The 🔵Optimist: (L)Earn with Defi #31-2

Tips, Tools & Strategies for your personal journey in DEFI on the Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed part 1 [Superchain News], don’t worry, just click HERE.

2 weeks ago you replied to this poll! Interesting to see that OP Mainnet is leading the race, surely because it’s the oldest, and so the less degen. Therefore, what would make you move your funds to other chains ?

Click on your preferred language to access the translated version:

Chinese - French - Japanese - Korean - Persian - Portuguese - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔵The best yield farm on the Superchain

Yields are completely insane lately. The number of opportunities is at ATH. So, where are the best yields farm where you won’t be diluted after 24hours?

🟢Crypto market review

Bi-weekly update on the Crypto Market.

➡➡➡🤯Quote of the week

🟤Tutorial on Velodrome - Concentrated Liquidity Pool

You see high APR on Velodrome. You find out it’s a concentrated pool, and you skip cause you read that users get rekt’ed because of Impermanent Loss. We tried it, we earned insane yield, and we didn’t get rekt’ed. How? This step by step guide will help you to understand, and it’s easier than what you think.

Spotlight project: Stake Together

Stake Together is a Liquid (Re)Staking Protocol on Optimism that offers the highest yield on the market, and can also fund public good projects by directing a share of the protocol fees to fund whitelisted projects.

Soon, their ReStaking solution will launch on OP Mainnet and will grant ETH stakers cheap fees to restake on EigenLayer as well as all the following rewards.

Ready to 🥩? Visit StakeTogether now.

🔵The best yield farm on the Superchain

by Subli

Opportunities are everywhere in Crypto, and more especially during this phase of the market. And those incredible opportunities won’t last forever cause:

The problem with yield farming is that Yields are volatile, assessing Airdrop results is difficult, increasing your risk for few % of extra yields is a risky play (smart contract risk, stablecoin depeg, etc…).

In this article, I’ll show some of my current plays, why i have deposited in those farms, and the incredible results in:

Airdrop farming

Blue chips farming

Degen farming

1. Airdrop Season

1.1 Mode: Airdrop 1

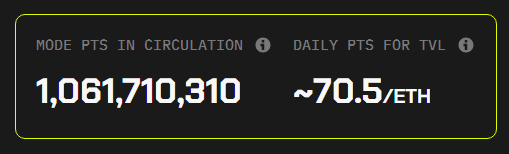

Yes, it’s not a surprise, until I understand how much i could earn due to a minor update the team made on the Airdrop website: Displaying the total number of points.

Total supply $MODE: 10 billions ➡ FDV at launch: 1b$ ➡ 1 $MODE = 0.1$

Total Airdrop: 550m $MODE = 55m$😱

# points allocated (as of 07-April): 1 billion. Current rate: 56m points/day ➡ Total points by end of April: 2,4 billion

1000 points = 23$ (estimated)

Since, you earn 70.5 points / deposited ETH, that can be easily boosted by 2x or 4x (now if deposited into a DEX) by just depositing them into any protocol: 70.5x2 = 141 points / ETH => 3.2$ day

Or 32% APR

TGE is planned for End of April according to James (Co-Founder of Mode). So only 3 weeks to do your best to earn $MODE.

And this is called Season 1 for a reason too… Don’t stop using the chain.

Here is our ref code if you don’t have any: https://ref.mode.network/k0l6ho

1.2 Build on Bitcoin: Fusion Season 1

In our last newsletter, we presented this new Hybrid L2 connecting EVM to Bitcoin security layer.

Why interesting to farm BOB? Bitcoin L2 is a very trendy narrative, most likely chain like this will hit 1b$ FDV, and there are currently 172m$ TVL.

Season 1: Currently Live until Halving planned around 20-April

Season 2: When BOB L2 mainnet goes live at the Bitcoin Halving

BOB Points = SPICE

Tips: Deposit wBTC or tBTC into the contract to earn +50% SPICE points

Unlock at BOB mainnet launch or 15-May the latest

Tips: At deposit, each $ makes you earn 1.5 SPICE.

The possible BOB token allocation has not been clarified by the team. The only thing I can say is: Watch out Blast program, and learn.

Sovryn is the OG DEFI project on Bitcoin L2 (DEX, Leverage Trading, CDP, Lending/Borrowing). By depositing through Sovryn, you can earn:

50% more Spice (need to keep liquidity for 30 days min)

Aidropped of the 1st RUNES token in the world (RUNES is the next BRC-20 format, that will be live on BITCOIN chain at the next Halving, and tradable on Sovryn) (Need to keep liquidity for 60 days min)

🛑If you deposit through SOVRYN, at BOB launch, your deposit will be converted into a LP, with half of your funds swapped to buy & pair with SOV.

Here is our ref. code if you don’t have any: https://fusion.gobob.xyz/lock - Code cn0pfw

2. ETH Yield farming

A Big part of my wallet is in ETH, and none is staying idle in my wallet. I’m not checking the best yield every 24hours, and moving my ETH from one protocol/chain to another chain/protocol, especially with a cold wallet, it’s painfull. So i’m finding farms where yield can be stable such as:

2.1 Velodrome

🔴 OPTIMISM - Concentrated Liquidity Pool wstETH/ETH: 38% APR + LIDO staking yield (With slipstream ramping up + Velo price up, this yield could be maintained mid-term)

🔴🔵OPTIMSIM/BASE - wETH/LST or LRT: There are several farms with LST such as pxETH or frxETH paying 30% APR, and in couple of weeks you’ll see more LST & appearance of LRT on Optimism. Be early. => Same on Aerodrome with the cbETH/wETH pool printing 28% APR, or the new ezETH from Renzo Protocol printing 38% APR on Aerodrome.

2.2 Lending/Borrowing protocols

Everyone is long, there is not enough liquidity on the market, you remember?

🔵BASE - Extra Finance: Lending pools - ETH: 59% APY

🟡MODE - Sturdy finance: Aggregator vault (I.e optimized lending pools) - ETH: 66% APY

🟡MODE - Ironclad (Granary Finance fork): Lending pool ETH: 30% APY

3. Stable farming

🔵BASE - Toros Finance: what if you could enjoy the same yield as USDe, while not being exposed to USDe from Ethena? 70% APY on a Delta Neutral Stablecoin Yield

🔵BASE - Avantis: Junior Tranch counter party vault on Perpetual protocol. Max locked during 6 months, and earn >100% APR

🔵BASE - Aerodrome offers some interesting stable pools: USDC+/USD+ 83% APR. USDC+ & USD+ are delta neutral stablecoins with underlying yield, respectively 13% & 45% APR on base

4.Degen farming

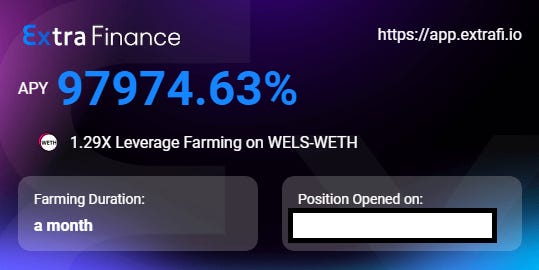

4.1 Extra Finance

There is one place for degen farming, leverage through Extra Finance. But be cautious, the yield won’t break even a shitcoin going to Goblin Town. So you need to check:

TVL on the DEX + TVL on Extra Finance

Project Market Cap (coingecko)

Token holders (Etherscan)

And if stars are aligned, welcome in the Degen play:

4.2 AIRPUFF

A brand new protocol just launched on Mode. This protocol allows people to leverage LRT in a very friendly UI. Leverage Renzo LRT ezETH up to x7 & earn:

On the other side, Lenders can deposit ETH and earn 50% APR!

On top of this, you can earn 3x AirPufff points when depositing on Airpuff. This is a brand new protocol, so do your own due diligence on it.

Do you know how to make more points? Join our team by clicking on this link & select one of these codes (one code per user):

ZK0Y86 / QRT9GO / FUMCEW / EGH2WL

JS6ZCW / QWIN4M / KPFLMI

CC5ZGW / LKUY3O / QTHZE2

J2VIR4 / 4FXJOQ / EOW25X

2JPWTW / 645DOY / K1M1SS

YV8JIR / W80BSB / AQQAH0

Note: If codes are already taken out, dm me on X.

All the above strategies are some plays i’m personally doing. Do you own research, read the docs & understand where the yield is coming from as well as the underlying risk.

Happy farming & stay safe.

Note: When Ethena will launch on Mode (expecting in May), expect Pendle to come too. Don’t be afraid, we will have your back and will go through a complete tutorial about farming USDe through Pendle.

🟢Crypto market review

by Axel

Bitcoin

The market has reset. Indeed, funding has decreased significantly, which is important to continue the bullish movement. If you follow crypto Twitter, you might almost believe that it's the end of the movement.

It is very important to keep in mind the big picture. This is what we present to you here every two weeks. We will try to give you some tips to keep your conviction during corrections.

Bitcoin is consolidating above the middle of its bullish range. It has surpassed its weekly all-time high. The uptrend is healthy despite a high weekly RSI.

Bullish signs: Bitcoin has consolidated above the middle of the range. It has surpassed its weekly all-time high with a retest (fib 1).

Bearish signs: The weekly RSI is high but without divergence.

Inverse BTC

Above is a reversed daily chart of Bitcoin. This graph allows us to view the price action from a different perspective. The continuation of the movement appears evident with this presentation.

CME gap

We have a CME gap open this week at $68,000. We will no longer highlight the open CME gaps below $48,000 as we believe they are currently irrelevant. If Bitcoin were to correct sharply, we will once again focus on the open CME gaps below $45,000.

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin Dominance: We are keeping a close eye on this indicator. Its breakout to the upside or downside will be a strong signal for altcoins. The resolution is near.

ETHBTC: The pair continues to consolidate and diverge on the weekly chart. We believe that this low is the bottom or close to it. We should have a resolution of this trading pattern very soon.

Conclusion

The Bitcoin consolidated for some time. The altcoin market corrected for the most impulsive cryptos and consolidated for others. The correction made many people bearish according to Crypto Twitter.

Therefore, it is necessary to keep the big picture in mind to avoid changing sentiment too quickly during corrections. Inverting the Bitcoin chart allows us to have another perspective and analyze the market more calmly.

For us, the market should soon continue its uptrend. We remain bullish. For altcoins, we favor two scenarios:

Bitcoin rises while altcoins consolidate. The BTC.D ticker breaks its range to the upside while ETHBTC continues to consolidate.

Bitcoin rises and consolidates while altcoins climb. The BTC.D ticker breaks its range to the downside while ETHBTC breaks out of consolidation and enters an uptrend.

We will remain bullish as long as the mid-range is defended on a weekly basis.

Meanwhile, during these correction phases, we take the opportunity to rebalance our portfolio to focus on the top gainers. But be careful not to overtrade at every candle. Money goes from the impatient to the patient."

🤯Quote of the week

By courtesy of QuotableCrypto

🟤Tutorial on Velodrome - Concentrated Liquidity Pool

By Thomas

Dear readers,

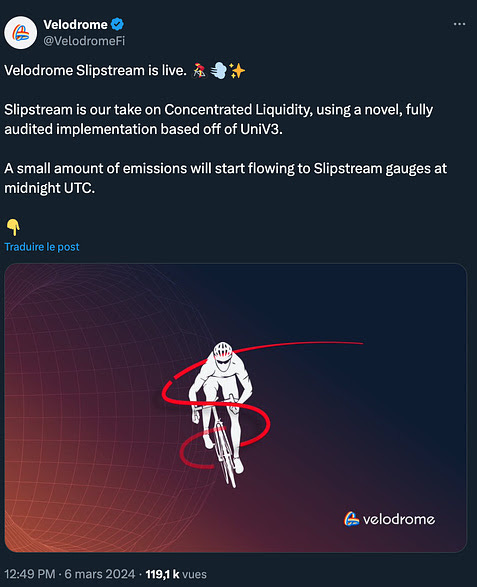

After many months of development, concentrated liquidity pools have finally arrived on Velodrome!

These new pools enable the creation of new strategies. Discover how to set them up within this tutorial.

Introduction to Slipstream

On March 6th, the Velodrome Finance team officially announced the release of "Slipstream," the platform's concentrated liquidity solution.

Based on the principle of Univ3, this technological advancement leverages Velodrome's technical architecture, making LP incentives even more profitable.

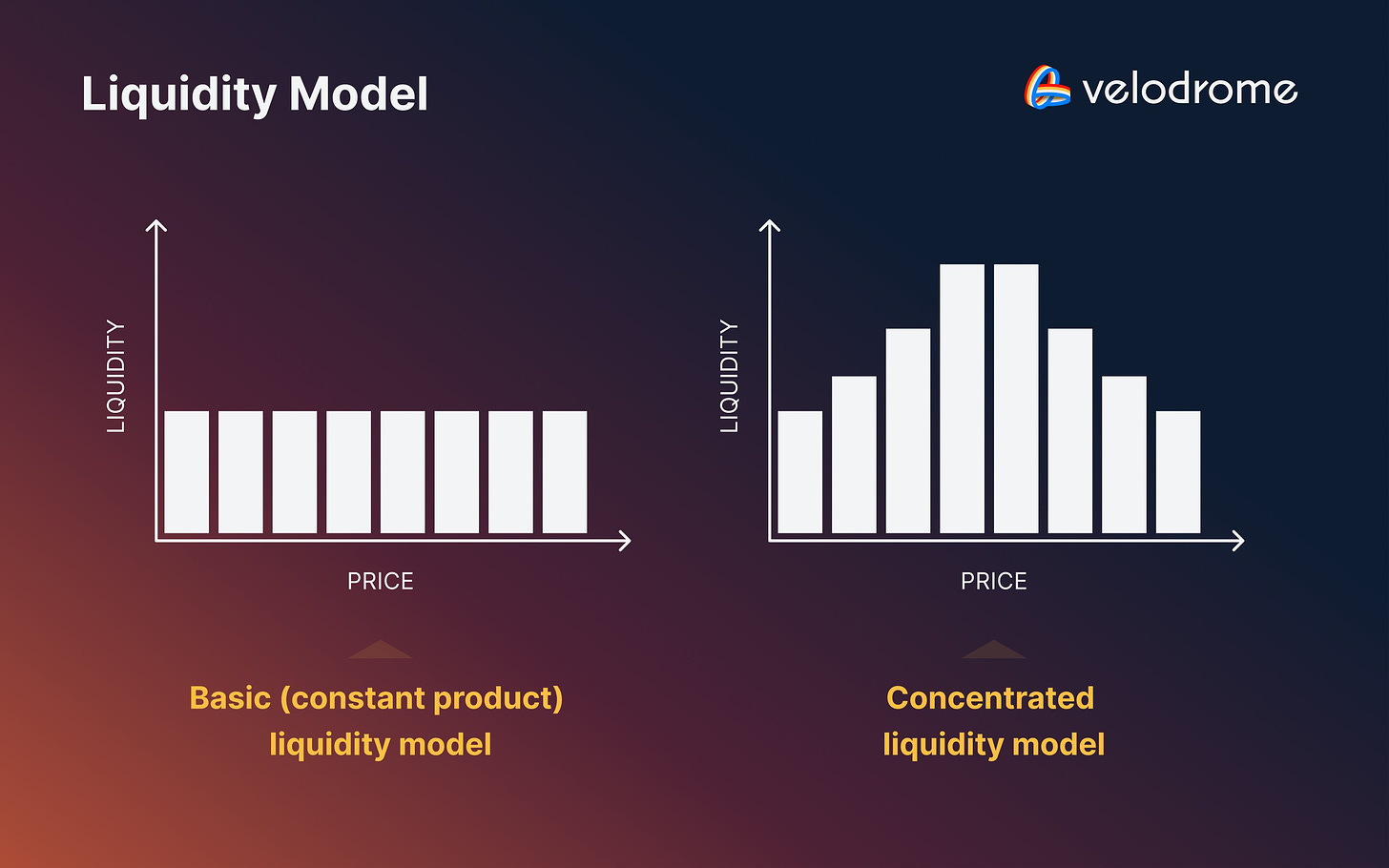

But before delving into the details, let's briefly review concentrated liquidity pools: Unlike traditional pools, concentrated liquidity pools contain the majority of liquidity in distinct price ranges.

This allows for better capital efficiency since the funds deposited in LP are not spread across the entire price range (0 > ∞) but rather defined within a specific price range.

On the trader's side, concentrated liquidity pools are more appealing because more liquidity in one place means less slippage during a trade.

On the LP side, this allows for collecting more fees.

In this way, Liquidity Providers are FULLY aligned with protocol growth. More volume = more fees = more liquidity = less slippage = More volume = …

But as you'll see, it's not all straightforward: setting up a concentrated LP position requires some practice and more monitoring.

How to set up a position?

Concentrated pools are located in the same place as classic pools: you will find them in the "Liquidity" menu of the protocol.

To make them easily identifiable, they are represented by a "CL" prefix (Concentrated Liquidity).

To ensure you don't get confused, we suggest sorting the pools using the "Concentrated" filter: this will allow you to see only the concentrated pools.

Once you have selected the pool, click on the "Deposit" button.

Price Range selection

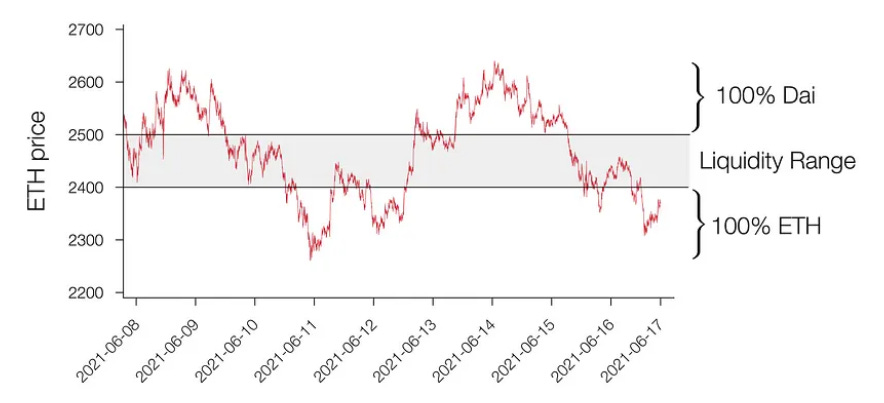

Now it gets interesting: To set up your position, you need to select a price range where your assets will be deployed.

(Our example concerns the CL1-wstETH/WETH pool).

Note: CL1 means that prices are spaced 0.01% apart in an equidistant manner; these are called "ticks." They help define the boundaries of the range.

For CL200-wETH/OP, prices are spaced 2% apart from the average price.

At the time of writing, wstETH is trading at 1.16 ETH.

For your LP position to be within the active price range, you must therefore position your liquidity within a price range encompassing this value.

If you choose a price range of 1.15 - 1.17 (meaning spreading liquidity over 200 ticks), your position will be "on range": your liquidity will be used for trades, and you will earn transaction fees. But since the price of wstETH is very correlated to ETH (3% yield/year = 0.008%/day), you can easily reduce to +/-0.1% (20 ticks) and thus setting your upper & lower tick to: 1,15884 - 1,16116 => More yield

If you choose a price range of 1.10 - 1.15, your position will be "off range": your liquidity will not be within the active price range, and you will not generate any APR.

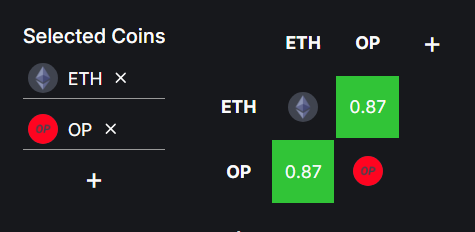

For volatile pairs like wETH/OP, tick space is very friendly but can still be adjusted. First assess the correlation between the price action of both assets. Use Defillama Correlation website for this. Value goes from +1 (totally correlated) to -1 (uncorrelated).

In our case, for the pool wETH/OP, both assets are quite correlated. So setting up a +/-10% range (10 ticks) might get you most in the time in the active range while minimizing rebalancing.

Note: Yield set like this is about 300%APR. Displayed APR on Velodrome is based on a very wide range.

Reminders

Here are some reminders for deploying an effective position:

The tighter your range, the more concentrated your liquidity: therefore, your APR will be higher, but the more often you’ll need to rebalance your position.

The proportion of your assets changes dynamically based on the price movement of the assets: when you are out of range, your deposit consists of 100% of asset A or B of the pool, and 0% of the other asset (thanks to Guillaume Lambert for this chart)

When you are out of range, you do not generate any yield.

Liquidity Management (Manual)

When price between the 2 assets move, the ratio of your assets will change. If you’re away from 50/50 (90/10 or 10/90), then that means you need to rebalance.

When you are out of range, you can exit the pool and recreate a position within the active price range: this is called rebalancing.

This allows you to recreate an LP and earn fees again, but exposes you to a minor loss since you swapped the weaker asset at a less favorable rate than what you initially had (to re-enter the pool).

The goal is therefore to calculate if the fees generated while you are "on range" offset the cost of rebalancing.

Spoiler: if this is the case, you are profitable! (This is quite often the case on stable pools).

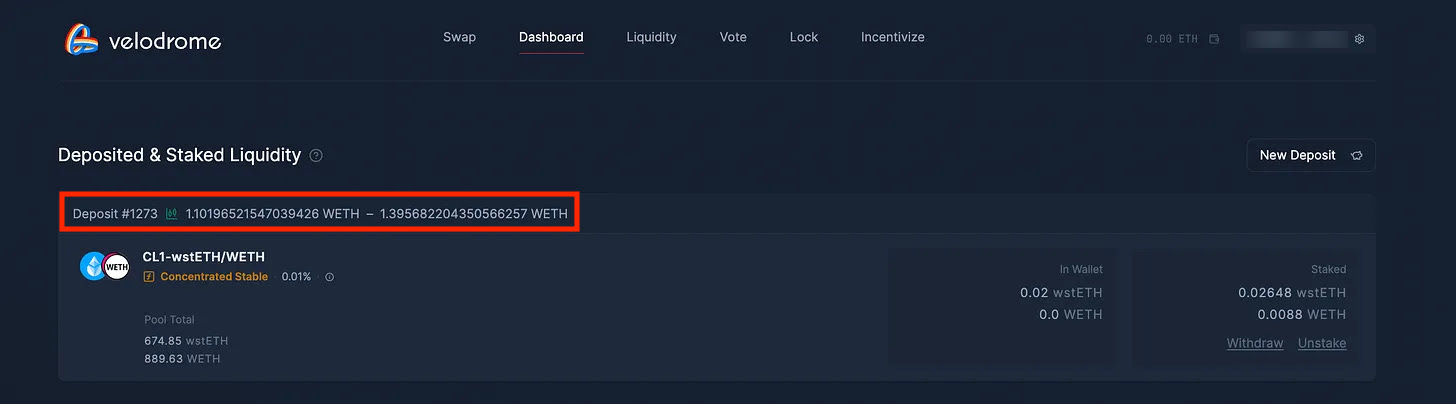

Once you've chosen your range, click on the "Deposit" button and sign the transaction: you'll receive an LP token.

Finally, stake your LP token to generate all the incentives. Once done, your position will look like this:

The small green "chart" symbol indicates that your position is within the active price range.

And there you have it! You can now enjoy the juicy APRs of concentrated liquidity pools.

Tips: If you love maths, check this work from Guillaume Lambert, guide to select ticks in Concentrated Liquidity Pool.

Liquidity Management (Automated) or ALM

If you prefer not to manually handle LP management, you can delegate this task to Beefy Finance by depositing your LP tokens into their new dedicated vaults.

They will handle the rebalancing to maximize APR for depositors.

Currently, Velodrome is not yet supported as this has been launched on 08-April, but expect it soon.

And Velodrome is also working with a partner to bring custom-made ALM for Racers.

Now that concentrated liquidity pools are deployed on Velodrome, who will be next? Perhaps Aerodrome?

If you have any question about how to set up a position, leave us a comment. We will be happy to answer you:

The Optimist Social accounts:

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.