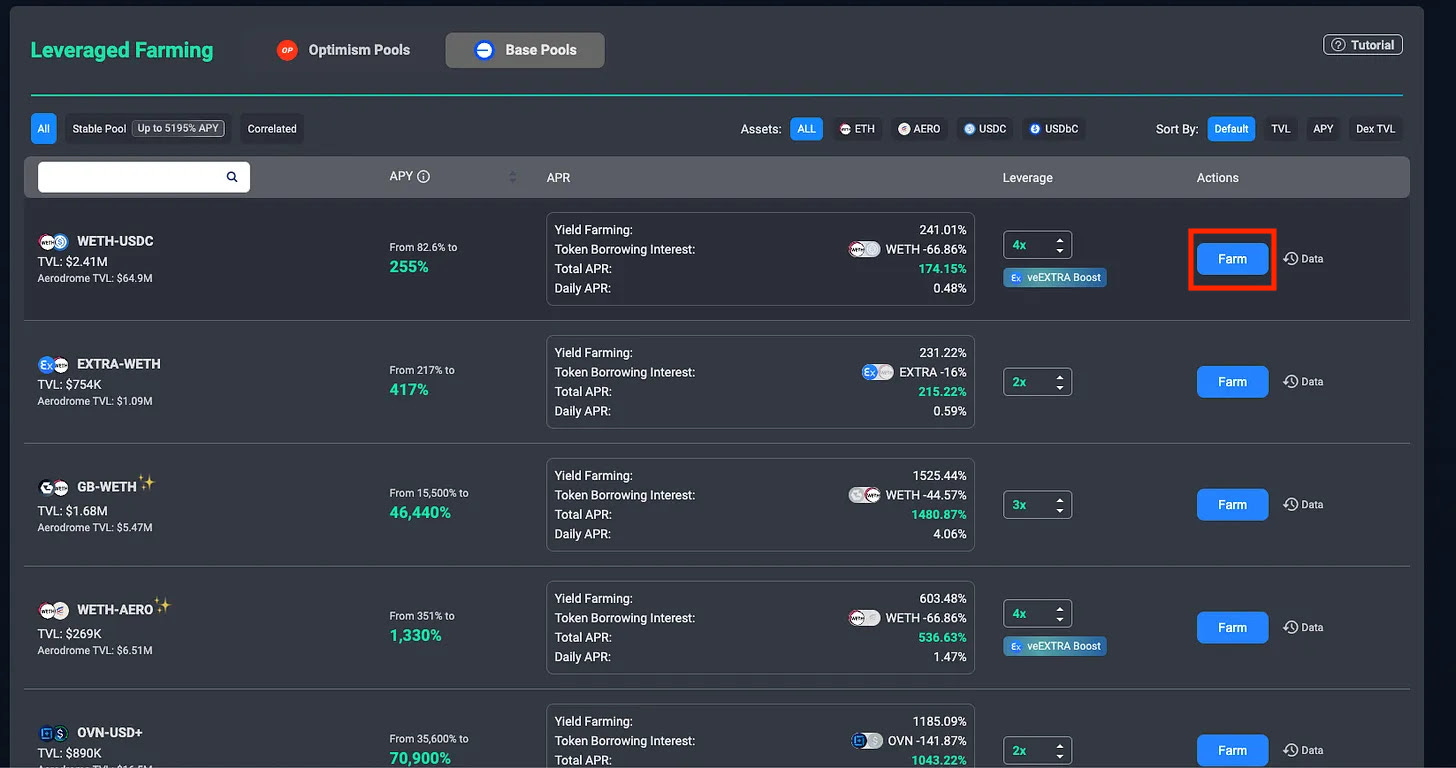

The "Farm" tab is certainly the most used since it's where you can deploy leveraged LP positions.

As you can see on the screen, all you need to do is select the pool you want to invest in to get started.

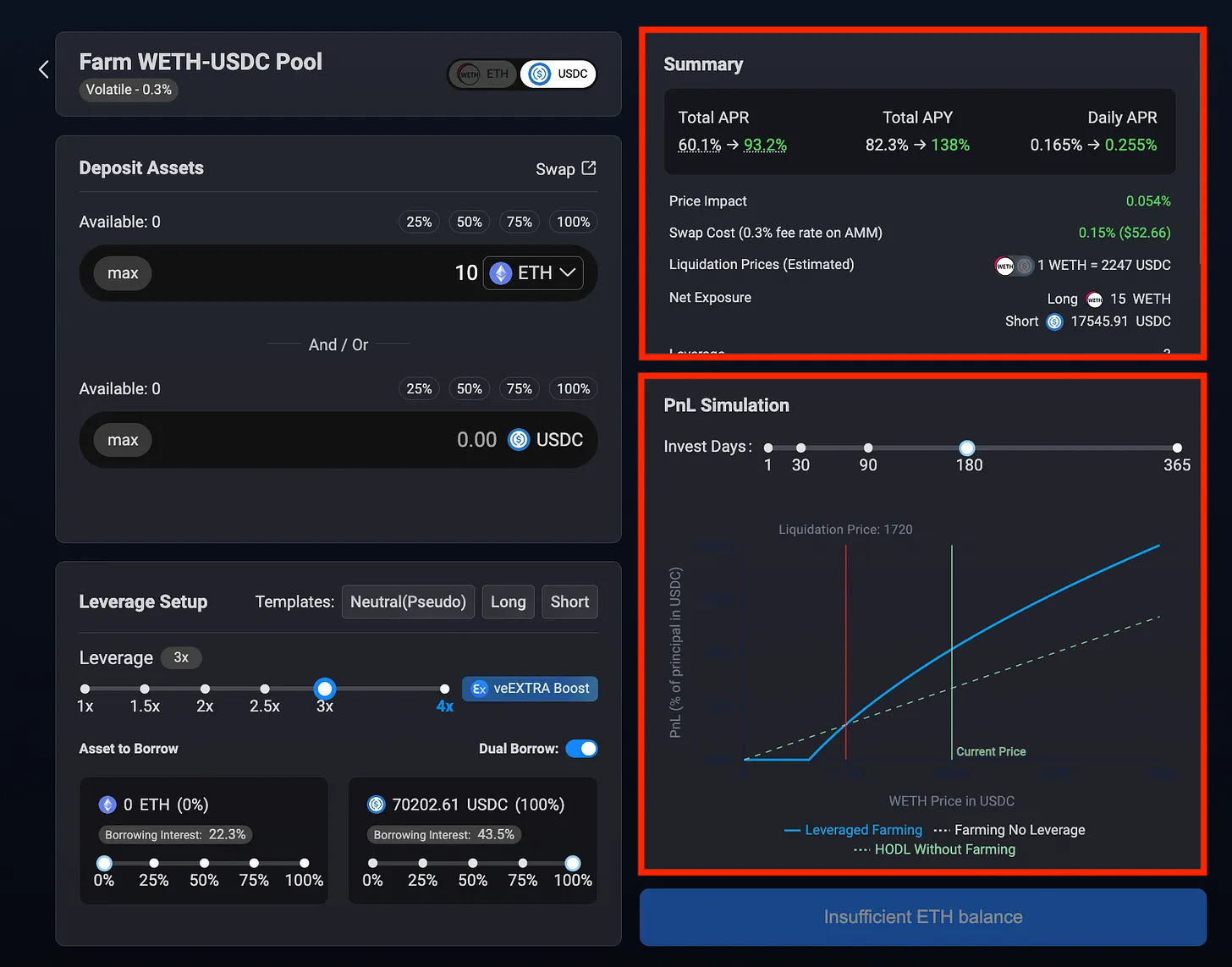

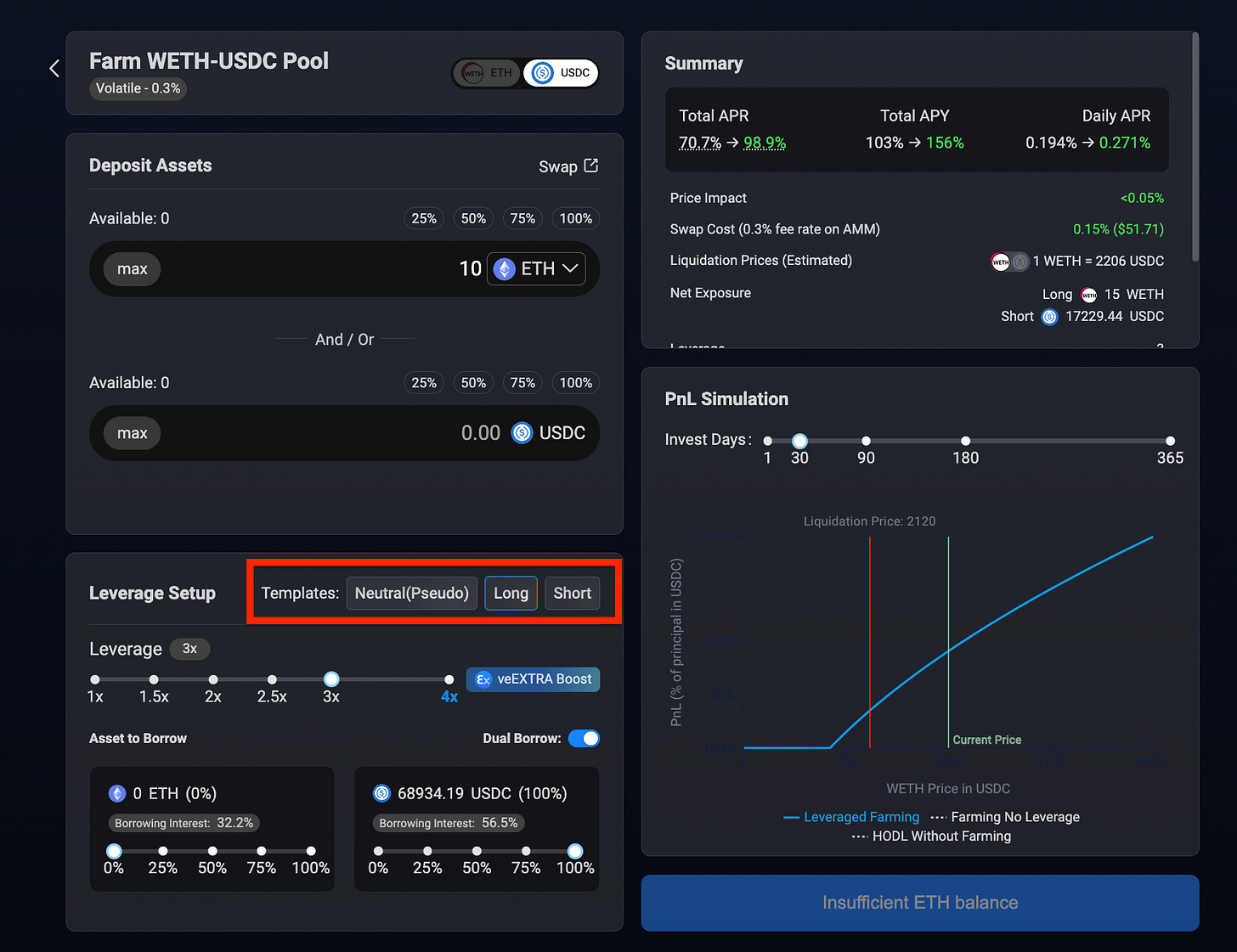

In our example, we want to deploy a long position at X3 leverage on the WETH/USDC pool on Aerodrome. So, simply click on the "Farm" button for this pool.

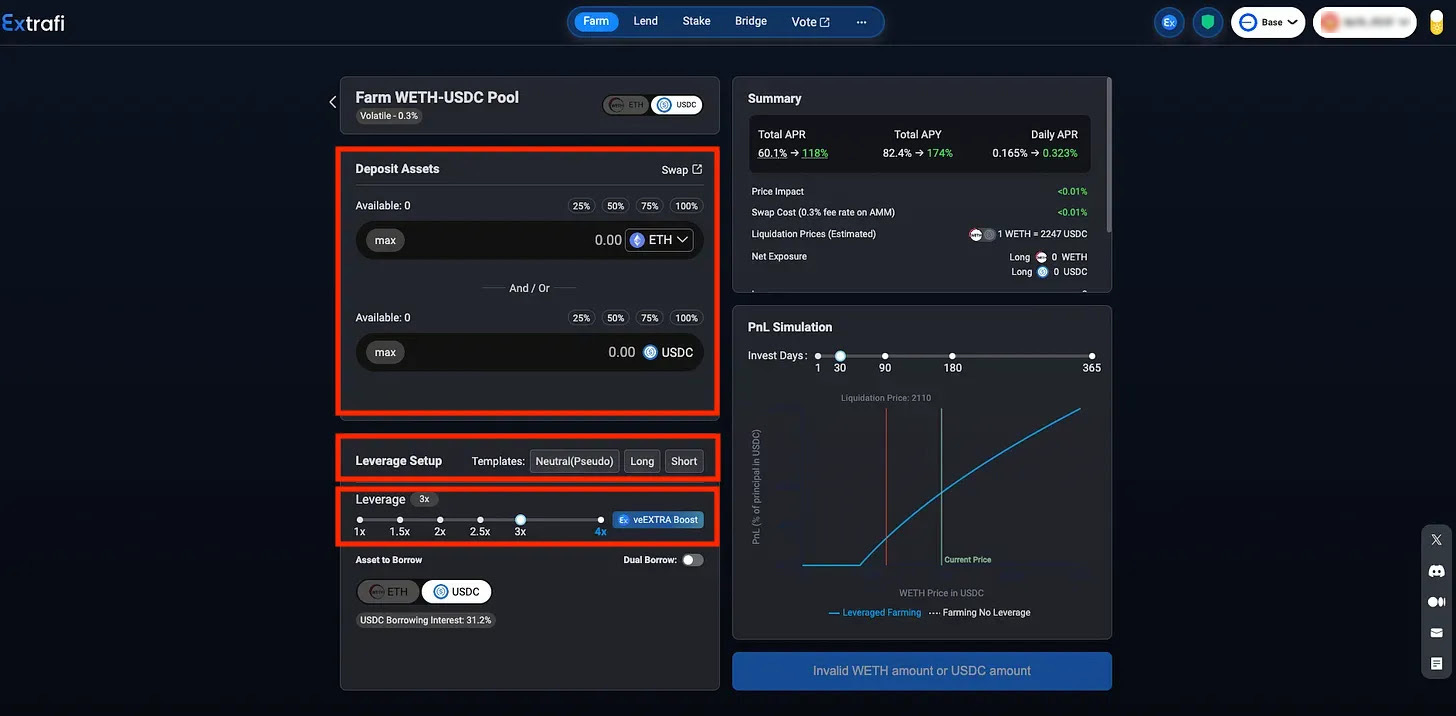

Once there, this is where we can configure and deploy the position (the interface isn't as complicated as it may seem).

To set it up:

Deposit the initial asset in the "Deposit Assets" section: this will be your collateral (you can deposit multiple assets).

Select your strategy by choosing one of the 3 templates (Neutral - Long - Short): in our case, it will be the long template.

Then adjust your leverage. The higher it is, the more expensive your borrowing will be, and vice versa.

Once these 3 steps are completed, you will have a summary in the box on the right side of the page indicating exactly your net exposure, as well as your APR.

You can also use the performance simulator below, which will indicate your liquidation price.

To recap, we've just set up a long position of 10 ETH with 3x leverage on the WETH/USDC pool at Aerodrome.

When we launch it, the strategy will thus :

Deposit 10 ETH into the pool on Extra Finance.

Borrow 70k$ USDC.

Create an LP position for WETH/USDC on Aerodrome.

Swap 17.5k$ USDC for 5ETH.

Deposit 15 ETH & 52.5k$ USDC into the pool.

To check your liquidation price: Watch the PnL simulation tab. Select “Invest Days” at One. The vertical red line is your liquidation threshold. The more you farm & auto-compound rewards, the further will be your liquidation point. In our case, the liquidation point at start will be when ETH = 2,200$.

Our position will generate a 93.2% APR (instead of the initially projected 60.1%, so +55% in yield).

The longer we hold the position, the more it will grow as farming rewards are automatically compounded into the pool.

Risk: Yes there are some risks that you need to be aware of.

Liquidation: Read above

Impermanent Loss: By taking a leverage position, you’ll amplify IL on your position

Borrow yield: High utilization rate will result in High borrow interest rates, that could end up reducing your overall APR or even make it Negative.

If you want to set up a short or a delta-neutral strategy (more explanations here), you simply need to change the template.

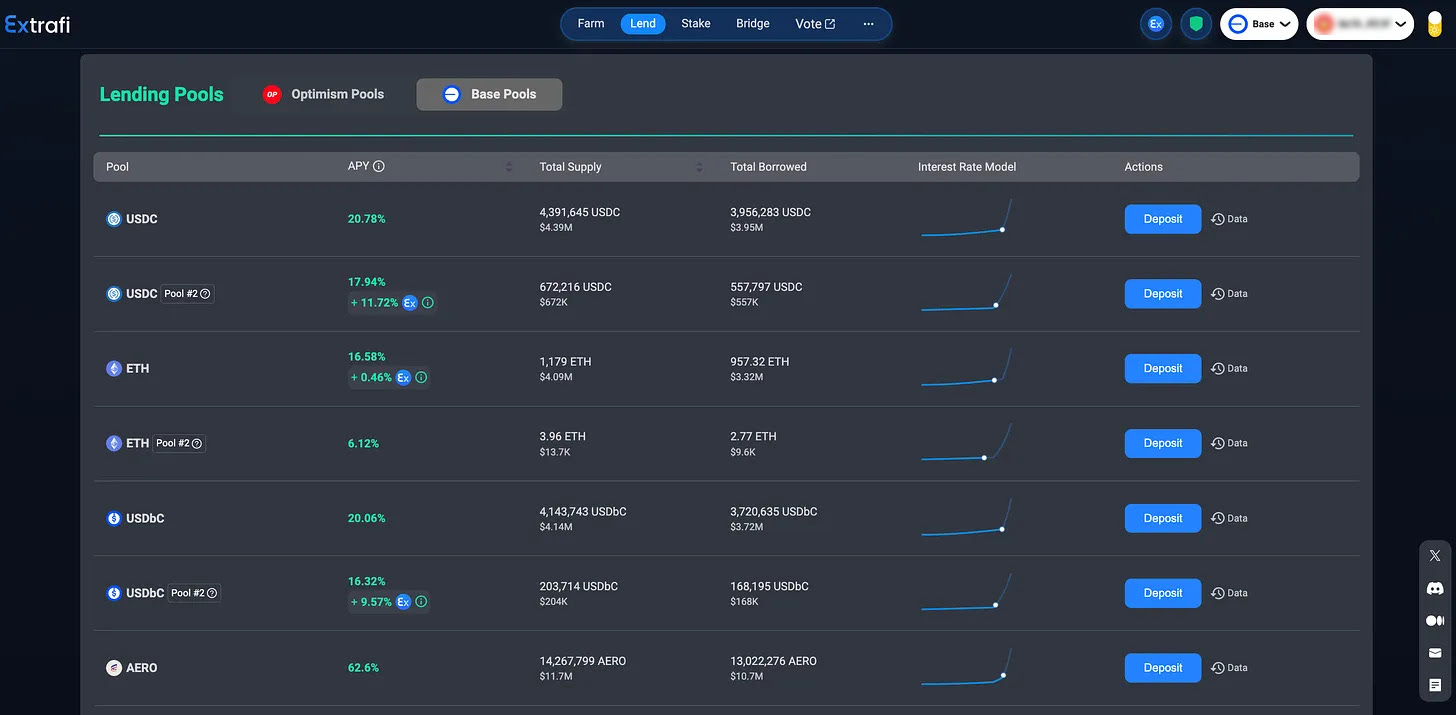

Lend

If you have been following along, you know that users deploying leveraged LP strategies borrow assets.

Well, these assets are directly borrowed from lending pools integrated into the protocol.

From the Lend tab, you can lend your assets to farmers and generate a completely passive yield.

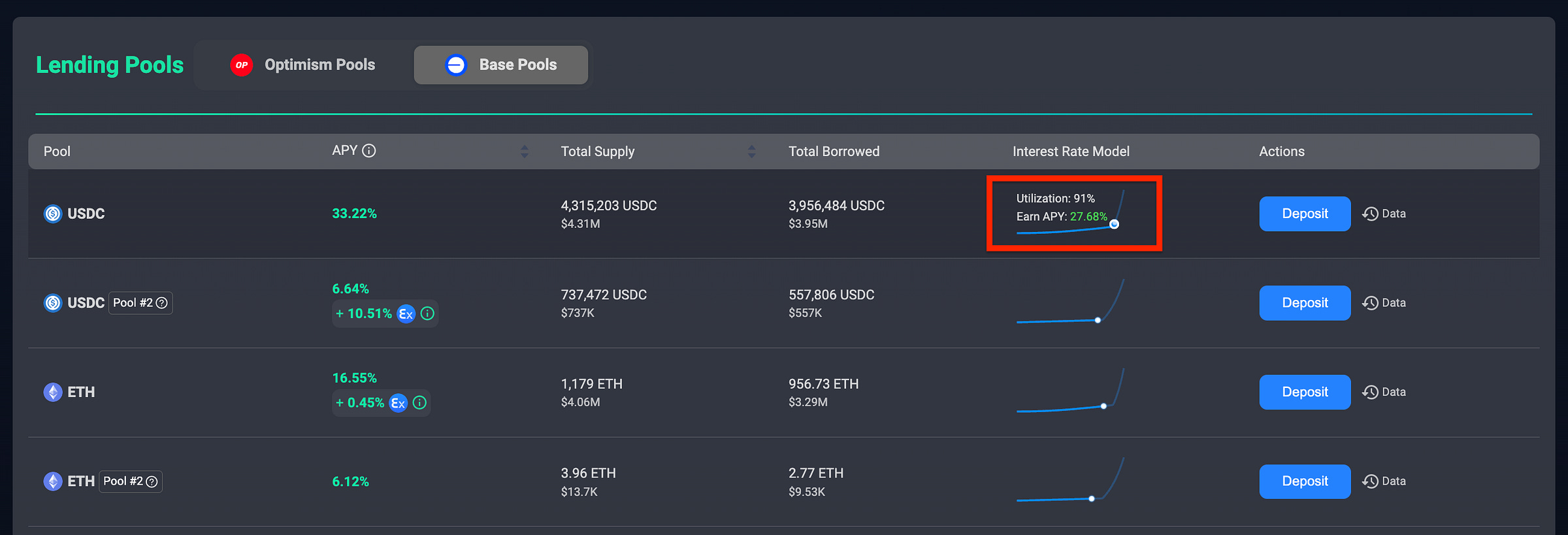

Here, there is no concept of liquidation or impermanent loss to consider: the APR is paid in the token you deposit and varies depending on the number of tokens borrowed.

The more tokens are borrowed from the pool, the higher the deposit APR increases (as well as the borrowing APR), and vice versa.

To benefit from the yield, simply select the asset you want to deposit and click on the "Deposit" button.

Caution: please never forget that your assets are lent to borrowers.

If 100% of the assets in the pool are borrowed, you won't be able to withdraw your deposit until a borrower repays their loan or someone deposits new assets into the pool.

You can monitor the pool utilization rate by hovering your mouse over the interest model curve (cf screen).

Extra Fi token: $EXTRA

EXTRA holders are incentivized to lock their tokens for veEXTRA up to a duration of 1 year because, in addition to earning yield, veEXTRA holders unlock:

Staking Yield (Real yield + 30% matched in $EXTRA: More info here.

You've got it! Extra Finance can be a valuable tool if you're looking to amplify your farming yield or take slightly more aggressive positions. If you have any question on the protocol, contact us right below:

Happy farming!

The Optimist Social accounts:

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.