Thank you for reading this freshly cooked newsletter. Your continuous support means a lot for me, and keeps fueling me to dig into Base and the surrounding ecosystem for you.

If you missed the previous newsletter, it’s just one click away from you HERE.

————————————— This Week Menu ——————————

🦸♂️ Superchain news

📈 Superchain Stats

🔵Aerodrome Finance: Bull case thesis follow up

Back in September 2023, I have predicted that Coinbase will invest in $AERO to support $cbETH growth. But my prediction was very underestimated. Let’s update this and why i see AERO becoming one of the largest Defi App.

🏈 Post of the Week

🤓 Smart money on Base

Partner: Ozean

Introducing 🌊Ozean — the blockchain for RWA yield build on the 🔴Optimism Superchain!

Ozean is being launched by Clearpool, the leading RWA DeFi lending protocol, and Hex Trust, the fully-licenced digital asset custodian. Ozean revolutionizes DeFi by seamlessly integrating RWAs in a compliant and user-friendly manner, enabling users to earn native yield on-chain automatically.

Key Features:

Native stablecoin (USDX) & auto-rebasing yield (ozUSD)

Oxygen (O2) — an innovative RWA liquidity layer

Native custodial wallet providing on-ramping, secure seed phrase storage, and transaction management

Compliance layer enabling different levels to access various dApps and products.

Powered by $CPOOL with a new staking mechanism set to launch soon.

🔗 Learn more: https://ozean.finance/

🦸♂️ Weekly News on the Superchain

⬛ BUILD, the tokenized fund from Blackrock, is now available on OP Mainnet with already 26m$ TVL

🚴♂️Velodrome Interoperability is now live on 🟡Mode network & ⚪Lisk

🟣Ink chain, from Kraken, is now live on testnet with Fault Proof & Stage 1 upgrades

🎲 Yield Guild Games is planning to develop & grow on Base. $YGG has landed on the blue chain and can be traded/farmed on Aerodrome

🌊 Ozean will integrate SolvBTC from SolvProtocol in O2, the RWA liquidity layer

🛶 Tokemak, an OG defi protocol I deeply loved back in 2021, is now live on Base with their new Autopilot product, optimizing $ETH yield from different liquidity pools, in a fully automated way

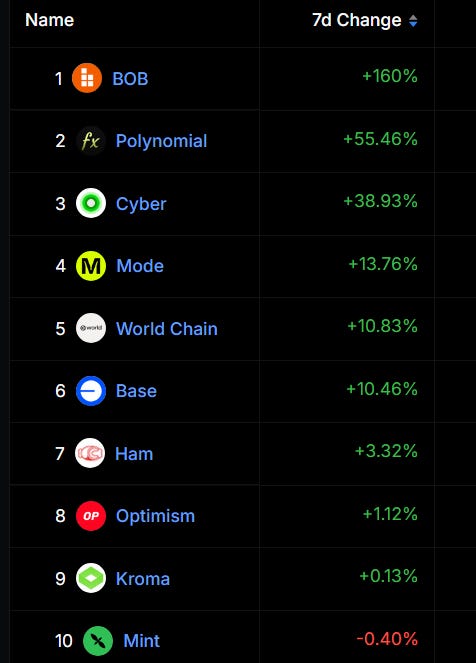

Superchain Stats - TVL Change Leaderboard

What a jump from BOB in the leaderboard with now 190m$ TVL in onchain dapps. Mode is showing great progress too with 300m$ TVL achieved in onchain dapps.

Source: https://defillama.com/chains/Superchain

🔵Aerodrome Finance: Bull case thesis follow up

As you know I’ve started a review of top tiers DEFI protocols on Base since couple of weeks. I already covered Anzen Finance [RWA], Vfat [Yield aggregator], Clearpool [RWA], Virtuals [AI], Morpho [Lending]. Of course, I had Aerodrome in my head since the begining, but if you’re used to read this newsletter, you may already know everything about Aerodrome Finance, the largest DEX on Base in TVL & Volume, but also the largest DEX accross all chains in terms of revenue.

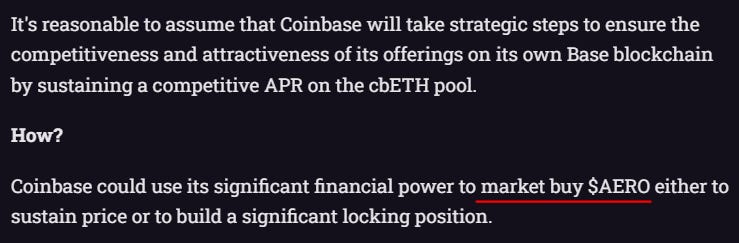

You may remember that i’ve predicted Coinbase listing $AERO back in September 2023. Read the complete article here.

Yes there is always a but… If you’re a new subscriber, you may want to know why I’m still bullish on Aerodrome. And eventhough you’re a former aficionados to my content, you would probably ask me, why i’m still bullish on Aerodrome.

Did $AERO top? Can it go higher? and if so, why and how much?

In this article, I’ll break down my thesis filled by things i’ve read in between the lines, worth noting that people usually put their money where their mouth is.

In this article, I’ll go through:

Aerodrome: The MetaDEX

Aerodrome = Base’s Engine

My Bull thesis

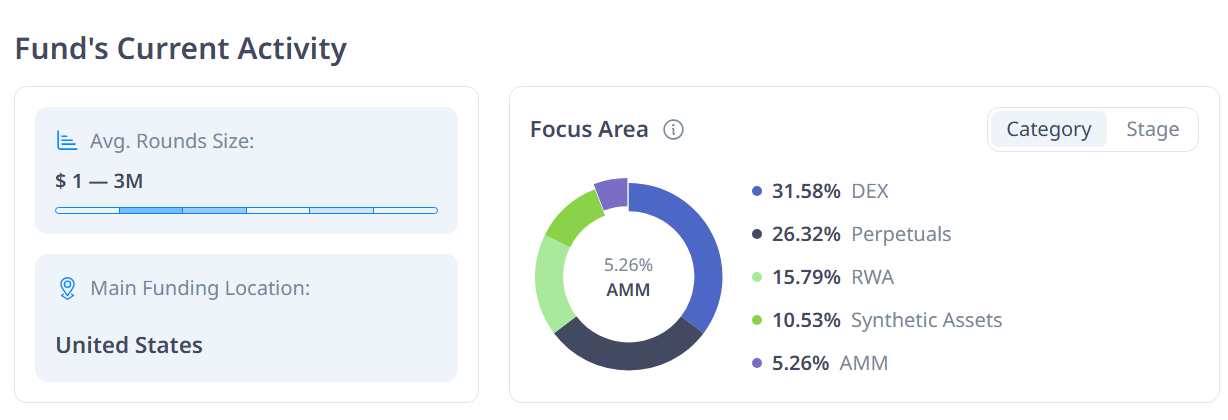

So to begin with, let’s picture where Aerodrome fits at the moment:

Protocol Type: Dex

Tokens: $AERO

TVL: 1,44b$

Market Cap: 883m$ (FDV : 1,8b$)

Trading volume: 1.5b$/day, #4 accross all chains on weekly volume

Aerodrome: The MetaDEX

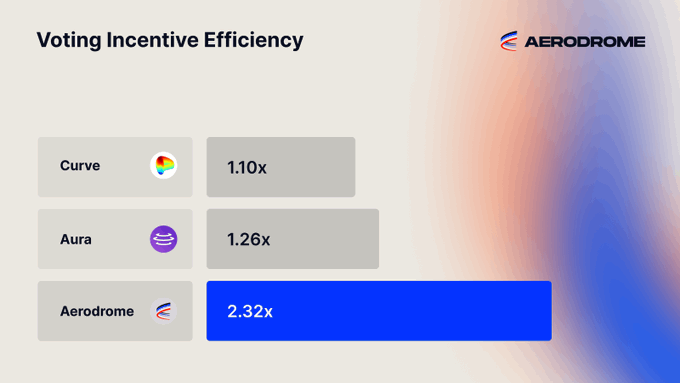

First, why projects are using Aerodrome and not another DEX? Simply because it’s more efficient to build up liquidity. For every 1$ spent by a project to attract liquidity, Aerodrome is better than Curve & Aura for example

And Aerodrome is more efficient than uniswap, cause liquidity providers don’t earn trading fees, but $AERO emission. The trading fees are going 100% to veAERO holders who vote every week on directing $AERO liquidity to pool.

Welcome to the METADEX! I think the best definition would be this one, given by Aerodrome in the MetaDEX & Defi : Introduction article →

The MetaDEX’s structure ensures that value flows permissionlessly to its participants

Results? Astonishing!!!

1- #1 onchain volume for $BTC & $ETH:

2- In less than 10 weeks, Moonwell built up a 25m$ liquidity pool, generating 200k$ in weekly fees going to veAERO voters.

Volume & swap fees are surging!

Aerodrome = Base’s Engine

Now, how Base fits into this ? Do you remember that Coinbase wants to bring all its users onchain?

COINBASE releases:

$cbETH => Fueled by Aerodrome

$cbBTC => Fueled by Aerodrome

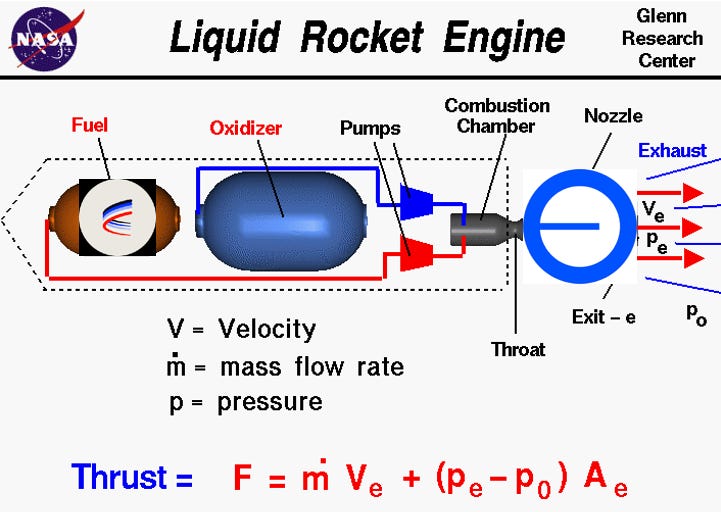

$COIN50 an index of the top 50 tokens listed on Coinbase => I expect soon on Aerodrome too

CIRCLE wants to grow $USDC => Fueled by Aerodrome

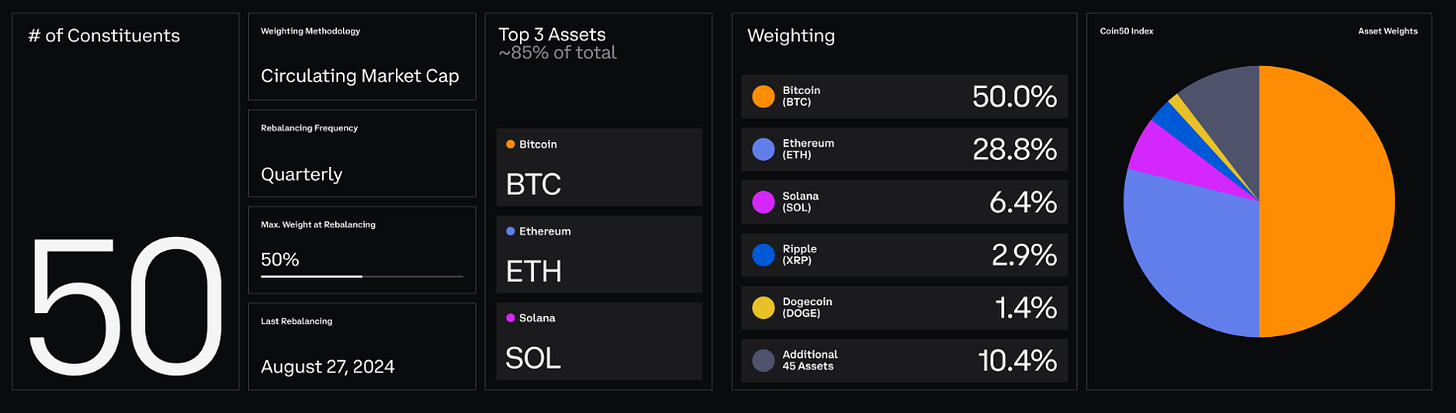

CIRCLE releases MICA approved $EURC => Fueled by Aerodrome making it cheaper & faster to swap onchain than in traditional finance => Welcome to Forex trading

Coinbase has released its 1st quarter earnings showing on the main picture figures from BASE chain: Impressive to see that Aerodrome is making 50% of the TVL of the chain!

So considering all the above, Coinbase is currently using Aerodrome to fuel its objective to move onchain and thus acquiring new users outside US, users who maybe cannot KYC on Coinbase platform for XYZ reasons.

Another power of Coinbase is what i call the COINBASE MAFIA (Moonwell founder & few others missing from the below pic):

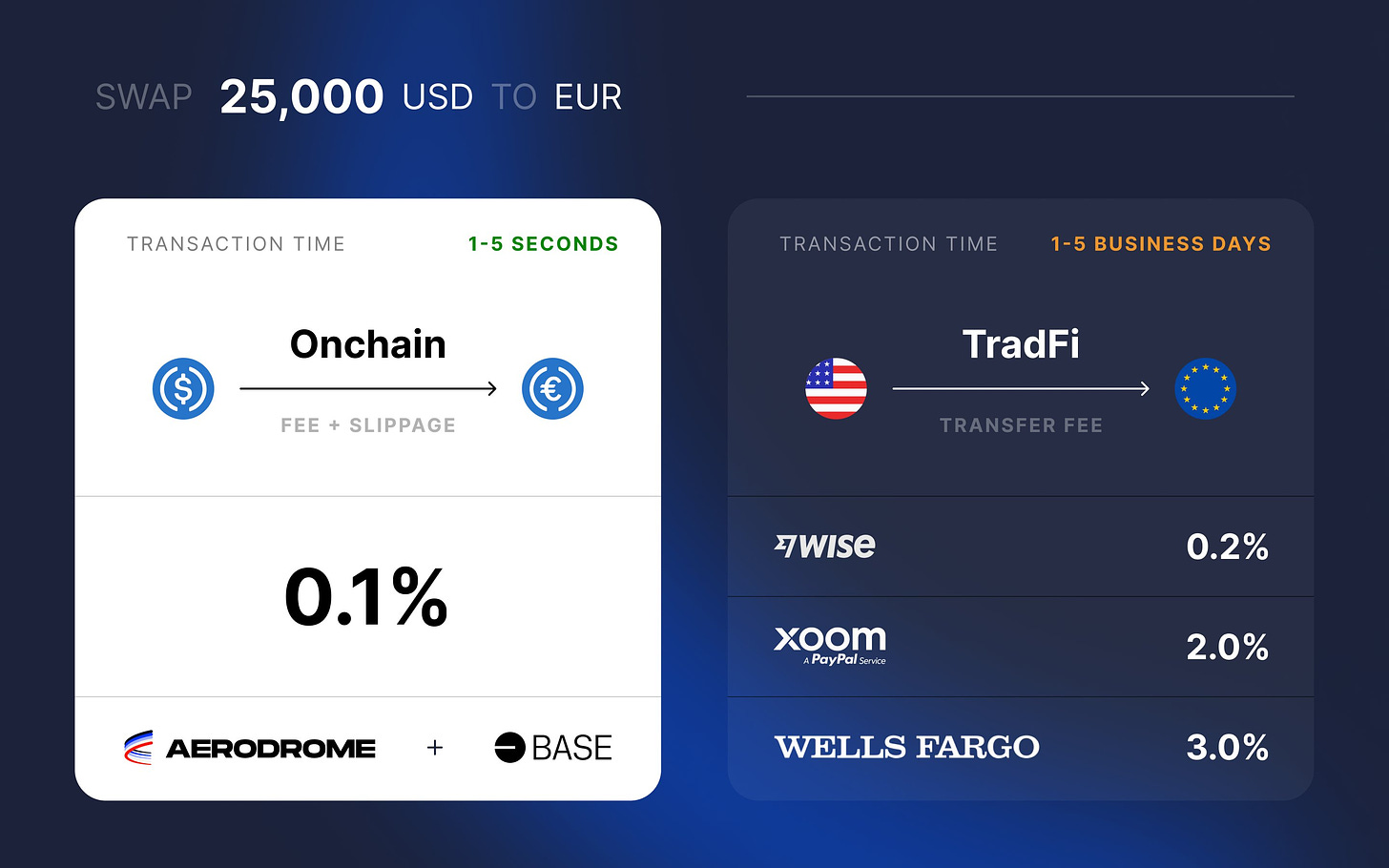

One of the missing projects could also be KEY to the Coinbase goal to move its trading volume onchain. A former COINBASE employees created a defi protocol that allows you to trade Major Token Assets not available on Base, on Aerodrome. Welcome to Universal.

The philosophy is:

Do you want to trade $DOGE on the cheapest and decentralized application or on Coinbase Wallet ? Trade $uDOGE on Aerodrome. Same with APT, SUI, SOL, XRP, etc… And the results are showing impressive traction!

I have made my Due Diligience on this protocol, talking with Austin, one of the co-founder of Universal.

All uAssets are 1:1 backed by the underlying asset with the collateral stored in Coinbase Prime

The Universal protocol has purchased AERO to vote towards uAsset pools in order to incentivize deeper liquidity

Coinbase has been a long time investor and the team is very excited to work closely with them on bringing more assets and experiences to Base

Austin is also the founder of Alongside project, building onchain Crypto index. And now, Coinbase has released COIN50… Do you see some confluence here? I do!

Back to Aerodrome, everything i explained above have only one outcome: Projects want to deploy liquidity on Base because they :

Benefit from Aerodrome flywheel to grow their liquidity

Benefit from Base users to grow their User Acquisition

Benefit from Coinbase exposure to raise funds through the Base Ecosystem Fund or Coinbase Ventures => Base Ecosystem Fund Portfolio by Cryptorank: https://cryptorank.io/funds/base-ecosystem-fund

My Bull thesis conclusion:

I’m not smarter than you. I’m not luckier than you. I just follow very closely the project announcements and what stakeholders are talking about. It’s not more difficult than that. If you invest in one project, you MUST follow every step the project is doing to see if the narrative for which you put your money in grows or fades. I was early thanks to Velodrome and being deep into DEFI & the superchain eco, but smart money has found Aerodrome too… a year after, but still ;)

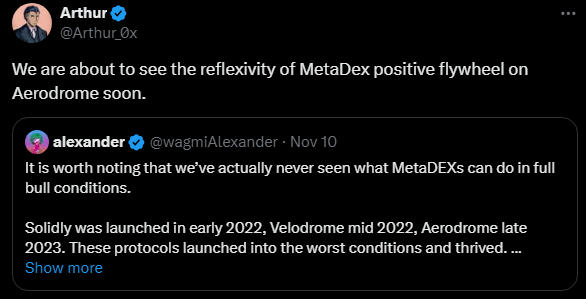

Defiance Capital founder:

Do you know the common thing between me, Defiance Capital, Coinbase Ventures & Spartan Group? We all bought $AERO from the market.

Thanks to Nansen, I’m able to give you their average buying price:

Who says retails are not better than VCs? 😂😂

Do you know the difference between me and Defiance Capital, Coinbase Ventures & Spartan Group? I got airdropped a veAERO NFT 😂😂😂

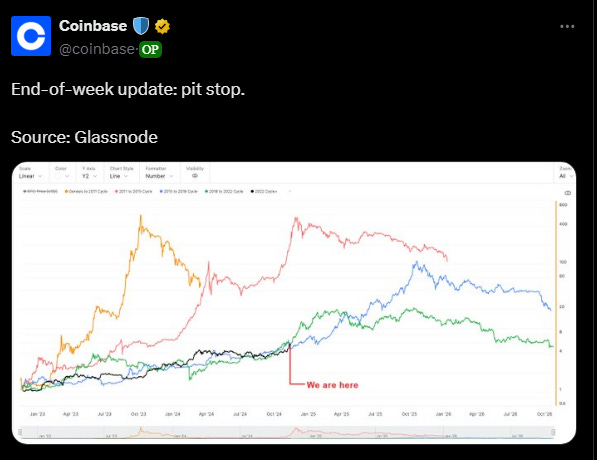

So my Bull Thesis is that simple: Coinbase will move its trading product onchain thanks to Aerodrome. And if Coinbase wins, Base will win, Aerodrome will win, and all project closely linked to Velodrome will win too…

Smart Money on Base

using Nansen App

Looking onchain not only gives you the best alpha, but gives it very early compared to the crowd.

The last 7 days I have tracked what smart money was buying and their unrealized PNL. Tracking unrealized profit is much more interesting than realized one cause it means they haven’t sold their position.

From the leader board,, by selecting funds only, Defiance Capital from Arthur_0X is #1 with 4m$ unrealized profit in 7 days… Good week Arthur!

Among the most interesting one, do you remember Sigil Fund? I have spotted them buying a HUGE bag of $VIRTUAL in my newsletter talking about AI Agent (read it here)… and you know why? He didn’t stop and doubled down! Result ? New ATH! Smart Sigil!

And finally, without any surprise, the top traded tokens are, as you would have expected:

AERO

Virtual

The above analysis was made using Nansen platform that gives you unique data about onchain activities on EVM & Solana chains. Save 10% by subscribing to a PIONEER or PROFESSIONAL plan using my referral link: http://nsn.ai/Subli

🏈 Post of the Week:

Disclaimer: Nothing in this content is financial advice. I may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky. Be ready to loose everything you invest in.