The 🔴🔵Optimistic Newsletter #9

The unique DEFI Newsletter on OP Superchain written by Defi Users for Defi Users

First of all, i’d like to express my thanks to you, for your comments, support, likes on this 🔴🔵Optimistic Journey. Big 👏 to my 4 teammates & all the translators as all this work could not have seen the light without them.

And finally, welcome to the 306 new subscribers to this newsletter.

Thanks for reading The 🔴🔵Optimistic Newsletter (by Subli_Defi)! Subscribe for free to not miss anything on the OP Superchain

Click in your preferred language to access the translated document:

Chinese - French - Japanese - Korean - Filipino - Persian - Spanish - Thai - Turkish - Vietnamese

MENU OF THE WEEK

🔴Gov. update: Season 4 - Grant reshuffle

Season 4 is planned to start on June 8th. The grant process has been completely reshuffled and allows group of people to be formed, later called Alliance, to apply for an OP Grant. Wanna know more?

🔵Base News

If you are ever wondering what’s is Base vision, what are Base biggest challenges and how it is to build Base as a Core Contributor, i’m more than honored to share a written AMA with Jesse Pollak, Creator of Base aka Contributor #001.

🟣Project update: Crypto Refills - How to use crypto in the real world

This article has been sponsored by Crypto Refills through the OP Ambassador Program. However, we wouldn’t have covered them if we thought the idea was not interesting.

Crypto Refills just integrates Optimism and allows anyone to buy real goods with Crypto. We’ve been trough a full step by step tutorial to show you how to proceed.

🟡New Projects : Arcadia Finance & Avantis Finance

Leverage trading is the backbone of finance, so we’re so happy to present you two new projects deployed on Optimism, soon on Base, being Arcadia Finance (Margin protocol) and Avantis (Perps protocol) bringing their own specificities to what you already know.

🟢Macro-Analysis: BTC / ALTCOIN

Bi-weekly update on the Crypto Market. The past 2 weeks were shaking, we hope you hung tight. Let’s see what the market tells us now.

🟤Farming Strategy on Overtime Markets

Being an early liquidity provider is often rewarded. What if we tell you, you can earn 4 digits yield on stablecoin? To be eligible, there are some requirements and risks of course. Everything detailed here, only for you dear subscribers.

🟠Podcast: Project interview (Updates & Roadmap)

The last 2 weeks, i was pleased to receive on Live :

Alluo

Avantis Finance

Podcast available at the end of the newsletter.

⚫The Optimistic series Campaign is live - Engage to Earn 30k OP

Questoors, come, engage about #Optimism by completing this series of quests, and earn OP token. https://www.tideprotocol.xyz/users/spaces/5d9682f7-8d61-4c97-b5af-547ad95b3a01

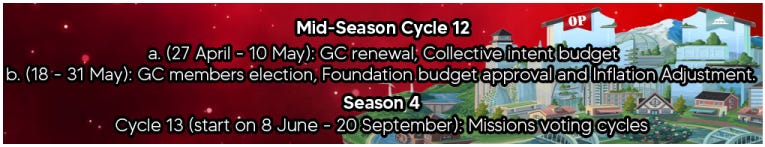

Timeline:

Quest #1: 🟢Live - End on 31-July

Quest #2: 🔴Closed

Quest #3: 🟡Launch planned around 10-May

GOVERNANCE TIMELINE

OP SUPERCHAIN STATUS

Ethos Reserve is the official Sponsor of The🔴🔵Optimistic Newsletter

Ethos Reserve is for me the most simple leverage position available on Optimism. Deposit ETH, wBTC or OP and mint ERN stablecoin with only a fixed fee on your borrowed amount, no more variable interest. Intuitive user interface, secured by 154 auditors, efficient architecture, users can also earn multiple rewards (ERN, OATH, wBTC, ETH, OP).

If you wanna try Ethos Reserve, it’s here: https://ethos.finance/

🔴Gov. Update: Season 4 reshuffle

What you observed on Season 3 as the process to allocate project grants to either Builders or Growth Category will be significantly changed for Season 4. Welcome to a brand new system which aims to align objectives set by the OP Collective and the means to achieve them.

Season 4 is articulated around 5 new ideas: Intent / Mission / Alliances / Collective Trust Tiers / Attestations.

This new governance concept has been seeded following a deep research conducted by the One & Unique Lavande, working at the Optimism Foundation, about the ways of working of Several DAOs. You can have access to the results of her research here (just click on the below text):

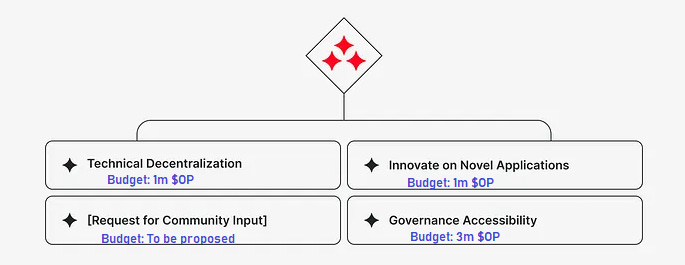

1. Intents

4 intents are going to be selected for this season with their own respective budget. Out of the four intents, 1 will be driven by the community and voted during cycle 12a, together with the allocated budget.

The first thing we can see here is that the budget for “Governance Accessibility” is three times higher than the other intents budget. This is resulting from an analysis showing that too few people are interested and involved in the OP Governance.

The budget is the maximum amount that can be granted to the best ranked missions that have been proposed to achieve the Intent.

More info here

2. Missions

Missions are specific initiatives aimed at achieving one of the Intents. They are tightly scoped to be accomplished start-to-finish by the end of the period (in this case Season 4). Each mission includes its own request for OP budget. How does it work:

Application for a mission: To be submitted before 21-Jun

Proposed Mission by a group of contributors called later on Alliances. Application will be done on the forum, when season 4 starts on June 8, following this template.

Foundation Mission set up by the Optimism Foundation, and any Alliance can apply to perform this mission. Application is done on Github.

Vote & Grants:

Proposed Mission: Voted & Ranked by the Token House (or token holders). The best missions will be approveduntil the intent budget is allocated.

Foundation Mission: The foundation will select the proposals

Very important: Mission MUST be accomplished by the end of Season 4, 20 September.

More info here

3. Alliances

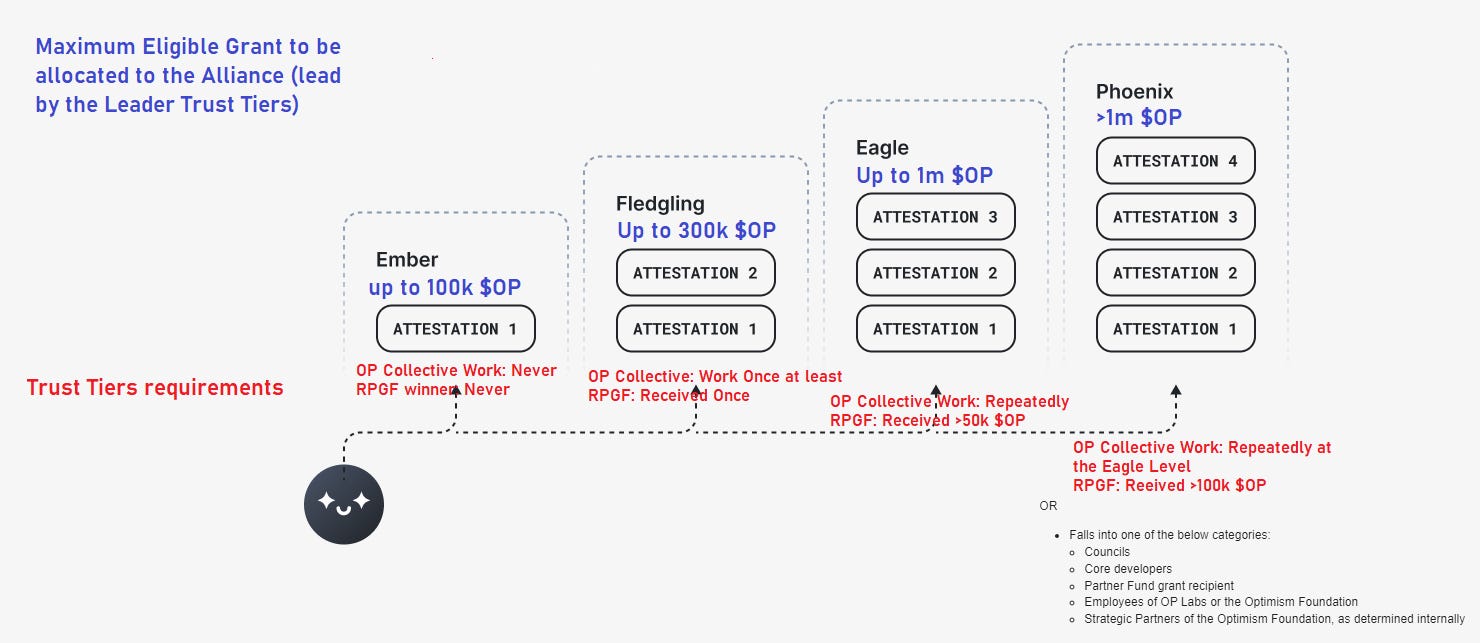

Alliance can be a group of contributors or a project/organization that joins forces to complete a mission. The alliance is held by a Leader. The Leader trust tiers will be the Alliance trust tiers, and we will see how this is important for your mission Budget.

As there will be several missions, only the best ranked will be selected for the OP Grant.

More info here

4. Collective Trust Tiers

Trust Tiers are specific roles that are given based on your previous contribution to the OP Collective and give eligibility to a certain level of OP grant. Here is a summary:

More info here

5. Attestation

Attestation is a way to testify from your engagement using on & off chain data. Most likely Trust Tiers will be then given by this tool. If you want to read more, please feel free to read the Newsletter #3.

6. Conclusion

Bringing new ways of thinking is always tough in any organization, but the different experiements the Optimism foundation is doing are really interesting, and we are very curious to see how this season will bring as positivie or to be improved topics.

And by the way, towards the decentralization of the Optimism ecosystem, we would like to remind you that on Cycle 12b, the Token House (aka token holders) will vote for:

Treasury Appropriations (Foundation budget approval)

OP token Inflation Adjustment.

🔵Today Base news is incredible, the least we can say. We had the opportunity and the pleasure to ask some questions to Jesse Pollak, Creator of Base and thus Core Contributor #001 about its role & vision of Base. We deeply thank Jesse for taking the time to answer those while continue building the testnet version of Base before a coming soon deployment on Mainnet. Here is the interview:

1. I read you created your coinbase account in 2014 when BTC was at $447, joined CB in 2017. Could you introduce yourself, your role at Base and tell us what does Crypto represent for you (business opportunities, new economy layer, etc...)?

I actually just looked back through my email and I created my Coinbase account in November 2012 - wow it’s been a long time! So grateful for the last decade of working on crypto.

I’m Jesse and I’m the creator of Base (AKA “contributor #001”). I’ve been at Coinbase for the last 6 years. For the first 4 years of my time at Coinbase, I led all of our Consumer engineering teams (e.g. the folks who built Coinbase, Coinbase Wallet, Coinbase Pro). Then for the last 2 years, I’ve been working to “bring Coinbase onchain” — which has been quite the journey, ultimately culminating in deciding to build Base. We launched the testnet in February and are pushing hard to launch the mainnet soon.

Crypto to me is all about creating an open, accessible financial system for the world. Today, in our legacy financial system, where you are born has a huge impact on the financial tools and systems that you have access to. This leads to massively different starting points for different people. With crypto, we have the opportunity to update our system to a new one that puts everyone on a level playing field — regardless of where you’re born, or who you are, you can access the same powerful financial tools. With this foundation, we’ll see people be able to more easily start businesses, support their families, and live their best lives. That’s what it’s all about.

2. DeFi is currently used by a minority of people, mainly DeFi natives, tech people (e.g. daily users of Optimism mainnet is around 40k people only). Driving 110m+ users onto Defi is an incredible objective, how does DeFi needs to be transformed to attract this next wave of users?

Our goal is even bigger: we want to bring 1 million developers and 1 billion users into crypto. I think to make that happen, we need to make everything easier and this is what we’re focused on with Base. We want to make it dead simple for developers to build new onchain applications, and then we want to make it dead simple for users to actually use those applications. There are three big challenges that I think we need to solve to unlock that ease of use.

First, we need to make sure that the cost of using these applications is low enough that anyone can access them. This is what we’re doing with Base, Optimism, and the OP Stack: we’ve already driven down costs 10x and in the year ahead, we’ll drive them down even further, until we ultimately get the cost of transactions to be less than one cent.

Second, we need to make wallets really great — at Coinbase, we’ve been doing this with Coinbase Wallet and the new web3 tab in the Coinbase app, which gives everyone a safe, easy to use wallet. We’ve also just launched our Wallet as a Service product, which enables developers to embed wallets in their apps, enabling crypto to “just work” inside your favorite products. We think these investments are going to help bring wallets everywhere.

Finally, we need better identity tools, so people can interact with apps in a trusted way, and so apps can customize their experiences to the actual people who are using them. For financial products, this is particularly important, and I think we’ll look back and see that identity was a huge unlock for the next wave of onchain financial products, including undercollateralized lending (which is a huge use case in the legacy financial system). It’s been encouraging to see so much progress in the broader ecosystem here, from Sismo to Worldcoin to Gitcoin Passport — I’m excited to also contribute some of our thinking here in the months ahead.

3. For building Base, what's the biggest challenge you'll have to face and how do you plan to overcome it?

I think it goes back to making Base incredibly easy to use for both developers and users. And making it so developers can build the next generation of applications that bring those billion users in. This is the largest challenge that the entire ecosystem is facing — and so that’s why we’re taking it head on.

We’re really excited about how Base can solve this by working closely with Coinbase and other consumer facing products to make them “just work” on L2. As an example, there are 110m+ users and $80B+ in assets in the Coinbase ecosystem — we’re working really closely with the Coinbase team to make it so those folks can use dapps built on Base in a dead simple way.

4. One year from now, how will Base look from a user perspective ?

Chains like Base will increasingly fade into the background. uUsers will experience the apps that are bringing them real value every day.

My hope is that a year from now, users know very little about Base other than that it’s safe, trusted, low-cost, and powers thousands of applications that are really useful to them. That’s what it’s all about - creating real world value for users.

5. What is the question you always wanted someone to ask you but never got, and could you reply to it?

I don’t have a specific question, but one interesting thing about me is that my two brothers are based in Nairobi, Kenya and run a company there that provides lending products to farmers. They help farmers get access to capital, which they can spend on basic things like fertilizer and tools, enabling them to increase their yield.

Getting to spend time there, with them, and learn from their experiences building financial products in that environment has been super informative to the overall Base journey. In particular, it’s hammered home how uneven the playing field is and how much work we have to do to get everyone on an equal footing.

All this has led to one of our core values for Base: Base is for everyone. We’re not building Base just for crypto-natives. We’re not building Base just for folks in the Americas. We’re not building Base just for DeFi. We’re building Base for everyone.

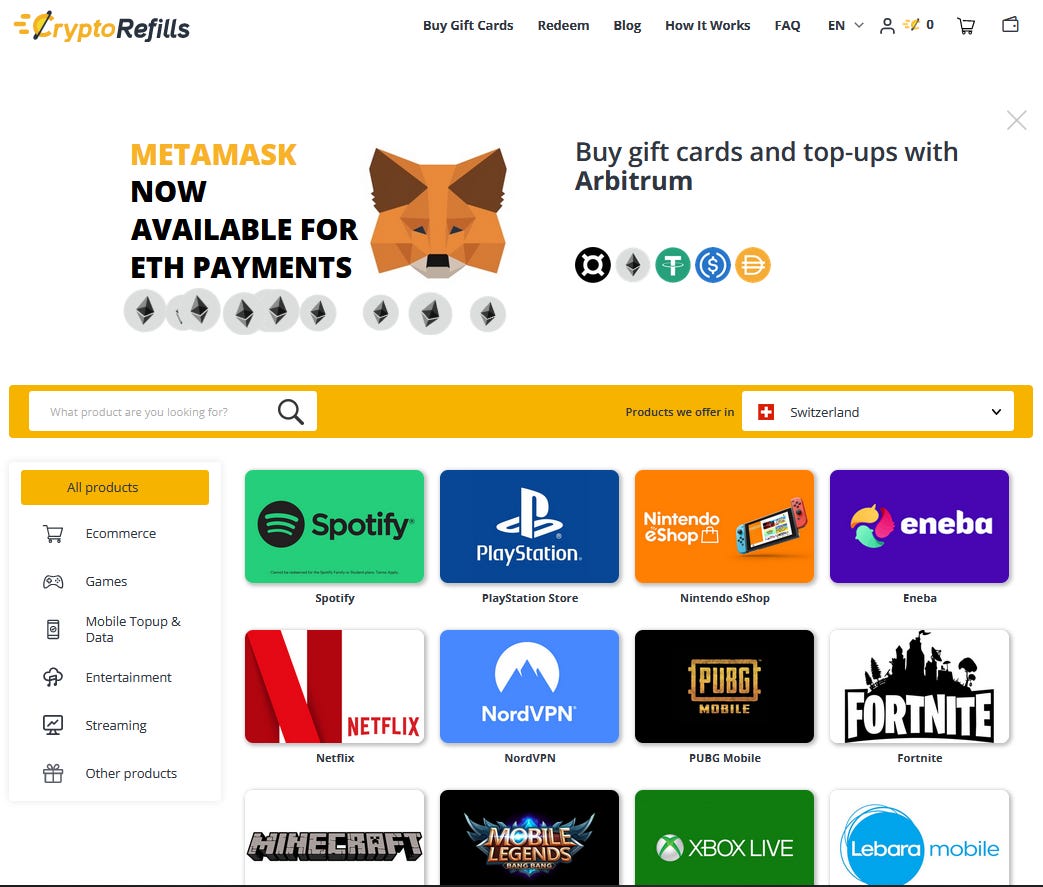

🟣Project update: Crypto Refills

CryptoRefills offers numerous possibilities for using your cryptocurrency to purchase a wide range of products and services. It supports over 600 mobile operators around the world for mobile phone top-ups and hundreds of gift cards and vouchers from popular brands like Amazon, Steam, Google Play, iTunes and much more.

CryptoRefills is designed to be quick, secure and private. Transactions are completed in just a few steps and your purchases are delivered instantly. One of the great things is that it allows you to use your cryptocurrency holdings for practical, everyday purchases, using multiple payment methods and multiple chains.

CryptoRefills has just integrated Optimism and is now the best offramp service you would find for real world products. We have been through a step by step guide to show you how to use the platform, and the least we can say is that we had an incredible user experience.

Which cryptocurrencies are accepted for purchasing products on the Optimism blockchain?

Here is a list :

Ethereum / USDT / USDC / FRAX / DAI

You can also choose BinancePay and GatePay for your purchases

How does CryptoRefills work ?

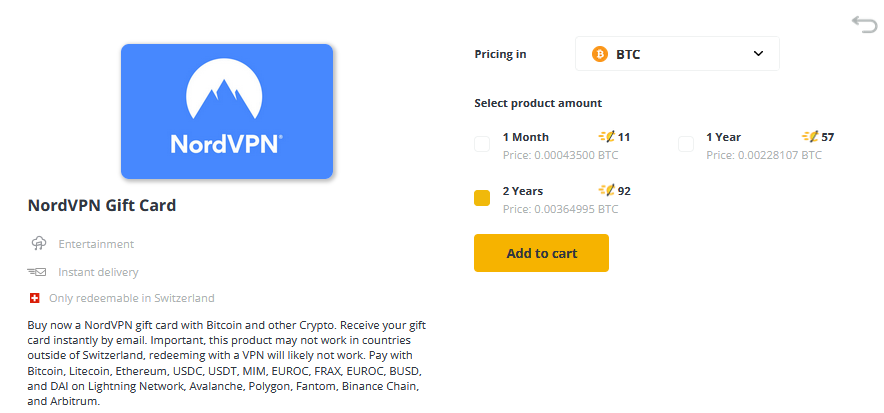

Go to CryptoRefills.com, create an account (NO KYC required), if you don’t have one, make sure to correctly select your country or region and choose a product available in your zone.

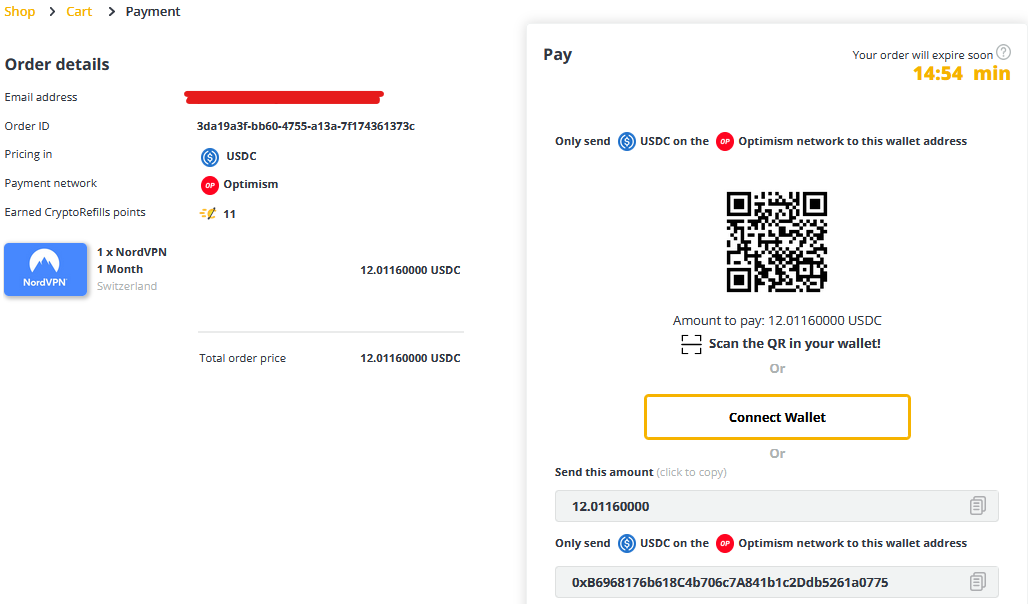

Once you’ve chosen the product that you want, the next step is to select the cryptocurrency you wish to use for your purchase and the package available for your product.

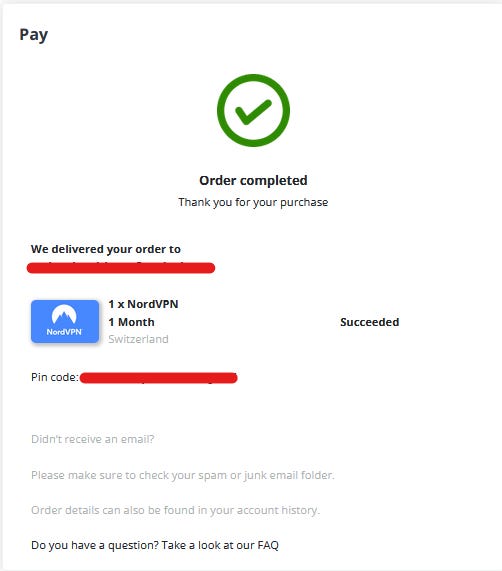

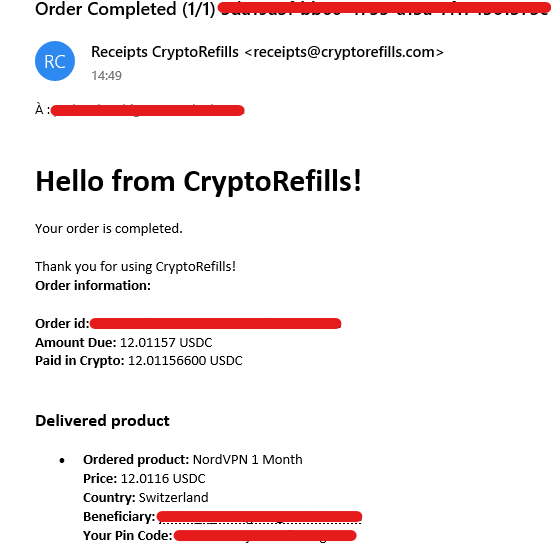

Once the payment is confirmed in the blockchain, the product is directly delivered to you, check your emails and don’t forget to check your spam folder.

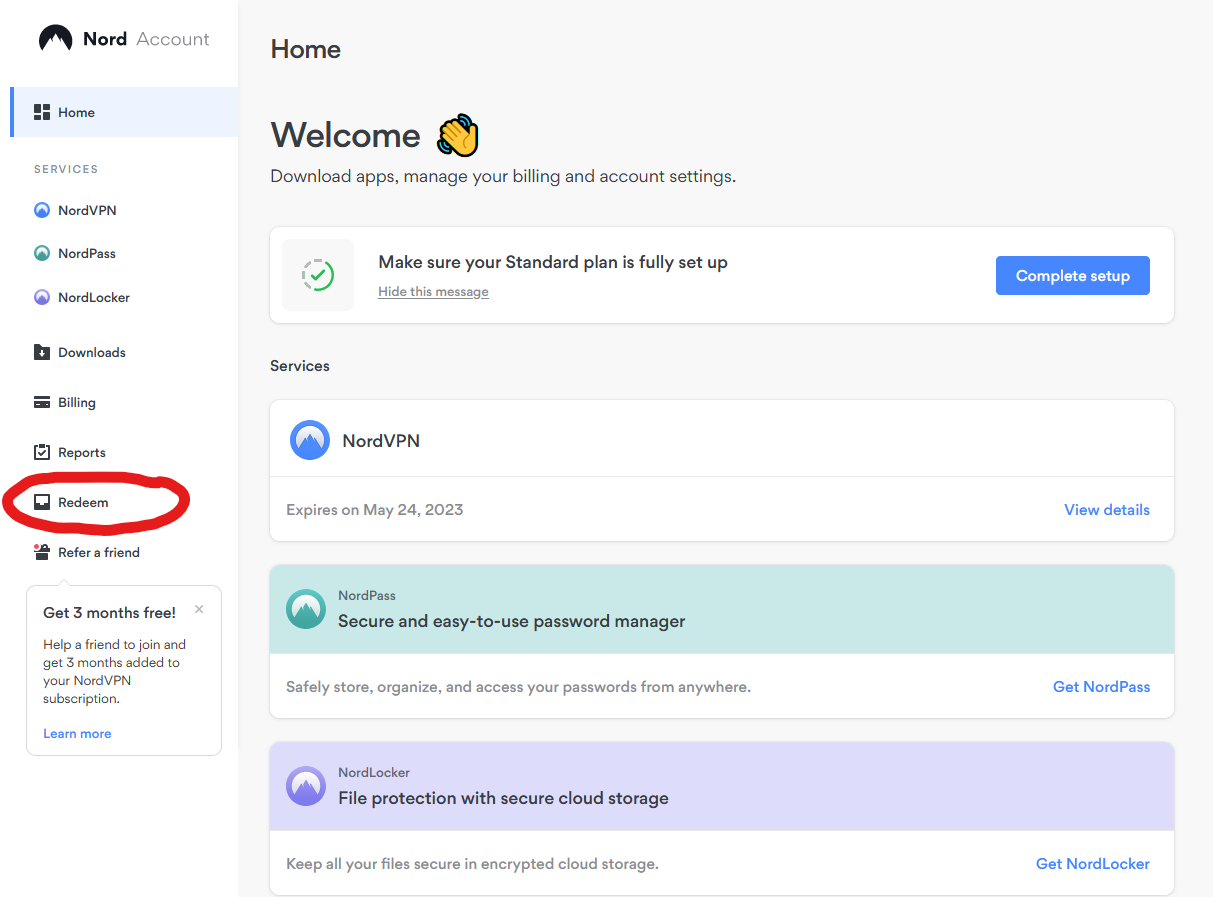

I purchased a one-month NordVPN subscription. In order to exchange the received voucher, I simply go to their website and look for the 'Redeem' section. And I put the code I got and the mail linked to my account.

CryptoReffils Loyalty Program or Cash Back

The CryptoRefills loyalty program is designed to incentivize customers to make purchases by offering them rewards in the form of cryptocurrency. When you buy a product on the website, you win points, which you can later exchange for Bitcoin, Litecoin, soon for other cryptocurrencies and products. Essentially, by participating in the program, you are able to accumulate cryptocurrency through regular shopping activities on the website.

I had an excellent experience using CryptoRefills, the website's user-friendly interface made it effortless to browse and find the products I was interested in. You can choose from a wide variety of products that can be purchased with cryptocurrency, and the loyalty program incentivizes repeat purchases with cryptocurrency rewards. My amazing experience makes it my go-to website for anyone looking to buy products or earn rewards using cryptocurrency.

Spotlight Project:

Socket, a well known cross-chain messaging protocol, is currently building itw own messaging layer and has launched Socket Data Layer (Socket DL) incentivized Testnet on May 1st for a period of 4 weeks. Break the testnet to earn your place in SocketSentinels, a collective that drives security for the Socket Protocol.

Register on the website: surge.socket.tech

🟡New projects : Arcadia Finance & Avantis Finance

We had the chance to host these 2 projects in the Optimistic Podcast. And if you didn’t listen to the records, we can just tell you that these 2 projects needed a more detailed article on what they are up to. Let’s get into it!

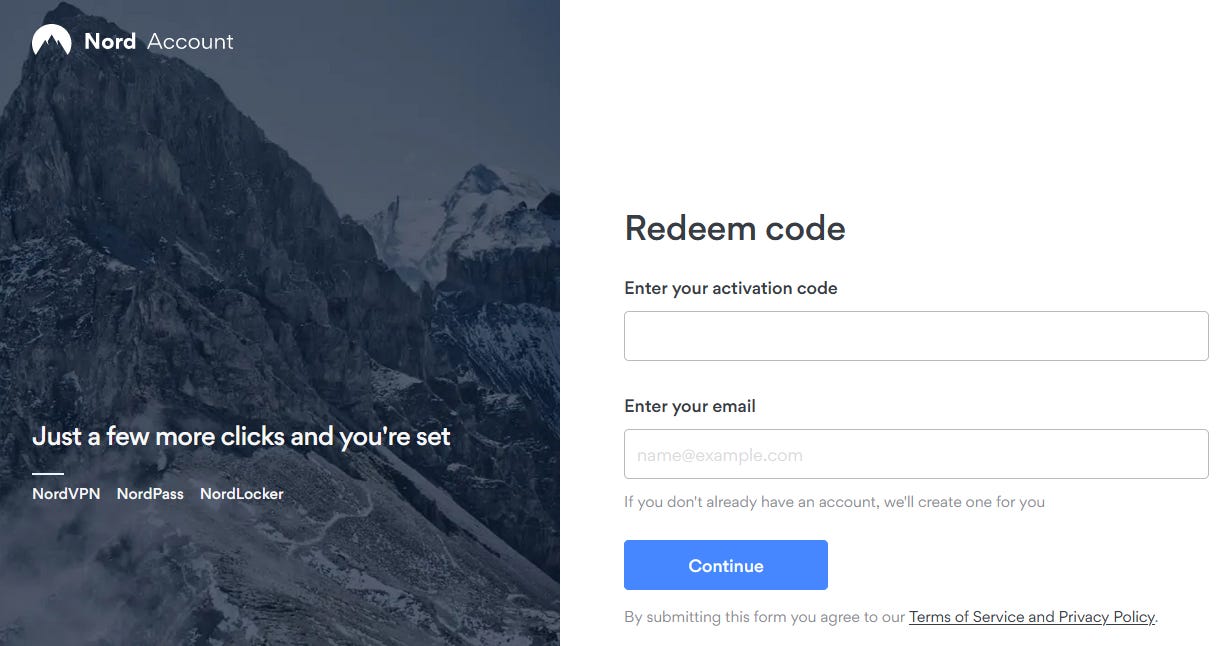

Arcadia Finance allows users to leverage your position trhough Margin trading, while Avantis Finance is using Perpetual trading. Before we move on, here is the main difference between the 2 types of leverage trading:

Margin trading: User owns the borrowed asset. User A has 1 ETH on its account and opens a trade at 3 ETH. User A owns 3 ETH

Perpetual trading: User signs a contract that simulated the price of the traded asset. User A has 1 ETH on its account and opens a trade at 3 ETH. User A doesn’t hold 3 ETH

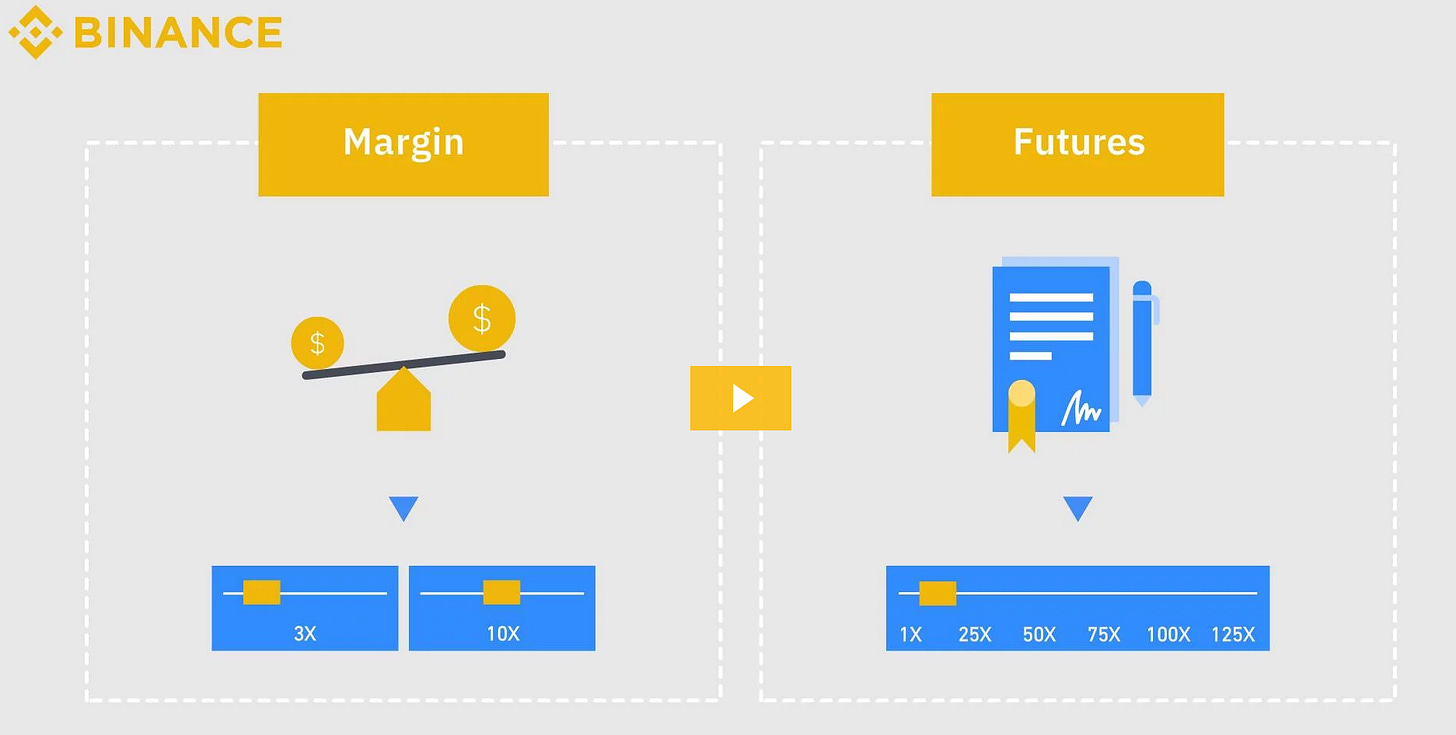

1. Arcadia Finance

If you know what is Margin Trading & have ever used it on a Centralized Exchange like Binance, then Arcadia Finance is the same but in a permissionless and non custodial way, welcome to DEFI.

Arcadia Finance has unique characteristics that make it unique:

Allowed collateral: Arcadia Finance accepts different type of collaterals such as:

ERC-20 token such as ETH

NFT

Farming position such as LP token, yearn vault, and other ERC-4626 token

Maximize Capital Efficiency: use collateral in other DEFI protocols.

Flash Action: Users will be able in one click to:

Withdraw any asset from their margin account (flash withdrawals).

Borrow as much assets as they want (flash loans).

Use both the withdrawn assets and the borrowed funds in a permissionless way in other DeFi protocols.

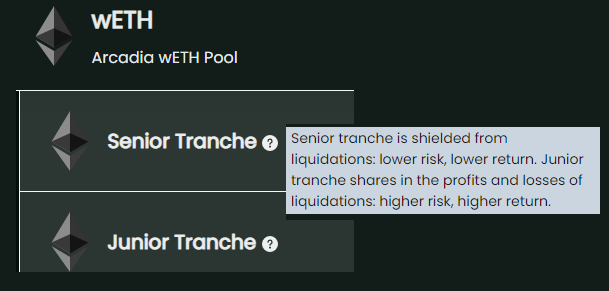

Liquidity Providers risk tranches: Manage your risk exposure by selecting junior or senior tranche.

Current State & Roadmap 2023

Arcadia Finance is currently live on Ethereum Mainnet and Optimism since end of March 2023 and users can now:

- Lend ETH or USDC in either of the 2 tranches

- Borrow up to 10x leverage

In the coming weeks & months, users will be able to use Univ V3 LP position as collateral, and use flash actions to perform all transactions in one click.

In the near future, Arcadia will add other Dexes LP position such as Curve & Velodrome and will move, tentatively in Q4, to a DAO structure by issuing their own token. Early users might be rewarded, but nothing confirmed by the team 🔥.

For 2024, the team has already a clear idea in mind of what will look like Arcadia V2: Building a chain abstraction Margin protocol. And you know how much i love projects building the future of DEFI. Using NFT, LP position on one chain while borrowing on other chains.

Finally, the team also confirmed their wish to deploy on Base layer 2, as well as applying for an OP Grant for Season 4. I can only suggest to follow the project very closely and don’t miss any of the forthcoming news.

Arcadia Finance can be accessed here: https://arcadia.finance/

2. Avantis Finance

How do you call a perpetual project that takes the scalability of GMX and the efficient architecture of Kwenta? Simple: Avantis Finance

Scalability:

The more liquidity the protocol holds, the more leverage or Open Interest it can offer to users.

Kwenta is being built on top of sUSD, the 14th stablecoin used in DEFI. Minting sUSD requires staking SNX until Synthetix V3 will be released, so the scalability is currently limited. On the other side, GMX is being built on GLP, a pool of assets comprising very liquid assets, but subject to the volatility of the market.

Understanding the limitations of the two above solutions, Avantis has therefore chosen to build on top of USDC, the 2nd largest stablecoin in DEFI, allowing close to no limit to scale their protocol.

Efficient Architecture:

On the backend, Avantis is using Pyth Network & Chainlink oracles to provide reliable & fast data for the listed assets. On the frontend, Avantis will build something that i would love to find right away: Web3 abstraction user intergace. Avantis will allow users to:

On/off ramp on their own smart wallet account

Log in with web2 credentials (login + password)

Trade different assets with the same wallet

Automatically manage Gas on user behalf

In addition to the above, and in a very similar as Arcadia, Avantis will provide different risk tranches to liquidity providers.

Current State & Roadmap 2023:

Avantis Testnet phase 1 is currently live and only accessible by a list of whitelisted members. Avantis said during the Optimistic Podcast that phase 2 is planned in the coming weeks, and phase 3 will be an Incentivized testnet, yes you hear it well 🔥🔥!

Phase 3 will be launched around June ’23, with a mainnet planned for around September.

The team also confirmed being very close to the 🔵BASE Team, and will launch on Base as well. Avantis planned also a public sale of their token $AVNT, watch out for project announcement for more info about this.

Finally, as a long term vision, the team confirmed that after succeeding building deep liquidity on the USDC vault, they have already in mind to build various other financial products on top of this vault such as On-Chain Casino.

If you want to join the Testnet, please join the project discord.

3. Conclusion:

The leverage trading narratives, started in Summer 2022, is just at its beginning. Building more efficient application, easing users onboarding, abstracting chain & wallet usage, seems to be the common targets of Avantis Finance & Arcadia Finance. We are very lucky to get these 2 teams building on 🔴Optimism & 🔵Base (aka the OP Superchain). Give them both a follow to their twitter account.

🟢Macro-Analysis: BTC / ALTCOIN

As presented in the previous newsletter, the daily support of the range in which Bitcoin was trading didn’t hold, and we are currently experiencing a correction in the cryptocurrency market. Will the adage "sell in May and go away" come into play in 2023? We will try to answer that.

Bitcoin:

On the weekly chart, BTC is consolidating above the green resistance level, which is turning into support. As long as we close above this weekly support, we can expect new highs before a more significant correction in the market.

DXY index:

Since Bitcoin is often inversely correlated with the DXY index, we are observing a strong bullish divergence on the index, which could justify a bigger correction in the crypto market if the index increases in the coming weeks.

Bitcoin dominance compared to altcoins:

The divergence presented in the previous newsletter didn’t play out, as the BTC.D ticker made a new high compared to the previous peak. This is the definition of a bullish trend for BTC, but the situation is bearish for altseason. We are above the green resistance level, which is currently being confirmed as support. However, the RSI is overbought, and we are currently in a demand zone. This break of the green line could still be a fakeout.

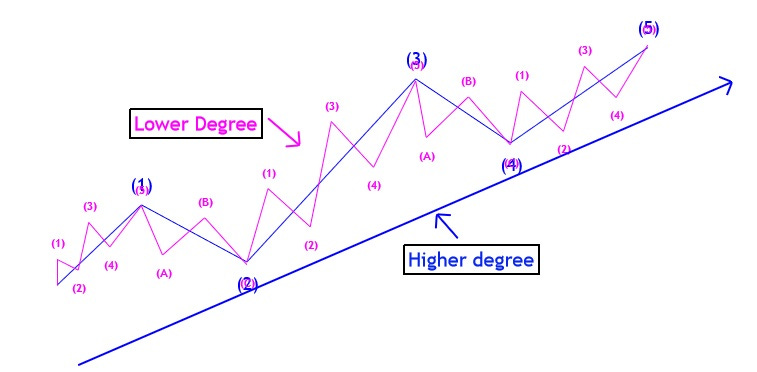

The Elliott Wave Theory

The Elliott Wave Theory is a tool used to structure the market, take positions and take profits. It is based on the idea that markets evolve through a series of successive movements, or waves, which repeat themselves endlessly, regardless of the time scale being observed (from minutes to the very long term). This is referred to as FRACTALS, which are an endless pattern that repeats itself multiple times.

The Elliott Wave Theory is based on the following principles:

Every impulse is followed by a corrective reaction;

Five waves move in the direction of the main trend (12345), followed by three corrective waves (ABC);

A 5-3 movement completes a cycle.

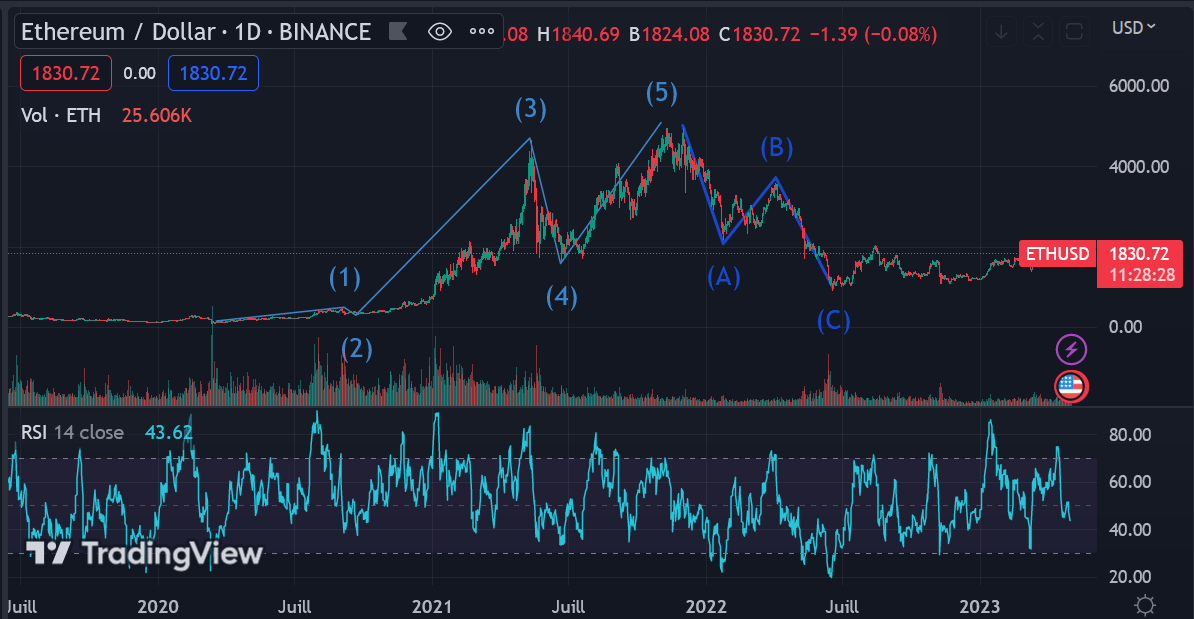

This tool allows us to know where we are in a bullish or bearish phase. Let's take the example of the Ethereum daily chart in HTF (High Time Frame).

We are observing the bullish phase with waves 12345, followed by the corrective phase with waves ABC.

We notice that wave 1 is an accumulation phase and has the smallest amplitude. Wave 3 is the most explosive, and wave 5 is the phase where profits should be recorded, or else gains could disappear. In each wave, the price also moves in waves 12345 and ABC. Below is the chart of Ethereum with Elliott waves in MTF (Mid Time Frames).

Now let's apply the Elliott Wave Theory to Bitcoin in MTF (Medium Time Frame):

We are currently in Wave 5 in MTF in Wave 1 in HTF, and that is why we need to be attentive to the market and preserve our gains made in the bullish movement initiated at the end of 2022. However, we are very optimistic for the coming months. Indeed, we now know that Waves 3 and 5 will come to the crypto market, but the time to aggressively expose oneself is no longer current.

It is now up to you to educate yourself on Elliott waves if you wish to master this tool.

Conclusion:

We consider the market currently to be at risk. We have more bearish signals than bullish ones. We exited our positions when Bitcoin failed to confirm the previous range as support in daily around $28,800. However, as long as Bitcoin stays above the green support in weekly, a new bullish momentum is possible to finish Wave 5 in MTF. We could also come to take liquidity at $25,000 in daily and close above the support in weekly. It is too early to say and take a position, so patience will be required.

Trading: Sit on our hands. We never trade against the higher wave structure. We are currently in a bullish phase, so we do not wish to short the market right now.

Investing: We are now out of consolidation. It's always interesting to buy Bitcoin in DCA for a long-term vision. Otherwise, we need to wait for Wave 2, which should come soon following the Elliot Waves count in MTF presented above.

🟤Farming strategy: LP on Overtime

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

Overtime is the first Sports AMM with 9 supported different sports from Soccer to Cricket, and more recently Tennis.

All AMM need liquidity to work, which was formerly provided by Thales, who incubated Overtime. As the decentralization of the protocol is progressing, liquidity pool has been opened to few eligible people, rewarding them through protocol fees.

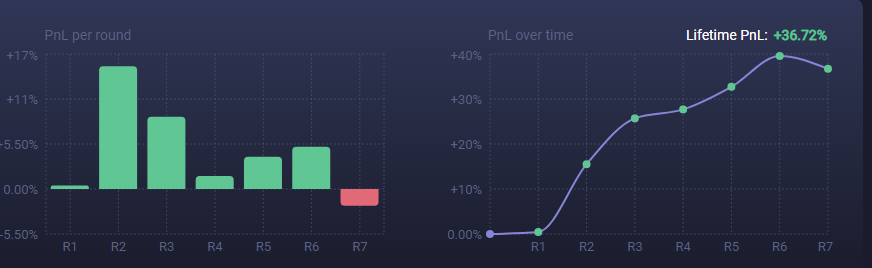

As of today, yield has been around +37% over 7 weeks only. If we estimate the same trend to continue over a year, that would lead to a APR of 275% 🔥🔥🔥 How come mercenary farmers don’t get in?

Overtime has been smart, or too restrictive, depends on how you see it.

You can deposit sUSD, stablecoin issued by Synthetix and used by the Synthetix ecosystem, but liquidity deposit is :

Capped to 500k$ at the time of writing

Capped to 200 liquidity providers

Provided only by $THALES stakers. 5 staked $THALES = 1$sUSD to be deposited. $THALES is currently priced at around 0.6$, so for each 1sUSD you deposit in Overtime, you are exposed to 3x in Thales token.

Rewards are directly added to your deposit (auto-compounded)… Hope you know the difference between APR and APY, if not: https://www.aprtoapy.com/

275% APR => 1358% APY

So if yield remains constant it will take approximately 6 months to be breakeven (i.e your rewards = your initial staking value)

Important note:

To withdraw, you need to have at least 5 THALES staked per each sUSD you are withdrawing

sUSD has deep liquidity on Optimism and can be bought on any Velodrome Finance

LP on Overtime presents smart contract risk, but also you are playing against Traders. If traders win, LPers loose.

🟠Podcast:

Alluo

Avantis

Note: The 🔴Optimistic Podcast partnered with Revelo Intel to provide written notes of all podcasts. Access granted to Revelo members.

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

Subli_Defi Social accounts:

Discord Handle: Subli#0257

Twitter: Subli_Defi

Lenster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

————————————————Disclaimer—————————————————

Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.

——————————————————————————————————————

Nice

Good Job