The 🔵Optimist: (L)Earn with Defi #23-2

Learn & Earn with DEFI on Layer 2 chains / OP Stack / Optimism Superchain

Welcome in Part 2 of this newsletter providing tools & tips to ease your journey in personal finance management in Web 3.

If you missed part 1 [OP Superchain News], don’t worry, just click HERE.

Click on your preferred language to access the translated version:

Chinese - Filipino - French - Japanese - Korean - Persian - Portuguese - Russian - Spanish - Thai - Turkish - Vietnamese

————————————— KEY TAKEAWAYS ——————————

🔵My DEFI TOOLBOX

Navigating DEFI without the proper tools is like navigating in the Ocean without a compass is like trying to aim at one direction in plain see. Let me show you the Tools i’m using to make my research & investment.

🟢Crypto market review

Bi-weekly update on the Crypto Market

🍀Trading Tips: Funding rate

Funding rate very often gives the direction of the crowd. If you wanna know where & how to read them, this article is for you

🟤Double Farming Strategy: 4x Airdrops & ETH

Farm your ETH & at the same time 4x different airdrops through Gravita, Layer Zero, Linea & OP mainnet.

Spotlight project: Oath Ecosystem

The OATH ecosystem is changing the world of DEFI by setting up new standards for security, capital efficiency and real yields.

With Ethos V2 now live, bringing new features such as 1-click leverage & LST as collateral, and updated tokenomics on the way, OATH is set to shake things up on Optimism in 2024. You can find $OATH on Velodrome and check out their site at oath.eco.

Follow Oath Foundation on X & Turn on notifications.

🔵My DEFI TOOLBOX

by Subli

What are you current problems in DEFI?

Lack of time

How to find good investment opportunities

How to efficiently swap

How to move from one chain to another

Understanding how it works

As I always say, the less tools you have, the better you will be. So yes, today I’m going to share with you only, my TOP tools that have given me sufficient edge to overcome all above listed problems. The list goes from the most efficient but basic dAPPS to the ones I used for research, so just skip the part you already know.

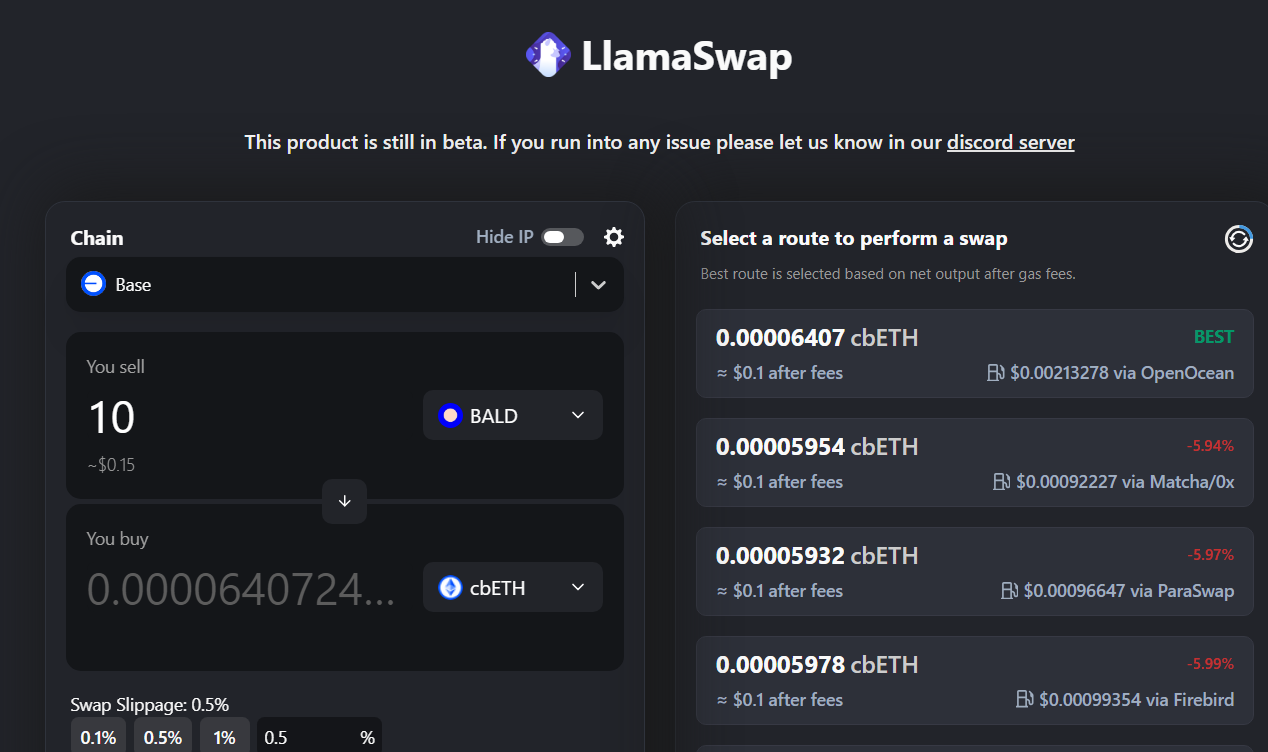

1. DefiLlama Swap

DefiLlama is maybe the most used FREE tools by anyone in DEFI. But do you know that it also integrates a SWAP module being a Meta-Dex aggregator (that aggregates DEX-Aggregator).

So no need to go on 1inch all the time, or on your favorite DEX, as DefiLlama covers all the most recent chains & protocols, you can be sure to find the best rate ever, and they take 0$ fee on top of your trade: PUBLIC GOOD

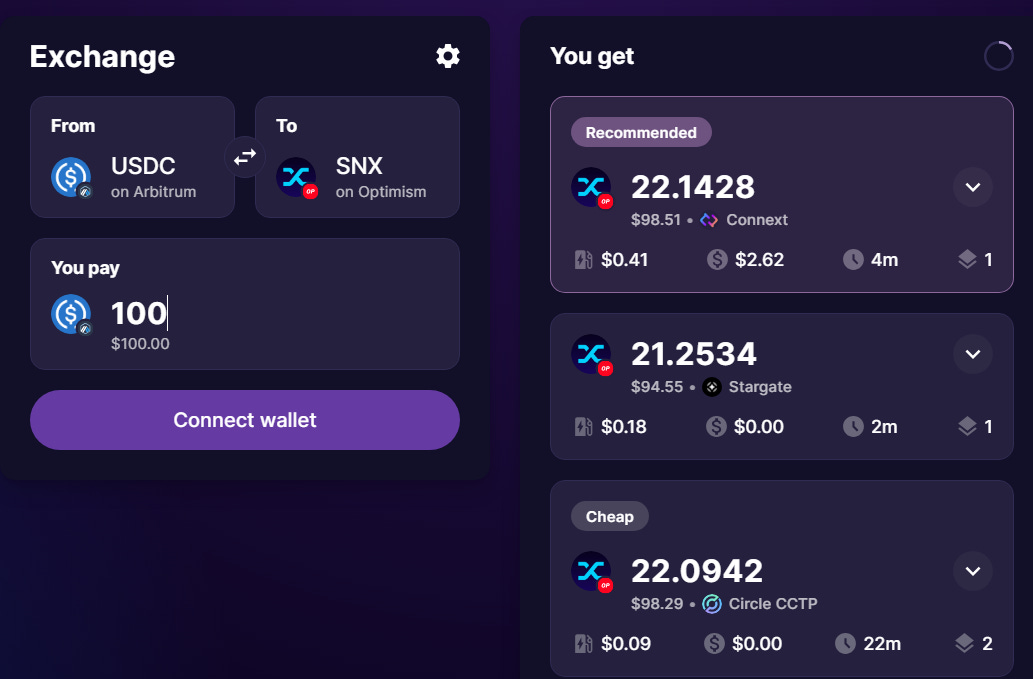

2. Cross chain SWAP with Jumper Exchange

If you want to move from Optimism to Linea, or from opBNB to Base, forget about searching for the right bridge, safest & most efficient route. JUMPER EXCHANGE is the Cross chain Swap dAPP powered by LI.FI. You can set a swap from Optimism to Linea and everything is then managed through a single User Interface.

Best, you can farm LI.FI Airdrop, as covered in our previous newsletter #20-2.

3. NFT marketplace aggregator

Where to find the best price for your NFT whether it is a Penguin, APE or a Bong Bear NFT? My best tool so far, shilled by one crypto OG, is OpenseaPro. It aggregates 170 different market place where you can access the cheapest price, optimized fees, and possibility to list your NFT on multiple market places (OpenSea, Looksrare, Blur). This tool provides also aggregated statistics, making it very interesting to analyze NFT collection, but it is only aggregating NFT on Ethereum mainnet, for now.

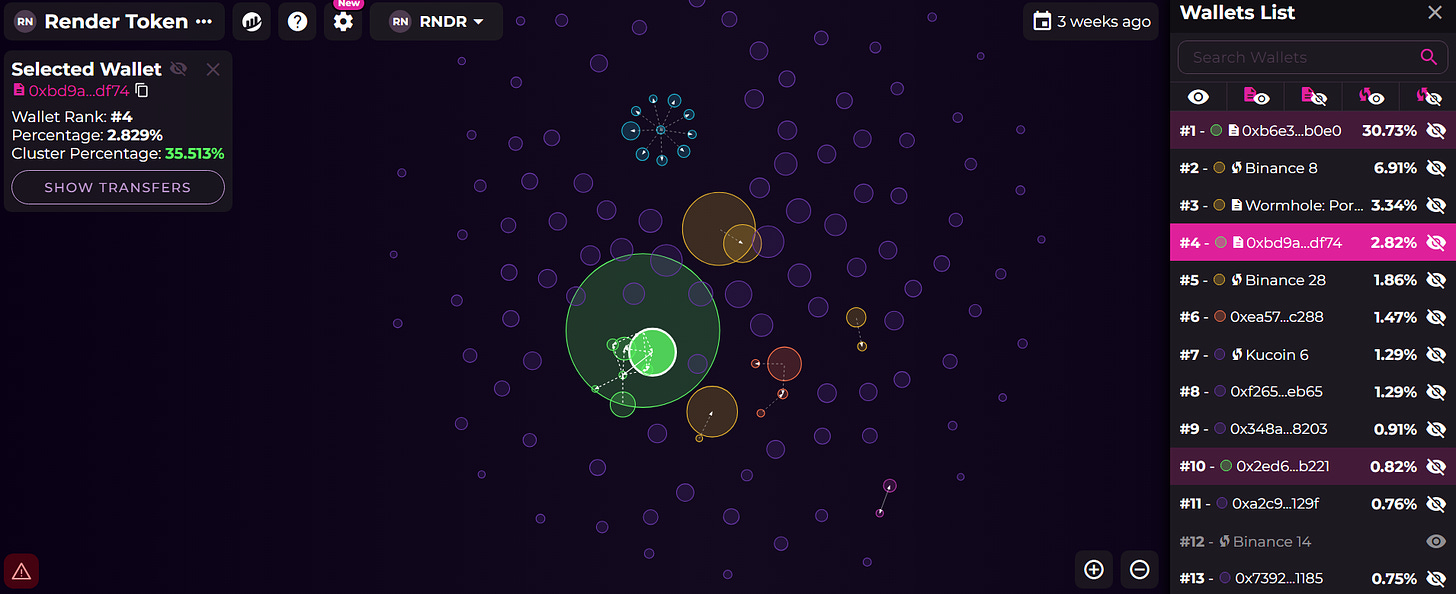

4. Bubblemaps: Token distribution Analysis

Token distribution is so important, for liquid tokens & NFT. It concentrated, you may face price manipulation. If diluted, the distribution is healthy.

Bubblemaps will show this concentration is a very intuitive way. Currently available on 7 chains, it might come very soon on OP mainnet (🤐).

If you’ve been investing in AI, you should know $RNDR token. Here is the distribution, with BINANCE holding 8.7% of the total supply. But in the overall the distribution is very Healthy.

5. Token Terminal

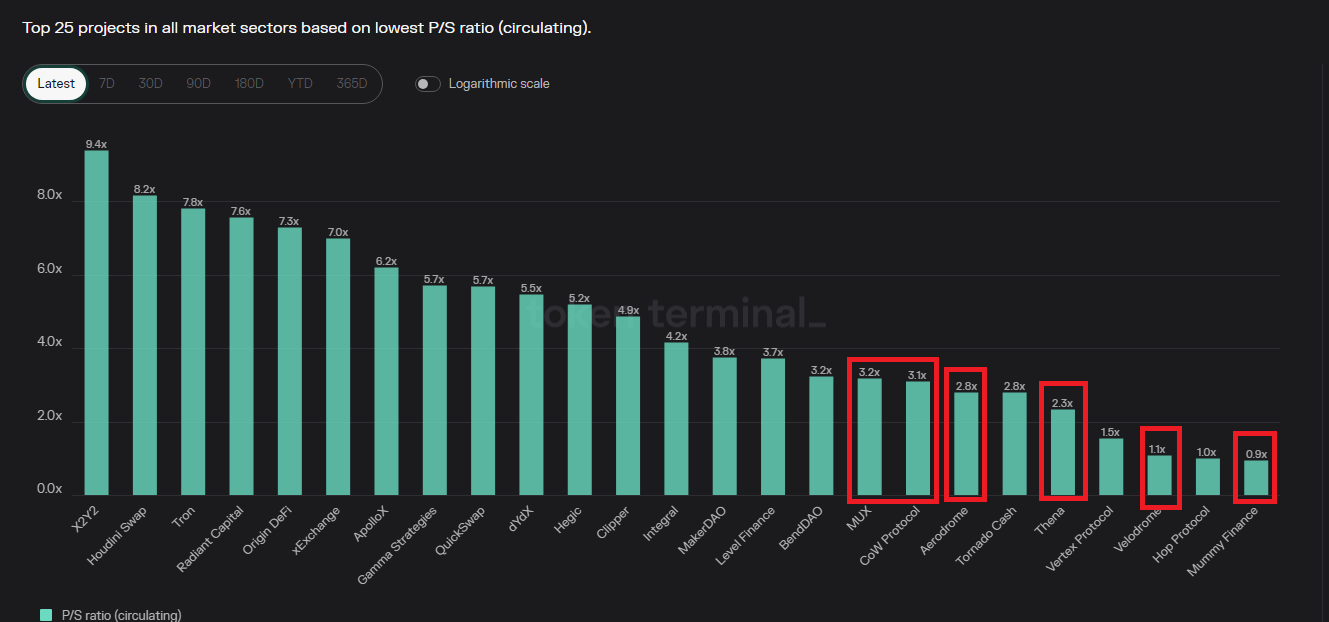

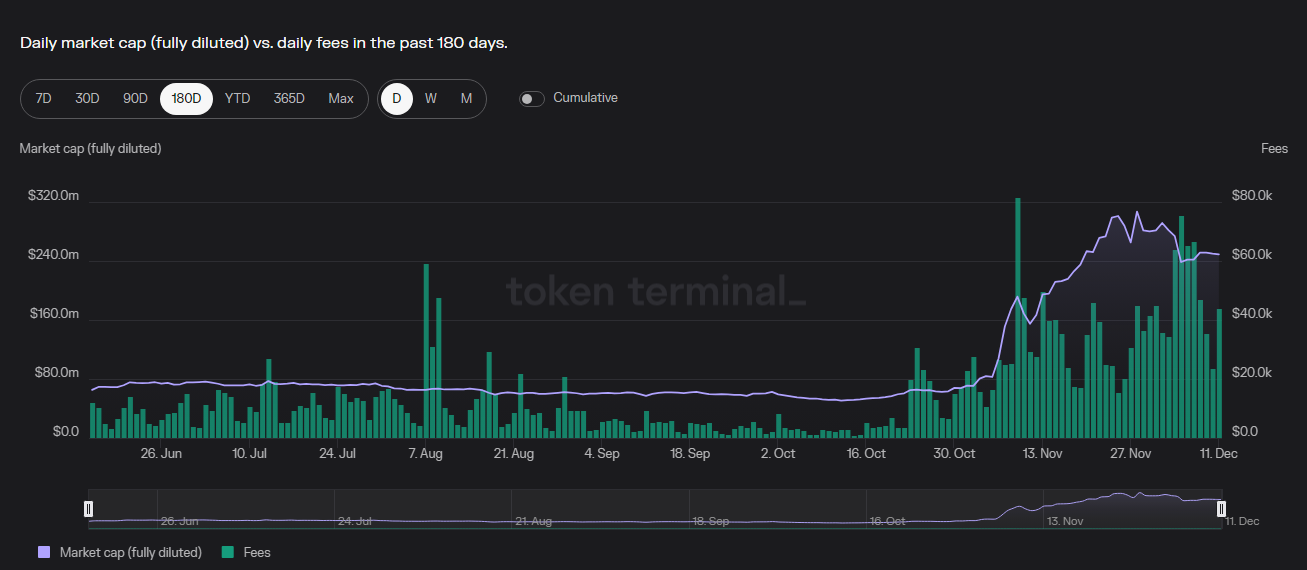

Token terminal is a research engine aggregating a lot of onchain stats of projects, making it possible to compare TVL with volume with fees for example.

In any crypto project, revenue is key. So 2 ratios I love to calculate and compare with other projects in the same category is

{Price_of_token}/{Total_Collected_Fees) = P/S

{Price_of_token}/{Total_Earnings) = P/F

Here is the top 25 projects based on lowest P/S ratio (circulating supply). There are several interesting projects here where you could base your research on like CowSwap:

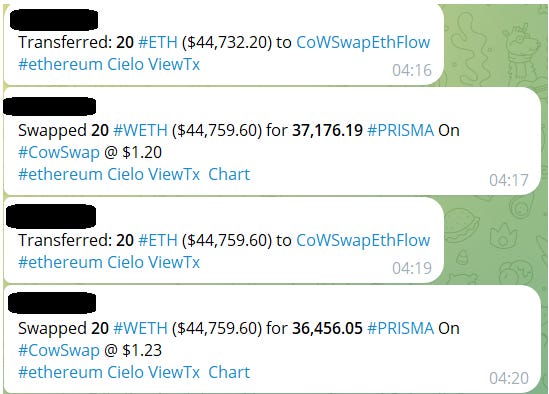

6. Wallet tracker by CIELO

I definitively hate the type of thread “This guy has turned 1k$ into 1m$, here is how he did it”… Bullshit. You can spend hours on tracking people making hundred of Transactions per day and not having the right information/analysis to make your own decision.

Instead, once you have spotted one crypto asset you would like to invest, check with Bubblemaps who are the whales, put their address in Debank & check their behavior. Look for whales having a concentrated bet on your project, easier to spot their moves.

CIELO offers to track any whale move by sending you Telegram Notification. I’ve been using it on few plays, and it worked so well.

This whale is accumulating $PRISMA since days. So it’s very easy to assess his average buy price, and then understand his move.

7. Debank & Rabby

These 2 tools have already been presented in a previous newsletter, and I truly hope that you’re now using it. If not, then it’s time to make the move as it will change your life for ever:

Debank: The Web3-native messenger & the best Web3 portfolio tracker that covers all your tokens, DeFi protocols, NFTs across all EVM chains.

Rabby: The game-changing wallet for Ethereum and all EVM chains

Spotlight project: Liquid Restaking Token by KELP DAO

Kelp DAO is thrilled to bring forward the next innovation in the staking landscape: Liquid Restaked Token (LRT). Kelp DAO is the first LRT project to finish audits (by SigmaPrime & Code4rena) & be ready for deposit.

With Eigenlayer adding new LST & raising caps on Dec-18, deposit your Liquid Staked Token (stETH or ETHx) on KELP DAO between 12 & 18-December, mint $rsETH, and access new DEFI & Liquidity opportunities while accruing (re)staking rewards.

🪂But that’s not all, by depositing in Kelp DAO, you will be earning BOTH $Kelp and EigenLayer points for their airdrops!

Available on Ethereum Mainnet HERE.

🟢Crypto market review

by Axel

Bitcoin

Bitcoin has remained above the weekly range and the daily support despite the bearish divergences presented two weeks ago. The support has been defended, and Bitcoin has initiated a new bullish momentum, pulling the entire market with it.

Where do we stand today? Can we expect new highs, or is it time to consider taking profits?

Bullish signs: We are currently in an uptrend.

Bearish signs: We haven't experienced a significant correction for 8 weeks now. Bitcoin is at the resistance of its bullish channel. The weekly RSI is oversold.

We have witnessed 8 consecutive weeks of gains without a significant correction since the breakout above the $30,000. The RSI has surpassed 80 on the weekly chart, which is quite rare and often signals a potential top.

On the daily timeframe, the bearish divergence continues to develop.

DXY (U.S. Dollar Index):

We have little to say about this DXY index. As explained in the previous newsletter, the index is down in the higher time frame (HTF), which is favorable for the cryptocurrency market.

Feel free to refer to NL #1 to understand how to interpret the DXY index.

CME gap

Following the bullish momentum in the cryptocurrency market, a new CME gap has been created.

The currently open CME gaps are at the following price levels:

$40,000

$31,600

$29,800

$27,000

$26,300

$20,500

Feel free to refer to NL #5 to understand how to interpret the CME gaps.

Altcoin

Bitcoin Dominance: We are still in an uptrend, but it seems that the trend is losing momentum with this peak in the weekly chart. Perhaps the first lower high indicating a potential downtrend for this index? Only time will tell.

Tickers TOTAL2 & TOTAL3: We finally got the long-awaited breakout on the TOTAL2 and TOTAL3 tickers. It's crucial to monitor closely to ensure it's not a fakeout as the RSI is already oversold on the Weekly time frame.

Conclusion

The Bitcoin continues to exhaust itself. We must be attentive to the daily divergence and the high weekly RSI. Bitcoin doesn't necessarily have to dump and can consolidate. If a bearish move takes shape, the $30,000 support seems evident. If this support is broken, we should look at lower open CME gaps as buying targets.

It seems that the play is in altcoins for now, but some are already very stretched. We will continue to play as long as the music plays, but we must remain cautious to avoid seeing our recent gains fade away and be able to buy lower in case of more significant corrections.

After 8 weeks of gains, it is wiser to adopt a profit-taking philosophy than to enter new positions. We will play altcoins but with a stop loss, and we will set a stop loss on a third of our position to be able to buy lower on our long-term positions.

We are not bearish, but we must be prepared for a market reversal. Money will move from the impatient to the patient.

🟩Trading Tips: Funding rate

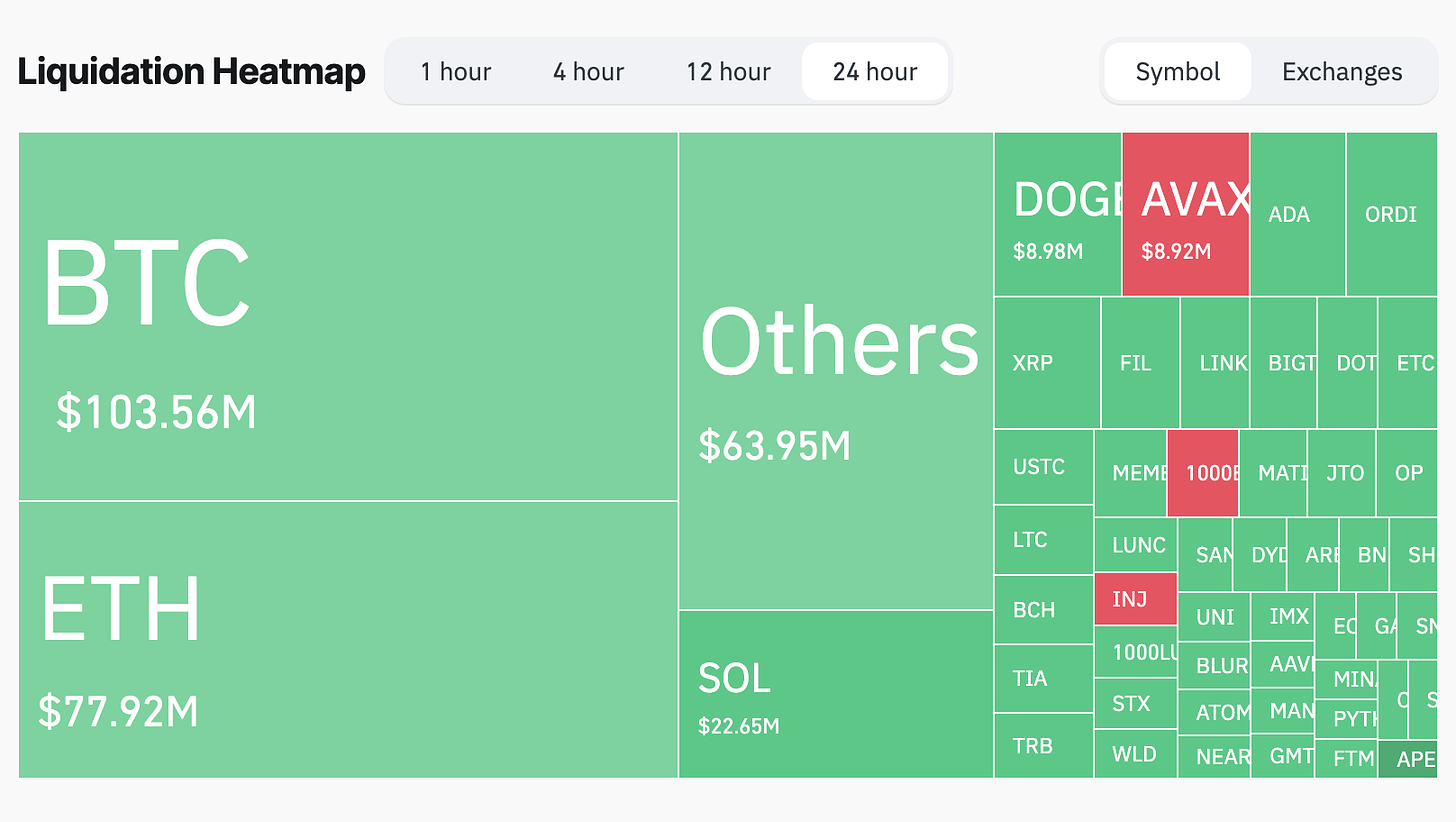

This week, we experienced a flush in the crypto market. This means that there was a sudden drop in the entire market with cascading position liquidations.

There might be an explanation for this, and these are observations that have been verified through practice but are challenging to prove.

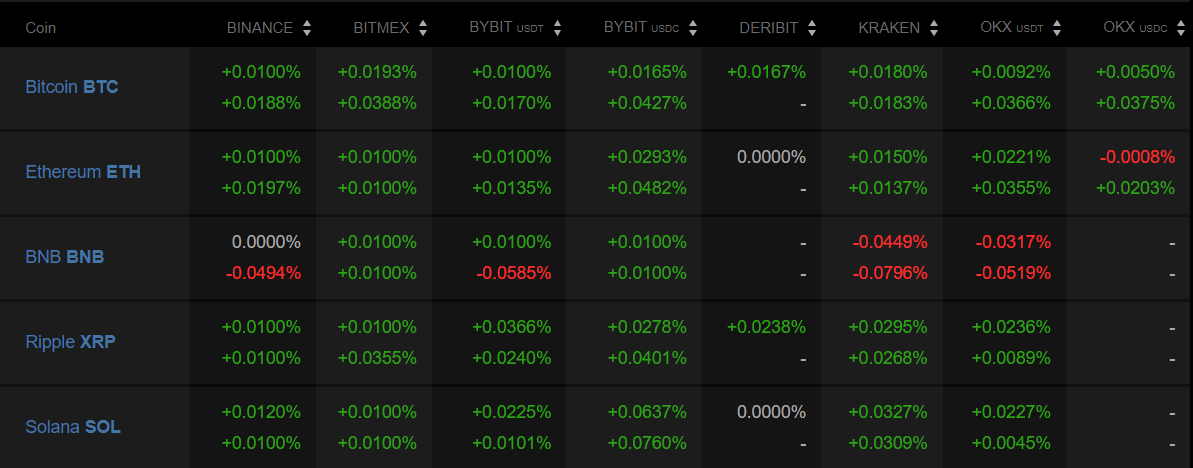

Are you familiar with funding rates?

When a long or short is taken with an exchange (such as futures on Binance), the funding rate corresponds to the commission paid by the actors taking positions. You can easily research this topic to understand its workings in more detail if needed.

This mechanism primarily aims to maintain a correlation between the spot market and derivative products. It makes participants less inclined to manipulate the market. You can check real-time funding rates on Centralized Exchanges via the following link:

https://coinalyze.net/funding-rates/

Leverage Effects in Futures Positions:

When taking a futures position, it is often multiplied through leverage. For example, if you take a position with $100 and choose a leverage of 5, you will have a $500 position, of which $400 belongs to the exchange where the futures contract is made. Thus, if the price drops by 20% (resulting in a $100 loss for you), the exchange will liquidate your position because.

When funding rates are high, it indicates that many people are taking bullish bets. If the price drops, these positions will be liquidated and pocketed by the exchanges. When a bullish position is liquidated, a buyer needs to be found, which can drive the price down and trigger further liquidations.

What does this tell us?

When funding rates are high, there is often a sudden drop in cryptocurrency prices. These drops lead to cascading liquidations, with exchanges being the big winners.

As you may have understood, there is strong speculation that exchanges manipulate prices in the short term by dumping some Bitcoin, triggering cascading liquidations. It is, therefore, interesting to monitor these funding rates during a bull market to anticipate such movements.

$OP Trade

After the fakeout that we attempted to play in the previous newsletter, the $OP token has broken its resistance to the upside, thus breaking out of consolidation.

Did you enter this trade? On our side, yes we did because:

All altcoins were on the rise;

A continuation pattern was forming on the daily chart;

We had a clearly defined support (purple line).

Identifying strong setups on the weekly chart and then examining the daily chart for entry points is a key strategy.

It is important to have a trading plan, and we hope this analysis can be useful to you before entering a position.

🤯Quote of the week

By courtesy of QuotableCrypto

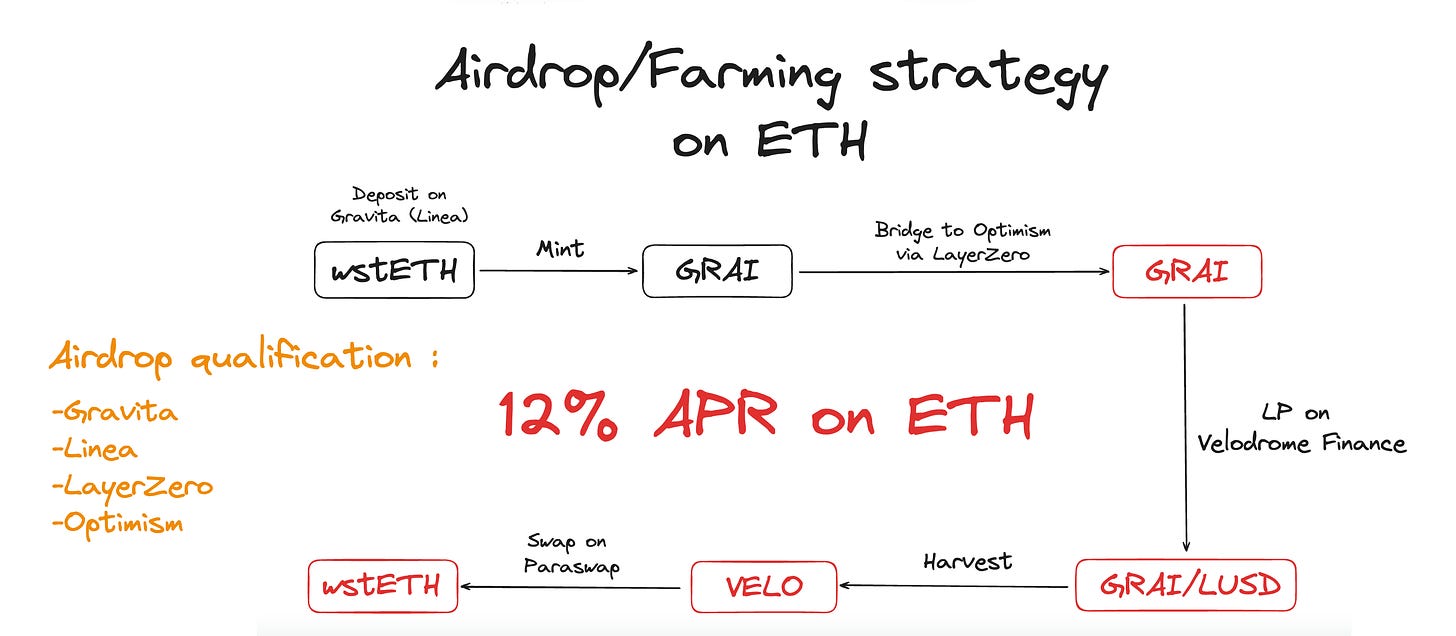

🟤Double Farming Strategy: 4x Airdrops & ETH

By Thomas

Farming airdrops can sometimes take a lot of time and exposes you to being considered a Sybil if your strategy is too aggressive (🤖).

So, we've chosen to talk to you about an approach that we believe is better:

Instead of multiplying transactions mechanically, discover a farming strategy that allows you to generate yield and efficiently qualify for a maximum number of airdrops.

Explanations

As you can see, this dual strategy involves a final yield in $wstETH (liquid staking ETH from Lido Finance) and exposes you to different protocols.

These have been carefully chosen for their high probability of conducting an airdrop. Here is the detailed reasoning:

#1 Gravita

Gravita is interesting because the protocol not only allows you to borrow at a maximum fixed rate of 1%, but also qualifies you for the upcoming $GRVT airdrop, the governance token of the platform.

Indeed, the protocol recently launched a quest program called Gravita Ascend, allowing Gravita users to earn points based on various completed missions.

The top 3 missions earning the most points are as follows:

Open & maintain a borrowing position (Vessel) ✅

Provide liquidity in the stability pool ❌

Provide liquidity on the $GRAI token ✅

Fortunately, our strategy fulfills two out of these 3 missions 😛

The points you earn, called "MARKS," will allow you to earn $GRVT tokens when the time comes. The goal is to accumulate as many as possible.

Access the program here.

#2 Linea

Given that Gravita has just been deployed on Linea, why miss out on an additional opportunity to earn an airdrop!

By deploying your borrowing position on this network, you are likely fulfilling a criterion based on the volume deposited in contracts.

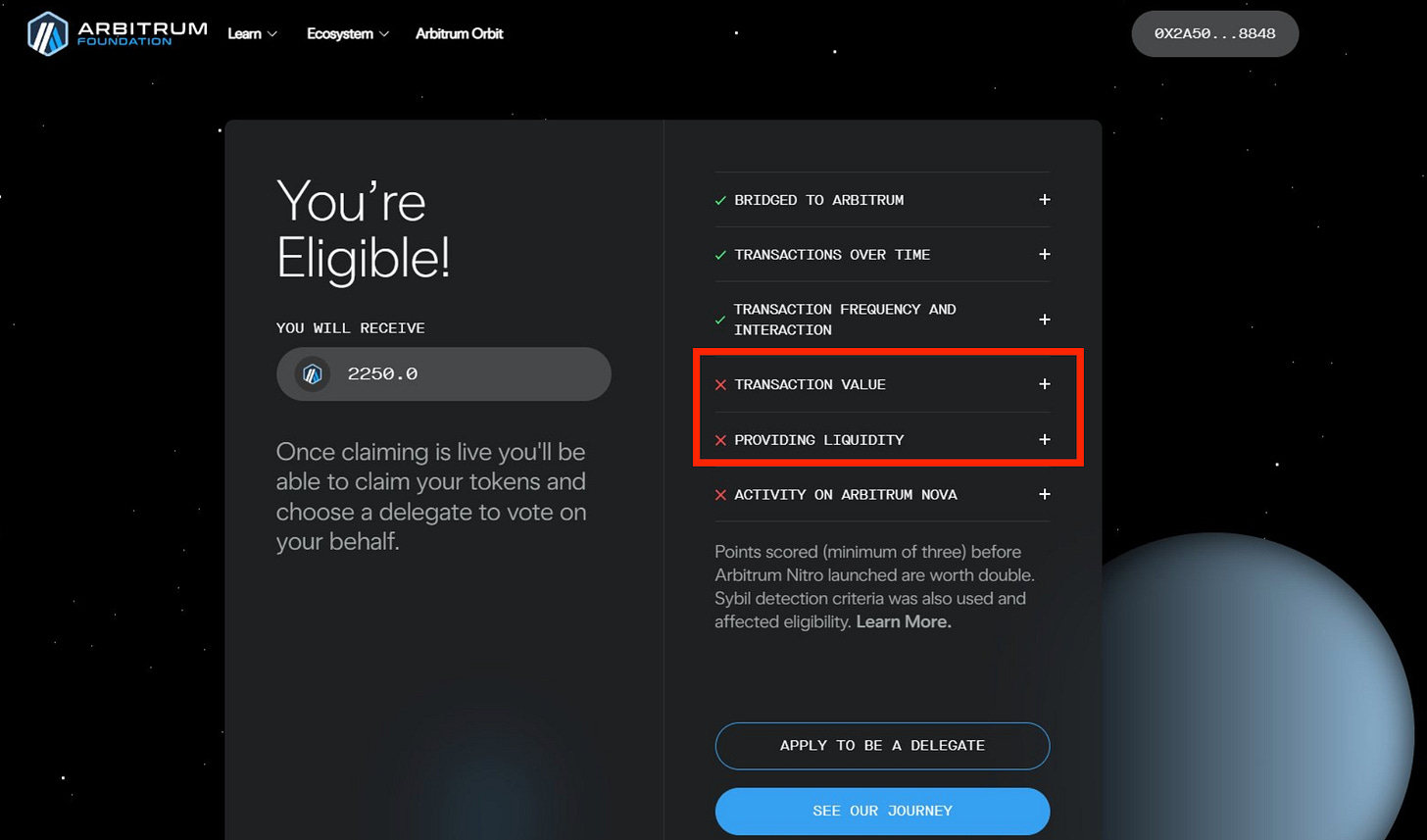

This is what Arbitrum did for its airdrop, thus rewarding the "real" farmers rather than low-value transaction spammers.

And remember that Linea is funded at $700M, which is approximately 4 times more than Arbitrum... 👀

NB: Linea is a relatively recent solution, so if you're not comfortable deploying funds on it, you can still use the version on Arbitrum.

However, the $GRAI you borrow and bridge to Optimism reduces your exposure to this blockchain. In case of fund loss on Linea, you retain your loan in $GRAI.

#3 LayerZero

A few days ago, LayerZero Foundation confirmed that there will indeed be a token.

It is expected to arrive in the first half of 2024, but the distribution method has not been announced yet.

If the snapshot has not been taken yet, the strategy will allow you to qualify for this airdrop by bridging the GRAI created on Linea to Optimism.

#4 Optimism

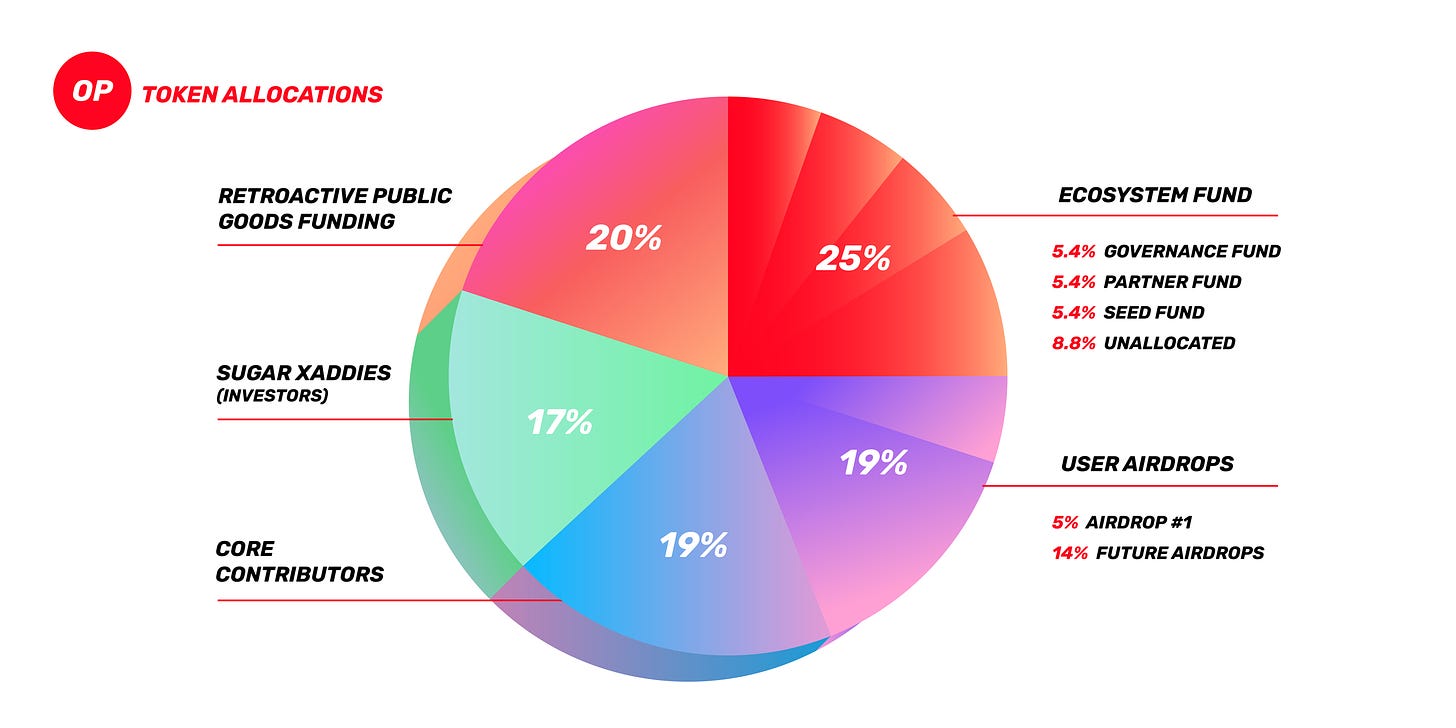

19% of the total $OP supply is reserved for airdrops. As of today, 3 have been conducted:

One on 06/06, 2022

One on 09/02, 2023

One on 18/09, 2023

The latest airdrop, dedicated to governance (required delegating $OP to be eligible), suggests that the next airdrop might be primarily focused on the Optimism Quests and on-chain activity.

That's why the second part of this strategy is based on Optimism: by deploying a farming position on Velodrome, you significantly increase your chances of qualifying for the next airdrop.

Additional information/Risks:

Recommended minimum capital: $500

Recommended LTV: 40% (to avoid redemptions)

Risk exposure to: Gravita, Linea, Velodrome, Optimism

⚠️ Beware of transaction fees on Linea!!!

We sincerely hope that this strategy will help you secure on or more future airdrops.

Happy farming! 🧑🌾

Optimism Twitter accounts:

@OPLabsPBC for protocol development

@OptimismGov for governance

@OptimismGrants for Grant Council uipdates

Optimism Website:

Base Social links

Twitter: @BuildOnBase

The Optimism Social accounts:

Discord Handle: Subli#0257

Twitter: The Optimist

Farcaster: Subli_Defi

Notion (Research database): https://sublidefi.notion.site/sublidefi/Subli_Defi-c57a3141c983433ca74e785a0bf1bcd0

Youtube: https://www.youtube.com/c/Subli_Defi

Disclaimer: Nothing in this content is financial advice. We may have some positions on the presented projects, however these articles are written in a non biais way so that you can make you own opinion out of it.

Do your own research before investing, and remember that Crypto is extremely volatile and risky.

Thanks for the alpha's

great project