The 🔴Optimist: (L)Earn with Defi #20-2

Learn & Earn with DEFI on Layer 2 chains / OP Stack / Optimism Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed part 1 [OP Superchain News], don’t worry, just click HERE.

Click in your preferred language to access the translated version:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Turkish - Vietnamese

KEY TAKEAWAYS

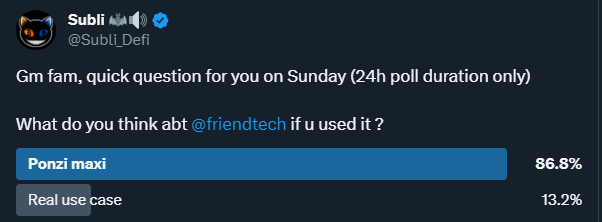

🟡Social_Fi with Friendtech

If you haven’t heard about Friendtech, this is currently the most lucrative dAPP on Base. Can you make money on it? What about this massive week sell-off? Let’s read feedback from one of our contributor.

🟢Crypto market review & Tips

Bi-weekly update on the Crypto Market & educational content about Trading

🟤Farming strategy: LI.FI Airdrop

My strategy to be well prepared for LIFI speculative Airdrop. It’s a Marathon, so time to start now.

Spotlight project: Oath Ecosystem

The OATH ecosystem is changing the world of DEFI by setting up new standards for security, capital efficiency and real yields.

With Ethos Reserve V2 coming soon and updated tokenomics on the way, OATH is set to shake things up on Optimism going into 2024. You can find $OATH on Velodrome and check out their site at oath.eco.

Follow Oath Foundation on X & Turn on notifications.

🟡Social_Fi with Friendtech

Welcome to Social_fi or the combination of Decentralized Finance & Social Media where Friend.tech (FT) was the 1st protocol of this type, backed by Venture Capital Paradigm & launched on 🔵Base. Which then triggered several forks to follow on other chains:

For people who live under a rock, briefly, FT allows people with a X account to buy/sell keys (previously called shares). If you buy an influencer key, you will be able to ask him private questions and every key holder can read his replies.

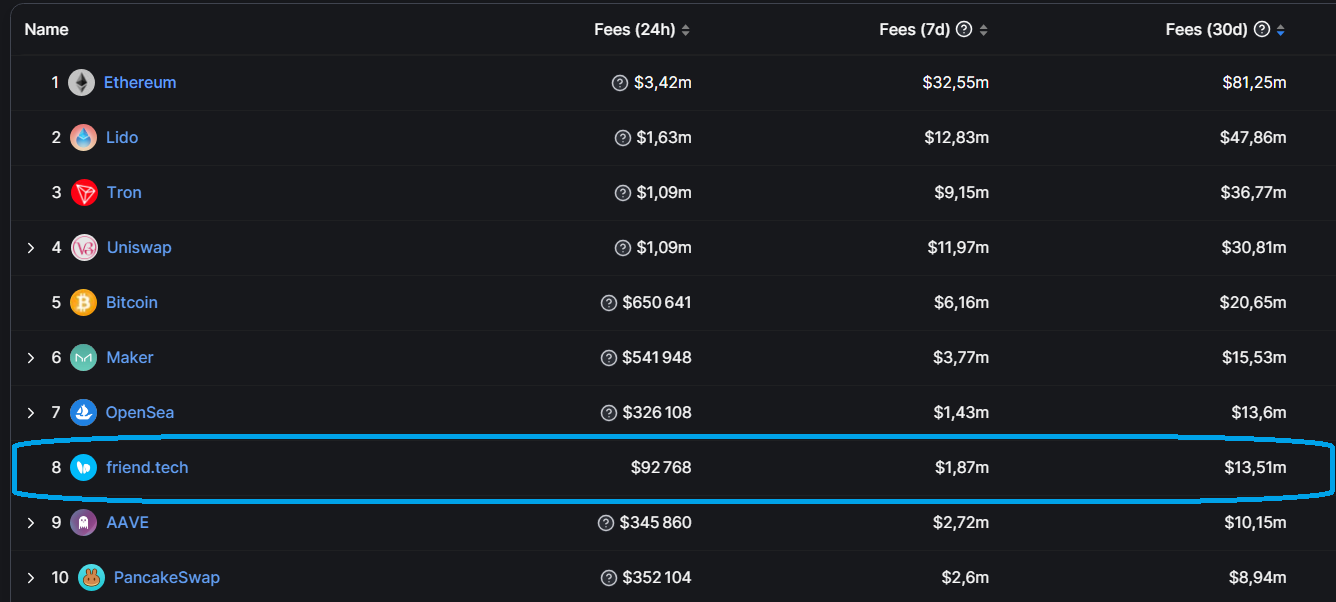

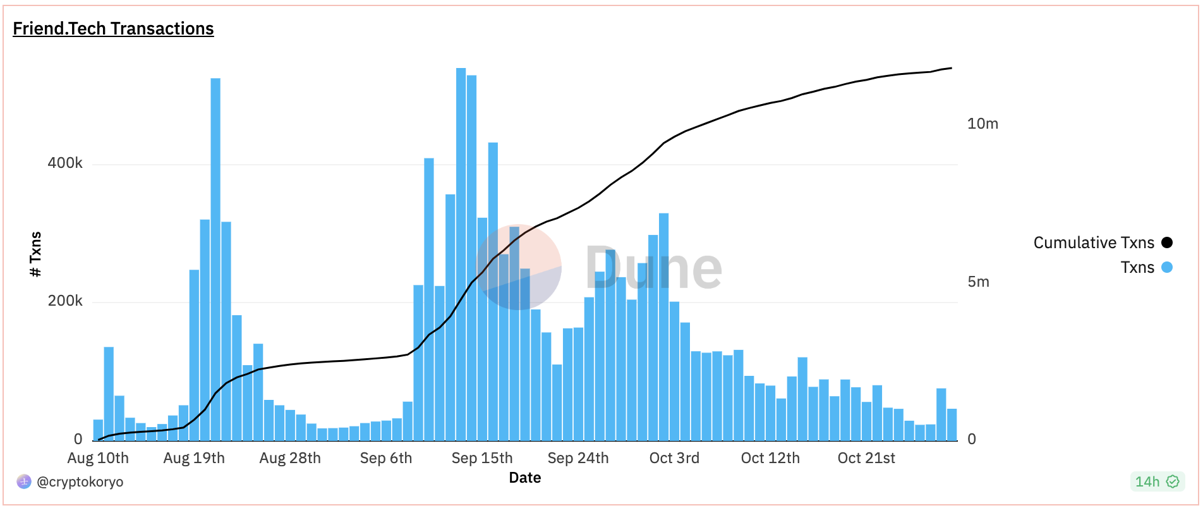

Since its launch in early August 2023, Friend.tech has gotten a lot of attention, due to the impressive amount of fees it generates. With only 2.5 months of existence, and 40m$ TVL, FT has been quickly propelled to the top 10 projects in terms of revenue.

Where does revenue/fees come from? There is a 10% tax on every transaction split between FT (5%) and the content creator (5%). This means that if you purchase a key worth 1 ETH, you will end up paying 1.1 ETH. The same tax applies when people sell a key.

Why would one want to be on that platform?

People are on this platform for various reasons, such as:

- Friend.Tech governance token Airdrop farming

- People looking to interact with famous CT accounts (alpha calls or just chatting) (replacing the previous illiquid NFT gated group)

- Traders: Keys trading/speculation (including sniping bots)

- Making frens

There might be other reasons, but these are the main ones currently.

Personal feedback

In my case, I registered on FT to farm airdrop points. These points are distributed on a weekly basis and, depending on your account behaviour, you will receive more or less points. The most important factor being the value of the keys you hold (so the more Ethereum value your portfolio has, the more points you will receive). There are other factors, such as the amount of purchases and sales you make in a given week (trading volume).

My initial plan was to deposit 5 Ethereum to initiate bonds also called (3,3). The (3,3) meta, also known as the prisoner's dilemma, initially started in crypto with Olympus DAO, quickly adopted by well known DEX Velodrome.

On FT, it means that 2 participants agree to buy each other's keys and hold them, ideally for a long timeframe 🤝.

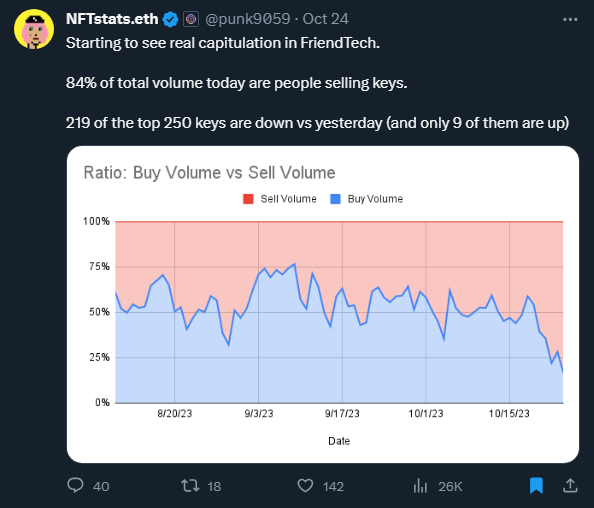

I started this (3,3) journey on the 1st of October. Unfortunately, I did not entirely deploy my portfolio. As of today, my portfolio value is 2.862 ETH and my wallet holds 2.382 ETH. I generated a total of 0.883 ETH in trading fees. This means that I am currently at a loss of around -0.6 ETH (+2.862 +2.382 -5 ETH initial deposit- 0.883 fees=-0.638 difference). I used to be at a +0.5 ETH profit, but the emergence of new SoFi platforms has led people to leave FT.

Security concerns (about the centralized front end) also hurt FT’s growth, as its TVL decreased from an ATH of $52M to $40M. Total fees generated since the start are now over $23M (after only 2.5 months)!

I have a total of 698 points. These points currently seem to trade for around $0.8-$1.2 OTC (on a secondary market called “Over The Counter”). In ETH, they’re worth 698pts=0.4ETH if we assume that each point is worth $1.

▶Total loss would be then around —0.2 ETH.

I did not fully allocate yet, because it hasn’t been as easy as anticipated to find bonds. People generally want to buy a key that is worth around the same price as theirs.

Furthermore, a few of my bonds have recently fully defected, which means that they sold their entire portfolio. When this happens, expect their key value to freefall. So a key that you purchased for 0.15 ETH can quickly be worth only 0.02 ETH… This airdrop farming meta has attracted a lot of fresh twitter accounts, so I have gotten increasingly suspicious of most accounts. Even people with a large following recently sold their entire portfolio, and this really hurts (3,3)ers.

Nonetheless, one key I purchased performed really well (from around 0.15 to 0.6 ETH - X4).

Involvement required

Moreover, forget the peaceful yield farming, deposit & forget. It is quite time consuming. You need to look for solid (3,3)ers. Usually this can be done through various Dune dashboards created by the community (https://dune.com/0xbreadguy/ultimate-frenfren-dashboard this one is 0xbreadguys’ dashboard, the methodology is explained at the top).

Keeping up with chats, trying to add some value to your key, etc.. all take a lot of time. If you’re not checking your FT frequently, you might come back and see that one person defected and their key is worth nothing…

Conclusion

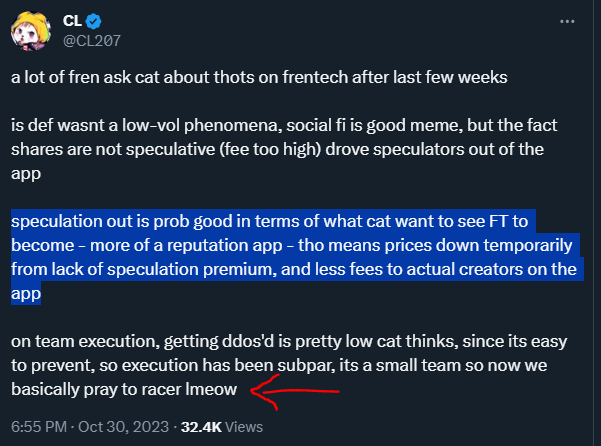

Overall, the experience is quite fun and I plan on continuing, unless the platform’s TVL really starts to shrink. The team has been pushing a few updates here and there, which is positive. But, I think that fees are too high. The creator fee is great and motivates people to provide value or to generate trading volume. The 5% FT tax feels excessive, though. I wonder whether trading volume would increase if they decreased this tax by a few percentage points. Furthermore, I also wonder whether giving a percentage of trading fees to all key holders could have an impact on trading volume and desirability.

Launched through the wave of pure speculation & cash machine, Friend.Tech could have pretty well launched the Social_Fi narrative.

Which is then the perfect way if the project will be able to survive and find its product market fit out of pure speculation.

As anything in Crypto, ape early with a high risk/reward or invest later when things stabilize but require more research and analysis.

Reading recommendation : The Cross-chain Insider

by LI.FI

LI.FI is a multi-chain liquidity aggregation protocol that supports any-2-any swaps by aggregating bridges and DEX aggregators across +20 networks. As Vitalik said, the future will be multi-chains.

Are you interested in the cross-chain technology, or simply would you like to keep being updated of the new trends?

🟢Crypto market review

by Axel

Bitcoin

Today, Bitcoin has challenged the $35,000 resistance, which was our long target set when we entered at the $25,000 support. This represents a remarkable 40% move. It's time to stick to the plan and take our profits.

At the moment, Bitcoin is overbought on the daily chart. What should we do now? Let's take a deep breath and observe the chart without emotion.

Bullish signs: Bitcoin has breached the $31,500 resistance on the weekly chart.

Bearish signs: The RSI indicator is overbought on the daily and close to be on the weekly chart.

This week, Bitcoin is sending us a strong signal. We closed the week above the $31,500 resistance. The more times this line is tested, the more significant it becomes. So, Bitcoin is currently in good health. The king is back.

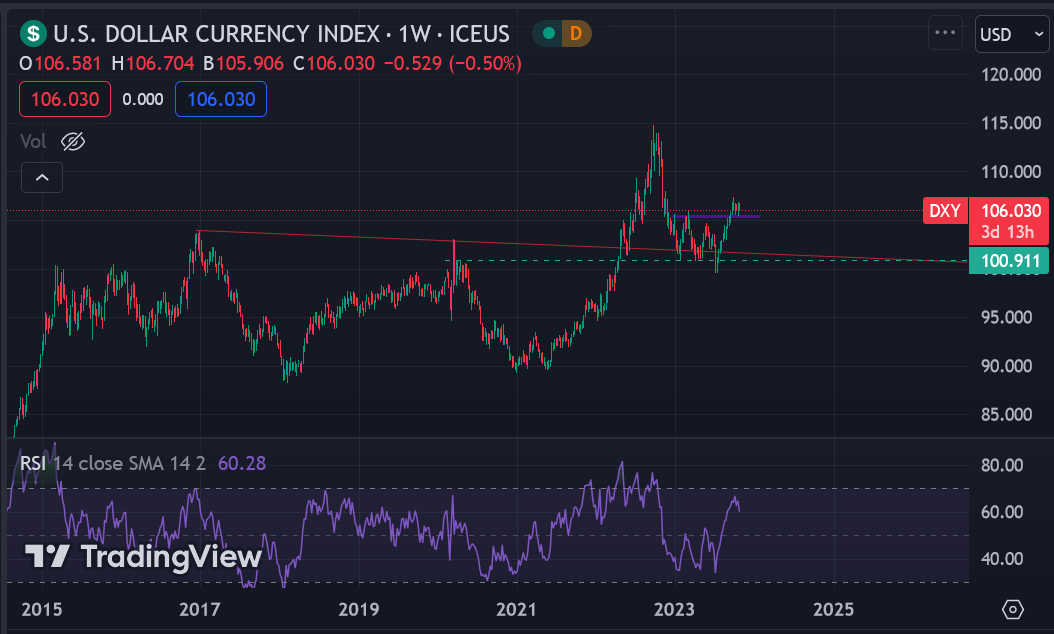

DXY (U.S. Dollar Index):

Concerning the DXY index, there are no new developments to report. We maintain a bearish outlook on this index as global hegemony dynamics are being reshuffled.

Feel free to refer to the Newsletter #1 to understand how to interpret the DXY index.

CME gap

As anticipated in the previous newsletter, Bitcoin has closed the CME gap at $35,000.

However, new gaps have emerged with this impulsive move.

The currently open CME gaps are at the following price levels:

$31,600

$29,800

$27,000

$26,300

$20,500

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

The BTC.D ticker (see NL #6 for more details) continues to establish new higher lows, which is the definition of an uptrend. We have just closed a significant 53% resistance on the weekly chart.

The TOTAL3 ticker is still in consolidation and has not yet broken its downtrend. However, we have an ongoing bullish weekly divergence, and we hope for a resolution soon. In any case, a weekly divergence takes several weeks to play out, signaling a long-term trend.

Conclusion

Bitcoin appears to be making a comeback, but it has left several CME gaps open to the downside. We are becoming increasingly bullish, but for this, Bitcoin will need to stay above $31,500 on the weekly chart. There are five CME gaps open to the downside. Of course, we don't know when they will be closed, but a significant correction could bring us to those levels. However, that is not on the horizon at the moment.

We have seen some impressive rebounds in certain altcoins, which is promising. However, Bitcoin's dominance over altcoins continues to grow, and we have not yet broken the downtrend of the TOTAL3 index. Additionally, until TOTAL3 breaks the $410 billion resistance, we consider the altcoin market to still be in consolidation, even though some are starting their bull run. We will delve into this in the educational section.

So, we will trade altcoins, but it's essential to remain cautious and set stop losses.

Educationnal content: How to identify the most explosive altcoins?

How to enter at the right moment? Why isn't my favorite altcoin pumping when others are exploding day by day? Let's explore market cycles together and how to identify and play the most explosive altcoins.

First, you need to understand market bubble cycles. We've recently experienced a significant correction since 2021 in the cryptocurrency market following the 2020/21 bull run. This correction is typically followed by an accumulation phase. Let's look at the previous bull market:

Before the start of the bull run, we went through an accumulation phase that began in 2018 and lasted for 1000 days. This was followed by an explosive move, and the price of Bitcoin multiplied by 5 in a year.

It's essential to understand that the entire cryptocurrency market behaves in a similar way. However, each coin has its own cycle, and they don't all start at the same time.

A swing trader will aim to enter on the breakout to the upside from the consolidation, while an investor may look to enter at the lower end of the consolidation zone. However, it can be quite challenging to hold negative positions for extended periods, sometimes exceeding a year. The gains may be smaller but also much quicker and less stressful for a swing trader. Know who you are and how to position yourself in your trading.

Let's take a concrete example. We have the TOTAL3 ticker, which is still in accumulation, as described in our analysis. However, the $Link coin has already broken out of its consolidation after 525 days of accumulation:

It wouldn't be surprising to see this coin among the top gainers in the coming days/weeks.

So, all you need to do is apply this strategy to your favorite altcoin and set up a daily alert when a specific price level is breached.

Let's take a look at the $OP token:

The coin has broken the downtrend line and is now in accumulation. An investor might consider entering when the blue diagonal is touched, with a stop loss just below it. On the other hand, a swing trader may prefer to wait for a breakout above the red line to establish a position. We can remain below the red curve for several more months, tying up our funds in this coin while others exit consolidation.

The swing trader can then take profits on coins that have already exited consolidation and reinvest in those that are breaking out.

Now, you have all the elements to identify an explosive altcoin:

The longer it has been in accumulation, the more explosive the price action is likely to be.

Wait for the breakout from consolidation by setting a price alert.

If your favorite altcoin isn't surging, it's probably still in accumulation.

Take profits on the rise and reinvest in those breaking out of consolidation.

It’s your turn 👉

Now, let’s practice: Identify one altcoin that is in consolidation zone et show us what would be the start of the bull run for this coin. Comment here, and we will reply to you.

🤯Quote of the week

By courtesy of QuotableCrypto

🟤Farming strategy: LI.FI Airdrop

By Subli

Any Optimism community member can see his farming strategy published in this newsletter. You just need to publish your strategy on twitter and send me the link via DM.

Jumper Exchange powered by LI.FI is an aggregator of Bridges & Dex Aggregators. Covering 18 Chains / 14 Bridges (incl. Circle) / 35 DEXs or DEXs aggregators, I’ve used this tool since more than a year now on a daily Basis and resulting in making my DEFI journey very but very confortable.

Is this Airdrop is real or just a chimera?

Followed by:

Such fund raising leads very often to a decentralized & permissionless way to run a WEB3 project, and decentralization usually leads to token issuance.

How do I farm LI.FI airdrop?

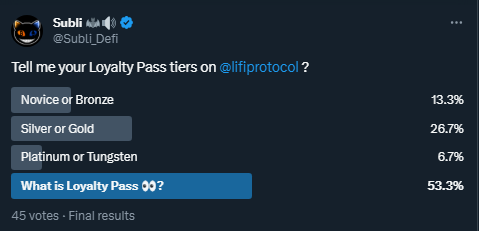

Using their brand new Loyalty Pass. WHAT??😲

In August this year, LI.FI introduced the Loyalty Pass.

Holders of the Loyalty Pass will enjoy exclusive benefits, including potential fee reductions, Jumper Merch packs, early product access, and special discounts courtesy of our collaborations with partner protocols.

So I’m expecting (pure speculation) an airdrop too.

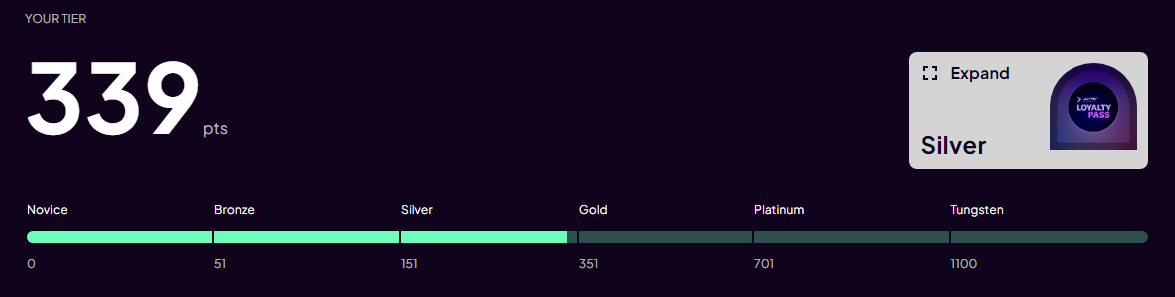

The Loyalty Pass has 6 rank levels & depends on the # of points you earn every month since early 2023.

You can connect your wallet on this website & check your rank: https://www.tryodyssey.xyz/org/lifi

How do you earn points?

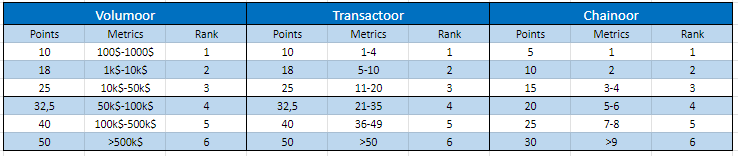

As of today, there are only 3 tasks that make you accrue points:

Volume (In USD)

# of Transactions

# of Chains Used

And soon, social activities will also make you earn some points. Based on my own activity, i have defined the following point earning based on your activity:

Therefore, I have set-up the following monthly routine to achieve the maximum based on my own portfolio while reducing money spent on this:

Bridge 350$ from 🔴to 🔵 and back - Repeat 3x times

Bridge 350$ from 🔴to 🔼 and back

Bridge 350$ from 🔴to 🟡 and back

Bridge 350$ from 🔴to 🟣 and back

🔴OP Mainnet / 🔵Base / 🔼Arbitrum / 🟡BNB Chain / 🟣Polygon

Volumoor: 3,850$ => 18pts

Transactoor: 12 => 25pts

Chainoor: 5 => 20pts

Total Monthly pts: 63pts (Silver in 3 months, Gold 5,5 months)

And gentle reminder, as from now, think of doing all social tasks too & join the discord: https://discord.gg/lifi

Hope you liked this Airdrop post. We will only provide detailed analysis on Top Tiers projects. So comment this post & tell us which one we should cover next?

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

The Optimism Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.