The 🔴🔵Optimistic Newsletter #11

The unique DEFI Newsletter on OP Superchain written by Defi Users for Defi Users

First of all, i’d like to express my thanks to you, for your comments, support, likes on this 🔴🔵Optimistic Journey. Big 👏 to my 4 teammates & all the translators as all this work could not have seen the light without them.

And finally, welcome to the 221 new subscribers to this newsletter, reaching now the milestone of 5,000 fellow readers all around the world🚀🚀

Thanks for reading The 🔴🔵Optimistic Newsletter. Subscribe for free to not miss anything on the OP Superchain.

Click in your preferred language to access the translated document:

Chinese - French - Japanese - Korean - Persian - Russian - Thai - Turkish - Vietnamese

MENU OF THE WEEK

🔴Tech. update: Mainnet Bedrock Upgrade - Accelerating Scalability & DeFi Adoption

Bedrock upgrade is set to be a major milestone for the whole OP Stack (faster, cheaper fees, greater scalability). Planned to be live on June 6, let’s review how this will change Optimism.

🔵On-Chain Data: OP token Analysis from IntoTheBlock

IntoTheBlock has released its intelligence market on Optimism. For its 1st article, on-chain analysis was used to analyse the Optimism token on 6 topics: financials, Network, Ownership & Social. We prepared for you all the key points of this article.

🟣Project update: Overtime Markets

Overtimes Martkets is a sports AMM protocol. With several different sports available & now boosted by some OP incentives, sports fans all over the world can now buy a position on their expected winning favorite team and expect earning $. Read the article completely, early readers will be rewarded.

🟢Macro-Analysis: BTC

Bi-weekly update on the Crypto Market. We are getting close to an USD crisis. BTC & ETH are still holding, while alt coins are bleeding. China narratives, since Hong-Kong allows retails to trade crypto, is all over Crypto Twitter. Let’s see where we stand now.

🟤Farming Strategy: DCA on Staked ETH using Mean Finance

Mean Finance is an decentralized application allowing users to DCA-in and out, on-chain, in a non custodial way. What if you could DCA on Liquid Staked Tokens?

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live :

Aori

Mux Protocol

Podcast available at the end of the newsletter.

⚫The Optimistic series Campaign is live - Engage to Earn 30k OP

Questoors, come, engage about #Optimism by completing this series of quests, and earn OP token.

https://www.tideprotocol.xyz/users/spaces/258

Timeline:

Quest #1: 🟢Live - End on 31-July

Quest #2: 🔴Closed - 🔥14 🔴OP earned by every NFT holder! CONGRAT’S! 🪂Airdrop will be done in the coming weeks (setting up the process with Tide3)

Quest #3: 🔴Closed - 🔥25🔴OP earned by every NFT holder! CONGRAT’S! 🪂Airdrop will be done in the coming weeks (setting up the process with Tide3)

Quest #4: 🟡Planned in couple of days. Stay tuned.

Quest #5: 🌽Planned in couple of weeks. Stay tuned.

Quest #6: 🐻You’re not ready for this…

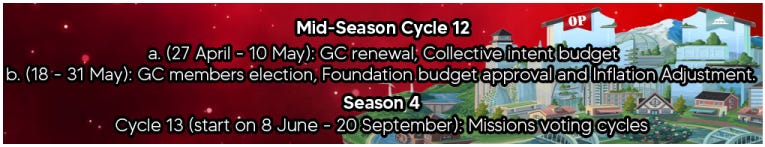

GOVERNANCE TIMELINE

Cycle 12b votes (click on the links below to access the detailed proposals):

Election of Growth & Builder Grant Council members ✅

Treasury appropriation (Year 2 budget voted at 1 OP) ✅

Inflation adjustment proposal (to 0%) ✅

Intent #4 Budget proposal (3m OP) ✅

OP SUPERCHAIN STATUS

🟡Pika Protocol

⚫Worldcoin Worldcoin is building the world’s largest identity and financial network.

Ethos Reserve is the official Sponsor of The🔴🔵Optimistic Newsletter

Ethos Reserve is for me the most simple leverage position available on Optimism. Deposit ETH, wBTC or OP and mint ERN stablecoin with only a fixed fee on your borrowed amount, no more variable interest. Intuitive user interface, secured by 154 auditors, efficient architecture, users can also earn multiple rewards (ERN, OATH, wBTC, ETH, OP).

If you wanna try Ethos Reserve, it’s here:

🔴Tech. Update: Mainnet Bedrock Upgrade - Accelerating Scalability & DeFi Adoption

Introduction

The long-awaited launch of Bedrock on the Optimism network marks a significant milestone in the evolution of decentralized finance (DeFi) and blockchain scalability. With the Bedrock mainnet going live on Optimism, users can expect improved transaction speeds, reduced fees, and increased scalability, fostering a more efficient and user-friendly DeFi ecosystem. This article explores the key features of Bedrock on Optimism and its potential impact on the broader blockchain landscape.

The OP Mainnet upgrade to the Bedrock release

The upcoming OP Mainnet upgrade to the Bedrock release on June 6, 2023, marks a highly anticipated milestone in the evolution of the Bedrock platform. This upgrade introduces a range of significant improvements and features that are expected to enhance the functionality, performance, and user experience of the platform.

The Bedrock release is a complete re-write of an entire rollup stack, and will be the largest upgrade ever released on OP Mainnet.

Enhanced Scalability and Speed

Scalability has been a persistent challenge for blockchain networks, often leading to congestion and high transaction fees. Bedrock, built on top of the Optimism protocol, aims to address these issues by leveraging layer-two technology. By processing transactions off-chain and periodically committing them to the Ethereum mainnet, Bedrock achieves faster transaction speeds and significantly reduces congestion.

Optimism's optimistic rollup technology allows for the aggregation of multiple transactions into a single batch, reducing the load on the Ethereum network. This approach enables Bedrock to handle thousands of transactions per second while maintaining the security and decentralization of the underlying Ethereum network. The result is a seamless and responsive user experience that rivals traditional financial systems.

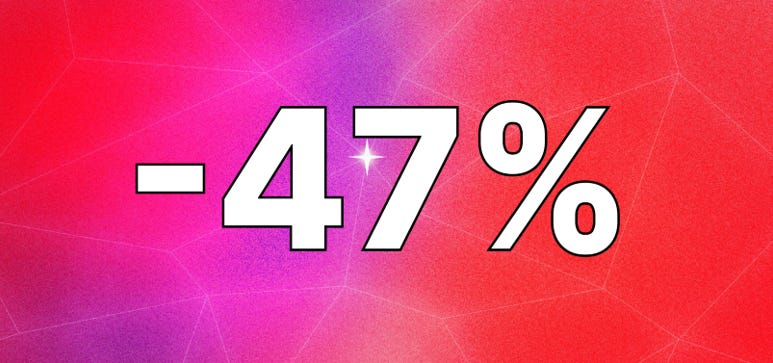

Lower Fees and Improved Accessibility

High gas fees on Ethereum have been a barrier to entry for many users, particularly those engaging with DeFi applications. Bedrock on Optimism offers a solution to this problem by dramatically reducing transaction costs by -47%! With transactions processed off-chain and only the final results posted on Ethereum, users can enjoy significantly lower fees without compromising security.

Lower fees not only make DeFi more accessible to retail users but also attract institutional players seeking to capitalize on the burgeoning DeFi market. The reduced transaction costs unlock new possibilities for decentralized finance (DeFi), enabling users to interact with protocols and smart contracts without being burdened by exorbitant fees. This affordability drives accessibility and inclusivity, attracting both retail users and institutional players to the world of DeFi, and accelerating the growth of the decentralized economy.

Seamless Interoperability

One of the key strengths of Bedrock on Optimism is its interoperability with existing Ethereum-based applications. Bedrock allows developers to seamlessly port their applications from Ethereum to the Optimism network, taking advantage of the increased scalability and reduced fees. This compatibility ensures a smooth transition for existing projects, expanding the reach of decentralized applications (dApps) and fostering a vibrant ecosystem.

The interoperability of Bedrock also opens up possibilities for cross-chain communication and integration with other layer-two solutions. By establishing connections with networks such as Polygon, Arbitrum, and others, Bedrock can further enhance its scalability and interoperability, creating a thriving multi-chain DeFi ecosystem.

Expanding the Frontiers of DeFi

The launch of Bedrock on Optimism brings the decentralized finance revolution to new heights. By combining scalability, efficiency, and interoperability, Bedrock unlocks the true potential of DeFi applications. Users can now experience rapid transaction speeds, low fees, and seamless interactions with a wide range of DeFi protocols.

This enhanced user experience and improved accessibility are poised to drive DeFi adoption to unprecedented levels. As Bedrock reduces entry barriers, traditional financial institutions, retail users, and new market entrants are enticed to explore the immense opportunities and advantages offered by DeFi.

Conclusion

The launch of Bedrock on the Optimism network represents a significant leap forward for DeFi scalability and adoption. By leveraging Optimism's layer-two technology, Bedrock offers enhanced transaction speeds, reduced fees, and improved interoperability, making DeFi more accessible and user-friendly, like Polynomial has stated recently:

As blockchain technology continues to evolve, solutions like Bedrock pave the way for a decentralized and inclusive financial future. With its launch, Bedrock brings us one step closer to achieving the full potential of DeFi on a global scale.

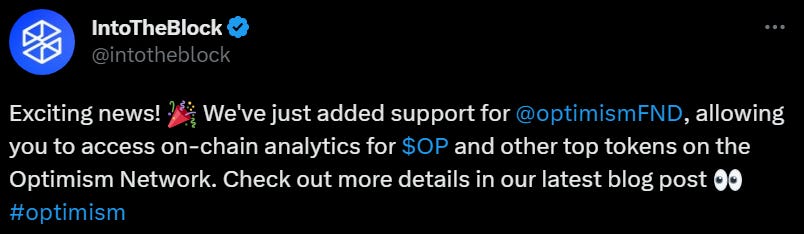

🔵On-Chain Data: OP Analysis from IntoTheBlock

IntoTheBlock is a market intelligence platform created in 2019, for crypto assets completely based on machine learning. IntoTheBlock recently added Optimism mainnet into his on-chain analysis.

They made a first research article about the OP Token. After studying this report, we collected the key points for you. IntoTheBlock research tool gives insights on 6 topics, let’s get into it! Keep in mind that the analysis was updated with today OP price at 1.56$, analysis done on 29-May.

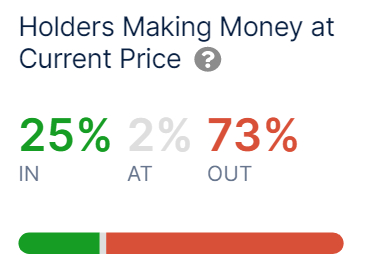

Optimism Financials:

At this price, only 25% of the holders are in profit. Keep in mind that on 31-May, there is a big unlock from contributors and investors that will more than double the circulating supply. Check the newsletter #4 for more info about the OP tokenomics.

Network analysis:

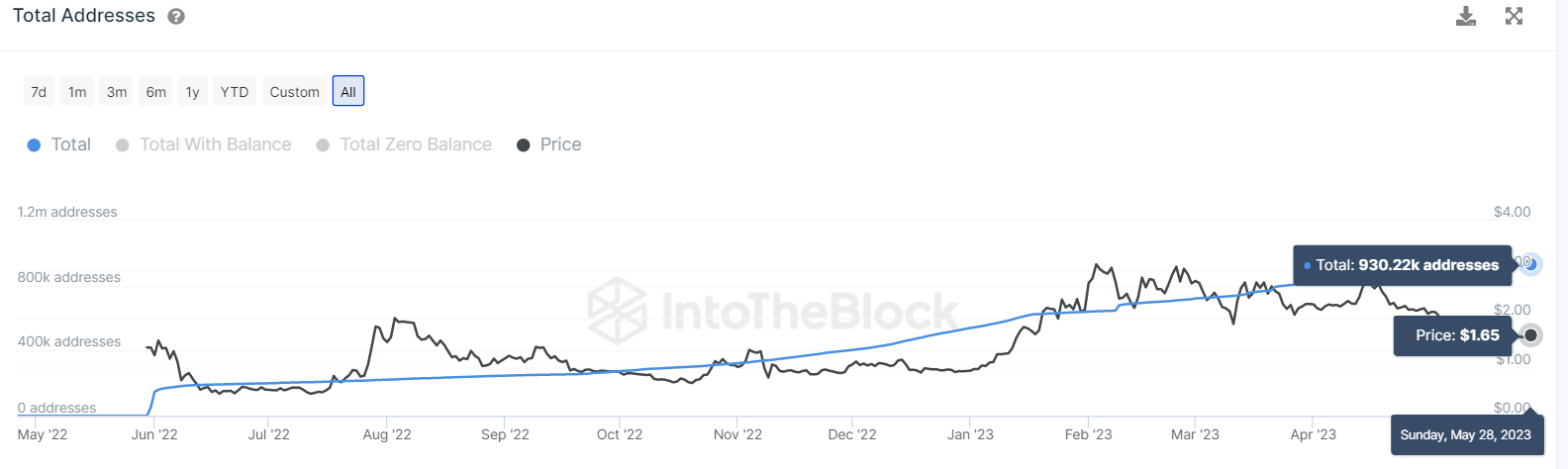

The total number of addresses has continuously and steadily increased (around 75k new adresses per month) and at a faster pace between end of 2022 and beginning of 2023 which coincides with the end of the optimism quests we are pretty sure you’ve been doign to farm Airdrop #2.

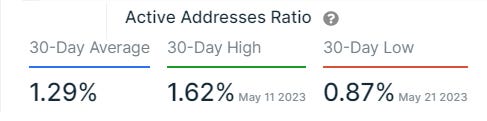

However, this metrics does not represent the activity level on-chain. We should have a look at the number of active users. The report states that on the average 1.29% of the total wallets are active every day, which is about 12k users/day.

Ownership

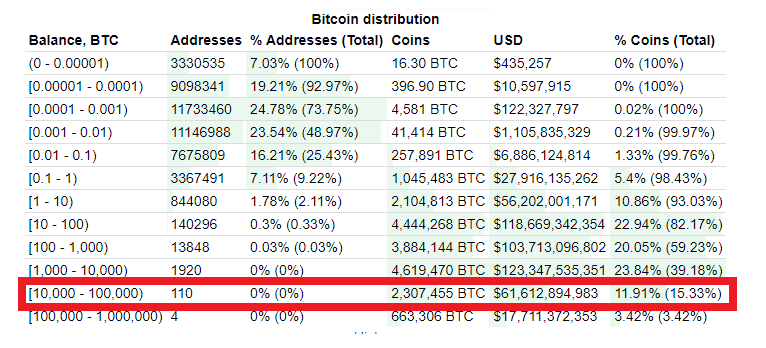

Are you aware of this table categorizing BTC holders?

What if we do the same with OP:

Sit down and read this:

🔥🔥92% of the total supply is held by 49 wallets🔥🔥 That needs more data of course, as it includes the Optimism Foundation holdings. Let’s use now Dexscreener that can show you the distribution of OP Token holders:

At least the 3 red-circled addresses are the ones belonging to the OP Foundation. The sum of OP tokens hold by the wallets highlited in yellow could be Early Investors or Sugar Xaddies.

No comment on the investors name!!

Social Stats:

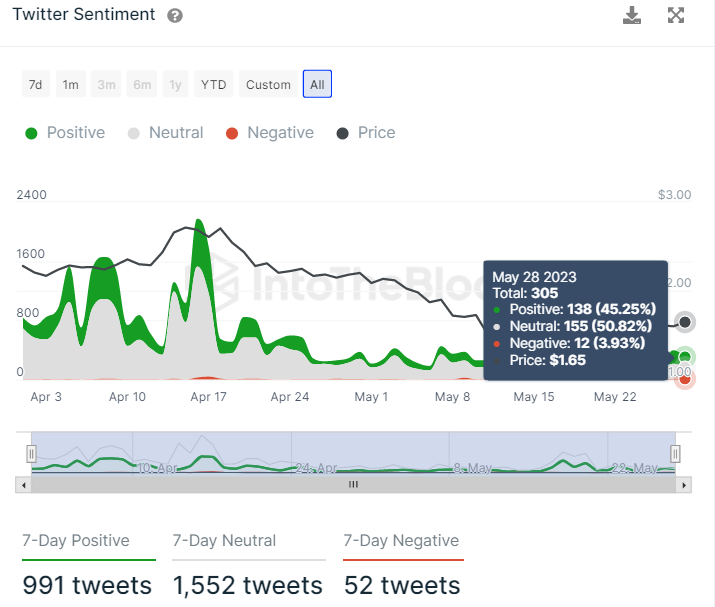

IntoTheBlock allows researchers to access engagement data, and we know how much community engagement is important in terms of Price impact.

Interesting thing to see is that despite being at few days before the unlock, there is a very low negative sentiment about OP token. My own conclusion is that the dynamic of the ecosystem, and not only in DEFI, is impacting positively users, retails attention.

And for the large private holders, please keep in mind that approx 38m OP tokens have been delegated for voting. Most of them are held by delegates, but retails also keep them in view of future airdrop eligibility.

Final words:

We would like to thank IntoTheBlock for having answered some of our questions, and we invite any nerdy to have a look at their website:

🟣Project update: Overtime Markets

Hey there, folks! Welcome to a new article on the Optimism Newsletter, today we've got something special to talk about: Overtime Markets!

But what sets Overtime Markets apart? They bring the world of sports and predictions together! Built on Thales Protocol and using their contracts as inspiration for this new Sports AMM, this opens up endless opportunities for sports enthusiasts!

So, get ready to dive deep into the fascinating world of Overtime Markets.

What is Overtime Markets ?

Overtime Markets is a decentralized prediction market that is specially designed for sports events. Using Thales Protocol technology, that allows you to trade binary options on chain.

Want to take a shot at guessing the outcome of a match? Go for it! Feel like predicting the total score? You're in the right place! And hey, if you're bold enough, you can even speculate on how individual players will perform. Talk about an adrenaline-packed environment for all you sports enthusiasts out there!

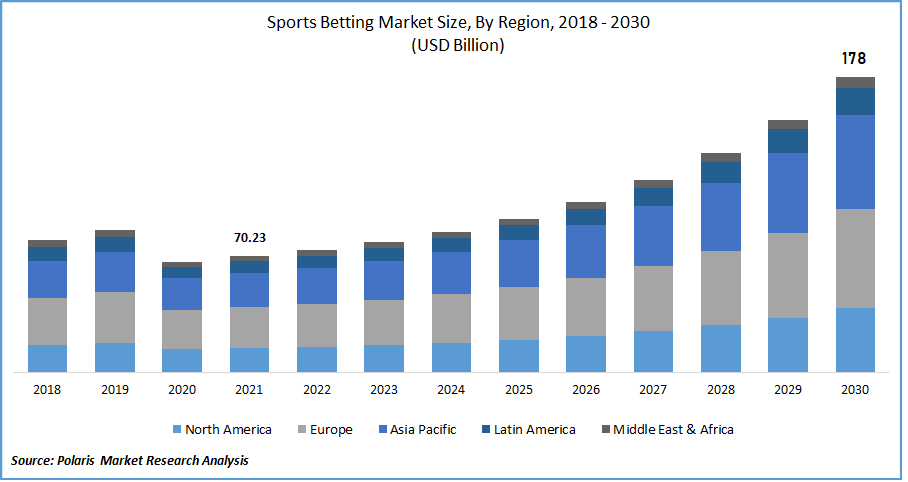

Altough Overtime is not a betting protocol, we couldn’t resist to dig into the tradfi worlwide Sports betting markets by 2030, data taken from Polaris Market Research (click on the picture below to access the full report). So predictions estimated Market Size to be at 178b$ in 2030. For info, Thales Market Cap is 21m$.

Now that you know what Overtime Markets is about, let’s see how it works!

How Do Overtime Markets Work?

Overtime Markets uses an automated market maker (AMM) mechanism to facilitate trading. Unlike traditional order book exchanges, which rely on matching buy and sell orders, AMMs use liquidity pools and algorithms to determine prices. In the case of Overtime Markets, these pools are focused on sports events.

You can participate in the Overtime Markets ecosystem by providing liquidity to the pools and trading binary options. For example, if you believe ‘’Team A’’ will win a basketball game over ‘’Team B’’, you can purchase binary options that represent this outcome. The prices of these options are determined by the supply and demand dynamics within the liquidity pool.

But what are the benefits of using Overtime Markets ?

Accessibility: Overtime Markets provide a decentralized and inclusive platform, allowing users from all around the world to engage in sports prediction markets without the need for intermediaries.

Transparency: Built using the blockchain technology, Overtime Markets offers transparency and immutability. All transactions and trades are recorded on the blockchain, ensuring that the outcomes and payouts are verifiable.

Liquidity: The AMM model ensures continuous liquidity, as participants trade directly against the liquidity pool. This allows for seamless trading and reduces the reliance on order book depth.

Diverse Trading Options: Overtime Markets offer a wide range of binary options for various sports events. You can choose from different markets, including match outcomes, scores, player performance, and more, providing an engaging experience for sports enthusiasts.

🔴Incentives: Overtime is ready to reward traders for getting in on the big games. NBA, NHL Playoffs, Roland Garros markets on Overtime are currently being incentivized based on the volume each trader generates. There is also a Bi-Weekly Parlay Competition with the top 10 quoted parlays earning the trader a portion of the total incentives. But that’s not all! 90% of trading fees incurred on Optimism will be paid back to traders as OP & THALES rewards.

Complete tutorial:

If you want a complete tutorial of Overtime Markets you can check this video clicking here. For more videos about Thales Protocol and Overtime Markets check their youtube channel.

Final words:

Overtime Market is for us a true innovation in DEFI, and we all know how much Sports is important all around the world. Overtime Markets is the best example of what could define DEFI or Decentralized Finance: Non custodial, No-KYC, Accessible by anyone and with any portfolio size, Low fees.

And since we love so much the team behind, we are so glad to offer 10x 5$ vouchers to the 1st ten wallets who answer the below question.

Question: How many sports Overtime offer ?

Reply: Send a DM + your wallet addres to Subli

Macro Highlights:

The US Government approves to increase debt ceiling & thus avoiding USA to be in Financial Default (@GRDecter):

🟢Macro-Analysis: BTC

BTC has barely moved since our last market review, and we are still in a correction with very low volatility.

DXY

The DXY is currently continuing its upward movement, as mentioned in the latest newsletter.

With a bearish divergence on the weekly and daily RSI approaching the 70 level, it could soon reach a rejection zone. Historically, this zone has often acted as resistance for the DXY. After this retracement, a new downward impulse could occur, potentially driving risk assets like the cryptocurrency market higher.

BTC

The correction of BTC is still ongoing, as it has hardly moved since our last market review.

The appearance of an initial daily divergence on the RSI indicates that the selling pressure is starting to weaken. A rebound may occur, but it may not necessarily mark the start of the bullish impulse, as the significant liquidity zones mentioned in the previous newsletter have not been revisited yet. In daily Bitcoin is currently forming a flag pattern, which is a continuation pattern in a bull market.

The direction of BTC has not changed for now; as long as it remains in this range, it is still undergoing a correction from its last impulse. Once this correction is completed, we can expect a new impulse that could reach its 2023 highs.

3 CME gaps still need to be filled. For more details, we invite you to refer to newsletter 5.

The interesting price levels to watch are therefore $35,000, $27,200, and $20,400.

Regarding altcoins, as explained in previous newsletters, Bitcoin remains the king. We will have to wait for Bitcoin to show signs of strength before we see altcoins rising again. The BTC.D ticker (Bitcoin dominance over altcoins) is consolidating and waiting for Bitcoin to make a decision. We will then determine if it is interesting to allocate to altcoins. Nevertheless, a general correction of more than 50% has already occurred, and prices are at attractive levels for those who want to dollar-cost average (DCA) into their favorite projects.

Psychology of a Trader:

What is a trader? A trader is an individual who develops price movement scenarios, taking into account various factors such as market analysis or the historical performance of an asset over time, in order to profit from the market. We use the term "play" because losses are part of a trader's daily routine.

It is important to be aware that traders compete against more experienced individuals, powerful investment funds, governments (regulation), and even themselves. Over a 10-year period, less than 5% of the mentioned individuals actually achieve consistent profits in financial markets.

If you aspire to be one of those winning traders, it will require discipline and a long-term approach, as well as education on the psychology of trading. We recommend educating yourself on the psychological aspect of trading, for example, through books like "TRADING IN THE ZONE" by Mark Douglas.

Twitter can be misleading during uncertain market times. Those who have been in the market long enough know that even the best traders have made mistakes. You will often see people sharing their unrealized profits, but they won't share their losses. Some top traders have lost their entire portfolios in a matter of weeks or even days by not adhering to risk management or the rules they had followed for a long time.

It is often advised for retail investors to avoid trading and instead focus on long-term investing. Alternatively, it is preferable to have one investment portfolio and a separate trading portfolio to allocate funds. Until you have developed a reliable technique that suits you and consistently generates profits over the long term, this approach is recommended.

Conclusion

The market is neither bullish nor bearish; it needs to breathe after its last impulse. It is possible that we could touch $25,000 while remaining within the daily bullish flag, and then resume the uptrend. This is the trading scenario we are monitoring. However, we should be ready to change our perspective if the market decides otherwise.

Trading: We will continue to observe price action and try to take advantage of the next bullish wave while avoiding excessive greed and taking profits if BTC returns to $31,000.

Investment: It is preferable to wait for Bitcoin to drop below $25,000 to continue gradual investment (DCA). Altcoins are at attractive valuation levels.

🟤Farming Strategy: DCA on Staked ETH using Mean Finance

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

So you and we are bullish on Ethereum, of course, no question about it. But, if you wanna buy ETH, why not buying Staked ETH that includes the staking yield (around 4-7% APR).

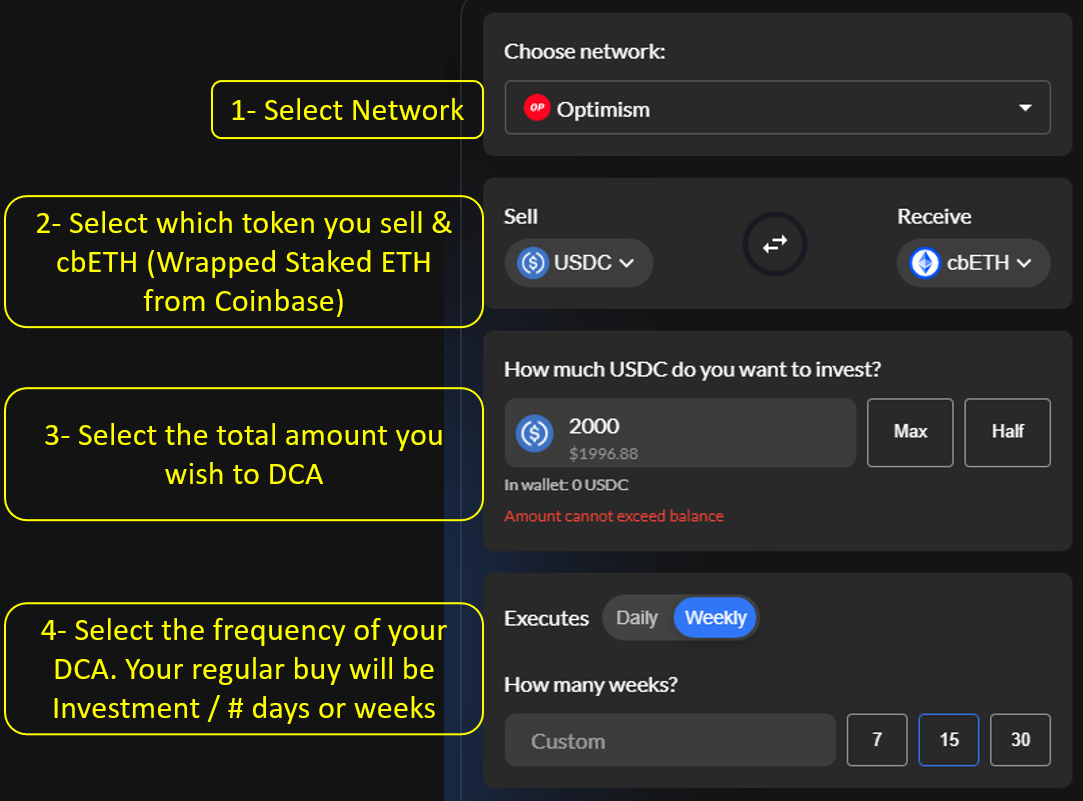

Coinbase launched recently their Liquid Staked Token cbETH (around 4% APR). ANd now, Mean Finance allows anyone to DCA on cbETH.

Just go to Mean Finance website: https://mean.finance/create/10/0xaddb6a0412de1ba0f936dcaeb8aaa24578dcf3b2/

And follow these steps.

If you prefer the Staked ETH from Lido FInance, you just have to select the wstETH in the Receive token list.

I love when DEFI is simple as 1, 2, 3.

🟠Podcast:

Aori

Mux Protocol

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of some of the podcasts. Access granted to Revelo members.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

Subli_Defi Social accounts:

Discord Handle: Subli#0257

Twitter: Subli_Defi

Lenster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

—————————————————————————————Disclaimer————————————————————————————

Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.

———————————————————————————————————————————————————————————————————

great

Nice