The 🔴🔵Optimistic Newsletter #13

The unique DEFI Newsletter on OP Superchain written by Defi Users for Defi Users

First of all, i’d like to express my thanks to you, for your comments, support, likes on this 🔴🔵Optimistic Journey. Big 👏 to my 4 teammates & all the translators as all this work could not have seen the light without them.

And finally, welcome to the 1,045 new subscribers to this newsletter.🚀🚀

Thanks for reading The 🔴🔵Optimistic Newsletter. Subscribe for free to not miss anything on the OP Superchain.

Click in your preferred language to access the translated document:

Chinese - Filipino - French - Japanese - Korean - Persian - Russian - Spanish - Thai - Turkish - Vietnamese

TOPICS OF THE WEEK

🔴Optimism: Co-Granting

Co-Granting provided by Syndicate protocol has been launched & is available for Season 4. All you need to know is here: explanation + tutorial. Might be worth doing this to attest to your positive contribution on-chain… Read me twice…🪂

🟣Project Review : Aevo Mainnet Launch

Aevo, an orderbook options protocol, recently announced its mainnet launch on its own APP Chain, built on the OP Stack, and the least we can say is that metrics don’t lie.

🟡opBNB versus 🔵Base

Binance just announced building its new L2 based on the OP Stack. Yes it’s bullish for Optimism, but maybe not the way you think. We have detailed this for you in this article.

🟢Crypto market review & Learning tips

Bi-weekly update on the Crypto Market + we added this time a learning section for you traders.

🟤Farming Strategy: Where to Farm your OP Token

Best places to farm your OP token in a single deposit vault (i.e with no Impermanent Loss), with a little surprise for the most loyal readers! 🪂

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live :

Lifi

Podcasts available at the end of the newsletter.

Spotlight project: Ethos Reserve

Ethos Reserve is an official Sponsor of The🔴🔵Optimistic Newsletter

Ethos Reserve is for me the most simple leverage position available on Optimism. Deposit ETH, wBTC or OP and mint ERN stablecoin with only a fixed fee on your borrowed amount, no more variable interest.

Ethos Reserve has sett up new partnerships to increase ERN usage. The most significant one is with Axelar, who will provide bridges solution for ERN. ERN is now available on Arbitrum on different DEXes (@RamsesExchange; @ChronosFi_; @GainsNetwork_io).

If you wanna try Ethos Reserve, it’s just here: https://ethos.finance/

⚫The Optimistic series Campaign is live - Engage to Earn 30k OP

Questoors, come, engage about #Optimism by completing this series of quests, and earn OP token.

https://www.tideprotocol.xyz/users/spaces/258

Timeline:

Quest #1: 🟢Live - End on 31-July

Quest #2: 🔴Closed - 🔥14 🔴OP earned by every NFT holder! CONGRAT’S! 🪂

Quest #3: 🔴Closed - 🔥25🔴OP earned by every NFT holder! CONGRAT’S! 🪂

Quest #4: 🟢Live / End of submission: 02-July. NFT mint due date: 05-July

Quest #5: 🌽Planned to start on 7t

Quest #6: 🐻You’re not ready for this…

GOVERNANCE TIMELINE

Cycle 13 : Started, application for grants closed on 22-June, with 115 proposals. Missions proposals are also closed since 28-June.

Season 4 just started on June 8 for a 15 weeks governance period which will include 3 different cycles (13, 14 & 15).

Spotlight Project: Overtime

Overtime Markets is an official Sponsor of The🔴🔵Optimistic Newsletter

Are you an ardent sports and crypto enthusiast? Here's a platform you need to check out: Overtime. As your premier web3 sportsbook, Overtime is leveraging blockchain technology to bring transparency, innovation, and security to the sports markets world. Their integration with Chainlink ensures data integrity while offering the sharpest odds in the industry.

Whether you're a seasoned sports trader or a newcomer looking for a fresh experience, Overtime is your go-to platform.

Trade your favorite team here => Overtime Webpage

🔴Optimism Co-Granting

We would like to remind you that The Optimism Collective, in collaboration with Syndicate, announced on June 1 the launch of co-granting in Season 4.

Note post release: The co-granting program ended on June-28 for season 4. So watch out for the next one.

And what does this mean for us?

This new initiative allows individuals to actively support the work carried out by the Optimism Grants Council and create an on-chain record of their contributions to the Collective. Co-granting offers an opportunity to provide upfront capital to builders working on novel use cases, reinforcing the mission to bootstrap a profitable market for public goods. In return, co-grantors will receive an NFT (non-fungible token) and an Optimism Attestation, recognizing their support and impact within the community.

What is Co-Granting?

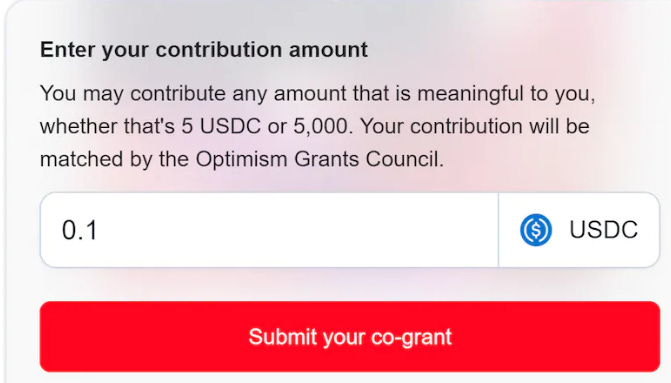

Co-granting enables individuals to contribute USDC (USD Coin) to "match" the builders' grants awarded by the Optimism Grants Council. By participating, co-grantors provide upfront capital to important grant applications, particularly those focused on innovating novel use cases. The co-grant proceeds are directed to the matching contract, and distributions are executed based on decisions made by the Grants Council during Season 4.

Benefits of Co-Granting

Co-granting plays a crucial role in supporting the Collective and its goals. By providing upfront capital to builders, it helps overcome barriers faced by teams that require immediate access to capital. Promising grants, particularly those exploring novel use cases, benefit significantly from this type of support. Additionally, co-grantors receive a co-grantor NFT and an Optimism Attestation, signifying their commitment and impact within the Optimism Grants Council community.

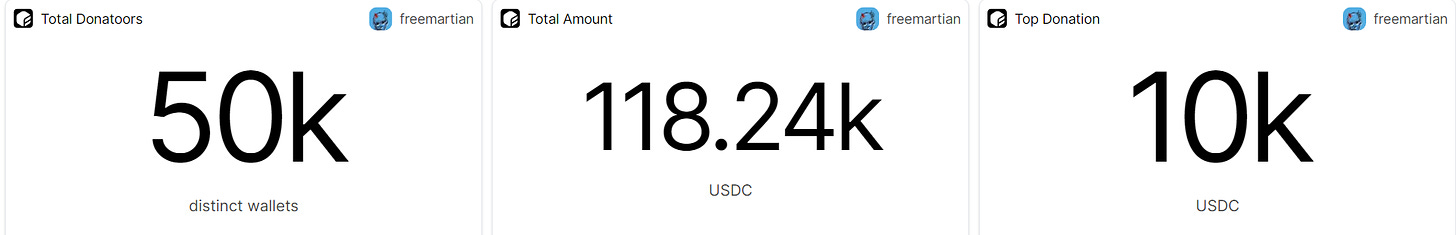

In less than a month, users have contributed more than 117k USDC!

Look at these statistics!

Already 50k wallets have taken part in Co-granting

Total amount - 118k USDC

Top Donation - 10k USDC

*the data is current as of 06/24/2023

You can always find up-to-date statistics by following the link

The Role of the Grants Council

The Grants Council manages the Governance Fund grants program and consists of nine elected community members. Their responsibility includes evaluating and selecting grant recipients based on their proposals' merit and alignment with the Collective's vision. The grants made by the Grants Council are in the form of OP tokens, which are locked for a period of one year, ensuring long-term incentive alignment between grant recipients and the Collective.

How Co-Grants Work: A Step-by-Step Explanation

Enter the amount you want to contribute: To participate in co-granting, simply specify the desired amount you wish to co-grant. Once you've decided on the contribution, submit it. Your co-grant proceeds will be directed straight to the matching contract, ensuring that your support reaches the intended recipients. During the initial version (v1), the distributions from the matching contract will align with the decisions made by the Grants Council.

Distribution during Season 4: As the Grants Council selects and awards grants, your co-grant will be distributed in a similar manner. This distribution process continues until Season 4 concludes, which is tentatively set for September 20th. By aligning your co-grant with the Grants Council's decisions, you actively contribute to the development of the projects and initiatives supported by the Collective.

Receive recognition for your support: As a co-grantor with the Optimism Grants Council, you will receive two tokens of appreciation. First, you will receive a co-grantor NFT, which serves as a unique digital collectible, symbolizing your participation and support within the community. Additionally, you will receive an Optimism Attestation, further affirming your role and impact in contributing to the Collective's mission. These tokens provide tangible proof of your involvement and showcase your commitment to driving positive change.

Frequently Asked Questions (FAQ):

What is the Grants Council? The Grants Council oversees the Governance Fund grants program and comprises elected community members.

Can I contribute assets other than USDC? Currently, only USDC contributions are accepted in Season 4, but future versions may expand the options.

Can I withdraw or edit the amount of my funds after depositing? In Season 4, fund withdrawals or edits are not permitted.

What happens to remaining funds in the matching contract at the end of Season 4? Any remaining funds will be returned to the Governance Fund to support grants in future seasons.

Will my contribution will be returned afterwards? No, co-granting is not like an investment, and you will not get any return on your contribution

Co-granting offers a unique opportunity for individuals to contribute to the Optimism Grants Council, supporting innovative projects and helping to create a profitable market for public goods. By participating, co-grantors receive an NFT and an Optimism Attestation, providing an on-chain record of their contributions and impact within the Optimism Collective.

To learn more and participate in co-granting, visit this website:

Remember that all your activity and especially this one could be an eligibility criteria for future OP token airdrop ;) 🪂 (100% speculation)

Stay 🔴Optimistic!

The OP Superchain widens: ZORA, a NFT-Focused L2 network joins the OP Superchain

Interesting links:

Dune Dashboard by PandaJackson: https://dune.com/pandajackson42/zora-network

Airdrop hunting by CryptoSnooper: https://twitter.com/CryptoSnooper_/status/1671698591319232513?s=20

Zora webpage: https://zora.co/

🟣Project Review : Aevo Mainnet Launch

First of all, Aevo is a project incubated by the Ribbon Finance team, with the aim to build an Decentralized Application (DApp) towards pure traders and not only yield farmers. Aevo launched its Aevo Chain mainnet on June-14 revealing the full suite of trading products to traders.

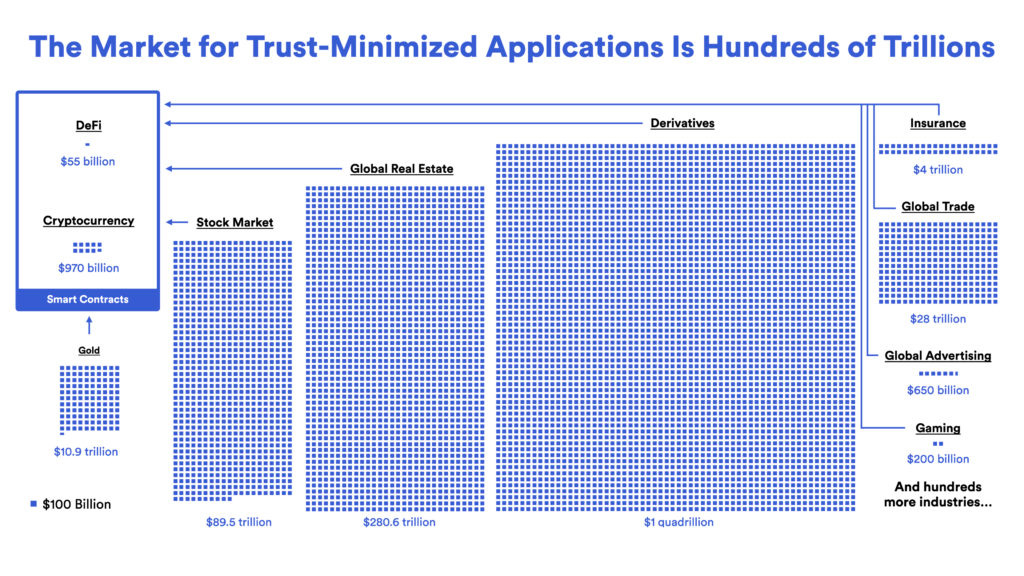

We have already been covering intensively the Derivatives market which include Perps (Perpetual trading protocol) and Options. Derivatives are well-known financial products used in Traditional Finance, where option volume has surpassed spot volume in recent years.

But Derivatives in Defi (especially Options) is currently not scaled as in Tradfi. Look at what Chainlink did as comparisoon back in Nov-22:

The derivatives market in Tradfi is a 1,000,000 Billions$ Market cap, while in DEFI, according to DefiLlama, the Derivatives market is a 1.3b$ MC size. Do you see the growth opportunity?

Typical Options protocol suffer from Scalability, Impermanent Loss for Liquidity Providers, and capital inefficiency due to partial collateralization. So why Aevo tends to revolutionize the Options market?

1. Order Book

Aevo is offering a Full Pro-Trader User Experience thanks to an Order Book, like you can find on CEXes. In terms of UX, Aevo provides:

100+ instruments, with many strikes and expiries → Capital efficiency

Deep liquidity, by partnering with the best options trading firms in the world → Scalability

Instant onboarding, deposit USDC from any EVM-chain → Seamless experience

2. APP Chain built on the OP Stack

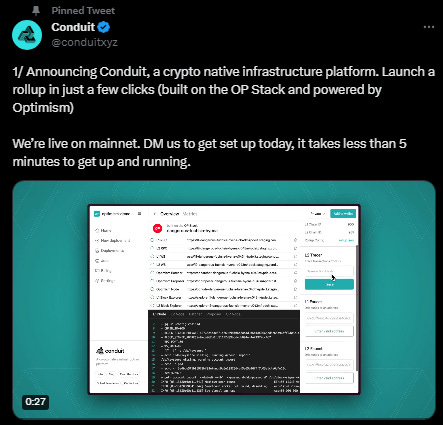

Aevo Exchange is built on Aevo Chain, an optimistic roll-up to Ethereum that runs on the OP Stack.

⚡ High performance orderbooks, matching engine, and risk engine

⛓Built on Aevo Chain, an optimistic roll-up to Ethereum that runs on the OP Stack

🌊Liquid options markets across expiries

🚀Instant bridging into Aevo Chain, and fast withdrawal times

How can users deposit $USDC on Aevo App, running on the Aevo chain?

Aevo APP Chain is operated by Conduit, and the chain used $ETH to pay for Gas Fees.

Interesting things for traders, is that setting or cancelling order is gasless, versus to settle trading position, deposit/withdraw funds. And remember, thanks to Bedrock upgrade, fees have been considerably lowered making OP stack chain the lowest L2 in fees.

3. Protocols made for PRO-Traders

Aevo tends to be the Home of derivatives trading. During the gated testnet, they have released the following products:

ETH Options & Perps trading

Aevo OTC: Allowing users to trade altcoin options on-chain (currently 14 altcoins referenced)

BTC Options & Perps trading

Fees are also one of the lowest you can find & are competing with Kwenta, well known to be the cheapest platform for trading.

Trading fee: 0.05%/0.08% of the notional volume for BTC & ETH

Leverage: x20

Mochi just tested the platform, and found it very smooth. Check his feedback

4. Metrics don’t lie

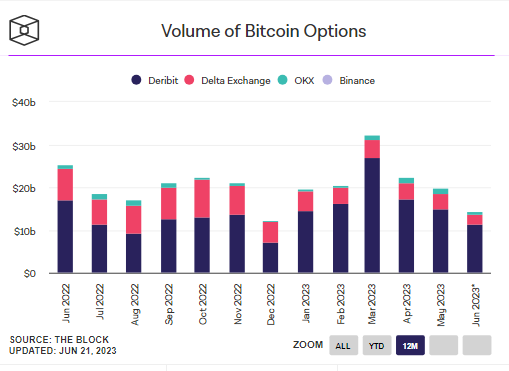

Aevo is set to be a direct competitor to Deribit and the various Perps protocols for BTC and ETH at first, and also providing a solution for Alt Coin options, which is a brand new product not yet available in DEFI.

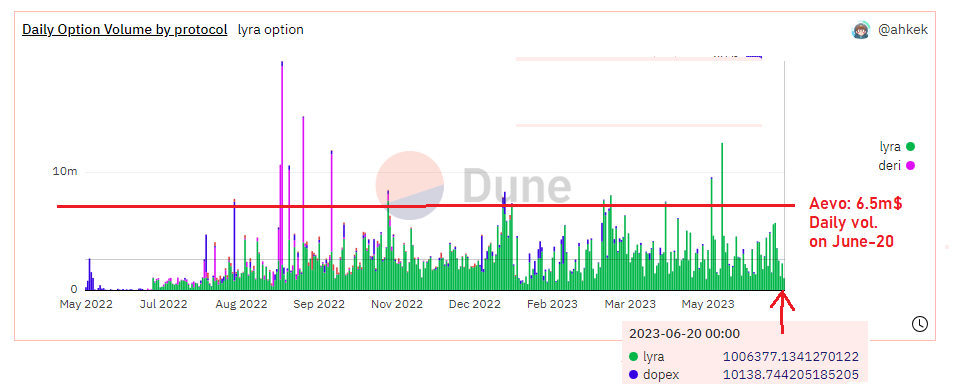

On June-20, Aevo did experience a new ATH of options trading volume:

And if you compare to other options protocol, thanks to Impossible Finance for this dashboard:

Just to compare, the monthly options trading volume on Centralized Exchanged is 20b$, so approx 650m$/day.ETH trading volume is approx the same on CEX, so Aevo represents only 0.05% of off-chain trading volume. Bullish?

5. Conclusion

So for traders, have a look at Aevo on https://www.aevo.xyz/ and keep an eye on their growth. Seems to be pretty interesting.

And there is an on-going trading competition that ends on July 5. Check this out:

New project just launched on Optimism: CIAN

CIAN is a yield optimizer focused on LST (Liquid Staking Tokens), who offer user automated strategy to maximize their yield on various stakedETH and various yields offered by DEXes and Lending protocols.

Check this out: https://vault.cian.app/vaults

🟡opBNB Versus 🔵Base

After Coinbase, it is the turn of the BNB Chain to take place in the race for the best layer 2 chain EVM compatible, by formalizing the release of “opBNB” based on the Optimism OP Stack 🔴

OpBNB, aims to improve the performance and scalability of the BNB Chain network. High Performance, Secure and Low Cost = opBNB

Why does the BNB Chain need a new L2?

As we all know, layer 1 networks like the BNB Chain or Ethereum, are constantly undergoing what is called “the DEFI of network congestion”

For example, when a popular project carries out a promotional campaign, attendance becomes so high that the network quickly becomes congested, which leads to significant disruptions such as transaction delays or higher-than-average transaction fees, which is a real problem.

To overcome this, Layer 1 networks must constantly improve their scalability, i.e. their ability to handle more transactions per second without compromising security.

opBNB, solves these problems by providing a fast, secure and inexpensive solution for developers and users.

OpBNB vs Base = Binance vs Coinbase

The competition between the 2 exchange platforms, becomes more and more palpable as we advance in time (to the delight of users).

It was therefore obvious to see Binance respond to the announcement of Coinbase’s new product. Each wants to surpass the other, to be the “BEST”.

But WHO will win the final victory? The answer in a future episode

The strength of the OP Stack

As stated at the beginning of the article, opBNB is based on the OP Stack.

The OP Stack is a framework for building scalable and interoperable layer-2 solutions based on the utility, simplicity and extensibility principles.

By choosing OP Stack, opBNB has access to many advantages, such as:

Modularized frameworks

An open and collaborative ecosystem

Contributing to the optimism of OP Stack

Using this stack simplifies the process for EVM developers to move their applications to BSC, which could help them reach even more users.

But, there were a lot of confusions recently made on Twitter content, saying that opBNB is bullish for the OP Token. Actually, it’s a NO, NO, & NO!

opBNB is built on the opSTACK, but does not take part of the Optimism Superchain. But, since we are all here for the TECH:

We should see it like this:

The OP Stack is an open source Public Good product

Everyone who builds on the OP Stack increase the performance of this framework

Instead of having 1 team like on Polygon or Arbitrum, you have now dozens of well financed & staffed teams contributing to the OP Stack

The power of Optimistic Rollups

Optimistic rollups also drastically reduce the computational load on the main chain by executing off-chain transactions and publishing only transaction data on the main chain.

This approach greatly improves scalability by grouping multiple transactions together before submitting them to the main chain.

Validity of transactions (Security)

In order to preserve both efficiency and transparency, opBNB adopts an ingenious fraud proof system to ensure the validity of transactions.

Anyone can dispute the results of a cumulative transaction by calculating anti-fraud evidence and, if successful, the transaction(s) will be reexecuted, preserving the integrity of the network.

Improved scalability

These new dedicated features, allow opBNB to handle more than 4000 transfer transactions every second while keeping the average cost of a transaction below $0.005 with a gas limit of up to 100M. Impressive!

OpBNB: Testnet is LIVE

The opBNB Testnet was launched on June 19. Testnet validators and dApp constructors were invited to try the testnet and provide feedback.

Some useful links

Testnet Link: opBNB: A high-performance optimistic layer-2 solution for BNB Smart Chain (bnbchain.org)

Article source 1 (BNB Chain): opBNB: High Performance and Low Cost L2 based on Optimism OP Stack (bnbchain.org)

Article source 2 (Testnet): Introducing opBNB: Unleashing a New Era of Scalability (bnbchain.org)

🟢Crypto market review & Learning Tips

Crypto Market Review

Disclaimer: We will no longer provide specific analysis on a cryptocurrency as we had previously offered on $OP. There are numerous educational contents available on the internet, YouTube, or Twitter that will provide you with all the necessary basics.

However, we believe that the most important thing is for each individual to find their own trading/investment style rather than replicating what we do. Trading goes beyond technical analysis; it also involves market psychology, portfolio management, risk management, emotional management, as well as trade execution. The goal of this newsletter is for the Optimism Community to draw inspiration and enhance your skills alongside us.

If you have been following the previous newsletters, you should be doing very well. Indeed, we were anticipating a breakout to the upside. Let's take a look at it together.

Bitcoin

As we expected, we saw a market rebound up to $31,500. Our plan was clear and therefore executed: we took profits on our positions when Bitcoin reached $31,000.

Bullish signals: We can observe that the price of Bitcoin is within a range between $25,000 and $31,000. The bullish trendline, indicated in green, remains intact. Additionally, there is a breakout of the bearish trendline on the RSI, represented in red.

Bearish signals: The breakout to the upside of the bullish flag lacks volume, represented in violet on the above chart.

DXY

No significant changes have occurred since the previous newsletter. The DXY index is currently in a no-trade zone, indicating a lack of clear direction. We are awaiting a decision, either an upward or downward move, which will have an inversely proportional impact on the crypto market.

CME

The CME gap at $26,300 has been filled. Since the previous newsletter, we have not witnessed any new gaps. As a reminder, the remaining open gaps are at $20,000 and $35,000.

Altcoin

The TOTAL3 ticker on TV is currently in an accumulation range between $300 billion and $410 billion. Additionally, the trendline on the RSI is being maintained. The longer the accumulation phase, the more likely it is to result in an impulsive movement.

This phase can be beneficial for accumulating your favorite altcoins. It is always a good idea to diversify your portfolio because history has taught us that even the most promising projects can disappear overnight.

Our next plan

So, we have bullish signals on Bitcoin. However, the lack of volume may hinder an easy breakthrough of the $31,000 level. We believe that Bitcoin needs to consolidate before reaching higher levels, which would provide an opportunity to reload our positions.

If the price of Bitcoin surpasses the $31,000 to $31,500 range, we will reenter the market. On the other hand, if the price of Bitcoin breaks the bullish trendline on the daily chart, we will need to exit the market and reassess our trading plan within the framework of our risk management..

Learning Tips

Previous newsletters

We have covered several important topics that some traders only discover after several years of trading, often after experiencing significant losses. We have discussed subjects that can be complex but should not be underestimated. It is now up to you to delve deeper into these topics or provide feedback if you would like further explanations.

Below is a list of the important subjects discussed in the previous newsletters:

How to take position

Here, we will go through the main questions to answer before taking a trade. We are specifically referring to a trade and not an investment.

When it comes to investment, it is important to buy a position gradually and average the cost over time, commonly known as Dollar Cost Averaging (DCA). Thus, a price drop should be seen as an opportunity. Warren Buffet, considered the world's greatest investor, has experienced negative returns of up to -50% on his positions for several years before seeing the stock price take off.

The goal of trading is to grow our portfolio. We must carefully calculate our risk before entering a position and always keep the portfolio's growth in mind.

What is the entry price?

What is my stop-loss?

What is the target price at which I will sell the majority of my position?

What is the trade's duration?

What risk am I willing to take on this position?

Concrete Example on OP/USDC:

First thing first, let’s go back to the chart:

If I have $10,000 in my trading portfolio, I am willing to lose 2%, which amounts to $200. To calculate the number of tokens to buy:

Entry price - Stop-loss price = $1.10 - $1.02 = $0.08 loss per token.

So, to calculate the number of tokens: $200 / $0.08 = 2500 tokens.

Therefore, I can buy 2500 tokens at $1.10, and I risk 2% of my portfolio if my stop-loss is reached.

Spreading by buy into 4 orders, I can buy 625 tokens per order.

We hope you took pleasure to read this new education series on trading & investment.

🟤Farming Strategy: Where to Farm your OP Token

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

This is the most common question found on the Optimism Discord:

Why so many question? Simple answer: OP airdrop #2 rewarded people who didn’t dump their Airdrop #1 rewards, so users speculate the same could happen for the future Airdrops

So here we are showing you how to earn a passive yield, with a minimal risk on your OP, while still being able to have it for voting, which was also a criteria for Airdrop #2 eligibility.

Mind that the OP tokens MUST be in your wallet during the snapshot at the start of the cycle. You can find the relevant dates at the top of this newsletter in GOVERNANCE TIMELINE section.

Here are the best places to single farm your OP token:

1. Check DefiLlama website & use the below filters:

Chain: Optimism

Token: OP

Attribute: Single exposure

Here is an extract of the 10 best pools in terms of APY, with a record on Tarot lending pool.

Just click on the arrow poiting upwards next to the # of the strategy to access the official webpage of the vaults.

Note: Vaults on Premia are Options vaults, so bring an additional layer of complexity compared to the other vaults.

2. Perpetual Protocol

We already covered Hot Tubs vault from perpetual protocol in The🔴🔵Optimistic Newsletter #5. Have a look to understand how it works.

TL;DR: It’s a single deposit vault, where your asset is used on a delta neutral strategy while benefiting from arbitrage between Perps protocol & DEXes on Optimism.

Mid-June, Perpetual Protocol announced the opening of the OP Hot Tub:

Deposit is limited at 100k tokens as the time of writting for the OP Vault & 115k USDC for the OP-USDC vault (you just have to single deposit USDC in this specific vault). Access Hot tub here: https://vaults.perp.com/

OP vault has a current INSANE yield of 35% since inception, knowing that it will vary a lot depending on the volatility of the market, so we are quite interested to see how this develops over time. Our experience tells us that Capped vault are usually pretty lucrative.

These Hot Tubs are exclusively opened to whitelist only. If you want to sign-up, go here: https://perp.com/hottub-signup

🎉Give Away🎉

But fellow readers, our team cares about you. So we will offer 10x WL on first come first serve with the below rules:

Answer correctly this question: How many Hot Tub vaults Perpetual protocol offer?

Wallet must hold 100 OP as a minimum

To proove your wallet identity, perform a Tx by swapping 1x USDC in OP on any DEX.

DM the answer to subli_defi on twitter + your wallet address

3. Farm & Vote

One of the thing everybody is waiting is to be able to farm while keeping your voting power accessible for the upcoming snapshot & not set an alarm to not forget to withdraw your OP back to your wallet. During this Cycle 13, Season 4, project grant, there is 1 interesting mission falling under Intent 4: “Governance Accessability”:

1- Fig/Flipside Crypto would like to have aOP (proof of deposit of your OP token on AAVE) holding the voting power. Click here to see the complete proposal.

Hope this article fits your expectations & questions about the best place to farm OP.

🟠Podcast:

Lifi (written notes available)

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of some of the podcasts. Access granted to Revelo members.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

Subli_Defi Social accounts:

Discord Handle: Subli#0257

Twitter: Subli_Defi

Lenster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.

hminhphuong.2006@gmail.com