The 🔵Optimist: (L)Earn with Defi #37

Tips, Tools & Strategies for your personal journey in DEFI on the Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed our previous Superchain News, don’t worry, just click HERE

Click on your preferred language to access the translated version:

Chinese - French - Japanese - Persian - Spanish - Thai - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔵RWA (Part 2) : Tokenized Treasuries & Securities

Following our Part 1 - Introduction article why Base could become the Home of RWA, let’s dive in this 2nd article of the RWA series to talk about Tokenized Treasuries & Securities

💹 Crypto market review

Bi-weekly update on the Crypto Market.

➡➡➡ 🤯 Quote of the Week

🔎 Technical Analysis: $CPOOL from ClearPool

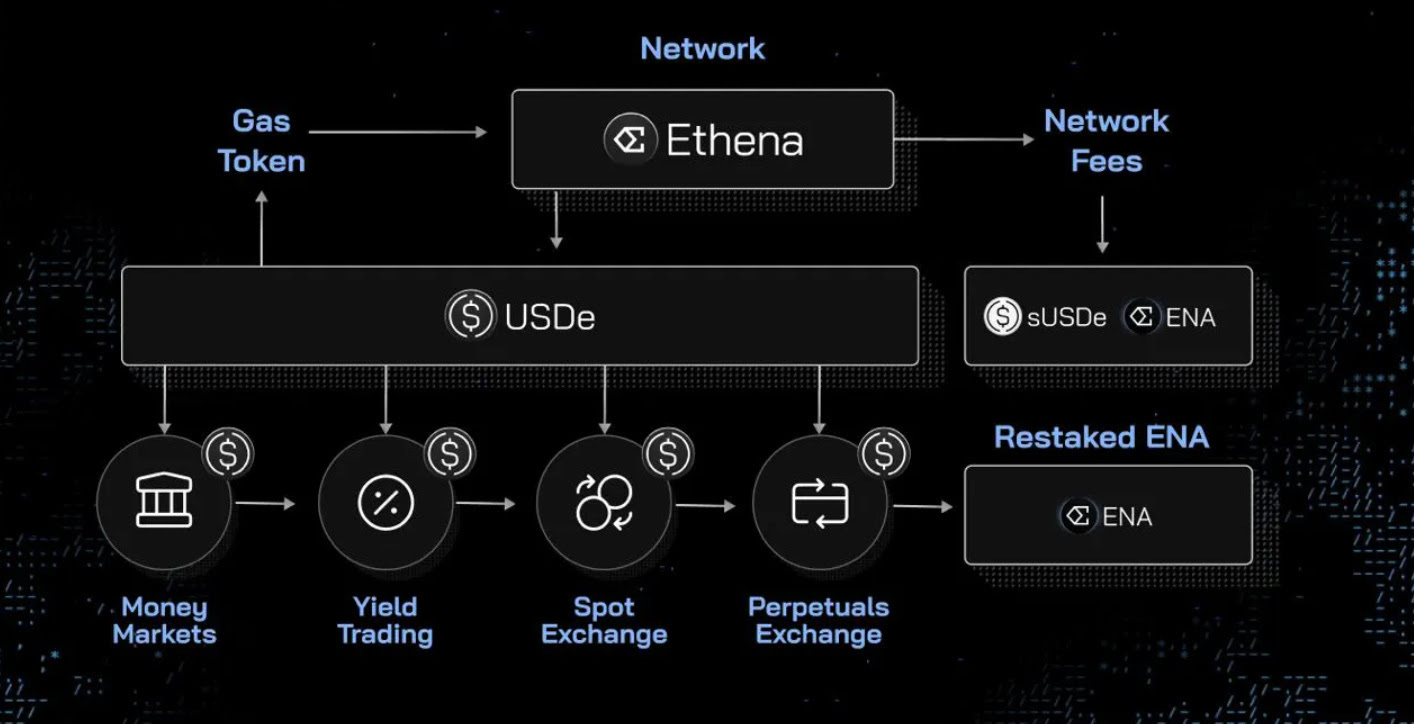

💲 Ethena Season 2 GamePlay

We have digged into how to play Season 2 point program of Ethena. Buckle up cause we’ll be talking about Blast, Symbiotic, Mellow & …🤫

Spotlight : Segment Finance

Discover Segment Finance, your top-tier lending and borrowing protocol on 🟠BOB. Deposit your assets and unlock a world of earnings: lending yields, Segment points, and Spice points with one of the highest ratio on BOB $/point, from the ongoing BOB Fusion Season 2 campaign.

With integrations of major assets from Threshold, StakeStone, Sovryn and working with reliable Oracles providers such as DIA & Redstone, borrowers can leverage their portfolio low interest rate.

Start Bridging on 🟠BOB here and connect to https://app.segment.finance/

🔵RWA (Part 2) : Tokenized Treasuries & Securities

by Subli

Following our 1st part about RWA on Base, read this here if you missed it, it’s now time to talk about the most famous RISK-FREE yield in US called Treasury Asset, and regulated tradable assets called Security.

What is a Treasury & Security:

Why USA and not China or other country assets? Because it’s the 1st economy in the world

What are “Treasury” assets? Wikipedia: “United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury” which makes it one of the world's lowest-risk investments

What is “Security” asset? It’s any tradable financial asset registered by the U.S. Securities and Exchange Commission [SEC]

As of April 2024, the total market cap of Treasury Asset is 27,000,000,000,000$ (27 kb$) according to SIFMA while DEFI is only 100b$

Treasury includes: Treasury Bill (T-Bill), Treasury Bond (T-Bond), Treasury Note (T-Note), Treasury Tips (T-Tips)

Yield changes based on the maturity date of the Treasury / security (from 3 months to 30 years - ranging from 4.5% to 5.5% as of 30/06/2024) which can be very competitive to lending/borrowing protocols or DEX like AAVE & Curve finance

Now that you have a better understanding of a Treasury / Security, lets move back to blockchain.

What does Tokenizing mean?

In case you don’t know yet, Chainlink is by far the #1 firm that are bridging offchain world with onchain world. Here is Chainlink definition (recommend to read this article):

Tokenized Treasury / Security:

So this means simply bringing the lowest-risk financial product on the blockchain (people being able to buy, sell this specific asset). This is what Blackrock has done recently by tokenizing a Money Management Fund backed by Treasury Bills and other low-risk assets on the Ethereum blockchain.

1 $BUILD = 1$ of treasury / security owned by Blackrock

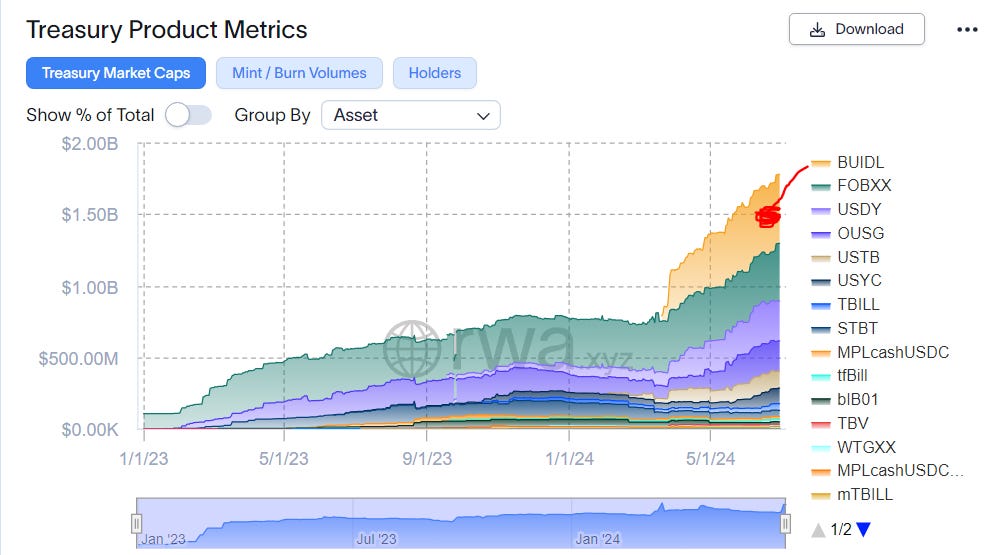

Tokenized Treasury represents today 1,78b$ (0.007% of the total market of 27 kb$), and $BUILD is now the highest market CAP tokenized treasury asset. Thanks to RWA.XYZ website for this amazing dashboard.

But…Yes there is a But… If you’re a North Korean hacker, or Edward Snowden, you won’t be able to buy this security. In order to comply with local regulation, only whitelisted entity are allowed to exchange Treasury Asset.

Fortunately, there are other companies which offer the same tokenized asset or derivative of it in a permissionless way. Do these projects comply with your local regulation? I’m not a lawyer, so I’ll just reply to this question by DYOR.

But what’s the reason to TOKENIZE Treasury Asset ? Earning more money onchain.

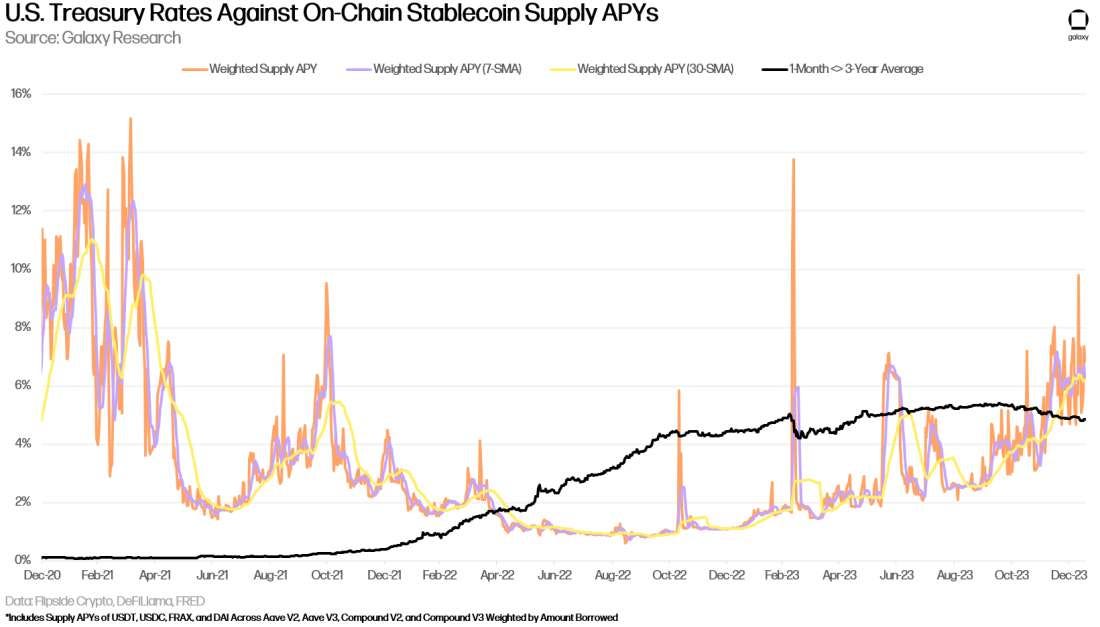

The chart below provided by Galaxy shows, the black curve below is showing the Treasury asset yield, while the other colored curves show the average yield you can find onchain by supplying funds into Top Tiers lending/borrowing protocols.

1- During bull market, people leverage so borrow stablecoin, and lending yield goes up

2- During bear market, less leverage, so lending yield goes down, and this is when low-risk yield becomes very interesting

As the market will become more & more mature, we could expect to have the 2 yields converging to an averaged value.

Tokenized Security on 🔵Base

The TVL market share of RWA in DEFI is really small (3.9% of the global DEFI TVL), which only 0.5% is on Base at the time of writing:

So far, here are the RWA projects backed by Tokenized Treasury / Security for which stablecoin can be traded on Base :

Backed Finance has been the 1st protocol launching a Tokenized Security on Base. While the milestone is exciting, it lacks demand right now, as the TVL is currently at 0$ 😥. However, most of the TVL is on Ethereum mainnet, and tokenized products from Blackrock institution funds are being used by Angle Protocol presented here below! I love the transparency of DEFI.

Backing: RWA & Defi Yield bearing asset

Stablecoin: stUSD

Specificities:

Minting: Permissionless

Redemption

Over collateralization: 10%

Available on Base, buy stUSD directly from the protocol website: https://app.angle.money/savings/usd

Yield: 16% APY

Backing: Treasury assets & $BUILD from Blackrock

Stablecoin: USDm

Specificities:

Minting: Enabled through KYC

Redemption: Enabled back into USDC

Over collateralization:

Yield: 5% APY, interest accrues daily

Mountain Protocol is thrilled to be the only regulated and permissionless, yield-bearing stablecoin on Base and on the Superchain. We are eager to contribute to the growth of this vibrant ecosystem through a safe, innovative stablecoin that gives back to the community.

In the coming weeks, the team will roll out exciting opportunities on Base with bluechip protocols such as Morpho Blue & Jojo, that will help the ecosystem grow while providing utility for its users.

Backing 100% RWA: Short-term US Treasuries & US $dollard deposits

Stablecoin: USDy

Specificities:

Minting: Only KYC people, transferrable only after 40days holding

Redemption: Enabled to backing assets

Over collateralization: 3%

Not yet on Base, but deployment on other chains have already started. Something tells me, it won’t last long before finding USDy on Base

Native yield: 5%

Backing 100% RWA: $BUILD from Blackrock (18%), other finance products like Private Credit Notes (54%) - custody by Percent (company backed by Coinbase) - and Cash (28%)

Stablecoin: USDz

Specificities:

Minting: Possible under KYC

Redemption: Enabled to backing assets

Over collateralization: Around 10%

Available on Aerodrome & Extra finance - with a pretty interesting yield (30% APY)

Staking yield: 35% APY

Points program ongoing: Best place to earn Z-Point is by LPing on Aerodrome or Extra Finance

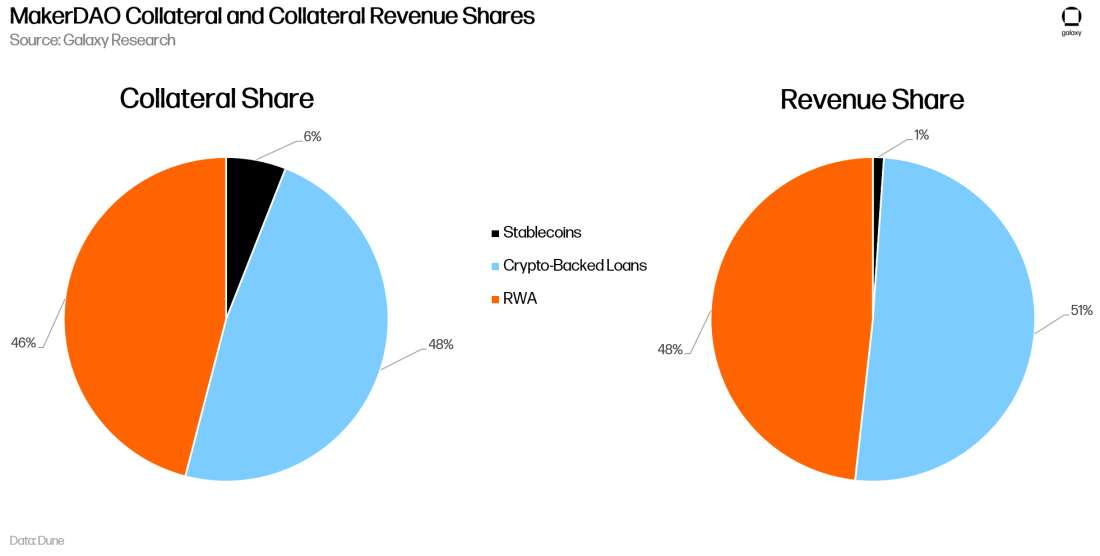

RWA: stablecoin backed by Crypto currency (54%) and RWA (46%)

Stablecoin: $DAI

Yield: Native yield on Spark Finance (the native Defi protocol of Maker DAO): 8%

Backing 100% RWA: WisdomTree Floating Rate Treasury Fund (90%) & USDC

Stablecoin: USD+ & stUSD+

Specificities:

Minting: Permissionless by depositing USDC

Redemption: Enabled but paid back using the USDC pool only

Announcement that USD+ will be soon on Base

Native yield: stUSD+ = 5%

Risk & Conclusion:

The stablecoin landscape is a multi-trillion market, and everyone wants a piece of that massive cake. You have only 2 use cases for stablecoin:

1- Either it’s used for Payment → Welcome $USDC

2- Or it provides a native yield

In the 2nd case, the end game is the Distribution as the BD lead of Ethena stated weeks ago, and no one will argue about the rapid growth of $USDe

As USDy is set to be onboarded onto Perps protocols, different chains EVM & non-EVM, we recommend to look at the ones who will stick to this roadmap.

I will just end up quoting Ondo Finance latest blog post: “Assuming 180b$ being set as collateral in Perp Exchanges, not using yield bearing stable results in a $9.5 billion annual loss in potential yield accrual for traders.”

💹 Crypto market review

by Axel

Bitcoin

The market continues its correction/consolidation, testing our patience. Let’s examine the signals it’s giving us.

On the monthly chart, Bitcoin remains in consolidation. The price is still above its support at $61,500.

On the weekly chart, Bitcoin continues to consolidate above its monthly support. We observe a divergence: the price is stable while the RSI is declining.

On the daily chart, Bitcoin has broken its blue support and re-entered the bearish channel/bull flag. We observe a bullish divergence in green.

Bullish signs: In the weekly and monthly charts, Bitcoin is consolidating above its monthly support (green line). In the daily chart, Bitcoin has broken its supports and continues its consolidation. Divergences are observed in both the weekly and daily charts.

Bearish signs: We are in the summer trading period.

DXY

The indicator is still moving within its range. It appears to have short-term strength; however, it is currently at resistance. At worst, we expect a deviation above the range before it re-enters.

USDT.D

The indicator seems to be losing strength, with a weekly divergence forming. As a reminder, like the DXY, this indicator moves inversely to the market.

Altcoin

Bitcoin Dominance: The indicator is still trading above its blue support. If the indicator breaks above the 57% resistance, it would be a strong bearish signal for altcoins. The resolution of the ongoing bearish divergence formation may take some time.

ETHBTC: Ether has broken above its blue resistance from the bottom of its range. The weekly divergence is still ongoing. We need more consolidation before next leg up.

TOTAL3: The indicator is at support. We hope this is the bottom because if the support is broken, the next significant support is at 450-470B market cap (-25%).

Conclusion

Bitcoin continues its long consolidation. Many people, hoping for quick gains, are exiting the market due to impatience. These will be the future buyers who will help the market perform later in the year.

For now, there is no reason to panic. We are still in a bull market. We are still above major supports, and other indicators that move inversely to the market seem close to their tops.

Regarding altcoins, many majors appear to be consolidating while others are nearing their bottom. When prices rise, there's a tendency to expect continual upward movement; and when prices fall, there's a tendency to anticipate further declines.

In terms of timing, we do not expect much from July. We think the market will continue to consolidate, and we will start to see the first signs of recovery in August.

Finally, we confirm that we have exited 20% of our positions as explained in the last newsletter. We warned that if Bitcoin broke its daily supports, we would recover some liquidity to DCA our investment portfolio. We have already started entering and will continue progressively throughout the month.

Reminder: patience will be rewarded once the summer trading period passes. These times are challenging but necessary to exhaust all sellers, allowing the market to regain momentum when the time comes.

🤯 Quote of the week

By courtesy of QuotableCrypto

🔎 Technical Analysis on $CPOOL (Clear Pool)

By Axel

In this newsletter, we propose to chart $CPOOL. As a reminder, we believe that RWA (Real-World Assets) will be one of the top narratives in the continuation of this bull market.

$CPOOL (Clearpool)

After almost 2 years of consolidation, the price broke out above its resistance (green), followed by several months of upward movement.

We observe that the price topped with a weekly divergence (blue). Subsequently, the price corrected to the 0.236 fib level, which is a buying zone. It then formed a higher low in June and created a double bottom. A weekly divergence (red) also forms a support on the price.

On the daily chart, we can clearly see the 12345 waves of the ascending phase. However, it is still too early to determine if the correction is complete (orange fib) or if it is still ongoing (yellow fib).

This case is interesting because the purpose of technical analysis is to create probable scenarios.

Action Plan:

If the price has bottomed and follows the orange fib correction, we can already be buying as long as the price has not broken its red support.

If the red support breaks down, it is highly likely that the price will continue its correction significantly, as this would form a head and shoulders pattern.

Therefore, we will begin building our position as long as the price remains above the red support. If the price breaks below the neckline on the daily chart, we will cut our position and wait until a new trading pattern becomes clear.

💲 Ethena Season 2 GamePlay

By Thomas

Dear readers,

If you farmed season 1 of Ethena Labs, you know that season 2 is also full of opportunities. There are still a few weeks left to take advantage of them.

Find out how to farm it efficiently through our selection of DeFi strategies.

Context

If we objectively look at Ethena's development since its launch, it would be dishonest to say it hasn't been a great success.

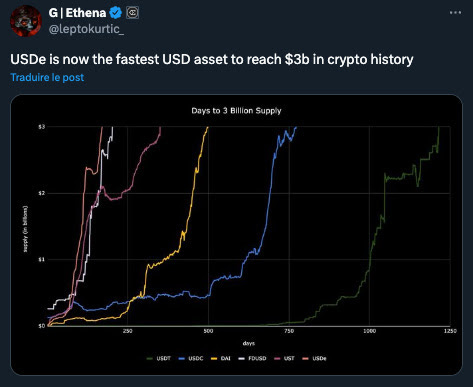

Indeed, USDe is experiencing exceptional growth: at the time of writing, its supply is around 3.6 billion tokens. This is quite surprising for a stablecoin launched so recently.

Moreover, when comparing its growth to other stablecoins, USDe is the fastest to reach a $3 billion market capitalization. Even UST didn't achieve this!

How can a stablecoin experience such rapid growth?

Well, one could argue that this success is primarily due to Ethena's points program. Divided into three seasons, it rewards users with airdrops of $ENA tokens.

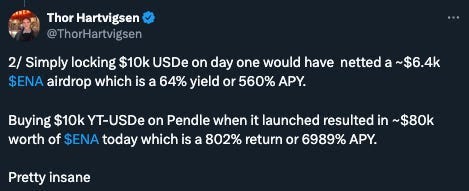

The first season of this program was very well received by the community: 750 million tokens were airdropped, representing 5% of the total supply.

By implementing the right strategies, it was easy to achieve a significant return on investment.

Farming Stategy

Even though we are in the midst of season 2, it is not too late to implement effective farming strategies.

We have prepared three optimized strategies that cater to different needs.

1: Semi-Passive LP Strategy

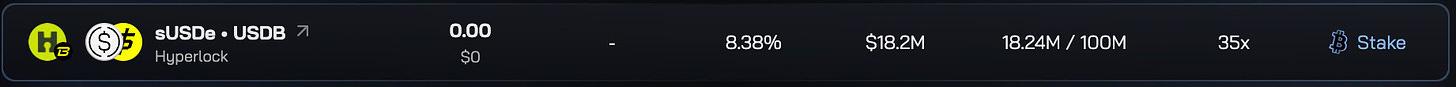

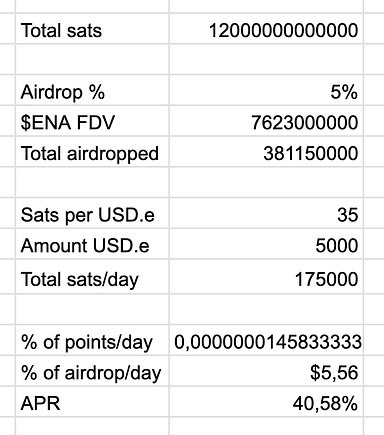

If you want to accumulate as many points as possible through a small LP strategy, it would certainly be relevant to choose the sUSDe-USDB pool/farm on Hyperlock on Blast.

Deploying it is very simple: just create an LP position on Thruster with these two assets, then stake it on Hyperlock.

Note: For your LP position, a range of approximately 3% spread is sufficient to keep the position semi-passive.

In addition to obtaining the highest points multiplier in Ethena's LP category (X35), you will farm:

Thruster points (X3)

Hyperlock points (X3)

Blast Gold

According to Thor Hartvigsen's prediction model (available here for Ethena), deploying such a position would hypothetically generate an APR of around 40%.

Note: Unlike other LP strategies, you do not need to lock your position on Ethena for this one.

2: Borrowing Strategy

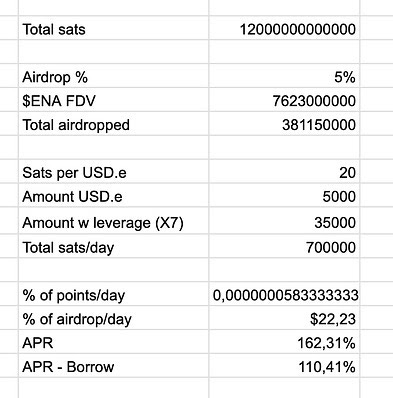

If you're a more aggressive investor, you can consider a leveraged borrowing strategy from a money market. This is a good alternative to Pendle's YT products.

Currently, the Gearbox borrowing strategy is among the most optimized in its category. By opening a borrowing position in USDe/crvUSD, you can leverage your USDe balance and thereby increase your points generation.

What's appealing about Gearbox is that you can apply leverage up to X9 while benefiting from a reasonable borrowing cost (approximately 7.5%/y).

As for the yield of this strategy, our predictions indicate an estimated APR of around 110%

Caution: This strategy exposes you to liquidation risk. Always monitor your collateralization ratio carefully!

These estimates also vary based on the valuation of ENA and the total number of points at the end of the season.

3 : Restaking Strategy

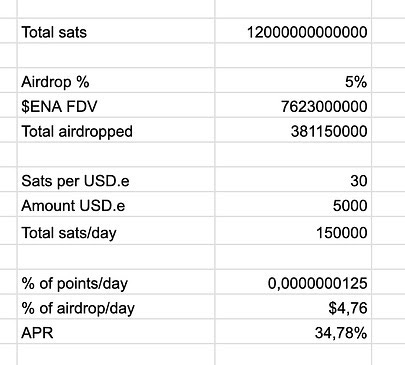

Finally, if you're looking for an alternative strategy, restaking through Symbiotic via Mellow Finance could be a good solution.

Just a few days ago, Symbiotic announced its partnership with Ethena: ENA and sUSDe tokens can now be used to secure networks.

What's quite interesting is that using Mellow Finance (LRT's modular infrastructure), you can also generate additional points.

Therefore, by depositing these tokens on Mellow, you'll generate Ethena points along with Symbiotic and Mellow points.

Given that the Symbiotic ecosystem is emerging and promising, it would likely be beneficial to passively expose yourself to it through Ethena.

The limits on sUSDe deposits have been reached. You will need to wait for Symbiotic to increase them or for users to withdraw their funds.

But there's more!

As Ethena will use this restaking layer to secure its future network, the protocol has announced that ENA restakers will likely be eligible for future airdrops (conducted by protocols integrated into Ethena).

If holding ENA doesn't scare you, you'll likely be rewarded with airdrops in the coming months.

Bonus: ENA restaked will likely be eligible for LayerZero's upcoming RFP airdrops.

And now… Alpha for the ones who read up to the end: Don’t say it’s coming from me!

This overview is now complete!

If you have any questions or feedback on these strategies, please feel free to let us know.

The Optimist Social accounts:

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.